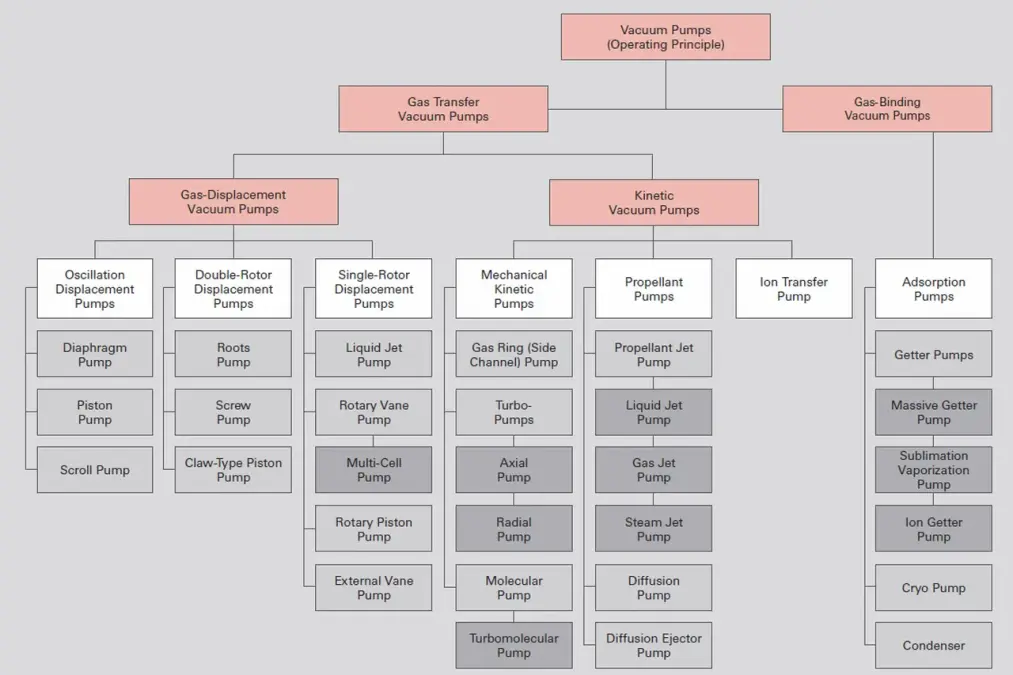

The global vacuum pump market is experiencing robust growth, driven by increasing demand across industries such as semiconductor manufacturing, pharmaceuticals, food packaging, and chemical processing. According to a report by Mordor Intelligence, the vacuum pump market was valued at USD 3.03 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.1% from 2024 to 2029. This expansion is fueled by advancements in vacuum technology, rising automation, and the need for high-efficiency pumping solutions in critical applications.

