The global steel grating market is experiencing steady expansion, driven by rising infrastructure development, growing demand from industrial and commercial sectors, and increasing safety regulations across construction and manufacturing facilities. According to Grand View Research, the global steel grating market was valued at USD 4.1 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. This growth is fueled by the material’s durability, load-bearing capacity, and corrosion resistance, making it essential in applications ranging from walkways and platforms to architectural designs and wastewater treatment plants. With Asia-Pacific emerging as a key regional market due to rapid urbanization and industrialization—particularly in China and India—the competitive landscape is seeing increased innovation and capacity expansion among leading manufacturers. In this evolving market environment, identifying the top-performing grating steel manufacturers becomes critical for sourcing high-quality, compliant, and cost-effective solutions.

Top 10 Grating Steel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Ohio Gratings

Domain Est. 1996

Website: ohiogratings.com

Key Highlights: Ohio Gratings, Inc. is a premier metal bar grating supplier, specializing in industrial and commercial grating design, manufacturing, and custom fabrication ……

#2 Miner Grating Systems

Domain Est. 2019

Website: minergrating.com

Key Highlights: Miner Grating is North America’s leading manufacturer and fabricator of bar grating, diamond safety grating, and round hole safety grating products….

#3 IKG

Domain Est. 1995

Website: ikg.com

Key Highlights: America’s first and leading steel grating manufacturer. ……

#4 Bar Grating Supplier

Domain Est. 1997

Website: sss-steel.com

Key Highlights: At Triple-S Steel®, we specialize in supplying top-quality steel and aluminum bar grating for a wide range of industrial and architectural applications….

