The global fuel filter market is experiencing robust growth, driven by rising vehicle production, stringent emission regulations, and increasing demand for fuel-efficient engines. According to Grand View Research, the market was valued at USD 8.7 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is further fueled by advancements in filtration technology and the expanding adoption of diesel and hybrid vehicles, particularly in emerging economies. As demand intensifies, manufacturers are ramping up innovation in materials and design to enhance filter performance, longevity, and environmental compliance. In this competitive landscape, a select group of companies are leading the charge through strategic R&D investments, global supply chain networks, and strong partnerships with OEMs. Based on market presence, technological capabilities, and production scale, the following are the top 10 fuel filter manufacturers shaping the industry’s future.

Top 10 Fuel Filter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Cim-Tek

Domain Est. 1996

Website: cim-tek.com

Key Highlights: A leader in the petroleum, industrial, agricultural, and biofuel market for more than 68 years, Cim-Tek has an unparalleled breadth of expertise with……

#2 Facet Filtration: High

Domain Est. 2017

Website: facetfiltration.com

Key Highlights: High-performance filtration solutions by Facet to solve end-to-end filtration challenges in aviation, environmental, heavy equipment and marine industries….

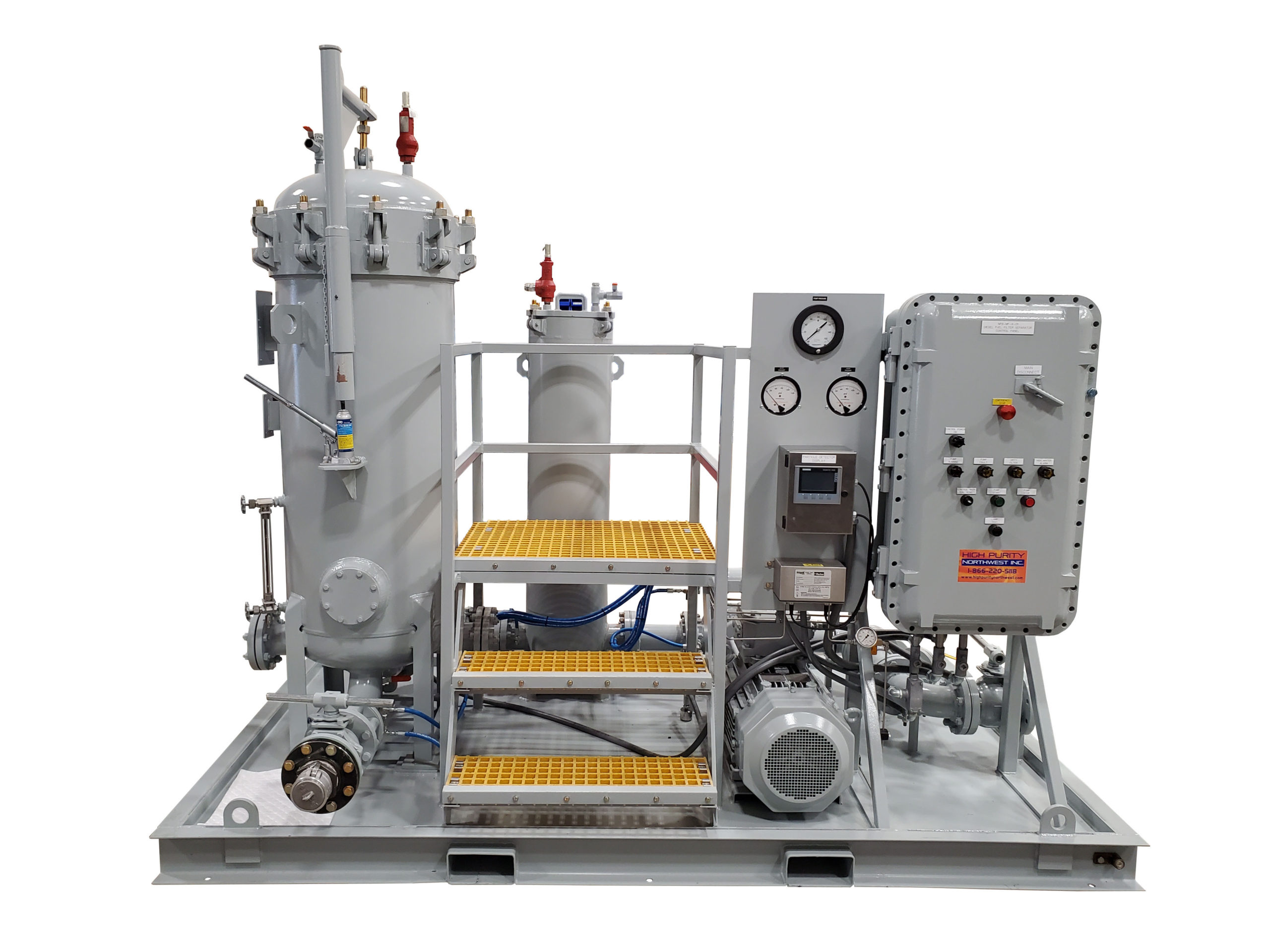

#3 Diesel Fuel Filtration Systems

Domain Est. 1995

Website: davco.com

Key Highlights: DAVCO is the leader in diesel fuel filtration systems and water separator filters. Maximize the protection of your engine’s fuel system with DAVCO….

#4 Filter & Parts

Domain Est. 1995

Website: donaldson.com

Key Highlights: We deliver a full line of aftermarket fuel, lube, coolant and air intake filters for diesel engines, hydraulic and bulk tank filtration – plus exhaust system ……

#5 STP Filters

Domain Est. 1996

#6 Baldwin Filters

Domain Est. 1999

Website: baldwinfilters.com

Key Highlights: Baldwin Filters, a brand of Parker Engine Mobile Aftermarket Division, provides of filtration products for light-, medium- and heavy-duty mobile ……

#7 Fuel filters protect your fuel system against corrosion

Domain Est. 1999

Website: mann-filter.com

Key Highlights: Fuel filters provide proven protection against abrasive contaminants in your system’s fuel. Find out how our filters keep things in top shape….

