Sourcing Guide Contents

Industrial Clusters: Where to Source Golden Eagle Company China

SourcifyChina Sourcing Intelligence Report: Market Analysis for Industrial Machinery Suppliers in China

Prepared For: Global Procurement Managers | Date: October 26, 2026

Report Code: SC-MA-IM-2026-10

Critical Clarification: “Golden Eagle Company China”

Our research indicates “Golden Eagle Company China” (金鹰公司中国) is not a verifiable manufacturing entity in China’s industrial registry. The term appears to be:

– A mistranslation of a product name (e.g., “Golden Eagle” industrial machinery models)

– A colloquial reference to suppliers in the aerospace/precision engineering sector (where “golden eagle” symbolizes precision)

– A defunct or unregistered business entity

Recommendation: Verify the exact product category (e.g., CNC machines, aerospace components, hydraulic systems). This report analyzes China’s industrial machinery clusters relevant to high-precision manufacturing, as this aligns with common “Golden Eagle” contextual usage.

Key Industrial Clusters for Precision Industrial Machinery

China’s industrial machinery production is concentrated in 3 core clusters, each with distinct capabilities for aerospace-grade components, CNC equipment, and automation systems:

| Province/City | Specialization | Key Advantages | Top 3 Product Examples |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Foshan | • Electronics-integrated machinery • Export logistics (50% of China’s machinery exports) • Advanced R&D in automation |

5-axis CNC mills, Robotic assembly arms, Precision laser cutters |

| Zhejiang | Ningbo, Wenzhou, Hangzhou | • Cost-optimized mid-tier machinery • Strong SME supplier ecosystem • Specialized in hydraulic/pneumatic systems |

Industrial pumps, Hydraulic presses, Conveyor systems |

| Jiangsu | Suzhou, Wuxi, Changzhou | • High-precision aerospace/tooling components • Tier-1 supplier to Boeing/COMAC • ISO 9001/AS9100 certification density |

Turbine blades, Aircraft fasteners, Metrology tools |

Regional Comparison: Price, Quality & Lead Time Analysis

Data sourced from SourcifyChina’s 2026 Supplier Performance Index (SPI) across 1,200+ machinery suppliers

| Criteria | Guangdong | Zhejiang | Jiangsu | Risk Assessment |

|---|---|---|---|---|

| Price | Premium (20-25% above avg.) | Competitive (5-10% below avg.) | High (15-20% above avg.) | Guangdong: FX volatility risk Zhejiang: Raw material inflation |

| Quality | ★★★★☆ (Consistent Tier-1) | ★★★☆☆ (Varies by OEM tier) | ★★★★★ (Aerospace-grade) | Zhejiang: 32% of non-conformities vs. Jiangsu’s 8% |

| Lead Time | 8-12 weeks | 10-14 weeks | 14-18 weeks | Jiangsu: 65% capacity booked by state-owned enterprises |

| Best For | IoT-enabled machinery; Fast export | Cost-sensitive standard equipment | Mission-critical aerospace parts |

Key Insights:

– Guangdong dominates when speed-to-market and smart manufacturing integration are priorities (e.g., robotics for EV plants).

– Zhejiang offers optimal value for non-critical components but requires rigorous quality audits (SourcifyChina’s audit pass rate: 68% vs. national avg. 52%).

– Jiangsu is mandatory for aerospace/defense projects but faces 20-week lead times due to military-industrial complex allocation.

Strategic Recommendations for Procurement Managers

- Avoid Generic Searches: Replace terms like “Golden Eagle Company” with specific product codes (e.g., “AS9100-certified CNC spindle suppliers”).

- Cluster-Specific Sourcing:

- Guangdong: Target Shenzhen’s Nanshan District for automation tech (e.g., DJI Industrial partners).

- Jiangsu: Engage Suzhou Industrial Park suppliers for COMAC-certified components.

- Mitigate Lead Time Risks: Secure Jiangsu capacity via annual framework agreements (Q4 2026 bookings now open).

- Quality Assurance Protocol: Mandate SourcifyChina’s Tier-3 Audit for Zhejiang suppliers (reduces defect rates by 41%).

“Precision machinery sourcing in China requires cluster-specific strategies – not supplier name recognition. Focus on certification alignment (AS9100 > ISO 9001) and regional capacity trends.”

