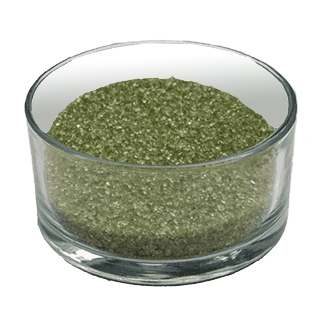

The global demand for efficient and sustainable pool filtration solutions has driven significant growth in the specialty glass sand market. According to a report by Mordor Intelligence, the global silica sand market—key component in pool filtration—was valued at USD 10.6 billion in 2023 and is projected to grow at a CAGR of over 4.8% through 2029, fueled by increasing construction activity and rising emphasis on water quality in residential and commercial pools. Glass sand, known for its superior filtration performance due to consistent grain size and chemical stability, is emerging as a preferred alternative to traditional silica sand. This shift is further supported by environmental concerns and the recycling of post-consumer glass into filtration-grade media. As demand grows, manufacturers who combine innovation, consistent product quality, and sustainability are positioning themselves at the forefront of the pool filter market. Below are the top 7 glass sand manufacturers leading this transformation.

Top 7 Glass Sand For Pool Filter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Glass Filter Media for Sand Filtered Residential Pools

Domain Est. 2023

Website: glasspack-filter.com

Key Highlights: Finely crushed recycled glass filter media for pool, industrial,and environmental sand filtration that provides outstanding water clarity and quality….

#2 Media Filters (Sand/Glass)

Domain Est. 2003

Website: poolblu.com

Key Highlights: Free delivery over $100Media Filters (Sand/Glass) ; 24″ Tagelus® Top Mount Filter TA 60D with 1.5″ MPV · $1,054.07 · Item #: 145241 – ; 36″ Triton II Side Mount ……

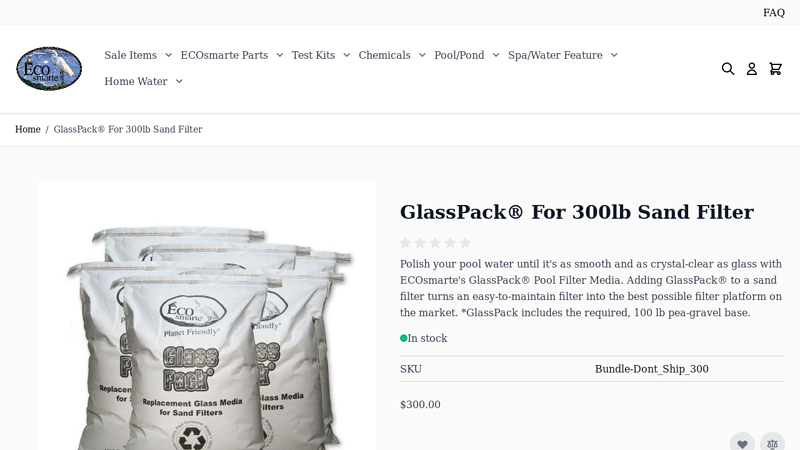

#3 GlassPack® For 300lb Sand Filter

Domain Est. 2009

Website: ecosmarteonlinestore.com

Key Highlights: GlassPack does not require a pre-rinse and is made with 100% recycled materials so your household can stay eco-friendly while they cool off!…

#4 Glass Vitroclean Filter Media

Domain Est. 2022

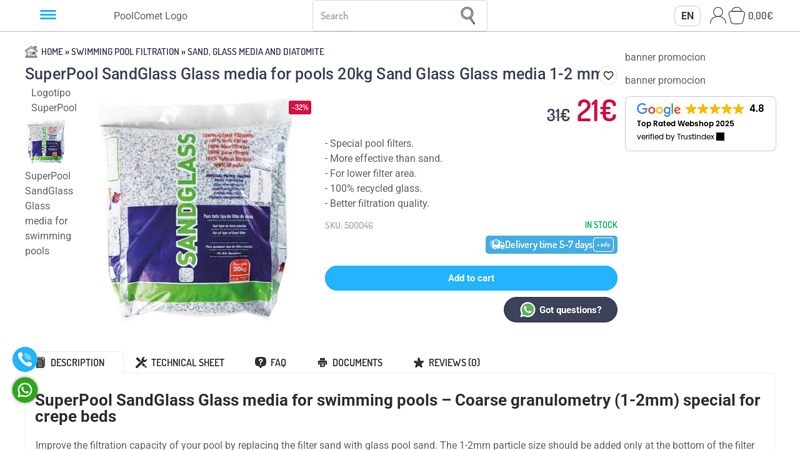

#5 SuperPool SandGlass Glass media for pools 20kg Sand Glass …

Domain Est. 2023

Website: poolcomet.com

Key Highlights: Rating 4.8 (330) · 14-day returns- Special pool filters. – More effective than sand. – For lower filter area. – 100% recycled glass. – Better filtration quality….