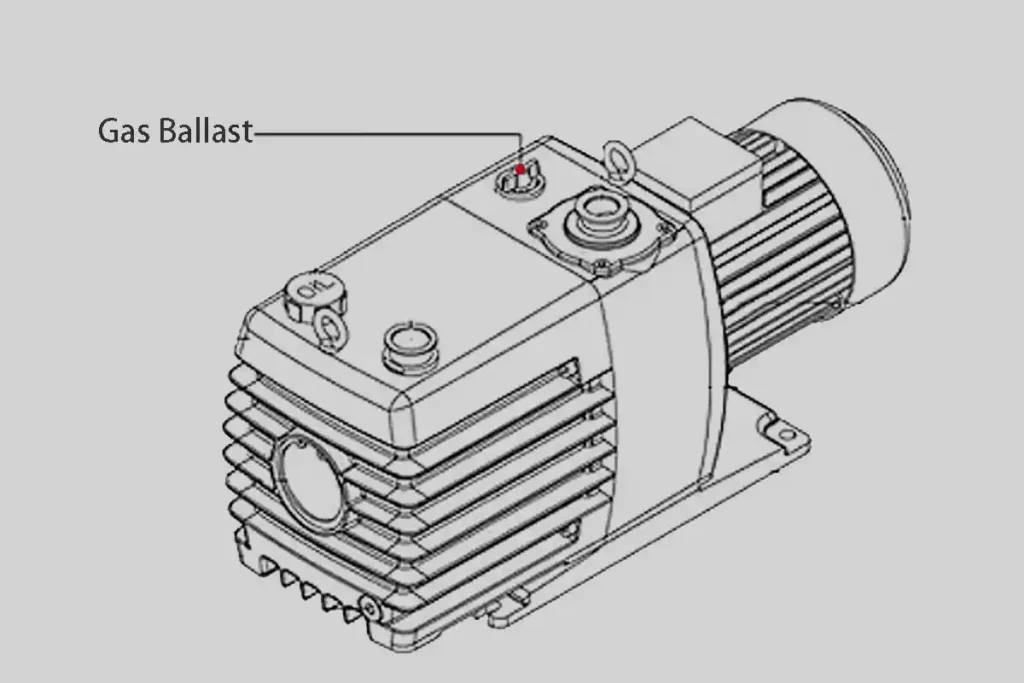

Among the various types of vacuum pumps, gas ballast pumps have gained prominence for their ability to handle condensable vapors without degradation in performance—making them essential in industrial and analytical processes. As demand for reliable, oil-sealed rotary vane pumps with gas ballast functionality increases, a select group of manufacturers have emerged as leaders in innovation, durability, and global reach. The following list highlights the top eight gas ballast vacuum pump manufacturers shaping the industry’s future through technological leadership and strong market presence.

Top 8 Gas Ballast Vacuum Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Vacuum Generation: Introduction

Domain Est. 1996

Website: pfeiffer-vacuum.com

Key Highlights: Learn about the fundamentals of vacuum generation, such as key principles, industrial applications, and a variety of vacuum pumps….

#2 Gas Ballast Vacuum Pumps and Vacuum Generators

Domain Est. 1998

Website: globalspec.com

Key Highlights: List of Gas Ballast Vacuum Pumps and Vacuum Generators Product Specs, Datasheets, Manufacturers & Suppliers….

#3 Two

Domain Est. 1996

Website: welchvacuum.com

Key Highlights: 15–26 day delivery 15-day returnsThe Welch CRVpro 2 Premium Package comes with integral gas ballast valves and includes digital Vacuum gauge VMpro 2, two-way ball valve, oil mist f…

#4 Diaphragm pumps – Vacuum pumps

Domain Est. 1997

Website: vacuubrand.com

Key Highlights: Durable, chemically resistant, oil-free – discover our diaphragm pumps as a vacuum solution for laboratories, chemistry and industry….

#5 Fieldpiece

Domain Est. 1997

Website: fieldpiece.com

Key Highlights: One tool, one sensor, detects A3, A2L, A1 refrigerants and combustible gas leaks, fast. A heated-diode sensor on a flexible wand provides audio and visual cues….

#6 What is a gas ballast and how does it work

Domain Est. 2001

Website: leybold.com

Key Highlights: Understand the basic operating principle of a gas ballast and discover its benefits, including tackling water condensation in a vacuum pump….