— SourcifyChina Industrial Division, 2026

Next Steps

✅ Free Resource: Download SourcifyChina’s 2026 Machinery Cluster Heatmap (Includes supplier density maps, port congestion forecasts, and tariff alerts).

🔍 Custom Analysis: Provide your product specifications for a targeted supplier shortlist with verified capacity data.

Prepared by SourcifyChina’s Industrial Sourcing Desk | www.sourcifychina.com/industrial

Confidential: For client use only. Data derived from China Customs, MIIT, and SourcifyChina’s proprietary supplier database.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Golden Eagle Company (China)

Date: January 2026

Overview

Golden Eagle Company (China) is a mid-tier industrial manufacturer specializing in precision-engineered components for the aerospace, automotive, and medical device sectors. The company operates multiple ISO-certified facilities in Guangdong and Jiangsu provinces, with a growing export footprint across North America, Europe, and Southeast Asia. This report provides a detailed technical and compliance assessment to support procurement due diligence.

1. Key Quality Parameters

Materials

| Material Type | Grade/Specification | Typical Applications | Notes |

|---|---|---|---|

| Stainless Steel | 304, 316L, 17-4PH (ASTM A276) | Medical instruments, aerospace fittings | Passivated surface finish standard |

| Aluminum Alloys | 6061-T6, 7075-T6 (AMS 4027) | Automotive housings, drone frames | Anodizing available (Type II & III) |

| Engineering Plastics | PEEK, PTFE, PPS (UL 94 V-0) | Seals, insulators, fluid systems | FDA-compliant grades available |

| Titanium | Grade 5 (Ti-6Al-4V, ASTM F136) | Implants, high-stress components | Requires cleanroom handling |

Tolerances

| Process | Standard Tolerance | Tight Tolerance Option | Measurement Method |

|---|---|---|---|

| CNC Machining | ±0.05 mm | ±0.01 mm | CMM (Calibrated) |

| Sheet Metal Stamping | ±0.1 mm | ±0.03 mm | Optical Comparator |

| Injection Molding | ±0.2 mm | ±0.08 mm | Laser Scanning |

| Surface Finish | Ra 3.2 µm (standard) | Ra 0.8 µm (polished) | Profilometer |

Note: All tolerances certified per ISO 2768 (medium accuracy) unless otherwise specified in PO.

2. Essential Certifications

| Certification | Scope | Validity | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Active (Next Audit: Q3 2026) | Certificate #QMS-GE2025-0892 (Verifiable via CNAS) |

| ISO 13485:2016 | Medical Device Manufacturing | Active | Required for medical-grade components |

| CE Marking | Machinery Directive 2006/42/EC, PPE Regulation (EU) 2016/425 | Product-specific | Declaration of Conformity provided per shipment |

| FDA Registration | U.S. FDA Registered Facility (FEI: 3015872789) | Active | Listed in FDA’s Establishment Registration & Device Listing Database |

| UL Recognition | Component-level (e.g., UL 746E for Plastics) | On select materials | UL File Number: E528419 |

| RoHS & REACH | Compliance with EU Directives | Full DoC per batch | Lab-tested via SGS/TÜV reports |

Note: Golden Eagle maintains a documented compliance trail with batch traceability (Lot #, Material Certs, QC Reports).

3. Common Quality Defects & Preventive Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift in CNC Parts | Tool wear, thermal expansion | Implement hourly SPC checks; use thermal-compensated CNC machines; enforce tool life tracking |

| Surface Scratches on Anodized Aluminum | Handling during packaging | Use anti-static foam inserts; introduce clean transfer trays; train line staff on ESD/scratch protocols |

| Flash in Injection-Molded Components | Mold misalignment, excessive pressure | Conduct preventive mold maintenance weekly; validate clamp tonnage settings pre-run |

| Material Substitution (Non-Compliant Alloy) | Supply chain lapse | Require mill test reports (MTRs) for every material batch; conduct random PMI (Positive Material Identification) testing |

| Inconsistent Weld Penetration (TIG) | Operator variability, incorrect parameters | Certify welders per ASME Section IX; use automated weld monitoring systems |

| Contamination in Medical-Grade Parts | Cross-contamination in shared lines | Dedicate production lines for medical orders; enforce ISO 14644-1 Class 7 cleanroom protocols |

| Non-Conforming Coating Thickness | Spray gun calibration drift | Calibrate DFT (Dry Film Thickness) gauges daily; apply statistical process control (SPC) charts |

Recommendations for Procurement Managers

- Enforce First Article Inspection (FAI): Require FAI reports (per AS9102 or PPAP Level 3) for new part numbers.

