The global elastic bands market, including garment-specific applications, is experiencing robust growth driven by rising demand in the apparel, medical, and hygiene sectors. According to Mordor Intelligence, the global elastic bands market was valued at USD 3.1 billion in 2023 and is projected to grow at a CAGR of over 5.2% through 2029. The apparel segment remains a dominant force, fueled by the expansion of fast fashion, increased production of activewear, and the need for high-performance, durable elastic materials in mass-market clothing. Meanwhile, Grand View Research highlights the Asia-Pacific region as a key hub for both production and consumption, thanks to its dense network of garment manufacturers and low-cost manufacturing capabilities. As brands prioritize supply chain efficiency, quality consistency, and sustainable materials, the choice of elastic band suppliers has become a critical factor in maintaining competitive advantage. This list highlights the top 10 garment elastic band manufacturers excelling in innovation, production scale, global reach, and compliance with evolving textile standards—key players shaping the backbone of modern apparel manufacturing.

Top 10 Garment Elastic Band Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Elastic Manufacturers

Domain Est. 2003 | Founded: 1977

Website: manufacturers.com.tw

Key Highlights: Yi Chun Textile Ltd. established in 1977. We manufacture high quality nylon, polyester and synthetic leather fabrics, Elastic for luggage and bags….

#2 Amanda Textile

Domain Est. 2018

Website: amdwebbing.com

Key Highlights: Amanda Textile Co.,Ltd is a famous elastic band, elastic webbing manufacturer, supplier in China, we have been supplying quality elastic band and webbing ……

#3 Global Elastic

Domain Est. 2018

Website: globalelastic.com

Key Highlights: Global Elastic. Specialists in elastic and ribbons for the technical garment and underwear industry. Global Elastic Installations manufacturers of elastic bands….