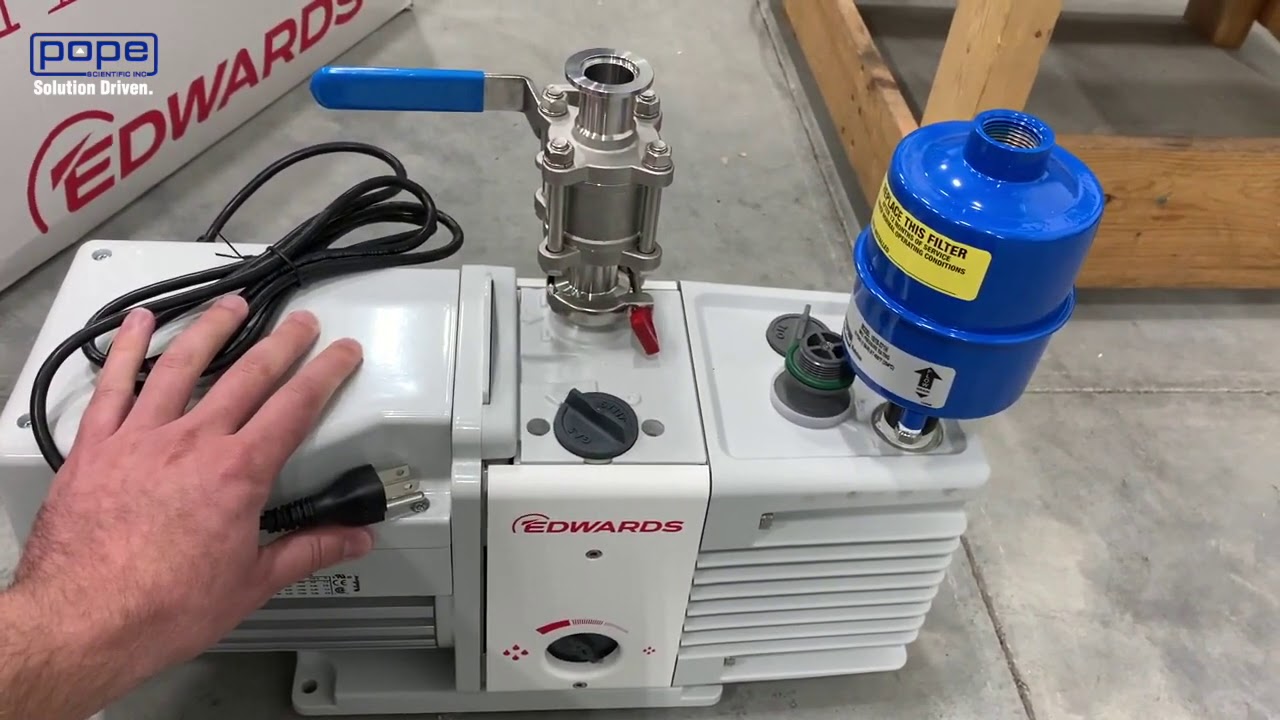

#7 The principle and application of gas ballast

Domain Est. 2005

Website: edwardsvacuum.com

Key Highlights: Gas ballast is a constructional feature widely applied in many primary vacuum pumps for the pumping of vapours. It permits a pump to operate on vapour duty ……

#8 Gas ballast for D

Domain Est. 2005

Website: us.my.edwardsvacuum.com

Key Highlights: Gas ballast for D-Lab pumps 10-100,10-8, A48015135. Part Number: A48015135. USD 85.00. USD 100.00 Price. Your Price (discount of 15%). 1 In Stock….

Expert Sourcing Insights for Gas Ballast Vacuum Pump

H2: Projected Market Trends for Gas Ballast Vacuum Pumps in 2026

By 2026, the global market for gas ballast vacuum pumps is expected to experience steady growth, driven by increasing demand across key industrial sectors and technological advancements aimed at improving energy efficiency and reliability. These pumps, which are essential in applications requiring the removal of condensable vapors from vacuum systems, are witnessing a shift in adoption patterns due to evolving industrial needs and environmental regulations.

One of the primary drivers of market expansion is the growing emphasis on process reliability in the pharmaceutical and chemical industries. Gas ballast technology enables vacuum pumps to handle moisture and solvent vapors without oil degradation, making them ideal for sterile manufacturing and distillation processes. As regulatory scrutiny intensifies around product purity and equipment performance, manufacturers are increasingly investing in vacuum systems with gas ballast capabilities to ensure consistent output and reduce maintenance downtime.

Additionally, the industrial automation trend is contributing to the integration of smart vacuum systems. By 2026, gas ballast vacuum pumps are anticipated to feature enhanced monitoring systems, including IoT-enabled sensors that provide real-time diagnostics and predictive maintenance alerts. This shift supports Industry 4.0 initiatives, improving operational efficiency and minimizing unplanned outages in advanced manufacturing environments.

Energy efficiency remains a critical focus area. Manufacturers are developing next-generation gas ballast pumps with variable speed drives and optimized ballast control mechanisms to reduce power consumption. These innovations align with global sustainability goals and help end-users comply with energy regulations such as the EU Ecodesign Directive, further boosting market demand in Europe and North America.

