The global fuel dispenser market is experiencing steady expansion, driven by rising fuel consumption, modernization of existing fuel retail infrastructure, and increased investments in smart and contactless fueling technologies. According to Mordor Intelligence, the gas pump market was valued at approximately USD 5.2 billion in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2029. Alternatively, Grand View Research estimates the global fuel dispenser market size at USD 5.6 billion in 2023, with a projected CAGR of over 4% during the same forecast period, underpinned by technological advancements such as IoT integration, EMV compliance, and digital payment systems. As demand surges across emerging and developed economies alike, leading manufacturers are focusing on innovation, durability, and compliance with environmental and safety standards. Against this backdrop, the following list highlights the top 10 gas pump manufacturers for gas stations that are shaping the future of fuel retail through reliable performance, global reach, and cutting-edge solutions.

Top 10 Gas Pump For Gas Station Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Petroleum Equipment & Industrial Pumps

Domain Est. 1996

Website: nwpump.com

Key Highlights: Northwest Pump provides top tier petroleum equipment and industrial pumps and compressors to companies across the US….

#2 OPW

Domain Est. 2009

Website: opwglobal.com

Key Highlights: OPW is the only manufacturer that can deliver the best quality loading arms, from pre-manufactured to custom designed for your specifications….

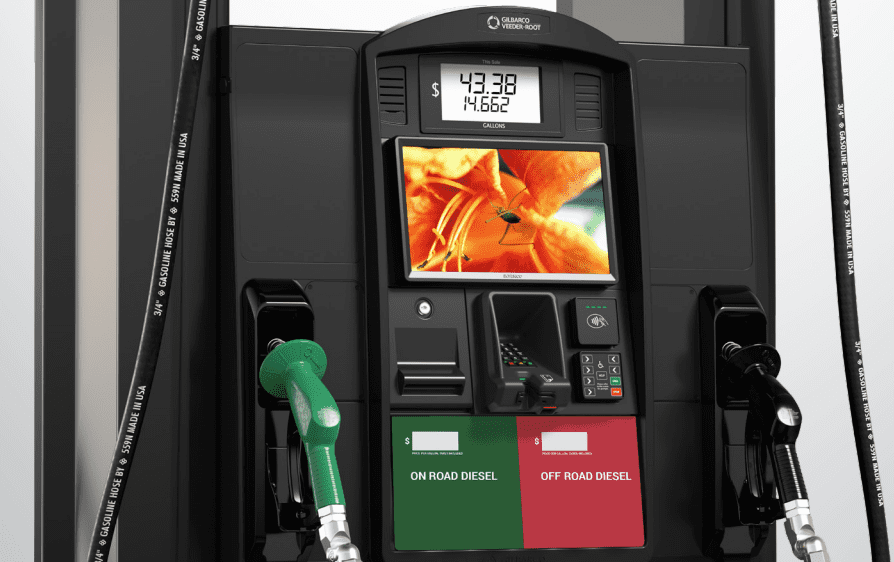

#3 Fuel Dispensers and Point of Sale Platforms for Convenience Stores …

Domain Est. 1994

Website: gilbarco.com

Key Highlights: The world’s most trusted name for fueling equipment & services that ensure regulatory compliance, and optimize flow and profits. From Automatic Tank Gauges ……

