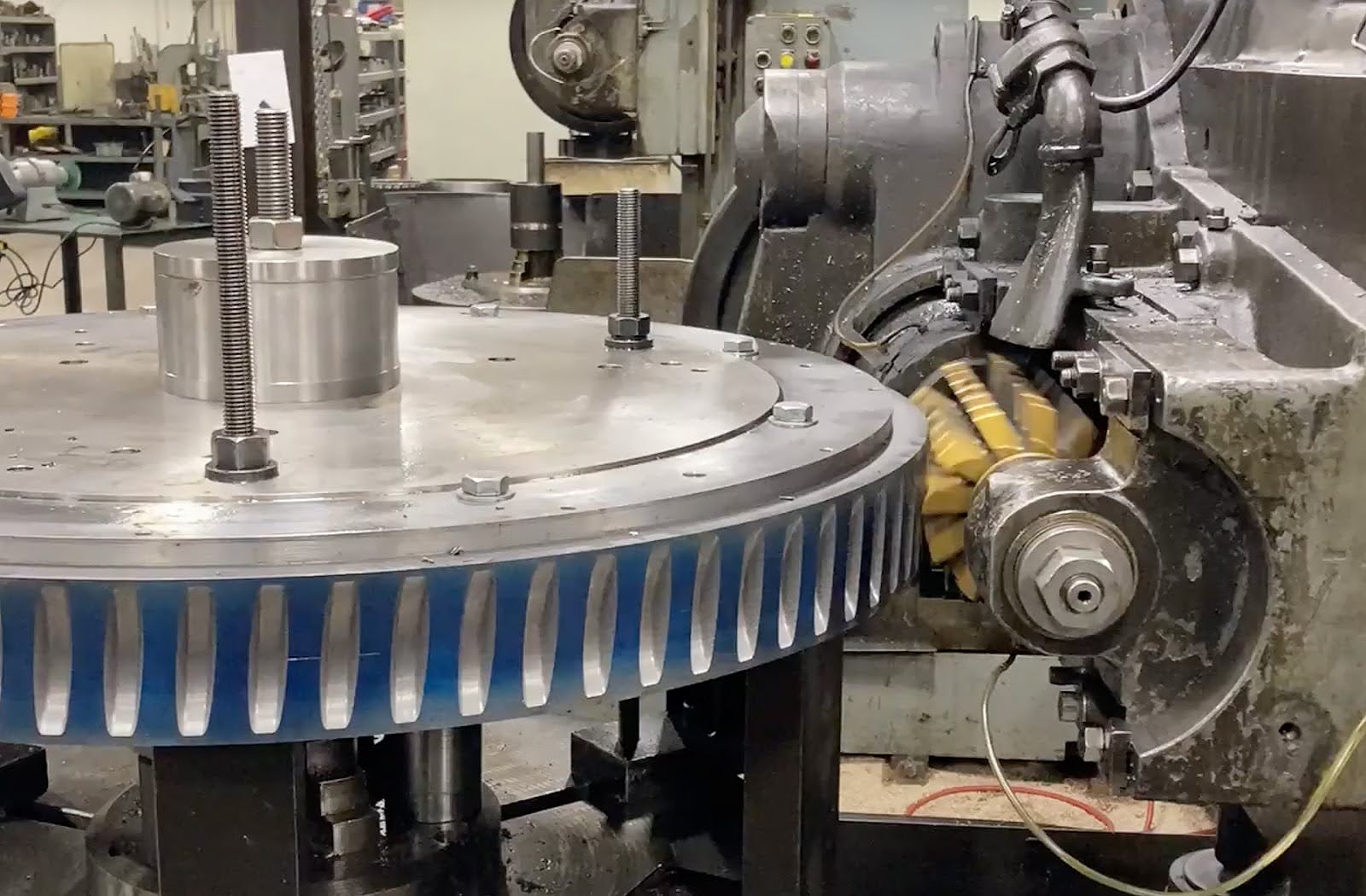

The global gear manufacturing market is experiencing steady expansion, driven by increasing demand across automotive, industrial machinery, and renewable energy sectors. According to Grand View Research, the global gear market size was valued at USD 98.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030. This growth is fueled by advancements in precision engineering, rising automation adoption, and the push for more efficient power transmission systems. As industries demand higher performance and durability, gear toothing—critical for smooth torque transfer and mechanical efficiency—has become a key differentiator among manufacturers. In this competitive landscape, a select group of companies are leading innovation in tooth profile accuracy, material science, and custom gear solutions. Below is a data-informed look at the top 10 gear toothing manufacturers shaping the future of mechanical power transmission.