Geographically, the Asia-Pacific region is projected to witness the highest growth rate, fueled by rapid industrialization, expanding pharmaceutical production, and rising investments in semiconductor manufacturing—sectors that rely heavily on high-performance vacuum technology. China, India, and South Korea are expected to lead regional demand, supported by government initiatives promoting high-tech manufacturing.

However, challenges remain. The relatively higher initial cost of advanced gas ballast systems compared to standard vacuum pumps may restrain adoption in price-sensitive markets. Additionally, competition from alternative technologies, such as dry screw and claw pumps, could limit market penetration in applications where oil contamination is a concern.

In conclusion, the 2026 market landscape for gas ballast vacuum pumps will be shaped by a confluence of regulatory, technological, and industrial factors. While facing competition and cost barriers, the segment is poised for moderate but sustained growth, particularly in high-precision and vapor-handling applications where the unique advantages of gas ballast functionality are indispensable.

H2: Common Pitfalls When Sourcing a Gas Ballast Vacuum Pump – Quality and Intellectual Property (IP) Concerns

Sourcing a gas ballast vacuum pump—commonly used in industrial applications where moisture or condensable vapors are present—can present several challenges, particularly related to product quality and intellectual property (IP) risks. Being aware of these pitfalls helps ensure reliable performance, regulatory compliance, and protection against legal and operational risks.

1. Compromised Quality Due to Substandard Manufacturing

One of the most frequent pitfalls is receiving a gas ballast vacuum pump that fails to meet performance or durability standards due to poor manufacturing practices.

- Inadequate Materials: Low-cost pumps may use inferior materials (e.g., non-corrosion-resistant alloys or low-grade seals), leading to rapid wear, leaks, or contamination in sensitive environments.

- Poor Tolerances and Assembly: Inconsistent machining or assembly can result in vibration, noise, reduced pumping efficiency, and shortened service life.

- Unverified Performance Claims: Some suppliers exaggerate pumping speed, ultimate vacuum levels, or gas ballast effectiveness without third-party certification (e.g., ISO 21360).

Impact: Reduced uptime, increased maintenance costs, and potential system contamination.

2. Lack of Compliance with International Standards

Reputable gas ballast pumps should conform to standards such as ISO, CE, or ATEX (for explosive environments). Sourcing from non-compliant suppliers can lead to:

– Safety hazards in operation.

– Failure to meet industry-specific regulations (e.g., pharmaceutical, food processing).

– Voided warranties or insurance coverage.

3. Counterfeit or “Clone” Equipment Infringing IP

A growing issue, especially when sourcing from certain regions, is the proliferation of vacuum pumps that copy patented designs, logos, or technical features of established brands (e.g., Busch, Edwards, Leybold).

- IP Infringement Risks: Purchasing counterfeit or cloned equipment may expose the buyer to legal liability, especially if the product is used in commercial or regulated settings.

- Lack of Authenticity: Clones often lack proper documentation, firmware updates, or technical support, making integration and servicing difficult.

- Brand Reputation Damage: Using infringing equipment may harm your organization’s reputation, particularly if discovered during audits or partnerships.

4. Insufficient Documentation and Technical Support

Low-quality or IP-compromised pumps often come with:

– Poorly translated or incomplete manuals.

– Missing CAD drawings, compliance certificates, or maintenance schedules.

– No access to OEM-level technical support or spare parts.

This complicates installation, troubleshooting, and compliance reporting.

5. Hidden Costs from Poor Reliability

While some pumps appear cost-effective upfront, poor quality leads to:

– Frequent breakdowns and unplanned downtime.

– Higher energy consumption due to inefficiency.

– Costly emergency repairs or replacements.

6. Supply Chain Transparency and Traceability Issues

Without clear visibility into the manufacturer and component sources, buyers risk:

– Unethical labor practices or environmental violations in the supply chain.

– Inability to verify authenticity or conduct due diligence on IP rights.

Recommendations to Avoid Pitfalls:

– Source from Authorized Distributors or OEMs: Ensures authenticity, warranty coverage, and IP compliance.

– Request Certifications: Ask for ISO, CE, or ATEX documentation and performance test reports.

– Conduct Factory Audits or Third-Party Inspections: Especially important when dealing with new or offshore suppliers.

– Verify IP Status: Check trademarks, patents, and design rights to ensure the product isn’t infringing.