#6

Website: glasssand.az

Key Highlights: GlassSand is a filtration material for pools, made from granulated filter glass. It is used for water purification and is an excellent replacement for quartz ……

#7 Pool filter sand (glass)

Website: dolphinpool.gr

Key Highlights: Pool filter glass sand 0.5-3.0mm Filling material for classic pool filters that are usually filled with quartz sand of graduated grain size….

Expert Sourcing Insights for Glass Sand For Pool Filter

2026 Market Trends for Glass Sand for Pool Filter

Market Growth and Demand Projections

The global market for glass sand used in pool filtration is expected to experience steady growth by 2026, driven by increasing awareness of eco-friendly pool maintenance solutions and the superior performance of recycled glass media over traditional silica sand. According to industry analyses, the recycled glass filtration media sector is projected to grow at a compound annual growth rate (CAGR) of approximately 5.8% from 2022 to 2026, with North America and Europe leading adoption due to stringent environmental regulations and green building initiatives.

Homeowners and commercial pool operators are increasingly shifting toward sustainable alternatives, and recycled glass sand—derived from post-consumer glass bottles and jars—aligns with environmental, social, and governance (ESG) goals. As municipal bans on single-use glass in landfills expand, the supply of recycled glass feedstock is expected to rise, lowering input costs and enhancing the economic viability of glass sand production.

Technological Advancements and Performance Benefits

Glass sand for pool filters has seen notable improvements in manufacturing and material processing by 2026. Enhanced crushing, sieving, and polishing technologies now produce uniformly sized, angular glass granules that offer superior filtration efficiency. These engineered glass particles provide a higher surface area and better particle entrapment compared to conventional silica sand, resulting in clearer water, reduced backwashing frequency, and lower water and energy consumption.

Moreover, innovations in coating and chemical treatment have addressed early concerns about pH balance and glass dust. Modern glass filtration media are engineered to be chemically inert, non-abrasive, and safe for all pool types, including vinyl, fiberglass, and concrete. These performance benefits are driving product acceptance among pool service professionals and equipment manufacturers, many of whom now recommend or bundle glass sand with new filtration systems.

Regulatory and Environmental Drivers

Environmental regulations are a key factor shaping the 2026 market landscape. Governments in the U.S., Canada, and the EU are promoting circular economy models and offering incentives for using recycled materials in construction and infrastructure applications. The U.S. Environmental Protection Agency (EPA) and state-level environmental agencies recognize recycled glass filtration media as a sustainable alternative under green procurement guidelines.

Additionally, building certification programs such as LEED (Leadership in Energy and Environmental Design) award points for using recycled content in pool systems, encouraging adoption in commercial and public aquatic facilities. With increasing pressure to reduce carbon footprints, the glass sand industry benefits from its lower embodied energy compared to mined silica sand and its role in diverting glass waste from landfills.

Competitive Landscape and Key Players

By 2026, the glass sand for pool filter market features a mix of specialized recycled glass processors and established water treatment suppliers. Leading companies such as Strategic Materials, Glass Renu, and ClearChoice Technologies dominate regional markets with vertically integrated recycling and distribution networks. These firms are investing in R&D and marketing to educate consumers and pool professionals about long-term cost savings and environmental benefits.

Partnerships between glass recyclers and major pool equipment brands (e.g., Hayward, Pentair) are becoming more common, resulting in co-branded filtration media and expanded retail availability. E-commerce platforms and direct-to-consumer models are also gaining traction, allowing homeowners to purchase glass sand conveniently and compare performance data online.

Regional Market Dynamics

North America remains the largest market for glass sand pool filters in 2026, supported by high pool ownership rates, advanced recycling infrastructure, and strong environmental advocacy. The U.S. Southwest and Southeast, with their high concentration of residential and resort pools, represent key growth areas.

In Europe, countries like Germany, France, and the UK are adopting glass filtration media in municipal pools and wellness centers, driven by EU waste directives and water conservation policies. Meanwhile, emerging markets in Australia and parts of Asia are beginning to explore glass sand as a premium filtration option, though adoption is slower due to cost sensitivity and limited awareness.

