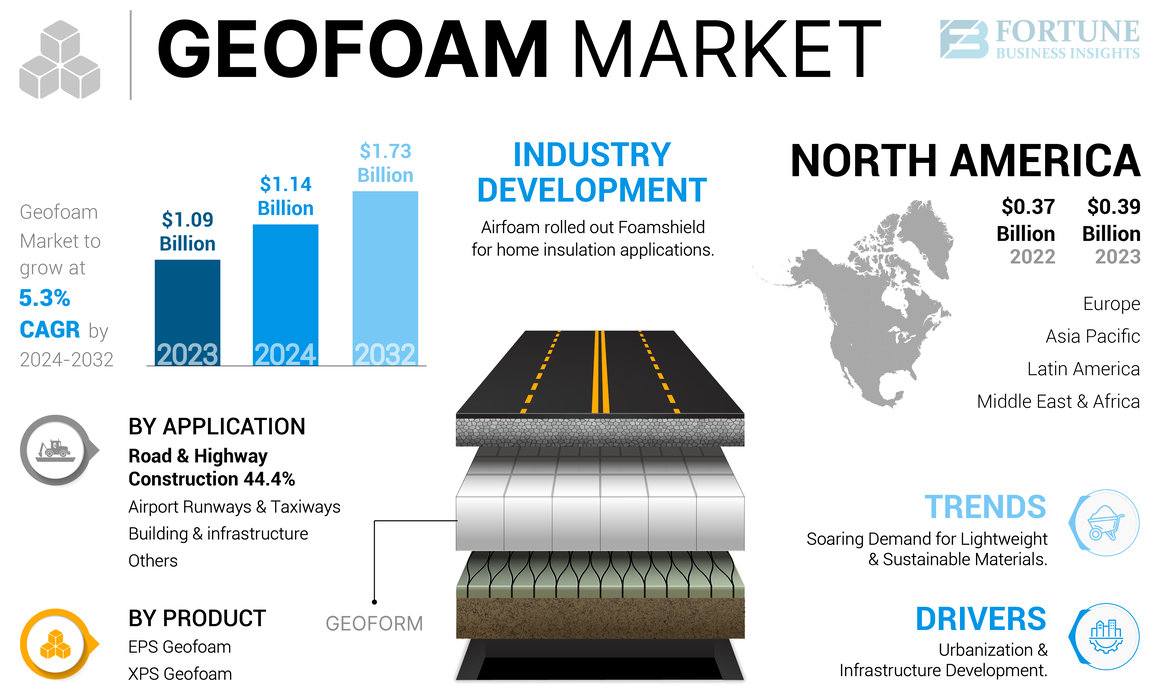

The global expanded polystyrene (EPS) geofoam market is experiencing robust growth, driven by rising demand for lightweight fill materials in infrastructure projects such as roadways, bridges, and retaining walls. According to Grand View Research, the global geofoam market size was valued at USD 587.6 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by increasing urbanization, advancements in construction technologies, and the material’s proven benefits in reducing settlement and improving structural stability. As demand surges, manufacturers are scaling production and optimizing pricing strategies to meet regional needs. Based on comprehensive pricing analysis, production capacity, and market reach, the following seven manufacturers stand out as key players offering competitive geofoam pricing without compromising on quality or performance standards.

Top 7 Geofoam Price Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Geofoam

Domain Est. 1997

Website: cellofoam.com

Key Highlights: EPS Geofoam is ideal for these types of projects, as it is highly versatile, durable, and lightweight. It is approximately 1% the weight of soil….

#2 Geofoam for Structural Insulation

Domain Est. 1998

Website: insulfoam.com

Key Highlights: InsulFoam GF (EPS Geofoam) is a lightweight, geo-synthetic fill material used as an alternative to various fill-materials, as a soil stabilizer, and in various ……

#3 Geofoam

Domain Est. 2001

Website: geofoam.com

Key Highlights: Geofoam is a lightweight fill in compliance with ASTM D6817 that gives you control over your geotechnical project….

#4 Design

Domain Est. 2001

Website: geofoam.org

Key Highlights: EPS geofoam is manufactured in various unit weights that typically range from about 0.7 to 2.85 pounds per cubic foot (11.2 to 45.7 kilograms per cubic meter)….

#5 GeoFoam America – America’s Source for all things Geo

Domain Est. 2015

Website: geofoamamerica.com

Key Highlights: We have been America’s source for GeoFoam for 40 years. Come to us with all your GeoFoam needs, No production limits / $300 Minimum Order….

#6 Standard Sized EPS Geofoam Blocks

Domain Est. 2015

Website: geofoamintl.com

Key Highlights: Standard Sized EPS Geofoam Blocks for Versatile Construction. Ideal for bridge abutments, slope and road construction, and more….

