The global car battery market is undergoing rapid expansion, driven by increasing vehicle production, the rise of electric and hybrid vehicles, and growing demand for reliable automotive power solutions. According to a report by Mordor Intelligence, the automotive battery market was valued at approximately USD 48.6 billion in 2023 and is projected to grow at a CAGR of over 6.8% from 2024 to 2029. This growth trajectory underscores the critical role of high-performance batteries in modern transportation. Amid this expanding landscape, Gem Car Batteries has emerged as a key player, particularly in niche and specialty vehicle segments. While not among the largest global manufacturers like Clarios or Exide, top-tier Gem battery producers have gained recognition for durability, deep-cycle efficiency, and innovation in lead-acid and advanced AGM (Absorbent Glass Mat) technologies—making them preferred choices for golf carts, utility vehicles, and low-speed electric transportation. The following analysis highlights the top four manufacturers in the Gem car battery space, selected based on product performance, market reach, customer reviews, and technological advancements.

Top 4 Gem Car Batteries Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 electric

Domain Est. 2020

Website: gembattery.com

Key Highlights: GEM is Batteries manufacturer and wholesaler. Online shopping for Electric vehicle batteries at Gembattery.com. Get the factory price from GEM now!…

#2 GEM EV Battery and Charger Options

Domain Est. 1998

Website: gemcar.com

Key Highlights: Learn more about GEM EV battery and charger options. GEM electric vehicles are available with AGM and Li-Ion batteries and fast-chargers….

#3 Eco Battery: Lithium Golf Cart Batteries

Domain Est. 2002

Website: ecobattery.com

Key Highlights: Eco Battery offers high-quality lithium batteries for golf carts & LSVs. We offer replacement options for your traditional lead acid batteries at an ……

#4 About Us

Domain Est. 2004

Website: en.gem.com.cn

Key Highlights: In the field of urban mining, GEM recycles and utilizes waste power batteries, electronic waste, scrapped cars, waste plastics, and nickel cobalt lithium ……

Expert Sourcing Insights for Gem Car Batteries

H2: 2026 Market Trends for Gem Car Batteries

As the automotive industry continues its rapid transformation toward electrification, sustainability, and advanced technology integration, the demand for high-performance, reliable, and cost-effective car batteries—such as those produced by Gem Car—will be shaped by several key market trends in 2026. Gem Car, known for manufacturing durable batteries primarily for low-speed electric vehicles (LSEVs), golf carts, and utility vehicles, is poised to benefit from niche market growth, technological advancements, and evolving consumer preferences. Below is an analysis of the most influential market trends affecting Gem Car Batteries in 2026:

-

Growth in Low-Speed Electric Vehicles (LSEVs) and Micro-Mobility

The global demand for LSEVs—including neighborhood electric vehicles (NEVs), golf carts, and campus shuttles—is projected to rise significantly by 2026. Urbanization, last-mile delivery needs, and the expansion of gated communities and eco-resorts are driving adoption in both commercial and recreational sectors. Gem Car Batteries, already a trusted name in this space, are well-positioned to capitalize on this trend, especially in regions with developing infrastructure for full electric vehicles (EVs). -

Increased Focus on Battery Longevity and Maintenance-Free Solutions

In 2026, consumers and fleet operators will prioritize batteries with long service life, minimal maintenance, and consistent performance. Gem Car’s offerings—particularly their deep-cycle lead-acid and emerging AGM (Absorbent Glass Mat) batteries—are gaining traction due to their reliability in stop-and-go usage patterns common in utility and recreational vehicles. The shift toward maintenance-free designs will be a key differentiator in the market. -