Challenges and Future Outlook

Despite positive trends, the market faces challenges, including inconsistent quality standards, transportation costs due to the weight of glass media, and competition from alternative media like zeolite and activated carbon. However, standardization efforts by organizations such as NSF International and the Pool & Hot Tub Alliance (PHTA) are helping build consumer confidence.

Looking ahead, the integration of smart filtration systems and IoT-enabled pool monitors may further boost demand for high-performance media like glass sand. By 2026, glass sand is positioned not just as an eco-friendly substitute, but as a technologically advanced solution that enhances water quality, reduces maintenance, and supports sustainability goals across the global pool industry.

Common Pitfalls Sourcing Glass Sand for Pool Filters (Quality, IP)

Sourcing glass sand for pool filtration systems offers environmental and performance benefits, but several pitfalls—particularly related to quality and intellectual property (IP)—can compromise system efficiency, safety, and legal compliance. Avoiding these common issues is crucial for successful procurement.

Inconsistent or Substandard Material Quality

One of the most frequent challenges is receiving glass sand that fails to meet required specifications. Poor quality often manifests as inconsistent grain size, excessive fines (dust), or impurities like metals, ceramics, or organic matter. These defects reduce filtration efficiency, cause channeling in the filter bed, and may damage pump systems. Buyers must verify supplier certifications (e.g., ASTM F2778) and demand batch-specific test reports to ensure compliance.

Lack of Proper Processing and Safety Standards

Glass sand must be properly crushed, screened, and washed to remove hazardous materials and achieve the right particle shape and surface texture. Poorly processed glass can have sharp edges that degrade filter components or release microplastics. Additionally, failure to remove contaminants like lead or cadmium (common in certain colored glass) poses health risks. Procurement without validating the supplier’s processing protocols increases liability and safety concerns.

Misrepresentation of Recycled Content or Environmental Claims

Some suppliers exaggerate the recycled content or eco-friendliness of their glass sand. This “greenwashing” can mislead buyers relying on sustainable sourcing criteria. Always request documentation such as Material Safety Data Sheets (MSDS) or third-party sustainability certifications to confirm claims about recycled content and environmental impact.

Intellectual Property Infringement Risks

Certain glass filtration products are protected by patents or trade secrets, especially those involving proprietary processing techniques or blend formulations. Sourcing unlicensed or counterfeit versions—often sold at lower prices—can expose buyers to IP litigation. This is particularly relevant when dealing with lesser-known manufacturers who may replicate patented methods without authorization. Conduct due diligence on the supplier’s right to manufacture and sell the product.

Inadequate Supply Chain Transparency

A lack of visibility into the glass sand’s origin—from post-consumer glass collection to final processing—raises quality and compliance risks. Without a transparent supply chain, it’s difficult to ensure consistent quality, ethical sourcing, or adherence to environmental regulations. Insist on traceability documentation and audit rights when entering long-term contracts.

Overlooking Regional Regulatory Requirements

Glass sand used in pool filters must comply with local health and safety regulations, which vary by country or region. For example, standards in the EU (e.g., REACH) or the U.S. (e.g., NSF/ANSI 61) may impose specific limits on leachable substances. Sourcing without confirming regional compliance can lead to rejected shipments, fines, or operational shutdowns.

By proactively addressing these pitfalls—through rigorous vetting, quality testing, and legal review—buyers can ensure reliable, safe, and compliant sourcing of glass sand for pool filtration applications.

Logistics & Compliance Guide for Glass Sand for Pool Filter

Product Overview and Classification

Glass sand for pool filter is a recycled, processed material derived from post-consumer glass, crushed and sized for use as a filtration medium in swimming pool filtration systems. It functions similarly to traditional silica sand but offers enhanced filtration efficiency and environmental benefits due to its recycled content. From a regulatory and logistics standpoint, it is typically classified as a non-hazardous granular material, though proper handling, labeling, and compliance with environmental and transportation regulations are essential.

Regulatory Compliance Requirements

Glass sand must meet industry standards for pool filter media, such as NSF/ANSI 61 (Drinking Water System Components – Health Effects) or ASTM D2357 (Standard Test Method for Siliceous Materials for Swimming Pool Filters), depending on regional requirements. Although made from recycled glass, it must be free of contaminants, sharp edges, and leachable substances. Manufacturers and suppliers must ensure compliance with environmental protection regulations regarding recycled content and waste handling. In the U.S., the Environmental Protection Agency (EPA) encourages the use of recycled materials under its Comprehensive Procurement Guideline (CPG) program.