Top 10 Gear Toothing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Horsburgh & Scott

Domain Est. 1996

Website: horsburgh-scott.com

Key Highlights: Horsburgh & Scott engineers and manufactures a wide range of small to large gears and gearboxes, then supports them with value-added services….

#2 Worm Gears

Domain Est. 1998

Website: theadamscompany.com

Key Highlights: Custom worm gears made to print for OEM speed reducers and custom drive applications. Teeth as coarse as 1 DP and as fine as 24 DP, ratios from 1:1 to 10:1, ……

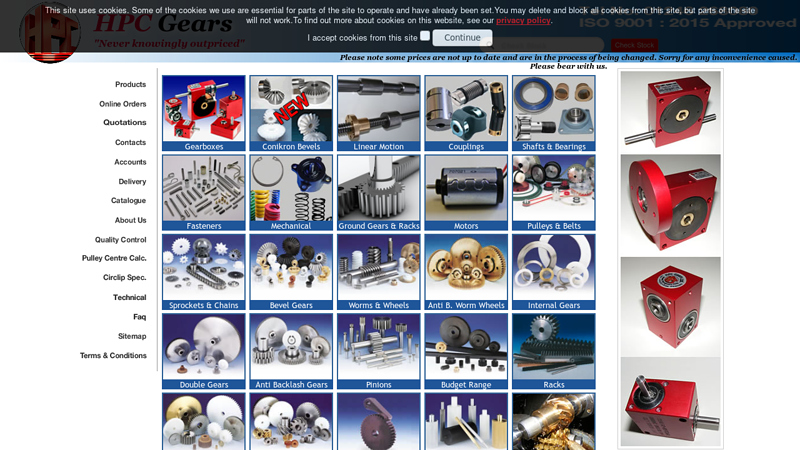

#3 HPC Gears

Domain Est. 2000

Website: hpcgears.com

Key Highlights: MANUFACTURER AND STOCKIST OF GEAR TRANSMISSION PRODUCTS….

#4 Pragati Transmission gear manufacturing

Domain Est. 2006

Website: pragatigears.com

Key Highlights: A professionally managed global Gear manufacturing company, Pragati Transmission is a recogonised manufacturer, supplier and exporter of Gears….

#5 KHK USA Inc

Domain Est. 2015

Website: khkgears.us

Key Highlights: PRECISION METRIC GEARS. WORLD-CLASS MANUFACTURING. Our Factory Direct Shipping enables all KHK stock gears to be delivered to any customer located anywhere ……

#6 Types of Gears

Domain Est. 2015

Website: khkgears.net

Key Highlights: There are many types of gears. This page explains the various types of gears, including spur gears, bevel gears, worm gears and helical gears….

#7 Gears, Racks, Pinions & Differentials

Domain Est. 1995

Website: sdp-si.com

Key Highlights: At SDP/SI, we offer high-quality gear blanks used to manufacture a wide variety of gear types, including spur gears and internal gears. In spur gears, teeth ……

#8 High-Precision Gears & Gear Manufacturing

Domain Est. 1996

Website: wmberg.com

Key Highlights: WM Berg designs and manufactures several styles of precision gears, including helical, spur, anti-backlash and worm gears….

#9 to rushgears.com

Domain Est. 1997

Website: rushgears.com

Key Highlights: Welcome to rushgears.com. We manufacture all types of gears and machine parts in just about any material to suit your needs….

#10 Atlas Gear Company

Domain Est. 2003

Website: atlasgear.com

Key Highlights: Atlas Gear Company produces prototype and small-batch gears, shafts, and custom machined components to your exact specifications….

Expert Sourcing Insights for Gear Toothing

H2: Projected 2026 Market Trends for Gear Toothing

The global gear toothing market is poised for significant transformation by 2026, driven by advancements in manufacturing technologies, rising demand from key industries such as automotive, aerospace, and industrial automation, and a growing emphasis on precision engineering and energy efficiency. Gear toothing—the process of creating teeth on gears to enable effective torque transmission—is undergoing a shift toward higher precision, durability, and customization to meet evolving performance standards.