#8 Separ Filter

Domain Est. 2001

Website: separfilter.com

Key Highlights: The company provides genuine Separ fuel and water filtration systems and components to transportation, power generation, agriculture, military and commercial…

#9 Fuel Filters

Domain Est. 2004

Website: boschautoparts.com

Key Highlights: Bosch Fuel Filters help to protect the most expensive parts of the engine by filtering out foreign particles that can damage a fuel injector….

#10 Premium Guard Filters: Page

Domain Est. 2006

Website: pgfilters.com

Key Highlights: Premium Guard® delivers world-class aftermarket automotive solutions, offering one of the industry’s most complete lines of oil, air, fuel, and transmission ……

Expert Sourcing Insights for Fuel Filter

2026 Market Trends for Fuel Filters (H2 Analysis)

As the global automotive and industrial sectors evolve in response to technological innovation, environmental regulations, and shifting energy policies, the fuel filter market is poised for significant transformation by 2026. This H2 analysis explores key trends expected to shape the fuel filter industry during the second half of the forecast period, from mid-2025 through 2026.

H2 2025–2026: Key Market Trends

1. Shift Toward High-Efficiency and Advanced Filtration Technologies

By H2 2026, demand for high-efficiency fuel filters will continue to rise, driven by increasingly stringent emissions standards—especially in the EU, North America, and China. Original Equipment Manufacturers (OEMs) are integrating multi-stage filtration systems capable of removing ultrafine particulates (<5 microns) and water contaminants. Nanofiber-based and synthetic media filters are gaining traction due to their superior dirt-holding capacity and longer service life.

- Growth Driver: Euro 7 and China 7 emission norms pushing for cleaner combustion.

- Impact: Higher ASPs (Average Selling Prices) for advanced filters, boosting market value.

2. Integration with Hybrid and Range-Extender Powertrains

While the long-term trajectory favors electrification, hybrid vehicles (especially plug-in and range-extender models) will continue to rely on internal combustion engines (ICEs) through 2026. These systems require optimized fuel filtration due to intermittent engine use and potential fuel degradation.

- Trend: Fuel filters designed for extended idle periods and biofuel compatibility.

