The global gas pipe fittings market is experiencing steady growth, driven by rising demand in the oil & gas, petrochemical, and industrial sectors. According to Grand View Research, the global industrial pipe fittings market size was valued at USD 34.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. Similarly, Mordor Intelligence projects that the gas pipeline market will grow at a CAGR of over 4.5% during the forecast period of 2023–2028, underpinned by infrastructure development and expanding natural gas distribution networks. As safety, durability, and leak-proof performance become critical in gas transmission systems, the role of high-quality gas pipe unions—essential for easy assembly, maintenance, and system flexibility—has intensified. This demand has spurred the emergence of specialized manufacturers renowned for engineering precision, material integrity, and regulatory compliance. Here, we spotlight the top 10 gas pipe union manufacturers shaping the industry through innovation, scalability, and global supply capacity.

Top 10 Gas Pipe Union Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Fittings

Domain Est. 1996

Website: nibco.com

Key Highlights: Nibco is a leading provider of industrial and municipal fluid flow solutions—valves, piping, fittings, flow control, and engineered systems….

#2 HDPE Pipe Solutions

Domain Est. 1995

Website: isco-pipe.com

Key Highlights: ISCO is the leading HDPE pipe & fusion equipment supplier in North America, providing expert solutions for municipal, industrial & oil/gas HDPE piping ……

#3 ASC Engineered Solutions

Domain Est. 2020

Website: asc-es.com

Key Highlights: Manufacturer and solutions provider of precision-engineered pipe joining products, valves, and related services for the entire construction project ……

#4 U.S. Pipe

Domain Est. 1995

Website: uspipe.com

Key Highlights: US Pipe, a Quikrete company, offers a complete range of Ductile Iron Pipe, Restrained Joint Pipe, Fabrication, Gaskets, and Fittings….

#5 Gas Distribution

Domain Est. 1995

Website: hubbell.com

Key Highlights: For 60 years, Continental Industries has been an industry leader in the manufacturing of connector fittings for the Gas Utility, Gas & Water Distribution, ……

#6 Western Enterprises: High

Domain Est. 1996

Website: westernenterprises.com

Key Highlights: Western Enterprises offers premier solutions for high-pressure gas control, storage, and transmission. Ensure safety and efficiency with our products….

#7

Domain Est. 1998

Website: consolidatedpipe.com

Key Highlights: A national leader in piping, fittings, valves, and all accessories for the energy, oil & gas, utility, construction, water and sewer industries….

#8 XR3 Series Fittings

Domain Est. 1999

Website: gastite.com

Key Highlights: Gastite provides corrugated stainless steel gas piping for propane and natural gas in commercial and residential applications. Gastite flexible gas piping ……

#9 Gas Industry

Domain Est. 2001

Website: gfps.com

Key Highlights: Georg Fischer Central Plastics is North America’s largest single source supplier of piping systems for the natural gas industry….

#10 Streamline Your System

Domain Est. 2013

Website: muellerstreamline.com

Key Highlights: From tubing and fittings to line sets, valves, and more, trust your piping systems to the proven performance and reliability of the industry leader….

Expert Sourcing Insights for Gas Pipe Union

H2: Projected Market Trends for Gas Pipe Unions in 2026

The global market for gas pipe unions is poised for significant evolution by 2026, driven by advancements in energy infrastructure, increasing regulatory standards, and a growing emphasis on safety and efficiency in gas distribution systems. As natural gas continues to serve as a transitional energy source toward lower-carbon economies, demand for reliable and durable pipeline components—such as gas pipe unions—will rise in both developed and emerging markets.

-

Increased Demand in Emerging Economies

Countries in Asia-Pacific (notably India, Indonesia, and Vietnam), the Middle East, and parts of Africa are expanding their natural gas networks to support industrialization and urban development. These regions are investing heavily in pipeline infrastructure to enhance energy access and reduce reliance on imported fuels. Gas pipe unions, which allow for easy assembly, disassembly, and maintenance of gas lines, are becoming critical components in these projects, especially in modular and prefabricated piping systems. -

Growth in LNG and CNG Infrastructure

The global shift toward liquefied natural gas (LNG) and compressed natural gas (CNG) for transportation and industrial applications will boost demand for specialized gas pipe unions designed to handle high pressures and cryogenic temperatures. The proliferation of LNG terminals, CNG fueling stations, and floating storage units (FSRUs) will require robust, leak-proof union fittings compliant with international standards like API, ASME, and ISO. -

