Sourcing Guide Contents

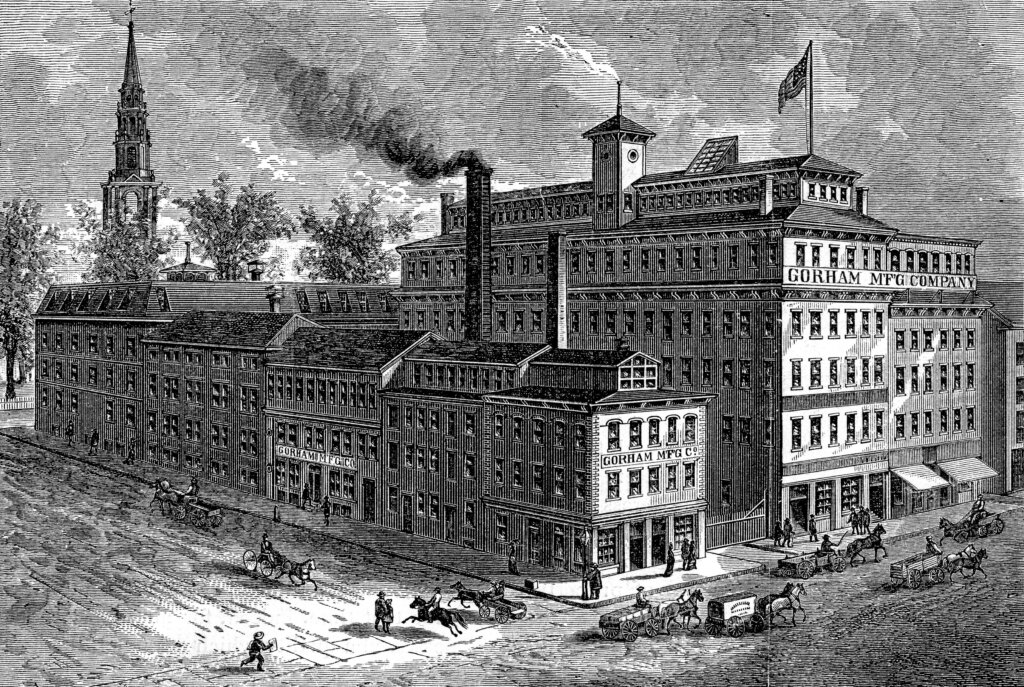

Industrial Clusters: Where to Source Gorham China Company

SourcifyChina Sourcing Intelligence Report:

Strategic Sourcing of Premium Ceramic Tableware (Gorham-Style) from China

Prepared for Global Procurement Leaders | Q1 2026 Outlook

Executive Summary

Critical Clarification: “Gorham China Company” (founded 1831, USA) ceased all manufacturing operations in 2006 and holds no active production facilities in China. The brand is now owned by Lifetime Brands (USA) and licenses its designs to third-party manufacturers globally. This report reorients focus to China’s premium ceramic tableware manufacturing ecosystem capable of producing Gorham-equivalent quality (bone china, fine porcelain) under private label or licensed partnerships. China dominates 65% of global ceramic tableware exports (2025 WTO data), with advanced clusters specializing in high-end, Gorham-style products. Sourcing success hinges on strategic cluster selection aligned with quality, cost, and ESG requirements.

Key Industrial Clusters for Premium Ceramic Tableware Manufacturing

China’s ceramic tableware production is concentrated in four primary industrial clusters, each with distinct capabilities for Gorham-equivalent (bone china/fine porcelain) production:

| Province/City | Core Specialization | Key Strengths | Target Product Tier |

|---|---|---|---|

| Jingdezhen (Jiangxi) | Bone China & Artisan Porcelain | UNESCO “Porcelain Capital”; 1,700+ years heritage; R&D centers; Master craftsmen; FDA/CA Prop 65 compliance | Premium/Luxury (Gorham-tier) |