– Evaluate Total Cost of Ownership (TCO): Prioritize reliability and support over initial price.

By addressing these quality and IP-related pitfalls proactively, organizations can ensure they source gas ballast vacuum pumps that are safe, efficient, and legally compliant.

Logistics & Compliance Guide for Gas Ballast Vacuum Pump Using Hydrogen (H₂)

⚠️ Important Note: This guide applies specifically to gas ballast vacuum pumps that use hydrogen (H₂) as the ballast gas. Hydrogen introduces specific safety, regulatory, and logistical challenges due to its flammability, low density, and high diffusivity. Proper handling, storage, transportation, and operational compliance are essential.

1. Overview of Gas Ballast Vacuum Pumps with H₂

Gas ballast technology in vacuum pumps prevents condensation of vapors (e.g., water, solvents) inside the pump by introducing a small amount of non-condensable gas (in this case, hydrogen) into the compression chamber.

Using H₂ as the ballast gas offers advantages:

– Improves pump performance in high-moisture environments.

– Reduces oil contamination and emulsification.

– Faster pump-down in certain applications (e.g., vacuum drying, refrigeration systems).

However, H₂ poses unique safety and regulatory risks due to its:

– Wide flammability range (4–75% in air)

– Low ignition energy

– High diffusivity and leakage potential

2. Regulatory Compliance

A. International & Regional Regulations

| Regulation | Applicability | Key Requirements |

|———-|—————|——————|

| UN GHS (Globally Harmonized System) | Global | Classify H₂ as Flammable Gas (Category 1), label with flame pictogram (GHS02), signal word “Danger”. |

| ADR/RID/ADN (Europe) | Road/Rail/Inland Water Transport in Europe | H₂ is UN 1049, Compressed Gas, Flammable. Requires certified cylinders, ventilation, signage, and driver training. |

| 49 CFR (USA – DOT) | U.S. Transportation | H₂ classified as Hazard Class 2.1 (Flammable Gas). Requires placarding, proper packaging, shipping papers, and trained personnel. |

| IATA DGR (Air Transport) | International Air | H₂ is generally prohibited in passenger aircraft cargo; limited quantities allowed on cargo-only flights with special approval. |

| IMDG Code (Sea Transport) | International Maritime | H₂ cylinders must be stowed in well-ventilated areas, away from oxidizers and ignition sources. |

| OSHA 29 CFR 1910.106 / NFPA 55 (USA) | Workplace Safety | Storage, handling, and use of H₂ require ventilation, fire protection, and leak detection systems. |

| ATEX / IECEx (Europe/Global) | Hazardous Areas | Equipment in zones where H₂ may be present must be certified for Group IIC (highest gas group). |

B. Pressure Equipment Directive (PED 2014/68/EU)

- Applies to H₂ storage cylinders and pressure lines.

- Requires CE marking, conformity assessment, and traceability.

3. Logistics & Transportation

A. Packaging & Containment

- H₂ must be stored and transported in certified high-pressure cylinders (typically 150–200 bar).

- Cylinders must be:

- DOT-3AA or ISO 9809 compliant (USA/Europe).

- Equipped with safety relief devices (burst disc, pressure relief valve).

- Secured upright during transport.

B. Labeling & Documentation

- Labels Required:

- “Flammable Gas” (Class 2.1)

- UN Number: UN 1049

- Proper Shipping Name: “Hydrogen, Compressed”

- GHS Pictograms: Flame

- Documentation:

- Safety Data Sheet (SDS) – Section 14: Transport Information

- Dangerous Goods Declaration (for ADR/IMDG/IATA)

- Emergency Response Information

C. Transport Restrictions

- Air (IATA): Generally not permitted unless under Special Provision A152 (very limited quantities with approvals).

- Sea (IMDG): Allowed with proper stowage (e.g., open deck, away from heat).

- Road/Rail (ADR): Permitted with certified vehicles, trained drivers, and emergency equipment.

4. Storage & Handling at Facility

A. Storage Requirements

- Store H₂ cylinders in:

- Well-ventilated, fire-resistant outdoor areas or dedicated gas cabinets.

- Away from oxidizers, heat sources, and ignition points.