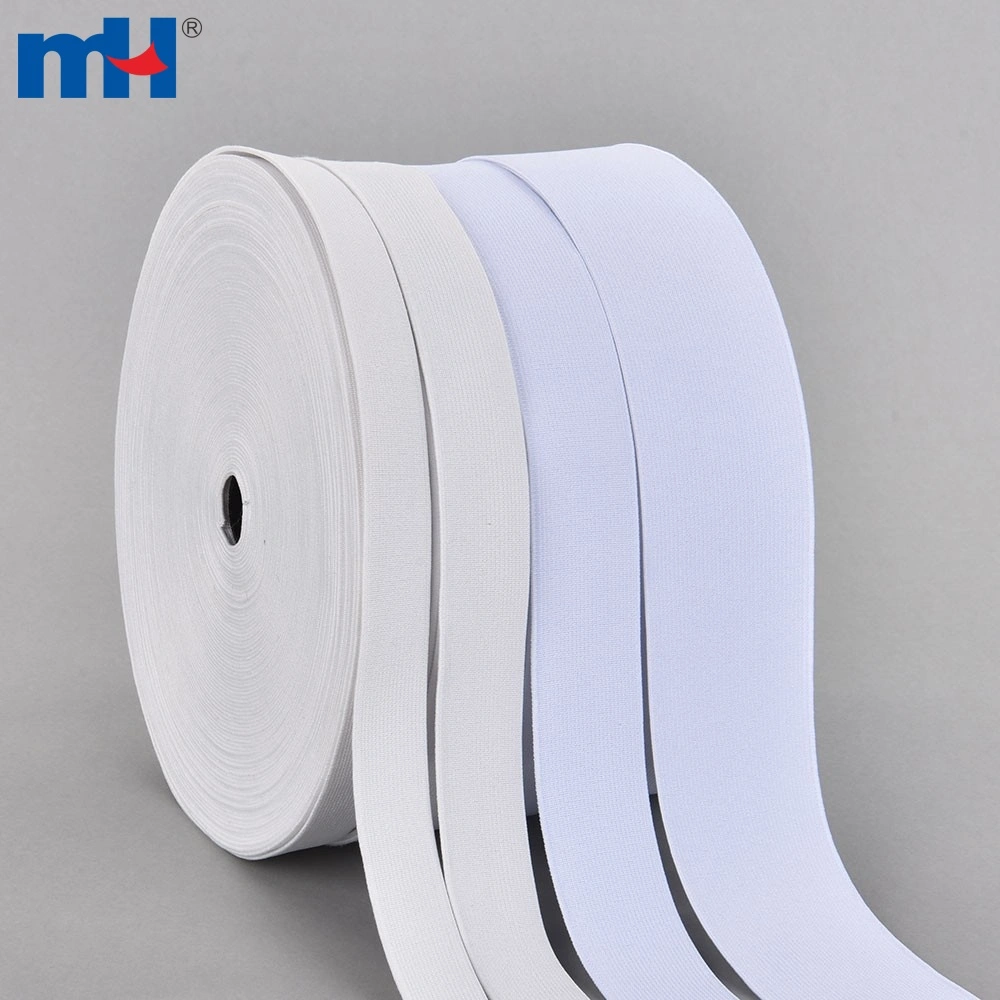

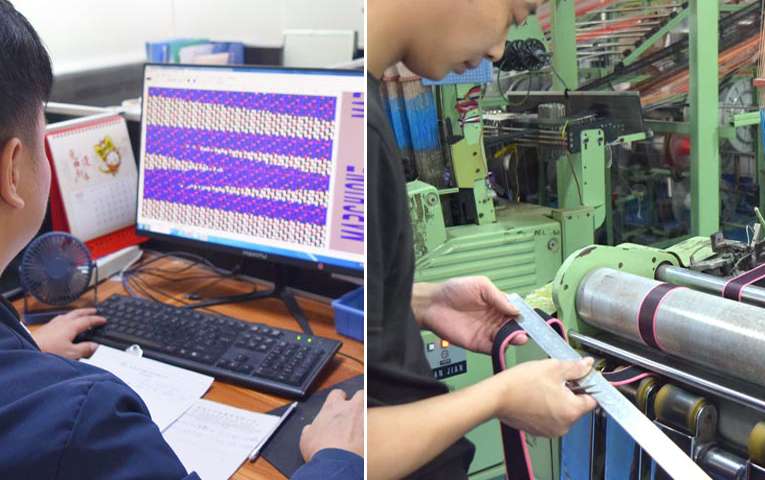

#4 Woven Elastic Bands & Knitting Elastic Bands

Domain Est. 2022

Website: elastic-bands.com

Key Highlights: Huayan has always been committed to the development of elastic business. The entire production process adopts international advanced professional equipment….

#5 Min Yuen Rubber

Domain Est. 2023

Website: elasticrubbertape.com

Key Highlights: We produce high-grade, customizable rubber products for diverse applications, including textiles, swimwear, medical, and industrial products….

#6 Custom Elastic Tape Manufacturer

Website: ecigroup-global.com

Key Highlights: E.C.I. is a leading elastic tape manufacturer providing custom narrow fabric solutions for apparel, sports, and medical applications….

#7 Custom Elastic Bands For Clothing

Domain Est. 2016

Website: weavertex.com

Key Highlights: Out of stockOur elastic bands are designed to stay in place while providing comfort and flexibility, making them a popular choice for everything from garments to home decor ……

#8 Elastic Tapes

Domain Est. 2021

Website: rtrims.com

Key Highlights: We design elastic tapes – also known as elastic trims or bands, for specified apparel to provide support, hold garments in place, and create the finishing edge….

#9 Elastic Bands & Tapes Supplier

Domain Est. 2023

Website: reveluz.com

Key Highlights: Complete Range of Elastic Bands & Tapes. Every type of elastic your garment production needs – all from one reliable supplier. Woven Elastics….

#10 Top 10 Elastic Band Manufacturers and Suppliers 2025

Domain Est. 2024

Website: slelastic.com

Key Highlights: We’ve compiled a list of the top elastic band manufacturers and factories that offer custom solutions, competitive prices, and consistent quality….

Expert Sourcing Insights for Garment Elastic Band

H2: 2026 Market Trends for Garment Elastic Bands

The global garment elastic band market is projected to experience significant transformation by 2026, driven by shifting consumer preferences, technological advancements in textile manufacturing, and growing demand for comfort-driven apparel. As fashion continues to prioritize functionality and wearability, elastic bands have evolved from simple functional components to integral elements in both high-performance and everyday clothing.

One of the dominant trends shaping the 2026 market is the rising demand for sustainable and eco-friendly materials. Consumers and brands alike are prioritizing environmental responsibility, leading to increased adoption of biodegradable, recycled, and low-impact elastomeric fibers. Manufacturers are investing in plant-based rubber alternatives and recycled polyester-spandex blends to meet stringent sustainability standards set by global apparel brands. This shift is particularly evident in Europe and North America, where regulatory frameworks and consumer awareness are accelerating the green transition.

Another key trend is the integration of smart textiles and performance-enhancing features into elastic bands. By 2026, we are seeing a surge in elastic bands embedded with moisture-wicking, antimicrobial, and temperature-regulating properties—especially in activewear and medical garments. Innovations such as seamless knitting and 4D stretch technology allow for greater flexibility and durability, improving garment fit and longevity. These advancements support the booming athleisure segment, which continues to drive demand for high-performance elastic solutions.