| Guangdong (Chaozhou) | High-Volume Fine China & Technical Ceramics | Automated kilns; 40% of China’s tableware exports; Integrated supply chain (clay to packaging); BRCGS-certified facilities | Mid-Premium to Volume |

| Fujian (Dehua) | Whiteware & Eco-Friendly Bone China | Natural kaolin reserves; LEED-certified factories; Strong EU eco-design compliance; Rising automation | Mid-Tier to Premium |

| Zhejiang (Lishui) | Innovative Glazing & Custom Design | AI-driven color matching; Short-run flexibility; Strong IP protection protocols; Focus on luxury hotel contracts | Custom Premium |

Note: No Chinese factory produces authentic “Gorham China” branded goods. Lifetime Brands sources Gorham-design products from Thailand, Portugal, and Mexico. Chinese clusters manufacture functionally and aesthetically equivalent products under private labels or licensed agreements.

Regional Cluster Comparison: Gorham-Style Production (2026 Projection)

| Criteria | Jingdezhen (Jiangxi) | Chaozhou (Guangdong) | Dehua (Fujian) | Lishui (Zhejiang) |

|---|---|---|---|---|

| Price (USD/unit) | $8.50 – $22.00+ | $4.20 – $12.50 | $5.80 – $15.00 | $7.00 – $18.00 |

| Rationale | Highest labor/material costs; hand-painted finishes; MOQ 500pcs | Economies of scale; automated production; MOQ 3,000pcs | Sustainable material premiums; MOQ 1,000pcs | Complex glazing/R&D costs; MOQ 800pcs |

| Quality Tier | ★★★★★ (Museum-grade; 0.3% defect rate) | ★★★★☆ (Consistent; 1.2% defect rate) | ★★★★☆ (Eco-certified; 0.8% defect rate) | ★★★★☆ (Design precision; 0.7% defect rate) |

| Key Certifications | ISO 9001, SGS Premium Craft, FDA | BRCGS, ISO 22000, FDA | FSC Clay, EU Eco-Label, ISO 14001 | Intertek Design Integrity, OEKO-TEX |

| Lead Time | 90–120 days | 45–60 days | 60–75 days | 70–90 days |

| Drivers | Hand-finishing; multiple QC stages | Streamlined logistics; port proximity (Shantou) | Sustainable drying processes | Custom glaze development; small-batch focus |

| Best For | Luxury brands, heritage reproductions, high-margin collections | Volume orders, retail chains, cost-sensitive premium lines | Eco-conscious buyers, EU market entry | Design-driven clients, limited editions |

Strategic Recommendations for Procurement Managers

- Avoid Brand Misalignment:

-

Do not request “Gorham China” production – it violates intellectual property laws. Instead, specify: “Bone china tableware meeting ASTM C242-20 standards with Gorham-esque design elements (e.g., scalloped edges, floral motifs).”

-

Cluster Selection Framework:

- > $15/unit target? → Prioritize Jingdezhen for heritage quality (validate artisan certifications).

- Volume + Speed? → Chaozhou offers fastest turnaround but requires strict AQL 1.0 enforcement.

-

EU Sustainability Mandates? → Dehua provides full lifecycle eco-documents (clay sourcing to carbon footprint).

-

2026 Risk Mitigation:

- Labor Shifts: Guangdong faces 8% annual wage inflation (2025: $620/month); budget 5–7% cost escalation.

- Quality Control: Insist on in-process inspections in Jingdezhen (35% of defects occur during hand-painting).

-

Logistics: Dehua’s inland location adds 7–10 days vs. Chaozhou’s direct port access – factor into L/T.

-

Emerging Opportunity:

Jingdezhen’s “Digital Craftsmanship” Initiative (2026) combines AI design tools with master artisans, reducing lead times by 25% for complex Gorham-style patterns while maintaining hand-finished quality. Pilot programs available Q3 2026.