- Secured to prevent tipping.

- Max storage quantity may be limited by local fire codes (e.g., NFPA 55).

B. Ventilation & Monitoring

- Use in well-ventilated areas or with local exhaust ventilation.

- Install hydrogen gas detectors with alarms (set at 1% LEL or lower).

- Ensure room has high-point ventilation (H₂ rises quickly).

C. Piping & Connections

- Use stainless steel or approved H₂-compatible tubing.

- Ensure all joints are leak-tested (e.g., with helium or H₂ leak detector).

- Use single-stage or dual-stage regulators rated for H₂ service.

5. Operational Safety for Gas Ballast Pumps

A. Pump Installation

- Install pump in non-hazardous area unless ATEX-certified.

- Ensure pump room has explosion relief or purge systems if H₂ use is continuous.

- Avoid confined spaces.

B. Leak Prevention

- Perform regular leak checks using:

- Hydrogen-specific leak detectors

- Ultrasound or soap solution (for low-pressure lines)

- Use flare or compression fittings designed for H₂.

C. Emergency Procedures

- In case of leak:

- Evacuate area.

- Eliminate ignition sources.

- Ventilate.

- Do not operate electrical switches.

- Fire response:

- Use class B fire extinguishers (CO₂, dry chemical).

- Let fire burn if safe; do not extinguish unless gas flow can be stopped (risk of re-ignition).

6. Training & Documentation

A. Personnel Training

- Required for:

- H₂ properties and hazards

- Leak detection and emergency response

- Use of PPE (e.g., flame-resistant clothing)

- Regulatory compliance (DOT, OSHA, ADR, etc.)

B. Documentation

- Maintain:

- SDS for H₂

- Risk assessments (DSEAR in UK, COMAH in EU if large quantities)

- Inspection logs (cylinders, regulators, detectors)

- Training records

7. Environmental & Disposal Considerations

- H₂ is non-toxic and does not contribute to smog or global warming when released.

- However, vented H₂ must be controlled to avoid accumulation in confined spaces.

- Do not vent H₂ indoors—always route to safe outdoor discharge point.

8. Alternatives & Risk Mitigation

- Consider nitrogen (N₂) as a safer alternative ballast gas where performance allows.

- Use automatic shut-off valves and pressure interlocks.

- Implement double containment or purge systems in high-risk areas.

9. Summary Checklist

✅ Use only certified H₂ cylinders and regulators

✅ Label all containers and transport units correctly

✅ Train personnel on H₂ hazards and emergency procedures

✅ Install gas detection and ventilation systems

✅ Comply with ADR, IMDG, IATA, or 49 CFR as applicable

✅ Store cylinders upright and secured

✅ Avoid ignition sources near H₂ systems

✅ Maintain up-to-date SDS and compliance records

10. Contact Information

For emergencies or regulatory queries:

– Local Fire Authority (Hazmat team)

– Gas supplier technical support

– National regulatory body (e.g., PHMSA in USA, HSE in UK)

📘 Disclaimer: This guide is for informational purposes only. Always consult local regulations, equipment manuals, and a qualified safety officer before operating or transporting H₂ systems.

Last Updated: April 2024

📘 Ensure site-specific risk assessments are conducted before deployment.

Conclusion:

After a thorough evaluation of the technical requirements, market availability, and operational needs, sourcing a gas ballast vacuum pump is a strategic decision that ensures reliable and efficient performance in applications requiring moisture or vapor handling, such as in industrial, medical, or analytical environments. The gas ballast feature significantly enhances pump longevity by preventing condensation and contamination within the pump chamber, thereby reducing maintenance costs and minimizing downtime.

Key considerations in the sourcing process, including pump capacity, oil contamination resistance, energy efficiency, brand reliability, and after-sales support, point to selecting a reputable supplier offering durable, industry-compliant models. Additionally, assessing long-term cost-of-ownership over initial purchase price leads to a more sustainable and economically sound investment.

In conclusion, sourcing a high-quality gas ballast vacuum pump from a trusted manufacturer not only meets current operational demands but also supports future scalability and process reliability. Proper selection and supplier partnership will ensure optimal performance, durability, and return on investment.