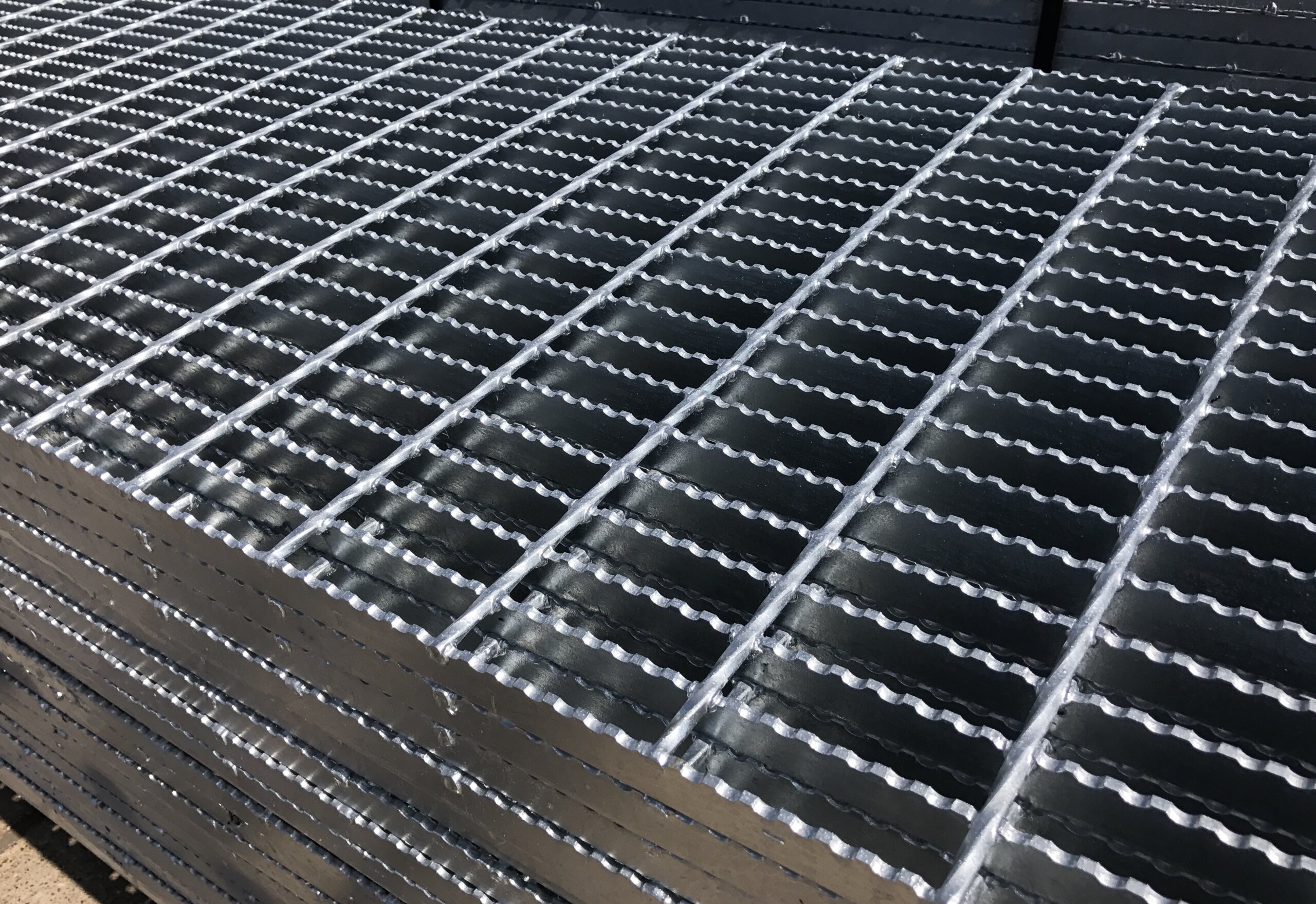

#5 Nucor Steel Grating

Domain Est. 1997

Website: nucor.com

Key Highlights: Vulcraft Grating is a leading North American producer of bar grating products. Our grating products are manufactured at modern plants using specially designed ……

#6 Vulcraft Grating

Domain Est. 1997

Website: vulcraft.com

Key Highlights: Steel bar grating from Vulcraft-standard, heavy-duty, and stair treads. Custom fabrication, fast delivery, and expert support for all your grating needs….

#7 Grating Pacific

Domain Est. 1997

Website: gratingpacific.com

Key Highlights: Grating Pacific is the Western States’ leading fabricator and supplier of metal bar grating, aluminum, and fiberglass grating, woven and welded wire mesh ……