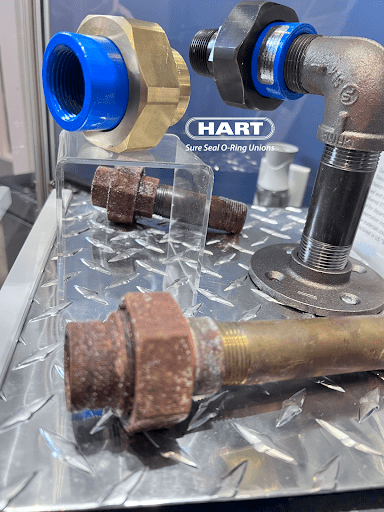

Emphasis on Safety and Leak Prevention

With tightening safety regulations and public scrutiny following gas-related incidents, there is a growing preference for high-integrity gas pipe unions with enhanced sealing technologies. Manufacturers are responding by incorporating advanced materials such as stainless steel, duplex alloys, and fluoropolymer seals to improve corrosion resistance and longevity. Smart unions with integrated sensors for pressure and leak detection are also expected to enter mainstream markets by 2026, particularly in smart city and industrial IoT deployments. -

Sustainability and Material Innovation

Environmental concerns are pushing manufacturers to adopt sustainable production practices and recyclable materials. The use of lightweight yet durable alloys reduces the carbon footprint of transportation and installation. Additionally, some companies are exploring 3D-printed unions for customized applications, which can reduce material waste and lead times. -

Market Consolidation and Regional Supply Chains

By 2026, the gas pipe union market is likely to see increased consolidation among mid-tier suppliers, driven by the need for economies of scale and global certification compliance. Regional manufacturing hubs in Southeast Asia and Eastern Europe are expected to gain prominence, reducing dependency on traditional suppliers in North America and Western Europe and improving supply chain resilience. -

Impact of Digitalization and BIM

Building Information Modeling (BIM) and digital twin technologies are transforming pipeline design and maintenance. Gas pipe unions are being modeled with precise digital specifications, enabling seamless integration into automated construction workflows. This trend supports prefabrication and just-in-time delivery, enhancing project efficiency and reducing on-site errors.

In summary, the 2026 gas pipe union market will be shaped by infrastructure expansion, technological innovation, and regulatory demands. Companies that invest in high-performance materials, digital integration, and regional supply chain agility are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Gas Pipe Unions: Quality and IP (Intellectual Property)

Sourcing gas pipe unions involves critical considerations beyond basic functionality, especially regarding quality assurance and intellectual property (IP) risks. Overlooking these aspects can lead to safety hazards, operational failures, legal liabilities, and reputational damage. Below are common pitfalls to avoid:

1. Compromising on Material and Manufacturing Quality

One of the most frequent pitfalls is selecting gas pipe unions based solely on cost, leading to substandard materials and poor workmanship.

- Use of Inferior Materials: Low-grade steel or non-compliant alloys may corrode quickly or fail under pressure, risking gas leaks and explosions. Ensure unions meet recognized standards such as ASTM A106, API 5L, or ISO 15156 for sour service environments.

- Poor Thread Quality: Improperly cut or mismatched threads (e.g., NPT, BSP) can result in leaks or difficulty during installation. Verify thread accuracy and surface finish.

- Lack of Pressure and Leak Testing: Reputable suppliers provide traceable pressure test certifications (e.g., hydrostatic tests at 1.5x working pressure). Avoid suppliers who cannot provide test reports or material traceability (MTRs).

2. Ignoring Certification and Compliance Requirements

Gas systems are highly regulated due to safety risks. Sourcing non-compliant unions can violate local codes and international standards.

- Missing Certifications: Ensure products are certified to relevant standards such as ASME B16.11, API 6A, or PED (Pressure Equipment Directive) for European markets. Lack of third-party certification (e.g., CE, CRN, UL) increases liability.

- Counterfeit or Non-Conforming Products: Especially in global supply chains, counterfeit parts may mimic genuine brands but fail under operational stress. Always verify certifications and conduct factory audits when possible.

3. Overlooking Intellectual Property (IP) Infringement

Using or sourcing gas pipe unions that infringe on patented designs or trademarks is a serious legal and operational risk.