- Market Segment Growth: Filters tailored for hybrid applications expected to grow at a CAGR of 6.3% (2024–2026).

3. Rise in Aftermarket Demand in Emerging Economies

In regions such as Southeast Asia, Africa, and Latin America, the aging vehicle fleet and limited access to EVs are bolstering aftermarket fuel filter sales. H2 2026 will likely see a peak in replacement filter demand due to increased vehicle mileage and poor fuel quality in these markets.

- Key Insight: Aftermarket segment to account for over 60% of total fuel filter sales in emerging regions by end-2026.

- Opportunity: Localized manufacturing and distribution partnerships to reduce costs.

4. Biofuels and Alternative Fuels Driving Material Innovation

With global adoption of E10, E20, and biodiesel blends (e.g., B20, B30), fuel filters must resist ethanol-induced degradation and microbial growth. Manufacturers are investing in chemically resistant materials like fluoropolymer seals and specialized filtration media.

- H2 2026 Outlook: Filters compatible with biofuels to grow at ~7.1% CAGR, outpacing conventional filter segments.

- Challenge: Balancing cost, durability, and compatibility in diverse fuel environments.

5. Consolidation and Vertical Integration Among Suppliers

The competitive landscape is shifting as Tier-1 suppliers (e.g., Mann+Hummel, Bosch, Cummins Filtration) consolidate operations and vertically integrate production to control costs and ensure supply chain resilience. Smaller players are increasingly partnering with technology firms to co-develop smart filtration solutions.

- Trend: Increased M&A activity in H2 2025–2026, particularly in Europe and North America.

- Strategic Move: Integration of digital monitoring (e.g., filter life sensors) into next-gen products.

6. Sustainability Pressures and Circular Economy Models

Environmental regulations are pushing manufacturers toward recyclable filter housings and reduced plastic use. Some leading players are piloting take-back programs and reusable filter systems.

- H2 2026 Initiative: EU mandates on recyclability expected to influence global design standards.

- Impact: Rise in bioplastics and modular filter designs to support circular lifecycle models.

Regional Outlook for H2 2026

| Region | Key Trend |

|—————-|———|

| North America | Strong demand for heavy-duty diesel filters; adoption of smart filters with IoT integration. |

| Europe | Strict emissions rules drive advanced filtration; decline in ICE passenger vehicles offsets growth. |

| Asia-Pacific | Fastest growth due to vehicle production surge; high demand for cost-effective aftermarket filters. |

| Rest of World | Infrastructure limitations sustain reliance on ICEs, supporting steady filter demand. |

Conclusion

Heading into H2 2026, the fuel filter market is navigating a transitional phase shaped by regulatory pressure, fuel diversification, and technological innovation. While the long-term outlook for ICE components remains uncertain due to electrification, the near-term demand—especially in hybrids, commercial vehicles, and emerging markets—ensures continued relevance and growth for fuel filter manufacturers. Success will depend on agility in product development, regional market adaptation, and sustainability integration.

Common Pitfalls When Sourcing Fuel Filters (Quality and IP)

Sourcing fuel filters involves more than just finding a low-cost component—ensuring quality and protecting intellectual property (IP) are critical. Failure to address these aspects can lead to performance issues, warranty claims, legal disputes, and reputational damage. Below are key pitfalls to avoid:

1. Prioritizing Cost Over Quality

One of the most common mistakes is selecting suppliers based solely on price. Low-cost fuel filters may use substandard materials or inadequate filtration media, leading to:

- Reduced engine performance

- Increased risk of contamination and fuel system damage

- Higher long-term maintenance and replacement costs

Best Practice: Evaluate total cost of ownership, including reliability, service life, and warranty support.

2. Inadequate Supplier Qualification

Failing to conduct thorough due diligence on suppliers can result in inconsistent quality and supply chain vulnerabilities.

Risks include:

– Lack of ISO/TS 16949 or IATF 16949 certification

– Poor process controls and quality management systems

– Inconsistent batch-to-batch performance

Best Practice: Audit suppliers for certifications, production capabilities, and quality control processes before onboarding.

3. Ignoring Filtration Efficiency and Compatibility

Not all fuel filters meet the same performance standards. Using filters with incorrect micron ratings or incompatible materials can compromise engine integrity.