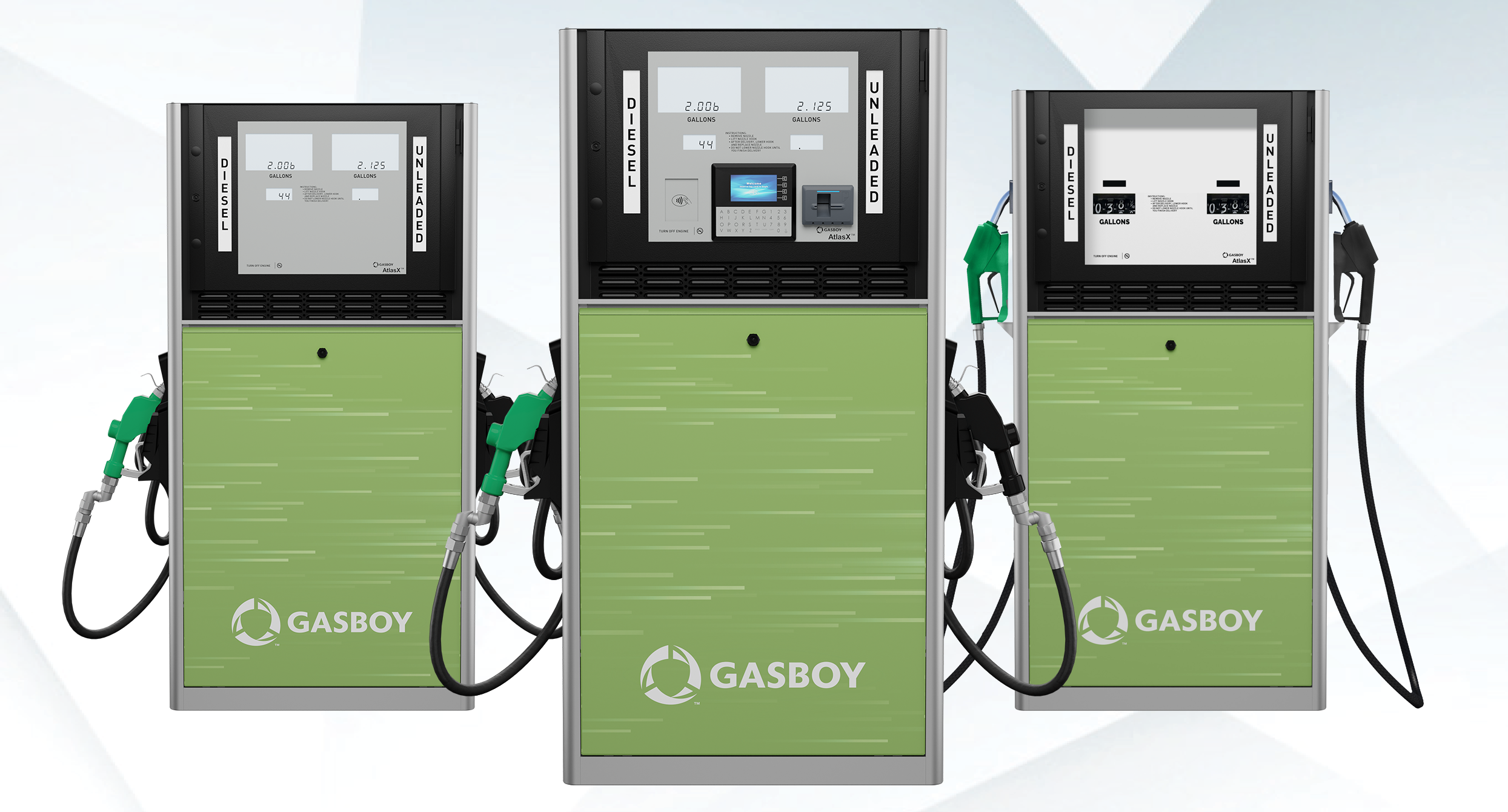

#4 Gasboy: Fuel Management Systems for Retail

Domain Est. 1994

Website: gasboy.com

Key Highlights: Gasboy provides innovative, efficient, cost-effective solutions to meet your needs for fueling, controlling, and managing your fleet….

#5 PMP Corporation

Domain Est. 1998

Website: pmp-corp.com

Key Highlights: Proudly serving gas stations across the nation with professionally remanufactured equipment that performs better than new….

#6

Domain Est. 2001

Website: franklinfueling.com

Key Highlights: We offer the world’s most complete line of petroleum equipment including Submersible Pumping Systems, Piping & Containment Systems, Service Station Hardware,…

#7 GAS PUMP EXCHANGE

Domain Est. 2007

Website: gaspumpexchange.com

Key Highlights: Providing fully remanufactured Gas Pumps & POS Systems for Service Stations across the US. With over 15 years’ experience providing equipment including custom ……

#8 Gas Pos

Domain Est. 2015

Website: gaspos.co

Key Highlights: Fastest-growing POS for gas stations & truck stops. Receive EMV fuel dispensers. Gas Pos includes OTR (over-the-road) fleet card acceptance for your truck ……

#9 Dover Fueling Solutions

Domain Est. 2016

Website: doverfuelingsolutions.com

Key Highlights: Dover Fueling Solutions is a leading name in the North America fueling industry, providing advanced fueling services for retail, fleet, and EV sites….

