The global graphite melting pot market is experiencing steady growth, driven by rising demand for high-purity metal processing in industries such as aerospace, automotive, and electronics. According to Grand View Research, the global graphite crucible market size was valued at USD 387.6 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is fueled by the superior thermal stability, corrosion resistance, and conductivity of graphite materials, making them ideal for high-temperature melting applications. As foundries and metal casting operations increasingly prioritize efficiency and material longevity, manufacturers of graphite melting pots are innovating to meet evolving technical and environmental standards. In this competitive landscape, a select group of eight leading manufacturers have emerged, combining advanced material science with scalable production to serve diverse industrial needs worldwide.

Top 8 Graphite Melting Pot Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Graphite Crucible Manufacturers Suppliers

Domain Est. 2000

Website: machinedgraphite.com

Key Highlights: A graphite crucible offers a non-reactive container that can withstand the high temperatures required for melting and treating metal. Crucibles offer a reliable ……

#2 Top Graphite Crucible Manufacturer in China

Domain Est. 2015

Website: superbmelt.com

Key Highlights: SuperbMelt is a professional graphite crucible manufacturer in China, we can provide various sizes for various metal smelting. RFQ Now….

#3 High Temperature Resistant Graphite Melting Pot Manufacturers …

Domain Est. 2016

Website: graphite-sino.com

Key Highlights: High Temperature Resistant Graphite Melting Pot. Place of Origin:Shandong, China Brand Name:YINXUAN Model Number:YXGR190305 Application:Used in metal ……

#4 China Customized Foundry Melting Graphite Pot Manufacturers …

Domain Est. 2019

Website: graphitemolds.com

Key Highlights: As one of the leading foundry melting graphite pot manufacturers and suppliers in China, we warmly welcome you to wholesale bulk cheap foundry melting ……

#5 Graphite Crucible Factory, Supplier

Domain Est. 2023

Website: osneq.com

Key Highlights: A graphite crucible is a container used for melting and holding metals and other materials at high temperatures. Made primarily from graphite, ……

#6 Silicon Carbide Graphite Crucible factory

Website: sicgraphitecrucible.com

Key Highlights: Qinadao Baidun and it’s subsidiaries specializes in the manufacture of crucibles for non-ferrous metal smelting, refractory products for continuous casting and ……

#7 Graphite Crucible &Graphite Mould

Domain Est. 2018

Website: cdocast.com

Key Highlights: CDOCAST Also Provide high quality Customized Graphite Crucible &Graphite Mould for the precious metal melting furnace & casting machine ,inquiry Now….

#8 Best Quality Graphite Melting Crucibles Contenti 170

Domain Est. 1997

Expert Sourcing Insights for Graphite Melting Pot

H2: Projected Market Trends for Graphite Melting Pots in 2026

The global market for graphite melting pots is poised for significant transformation by 2026, driven by advancements in industrial manufacturing, increasing demand for high-purity metal processing, and the expansion of clean energy technologies. Below is an analysis of key market trends expected to shape the graphite melting pot industry in 2026:

-

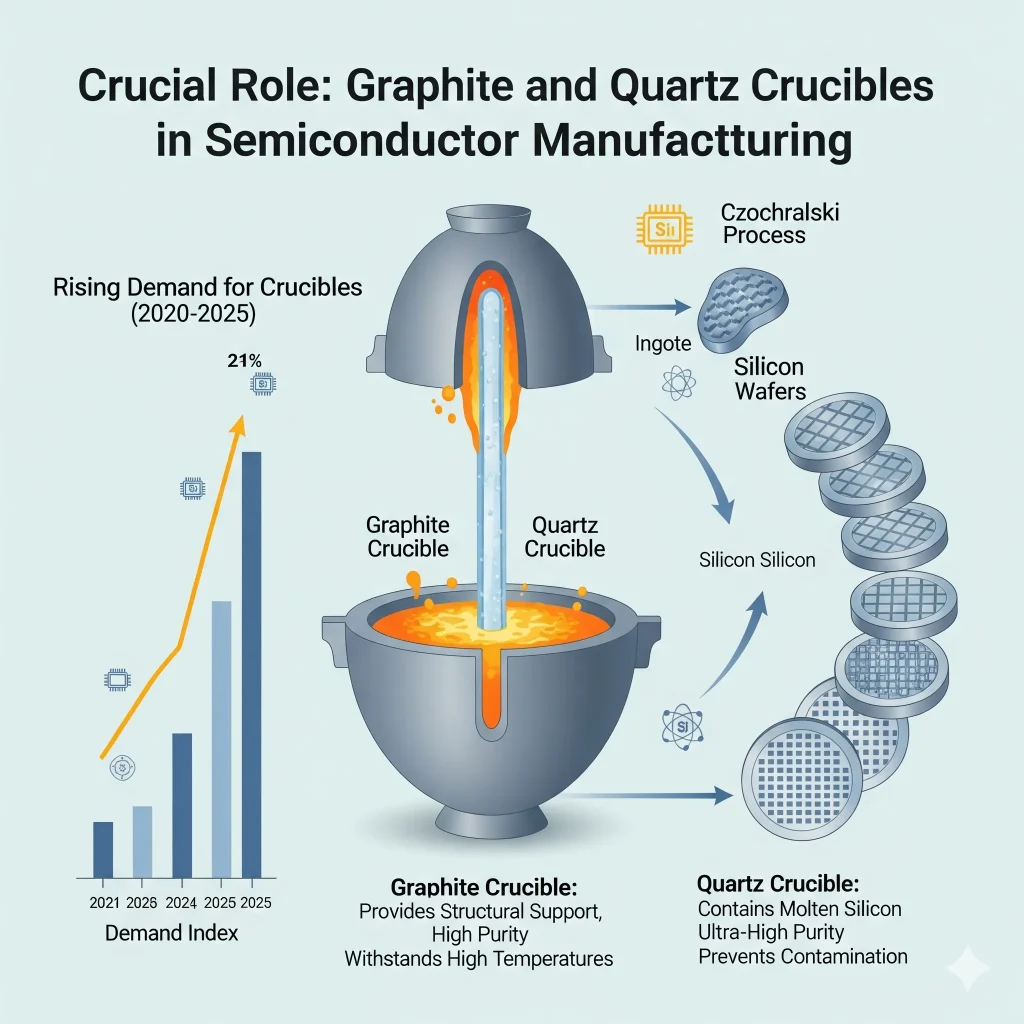

Growing Demand from the Semiconductor and Electronics Industry

The semiconductor industry’s need for ultra-pure materials is driving demand for high-performance graphite crucibles used in melting and casting processes. As semiconductor fabrication expands—particularly in Asia-Pacific regions like China, South Korea, and Taiwan—graphite melting pots with high thermal stability and low contamination properties will see increased adoption. By 2026, this segment is expected to be a primary growth driver. -

Rise in Renewable Energy Applications

The production of photovoltaic (PV) silicon for solar panels requires graphite crucibles capable of withstanding extreme temperatures during the crystal growth process (e.g., Czochralski method). With global investments in solar energy accelerating under climate goals, demand for specialized graphite melting pots in solar manufacturing is projected to grow at a CAGR of over 7% from 2023 to 2026. -

Increased Use in Foundries and Metal Casting

Graphite melting pots remain essential in non-ferrous metal casting (e.g., aluminum, copper, and zinc alloys) due to their excellent thermal conductivity and resistance to thermal shock. Automation and energy efficiency improvements in foundries are prompting upgrades to advanced graphite-based systems. Foundries seeking to reduce energy consumption and improve melt consistency are turning to high-density, isostatically pressed graphite pots, a trend expected to strengthen through 2026. -

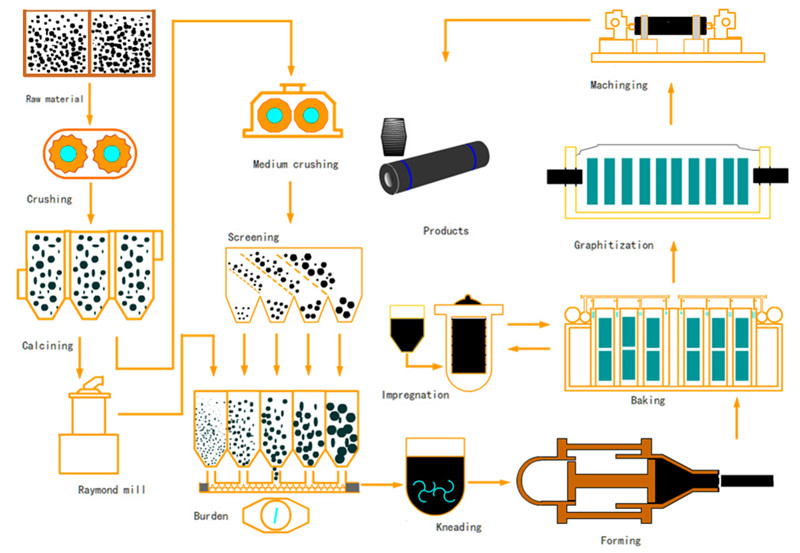

Technological Advancements and Material Innovation

Manufacturers are investing in enhanced graphite formulations, including coated or composite graphite pots with improved oxidation resistance and longer service life. Innovations such as silicon carbide-coated graphite and nano-reinforced carbon matrices are expected to enter mainstream production by 2026, reducing downtime and operational costs for end-users. -

