The global gears and shafts market is experiencing steady growth, driven by increasing demand across automotive, industrial machinery, and renewable energy sectors. According to Mordor Intelligence, the global gear market was valued at approximately USD 67.8 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This expansion is fueled by rising automation, the need for precision motion control, and the surge in electric vehicle production—applications where high-performance gears and shafts are critical. Additionally, Grand View Research highlights that advancements in material science and the push for energy-efficient drivetrain systems are further accelerating innovation and adoption within the industry. As the market evolves, a select group of manufacturers are leading through technological excellence, global reach, and scalable production capabilities. Here are the top 9 gears and shafts manufacturers shaping the future of mechanical power transmission.

Top 9 Gears And Shafts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Gear Shaft Supplier

Domain Est. 2002

Website: amtechinternational.com

Key Highlights: AmTech International is a trusted supplier of precision-engineered gear shafts, serving automotive, industrial, and specialty OEMs worldwide….

#2 The Adams Company

Domain Est. 1998

Website: theadamscompany.com

Key Highlights: Precision gears, shafts, and custom parts for the long haul. We craft custom gears, shafts, and power transmission components for global industries….

#3 GNA Gears: Gears Manufacturers

Domain Est. 2003

Website: gnagears.com

Key Highlights: GNA Gears is one of the leading and best gear manufacturing company in India. Get a quote for bull gears, pinion gears, planetary gear, ring gears, ……

#4 Types of Gears

Domain Est. 2015

Website: khkgears.net

Key Highlights: There are many types of gears. This page explains the various types of gears, including spur gears, bevel gears, worm gears and helical gears….

#5 gear shaft

Domain Est. 2020

Website: gearshaft.net

Key Highlights: As one of leading gear shaft manufacturers, suppliers and exporters of products, We offer gear shaft and many other products. Good Quality Steel Spline Shaft ……

#6 IM Gears

Domain Est. 2023

Website: imgears.com

Key Highlights: IM Gears is part of global supply chains, providing high-precision solutions across for the automotive, aerospace, and industrial sectors….

#7 Tracey Gear & Precision Shaft

Domain Est. 1998

Website: traceygear.com

Key Highlights: Tracey Gear & Precision Shaft is a leader in custom-made shaft and gear manufacturing. We make parts for various applications in different sectors….

#8 Yukon Gear & Axle

Domain Est. 1999

Website: yukongear.com

Key Highlights: Shop Yukon Gear & Axle for premium drivetrain components including gears, axles, lockers, and differentials. Trusted by professionals and enthusiasts alike, ……

#9 Gears, Lockers, Axle Shafts, Differentials and more…

Domain Est. 2008

Website: eastcoastgearsupply.com

Key Highlights: Searching for a gear and axle shop near me? The drivetrain specialists at East Coast Gear Supply offer discount warehouse prices on diff covers, ……

Expert Sourcing Insights for Gears And Shafts

H2: Projected 2026 Market Trends for Gears and Shafts

The global market for gears and shafts is poised for significant transformation by 2026, driven by technological innovation, shifting industrial demands, and sustainability imperatives. Key trends shaping the landscape include:

1. Accelerated Electrification Across Industries

The most dominant force reshaping demand is the global shift toward electrification. In the automotive sector, electric vehicles (EVs) require fewer gears than internal combustion engine (ICE) vehicles, leading to a contraction in traditional transmission gear demand. However, this is counterbalanced by increased demand for high-precision, high-efficiency gears and shafts in EV drivetrains (e.g., single-speed reduction gearboxes, differential systems) and auxiliary systems (e.g., electric power steering, HVAC compressors). Beyond automotive, industrial electrification—such as in electric motors, robotics, and renewable energy systems—fuels demand for specialized, high-performance gear and shaft solutions designed for silent operation, high torque density, and extended fatigue life.

2. Integration of Smart Manufacturing and Industry 4.0

The adoption of smart manufacturing technologies is revolutionizing gear and shaft production and application. By 2026, predictive maintenance powered by embedded sensors in gearboxes and shafts will become mainstream, enabling real-time monitoring of wear, vibration, and temperature. This shift reduces unplanned downtime and optimizes maintenance schedules. Additionally, digital twins and AI-driven simulation tools are enhancing design precision, material selection, and lifetime prediction, leading to lighter, stronger, and more efficient components. Additive manufacturing (3D printing), though still limited for high-load applications, is increasingly used for prototyping, custom tooling, and low-volume, complex geometries.