#10 JF Petroleum Group

Domain Est. 2020

Website: jfpetrogroup.com

Key Highlights: As the leading fuel equipment and gas station equipment supplier, we’re offering convenience that works! Order Online, Pick Up In-Store. Same Day Shipping….

Expert Sourcing Insights for Gas Pump For Gas Station

H2: 2026 Market Trends for Gas Pumps in Gas Stations

As the global energy landscape evolves, the gas pump market for gas stations is undergoing significant transformation in anticipation of 2026. Driven by technological innovation, regulatory changes, and shifting consumer behaviors, several key trends are shaping the future of fuel dispensing infrastructure.

-

Integration of Smart and Digital Technologies

Gas pumps are increasingly incorporating smart features such as IoT connectivity, real-time diagnostics, and remote monitoring. By 2026, most new pumps are expected to feature integrated digital payment systems, mobile app compatibility, and cloud-based fleet management tools. This shift improves operational efficiency, enhances customer experience, and enables predictive maintenance to reduce downtime. -

Multi-Fuel Dispensing Capabilities

With the rise of alternative fuels—including compressed natural gas (CNG), liquefied petroleum gas (LPG), and hydrogen—gas pumps are evolving into multi-fuel dispensers. Stations are investing in modular pumps capable of handling gasoline, diesel, and alternative fuels from a single unit. This diversification supports energy transition strategies and helps station operators remain competitive in a mixed-fuel future. -

Focus on Cybersecurity and Data Protection

As gas pumps become more connected, cybersecurity is a growing concern. By 2026, regulatory standards and industry best practices will require robust encryption, secure firmware updates, and compliance with data privacy laws (e.g., GDPR). Manufacturers are expected to embed security-by-design principles into pump hardware and software. -

Sustainability and Energy Efficiency

Environmental regulations are pushing manufacturers to design energy-efficient pumps with lower emissions and reduced vapor loss. Additionally, stations are adopting solar-powered pumps and energy recovery systems. The use of recyclable materials in pump construction is also gaining traction as part of broader ESG (Environmental, Social, and Governance) initiatives. -

Expansion in Emerging Markets

While developed regions focus on upgrading existing infrastructure, emerging economies in Asia-Pacific, Africa, and Latin America are experiencing rapid growth in gas station construction. This expansion is driving demand for cost-effective, durable, and easy-to-maintain gas pumps. Localization of manufacturing and service networks is expected to accelerate in these regions by 2026. -

Human-Machine Interface (HMI) Enhancements

Modern gas pumps are incorporating larger touchscreens, multilingual support, and interactive advertising displays. These interfaces not only streamline the refueling process but also open new revenue streams through targeted digital ads and loyalty program integrations. -

Impact of Electrification and EV Charging Competition

Although electric vehicle (EV) adoption is rising, internal combustion engine (ICE) vehicles will remain dominant in many regions through 2026. However, gas stations are increasingly adopting hybrid models—installing EV chargers alongside traditional pumps. This dual approach ensures relevance in a transitioning market and maximizes site utilization.

In conclusion, the 2026 gas pump market will be characterized by smarter, more versatile, and sustainable fueling solutions. While challenges related to energy transition persist, innovation and strategic adaptation will allow gas station operators and manufacturers to thrive in an increasingly complex environment.

Common Pitfalls Sourcing Gas Pumps for Gas Stations (Quality & IP)

Sourcing gas pumps for a gas station is a critical decision impacting operational efficiency, safety, compliance, revenue, and long-term profitability. Overlooking key quality and intellectual property (IP) aspects can lead to significant problems. Here are the most common pitfalls to avoid:

H2: Compromising on Build Quality and Certification

One of the most frequent and dangerous mistakes is selecting pumps based solely on upfront cost without verifying their build quality and compliance certifications.