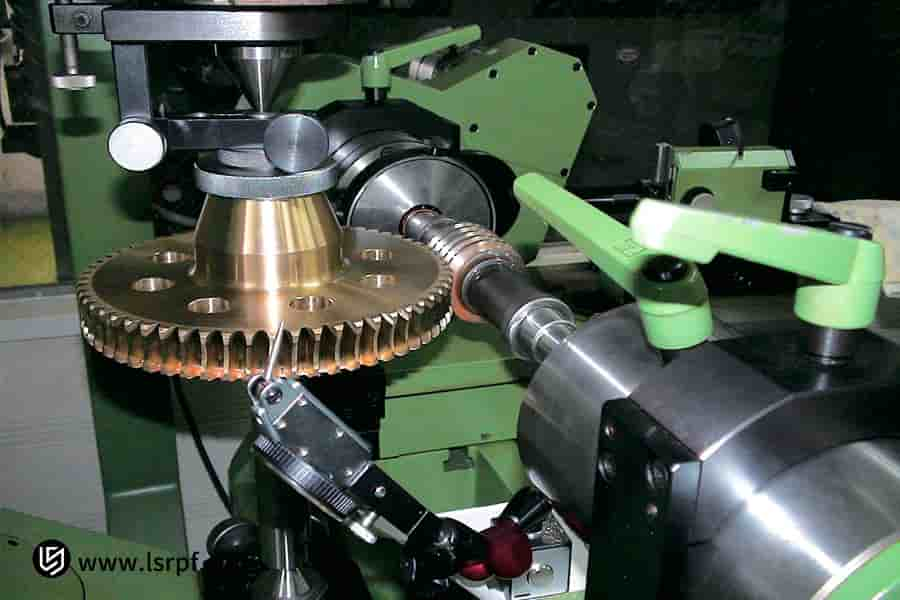

One of the primary drivers shaping the 2026 landscape is the increased adoption of electric vehicles (EVs). EVs require highly efficient, low-noise gear systems, prompting manufacturers to invest in advanced toothing techniques such as asymmetric tooth profiles, optimized helix angles, and precision grinding. This trend is fueling demand for high-accuracy CNC gear cutting machines and specialized materials like case-hardened steels and advanced polymers.

Additionally, the integration of Industry 4.0 principles is revolutionizing gear production. Smart factories are leveraging IoT-enabled gear monitoring, predictive maintenance, and real-time quality control to improve the consistency and reliability of toothing processes. By 2026, digital twin technology and AI-driven design optimization are expected to become standard in gear development, reducing lead times and enhancing performance.

Another notable trend is the growing focus on sustainability. Manufacturers are exploring lightweight materials and efficient tooth geometries to reduce energy loss in mechanical systems. This aligns with global regulatory pressures to improve energy efficiency across industrial and transportation sectors.