Supply Chain and Raw Material Challenges

The market may face volatility due to fluctuating prices and availability of petroleum coke and coal tar pitch—key raw materials in synthetic graphite production. Geopolitical factors and environmental regulations on carbon emissions could impact production costs. Companies are increasingly exploring recycling of spent graphite pots and alternative materials to mitigate supply risks. -

Regional Market Shifts

Asia-Pacific will remain the dominant market, accounting for over 60% of global demand in 2026, led by China’s robust manufacturing base and India’s expanding industrial infrastructure. North America and Europe will see moderate growth, driven by aerospace, automotive lightweighting, and recycling initiatives requiring precise metal reclamation. -

Sustainability and Regulatory Pressures

Environmental regulations targeting carbon emissions and industrial waste are pushing manufacturers to adopt energy-efficient melting technologies. Graphite melting pot producers are responding with eco-friendly production methods and longer-lasting products to align with circular economy principles.

In summary, the graphite melting pot market in 2026 will be characterized by rising demand from high-tech industries, material innovation, and regional shifts, all underpinned by sustainability imperatives. Companies that invest in R&D, supply chain resilience, and environmentally responsible practices are likely to gain a competitive edge in this evolving landscape.

H2: Common Pitfalls in Sourcing Graphite Melting Pots – Quality and Intellectual Property Risks

Sourcing graphite melting pots—used in high-temperature applications such as metal casting, semiconductor processing, and vacuum furnace operations—requires careful due diligence. Two major areas of concern are product quality and intellectual property (IP) risks. Failing to address these can lead to performance failures, safety hazards, legal disputes, and supply chain disruptions.

1. Quality-Related Pitfalls

a. Inconsistent Material Purity

Low-grade graphite may contain impurities (e.g., ash, metals, sulfur) that compromise performance in high-purity environments. Impure graphite can contaminate molten metals or degrade rapidly under thermal cycling.

b. Poor Thermal and Mechanical Stability

Not all graphite materials withstand extreme thermal shocks or prolonged high temperatures. Sourcing pots made from non-isostatically pressed or improperly baked graphite increases the risk of cracking, warping, or spalling during use.

c. Inadequate Density and Strength

Lower-density graphite is more porous and mechanically weaker, reducing the pot’s lifespan and increasing the risk of breakage. Buyers may unknowingly receive material that doesn’t meet ISO or ASTM standards.

d. Lack of Traceability and Certification

Suppliers may not provide material test reports (MTRs), certificates of conformance, or batch traceability. This absence makes it difficult to verify quality claims or troubleshoot failures.

e. Counterfeit or Recycled Materials

Some suppliers may pass off reclaimed or reprocessed graphite as virgin material, which can result in unpredictable performance and shorter service life.

2. Intellectual Property (IP) Risks

a. Design Infringement

Many high-performance graphite pots incorporate proprietary geometries, coatings, or composite structures protected by patents. Sourcing from manufacturers who replicate patented designs without authorization exposes buyers to legal liability, especially in regulated industries.

b. Reverse-Engineered Products

Suppliers may produce look-alike products based on competitors’ designs. Even if not explicitly copying, these products can infringe on utility or design patents, leading to cease-and-desist orders or import bans.

c. Unclear IP Ownership in Custom Tooling

When commissioning custom graphite pots, ambiguous contracts may leave IP ownership (e.g., molds, design specs) with the supplier. This limits control over future sourcing and enables competitors to access similar designs.

d. Use of Proprietary Manufacturing Processes

Some suppliers use patented production methods (e.g., specific impregnation or graphitization techniques). Purchasing pots made via such methods without proper licensing may indirectly implicate the buyer in IP violations.

Best Practices to Mitigate Risks

- Verify Material Specifications: Require detailed technical data sheets, including grain size, density, flexural strength, and ash content.

- Demand Certifications: Insist on ISO 9001 certification, material traceability, and third-party testing reports.

