The global furniture safes market is experiencing steady growth, driven by rising residential and commercial construction activities, increasing consumer demand for secure storage solutions, and evolving interior design trends that prioritize both aesthetics and functionality. According to Grand View Research, the global home security market — which includes furniture-integrated security solutions like hidden safes — was valued at USD 56.3 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 9.4% from 2023 to 2030. A significant portion of this growth is attributed to the rising adoption of discreet, furniture-embedded safes that offer enhanced security without compromising on design. As urbanization and disposable incomes continue to rise, particularly in emerging economies, manufacturers are innovating to meet demand for stylish, high-capacity, and technologically advanced furniture safes. In this competitive landscape, nine manufacturers have distinguished themselves through product quality, innovation, and market reach, positioning them at the forefront of the industry.

Top 9 Furniture Safes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 The biggest safe and steel furniture manufaturer in Europe Promet …

Domain Est. 2000

Website: safe.ru

Key Highlights: Promet is the largest European manufacturer and distributor of safes, metal office, medical and industrial furniture, metal doors, automatic storage systems and ……

#2 The largest manufacturer of safes and steel furniture in Europe

Domain Est. 2005

Website: promet-safe.com

Key Highlights: Promet is the largest European manufacturer and distributor of safes, metal office, medical and industrial furniture, metal doors and electronic locks….

#3 Safes Manufacturer

Domain Est. 1998

Website: agresti.com

Key Highlights: For over 75 years have been producing elegant safes, chests with drawers, fine furniture expertly handcrafted, and much more….

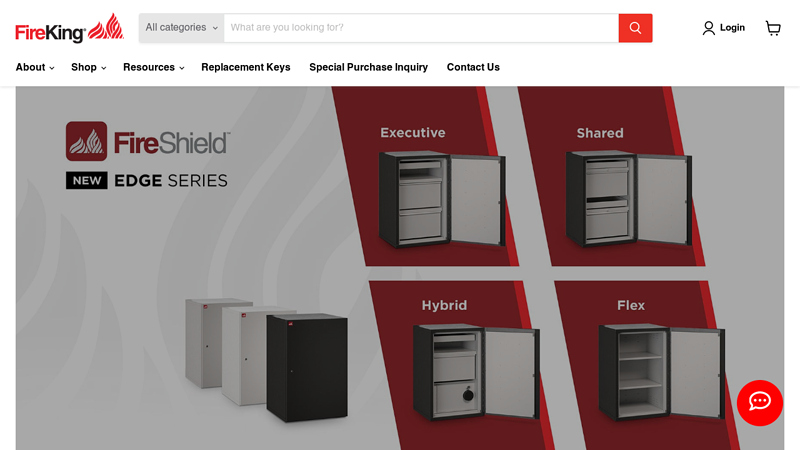

#4 FireKing

Domain Est. 1996

Website: fireking.com

Key Highlights: Industry Leading Safe Lineup. Meticulously engineered to offer unparalleled fire protection, security, and convenience for both home and office environments….

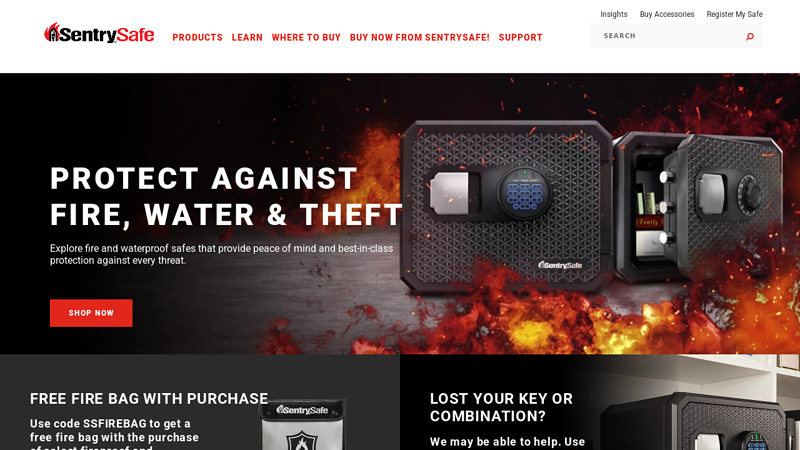

#5 SentrySafe®

Domain Est. 1998

Website: sentrysafe.com

Key Highlights: SentrySafe offers a broad range of secure storage solutions to keep your valuables protected from unexpected perils, theft and more. View safes….