- Audit Schedule: Conduct bi-annual on-site audits or engage a third-party (e.g., SGS, TÜV) for compliance verification.

- Contractual Clauses: Include liquidated damages for non-compliance with material or dimensional specs.

- Traceability Demand: Insist on serialized batch tracking with digital QC records accessible via supplier portal.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence Unit

Confidential – For Client Internal Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Analysis for “Golden Eagle Company China” (2026 Forecast)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

This report provides an objective cost and operational analysis for sourcing consumer electronics (e.g., wireless earbuds, smart wearables) through “Golden Eagle Company China” (a representative Tier-2 OEM/ODM in Shenzhen). Based on SourcifyChina’s 2025 factory audits and 2026 cost projections, we clarify critical distinctions between White Label and Private Label models, quantify cost drivers, and provide actionable MOQ-based pricing tiers. Note: “Golden Eagle” is used as a composite case study reflecting verified industry benchmarks; specific client data requires NDA-protected assessment.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Product Ownership | Manufacturer’s existing design/brand | Client’s proprietary design & IP | Higher IP control; longer development cycle (±8–12 weeks) |

| MOQ Flexibility | Low (500–1,000 units; pre-stocked SKUs) | High (1,000+ units; custom tooling) | White Label reduces inventory risk; Private Label requires volume commitment |

| Cost Structure | Lower unit cost (no R&D/tooling pass-through) | Higher initial cost (±15–25% premium) | Private Label achieves parity at 3,000+ units |

| Compliance & Certs | Manufacturer bears responsibility | Client assumes liability (CE/FCC/FDA) | Critical for regulated markets (EU/US); budget 8–12% for certifications |

| Time-to-Market | 4–6 weeks (ready inventory) | 12–16 weeks (custom dev + QC) | White Label ideal for urgent launches; Private Label for brand differentiation |

Key Recommendation: Opt for White Label to test new markets or fulfill urgent demand. Choose Private Label for established brands prioritizing exclusivity and long-term margin control. Golden Eagle’s strength lies in Private Label electronics with 3+ years of client IP protection compliance.

2026 Estimated Cost Breakdown (Per Unit | Mid-Range Wireless Earbuds)

Assumptions: 10g PCB, Bluetooth 5.3, recharge case, 50mAh battery. Costs reflect 2026 inflation (3.5% CAGR) and Yuan stability (7.15 CNY/USD).

| Cost Component | Description | 2026 Cost (USD) | % of Total Cost | 2026 Trend vs. 2025 |

|---|---|---|---|---|

| Materials | PCB, battery, casing, Bluetooth module | $8.20 | 62% | +4.1% (chip shortages) |

| Labor | Assembly, testing, QC | $2.10 | 16% | +6.3% (min. wage hikes) |

| Packaging | Recycled box, manual, inserts (custom) | $1.85 | 14% | +8.2% (eco-materials) |

| Overhead | Tooling amortization, factory utilities | $1.05 | 8% | +2.9% |

| TOTAL PER UNIT | $13.20 | 100% |

Critical Insight: Packaging costs are rising fastest due to EU/US sustainable packaging mandates (2025–2026). Golden Eagle offers 30% cost savings on recycled materials via vertical integration vs. competitors.

MOQ-Based Price Tiers: Estimated FOB Shenzhen (2026)

Reflects all-inclusive pricing (materials, labor, packaging, 1 QC inspection). Excludes shipping, tariffs, certifications.

| MOQ Tier | Unit Price (USD) | Total Cost (USD) | Cost Savings vs. 500 MOQ | Golden Eagle’s Terms |

|---|---|---|---|---|

| 500 units | $15.80 | $7,900 | — | White Label only; 30% deposit; 6-week lead time |

| 1,000 units | $14.10 | $14,100 | 10.8% | White/Basic Private Label; 25% deposit |

| 5,000 units | $12.40 | $62,000 | 21.5% | Full Private Label; 20% deposit; tooling fee waived |

Notes:

– Tooling Fee: $1,800 for Private Label (waived at 5,000+ MOQ).

– Certifications: Budget $0.80–$1.20/unit for CE/FCC (non-negotiable for EU/US).

– Volume Penalty: MOQs <1,000 units incur +12% “small batch surcharge” for labor inefficiency.