- Substandard Materials: Low-cost pumps may use inferior plastics, metals, or seals prone to corrosion, cracking, or failure under pressure and environmental stress (UV, temperature swings, fuel exposure). This leads to leaks, malfunctions, and safety hazards.

- Lack of Essential Certifications: Reputable pumps must have rigorous, region-specific certifications proving safety and accuracy:

- Explosion Protection (ATEX/IECEx): Mandatory in hazardous zones (Zone 1/2) where flammable vapors exist. Non-compliant pumps pose a severe explosion risk.

- Metrological Accuracy (e.g., OIML R117, NTEP, MID): Ensures the pump dispenses the exact amount charged, protecting consumers and the station owner from legal penalties and revenue loss due to over/under-dispensing.

- EMC (Electromagnetic Compatibility): Prevents interference with other station electronics (POS, security systems) and ensures reliable operation.

- Pitfall: Accepting vendor claims without independently verifying certificates (look for notified body stamps) or sourcing from regions with lax enforcement. Counterfeit certificates exist.

H2: Ignoring Intellectual Property (IP) and Software Risks

The software and firmware within modern gas pumps are valuable IP assets. Sourcing from unauthorized or dubious suppliers creates significant IP and operational vulnerabilities.

- Counterfeit or Cloned Pumps: Some suppliers offer “compatible” pumps that are outright copies of genuine OEM (Original Equipment Manufacturer) models, violating patents and trademarks.

- Pitfall: These clones often lack rigorous testing, use inferior components, and have no legitimate support or warranty. They are prone to failure and can be illegal to operate.

- Unauthorized Software/Firmware:

- Pirated Software: Using software not licensed by the OEM violates copyright and may lack security updates or critical features.

- Tampered Firmware: Firmware modified to bypass security, calibration, or reporting functions is a major risk. It can enable fuel theft (“fuel siphoning”), disable safety interlocks, or prevent accurate reporting.

- Pitfall: Purchasing from third parties offering “discounted” software licenses or “uncensored” firmware. This voids warranties, creates security black holes, and makes the station liable for non-compliance.

- Lack of Secure Software Updates & Support:

- Reputable OEMs provide secure, authenticated channels for firmware updates (security patches, feature upgrades, calibration adjustments).

- Pitfall: Sourcing pumps where the supplier cannot provide secure, legitimate update paths or long-term software support. This leaves pumps vulnerable to cyberattacks and outdated, potentially non-compliant software.

H2: Overlooking Long-Term Support and Serviceability

The total cost of ownership extends far beyond the initial purchase price. Poor sourcing decisions often neglect the critical aspect of ongoing support.

- Unreliable or Non-Existent Service Network: Choosing a pump from a manufacturer without local, trained technicians or readily available spare parts leads to extended downtime during breakdowns.

- Inaccessible or Proprietary Diagnostics: Pumps requiring specialized, non-standard tools or software only available from the OEM (or an obscure distributor) for troubleshooting and calibration create dependency and high service costs.

- Pitfall: Focusing only on the upfront price without evaluating the cost, speed, and reliability of future maintenance and repairs. Downtime directly impacts revenue.

H2: Underestimating Integration Complexity

Modern gas stations rely on seamless integration between pumps, POS systems, tank gauging, and back-office software.

- Proprietary Communication Protocols: Some pumps use closed, non-standard protocols, making integration with existing or future POS systems expensive or impossible without costly middleware.

- Lack of Open Standards Compliance: Pumps not adhering to open standards (like OIF – Open Interface Forum protocols) limit flexibility and vendor choice for future upgrades.

- Pitfall: Assuming any pump will “plug and play” with existing infrastructure. Integration failures lead to operational headaches, data inaccuracies, and lost sales.

Mitigation Strategy: Always source gas pumps from authorized distributors or directly from reputable OEMs with a proven track record, verifiable certifications, legitimate software licensing, robust local technical support, and adherence to open communication standards. Conduct thorough due diligence on certifications and IP legitimacy before purchase.

Logistics & Compliance Guide for Gas Pump For Gas Station

Overview of Gas Pump Logistics

The logistics of delivering and installing gas pumps at gas stations involve coordination between manufacturers, distributors, transportation providers, and installation teams. Proper planning ensures timely delivery, regulatory compliance, and operational efficiency.