#6 The most popular furniture safes

Domain Est. 2002

Website: hartmann-tresore.pl

Key Highlights: They are small in size, provide effective protection against theft and are most often chosen for homes and offices….

#7 Safes

Domain Est. 2009

Website: vawayside.com

Key Highlights: We carry Champion Safes made of the finest materials with careful attention to detail. These safes are American made with high strength steel and are tough ……

#8 Hidden Compartment Safes

Domain Est. 2014

Website: quicksafes.com

Key Highlights: Quick Safes. Easily installed on any wall we make your life easier and give you some piece of mind knowing your valuables are hidden and easy to access….

#9 Furniture safe 300

Domain Est. 2016

Website: waldis-safe.com

Key Highlights: WALDIS furniture safes are designed for installation in wall units or other pieces of furniture: these safes offer protection against burglary and are ideal ……

Expert Sourcing Insights for Furniture Safes

2026 Market Trends for Furniture Safes

Rising Demand for Discreet Home Security Solutions

By 2026, the global market for furniture safes is expected to experience significant growth, driven by increasing consumer emphasis on home security and the desire for discreet storage solutions. As residential burglary rates fluctuate and digital privacy concerns rise, homeowners are seeking innovative ways to protect valuables such as cash, jewelry, legal documents, and digital devices. Furniture safes—concealed within everyday household items like nightstands, dressers, bookshelves, and coffee tables—offer an aesthetically pleasing and covert alternative to traditional floor or wall safes. This trend is especially strong among urban homeowners and renters who prioritize both functionality and interior design.

Integration of Smart Technology and IoT Features

A key technological trend shaping the furniture safe market in 2026 is the integration of smart features. Manufacturers are increasingly embedding biometric scanners, Wi-Fi connectivity, mobile app integration, and remote monitoring capabilities into furniture safes. These smart safes can send real-time alerts to users’ smartphones in case of unauthorized access attempts, low battery levels, or tampering. Some models even integrate with home automation systems such as Amazon Alexa or Google Home, allowing voice-activated locking and status checks. As smart home adoption continues to surge, furniture safes with IoT compatibility are poised to capture a larger share of the security market.

Growth in E-Commerce and Direct-to-Consumer Sales

The distribution landscape for furniture safes is evolving rapidly, with e-commerce platforms becoming the dominant sales channel by 2026. Online retailers such as Amazon, Wayfair, and specialized security product websites offer consumers a wide range of styles, sizes, and price points. Direct-to-consumer (DTC) brands are also gaining traction by offering customizable furniture safes that blend seamlessly with modern interior decor. Enhanced product visualization tools—like augmented reality (AR) previews—allow shoppers to see how a safe-integrated furniture piece would look in their home before purchasing, improving buyer confidence and reducing return rates.

Emphasis on Aesthetic Design and Customization

Gone are the days when safes were purely utilitarian. In 2026, consumers expect furniture safes to complement their home décor. Manufacturers are responding by offering sleek, minimalist designs in a variety of finishes—such as walnut, matte black, and reclaimed wood—that match popular interior styles like Scandinavian, industrial, and mid-century modern. Customization options, including personalized dimensions, hidden compartment layouts, and branded hardware, are becoming standard offerings. This shift reflects a broader trend in consumer goods where security and style are no longer mutually exclusive.

Expansion in Commercial and Hospitality Applications

Beyond residential use, furniture safes are seeing increased adoption in commercial sectors, particularly in boutique hotels, vacation rentals, and co-living spaces. Property managers and hosts are installing furniture safes to enhance guest trust and provide a premium experience. By 2026, demand from the hospitality industry is expected to grow steadily, driven by travelers’ concerns about personal safety and the need to securely store passports, electronics, and medications. Modular and tamper-resistant designs tailored for high-traffic environments are being developed to meet these unique demands.

Sustainability and Eco-Friendly Materials

Environmental consciousness is influencing product development in the furniture safe market. By 2026, leading manufacturers are incorporating sustainable materials—such as FSC-certified wood, recycled metals, and non-toxic finishes—into their designs. Energy-efficient electronic components and recyclable packaging are also becoming industry benchmarks. Consumers, especially millennials and Gen Z buyers, are more likely to support brands that demonstrate environmental responsibility, prompting companies to adopt greener practices across their supply chains.