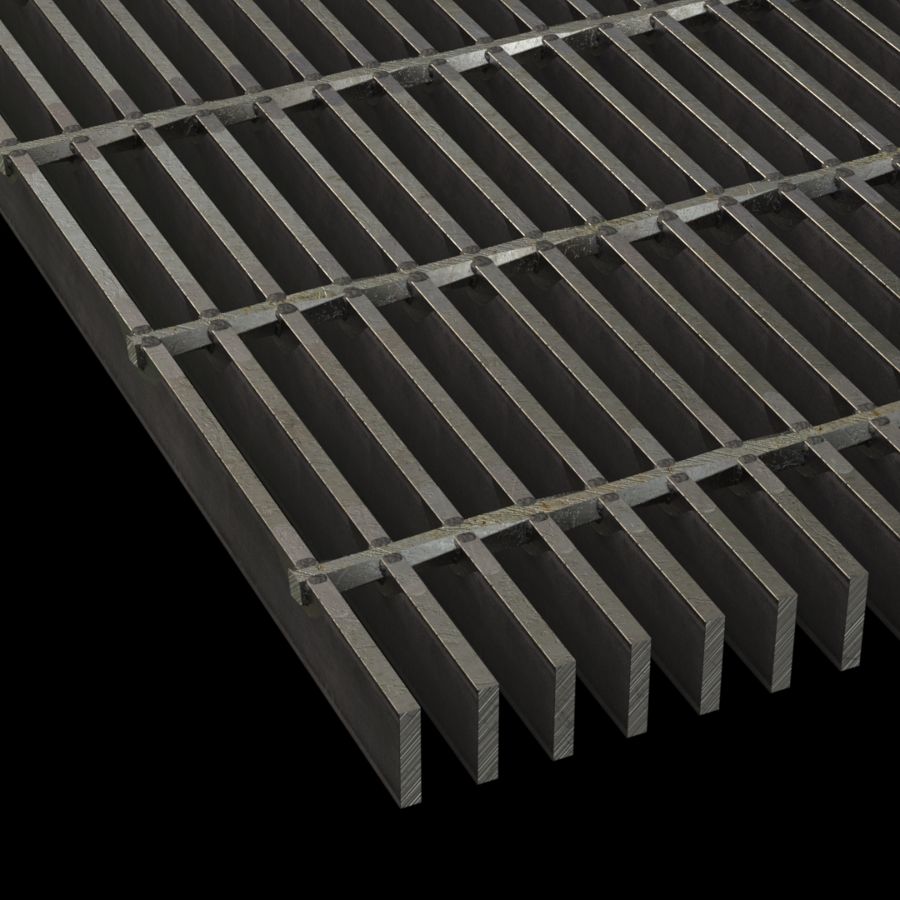

#8 Steel and Metal Grating

Domain Est. 1997

Website: metalsusa.com

Key Highlights: Metals USA offers a large inventory of bar grating, from serrated and galvanized steel grating to carbon steel bar grating, bar grating, and more….

#9 Grating Products

Domain Est. 1997

Website: chathamsteel.com

Key Highlights: Chatham Steel offers a large inventory of bar grating, from serrated and galvanized steel grating to carbon steel bar grating, stainless steel bar grating, and ……

#10 Metal Grating

Domain Est. 2011

Website: kloecknermetals.com

Key Highlights: Kloeckner offers an extensive range of metal grating products such as 19W4 serrated bar grating, 19W4 non-serrated bar grating, and expanded metal grating….

Expert Sourcing Insights for Grating Steel

H2: Projected 2026 Market Trends for Grating Steel

The global grating steel market is poised for significant evolution by 2026, driven by a confluence of macroeconomic, technological, and regulatory forces. Key trends shaping the landscape include:

1. Sustained Growth Driven by Infrastructure & Urbanization:

Global investment in infrastructure (transportation, energy, water treatment) and rapid urbanization, particularly in Asia-Pacific and emerging economies, will remain the primary engine for demand. Government stimulus packages focused on sustainable development and resilient infrastructure (e.g., smart cities, green buildings) will directly boost procurement of steel grating for walkways, platforms, drainage systems, and architectural applications. The push for modernization of aging infrastructure in developed regions will further contribute.

2. Accelerating Demand for Sustainability & Green Building:

Environmental regulations and ESG (Environmental, Social, Governance) imperatives will intensify. This will drive demand for:

* Recycled Content: Increased preference for grating manufactured with high percentages of recycled steel, reducing the carbon footprint.

* Longer Lifespan & Durability: Focus on corrosion-resistant coatings (advanced galvanizing, specialized polymers) and materials (stainless steel grades, aluminum) to minimize replacement cycles and waste.

* Lifecycle Assessment (LCA): Specifiers and end-users will increasingly demand LCA data, favoring suppliers demonstrating lower environmental impact across the product lifecycle.

3. Technological Advancements & Smart Integration:

Innovation will focus on enhancing functionality and integration:

* Smart Grating: Development of grating embedded with sensors (load, corrosion, temperature, vibration) for structural health monitoring in critical infrastructure (bridges, offshore platforms, industrial plants), enabling predictive maintenance.