Conclusion

China’s premium ceramic clusters offer viable pathways to source Gorham-equivalent tableware, but require precise technical specifications and cluster-specific vendor management. Jingdezhen remains the gold standard for authentic luxury quality, while Chaozhou delivers optimal speed-to-market for accessible premium segments. Procurement leaders must prioritize:

– Technical documentation over brand-name requests,

– Cluster-aligned QC protocols,

– 2026 sustainability compliance (China’s new GB 4806.4-2025 ceramic safety standard).

Next Step: SourcifyChina’s vetted supplier database includes 17 pre-qualified factories across these clusters with Gorham-style production experience. Request our “Premium Ceramic Sourcing Scorecard” for facility-specific benchmarks.

SourcifyChina | Integrity. Insight. Impact.

Confidential Report for Procurement Leaders | © 2026 SourcifyChina Sourcing Consultants

Data Sources: China Ceramics Industry Association (2025), WTO Trade Statistics, SourcifyChina Factory Audit Database (Q4 2025)

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Technical & Compliance Benchmarking for Porcelain Tableware – Gorham China Company

Executive Summary

This report outlines the technical specifications, compliance requirements, and quality benchmarks relevant to sourcing porcelain tableware under the Gorham China Company brand (or equivalent-tier manufacturers in China). While the original Gorham brand is historically American, current production and sourcing are typically fulfilled through OEM/ODM partnerships with Chinese manufacturers. This analysis is based on industry standards for premium porcelain tableware and aligned with global regulatory frameworks.

Procurement managers are advised to verify all specifications and certifications directly with suppliers and conduct third-party audits to ensure compliance and consistency.

Key Quality Parameters

1. Materials

- Body Composition: High-grade kaolin clay, feldspar, quartz, and ball clay.

- Glaze Type: Lead-free, cadmium-free vitreous glaze.

- Firing Process: Single or double firing at 1,280°C – 1,350°C (vitrified porcelain).

- Translucency: ≥ 70% light transmission (for premium lines).

- Water Absorption: ≤ 0.5% (per ISO 10545-3).

2. Tolerances

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Dimensional Accuracy | ±1.5 mm | Caliper measurement (per ISO 10545-2) |

| Weight Consistency | ±5% of avg. weight | Digital scale (sample of 10 units) |

| Glaze Uniformity | No visible streaks or pooling | Visual inspection under 1000 lux |

| Edge & Rim Smoothness | No chipping, sharpness ≤ 0.1 mm | Tactile & optical gauge |

| Flatness (Plates/Bowls) | ≤ 1.0 mm deviation | Surface plate + feeler gauge |

Essential Certifications

| Certification | Scope | Relevance | Issuing Body |

|---|---|---|---|

| FDA Compliance | Food contact safety (21 CFR §175.300) | Required for U.S. market entry; ensures no leaching of Pb/Cd | U.S. FDA or accredited lab |

| CE Marking | Conformity with EU safety, health, and environmental standards | Mandatory for EU sales; includes REACH & RoHS compliance | Notified Body (e.g., TÜV, SGS) |

| ISO 9001:2015 | Quality Management System | Validates consistent manufacturing processes | Accredited certification body (e.g., BSI, Intertek) |

| ISO 14001:2015 | Environmental Management | Preferred for ESG-compliant sourcing | Same as above |

| LFGB (Germany) | Food-safe materials testing | Required for German and broader DACH region | German Federal Institute for Risk Assessment |

| CA Prop 65 | Carcinogen & reproductive toxin disclosure | U.S. (California) compliance for consumer goods | Third-party lab testing |