Regional Market Dynamics

Regionally, North America and Western Europe are expected to lead the furniture safe market in 2026 due to high homeownership rates, strong disposable incomes, and advanced smart home infrastructure. However, the Asia-Pacific region—especially countries like China, India, and South Korea—is projected to witness the fastest growth. Rising urbanization, increasing middle-class wealth, and growing awareness of personal security are fueling demand in these emerging markets. Local manufacturers are adapting designs to suit regional tastes, such as compact safes for smaller living spaces common in Asian cities.

Conclusion

The furniture safe market in 2026 is characterized by innovation, design sophistication, and technological integration. As consumers seek secure yet stylish solutions for protecting their valuables, the industry is responding with smarter, more discreet, and eco-conscious products. With expanding applications in both residential and commercial spaces, and supported by robust e-commerce growth, furniture safes are transitioning from niche security items to essential components of modern living environments.

Common Pitfalls When Sourcing Furniture Safes (Quality and Intellectual Property)

Sourcing furniture safes—disguised safes built into everyday furniture like nightstands, dressers, or entertainment centers—can offer unique value for retailers and consumers. However, buyers often encounter significant challenges related to product quality and intellectual property (IP) risks. Being aware of these pitfalls helps mitigate costly mistakes and reputational damage.

Quality-Related Pitfalls

Inconsistent Build and Material Standards

Many furniture safes, especially those sourced from overseas manufacturers, use substandard materials such as particleboard or MDF instead of solid wood, compromising both durability and security. Thin metal linings or poorly constructed locking mechanisms may fail under stress, rendering the safe ineffective.

Compromised Security Features

While marketed as secure, some furniture safes prioritize aesthetics over functionality. Common issues include flimsy hinges, weak locking systems (e.g., basic cam locks instead of electronic or mechanical locks), and inadequate door seals that make tampering easy. Buyers may assume “safe” equates to theft resistance, but many models fail basic security tests.

Poor Craftsmanship and Finishing

Mass-produced furniture safes often exhibit inconsistent staining, misaligned doors, uneven joints, or visible seams that betray the hidden compartment. These flaws not only reduce aesthetic appeal but may also expose the safe’s presence—defeating its purpose of concealment.

Inadequate Testing and Certification

Unlike traditional safes, furniture safes rarely undergo independent security or fire-rating certifications (e.g., UL, ETL). Without third-party validation, claims about burglary or fire resistance are often unverified, leaving buyers vulnerable to misleading marketing.

Intellectual Property (IP) Risks

Design Infringement and Counterfeiting

Many furniture safes mimic the look and layout of popular branded furniture pieces (e.g., resembling designs from IKEA or high-end manufacturers). Sourcing such products may inadvertently involve counterfeit or knock-off items that violate design patents or trademarks, exposing importers to legal action.

Lack of Original Design Documentation

Suppliers may not provide proof of original design rights or IP ownership. Without proper documentation, buyers risk importing goods that infringe on existing patents, particularly in markets like the U.S. or EU, where IP enforcement is strict.

Copycat Manufacturing and Market Saturation

Because furniture safes are relatively easy to replicate, many factories produce near-identical units. This leads to market saturation, price erosion, and difficulty differentiating your product. Moreover, if a design becomes popular, multiple sellers may flood the market with copies—potentially yours—undermining exclusivity.

Limited Customization and Brand Protection

Generic suppliers often resist customization or branding, increasing the risk of your design being copied and resold to competitors. Without contractual IP protections in manufacturing agreements, your investment in unique designs may be quickly exploited.

Conclusion

To avoid these pitfalls, conduct thorough due diligence: vet suppliers for material quality and manufacturing standards, request third-party test reports, and ensure all designs are either original or properly licensed. Include strong IP clauses in contracts and consider working with reputable manufacturers who respect design ownership. By prioritizing both quality and legal compliance, you can source furniture safes that are both secure and market-ready.

Logistics & Compliance Guide for Furniture Safes

Product Classification & Regulatory Standards

Furniture safes—secure storage units integrated into or disguised as household furniture—must comply with various national and international standards. Understanding proper classification is essential for logistics and regulatory compliance. These products typically fall under:

– Furniture Category: Regulated by consumer safety standards such as ASTM F2057 (Standard Safety Specification for Chests, Door Chests, and Dressers) in the U.S.