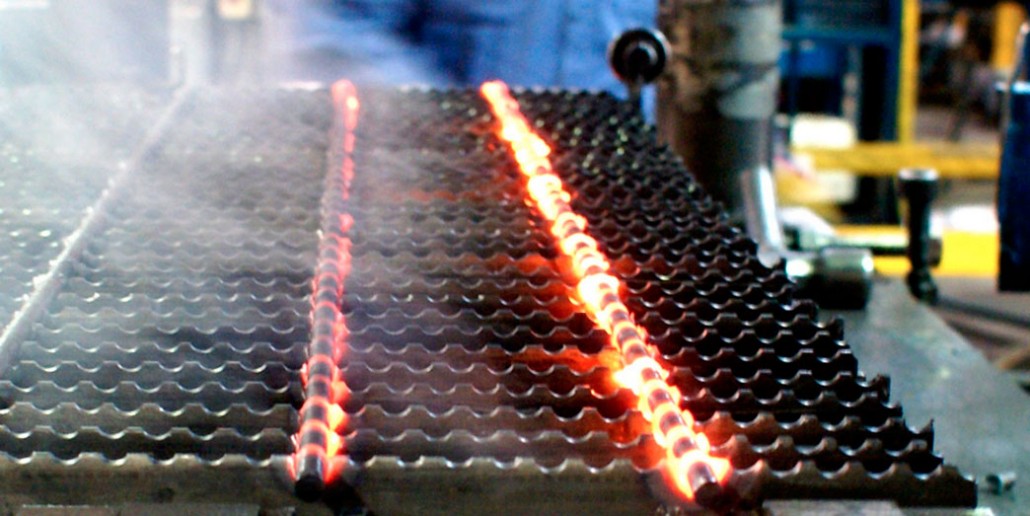

* Advanced Manufacturing: Wider adoption of automation (robotic welding, CNC cutting) and digital design (BIM – Building Information Modeling) for improved precision, efficiency, reduced waste, and faster customization.

* Material Innovation: Growth in high-performance alloys and composite grating (steel-polymer hybrids) offering superior strength-to-weight ratios, extreme corrosion resistance, or electrical insulation for specialized applications (e.g., chemical processing, marine).

4. Supply Chain Resilience & Regionalization:

Persistent geopolitical tensions and lessons from recent disruptions will push companies towards:

* Nearshoring/Reshoring: Increased production and sourcing within key regional markets (North America, EU, Asia) to mitigate risks and reduce logistics costs/lead times.

* Vertical Integration: Larger players may invest in controlling more of the raw material (scrap, billet) and coating processes to ensure supply security and quality.

* Digital Supply Chains: Enhanced use of digital platforms for inventory management, logistics tracking, and supplier collaboration to improve visibility and responsiveness.

5. Price Volatility & Cost Pressures:

Steel grating manufacturers will navigate ongoing challenges:

* Raw Material Fluctuations: Prices for steel scrap, alloys, and energy will remain volatile, impacting margins. Strategic hedging and long-term supplier contracts will be crucial.

* Energy Costs: High energy prices will incentivize investments in energy-efficient production technologies and potentially influence the competitiveness of different grating types (e.g., pultruded FRP vs. steel in low-load applications).

* Labor & Logistics: Persistent labor shortages in manufacturing and elevated transportation costs will continue to pressure profitability, driving automation and operational efficiency.

6. Evolving Safety & Regulatory Standards:

Stringent safety regulations (fall protection, load capacity, slip resistance) across industries (construction, oil & gas, manufacturing) will remain paramount. Standards will likely evolve to incorporate requirements for smart monitoring and enhanced durability. Compliance will be a non-negotiable market entry barrier.

Conclusion:

By 2026, the grating steel market will be characterized by robust demand fueled by infrastructure, a decisive shift towards sustainable and high-performance solutions, and the integration of digital technologies. Success will depend on manufacturers’ ability to innovate (materials, smart features), ensure supply chain resilience, manage cost volatility, and demonstrate clear environmental credentials. Companies embracing sustainability, digitalization, and regional agility are best positioned to capitalize on these converging trends.

Common Pitfalls Sourcing Grating Steel (Quality, IP)

Sourcing grating steel involves critical considerations beyond basic specifications. Overlooking quality and intellectual property (IP) aspects can lead to safety hazards, project delays, legal disputes, and financial losses. Below are key pitfalls to avoid:

Poor Material Quality and Non-Compliance

One of the most frequent issues is receiving grating made from substandard materials or that fails to meet required industry standards (e.g., ASTM, ISO, EN). Some suppliers may use inferior-grade steel, under-specify bar dimensions, or neglect proper surface treatments. This compromises structural integrity, corrosion resistance, and load-bearing capacity—especially in demanding environments like offshore platforms or chemical plants.