Transportation and Delivery

Gas pumps are heavy, sensitive equipment that require specialized handling during transport. Key considerations include:

- Packaging: Pumps must be securely packaged to prevent damage from moisture, vibration, and impact.

- Transport Vehicles: Use flatbed trucks or enclosed trailers with secure tie-downs to prevent shifting.

- Route Planning: Avoid routes with low bridges, weight-restricted roads, or difficult access to the gas station.

- Delivery Scheduling: Coordinate with the station owner to ensure availability for unloading and inspection.

Site Preparation and Installation

Before delivery, the gas station must be prepared to receive and install the equipment.

- Foundation and Mounting: Ensure concrete pads or mounting bases meet manufacturer specifications.

- Utility Connections: Verify electrical, communication, and fuel line connections are in place and up to code.

- Permits: Confirm all required construction and electrical permits are obtained prior to installation.

- Safety Protocols: Implement lockout/tagout procedures and fire safety measures during installation.

Regulatory Compliance Requirements

Gas pumps are highly regulated due to safety, environmental, and consumer protection concerns. Compliance is mandatory at federal, state, and local levels.

Weights and Measures Certification

- Legal for Trade: Gas pumps must be certified by the National Type Evaluation Program (NTEP) and approved by state weights and measures authorities.

- Initial and Periodic Inspection: Pumps must pass inspection before operation and be re-inspected annually or semi-annually, depending on jurisdiction.

- Sealing Requirements: Approved seals must be placed on critical components to prevent tampering.

Environmental Regulations

- Spill and Overfill Prevention: Equip pumps with auto-shutoff valves and overfill protection devices to comply with EPA regulations.

- Vapor Recovery Systems: In regulated areas, pumps must include Stage I and/or Stage II vapor recovery systems to limit VOC emissions.

- Secondary Containment: Underground piping and dispensers must be part of a leak detection and containment system.

Safety and Fire Codes

- NFPA 30 and NFPA 385 Compliance: Adhere to National Fire Protection Association standards for flammable liquid storage and dispensing.

- Electrical Classification: Install pumps in Class I, Division 2 hazardous locations as defined by NEC (National Electrical Code).

- Emergency Shutoffs: Install accessible emergency shut-off switches near dispensers and at central control panels.

Cybersecurity and Payment Compliance

Modern gas pumps include electronic payment systems that must meet strict security standards.

- PCI DSS Compliance: Payment terminals must comply with Payment Card Industry Data Security Standard to protect customer data.

- EMV Certification: Pumps with card readers must support EMV chip technology to reduce fraud.

- Remote Monitoring Security: Ensure SCADA and telemetry systems use encrypted communication and access controls.

Documentation and Record Keeping

Proper documentation supports compliance and simplifies audits.

- Manufacturer Certification: Retain NTEP certificates, installation manuals, and compliance labels.

- Inspection Records: Maintain logs of all regulatory inspections, repairs, and calibrations.

- Maintenance Logs: Document routine servicing, part replacements, and software updates.

- Training Records: Keep records of technician training on safety, operation, and emergency procedures.

Conclusion

Successfully deploying gas pumps at a gas station requires careful attention to logistics and strict adherence to regulatory requirements. From transportation and site preparation to certification and ongoing compliance, each step ensures safe, legal, and efficient operation. Partnering with certified suppliers and qualified installers helps mitigate risks and ensures long-term reliability.

Conclusion:

In conclusion, sourcing a gas pump for a gas station requires careful consideration of various factors including reliability, compliance with industry standards, cost-effectiveness, ease of maintenance, and technological features such as payment integration and fuel monitoring systems. Selecting a reputable supplier with a proven track record ensures long-term operational efficiency and customer satisfaction. Additionally, prioritizing energy-efficient and environmentally compliant pumps not only supports sustainability goals but also ensures adherence to regulatory requirements. By conducting thorough market research, evaluating after-sales support, and considering future scalability, station owners can make an informed decision that enhances safety, improves service quality, and maximizes return on investment. Ultimately, the right gas pump sourcing strategy is a critical component in building a successful and competitive fuel retail operation.