- Audit Suppliers: Conduct on-site audits of manufacturing facilities to assess quality control and raw material sourcing.

- Conduct IP Due Diligence: Review supplier patents, perform freedom-to-operate analyses, and include IP indemnification clauses in contracts.

- Protect Custom Designs: Clearly define IP ownership in procurement agreements and register custom designs where possible.

By proactively addressing quality and IP concerns, organizations can ensure reliable performance, regulatory compliance, and legal safety in their graphite melting pot sourcing strategy.

Certainly! Below is a comprehensive Logistics & Compliance Guide for a Graphite Melting Pot utilizing Hydrogen (H₂) as a fuel source. This guide covers handling, transportation, storage, safety, and regulatory compliance considerations specific to both the graphite melting pot equipment and the use of hydrogen in industrial or laboratory settings.

Logistics & Compliance Guide: Graphite Melting Pot Using Hydrogen (H₂)

1. Overview

This guide outlines the logistics and compliance requirements for the safe operation, transportation, storage, and maintenance of a graphite melting pot powered by hydrogen gas (H₂). Hydrogen is used as a clean-burning fuel to achieve high temperatures (>1500°C) required for melting metals such as aluminum, copper, or precious metals.

2. Equipment Description

-

Graphite Melting Pot:

High-temperature crucible made of graphite, capable of withstanding extreme thermal cycles. Used in foundries, research labs, or small-scale metal casting. -

Hydrogen (H₂) Fuel System:

Includes H₂ storage (cylinders, tanks, or on-site generation), regulators, piping, burners, and safety controls. -

Operating Temperature: 1200–1600°C (depending on application and metal type).

3. Regulatory Compliance

3.1. International & National Regulations

| Regulation | Applicable To | Key Requirements |

|———-|—————|——————|

| OSHA (USA) | Workplace safety | 29 CFR 1910 Subpart H (Hazardous Materials), 1910.106 (Flammable Liquids), 1910.119 (Process Safety) |

| NFPA 55 & NFPA 2 | Hydrogen systems | Storage, piping, ventilation, fire protection for compressed gases and hydrogen technologies |

| DOT 49 CFR | Transportation | Hazardous materials transport; H₂ classified as UN 1049, Hazard Class 2.1 (Flammable Gas) |

| EPA (USA) | Environmental | Air quality standards; minimal emissions from H₂ combustion (H₂O only), but facility reporting may apply |

| ATEX / IECEx (EU/Global) | Explosive atmospheres | Equipment certification for use in potentially explosive H₂ environments |

| ISO 16111 / ISO 11439 | Gas storage | Standards for transportable hydrogen storage systems |

4. Logistics

4.1. Transportation

- Hydrogen Cylinders/Tanks:

- Must be labeled: UN 1049, HAZMAT Class 2.1, Flammable Gas.

- Secure upright during transport with valve protection caps.

- Segregate from oxidizers (Class 5.1) and ignition sources.

- Use certified carriers for hazardous materials (DOT/ADR certified).

-

Temperature-controlled transport to avoid pressure buildup.

-

Graphite Melting Pot (Equipment):

- Fragile and sensitive to thermal shock; pack in shock-absorbing material.

- Use wooden crates with internal bracing.

- Label: “Fragile,” “This Side Up,” “Protect from Moisture.”

4.2. Storage

- Hydrogen Storage:

- Store in well-ventilated, fire-resistant outdoor areas or ventilated gas cabinets.

- Minimum 20 ft (6 m) from oxidizers and ignition sources.

- Use flame-arrestor valves and pressure relief devices.

-

Cylinders must be chained/secured to prevent tipping.

-

Graphite Pot Storage:

- Store in dry, clean environment to prevent moisture absorption (graphite is hygroscopic).

- Avoid exposure to dust, oils, or contaminants.

- Keep on pallets off the floor; cover if long-term storage.

5. Safety & Operational Compliance

5.1. Hydrogen Handling Safety

-

Ventilation:

Use in well-ventilated or fume-extracted spaces. Hydrogen is lighter than air but can accumulate near ceilings. -

Leak Detection:

Install hydrogen gas detectors with alarms (threshold: 1% LEL). Use soap solution for manual leak checks. -

Ignition Control:

Prohibit open flames, sparks, and static electricity. Use intrinsically safe tools and equipment. -

PPE Requirements:

- Heat-resistant gloves and face shield (for molten metal).

- Flame-resistant clothing.

- Safety goggles.