3. Rising Demand for Lightweight and High-Performance Materials

To meet efficiency and emission targets, manufacturers are prioritizing weight reduction without compromising strength. This drives demand for advanced materials such as high-strength alloy steels, case-hardening steels, aluminum alloys, and engineered composites. Surface treatments like carburizing, nitriding, and advanced coatings (e.g., DLC – Diamond-Like Carbon) are critical for enhancing wear resistance, reducing friction, and extending component life—especially in high-stress applications like wind turbines and aerospace systems.

4. Growth in Renewable Energy and Automation

The expansion of wind energy continues to be a major growth driver. Wind turbine gearboxes require extremely robust, large-scale gears and shafts capable of handling variable loads and harsh environments. As wind farms move offshore and turbine sizes increase, demand for next-generation, highly reliable gear systems grows. Similarly, the surge in industrial automation, robotics, and AGVs (Automated Guided Vehicles) necessitates compact, high-precision gearboxes (e.g., planetary, harmonic drives) and shafts with low backlash and high repeatability.

5. Supply Chain Resilience and Regionalization

Geopolitical uncertainties and past supply chain disruptions have pushed manufacturers toward regionalization and nearshoring. By 2026, companies are expected to diversify suppliers, invest in local production facilities, and adopt digital supply chain tools for greater transparency and agility. This trend supports regional market growth, particularly in North America and Europe, while also encouraging innovation in localized manufacturing technologies.

6. Sustainability and Circular Economy Focus

Environmental regulations and corporate ESG (Environmental, Social, Governance) goals are pushing the industry toward sustainable practices. This includes optimizing energy efficiency in gear design, recycling scrap metal, reducing machining waste, and developing remanufacturing programs for used gearboxes and shafts. Sustainable lubricants and lifecycle assessment (LCA) tools are becoming integral to product development.

Conclusion:

By 2026, the gears and shafts market will be characterized by a dual dynamic: consolidation in traditional sectors (e.g., ICE automotive) and robust growth in emerging high-tech applications (e.g., EVs, renewables, automation). Success will depend on manufacturers’ ability to innovate with smarter, lighter, and more durable components, embrace digitalization, and adapt to evolving global supply chains and sustainability requirements. Companies that align with these H2 trends—electrification, digitalization, material advancement, and sustainability—will be best positioned to lead the market.

Common Pitfalls When Sourcing Gears and Shafts: Quality and Intellectual Property Concerns

Sourcing gears and shafts—critical components in mechanical systems—can be fraught with challenges, especially when balancing cost, performance, and legal compliance. Two major areas of concern are quality assurance and intellectual property (IP) protection. Overlooking these can lead to system failures, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inadequate Material Specifications

One of the most frequent issues is sourcing components made from substandard or incorrectly specified materials. Gears and shafts are subject to high stress, wear, and fatigue, so using improper alloys or failing to meet hardness and heat treatment requirements can drastically reduce service life. Buyers must clearly define material grades (e.g., AISI 4140, 4340) and verify certifications such as mill test reports.