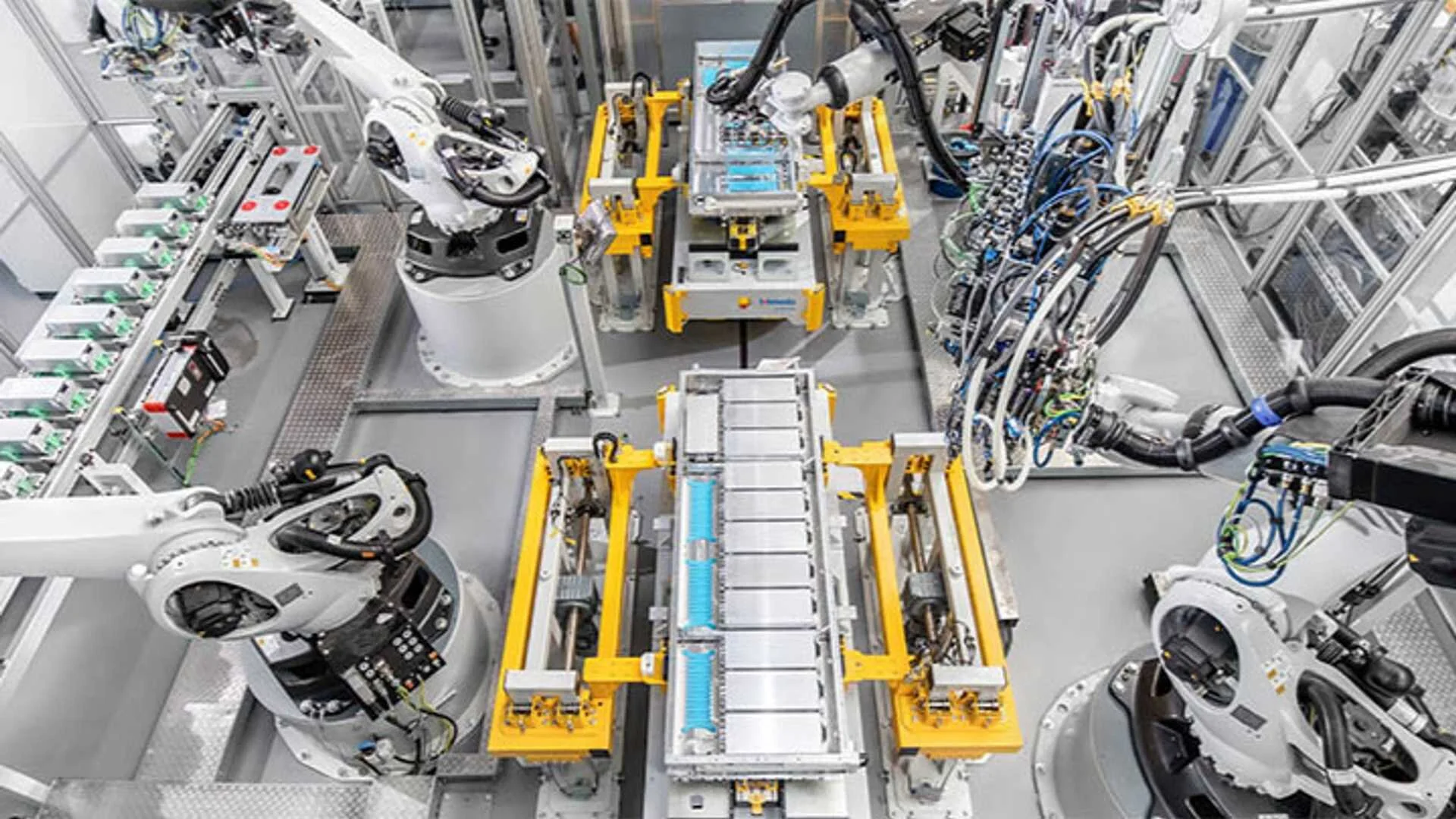

Sustainability and Recycling Initiatives

Environmental regulations and consumer awareness are pushing battery manufacturers toward greener practices. By 2026, there will be increased pressure to improve battery recyclability and reduce lead-acid environmental impact. Gem Car is expected to enhance its recycling partnerships and promote closed-loop systems to meet corporate sustainability goals and comply with tightening global environmental standards. -

Competition from Lithium-Ion Alternatives

While Gem Car primarily focuses on lead-acid technology, the broader market shift toward lightweight, high-efficiency lithium-ion batteries presents both a challenge and an opportunity. In 2026, more customers in the LSEV sector may demand lithium options for longer range and faster charging. Gem Car may need to expand into lithium-compatible battery systems or form strategic partnerships to remain competitive. -

Expansion in Emerging Markets

Developing economies in Asia, Latin America, and Africa are witnessing increased adoption of electric utility vehicles for tourism, agriculture, and logistics. Gem Car Batteries, with their cost-effective and rugged designs, are well-suited for these markets. Distribution partnerships and localized service networks will be critical to gaining market share in these high-growth regions. -