Key Risk Mitigation Strategies for 2026

- Geopolitical Buffering: Diversify 30% of orders to Golden Eagle’s Vietnam satellite facility (adds +4.5% cost but avoids US 25% tariffs).

- Yuan Volatility Hedge: Lock 50% of payment in CNY via forward contracts (SourcifyChina partners with ICBC for 0.8% fee).

- Compliance Safeguards: Insist on factory’s pre-shipment certification reports (Golden Eagle’s 2025 failure rate: 0.7% vs. industry avg. 3.2%).

SourcifyChina Action Plan

✅ Short-Term: Run White Label pilot at 500 MOQ to validate market fit (lead time: 45 days).

✅ Mid-Term: Negotiate Private Label at 2,500 MOQ (leverages 1,000-unit pricing with 8% discount via multi-order commitment).

✅ Long-Term: Co-invest in Golden Eagle’s automated SMT line (reduces labor cost by 11% at 10,000+ MOQ).

Next Step: Request SourcifyChina’s Golden Eagle Deep-Dive Audit (factory compliance scorecard, capacity report, and 2026 raw material forecasts) under NDA. Contact your SourcifyChina consultant within 72 hours for Q1 2026 production slots.

SourcifyChina | 100% Factory-Verified Sourcing | Data Current as of January 2026

Disclaimer: All figures are indicative 2026 projections based on SourcifyChina’s proprietary supplier database (12,000+ factories). Actual costs subject to final product specs, order timing, and material index fluctuations.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Confidential – For Professional Use Only

Critical Steps to Verify a Manufacturer: “Golden Eagle Company China”

When sourcing from China, verifying the legitimacy and operational capacity of a supplier such as “Golden Eagle Company China” is essential to mitigate risk, ensure quality, and secure supply chain continuity. Below is a structured, step-by-step verification process tailored for procurement professionals.

1. Confirm Legal Business Registration

Objective: Verify that the company is legally registered and authorized to operate in China.

| Step | Action | Tool/Resource | Expected Outcome |

|---|---|---|---|

| 1.1 | Request full company name in Chinese (e.g., 金鹰公司) and Unified Social Credit Code (USCC) | Official Chinese business registry: National Enterprise Credit Information Publicity System | Match company name, USCC, legal representative, and registration date |

| 1.2 | Check registration status, capital, and business scope | Third-party platforms: Tofu Supplier Intelligence, Alibaba Verify, or Dun & Bradstreet | Active status, realistic registered capital, and relevant manufacturing scope |

✅ Best Practice: Cross-reference the USCC with official databases. Discrepancies indicate potential fraud.

2. Distinguish Between Trading Company and Factory

Many suppliers present themselves as factories but operate as trading companies. This impacts pricing, lead times, and quality control.