Additionally, the global expansion of fast fashion and e-commerce is influencing production scalability and customization. Suppliers are adopting digital printing and on-demand manufacturing techniques to offer personalized elastic trims and bands, catering to niche markets and small-batch designers. This trend supports faster time-to-market and reduced inventory waste, aligning with lean production models.

Regionally, Asia-Pacific remains the largest producer and consumer of garment elastic bands, fueled by robust textile industries in China, India, and Bangladesh. However, increasing labor and environmental compliance costs are prompting some production shifts to Southeast Asia and South Asia. Meanwhile, North America and Western Europe are focusing on high-value, specialty elastic products, often used in premium lingerie, sportswear, and medical textiles.

In conclusion, the 2026 garment elastic band market is defined by sustainability, innovation, and customization. Companies that invest in eco-conscious materials, embrace smart textile technologies, and adapt to evolving supply chain dynamics will be best positioned to capitalize on these emerging trends and maintain a competitive edge in a rapidly advancing global market.

Common Pitfalls When Sourcing Garment Elastic Band (Quality, IP)

Sourcing garment elastic bands may seem straightforward, but overlooking key quality and intellectual property (IP) concerns can lead to product failures, customer dissatisfaction, and legal risks. Below are common pitfalls to avoid:

Inconsistent Material Quality and Performance

Suppliers may offer elastic bands that appear identical but vary significantly in composition, elasticity, recovery, and durability. Low-quality elastics can lose stretch after a few washes, cause skin irritation due to harmful dyes or chemicals, or break under normal wear. Always request physical samples, conduct wear-and-wash testing, and verify compliance with safety standards (e.g., OEKO-TEX, REACH).

Poor Colorfastness and Dye Migration

Inferior dyes used in elastic bands can bleed or transfer onto adjacent fabrics during washing or perspiration. This results in ruined garments and customer complaints. Ensure suppliers provide colorfastness test reports and conduct your own batch testing, especially for garments with light-colored or sensitive fabrics.

Inaccurate Width and Thickness Tolerances

Even minor deviations in elastic width or thickness can affect garment fit and manufacturing efficiency. Automated cutting and sewing lines require precise dimensions. Specify tight tolerances in your purchase agreements and conduct incoming quality inspections to verify consistency.

Lack of Batch-to-Batch Consistency

Mass production often involves multiple production runs. Without strict supplier controls, color shade, tensile strength, or width can vary between batches, leading to visible mismatches in finished garments. Require suppliers to maintain batch traceability and approve pre-production samples for every order.

Ignoring Intellectual Property (IP) and Design Rights

Some elastic weaves, patterns (e.g., jacquard logos), or proprietary technologies (e.g., moisture-wicking, anti-odor treatments) are protected by patents or design rights. Sourcing a “look-alike” elastic from an unauthorized supplier could expose your brand to IP infringement claims. Always verify that the elastic design or technology is either public domain or properly licensed.

Unverified Supplier Claims and Certifications

Suppliers may falsely claim certifications (e.g., sustainable fibers, recycled content) or performance attributes (e.g., UV resistance, chlorine resistance). Request documentation and consider third-party verification. Misleading claims can result in greenwashing allegations and reputational damage.

Overlooking Minimum Order Quantities (MOQs) and Lead Times

Custom elastics often carry high MOQs and long lead times. Failing to align these with your production schedule can cause delays or excess inventory. Plan early and negotiate flexible terms when possible, especially for seasonal or small-batch collections.

Failure to Secure Long-Term Supply Agreements

Relying on a single supplier without a formal supply agreement increases risk if the supplier discontinues a specific elastic or raises prices. Establish contracts that ensure continuity of supply and protect against unilateral changes.

By proactively addressing these pitfalls—through rigorous vetting, testing, and legal due diligence—brands can ensure reliable, compliant, and innovative use of garment elastic bands while safeguarding their reputation and IP.

Logistics & Compliance Guide for Garment Elastic Band

Garment elastic bands are widely used in apparel manufacturing for waistbands, cuffs, and other applications requiring stretch and recovery. Ensuring smooth logistics and compliance with international and local regulations is essential for timely delivery and market access. This guide outlines key considerations for logistics and regulatory compliance when importing or exporting garment elastic bands.

Product Classification & Customs Tariff Codes

Accurate classification under the Harmonized System (HS) is crucial for customs clearance and duty calculation. Garment elastic bands typically fall under Chapter 58 or 59, depending on composition and construction.