Pitfalls:

– Incorrect filtration levels allowing contaminants to pass

– Material incompatibility with modern fuels (e.g., biofuels, ethanol blends)

– Poor sealing leading to leaks or air ingress

Best Practice: Verify filter specifications against OEM requirements and fuel type.

4. Overlooking Intellectual Property (IP) Risks

When sourcing fuel filters—especially custom or OEM-equivalent designs—IP infringement is a serious concern.

Common IP pitfalls:

– Sourcing “copy” or reverse-engineered designs without licensing

– Using patented filter media, housing designs, or sealing mechanisms

– Suppliers falsely claiming IP ownership or freedom to operate

Best Practice: Conduct IP due diligence, require suppliers to provide proof of licensing or design freedom, and include IP indemnification clauses in contracts.

5. Lack of Traceability and Documentation

Poor documentation makes it difficult to track product origin, materials used, or compliance with industry standards.

Consequences:

– Inability to respond to recalls or field failures

– Challenges in proving regulatory compliance

– Vulnerability to counterfeit components

Best Practice: Require full traceability (batch numbers, material certifications, test reports) and retain documentation throughout the product lifecycle.

6. Insufficient Testing and Validation

Relying solely on supplier claims without independent verification can lead to undetected quality issues.

Risks:

– Filters passing basic tests but failing under real-world conditions

– Lack of durability under extreme temperatures or pressure cycles

Best Practice: Perform in-house or third-party validation testing, including flow rate, dirt-holding capacity, and burst pressure tests.

7. Poor Contractual Protections

Vague or missing terms in supply agreements can leave buyers exposed.

Missing protections may include:

– No quality assurance clauses

– Absence of IP ownership or infringement indemnity

– Inadequate warranties or return policies

Best Practice: Work with legal counsel to draft robust contracts that define quality expectations, IP rights, and remedies for non-compliance.

By proactively addressing these pitfalls, companies can ensure they source high-quality fuel filters while safeguarding their intellectual property and maintaining supply chain integrity.

Logistics & Compliance Guide for Fuel Filters

This guide outlines the key logistics and compliance considerations for the safe, efficient, and legal handling, transportation, storage, and disposal of fuel filters throughout the supply chain.

Regulatory Compliance

Fuel filters are subject to various international, national, and regional regulations. Adherence is critical to avoid penalties, delays, and safety incidents.

Environmental Regulations

Fuel filters, especially those removed from engines, are often classified as hazardous waste due to residual fuel and oil contamination. Compliance with environmental regulations such as RCRA (Resource Conservation and Recovery Act) in the US, WEEE (Waste Electrical and Electronic Equipment) and ELV (End-of-Life Vehicles) directives in the EU, and local hazardous waste disposal laws is mandatory. Used fuel filters must be handled, labeled, transported, and disposed of through authorized waste management providers. Proper documentation, including waste manifests and disposal certificates, must be maintained.

Transportation Regulations

When shipping new or used fuel filters, adherence to transportation safety regulations is required:

– UN Recommendations on the Transport of Dangerous Goods (UN Model Regulations): Used fuel filters containing flammable liquids may fall under Class 3 (Flammable Liquids), requiring appropriate packaging, labeling, and documentation.

– DOT (Department of Transportation) – US: 49 CFR regulations govern the packaging, marking, labeling, and shipping papers for hazardous materials.

– ADR (Europe): Governs the road transport of dangerous goods in Europe; applies when shipping used or contaminated filters.

– IATA/ICAO: Applicable for air freight; strict rules apply to flammable or hazardous contents.

Ensure Material Safety Data Sheets (MSDS/SDS) are available and reflect the contents (e.g., residual fuel, filter media, plastic/metal components).

Product Standards and Certifications

New fuel filters must comply with applicable product safety and performance standards:

– ISO 19438: Road vehicles – Method of mounting and testing of fuel filters for diesel engines.

– SAE J1839: Performance requirements for diesel fuel filters.

– EPA and CARB Regulations (US): Emissions compliance, especially for filters used in on-road or off-road vehicles.

– E-mark Certification (UN ECE Regulations): Required for filters sold in many European markets.