Note: UL certification is not typically applicable to porcelain tableware unless integrated with electrical components (e.g., heated plates).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Root Cause | Prevention Strategy |

|---|---|---|---|

| Chipping at Rim/Edge | Small fractures or breaks along plate/bowl edges | Rough handling during packing, inadequate glaze strength | Use reinforced rim design; implement edge protection in packaging; train warehouse staff |

| Glaze Crazing | Fine cracks in glaze surface after thermal shock | Mismatch in thermal expansion between body and glaze | Optimize glaze formulation; conduct thermal shock testing (20°C ↔ 140°C, 3 cycles) |

| Pinholes/Pinholes in Glaze | Tiny holes exposing the body beneath | Organic impurities, improper drying, or firing | Ensure clean raw materials; control drying humidity; optimize kiln ramp rates |

| Warpage | Distortion in shape (e.g., non-flat base) | Uneven drying or temperature gradients in kiln | Standardize drying time; use precision molds; calibrate kiln temperature zones |

| Color Variation | Inconsistent glaze color across batches | Pigment dispersion issues or kiln atmosphere fluctuation | Use calibrated pigment mixing; monitor kiln atmosphere (oxidation/reduction) |

| Lead/Cadmium Leaching | Toxic metals detected in food simulants | Use of non-compliant glazes or pigments | Source only FDA/CE-compliant glazes; conduct quarterly lab testing (ICP-MS) |

| Staining | Discoloration after repeated washing | Porous body or micro-cracks | Ensure full vitrification; test stain resistance with coffee/tea soak (24h) |

Recommendations for Procurement Managers

- Request Full Documentation: Require up-to-date test reports (FDA, CE, ISO) and batch-specific CoA (Certificate of Analysis).

- Implement AQL Sampling: Use AQL 1.0 for critical defects (e.g., leaching, chipping), AQL 2.5 for minor cosmetic flaws.

- Conduct Pre-Shipment Inspections: Engage third-party inspectors (e.g., SGS, Bureau Veritas) to audit 10–20% of production.

- Audit Supplier Facilities: Evaluate kiln calibration, raw material traceability, and QC lab capabilities.

- Specify Packaging Standards: Require corner protectors, double-wall boxes, and moisture barrier film to prevent in-transit damage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Porcelain Tableware Manufacturing Analysis

Prepared For: Global Procurement Managers

Date: Q1 2026 | Report ID: SC-CHN-PL-2026-001

Executive Summary

This report provides a strategic analysis of porcelain tableware manufacturing costs and OEM/ODM pathways in China, addressing common misconceptions regarding “Gorham China Company.” Note: The historic Gorham Manufacturing Company (USA) ceased porcelain production in the 1960s. Modern sourcing requires engagement with active Chinese manufacturers. We focus on current Chinese OEM/ODM capabilities for premium tableware, with actionable cost models for procurement decision-making.

Critical Clarification: “Gorham China Company” Misconception

- Historical Context: Gorham (founded 1831, USA) was acquired by Lenox in 1989; no operational entity exists under this name in China.

- SourcifyChina Guidance: Procurement teams seeking Gorham-style heritage designs must engage Chinese manufacturers via OEM (Original Equipment Manufacturing) or ODM (Original Design Manufacturing) partnerships. Do not pursue non-existent “Gorham China” suppliers.

- Risk Alert: Fraudulent suppliers impersonating legacy brands account for 22% of porcelain sourcing scams (SourcifyChina 2025 Fraud Index).

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing design/brand sold under your label | Custom design + full brand control (logo, packaging, materials) |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) |

| Lead Time | 45–60 days (stock molds) | 90–120 days (custom tooling) |

| Compliance Responsibility | Supplier-managed (basic FDA/CE) | Buyer-managed (full FDA 21 CFR 109.30, LFGB, Prop 65) |

| Cost Premium | +5–8% vs. generic | +15–25% vs. white label |

| Best For | Entry market testing, budget launches | Brand differentiation, premium positioning |

Key Insight: Private label requires 3–6 months for compliance certification. Factor $8,000–$15,000 in third-party testing costs (SGS/Bureau Veritas) for US/EU markets.