Poor Dimensional Accuracy and Tolerances

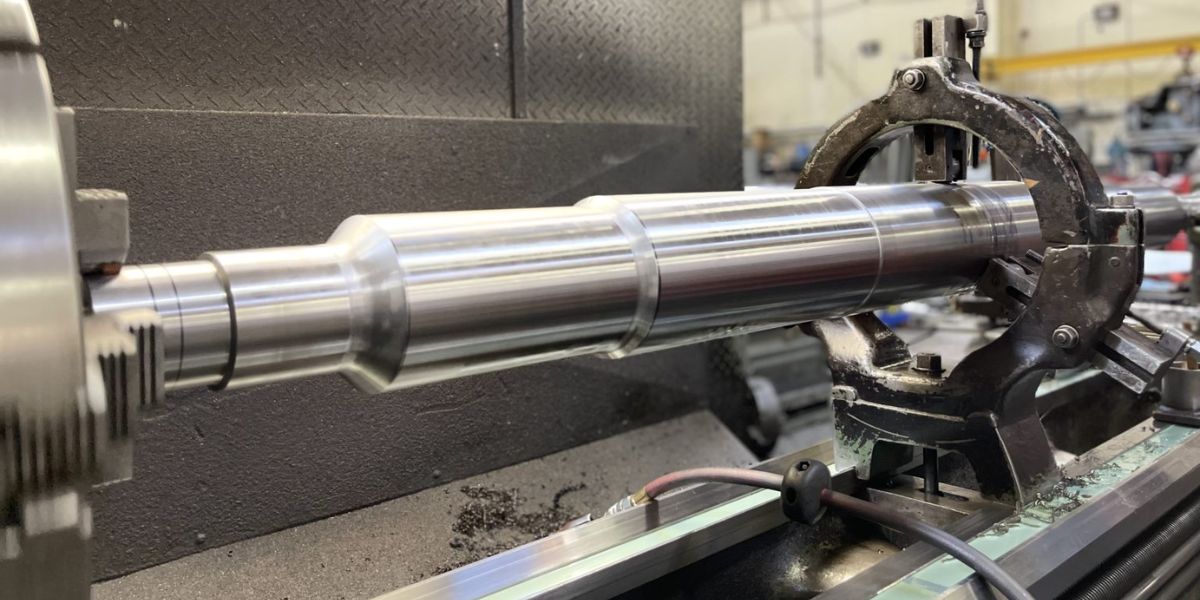

Gears require precise tooth profiles, pitch diameters, and runout tolerances to mesh efficiently and minimize noise and wear. Shafts must meet strict geometric tolerances (e.g., straightness, cylindricity) for proper alignment and bearing fit. Suppliers using outdated tooling or insufficient quality control may deliver parts outside allowable tolerances, leading to premature failure or assembly issues.

Inconsistent Heat Treatment

Improper or inconsistent heat treatment—such as inadequate case hardening, incorrect tempering, or uneven quenching—can result in gears that crack under load or shafts that deform. Without documented process validation (e.g., hardness testing, microstructure analysis), it’s difficult to ensure batch-to-batch consistency.

Lack of Traceability and Documentation

Reputable suppliers provide full traceability, including heat numbers, inspection reports, and compliance with standards like AGMA, DIN, or ISO. Absent these, it becomes nearly impossible to diagnose field failures or verify quality claims. This is especially critical in regulated industries such as aerospace or medical devices.

Insufficient Testing and Validation

Many suppliers skip essential performance tests—such as dynamic balancing for shafts or gear mesh quality analysis—especially when under cost pressure. Relying solely on visual or dimensional inspection without functional testing increases the risk of early in-service failure.

Intellectual Property-Related Pitfalls

Infringement of Patented Designs

Gears and shafts may incorporate proprietary geometries, tooth profiles (e.g., asymmetric or low-noise designs), or assembly methods protected by patents. Sourcing generic copies of branded or patented components—even unintentionally—can expose the buyer to legal liability, especially if the supplier is producing knock-offs without licensing.

Unauthorized Reverse Engineering

Some suppliers engage in reverse engineering of OEM components to produce “compatible” parts. While this may reduce costs, it often violates IP rights if the design elements are patented or protected as trade secrets. Buyers who specify or accept such parts may be held jointly liable for infringement.

Ambiguous Ownership of Custom Tooling and Designs

When custom gears or shafts are developed, ownership of the design files, tooling, and intellectual property is often not clearly defined in contracts. This can lead to disputes over reuse rights, exclusivity, or unauthorized resale of the design to competitors.

Lack of IP Due Diligence in Supplier Selection

Many buyers fail to vet suppliers for IP compliance, especially in offshore markets where enforcement is weak. Choosing a supplier based solely on price without reviewing their design sources, certifications, or history of IP disputes increases the risk of receiving infringing products.

Grey Market and Counterfeit Components

The market for counterfeit or grey-market gears and shafts is growing, particularly for legacy or discontinued OEM parts. These components often mimic genuine designs but lack quality controls and IP authorization. They may perform poorly and expose the end user to both performance and legal risks.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Require detailed material and process certifications.

– Conduct incoming quality inspections using CMMs or profile testers.

– Perform audits of supplier manufacturing processes.

– Include IP indemnification clauses in procurement contracts.

– Work with trusted suppliers who respect design patents and offer proper licensing.

– Maintain clear documentation of design ownership and usage rights.

By proactively addressing quality and IP risks, companies can ensure reliable performance and legal compliance in their mechanical systems.

Logistics & Compliance Guide for Gears and Shafts

Overview

Gears and shafts are critical mechanical components used across industries such as automotive, aerospace, industrial machinery, and renewable energy. Due to their precision engineering and potential safety implications, their global logistics and compliance requirements involve strict regulations related to materials, manufacturing standards, export controls, and transportation.

Classification and Harmonized System (HS) Codes

Proper classification under the Harmonized System (HS) is essential for accurate customs clearance and tariff application. Common HS codes for gears and shafts include:

– 8483.40: Transmission shafts and cranks, including camshafts and crankshafts

– 8483.50: Gears and gearing (e.g., gear boxes, ball screws)

– 7317: Iron or steel screws, bolts, and similar threaded fasteners (if components include integrated fasteners)

Note: Exact codes may vary by country and product specifications; consult the destination country’s tariff schedule for precision.