- H₂-specific gas monitor (personal or fixed).

5.2. Equipment Operation

- Pre-use inspection of all gas lines, seals, and regulators.

- Purge system with inert gas (e.g., N₂) before H₂ introduction.

- Use automatic shutoff valves and flame failure sensors.

- Never leave unattended during operation.

5.3. Fire Safety

- Hydrogen fires are invisible in daylight—use UV/IR flame detectors.

- Fire extinguishers: Class D (for molten metals), CO₂ or dry chemical for electrical/gas fires.

- Emergency shutoff valves for H₂ supply must be accessible.

6. Environmental & Emissions Compliance

- H₂ Combustion Byproduct: Only water vapor (H₂O) — zero CO₂ or particulates.

- No VOCs or hazardous emissions under complete combustion.

- Ensure proper venting to prevent condensation or oxygen displacement in enclosed areas.

✅ Note: While environmentally clean, improper combustion can lead to NOx formation at high temps if air is used (vs. pure O₂). Consider air-to-fuel ratio control.

7. Maintenance & Documentation

7.1. Maintenance Schedule

| Task | Frequency | Notes |

|——|———|——-|

| Inspect H₂ lines & connections | Weekly | Soap bubble test |

| Check regulator & pressure gauges | Monthly | Calibrate as needed |

| Inspect graphite pot for cracks | After 50 cycles or monthly | Replace if cracked or eroded |

| Test gas detectors & alarms | Quarterly | Full functional test |

| Review emergency procedures | Annually | Drills and training |

7.2. Required Documentation

- Material Safety Data Sheets (MSDS/SDS) for H₂ and graphite.

- Equipment manuals and certifications.

- HAZOP (Hazard and Operability Study) for H₂ system.

- Training records for personnel.

- Inspection logs and maintenance records.

8. Emergency Preparedness

- Emergency Procedures:

- Immediate H₂ shutoff in case of leak or fire.

- Evacuate area; do not attempt to extinguish H₂ flame unless gas flow is stopped.

-

Use emergency ventilation purge.

-

Spill/Leak Response:

- Eliminate ignition sources.

- Evacuate and ventilate.

-

Notify emergency responders—identify as flammable gas (UN 1049).

-

First Aid:

- Frostbite from cryogenic H₂: warm affected area slowly with lukewarm water.

- Inhalation: move to fresh air; seek medical attention if dizziness occurs.

9. Training & Personnel

- All operators must be trained in:

- H₂ properties and hazards.

- Equipment operation and emergency shutdown.

- PPE usage and fire response.

-

Confined space entry (if applicable).

-

Certification: NFPA 55 or equivalent hydrogen safety training recommended.

10. Summary Checklist

✅ H₂ storage compliant with NFPA 55/2

✅ DOT-compliant transport of H₂

✅ Proper ventilation and gas detection

✅ Fire suppression and emergency shutoff

✅ Graphite pot stored dry and protected

✅ Personnel trained and documented

✅ SDS and operating manuals on-site

11. Contact & Resources

- OSHA Hotline: 1-800-321-OSHA (6742)

- NFPA Standards: www.nfpa.org

- DOT Hazardous Materials: www.phmsa.dot.gov

- Hydrogen Safety Clearinghouse: hydrogen-tools.org

Prepared By: [Your Name/Company]

Date: [Insert Date]

Version: 1.0

Disclaimer: This guide is for informational purposes. Always consult local regulations and conduct site-specific risk assessments before operation.

Let me know if you need a printable PDF version, a site-specific risk assessment template, or a checklist for daily operations.

Conclusion for Sourcing Graphite Melting Pot

After evaluating various suppliers, material specifications, and performance requirements, sourcing a high-quality graphite melting pot is critical for ensuring efficient, durable, and safe high-temperature metal melting operations. Key factors such as thermal conductivity, purity, density, and resistance to thermal shock must be carefully considered to match the specific application—whether for foundries, jewelry making, or laboratory use.

Sourcing from reputable manufacturers with proven experience in producing graphite crucibles ensures consistency in quality and performance. While cost is an important consideration, prioritizing durability and efficiency often justifies investing in premium-grade graphite, which reduces downtime and replacement costs over time. Additionally, evaluating lead times, customization options, and after-sales support contributes to a reliable supply chain.

In conclusion, a strategic sourcing approach—balancing quality, cost, and supplier reliability—will ensure optimal performance of graphite melting pots, supporting efficient operations and long-term cost savings in high-temperature melting applications.