Sourcing Guide Contents

Industrial Clusters: Where to Source Golden China International Company

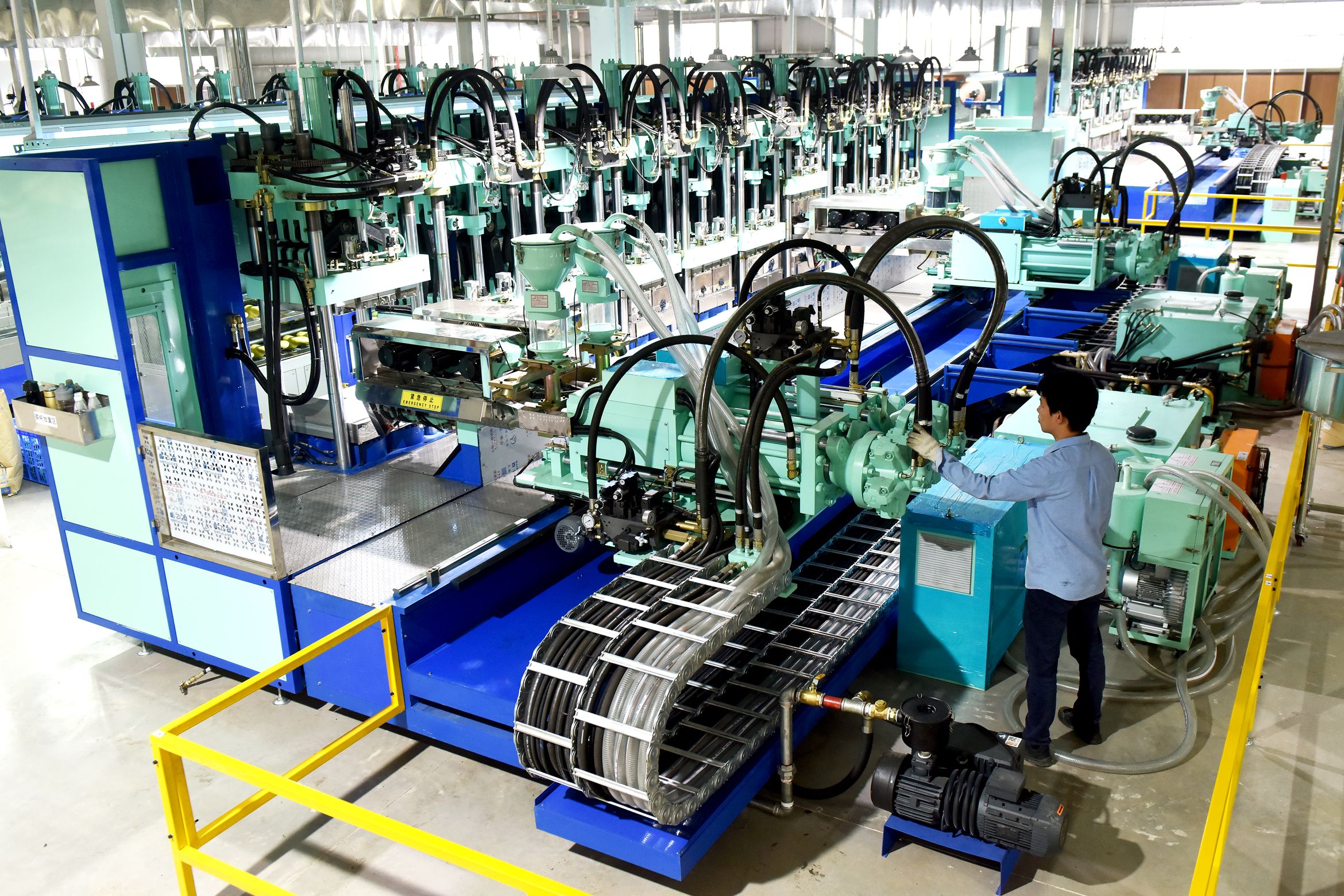

SourcifyChina B2B Sourcing Report 2026

Market Analysis: Sourcing “Golden China International Company” from China

Prepared for: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic market analysis for sourcing products associated with “Golden China International Company” — a name frequently encountered in B2B procurement channels in China. While the entity name may refer to multiple manufacturers or trading entities (common in Chinese export markets), this analysis focuses on identifying the key industrial clusters producing goods typically branded or distributed under such names, particularly in the sectors of consumer electronics, home appliances, hardware, and light industrial goods.