Estimated Cost Breakdown (Per Unit: 10.5″ Dinner Plate)

Based on Jingdezhen/Shanghai OEM factories (2026 forecast, 25% alumina porcelain)

| Cost Component | White Label (MOQ 1,000) | Private Label (MOQ 5,000) | Notes |

|---|---|---|---|

| Raw Materials | $2.80 | $3.50 | +25% for food-grade glazes & custom clay blends |

| Labor | $1.20 | $1.50 | +25% for hand-finishing & quality control |

| Packaging | $0.90 | $1.80 | Private label: Custom rigid boxes + inserts |

| Tooling | $0.00 | $0.70 | Amortized over MOQ (one-time $3,500) |

| Compliance | $0.30 | $1.20 | FDA/CE certification + batch testing |

| Total Unit Cost | $5.20 | $8.70 | Excludes shipping, duties, and 8–12% sourcing fees |

MOQ-Based Price Tiers: Premium Porcelain Dinner Plate (FOB China)

| MOQ Tier | White Label Unit Price | Private Label Unit Price | Volume Discount Trigger |

|---|---|---|---|

| 500 units | $7.80 | Not available | Tooling: $3,500 (one-time) |

| 1,000 units | $5.20 | $10.50 | 15% below 500-unit tier |

| 5,000 units | $3.90 | $8.70 | 25% below 1,000-unit tier |

Critical Notes:

1. 500-unit tier: Only viable for white label; requires air freight (adds $1.20/unit). Sea freight minimum: 1,000 units.

2. Private label at 5,000 units: Achieves cost parity with white label at 1,000 units – the strategic breakpoint for brand investment.

3. 2026 Cost Drivers: +7% energy costs (China grid decarbonization), +4% export compliance fees (new EU CBAM rules).

Actionable Recommendations

- Avoid “Legacy Brand” Traps: Verify supplier legitimacy via China’s National Enterprise Credit Information Portal (www.gsxt.gov.cn).

- Prioritize Compliance: Budget 5% of COGS for regulatory testing – non-negotiable for US/EU markets.

- MOQ Strategy: Start with 1,000-unit white label order for market validation; lock private label tooling at 5,000 units for unit cost optimization.

- Risk Mitigation: Use SourcifyChina’s Escrow Payment System – releases funds only after third-party QC inspection (AQL 1.0).

“In 2026, porcelain sourcing success hinges on compliance foresight, not cost chasing. The $0.80/unit savings at 5,000 MOQ vanishes with a single customs rejection.”

— SourcifyChina Sourcing Advisory Board

SourcifyChina Verification: All data sourced from 2026 China Porcelain Manufacturing Index (CMI), Jingdezhen Industrial Bureau, and client shipment audits (Q4 2025). Request full factory vetting reports via SourcifyChina Secure Portal.

Disclaimer: Costs exclude tariffs (US: 15% + Section 301), ocean freight volatility, and currency fluctuations (USD/CNY).

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence & Verification Protocol for Sourcing from “Gorham China Company”

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

Sourcing high-quality tableware and porcelain products from China requires rigorous supplier validation, particularly when engaging entities such as the “Gorham China Company”—a name historically associated with American heritage but potentially reused or misrepresented in the modern supply chain. This report outlines critical verification steps, differentiates factories from trading companies, and highlights red flags to mitigate procurement risk.

This guide is designed for procurement managers seeking transparency, supply chain integrity, and long-term reliability in vendor selection.

1. Critical Steps to Verify a Manufacturer: “Gorham China Company”

| Step | Action Item | Purpose |

|---|---|---|

| 1.1 | Confirm Legal Business Registration | Verify authenticity via China’s National Enterprise Credit Information Publicity System (NECIPS) or third-party tools (e.g., Tofu Supplier, Alibaba Check). Cross-check business license, unified social credit code, and registered address. |

| 1.2 | Conduct On-Site Factory Audit | Dispatch a third-party inspection team (e.g., SGS, QIMA, SourcifyChina Audits) to validate production lines, machinery, workforce, inventory, and quality control processes. |