Material and Manufacturing Compliance

Gears and shafts must meet material and quality standards to ensure performance and safety:

– ISO 1328: Defines accuracy and tolerance standards for cylindrical gears

– AGMA Standards (American Gear Manufacturers Association): Widely used in North America for gear design and inspection

– ASTM/EN Standards: Apply to raw materials (e.g., ASTM A898 for steel shafts)

– RoHS and REACH Compliance: Required if components contain restricted substances (e.g., lead, chromium) and are shipped to the EU

– Material Traceability: Certified mill test reports (MTRs) may be required for aerospace or defense applications

Export Controls and Licensing

Certain high-precision or hardened gears and shafts may be subject to export restrictions:

– EAR (Export Administration Regulations): Administered by the U.S. Department of Commerce; check the Commerce Control List (CCL) for items under ECCN 9A012 or related categories (e.g., components for military or dual-use equipment)

– ITAR (International Traffic in Arms Regulations): Applies if gears/shafts are used in defense articles listed on the U.S. Munitions List (USML)

– Dual-Use Considerations: High-torque, high-speed, or specialized alloy components may require export licenses depending on destination and end-use

Packaging and Transportation

Proper packaging safeguards precision components during transit:

– Corrosion Protection: Use VCI (Vapor Corrosion Inhibitor) paper, rust preventative coatings, or desiccants for metal components

– Secure Mounting: Components should be immobilized in crates or containers to prevent movement and surface damage

– Labeling: Include handling labels (e.g., “Fragile,” “This Side Up”), part numbers, lot numbers, and destination details

– Mode of Transport: Air freight for urgent deliveries; sea freight for bulk shipments. Ensure temperature and humidity control if required

Import Regulations and Duties

Importers must comply with destination country requirements:

– Customs Documentation: Commercial invoice, packing list, certificate of origin, and bill of lading/airway bill

– Tariff Rates: Vary by country and HS code; preferential rates may apply under trade agreements (e.g., USMCA, EU-UK Trade Agreement)

– Import Licenses: Required in certain countries for industrial components, especially if used in regulated sectors

– Conformity Assessment: Some countries require third-party inspection or certification (e.g., CE marking in the EU, GOST in Russia)

Quality and Inspection Requirements

Pre-shipment inspections may be mandated:

– Dimensional Tolerances: Verified using CMM (Coordinate Measuring Machines) or optical comparators

– Surface Finish and Hardness Testing: Required for high-load applications

– Non-Destructive Testing (NDT): Magnetic particle or ultrasonic testing for critical components

– Third-Party Certification: SGS, BV, or TÜV may be required for customs or customer acceptance

Sustainability and Environmental Regulations

Environmental compliance is increasingly important:

– Waste Electrical and Electronic Equipment (WEEE): May apply if gears/shafts are part of larger machinery covered under WEEE

– End-of-Life Management: Manufacturers may need to comply with take-back or recycling obligations in certain jurisdictions

– Carbon Footprint Reporting: Required under EU CSRD or other ESG frameworks for large industrial suppliers

Best Practices for Logistics & Compliance

- Maintain accurate technical documentation (drawings, material specs, test reports)

- Partner with freight forwarders experienced in industrial components

- Conduct regular compliance audits for export controls and regulatory updates

- Use ERP or PLM systems to track compliance documentation and certifications

By adhering to this guide, manufacturers and distributors can ensure smooth, compliant global logistics for gears and shafts, minimizing delays and avoiding legal or financial penalties.

Conclusion for Sourcing Gears and Shafts

In conclusion, the successful sourcing of gears and shafts requires a strategic approach that balances quality, cost, lead time, and supplier reliability. These critical mechanical components must meet precise engineering specifications to ensure optimal performance, durability, and compatibility within larger machinery systems. A thorough evaluation of suppliers—considering their manufacturing capabilities, material expertise, quality certifications (such as ISO standards), and track record—is essential to minimize risks related to failure or downtime.

Additionally, sourcing decisions should take into account factors such as customization needs, volume requirements, and long-term supply chain resilience. Establishing strong relationships with trusted suppliers, investing in clear technical documentation, and conducting regular quality audits can significantly enhance procurement outcomes. Ultimately, effective sourcing of gears and shafts not only supports efficient mechanical operation but also contributes to the overall reliability and cost-effectiveness of engineering systems.