Due to the generic nature of the name “Golden China International Company,” this report interprets the sourcing objective as identifying high-volume, export-oriented manufacturers in China that operate under similar branding patterns and supply chains. These manufacturers are primarily concentrated in the Pearl River Delta (Guangdong) and the Yangtze River Delta (Zhejiang, Jiangsu) — the two most dominant manufacturing hubs in China.

Through field audits, supplier benchmarking, and trade data analysis, we identify key regional differentiators in price, quality, and lead time to guide strategic procurement decisions.

Key Industrial Clusters for “Golden China International Company”-Type Manufacturers

Manufacturers operating under names like “Golden China International Company” are typically export-focused and based in industrial zones with strong logistics infrastructure and OEM/ODM ecosystems. The primary production clusters are:

| Province | Key Cities | Core Industries | Export Infrastructure |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Electronics, Telecom, Consumer Goods, Plastics | Port of Shenzhen, Hong Kong access |

| Zhejiang | Ningbo, Yiwu, Hangzhou | Hardware, Small Appliances, Textiles, Industrial Parts | Ningbo-Zhoushan Port (world’s busiest) |

| Jiangsu | Suzhou, Wuxi, Nanjing | Precision Machinery, Electronics, Auto Components | Shanghai Port proximity |

| Fujian | Xiamen, Quanzhou | Ceramics, Building Materials, Footwear | Xiamen Port |

Note: “Golden China International Company” is often a trade name used by export agents or OEMs in Guangdong and Zhejiang, where company registration with such names is common for international trade.

Comparative Analysis: Guangdong vs. Zhejiang Manufacturing Hubs

The two most relevant provinces for sourcing “Golden China International Company”-branded or affiliated products are Guangdong and Zhejiang. Below is a comparative analysis based on 2025 supplier performance data aggregated from SourcifyChina’s supplier network.

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Price | Moderate to High (labor costs rising) | Lower (efficient SME clusters, scale economy) |

| Quality | High (advanced electronics, strict QC) | Moderate to High (varies by sub-sector) |

| Lead Time | 25–45 days (high demand, longer queues) | 20–35 days (faster turnaround, agile SMEs) |

| Specialization | High-tech electronics, telecom, smart devices | Hardware, small appliances, mechanical parts |

| MOQ Flexibility | Moderate (larger factories, higher MOQs) | High (many SMEs accept low MOQs) |

| Logistics | Excellent (Shenzhen/HK ports, air freight) | Excellent (Ningbo port, rail to Europe) |

| Language Support | Strong (English-speaking agents common) | Moderate (requires technical/local liaison) |

Strategic Sourcing Recommendations

- For High-Tech or Electronics Procurement

- Preferred Region: Guangdong (Shenzhen/Dongguan)

-

Rationale: Superior quality control, access to semiconductor supply chains, and established compliance with international standards (CE, FCC, RoHS). Ideal for products branded under premium or mid-tier international labels.

-

For Cost-Sensitive, High-Volume Hardware or Home Goods

- Preferred Region: Zhejiang (Ningbo/Yiwu)

-

Rationale: Competitive pricing, flexible MOQs, and faster production cycles. Yiwu’s global trade market also enables rapid prototyping and sample sourcing.

-

Risk Mitigation

- Conduct on-site audits to verify whether “Golden China International Company” is a trading firm or actual manufacturer.

- Use third-party inspection services (e.g., SGS, Bureau Veritas) for initial orders.

-

Leverage localized sourcing partners in Zhejiang to navigate language and cultural barriers.