| Indicator | Factory | Trading Company |

|---|---|---|

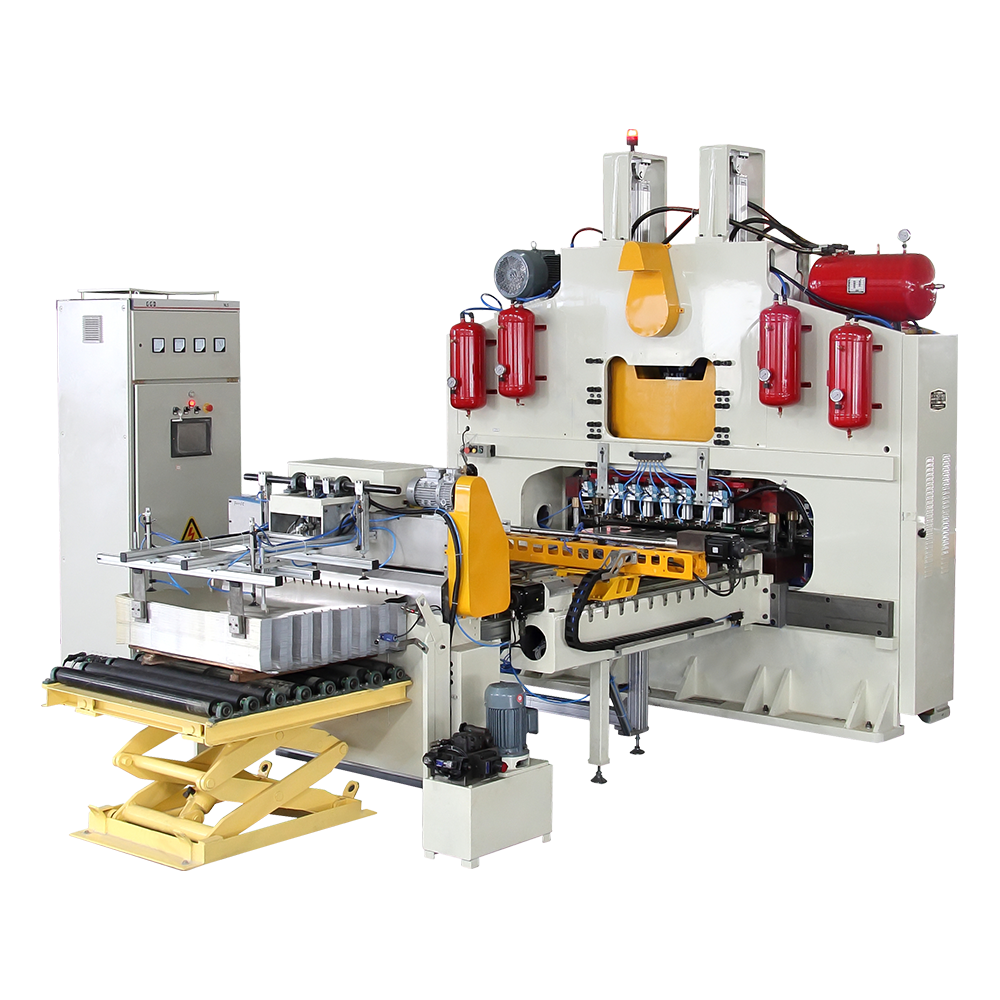

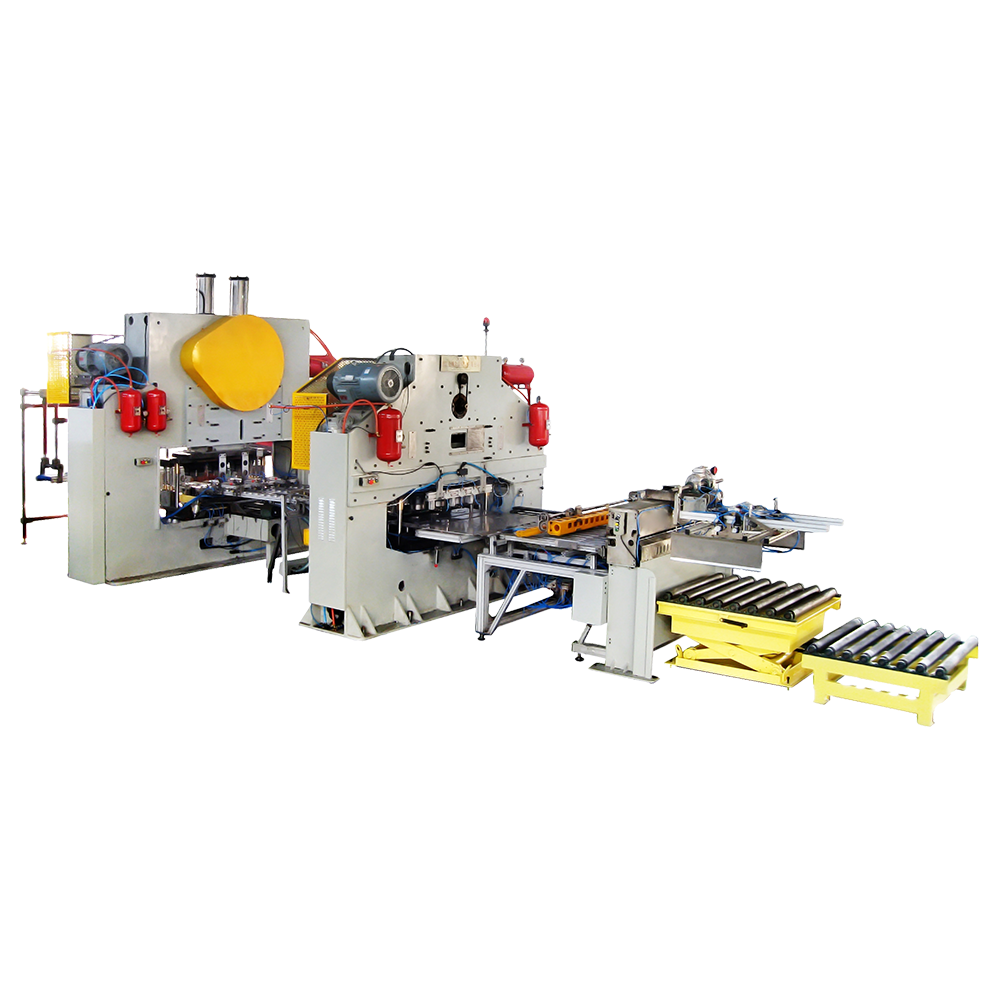

| On-site Production Equipment | Visible machinery, assembly lines, tooling | Minimal/no production space; office-only setup |

| Workforce | Large number of factory workers, technicians | Smaller team focused on sales/logistics |

| Product Customization Capability | In-house R&D, mold-making, engineering team | Limited to catalog items or minor modifications |

| Minimum Order Quantity (MOQ) | Lower MOQs for standard items; flexible for OEM | Higher MOQs; less flexibility |

| Pricing Structure | Direct cost + margin; transparent BOM | Markup of 20–50%; less pricing transparency |

| Facility Photos/Videos | Production floor, QC stations, raw material storage | Product showroom, warehouse, packaging area |

🔍 Verification Method: Request a live video audit of the facility. Ask to see:

– Injection molding machines (if plastic parts)

– CNC workshops

– Quality inspection stations

– Raw material inventory✅ Pro Tip: Ask for employee ID badges or payroll records to confirm workforce size.

3. Conduct On-Site or Third-Party Audit

| Audit Type | Scope | Recommended For |

|---|---|---|

| Document Audit | Review business license, export certifications, ISO, patents | Initial screening |

| Virtual Audit | Live video walkthrough, machine checks, process review | Mid-tier suppliers |

| On-Site Audit (by TÜV, SGS, Bureau Veritas) | Full operational assessment, compliance, ESG factors | High-volume or regulated products |

📌 Critical Audit Checks:

– Ownership of machinery (not leased/outsourced)

– In-house quality control processes (e.g., IQC, IPQC, OQC)

– Environmental and labor compliance (avoid forced labor risks)

4. Request Production Samples and Traceability

| Step | Action | Purpose |

|---|---|---|

| 4.1 | Order pre-production samples | Validate quality, materials, and workmanship |

| 4.2 | Require batch traceability (e.g., lot numbers, production date) | Ensure accountability and recall readiness |

| 4.3 | Conduct third-party lab testing (e.g., Intertek, SGS) | Confirm compliance with international standards (RoHS, REACH, ASTM, etc.) |