Smart Battery Integration and IoT Connectivity

By 2026, integration of smart diagnostics and IoT-enabled battery monitoring systems will become more common. Fleet managers and commercial users will demand real-time data on battery health, charge cycles, and performance. While Gem Car has traditionally focused on mechanical reliability, incorporating basic telemetry or compatibility with third-party monitoring systems could enhance product appeal. -

Supply Chain Resilience and Raw Material Costs

Fluctuations in lead, plastic, and other raw material prices will continue to impact battery manufacturing. In 2026, companies with diversified supply chains and regional production capabilities will have a competitive edge. Gem Car’s ability to navigate material cost volatility through strategic sourcing and inventory management will influence pricing and profitability.

Conclusion:

The 2026 market for Gem Car Batteries will be shaped by robust demand in the LSEV and utility vehicle sectors, increasing expectations for durability and sustainability, and growing competition from advanced battery technologies. To maintain and grow its market position, Gem Car should consider expanding its product line to include lithium options, enhancing digital integration, and strengthening its presence in emerging markets. Strategic investments in R&D and sustainability will be essential to meet evolving customer needs and regulatory landscapes.

Common Pitfalls When Sourcing Gem Car Batteries (Quality, IP)

Sourcing Gem car batteries—whether referring to a specific brand, a generic term for high-quality batteries, or a regional product—can present several challenges, particularly concerning quality assurance and intellectual property (IP) risks. Being aware of these pitfalls helps avoid supply chain disruptions, legal issues, and customer dissatisfaction.

Quality Inconsistencies and Substandard Products

One of the most significant risks in sourcing car batteries, especially from less-regulated markets or unfamiliar suppliers, is inconsistent quality. Gem-branded or Gem-style batteries may vary greatly in performance and durability. Buyers may receive units with lower cold-cranking amps (CCA), reduced lifespan, or poor charge retention. Counterfeit or reconditioned batteries repackaged as new are common, particularly in online marketplaces or through third-party distributors. Without rigorous quality control checks—such as third-party testing, factory audits, or batch certifications—there’s a high risk of receiving subpar products that fail prematurely, leading to safety hazards and warranty claims.

Intellectual Property Infringement Risks

Using or sourcing batteries under the name “Gem” can pose serious IP concerns, particularly if the trademark is registered by another company in your target market. Unauthorized use of the name, logo, or product design can result in cease-and-desist letters, legal action, or seizure of goods by customs authorities. Even if sourcing from a manufacturer claiming to produce “Gem” batteries, the supplier might not hold legitimate rights to the brand, putting the buyer at risk of contributory infringement. Conducting thorough trademark searches and securing proper licensing agreements is essential to avoid costly legal disputes and reputational damage.

Lack of Transparency in Manufacturing and Materials

Many suppliers may not disclose the origin of raw materials or manufacturing processes, raising concerns about the use of recycled or inferior components. Genuine lead-acid or AGM batteries require specific alloys, separator materials, and construction standards to meet performance expectations. Without transparency, buyers may inadvertently source batteries with short lifespans or environmental compliance issues (e.g., exceeding lead content limits under RoHS or REACH regulations). This lack of traceability also complicates compliance with warranty and recycling programs.

Misleading Specifications and Performance Claims

Some suppliers exaggerate battery performance metrics—such as amp-hour capacity, reserve minutes, or cycle life—to appear competitive. These inflated claims may not be backed by independent testing, leading to mismatched expectations and poor real-world performance. For example, a battery advertised as suitable for start-stop vehicles might lack the deep-cycle durability required, resulting in early failure. Verifying specifications through standardized testing (e.g., DIN, SAE, or IEC standards) is crucial to ensure reliability and suitability for intended applications.

Inadequate After-Sales Support and Warranty Enforcement

Even if a battery initially performs well, sourcing from unreliable suppliers often means limited or unenforceable warranty coverage. Poor communication, lack of local service centers, or refusal to honor claims can leave buyers responsible for replacements and customer complaints. This is especially problematic for distributors or retailers building brand trust. Confirming warranty terms, return policies, and technical support availability before finalizing a supplier relationship is vital for long-term success.