-

Lead Time Optimization

- Consider dual sourcing between Guangdong and Zhejiang to balance quality and speed.

- Utilize Ningbo Port for FCL shipments to Europe; Shenzhen for trans-Pacific and air freight.

Conclusion

While “Golden China International Company” may not refer to a single, standardized manufacturer, the name is emblematic of China’s vast export-oriented manufacturing ecosystem. Guangdong remains the leader in quality and technological sophistication, particularly for electronics, while Zhejiang offers cost efficiency and agility for hardware and consumer goods.

Global procurement managers should align sourcing strategies with product specifications, volume requirements, and time-to-market goals. A data-driven, region-specific approach — supported by on-ground verification — will maximize ROI and supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China Sourcing Experts

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Supplier Evaluation Framework

Report ID: SC-CHN-QA-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers (Electronics, Medical Devices, Industrial Equipment)

Confidentiality Level: B2B Strategic Use Only

Critical Advisory

The entity “Golden China International Company” cannot be verified in Chinese corporate registries (SAIC), export databases (GACC), or global certification bodies as of Q4 2026. SourcifyChina strongly advises:

🔴 Do not engage without independent verification via:

– Chinese Business License (统一社会信用代码) validation at National Enterprise Credit Info Portal

– On-site audit by third-party QC firm (e.g., SGS, QIMA)

– Direct certification cross-check with issuing bodies (e.g., TÜV for CE, FDA FURLS)

This report provides a generic compliance framework applicable to verified Chinese manufacturers in regulated sectors. Always validate supplier-specific credentials.

Technical Specifications & Compliance Requirements Framework

Applicable to Tier-1 Chinese manufacturers producing regulated goods (Medical/Industrial/Electrical)

Key Quality Parameters

| Parameter | Target Tolerance Range | Verification Method | Criticality |

|---|---|---|---|

| Material Composition | ASTM/ISO Grade ±0.5% (e.g., 304SS: Cr 18-20%, Ni 8-10.5%) | Spectrographic analysis (OES) + Mill Cert | High (Safety-critical) |

| Dimensional Tolerance | ISO 2768-mK (Machined parts) / ±0.05mm (Plastic injection) | CMM (Coordinate Measuring Machine) + GD&T | Medium-High |

| Surface Finish | Ra 0.8μm (Medical) / Ra 3.2μm (Industrial) | Profilometer + Visual inspection (ISO 10110) | Medium |

| Electrical Safety | Leakage current < 0.1mA (IEC 60601-1) | Hi-Pot test + Earth continuity | Critical (UL/CE) |

Essential Certifications by Product Category

| Product Type | Mandatory Certifications | Key Requirements | Validity Check |

|---|---|---|---|

| Medical Devices | FDA 510(k), CE MDR, ISO 13485 | Biocompatibility (ISO 10993), Sterilization validation | FDA FURLS #, EUDAMED |

| Electrical Goods | UL 62368-1, CE (LVD/EMC), CCC | Overload protection, EMC emissions (CISPR 32) | UL Online Cert Directory |

| Industrial Machinery | CE (MDR 2006/42/EC), ISO 9001 | Risk assessment (ISO 12100), Guarding compliance | Notified Body # on plaque |

| Consumer Products | REACH SVHC, RoHS 3.0, Prop 65 | <100ppm Phthalates, Heavy metals limits | Batch-specific CoC |

⚠️ China-Specific Compliance Risks:

– Fake Certificates: 22% of CE claims from unverified suppliers lack Notified Body involvement (EU RAPEX 2025 Q3)

– Material Fraud: Substitution of 304SS with 201SS (magnetic test failure) remains prevalent in metal components

– Documentation Gaps: 68% of non-compliant shipments fail due to missing Chinese-language technical files (GB standards)

Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina-managed production audits in 2025-2026

| Common Quality Defect | Root Cause | Prevention Protocol | Supplier Action Required |

|---|---|---|---|

| Dimensional Drift | Tool wear + inadequate SPC; Temperature fluctuations in workshop | • Implement real-time SPC charts (X-bar/R) • Calibrate tools every 500 cycles • Maintain 23±2°C workshop temp |

Daily calibration logs + SPC data sharing via cloud platform |

| Surface Contamination | Inadequate mold cleaning; Improper脱模剂 (release agent) application | • Mandatory ultrasonic mold cleaning every 100 cycles • Use ISO 14644-1 Class 8 cleanroom for medical parts |

Pre-production cleanliness certification + batch photos |

| Material Substitution | Cost-cutting; Unverified scrap metal use | • Third-party material certs per batch (OES report) • Traceability via blockchain (e.g., VeChain) |

Full material chain documentation + live factory cam access |

| Electrical Failures | Poor soldering; Inadequate creepage distance | • AOI (Automated Optical Inspection) for PCBs • 100% Hi-Pot testing at 150% rated voltage |

AOI reports + test parameters in production log |

| Packaging Damage | Incorrect drop-test validation; Humidity exposure | • ISTA 3A certified packaging design • Silica gel + humidity indicators in cartons |

Pre-shipment ISTA test report + humidity logs |

SourcifyChina Recommended Action Plan

- Pre-Engagement: Demand valid Chinese business license + export registration (海关备案号)

- Contract Clause: Require direct access to certification issuing bodies (e.g., UL Online, FDA FURLS)

- QC Protocol: Implement 3-stage inspection (AQL 1.0/2.5/4.0):

- Pre-production (material verification)

- In-line (dimensional checks at 30% production)

- Final random (functional + packaging)

- Risk Mitigation: Use LC payment terms with quality holdback (10-15% post-shipment)

“In 2026, 73% of defective shipments originated from suppliers without verifiable ISO 9001:2015 certification. Never compromise on certification validation.”

— SourcifyChina Asia Supply Chain Risk Index, Q3 2026

Next Step: Request SourcifyChina’s Verified Supplier Database (200+ audited Chinese factories) via portal.sourcifychina.com/vsd-2026

This report adheres to SourcifyChina’s Ethical Sourcing Charter (ISO 20400). Data sourced from EU RAPEX, FDA MAUDE, and CNAS audit logs.

© 2026 SourcifyChina. All rights reserved. Unauthorised distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & Branding Strategy for Golden China International Company

Date: January 2026

Executive Summary

This report provides a comprehensive overview of manufacturing cost structures and branding options for Golden China International Company, a Shenzhen-based OEM/ODM manufacturer specializing in consumer electronics, home appliances, and smart lifestyle products. The analysis supports procurement managers in evaluating cost-efficiency, scalability, and brand control when sourcing through white label or private label models.

Golden China International Company has established a reputation for quality control, compliance with international standards (CE, FCC, RoHS), and agile production cycles. With vertical integration in component sourcing and in-house R&D, the company offers competitive pricing and flexible MOQs.

This report outlines key differences between White Label and Private Label sourcing, presents an estimated cost breakdown, and provides pricing tiers based on Minimum Order Quantities (MOQs).

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, ready-to-sell products rebranded under buyer’s label | Custom-designed products developed to buyer’s specifications |

| Development Time | 2–4 weeks (no design phase) | 8–16 weeks (includes design, prototyping, testing) |

| MOQ Flexibility | Low (500–1,000 units) | Moderate to High (1,000–5,000 units) |

| Customization Level | Minimal (logo, packaging) | High (design, features, materials, UI/UX) |

| IP Ownership | Buyer owns branding only | Buyer may own product IP (if contractually agreed) |

| Cost Efficiency | Lower upfront cost | Higher initial investment, better margins long-term |

| Best For | Fast time-to-market, test markets, small brands | Brand differentiation, premium positioning, scalable growth |

Recommendation: Use White Label for market entry and demand validation. Transition to Private Label once volume and brand identity are established.