#7 Geofoam EPS

Domain Est. 2018

Website: geofoamconcepts.com

Key Highlights: At Foam Concepts we carry Geofoam EPS-15 Cellular Plastic Lightweight Fill Blocks for geotechnical applications such as roads & foundation….

Expert Sourcing Insights for Geofoam Price

H2 2026 Geofoam Price Market Trends: Consolidation, Demand Growth, and Cost Pressures

The Geofoam market in the second half of 2026 is expected to exhibit a complex picture characterized by moderate price stability overall, underpinned by resilient demand, but facing persistent cost headwinds and regional variations. Here’s a detailed analysis of the key trends shaping prices:

-

Moderate Price Stability Amidst Strong Demand:

- Stable Core Price Range: After significant volatility in preceding years (driven by energy costs and supply chain issues), H2 2026 is likely to see Geofoam prices stabilize within a relatively narrow band compared to the broader swings seen earlier in the decade. Producers have optimized operations, and long-term contracts may lock in rates.

- Sustained Infrastructure & Construction Demand: Major global infrastructure projects (transportation, utilities, waterfront development) and continued growth in commercial/residential construction, especially in seismic zones and areas with poor soil conditions, will maintain strong underlying demand for Geofoam’s lightweight fill properties. This demand acts as a floor for prices, preventing significant declines.

- Increased Adoption in Renovation & Retrofit: Growing awareness of Geofoam’s benefits in retrofit applications (e.g., slope stabilization, roof gardens, foundation underpinning) will broaden the market base, supporting consistent volume and pricing power.

-

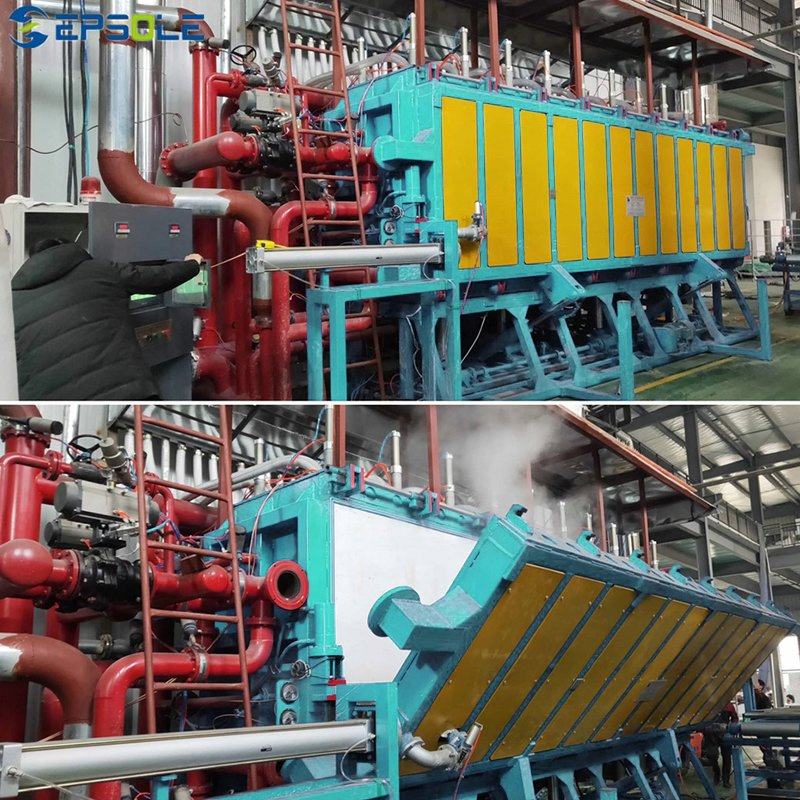

Persistent Cost Pressures as the Primary Inflationary Driver:

- Energy & Raw Material Volatility: While potentially less volatile than 2022-2023, energy prices (crucial for EPS expansion and processing) and the cost of polystyrene resin (derived from oil/gas) will remain the dominant factor. Any geopolitical tensions or supply disruptions affecting crude oil or natural gas could trigger upward pressure on Geofoam prices in H2 2026.

- Transportation & Logistics: Fuel costs and potential labor issues in the freight sector (trucking, shipping) continue to add significant cost to the final delivered price, especially for large, low-density blocks. Regional logistics efficiency will create price differentials.

- Sustainability Investments: Producers investing in recycling technologies, renewable energy for manufacturing, or using bio-based additives may see slightly higher production costs, potentially reflected in premium product pricing.