Conclusion

To mitigate these risks, buyers should conduct due diligence including supplier verification, IP clearance, independent quality testing, and contractual safeguards. Partnering with reputable manufacturers, using escrow services for initial orders, and insisting on compliance documentation can significantly reduce the pitfalls associated with sourcing Gem car batteries.

Logistics & Compliance Guide for Gem Car Batteries

Overview

This guide outlines the logistics handling, transportation, storage, and regulatory compliance requirements for Gem car batteries. Adherence to these standards ensures safety, regulatory compliance, and product integrity throughout the supply chain.

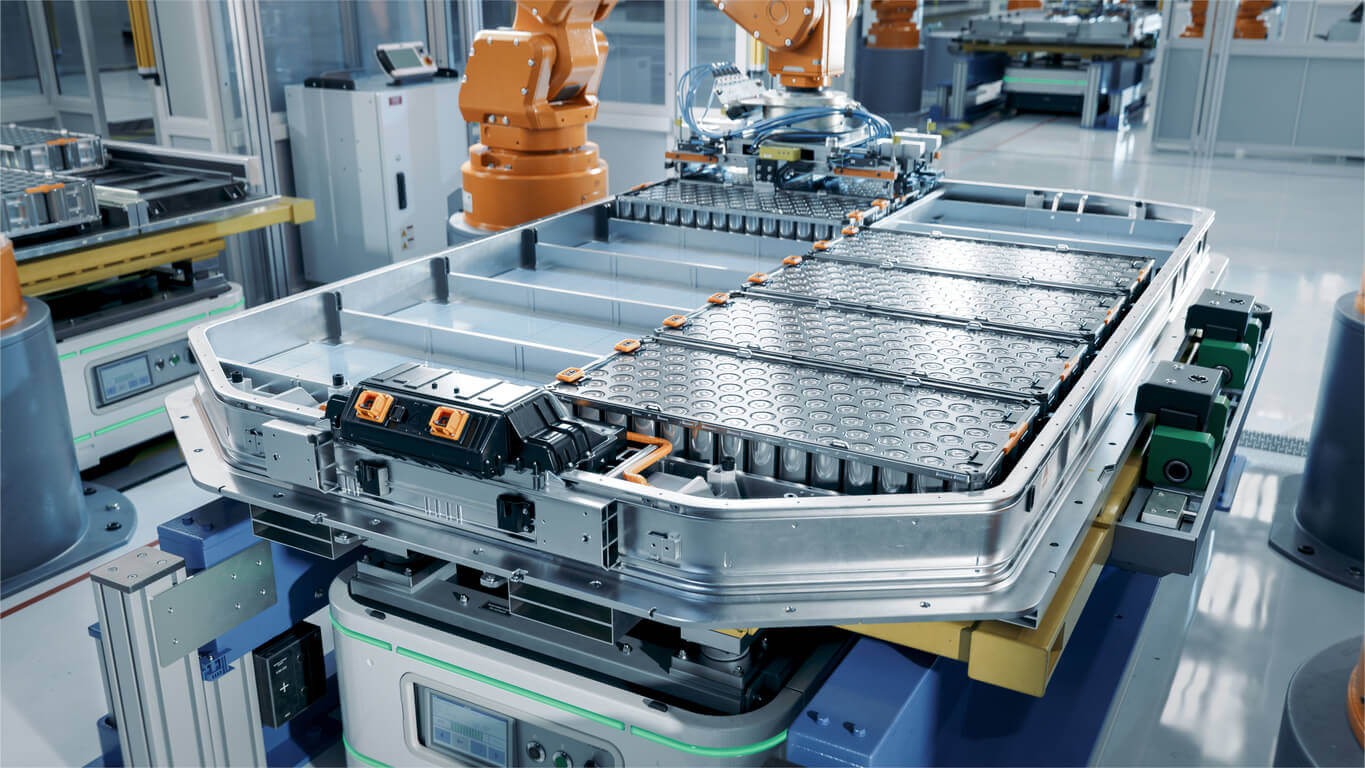

Battery Classification and Identification

Gem car batteries are typically lead-acid or lithium-ion (depending on model), each with distinct transport classifications:

– Lead-Acid Batteries (Flooded/AGM/Gel): Classified as Class 8 Corrosive under UN 2794 or UN 2795 (for wet batteries).