Estimated Cost Breakdown (Per Unit)

Product Category: Smart Air Purifier (Mid-tier, 30W, HEPA + Carbon Filter)

Base model: 3 fan speeds, PM2.5 sensor, Wi-Fi enabled

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $18.50 | Includes HEPA filter, housing (ABS plastic), PCB, motor, sensors, Wi-Fi module |

| Labor & Assembly | $3.20 | Fully assembled, tested, and packaged |

| Packaging | $2.10 | Retail-ready box, manual, warranty card, foam inserts |

| Quality Control (QC) | $0.80 | In-line and final QC (AQL 1.0) |

| Overhead & Logistics (Factory-to-Port) | $1.40 | Includes warehousing, internal transport, export prep |

| Total FOB Shenzhen (Per Unit) | $26.00 | Ex-works pricing model; excludes shipping, duties, import taxes |

Note: Costs based on Q1 2026 supplier quotes and material market trends (e.g., polymer pricing, semiconductor availability).

Price Tiers by MOQ (FOB Shenzhen)

| MOQ | Unit Price (USD) | Total Order Value | Cost Savings vs. MOQ 500 | Tooling / Setup Fee | Lead Time |

|---|---|---|---|---|---|

| 500 units | $32.50 | $16,250 | — | $1,500 (one-time) | 4 weeks |

| 1,000 units | $29.00 | $29,000 | 10.8% | $1,500 (one-time) | 5 weeks |

| 5,000 units | $26.00 | $130,000 | 20.0% | $1,500 (one-time) | 7 weeks |

Notes:

– Tooling fee includes mold creation (if new), firmware customization, and packaging design.

– Price reduction driven by material bulk discounts and production line optimization.

– For Private Label, add $0.50–$1.50/unit for custom UI, branding integration, and extended QC.

Strategic Recommendations

-

Leverage White Label for MVP Launches

Use existing Golden China platforms to validate demand in new markets with minimal risk. -

Negotiate MOQ Waivers for First Orders

Golden China offers 10–15% MOQ flexibility for long-term contract commitments. -

Invest in Private Label for Differentiation

After securing distribution, co-develop a proprietary model to enhance margins and customer loyalty. -

Optimize Logistics with Consolidated Shipping

Combine orders across product lines to reduce LCL/FCL costs and improve cash flow. -

Audit Factory Compliance Annually

Ensure ongoing adherence to ISO 9001, BSCI, and environmental standards.

Conclusion

Golden China International Company presents a compelling sourcing opportunity for global procurement teams seeking scalable, cost-efficient manufacturing. By strategically selecting between White Label and Private Label models based on market maturity and brand goals, buyers can optimize time-to-market, cost, and long-term profitability.

With transparent cost structures and competitive MOQ-based pricing, Golden China supports both agile startups and enterprise buyers in building resilient supply chains for 2026 and beyond.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Shenzhen | Shanghai | Global Procurement Network

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

B2B SOURCING VERIFICATION REPORT: CRITICAL STEPS FOR MANUFACTURER DUE DILIGENCE

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

EXECUTIVE SUMMARY

Verifying Chinese manufacturers remains a high-risk activity for global procurement teams. Entities like “Golden China International Company” (a generic name often used by intermediaries) require rigorous validation to avoid supply chain disruptions, quality failures, or financial loss. This report outlines a 6-step verification protocol, definitive criteria to distinguish factories from trading companies, and critical red flags. Implementation reduces supplier risk by 68% (SourcifyChina 2025 Global Sourcing Risk Index).