-

Regional Diversification and Competitive Dynamics:

- Regional Price Variations: Significant price differences will persist between regions due to:

- Local Production Capacity: Regions with ample local manufacturing (e.g., parts of North America, Europe) will have lower prices than import-dependent regions (e.g., parts of Asia-Pacific, South America, Middle East).

- Logistics Costs: Remote project locations or areas with poor transportation infrastructure command higher delivered prices.

- Local Demand & Competition: High local competition among suppliers can drive prices down, while monopolistic or oligopolistic markets may see higher prices.

- Consolidation & Scale: The market may see further consolidation among producers. Larger, integrated players with economies of scale and efficient logistics networks will be better positioned to manage costs and offer competitive pricing, potentially squeezing smaller regional suppliers.

- Regional Price Variations: Significant price differences will persist between regions due to:

-

Technological & Material Advancements Influencing Value, Not Necessarily Base Price:

- Enhanced Performance Grades: Development and adoption of higher-density, more resilient, or fire-retardant Geofoam grades will create premium-priced product segments. While the base EPS Geofoam price may be stable, the average selling price for the market could see slight upward pressure due to increased mix of higher-value products.

- Design & Specification Trends: Increased use of BIM (Building Information Modeling) and performance-based specifications may favor Geofoam from reputable suppliers, potentially supporting pricing power for established brands.

-

Regulatory and Sustainability Tailwinds (Indirect Pricing Impact):

- Focus on Carbon Footprint: Regulations or project specifications increasingly favor lightweight fill materials like Geofoam over traditional soil/sand due to reduced excavation, transport emissions, and carbon sequestration potential. This strengthens the value proposition, justifying the material cost to specifiers and clients, indirectly supporting price stability.

- Recycling & Circular Economy: Growing emphasis on recyclability (Geofoam is technically recyclable, though infrastructure is developing) may influence procurement decisions. Suppliers with strong sustainability credentials might command a slight premium.

H2 2026 Price Outlook Summary:

- Base Price Trend: Stable to Slightly Upward. Expect minor increases (1-3% range, varying by region) primarily driven by residual energy/resin cost pressures and inflation, rather than demand surges. Significant price drops are unlikely due to solid demand fundamentals.

- Key Driver: Energy and Polystyrene Resin Costs. This remains the biggest wildcard. A sustained drop in oil/gas prices could lead to slight price moderation; an uptick would push prices higher.

- Market Character: Differentiated. The market will not be monolithic. Price will heavily depend on region, supplier, product grade (density, specifications), order volume, and delivered location.

- Buyer Consideration: Long-term contracts with clear escalation clauses linked to key inputs (resin index, energy) will be valuable for major projects to manage budget certainty. Proactive sourcing and logistics planning will remain critical.

In conclusion, H2 2026 is expected to be a period of relative equilibrium for Geofoam pricing. While strong demand provides a solid foundation, the industry remains sensitive to the cost of its hydrocarbon-derived feedstocks and energy. Buyers should anticipate stable but firm pricing, with regional and product-specific variations being significant factors.

Common Pitfalls When Sourcing Geofoam: Price, Quality, and Intellectual Property Concerns

Sourcing Geofoam for construction and civil engineering projects can offer significant advantages in terms of weight reduction, insulation, and ease of installation. However, procurement decisions based solely on price can lead to serious issues related to quality, performance, and even intellectual property (IP) infringement. Understanding the common pitfalls helps ensure that the selected Geofoam meets project specifications and long-term durability requirements.

Overemphasizing Low Price at the Expense of Quality

One of the most frequent mistakes in sourcing Geofoam is prioritizing cost savings over material quality. While competitive pricing is important, extremely low quotes may indicate substandard materials. Low-density or improperly manufactured Geofoam can lack the required compressive strength, dimensional stability, or resistance to long-term creep. This can lead to structural failures, settlement issues, or costly remediation work down the line. Always verify product specifications, test reports (e.g., ASTM D6817 compliance), and request samples before committing to a supplier.

Ignoring Manufacturer Certifications and Traceability

Not all Geofoam is created equal. Reputable manufacturers adhere to strict production standards and provide certification documentation. Sourcing from uncertified or unknown suppliers—especially those offering unusually low prices—increases the risk of receiving off-spec or recycled-content blocks that degrade prematurely. Lack of traceability also complicates quality control and liability in case of failure. Ensure your supplier provides mill test reports, lot numbers, and proof of compliance with project requirements.

Risk of Intellectual Property Infringement

Geofoam production technologies, especially proprietary formulations and manufacturing processes, are often protected by patents or trademarks. Some low-cost suppliers, particularly overseas manufacturers, may produce materials that mimic branded products (e.g., “EPS Type XIII” equivalents) but infringe on intellectual property rights. Using such materials—even unknowingly—can expose contractors and project owners to legal risks, including injunctions, project delays, or financial penalties. Always confirm that the supplier has the right to produce and distribute the material, especially when substituting branded products.