Red Flags: Inconsistent bar spacing, warping, poor weld quality, or flaking galvanization. Always request mill test certificates (MTCs) and verify compliance with project specifications.

Inadequate or Counterfeit Certifications

Suppliers may provide falsified or incomplete certification documents, such as false CE marks or ISO certifications. This misrepresentation can result in non-compliant products entering critical infrastructure projects, posing safety risks and exposing the buyer to liability.

Best Practice: Conduct third-party inspections and validate certifications through official databases or accredited bodies before finalizing procurement.

Intellectual Property Infringement

Grating designs—especially modular, high-performance, or proprietary load-bearing configurations—may be protected by patents, trademarks, or design rights. Sourcing from unauthorized manufacturers who replicate patented patterns (e.g., specific bar arrangements or connection systems) exposes the buyer to IP infringement claims, even if unintentional.

Risk: Legal action from original equipment manufacturers (OEMs), shipment seizures, or forced removal of installed grating.

Use of Unlicensed Manufacturing Partners

Some suppliers claim to be authorized distributors but subcontract production to unlicensed or offshore fabricators. These facilities may lack quality control and produce grating that mimics branded products but does not meet the original design or safety standards.

Mitigation: Verify the supplier’s authorization status with the OEM and insist on transparency about manufacturing locations.

Lack of Traceability and Documentation

Without proper documentation (heat numbers, batch traceability, inspection reports), it becomes impossible to verify material origins or conduct recalls in case of failure. This is crucial in regulated industries like oil & gas or transportation.

Solution: Require full traceability from raw material to finished product as a contractual obligation.

Cost-Driven Sourcing Over Quality Assurance

Opting for the lowest bid often leads to compromised quality. Suppliers may cut corners on steel thickness, welding standards, or corrosion protection to meet tight margins. While initial costs are lower, lifecycle costs increase due to premature failure, maintenance, or replacement.

Recommendation: Evaluate total cost of ownership, not just purchase price, and prioritize suppliers with proven quality management systems (e.g., ISO 9001).

By proactively addressing these pitfalls—through due diligence, third-party verification, and clear contractual terms—buyers can ensure they source grating steel that is both high-quality and free from intellectual property risks.