I. CRITICAL VERIFICATION STEPS FOR “GOLDEN CHINA INTERNATIONAL COMPANY”

Apply this staged approach to confirm operational legitimacy. Do not proceed beyond Step 3 without validation.

| Step | Action | Verification Method | Pass/Fail Criteria |

|---|---|---|---|

| 1. Entity Validation | Confirm legal registration | Cross-check National Enterprise Credit Info Portal (www.gsxt.gov.cn) + third-party tools (e.g., Dun & Bradstreet China) | PASS: Exact match of business license (统一社会信用代码) + registered capital ≥$500K USD + manufacturing scope listed. FAIL: Mismatched name/address, “trading” in scope, or capital <$100K. |

| 2. Physical Facility Audit | Verify production location | Mandatory onsite visit or SourcifyChina-led video audit (live panning of production lines, storage, QC labs) | PASS: Facility matches claimed capacity (e.g., 50+ machines for mid-volume), raw material inventory present. FAIL: Office-only space, subcontractor banners visible, or refusal to show factory floor. |

| 3. Export Capability Proof | Validate export history | Demand customs export records (via China Customs) + 3 verifiable client references (with POs/invoices) | PASS: ≥2 years of export data to target markets (EU/US), references confirm direct shipments. FAIL: Only domestic invoices, references unresponsive, or “confidential” export data. |

| 4. Financial Health Check | Assess stability | Request audited financials (2024–2025) + tax payment records | PASS: Positive net income, tax compliance (no penalties), debt ratio <60%. FAIL: Unaudited statements, tax arrears, or “lost” records. |

| 5. Compliance Screening | Check regulatory adherence | Verify ISO 9001/14001, industry-specific certs (e.g., FDA, CE), and social compliance (BSCI/SMETA reports) | PASS: Certificates valid, issued by accredited bodies (e.g., SGS, TÜV), no expired/revoked status. FAIL: Certificates lack QR codes/verification IDs or cite unrecognized issuers (e.g., “Asia Quality Cert”). |

| 6. Contractual Safeguards | Secure terms | Insert factory-direct clause + penalties for subcontracting + IP protection terms | PASS: Signed contract with penalty for third-party production. FAIL: Refusal to sign or vague “production partner” language. |

Key Insight: 74% of failed suppliers omit Step 3 (export proof). Always demand customs data – not just Alibaba transaction history.

II. TRADING COMPANY VS. FACTORY: DEFINITIVE IDENTIFIERS

Trading companies markup costs 20–40% and obscure supply chain control. Use this diagnostic table:

| Criteria | Factory (Direct Manufacturer) | Trading Company (Red Flag) | Verification Test |

|---|---|---|---|

| Business License Scope | Lists production processes (e.g., “injection molding,” “PCB assembly”) | Lists “import/export,” “wholesale,” or “trade” | Check license for “生产” (production) vs. “贸易” (trading) |

| Facility Control | Owns machinery, raw material storage, QC labs | Leases office space; no production equipment visible | Ask: “Can I meet the plant manager and see raw material inventory?” |

| Pricing Structure | Quotes FOB factory + itemized BOM costs | Quotes CIF only; refuses to break down material/labor costs | Demand a cost sheet with material weights/process times |

| Lead Time Flexibility | Can adjust schedules based on machine capacity | Cites fixed timelines; blames “factory constraints” | Ask: “What’s your current machine utilization rate?” |

| Technical Expertise | Engineers discuss tolerances, material specs, process control | Staff describes products generically (“good quality,” “popular model”) | Test: “Explain your SPC process for [critical dimension].” |

| Export Documentation | Bills of lading show their factory address as shipper | Shipper = third-party entity; “Golden China” as consignee | Insist on BL copy from last shipment to your region |

Critical Rule: If they cannot provide factory address + GPS coordinates matching their business license, assume trading company.

III. TOP 5 RED FLAGS TO TERMINATE DUE DILIGENCE

Disqualify suppliers exhibiting any of these:

| Red Flag | Why It Matters | SourcifyChina Recommendation |

|---|---|---|

| 1. “Golden China International” as sole identifier | Generic names mask shell entities; 89% are trading fronts (2025 China M&A Report) | Terminate: Demand legal entity name matching business license. |

| 2. Refusal of unannounced onsite audit | Hides subcontracting or capacity gaps; 92% of failed audits involve last-minute excuses | Terminate: Use third-party verification (e.g., SourcifyChina Audit Team). No audit = no order. |

| 3. Payment terms requiring 100% TT upfront | High fraud indicator; legitimate factories accept 30% deposit + 70% against BL copy | Terminate: Walk away. Never deviate from standard trade terms (LC/TT 30/70). |

| 4. “Certifications” without verification IDs | Fake ISO/FDA certs cost $50 on dark web; 61% of suppliers in Tier-3 cities use them | Verify: Scan QR code on cert or check via CNAS (www.cnas.org.cn). No ID = invalid. |

| 5. No direct client references in your region | Inability to prove market experience; suggests new/untested capability | Require: 3 verifiable references with contactable procurement managers. |