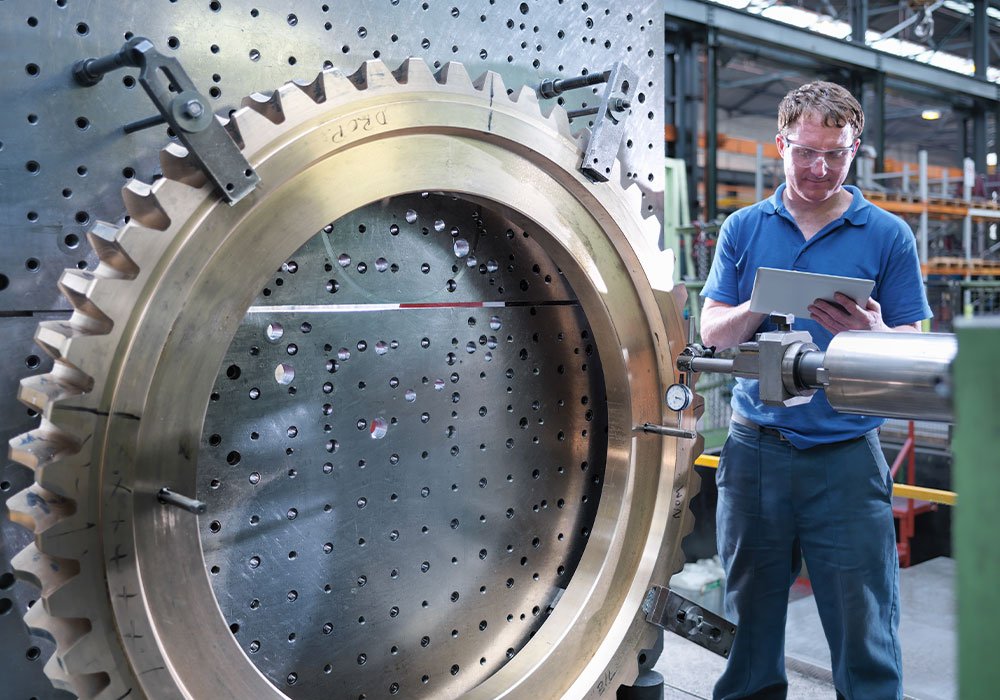

Regionally, Asia-Pacific is expected to dominate the gear toothing market by 2026, led by China, Japan, and India, due to rapid industrialization and strong automotive production. Meanwhile, North America and Europe are focusing on high-precision, high-value gears for aerospace and robotics applications.

In summary, the 2026 gear toothing market will be characterized by technological innovation, increased customization, and a push toward smarter, greener manufacturing—positioning precision toothing as a critical enabler of next-generation mechanical systems.

Common Pitfalls Sourcing Gear Toothings (Quality, IP)

Sourcing gear toothings involves critical considerations beyond basic specifications. Overlooking quality and intellectual property (IP) aspects can lead to significant operational, legal, and financial risks. Below are common pitfalls to avoid:

Inadequate Quality Control and Material Verification

Many suppliers may claim compliance with standards (e.g., AGMA, DIN, ISO), but fail to provide verifiable documentation or test reports. Without proper inspection protocols—such as hardness testing, tooth profile accuracy checks, and surface finish evaluations—defective gears can result in premature failure, noise, or system inefficiency.

Lack of Traceability and Certification

Omitting material traceability (e.g., heat treatment records, material test reports) undermines reliability. Gears used in aerospace, automotive, or industrial machinery require full certification. Sourcing without documented traceability increases the risk of counterfeit or substandard components.

Overlooking Geometric Precision and Tolerances

Gear performance heavily depends on precise tooth geometry, pitch accuracy, and runout. Suppliers in lower-cost regions may not have the metrology equipment (e.g., CMM, gear analyzers) to validate these parameters, leading to mismatched meshing, increased wear, and vibration issues.

Insufficient Supplier Qualification and Audits

Relying solely on price or lead time without auditing a supplier’s manufacturing capabilities, quality systems (e.g., ISO 9001), and production consistency can be risky. Unverified suppliers might subcontract work without approval, compromising control over quality and IP.

Intellectual Property Infringement Risks

Using gear designs protected by patents or proprietary tooth profiles (e.g., specialized helical or hypoid geometries) without proper licensing exposes buyers to legal action. Some suppliers may offer “compatible” or “reverse-engineered” gear sets that infringe on IP, especially when original equipment manufacturer (OEM) designs are copied.

Ambiguous Design Ownership and Documentation

Failing to clarify design ownership in contracts can lead to disputes. If a custom gear is developed, ensure IP rights are assigned or licensed appropriately. Poor documentation (e.g., missing CAD files, tolerance callouts) also hinders replication, maintenance, and future sourcing.

Inconsistent Surface Treatments and Coatings

Improper or unverified surface treatments (e.g., carburizing, nitriding, PVD coatings) impact wear resistance and fatigue life. Suppliers may skip post-treatment inspections or use inconsistent processes, reducing gear lifespan and performance.

Supply Chain Transparency Gaps

Hidden subcontracting or multi-tier supply chains make it difficult to ensure consistent quality and IP compliance. Lack of visibility increases the risk of unauthorized production or diversion of proprietary designs.

To mitigate these pitfalls, implement rigorous supplier vetting, require full documentation and testing, establish clear IP agreements, and conduct periodic audits throughout the sourcing lifecycle.

Logistics & Compliance Guide for Gear Toothing

Overview

This guide outlines the essential logistics and compliance considerations for the manufacturing, handling, shipping, and regulatory adherence of gear toothing components. Proper management ensures product quality, supply chain efficiency, and compliance with international and industry-specific standards.