- Copying Proprietary Designs: Some manufacturers develop unique sealing mechanisms, anti-rotation features, or quick-connect systems protected by patents. Sourcing look-alike products from unauthorized suppliers can lead to IP litigation.

- Trademark Violations: Using unlicensed replicas of branded unions (e.g., imitation Swagelok, Parker, or John Guest) may expose your company to legal action for trademark infringement.

- No IP Warranty from Supplier: Many low-cost suppliers do not offer IP indemnification. Always include contractual clauses requiring the supplier to assume liability for IP violations.

4. Inadequate Supply Chain Transparency

Lack of visibility into the manufacturing source increases risks related to both quality and IP.

- OEM vs. Grey Market: Grey market or parallel imports may offer lower prices but lack manufacturer warranties and traceability. These products may not meet original specs or could be counterfeit.

- No Factory Audits or Traceability: Without direct access to the manufacturer or audit rights, it’s difficult to verify quality processes or ensure ethical sourcing.

5. Poor Documentation and Traceability

Missing or falsified documentation undermines quality assurance and regulatory compliance.

- Lack of Mill Test Reports (MTRs): Without MTRs, you cannot verify the chemical composition or mechanical properties of the material used.

- No Batch or Heat Number Tracking: In case of a failure, traceability is essential for recalls and root cause analysis. Ensure each union is marked with batch/heat numbers.

Best Practices to Mitigate Risks:

- Source from Authorized Distributors or OEMs to ensure authenticity and IP compliance.

- Require Full Documentation, including MTRs, pressure test reports, and certification marks.

- Conduct Supplier Audits or use third-party inspection services (e.g., SGS, Bureau Veritas).

- Include IP Indemnification Clauses in procurement contracts.

- Verify Compliance with regional safety and pressure equipment regulations before deployment.

By addressing these common pitfalls, organizations can ensure they source gas pipe unions that are safe, reliable, and legally compliant.

Logistics & Compliance Guide for Gas Pipe Union

1. Overview

This guide outlines the essential logistics and compliance requirements for the safe handling, transportation, storage, and use of Gas Pipe Unions—specifically those used in hydrogen (H₂) service. Hydrogen’s unique properties, including low density, high diffusivity, flammability, and embrittlement potential, necessitate strict adherence to safety, regulatory, and industry standards.

2. Regulatory and Standards Framework

2.1 International Standards

- ISO 19880-1: Gaseous hydrogen – Fueling stations – Part 1: General requirements

- ISO 19881: Gaseous hydrogen – Land vehicle refueling connection devices

- ISO 23271: Metallic materials – Determination of resistance to hydrogen embrittlement

- ASME B31.12: Pipeline Transportation Systems for Hydrogen and Hydrogen Mixtures

2.2 Regional Regulations

- European Union: ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road) – Class 2.1 Flammable Gases

- United States: DOT 49 CFR Parts 100–185 (Hazardous Materials Regulations), OSHA 29 CFR 1910.106 (Flammable Liquids and Gases)

- Canada: TDG (Transportation of Dangerous Goods) Regulations

- China: GB/T 34542.2-2018 – Hydrogen safety standards

2.3 Industry-Specific Compliance

- CGA G-5.6: Compressed Gas Association – Safe Handling of Hydrogen

- NFPA 2: Hydrogen Technologies Code (U.S.)

- PED 2014/68/EU: Pressure Equipment Directive (Europe)

3. Material and Design Compliance

3.1 Hydrogen Compatibility

- Gas pipe unions must be constructed from hydrogen-resistant materials such as:

- Austenitic stainless steels (e.g., 316L)

- Low-carbon steels with protective coatings

- Certain nickel alloys (e.g., Inconel)

- Avoid materials prone to hydrogen embrittlement (e.g., high-strength carbon steels)

3.2 Design and Certification

- Unions must be rated for hydrogen service at specified pressure and temperature ranges.

- All components require Pressure Equipment Directive (PED) or ASME certification where applicable.