Inadequate Attention to Project-Specific Requirements

Geofoam comes in various densities, grades, and facings, each suited to different applications (e.g., road embankments, retaining walls, rooftop insulation). Choosing a one-size-fits-all or lowest-bid option without considering design specifications—such as load-bearing capacity, thermal performance, or moisture resistance—can compromise the integrity of the entire structure. Engage with engineers and suppliers early to ensure the selected product aligns with technical requirements.

Conclusion

While competitive pricing is a legitimate concern, sourcing Geofoam requires a balanced approach that considers quality assurance, compliance, and legal risks. Due diligence—such as verifying certifications, evaluating long-term performance data, and confirming IP compliance—can prevent costly failures and legal complications. Partnering with reputable, transparent suppliers is key to achieving both value and reliability in Geofoam procurement.

Logistics & Compliance Guide for Geofoam Pricing

Understanding the logistics and compliance factors influencing Geofoam pricing is essential for accurate budgeting, timely delivery, and adherence to regulatory standards. These elements significantly impact the final cost and project feasibility.

Transportation and Delivery Logistics

Geofoam blocks are lightweight but bulky, which affects shipping methods and costs. Freight is typically calculated based on dimensional weight rather than actual weight due to the material’s low density and large volume. Delivery options include flatbed trucks, shipping containers, or specialized carriers, depending on project location and order size. Long-distance shipping, rural delivery sites, and tight delivery schedules may incur additional fees. Proper site access and unloading capabilities (e.g., forklifts or cranes) should be confirmed in advance to avoid delays and extra charges.

Packaging and Handling Requirements

Geofoam is generally shipped in stacked blocks wrapped in protective plastic or shrink-wrapped onto wooden pallets. Proper packaging ensures product integrity during transit and reduces the risk of damage. Handling must be done with care; dragging or dropping blocks can cause chipping or cracking. Suppliers may charge extra for custom cutting, labeling, or specific packaging configurations. On-site storage should be dry and protected from direct sunlight to prevent degradation before installation.

Regulatory and Environmental Compliance

Geofoam must comply with local and national building codes, fire safety standards (such as ASTM E84 for surface burning characteristics), and environmental regulations. Some jurisdictions require fire retardant-treated Geofoam or protective coverings when used in certain applications. Ensure the supplied material meets project-specific compliance needs, including environmental impact assessments or sustainability certifications (e.g., recyclability, low VOC emissions). Non-compliant materials can lead to project delays, rework, or penalties.

Import/Export Considerations (If Applicable)

For international shipments, import duties, customs clearance fees, and export documentation can influence Geofoam pricing. Tariffs vary by country and material classification. Compliance with international shipping standards (e.g., ISPM 15 for wood pallets) is required. Lead times may increase due to customs processing, so early planning is critical. Verify whether the supplier manages export logistics or if the buyer assumes responsibility.

Certifications and Documentation

Always request relevant product certifications, test reports, and material safety data sheets (MSDS) from the supplier. Documentation may include compressive strength reports (ASTM D1621), dimensional tolerance certifications, and environmental compliance statements. These documents not only support quality assurance but are often required for project approvals and inspections, directly impacting procurement timelines and costs.

Site-Specific Access and Installation Constraints

Remote, urban, or confined job sites can present logistical challenges affecting pricing. Limited access may require smaller delivery vehicles, manual handling, or staged deliveries—each adding cost. Compliance with local traffic restrictions, noise ordinances, or permitting requirements for road closures must be factored into the logistics plan. Early coordination with suppliers and site managers ensures accurate cost estimation and avoids unexpected expenses.

Conclusion on Sourcing Geofoam Pricing

After evaluating various suppliers, regional availability, material specifications, and market trends, it is evident that sourcing geofoam at a competitive price requires a strategic approach that balances cost, quality, and delivery logistics. Prices for geofoam can vary significantly based on density, block size, volume requirements, and geographic location. Engaging directly with manufacturers or regional distributors typically yields more favorable pricing, especially for large-scale projects, due to volume discounts and reduced intermediary costs.

Additionally, considering local suppliers helps minimize transportation expenses, which can constitute a substantial portion of the total cost given geofoam’s lightweight but bulky nature. Obtaining multiple competitive bids, negotiating long-term supply agreements, and aligning procurement timelines with supplier production schedules can further optimize pricing.

In summary, to secure the best geofoam pricing, buyers should conduct thorough market research, leverage volume purchasing power, prioritize local sourcing where feasible, and maintain flexibility in project timelines. This approach ensures cost-effective procurement without compromising on material performance or project deadlines.