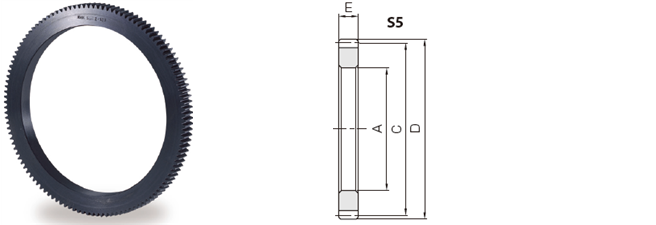

Manufacturing Standards and Specifications

Gear toothing must conform to recognized engineering standards such as AGMA (American Gear Manufacturers Association), ISO (International Organization for Standardization), or DIN (Deutsches Institut für Normung). Key parameters include tooth profile, module, pressure angle, backlash, and surface finish. Documentation of design specifications and process controls is required for traceability and quality assurance.

Material Compliance

Ensure all raw materials used in gear production—such as alloy steels, stainless steels, or engineered plastics—meet material certifications (e.g., RoHS, REACH, or ASTM). Certificates of Conformance (CoC) must accompany material batches to validate compliance with environmental and safety regulations.

Quality Control and Inspection

Implement a structured quality management system (e.g., ISO 9001). Conduct regular inspections using coordinate measuring machines (CMM), optical comparators, or profile projectors to verify tooth geometry, pitch accuracy, and runout. Maintain inspection records for audit purposes.

Packaging and Handling

Gear toothing components must be protected from contamination, corrosion, and mechanical damage. Use anti-corrosion packaging (VCI paper, rust inhibitors) and secure fixtures to prevent movement during transit. Label packages with part numbers, batch/lot numbers, and handling instructions (e.g., “Fragile,” “Do Not Stack”).

Shipping and Transportation Logistics

Coordinate with carriers experienced in industrial component shipping. Use climate-controlled or dry transport when necessary. For international shipments, prepare accurate commercial invoices, packing lists, and certificates of origin. Ensure compliance with Incoterms (e.g., FOB, DAP) agreed upon with customers.

Export and Import Compliance

Verify export control classifications (ECCN) under regulations such as the U.S. Export Administration Regulations (EAR) or equivalent. Obtain necessary export licenses if required. For imports, ensure customs documentation meets the destination country’s requirements, including tariff codes (HS codes) specific to mechanical gears.

Regulatory and Environmental Compliance

Adhere to environmental directives such as:

– RoHS (Restriction of Hazardous Substances) – Limits lead, cadmium, and other hazardous materials.

– REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) – Applies to substances in materials.

– Conflict Minerals Rule (Dodd-Frank Act) – Requires disclosure if tantalum, tin, tungsten, or gold are used in production.

Recordkeeping and Traceability

Maintain detailed records of production batches, inspection data, material certifications, and shipping documentation. Implement a traceability system (e.g., barcodes or RFID) to track gear components from raw material to final delivery. Retain records for a minimum of 7–10 years, depending on industry standards.

Audit and Continuous Improvement

Schedule internal and third-party audits to assess compliance with quality and regulatory standards. Use audit findings to drive corrective actions and continuous improvement in logistics and manufacturing processes.

Contact and Support

For compliance inquiries or logistics support, contact your designated Quality Assurance Manager or Compliance Officer. Ensure all personnel are trained on relevant standards and procedures to maintain ongoing compliance.

Conclusion for Sourcing Gear Toothing:

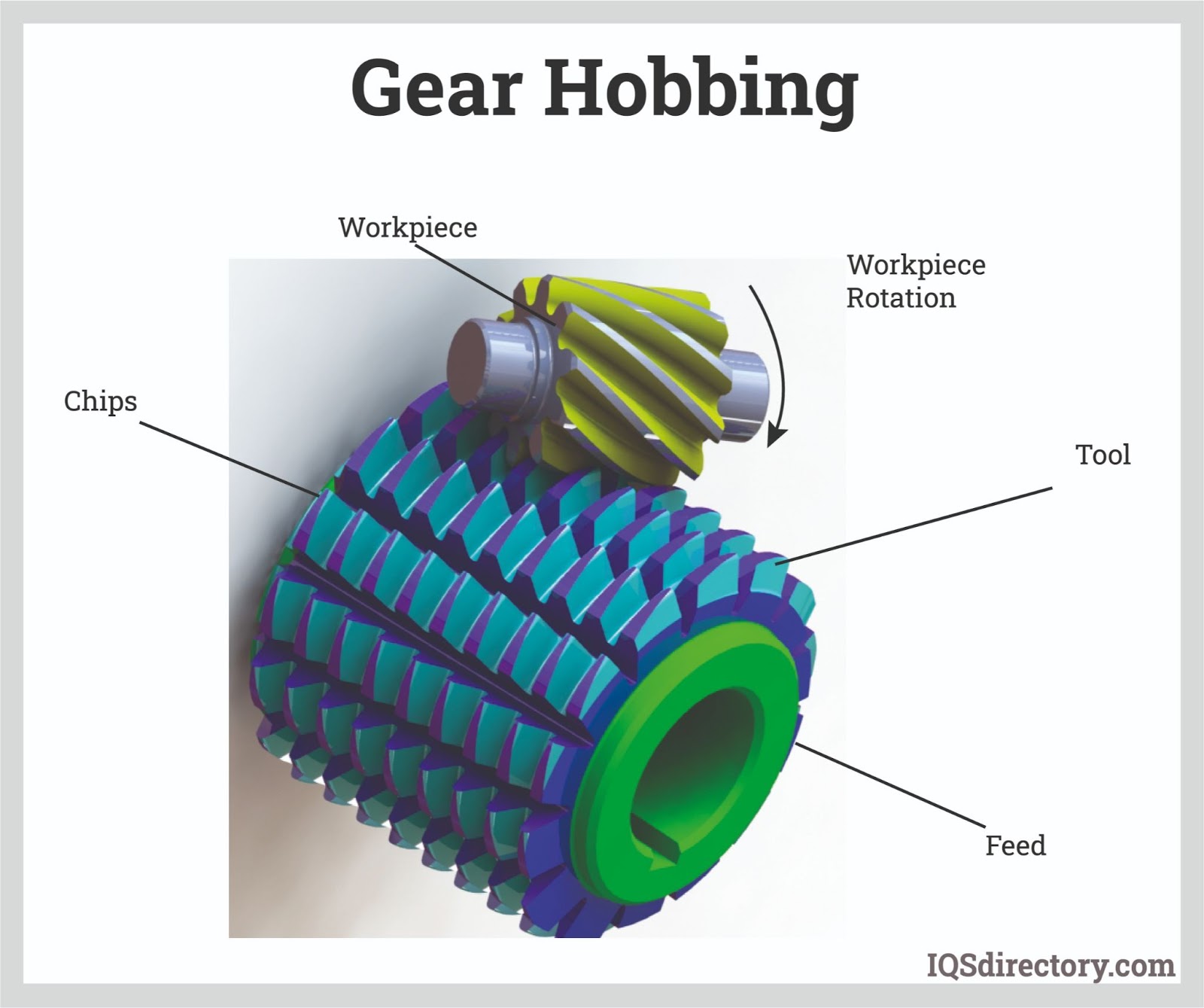

Sourcing gear toothing requires a strategic approach that balances precision, material compatibility, manufacturing capability, and cost-effectiveness. The selection of the appropriate toothing method—whether hobbing, shaping, milling, grinding, or powder metallurgy—depends on the required accuracy, volume, application environment, and load conditions. Close collaboration with reliable suppliers, adherence to industry standards (such as AGMA, ISO, or DIN), and thorough quality validation are essential to ensure performance, durability, and interoperability of the gears.

Additionally, advancements in manufacturing technologies, such as CNC machining and profile grinding, have expanded the possibilities for high-precision gear production, enabling tighter tolerances and improved surface finishes. When outsourcing, it is crucial to evaluate suppliers based on technical expertise, quality control processes, and capacity for custom solutions.

In summary, successful sourcing of gear toothing hinges on clearly defined specifications, early supplier involvement, and a comprehensive understanding of both design requirements and manufacturing constraints. By focusing on these factors, organizations can achieve optimal gear performance, reduce lifecycle costs, and support long-term reliability in their mechanical systems.