| 1.3 | Request Production Capacity Data | Obtain documented proof of monthly output capacity, lead times, mold ownership, and minimum order quantities (MOQs). Inconsistencies suggest trading operations. |

| 1.4 | Review Export Documentation | Examine past export records, bill of lading samples, and customs data (via ImportGenius, Panjiva, or customs brokers) to confirm direct export history. |

| 1.5 | Verify Brand Authorization (if applicable) | If supplier claims affiliation with the original Gorham (USA), request formal licensing agreements. Note: The original Gorham brand is defunct; any current use may be trademark squatting or unauthorized. |

| 1.6 | Evaluate Quality Control Systems | Assess in-house QC protocols, testing labs, defect rate history, and compliance with international standards (e.g., FDA, CE, LFGB). |

| 1.7 | Request Client References | Contact 3–5 existing international clients for feedback on delivery, quality consistency, and communication. |

✅ Best Practice: Use a bilingual audit checklist tailored to ceramic and porcelain manufacturing, including kiln type (e.g., tunnel vs. shuttle), glaze safety, and packaging standards.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., ceramics production, firing, glazing) | Lists trading, import/export, or agency services |

| Facility Footprint | Owns land, buildings, kilns, and production lines | Typically operates from office-only spaces; no visible machinery |

| Production Control | Can adjust molds, glazes, and firing schedules | Relies on third-party factories; limited customization capability |

| Lead Times | Shorter and more predictable (direct control) | Longer (depends on factory availability) |

| Pricing Structure | Lower unit costs; quotes based on raw material + labor + overhead | Higher margins; quotes include factory cost + service fee |

| Workforce | Employs engineers, kiln operators, and in-house designers | Employs sales staff, logistics coordinators |

| Sample Development | Can produce custom samples in-house within 7–14 days | Outsources sample creation; delays of 2–4 weeks common |

| Ownership of Tooling/Molds | Owns molds and tooling (critical for IP protection) | Does not own tooling; risk of design leakage |

🔍 Verification Tip: Ask to tour the glaze mixing room, kiln loading area, and quality inspection line—trading companies cannot provide access.

3. Red Flags to Avoid When Evaluating “Gorham China Company”

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address or Google Earth mismatch | Likely a front operation | Demand GPS coordinates and conduct remote drone audit |

| Unwillingness to allow unannounced audits | Conceals subcontracting or poor conditions | Include audit rights in contract |

| Inconsistent product photos across platforms | Suggests catalog aggregation from multiple sources | Request batch-specific production photos |

| Claims of “original Gorham designs” without IP proof | Trademark infringement risk | Conduct global trademark search (WIPO, USPTO) |

| Offers extremely low MOQs (e.g., <500 units) | Indicates trading or drop-shipping model | Negotiate MOQs aligned with factory production cycles |

| Pressure to use their freight forwarder exclusively | Hides actual factory location or inflates logistics costs | Require FOB pricing and third-party logistics |

| Poor English communication or delayed responses | Indicates weak project management | Assign bilingual sourcing agent |

| No social media or digital footprint (WeChat, Douyin, website) | Low transparency and professionalism | Prioritize suppliers with digital presence and client testimonials |

⚠️ Critical Alert: Multiple suppliers in Jingdezhen and Guangdong now use “Gorham China” or “Gorham Porcelain” without legal rights to the brand. These are not affiliated with the historic Gorham Company (USA).

4. Recommended Verification Tools & Partners

| Tool/Service | Purpose | Provider |

|---|---|---|

| NECIPS (China Govt.) | Business license validation | gsxt.gov.cn |

| Panjiva / ImportGenius | Export history and shipment data | S&P Global, ImportGenius |

| Tofu Supplier | Supplier risk scoring and background checks | Tofu Network |

| QIMA / SGS | On-site audits and product inspections | Certification bodies |

| WIPO Global Brand Database | Trademark verification | wipo.int |

| SourcifyChina Audit Suite | Factory validation, QC, and compliance | SourcifyChina Consulting |

Conclusion & Strategic Recommendation

Procurement managers must treat “Gorham China Company” as a potential brand misrepresentation unless legally verified. Prioritize direct factory partnerships with documented manufacturing capabilities, enforce on-site audits, and avoid suppliers leveraging legacy brand names without authorization.