- HS Code Example: 5806.32.00 – Elastic fabrics and trimmings, made from rubber thread over 5 mm wide, textile-covered.

- Key Factors:

- Width of the elastic

- Material composition (e.g., spandex/polyester/cotton blend)

- Whether rubberized or textile-covered

- Action: Confirm the correct HS code with your customs broker based on product specifications, as misclassification can lead to delays and penalties.

Import/Export Documentation

Complete and accurate documentation ensures efficient customs processing.

- Required Documents:

- Commercial Invoice (detailing product description, value, quantity, and Incoterms)

- Packing List (specifying dimensions, weight, and packaging type)

- Bill of Lading (for sea freight) or Air Waybill (for air freight)

- Certificate of Origin (to claim preferential tariffs under trade agreements)

-

Import/Export License (if required by destination country)

-

Tip: Clearly label shipments with SKU, lot number, and country of origin to facilitate tracking and compliance checks.

Packaging & Labeling Requirements

Proper packaging protects elastic bands during transit and meets regulatory standards.

- Internal Packaging: Use moisture-resistant materials; avoid PVC if restricted in destination markets.

- Labeling:

- Product name, composition (fiber content %)

- Lot/batch number for traceability

- Care instructions (if applicable)

- Country of origin

-

Compliance marks (e.g., CE, OEKO-TEX®, REACH)

-

Sustainability: Use recyclable packaging materials where possible to align with environmental regulations.

Chemical & Safety Compliance

Elastic bands may be subject to textile and chemical regulations due to dyes, finishes, and rubber content.

- REACH (EU): Ensure compliance with SVHC (Substances of Very High Concern); registration may be required for certain chemicals.

- OEKO-TEX® Standard 100: Certification confirms absence of harmful substances; often required by EU and North American buyers.

- CPSIA (USA): Applicable if elastic is used in children’s clothing; limits lead and phthalates.

-

Proposition 65 (California): Requires warning labels if products contain listed carcinogens or reproductive toxins.

-

Action: Request test reports from suppliers and conduct periodic third-party testing.

Environmental & Sustainability Regulations

Increasingly, elastic bands must meet eco-friendly standards.

- RoHS (EU): Restricts hazardous substances in electrical and electronic components; generally not applicable unless conductive.

- REACH Annex XVII: Bans certain phthalates and azo dyes.

-

Extended Producer Responsibility (EPR): Some countries require registration for textile waste management.

-

Best Practice: Source elastic bands made with recycled materials and low-impact dyes to meet sustainability goals.

Transportation & Storage Considerations

Elastic bands are sensitive to environmental factors that can affect performance.

- Temperature & Humidity:

- Store in dry, climate-controlled environments (ideally 15–25°C, 40–60% RH)

- Avoid direct sunlight and extreme temperatures to prevent rubber degradation

- Shelf Life: Typically 12–24 months; rotate stock using FIFO (First In, First Out)

- Transportation:

- Use sealed containers to prevent moisture exposure

- Avoid stacking heavy items on packed rolls

Incoterms & Risk Management

Clearly define responsibilities using internationally recognized Incoterms.

- Recommended Incoterms:

- FOB (Free On Board): Buyer manages freight and import; common for sea shipments

- DDP (Delivered Duty Paid): Seller handles all logistics and customs; suitable for e-commerce or small buyers

- Insurance: Cover goods for loss or damage during transit, especially for high-value shipments.

Country-Specific Requirements

Regulatory standards vary by market.

- United States: FTC labeling rules (fiber content), customs bond required for commercial imports

- European Union: CE marking not typically required for elastic bands, but REACH and textile labeling directives apply

- Canada: Textile Labeling Act requires fiber content and country of origin

-

Australia/NZ: AS/NZS 1957:1998 for fabric care labeling

-

Action: Consult local authorities or a trade compliance expert before entering new markets.

Conclusion

Effective logistics and compliance for garment elastic bands require attention to classification, documentation, chemical safety, and environmental standards. Partnering with certified suppliers, maintaining accurate records, and staying updated on regulatory changes will ensure smooth operations and market access worldwide.

In conclusion, sourcing garment elastic bands requires careful consideration of several key factors including material quality, elasticity, durability, width, color consistency, and supplier reliability. It is essential to partner with reputable suppliers who can provide consistent product quality, adhere to sustainable and ethical production practices, and offer competitive pricing and timely delivery. Conducting sample testing, verifying certifications, and maintaining clear communication with suppliers will help ensure that the elastic bands meet the specific requirements of the garment application. Ultimately, a well-strategized sourcing approach not only enhances product performance and customer satisfaction but also supports efficient production and long-term supply chain stability.