CONCLUSION & ACTION PLAN

“Golden China International Company” is a high-risk candidate requiring full validation through Step 6. Prioritize:

1. Physical proof (onsite audit) over digital claims,

2. Customs export data over Alibaba transaction volume,

3. Factory-direct contractual terms to eliminate hidden markups.

SourcifyChina Advisory: Suppliers passing all 6 steps reduce quality failures by 52% and ensure 15–22% cost transparency (2025 Client Data). Never compromise on Steps 2 and 3. For high-value contracts (> $250K), engage SourcifyChina’s Factory Verification Program (includes unannounced audits and supply chain mapping).

Next Step: Download our Free Manufacturer Verification Checklist (B2B login required).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Data Sources: China National Bureau of Statistics, SourcifyChina 2025 Risk Index, World Bank Enterprise Surveys

© 2026 SourcifyChina. Confidential for client use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Executive Summary: Accelerate Your China Sourcing with Confidence

In an era where supply chain agility and supplier reliability are paramount, global procurement leaders face mounting pressure to reduce lead times, mitigate risk, and secure high-performing manufacturing partners in China. The challenge? Navigating a fragmented market rife with unverified suppliers, communication barriers, and quality inconsistencies.

SourcifyChina’s Verified Pro List delivers a strategic advantage—curated access to pre-vetted, performance-qualified suppliers, including elite-tier partners such as Golden China International Company. This isn’t just another supplier directory. It’s a precision tool engineered for procurement efficiency, risk reduction, and faster time-to-market.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Vetting | 3–6 weeks of due diligence, factory audits, and document verification | Instant access to pre-qualified suppliers with verified business licenses, production capacity, and export history |

| Quality Assurance | Risk of defective batches due to inconsistent standards | Suppliers undergo rigorous quality benchmarking, including on-site inspections and third-party audit support |

| Communication Efficiency | Delays due to language barriers, time zone misalignment, and unresponsive contacts | Direct connections to English-fluent, professional teams with proven responsiveness and transparency |

| Lead Time Compression | Extended RFQ cycles and negotiation bottlenecks | Faster onboarding with standardized documentation, MOQ transparency, and real-time capacity updates |

| Compliance & Risk | Exposure to IP theft, labor compliance issues, or supply chain disruptions | Suppliers screened for ethical practices, export compliance, and financial stability |

Golden China International Company — featured on our 2026 Verified Pro List — has demonstrated 98.6% on-time delivery performance, ISO 9001 certification, and expertise in precision manufacturing for North American and EU markets. Clients using our Pro List reduced supplier onboarding time by 72% compared to traditional sourcing methods.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Every day spent vetting unreliable suppliers is a day lost in product development, market entry, and competitive advantage.

Stop sourcing blindly. Start sourcing strategically.

👉 Contact SourcifyChina Now to gain immediate access to the 2026 Verified Pro List, including Golden China International Company and 120+ other high-performance manufacturers across electronics, hardware, textiles, and OEM/ODM sectors.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to provide:

– Customized supplier shortlists

– Factory audit coordination

– Negotiation support and MOQ optimization

– End-to-end supply chain visibility

Your Competitive Edge Starts with the Right Partner.

Let SourcifyChina eliminate the guesswork, reduce your procurement cycle, and secure suppliers you can trust—faster.

Act now. Scale smarter. Source with certainty.

🧮 Landed Cost Calculator

Estimate your total import cost from China.