- Leak-tight design: Metal-seated or elastomer seals compatible with H₂ (e.g., Kalrez®, PTFE)

4. Logistics and Transportation

4.1 Classification and Labeling

- UN Number: UN 1049 (Hydrogen, compressed)

- Hazard Class: 2.1 (Flammable Gas)

- Labeling: Diamond-shaped label with flame symbol; “FLAMMABLE GAS” clearly marked

- Placarding: Required on transport vehicles per ADR, DOT, or TDG

4.2 Packaging and Containment

- Gas pipe unions should be transported:

- In sealed, corrosion-resistant packaging

- Protected from moisture and physical impact

- With end caps or plugs to prevent contamination

- If shipped with hydrogen systems, ensure systems are depressurized and purged

4.3 Transportation Modes

- Road: Comply with ADR or DOT regulations; use certified H₂ transport carriers

- Air: IATA Dangerous Goods Regulations – limited exceptions for small components

- Sea: IMDG Code – special provisions for hydrogen-compatible equipment

5. Storage Requirements

5.1 Environmental Conditions

- Store in dry, well-ventilated areas, away from direct sunlight and heat sources

- Maintain ambient temperature between 10°C and 40°C

- Humidity control to prevent corrosion

5.2 Segregation

- Store separately from oxidizers, flammable materials, and strong acids

- Use non-combustible storage racks; ground racks to prevent static buildup

5.3 Inventory Management

- Implement FIFO (First In, First Out) system

- Maintain traceability via batch/lot numbers and material test reports (MTRs)

6. Handling and Installation

6.1 Pre-Use Inspection

- Check for:

- Mechanical damage (scratches, dents)

- Corrosion or contamination

- Certification markings and documentation

- Verify thread compatibility and cleanliness

6.2 Installation Best Practices

- Use only calibrated torque tools to avoid over-tightening

- Clean all parts with hydrogen-compatible solvents (e.g., high-purity isopropyl alcohol)

- Purge lines with inert gas (e.g., N₂) before H₂ introduction

- Perform leak testing using H₂-compatible methods (e.g., helium leak testing or hydrogen sensors)

7. Safety and Emergency Procedures

7.1 Risk Mitigation

- Hydrogen is odorless and colorless; use odorants or sensors where permitted

- Install ventilation systems with hydrogen detectors in enclosed spaces

- Prohibit ignition sources within 5 meters of handling zones

7.2 Personal Protective Equipment (PPE)

- Flame-resistant clothing

- Safety goggles and face shield

- Anti-static gloves and footwear

7.3 Emergency Response

- In case of leak:

- Evacuate area and eliminate ignition sources

- Ventilate area; do not attempt to stop leak unless trained

- Notify emergency services; provide UN 1049 information

- Fire: Use dry chemical or CO₂ extinguishers; water spray to cool exposed containers

8. Documentation and Traceability

8.1 Required Documentation

- Material Test Reports (MTRs)

- Certificate of Conformance (CoC)

- Traceability records (batch numbers, heat numbers)

- Safety Data Sheets (SDS) for any cleaning agents or lubricants used

8.2 Record Keeping

- Maintain logs for:

- Inspections

- Maintenance

- Leak tests

- Training of personnel

9. Training and Competency

- Personnel involved in handling or installing gas pipe unions for H₂ service must receive:

- Hydrogen safety training

- Handling and installation certification

- Emergency response drills

- Training records must be retained for audit purposes.

10. Audit and Compliance Verification

- Conduct regular internal audits against:

- ISO, ASME, CGA, and NFPA standards

- Local regulatory requirements

- Third-party inspections recommended for critical applications (e.g., fueling stations, industrial plants)

Note: Always consult the latest version of applicable standards and local authorities before deployment. Hydrogen systems demand rigorous attention to detail to ensure operational safety and regulatory compliance.

Conclusion for Sourcing Gas Pipe Union:

Sourcing gas pipe unions requires careful consideration of quality, compliance, and supplier reliability to ensure safe and efficient gas transmission in both residential and industrial applications. It is essential to select unions that meet relevant industry standards—such as ASTM, ASME, or ANSI—and are compatible with the type of gas, pressure, and environmental conditions of the intended system. Material selection (e.g., brass, stainless steel, or carbon steel) should align with corrosion resistance and durability requirements.

Evaluating suppliers based on certification, track record, and ability to provide consistent, traceable products is critical to minimizing risks of leaks, failures, or non-compliance. Additionally, cost-effectiveness should not compromise safety or performance. By prioritizing certified materials, reputable suppliers, and proper specifications, organizations can ensure long-term reliability, regulatory compliance, and operational safety in gas piping systems.