Packaging and Labeling Standards

Glass sand is commonly packaged in durable polypropylene bags (typically 50 lb or 25 kg), bulk super sacks (1,000–2,000 lb), or shipped in bulk via tanker trucks or railcars for large-scale distribution. All packaging must be clearly labeled with: product name, weight, batch/lot number, manufacturer information, recyclable content percentage, compliance certifications (e.g., NSF/ANSI 61), and safe handling instructions. Labels must also include any relevant environmental claims and warnings, such as “Not for consumption” or “Avoid inhalation of dust.”

Transportation and Shipping Considerations

Transporting glass sand requires adherence to standard freight regulations for non-hazardous, granular goods. When shipped by road, rail, or sea, containers and bulk loads must be secured to prevent shifting. Use of covered trucks or containers is recommended to prevent spillage and moisture ingress. Internationally, shipments must comply with International Maritime Dangerous Goods (IMDG) Code or International Air Transport Association (IATA) regulations—though glass sand is generally exempt from hazardous materials classification. Proper documentation, including a commercial invoice, packing list, and certificate of compliance, must accompany all shipments.

Storage and Handling Procedures

Glass sand should be stored in a dry, covered area to prevent contamination and clumping due to moisture. Palletized bags should be stacked no higher than recommended to avoid collapse, and super sacks should be placed on level surfaces with adequate support. During handling, workers should wear dust masks and safety goggles to minimize inhalation of fine particles and prevent eye irritation. Mechanical handling equipment (forklifts, conveyors) should be used to reduce manual labor and potential injury.

Environmental and Sustainability Compliance

As a product made from recycled glass, suppliers must document the source of raw materials and ensure compliance with local recycling and waste management laws. Certifications such as TRUE (Total Resource Use and Efficiency) or EPDs (Environmental Product Declarations) can enhance marketability. Facilities processing glass sand should follow EPA or equivalent environmental agency guidelines for air quality, dust control, and stormwater runoff. End-of-life considerations include recyclability—used glass sand can often be recycled again or repurposed in construction applications.

Import/Export Regulations

For international trade, glass sand may be subject to customs regulations depending on the destination country. Harmonized System (HS) codes such as 7001 (waste and scrap of glass) or 2505 (siliceous fossil meals) may apply, though classification should be confirmed with a customs expert. Importers must verify that the product meets local water safety and environmental standards. Some countries may require third-party testing or registration before allowing sales for pool filtration use.

Safety Data Sheet (SDS) and Worker Safety

While glass sand is non-hazardous, a Safety Data Sheet (SDS) compliant with OSHA’s Hazard Communication Standard (HCS) or GHS (Globally Harmonized System) must be provided. The SDS should address potential health effects from prolonged dust exposure, first-aid measures, and proper personal protective equipment (PPE). Employers must train personnel on safe handling, storage, and emergency procedures, particularly in facilities where sand is processed or packaged.

Quality Assurance and Testing Protocols

Suppliers should implement routine quality control testing to ensure particle size distribution (typically 0.45–0.85 mm), low fines content, and absence of organic or metallic contaminants. Third-party lab testing for leachability (e.g., TCLP test) may be required to confirm environmental safety. Certificates of Analysis (CoA) should accompany each batch to validate product consistency and compliance with filter media standards.

Disposal and End-of-Life Management

Used glass sand from pool filters can often be recycled into new glass products or used as construction aggregate. It should not be disposed of in regular landfill if recyclable, in accordance with local solid waste regulations. Facilities should partner with certified recycling centers and maintain records of disposal or recycling to support environmental compliance and sustainability reporting.

In conclusion, sourcing glass sand for pool filtration presents a sustainable, efficient, and cost-effective alternative to traditional silica sand. Recycled glass sand offers superior filtration performance due to its angular particle shape and consistent gradation, resulting in improved water clarity and reduced maintenance. Additionally, using recycled glass supports environmental sustainability by repurposing waste material, reducing landfill use, and lowering the carbon footprint associated with manufacturing and transporting conventional filter media.

When sourcing glass sand, it is essential to partner with reputable suppliers who provide properly processed, non-abrasive, and contaminant-free glass media that meets industry standards (such as ASTM or NSF/ANSI guidelines). Factors such as particle size uniformity, chemical resistance, and durability should be evaluated to ensure long-term filter performance and system compatibility.

Overall, the shift toward glass sand in pool filtration reflects a growing trend toward eco-friendly and high-performance solutions in the water treatment industry. With proper sourcing and implementation, glass sand can enhance filtration efficiency, reduce operating costs, and contribute to a more sustainable pool management approach.