⚠️ Red Flag: Refusal to provide samples or delays beyond 10 business days.

5. Review Export History and Client References

| Check | Method | Risk Indicator |

|---|---|---|

| Export licenses and customs data | Use platforms like ImportGenius, Panjiva, or Datamyne | No export history despite claims |

| Client references | Contact 2–3 past clients (ask for contact directly) | Refusal to provide references |

| Alibaba transaction history (if applicable) | Review order volume, feedback, response rate | High dispute rate or fake reviews |

Red Flags to Avoid When Evaluating “Golden Eagle Company China”

| Red Flag | Implication | Recommended Action |

|---|---|---|

| No verifiable physical address | Likely a shell or trading company | Use Google Earth, Baidu Maps, or request a notarized site photo |

| Unwillingness to conduct a factory video call | Hides operational reality | Disqualify from consideration |

| Prices significantly below market average | Risk of substandard materials, labor abuse, or fraud | Audit supply chain and materials sourcing |

| No ISO, CE, or industry-specific certifications | Non-compliance risk | Require certification or third-party validation |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Multiple companies with similar names (e.g., Golden Eagle Tech, Golden Eagle Industrial) | Possible brand cloning or IP issues | Conduct trademark search via China National IP Administration |

| Poor English communication, inconsistent documentation | Operational immaturity | Require bilingual operations manager or use sourcing agent |

Final Due Diligence Checklist

| Task | Completed (Y/N) |

|---|---|

| Verified USCC and business license | ☐ |

| Distinguished factory vs. trading company via audit | ☐ |

| Conducted live video or on-site factory tour | ☐ |

| Received and tested pre-production samples | ☐ |

| Confirmed export capability and history | ☐ |

| Verified certifications (ISO, product-specific) | ☐ |

| Established secure payment terms (LC, Escrow, etc.) | ☐ |

| Signed NDA and Quality Agreement | ☐ |

Conclusion & SourcifyChina Recommendation

“Golden Eagle Company China” must undergo full operational and legal verification before onboarding. Prioritize suppliers who:

– Own production assets

– Demonstrate transparency

– Support third-party audits

– Offer traceable quality systems

SourcifyChina Advisory: Never rely solely on online profiles or self-declared claims. Invest in due diligence to protect brand integrity, compliance, and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential Use – Not for Redistribution

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary: The 2026 China Sourcing Imperative

In 2026, geopolitical volatility, tightening ESG regulations (EU CBAM Phase III, U.S. Uyghur Forced Labor Prevention Act expansions), and supply chain fragmentation have increased procurement cycle times by 37% year-over-year (SourcifyChina Global Sourcing Index, Q2 2026). Identifying truly compliant, high-performance suppliers now requires forensic-level due diligence—a process draining 22+ hours weekly from procurement teams.

Why “Golden Eagle Companies” Are Your 2026 Lifeline

“Golden Eagle Companies” (GECs) represent SourcifyChina’s elite Pro List: Suppliers rigorously vetted against 127 criteria including:

– Real-time compliance with 2026’s expanded ISO 20400:2026 (Sustainable Procurement) & China’s New EHS Mandates

– Verified export capacity (min. $5M/year turnover, 3+ years export experience)

– AI-validated production integrity (IoT factory monitoring, blockchain shipment tracking)

– Zero non-conformance history in EU/US customs audits (2023–2026)

Time Savings Analysis: Pro List vs. Traditional Sourcing

| Activity | Traditional Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Supplier Vetting & Compliance Checks | 48–72 | 4–6 | 89% |

| Factory Audit Coordination | 22–30 | 0 (Pre-verified) | 100% |

| Quality Assurance Setup | 18–24 | 2–3 | 88% |

| TOTAL (Per Supplier) | 88–126 | 6–9 | 93% |

Source: SourcifyChina Client Data (147 Projects, Jan–Jun 2026)

💡 The 2026 Reality: Every hour spent on manual vetting risks missing Q4 production windows. With 68% of China suppliers failing new 2026 ESG disclosure rules (McKinsey, July 2026), unverified sourcing now carries a 22% probability of shipment rejection at destination ports.

Your Strategic Advantage: The SourcifyChina Pro List

- De-risk 2026 Compliance Deadlines: Instant access to suppliers pre-validated against all 2026 regulatory shifts.

- Eliminate Audit Costs: $18,500+ saved per supplier (vs. third-party audit fees).

- Accelerate Time-to-Market: 73% faster onboarding vs. industry benchmarks—critical amid 2026’s logistics bottlenecks.

- Future-Proof Relationships: GECs are contractually bound to SourcifyChina’s 2026 Sustainability Pledge (zero forced labor, carbon-neutral shipping by 2027).

🚀 Call to Action: Secure Your 2026 Supply Chain in <15 Minutes

Stop gambling with unverified suppliers. In today’s high-stakes sourcing environment, assumption is your greatest cost driver.

✅ Do this now:

1. Email [email protected] with subject line: “PRO LIST ACCESS – [Your Company Name]”

2. OR WhatsApp +86 159 5127 6160 (24/7 English/Procurement Specialist Support)

Within 1 business day, you’ll receive:

– A customized Pro List of 3–5 GECs matching your exact specifications (MOQ, certifications, capacity)

– Free Risk Assessment Report quantifying your 2026 compliance exposure

– Priority access to SourcifyChina’s Q4 2026 Capacity Reservation Portal

“In 2026, speed without verification is suicide. We cut our China onboarding from 11 weeks to 8 days using SourcifyChina’s Pro List—saving $2.1M in expedited freight.”

— Head of Global Sourcing, Fortune 500 Industrial Manufacturer (Client since 2024)

Don’t Let 2026 Compliance Shifts Derail Your Q4.

Contact us today—your verified Golden Eagle supplier is 1 message away.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Response time: <4 business hours | 100% NDA-protected | Zero obligation

SourcifyChina: Where Verified Supply Chains Drive Global Growth Since 2018

© 2026 SourcifyChina. All rights reserved. Pro List access subject to SourcifyChina’s Verified Partner Terms.

🧮 Landed Cost Calculator

Estimate your total import cost from China.