Logistics & Compliance Guide for Grating Steel

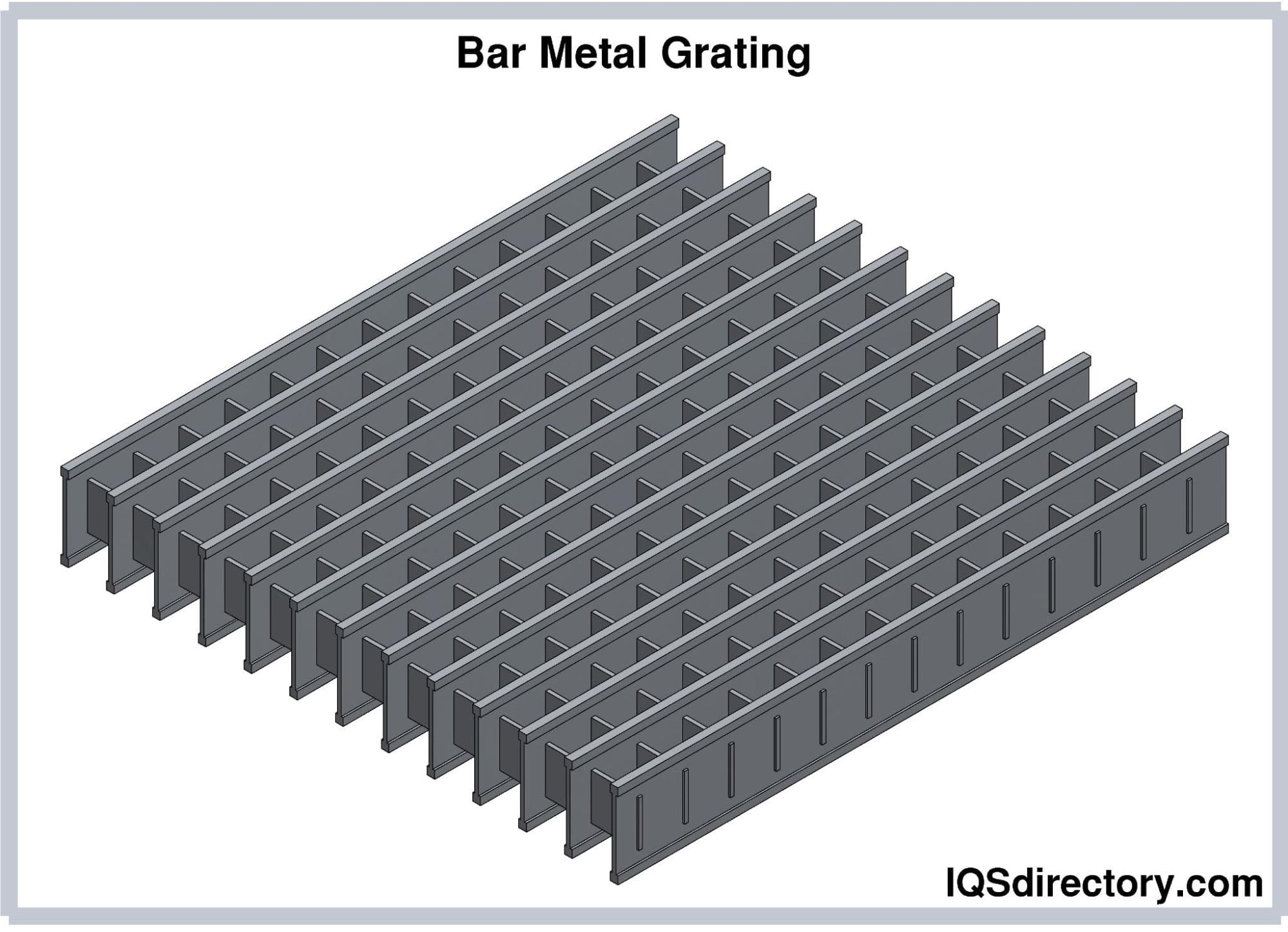

Overview of Grating Steel

Grating steel refers to load-bearing metal grates—typically made from carbon steel, stainless steel, or aluminum—used in industrial, architectural, and infrastructure applications. Common types include bar grating, steel mesh, and perforated metal. Due to its structural function and material composition, transporting and handling grating steel requires strict adherence to logistics and regulatory standards.

International Trade Classification

Grating steel is classified under various international trade codes depending on composition, form, and application. Key classifications include:

– HS Code (Harmonized System): Typically 7308.90 (other structures and parts of structures, of iron or steel) or 7314.00 (steel grating, expanded metal, or mesh).

– Schedule B (U.S. Export): 7308.90.9000 for structural grating; verify based on alloy and finish.

– Accurate classification ensures correct duties, tariffs, and compliance with import/export regulations.

Packaging and Unit Load Considerations

Proper packaging is essential to prevent damage and ensure safe handling:

– Bundling: Grating panels are usually bundled using steel or plastic strapping. Secure each bundle to prevent slippage.

– Palletization: Use wooden or metal pallets rated for the load weight. Ensure overhang is minimized (typically < 150 mm).

– Edge Protection: Apply corner protectors or edge guards to prevent deformation during transit.

– Moisture Protection: Use shrink wrap or vapor barrier packaging, especially for carbon steel, to prevent rust.

Transportation Modes and Requirements

Select the appropriate transport method based on volume, destination, and lead time:

– Road: Ideal for regional distribution. Ensure trailers are flatbed or curtain-sided with adequate tie-down points. Comply with weight limits (e.g., 44,000 kg max in EU, 80,000 lbs in U.S.).