– Security Equipment Category: Subject to burglary-resistance standards like UL 768 (Burglary Resistant Safes) or EN 1143-1 (European standard for resistance against burglary).

Ensure accurate product classification for proper labeling, certification, and import/export documentation.

Packaging & Handling Requirements

Due to their weight, size, and integrated security mechanisms, furniture safes require specialized packaging:

– Robust Packaging: Use double-walled corrugated cardboard or wooden crates to protect against impact, moisture, and compression during transit.

– Internal Bracing: Secure internal components (drawers, locking mechanisms) to prevent movement and damage.

– Weight Indicators: Clearly mark weight and center of gravity on packaging for safe handling.

– Forklift & Pallet Access: Design packaging with standard pallet dimensions (e.g., 48” x 40” in North America) and include notches for forklift access.

Transportation & Freight Logistics

Furniture safes are often heavy and bulky, impacting shipping methods and costs:

– Freight Classification: Classify under NMFC codes for “safes” or “furniture with metal components” (typically freight class 150–175, depending on density).

– Mode of Transport: Use full truckload (FTL) or less-than-truckload (LTL) freight. Air freight is generally cost-prohibitive except for small, high-value units.

– Weight Restrictions: Adhere to weight limits for liftgates and residential deliveries. Notify carriers in advance for units exceeding 150 lbs.

– Tracking & Insurance: Provide real-time freight tracking and ensure full-value insurance coverage due to high replacement cost.

Import/Export Compliance

Cross-border shipments require strict adherence to customs and trade regulations:

– HS Code Classification: Use appropriate Harmonized System (HS) codes (e.g., 9403.20 for metal safes, 9403.60 for wooden furniture with security features).

– Country-Specific Regulations: Verify compliance with destination country standards (e.g., CE marking in the EU, KC certification in South Korea).

– Documentation: Prepare commercial invoices, packing lists, certificates of origin, and safety compliance certificates.

– Duties & Tariffs: Calculate import duties based on material composition and country of manufacture. Consider free trade agreements (e.g., USMCA) to reduce tariffs.

Safety & Environmental Compliance

Furniture safes may contain materials subject to environmental regulations:

– Fire Safety: If fire-resistant, comply with standards like UL 1037. Avoid prohibited fire retardants (e.g., PBDEs) regulated under RoHS or REACH.

– Chemical Compliance: Ensure finishes, adhesives, and metals comply with TSCA (U.S.), REACH (EU), and Prop 65 (California).

– Battery Components: Safes with electronic locks may include lithium batteries—follow IATA/IMDG regulations for safe transport.

Installation & End-User Compliance

Provide clear guidelines for safe installation and compliance with building codes:

– Anchoring Requirements: Include instructions and hardware for wall or floor anchoring per ASTM F2057 to prevent tip-over.

– User Manuals: Supply multilingual manuals with safety warnings, maintenance procedures, and compliance certifications.

– Warranty & Registration: Facilitate product registration for recalls and warranty claims under Consumer Product Safety Commission (CPSC) guidelines.

Returns & Reverse Logistics

Plan for returns due to damage, defects, or customer dissatisfaction:

– Return Authorization (RMA): Implement a clear RMA process with inspection protocols.

– Refurbishment & Disposal: Establish procedures for testing, refurbishing, or environmentally responsible disposal of returned units.

– Carrier Coordination: Use freight carriers experienced in handling heavy furniture returns, including liftgate and inside pickup services.

Adhering to this logistics and compliance framework ensures safe, legal, and efficient distribution of furniture safes across global markets.

In conclusion, sourcing furniture safes requires a strategic approach that balances security, quality, functionality, and cost-effectiveness. It is essential to evaluate suppliers based on their reputation, product certifications, customization options, and compliance with safety standards. Conducting thorough market research, comparing multiple vendors, and performing due diligence on manufacturing processes will help ensure the selected furniture safes meet both operational needs and customer expectations. Additionally, considering long-term factors such as durability, warranty, and after-sales service contributes to a more sustainable and reliable procurement decision. By aligning sourcing strategies with organizational goals and end-user requirements, businesses can secure high-performing furniture safes that offer both peace of mind and value for money.