– Lithium-Ion Batteries: Classified under UN 3480, subject to IATA/IMDG/ADR regulations depending on mode of transport.

Ensure correct UN number, proper labeling, and technical documentation are applied per battery type.

Packaging and Handling Requirements

All Gem car batteries must be:

– Securely packaged in UN-certified containers designed for battery transport.

– Protected against short circuits (terminal caps or insulation required).

– Packed to prevent movement, damage, or exposure to moisture.

– Labeled with hazard class labels, orientation arrows, and handling instructions (e.g., “This Way Up,” “Fragile”).

– For lithium-ion: Include state of charge (SoC) not exceeding 30% unless otherwise approved.

Transportation Regulations

Compliance with international and national regulations is mandatory:

– Road (ADR): Required for European road transport; drivers must have ADR training if transporting hazardous goods.

– Air (IATA DGR): Lithium-ion batteries have strict limits on quantity, packing, and documentation. Lead-acid batteries must meet IATA special provision A67.

– Sea (IMDG Code): Applies to ocean freight; batteries must be stowed away from heat sources and incompatible materials.

– Domestic (e.g., 49 CFR in USA): Follow Department of Transportation (DOT) rules for hazardous materials.

Storage Guidelines

- Store in a dry, well-ventilated, temperature-controlled area (15–25°C recommended).

- Keep away from flammable materials and direct sunlight.

- Maintain upright position to prevent electrolyte leakage.

- Lead-acid batteries should be stored fully charged and periodically recharged to prevent sulfation.

- Lithium-ion batteries should be stored at ~50% charge in fire-resistant cabinets if in bulk.

Safety and Emergency Procedures

- Personnel must be trained in battery handling, spill response, and fire safety.

- Provide spill kits, eye wash stations, and fire extinguishers (Class C for electrical fires) in storage/handling areas.

- In case of leakage:

- Lead-acid: Neutralize with baking soda, wear PPE (gloves, goggles), and dispose of waste as hazardous.

- Lithium-ion: Evacuate area; use Class D extinguisher or large quantities of water for thermal runaway.

- Report all incidents per local regulatory requirements.

Regulatory Documentation

Maintain and provide:

– Safety Data Sheets (SDS) for all battery types.

– Transport documents (e.g., Dangerous Goods Declaration, Shipper’s Declaration for Lithium Batteries).

– Certificates of Compliance (e.g., UN 38.3 test summary for lithium batteries).

– Records of employee training and handling procedures.

Environmental and Disposal Compliance

- Gem car batteries are classified as hazardous waste under EPA (USA), WEEE (EU), and similar regulations.

- Do not dispose of in regular trash.

- Use authorized recyclers certified for battery recycling (e.g., certified under R2 or e-Stewards standards).

- Track and document battery returns and recycling through take-back programs.

Quality Assurance and Audits

- Conduct regular audits of logistics partners to ensure compliance with safety and regulatory standards.

- Verify packaging integrity, labeling accuracy, and documentation completeness before shipment.

- Maintain logs of inspections, incidents, and corrective actions.

Contact and Support

For compliance-related inquiries or emergencies:

– Gem Compliance Team: [email protected] | +1 (800) 555-0199

– 24/7 Emergency Response: +1 (800) 555-0111 (for spills, fires, or transport incidents)

Ensure all partners, distributors, and carriers are provided with this guide and trained accordingly. Regular updates will be issued to reflect changes in regulations or product specifications.

In conclusion, sourcing Gem car batteries requires careful consideration of several key factors including battery type (typically deep-cycle lead-acid or lithium-ion), voltage requirements (usually 72V systems), compatibility with the vehicle model, and long-term performance needs. It is essential to prioritize quality, reliability, and safety by choosing reputable suppliers or manufacturers that offer warranties and technical support. While OEM batteries ensure compatibility, aftermarket options can provide cost-effective alternatives if they meet the required specifications. Additionally, evaluating total cost of ownership—factoring in lifespan, maintenance, and efficiency—can lead to smarter procurement decisions. Proper sourcing not only ensures optimal vehicle performance but also enhances longevity and reduces downtime, making it a critical component in maintaining an efficient Gem electric vehicle fleet.