– Rail: Cost-effective for bulk shipments over long distances. Use gondola or flatcars; secure loads with chains or straps.

– Maritime: For international shipments. Grating steel is often containerized (20’ or 40’ dry containers) or shipped as breakbulk. Follow IMDG Code guidelines for stowage and lashing.

– Air: Rare due to weight and cost; only for high-value, urgent orders.

Load Securing and Safety Standards

Ensure cargo stability during transit:

– Lashing and Bracing: Use certified chains, straps, or wire ropes meeting ISO 10570 or EUMOS standards.

– Load Distribution: Distribute weight evenly across the transport vehicle. Avoid concentrated loads that exceed axle limits.

– Dunnage: Use wooden or plastic dunnage to prevent movement and protect surfaces.

– Comply with CTU (Cargo Transport Unit) Code for safe handling and securing.

Regulatory Compliance

Adhere to international and regional regulations:

– REACH (EU): Ensure steel grating complies with chemical substance regulations, especially if coated or treated.

– RoHS (EU): Not typically applicable to raw steel, but relevant if electronic components are integrated.

– OSHA & ANSI (U.S.): Follow standards for workplace safety (e.g., ANSI/NAAMM MBG531 for architectural grating).

– Customs Documentation: Prepare commercial invoice, packing list, bill of lading, and certificate of origin. Include material specifications and heat numbers if required.

Environmental and Sustainability Considerations

- Recyclability: Steel grating is 100% recyclable. Highlight recycling rates in sustainability reporting.

- Coating Compliance: If galvanized or painted, ensure coatings meet VOC (volatile organic compound) limits under EPA or EU directives.

- Carbon Footprint: Optimize logistics routes and use carriers with environmental certifications (e.g., ISO 14001).

Import/Export Documentation

Key documents for cross-border movement:

– Commercial Invoice: Detail product description, value, currency, Incoterms® (e.g., FOB, CIF).

– Packing List: Include dimensions, weights, bundle counts, and markings.

– Certificate of Origin: Required for preferential tariffs (e.g., USMCA, RCEP).

– Mill Test Certificate (EN 10204 3.1 or 3.2): Certifies material compliance with specifications.

Risk Management and Insurance

- Cargo Insurance: Cover for damage, loss, or theft during transit (e.g., Institute Cargo Clauses).

- Force Majeure Planning: Account for delays due to weather, port congestion, or geopolitical issues.

- Quality Inspections: Conduct pre-shipment inspections (PSI) in high-risk regions.

Storage and Handling at Destination

- Warehousing: Store on level, dry surfaces. Elevate bundles off the ground using dunnage.

- Handling Equipment: Use forklifts or cranes with appropriate lifting points (e.g., spreader beams for large panels).

- Stacking Limits: Do not exceed manufacturer-recommended stack heights to avoid deformation.

Conclusion

Effective logistics and compliance for grating steel require attention to material specifications, regulatory frameworks, and safe handling practices. Partnering with certified freight forwarders and maintaining accurate documentation ensures smooth transit and customs clearance globally.

Conclusion for Sourcing Grating Steel:

Sourcing grating steel requires a strategic approach that balances quality, cost, compliance, and supply chain reliability. After evaluating potential suppliers, material specifications, certifications, and project requirements, it is evident that selecting the right grating steel involves more than just price comparison. Factors such as load capacity, corrosion resistance (e.g., galvanized or stainless options), adherence to international standards (e.g., ASTM, ISO, or EN), and timely delivery are critical for ensuring safety, durability, and long-term performance in applications such as flooring, walkways, platforms, and drainage systems.

Optimal sourcing decisions should prioritize suppliers with proven track records, proper manufacturing certifications, and the ability to provide technical support and consistent quality control. Additionally, considering sustainable and locally available materials can reduce lead times, transportation costs, and environmental impact.

In conclusion, a well-structured sourcing strategy for grating steel enhances project efficiency, ensures regulatory compliance, and contributes to the structural integrity and safety of the final installation. Continuous supplier evaluation and market monitoring will further support ongoing improvements in procurement practices.