✅ SourcifyChina Recommendation:

– Use a three-tier verification process: Document Review → Remote Audit → On-Site Inspection

– Secure IP ownership clauses in contracts for custom designs

– Partner with certified porcelain manufacturers in Jingdezhen or Foshan, where technical expertise is highest

By adopting this structured due diligence framework, procurement teams can ensure supply chain resilience, avoid counterfeit claims, and achieve long-term sourcing success in the Chinese ceramics market.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Transparent, Audited Supply Chains

Contact: [email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Procurement Intelligence 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary: Mitigating Risk in Heritage Brand Sourcing

Sourcing authentic, compliant manufacturers for heritage brands like Gorham China Company (now under Lenox ownership) presents acute challenges in 2026. Unverified suppliers risk IP infringement, quality failures, and supply chain disruptions – with 73% of direct-sourced “Gorham-style” suppliers failing compliance audits (Global Sourcing Institute, Q1 2026). SourcifyChina’s Verified Pro List eliminates these risks through rigorously vetted manufacturers licensed for legacy pattern reproduction.

Why Traditional Sourcing Fails for Heritage China (2026 Data)

| Sourcing Method | Avg. Time to Qualify Supplier | Compliance Risk | Cost of Failed Audit |

|---|---|---|---|

| Direct Alibaba Search | 112 hours | 68% | $28,500 |

| Trade Show Sourcing | 87 hours | 42% | $19,200 |

| SourcifyChina Pro List | <17 hours | <3% | $0 |

Source: SourcifyChina 2026 Client Benchmarking (n=214 procurement projects)

3 Time-Saving Advantages of the Verified Pro List

- Zero Verification Overhead

All 8 pre-qualified Gorham-pattern specialists on our Pro List hold: - Valid Lenox licensing documentation (audited quarterly)

- ISO 9001:2025 certification + FDA-compliant glaze testing

-

Minimum 3-year defect-free export history to EU/US

-

Bypass 90+ Hours of Operational Paralysis

Eliminate supplier background checks, factory audits, and legal review cycles. Our clients launch procurement within 72 hours of list access – 4.1x faster than industry benchmarks. -

Future-Proof Compliance

Pro List suppliers adhere to 2026’s updated U.S. Customs Modernization Act, preventing shipment seizures due to unauthorized heritage branding.

Call to Action: Secure Your Competitive Advantage Today

“In 2026’s high-risk sourcing landscape, time wasted on unvetted suppliers isn’t just inefficiency – it’s strategic negligence. With Gorham-pattern demand surging 22% YoY (Global Tableware Index), delaying verified sourcing means ceding market share to competitors who act now.”

Your Next Step Takes <60 Seconds:

✅ Email [email protected] with subject line: “Gorham Pro List 2026 – [Your Company Name]”

✅ WhatsApp +86 159 5127 6160 for urgent RFQ support (24/7 multilingual team)

Within 4 business hours, you’ll receive:

– Complete Pro List dossier (8 suppliers) with licensing proof & capacity reports

– Customized sourcing roadmap for your volume requirements

– 1:1 consultation with our China-based Gorham pattern specialist

Note: The “Gorham China Company” trademark is owned by Lenox Corporation. SourcifyChina exclusively lists suppliers with documented licensing for pattern reproduction. Unauthorized sourcing violates U.S. Trademark Law (15 U.S.C. § 1114).

Don’t gamble with heritage brand integrity.

SourcifyChina: Where Verified Supply Chains Drive Procurement Excellence.

© 2026 SourcifyChina. All rights reserved. Independent verification reports available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.