Ensure filters are certified and labeled appropriately for the target market.

Packaging and Labeling

Proper packaging and labeling ensure product integrity, safety, and regulatory compliance.

New Fuel Filters

– Package in sealed, moisture-resistant materials to prevent contamination.

– Use robust outer packaging (corrugated boxes) to prevent crushing during transit.

– Include clear labeling with:

– Product name and part number

– Manufacturer and brand

– Compliance marks (e.g., ISO, E-mark, DOT)

– Country of origin

– Barcodes/UPC for inventory tracking

– Handling instructions (e.g., “Do Not Drop,” “Keep Dry”)

Used/Spent Fuel Filters

– Place in sealed, leak-proof containers to prevent fuel leakage.

– Label clearly with:

– “Used Fuel Filter – Contains Residual Flammable Liquid”

– Hazard pictograms (flammable, environmental hazard)

– Accumulation start date

– Generator information

– Use UN-certified packaging if shipping as hazardous materials.

Storage and Handling

Safe storage and handling practices minimize risks of fire, contamination, and product damage.

Storage of New Filters

– Store in a dry, temperature-controlled environment (typically 10°C–30°C).

– Keep away from direct sunlight, heat sources, and flammable materials.

– Use first-in, first-out (FIFO) inventory management to prevent obsolescence.

– Stack packages properly to avoid collapse or crushing.

Storage of Used Filters

– Store in a designated, well-ventilated area away from ignition sources.

– Use spill containment trays or secondary containment to capture leaks.

– Limit storage time per local regulations (e.g., 90 days under RCRA for large quantity generators).

– Prohibit food, drink, and smoking in storage areas.

Handling Procedures

– Use gloves and safety glasses when handling used filters.

– Avoid dropping or puncturing filters to prevent leaks.

– Clean spills immediately using absorbent materials and dispose of as hazardous waste.

Transportation and Distribution

Efficient and compliant transportation ensures timely delivery while minimizing risk.

Mode Selection

– Road: Most common for regional distribution. Ensure vehicles are equipped for hazardous cargo if transporting used filters.

– Air: Limited due to IATA restrictions on flammable contents; only permitted under specific conditions with proper declarations.

– Sea: Suitable for bulk shipments of new filters. Follow IMDG Code for any hazardous components.

Documentation

– Commercial invoice and packing list for all shipments.

– Dangerous Goods Declaration (if applicable).

– Waste manifest for used filters.

– Certificates of compliance (e.g., ISO, E-mark).

– Bill of Lading or Air Waybill.

Carrier Requirements

– Use carriers trained and certified in hazardous materials transport when required.

– Verify carrier compliance with ADR, DOT, or IATA standards.

– Track shipments in real time using GPS or logistics software.

End-of-Life and Recycling

Sustainable end-of-life management reduces environmental impact and supports circular economy goals.

Recycling Options

– Metal Components: Steel and aluminum housings can be separated and recycled.

– Filter Media: Often incinerated in controlled facilities; some advanced systems reclaim fibers.

– Plastic Housings: Recyclable if uncontaminated; otherwise treated as hazardous waste.

Disposal

– Partner with licensed waste recyclers or treatment facilities.

– Follow cradle-to-grave tracking for hazardous waste.

– Maintain records for audits and regulatory reporting.

Take-Back Programs

Consider implementing or participating in manufacturer take-back or trade-in programs to responsibly manage used filters and enhance brand sustainability.

Training and Recordkeeping

Ensure all personnel involved in logistics and handling are properly trained.

Employee Training

– Hazard communication (HazCom)

– Spill response procedures

– Proper use of PPE

– Regulatory requirements for handling and transport

Documentation Retention

– Keep records of:

– Waste manifests (minimum 3 years under RCRA)

– SDS sheets

– Training logs

– Compliance certifications

– Shipping and delivery records

Regular internal audits help ensure ongoing compliance and identify areas for improvement.

Conclusion

Effective logistics and compliance management for fuel filters requires attention to environmental, safety, and regulatory standards at every stage—from manufacturing and distribution to end-of-life disposal. By implementing robust procedures for packaging, handling, transportation, and documentation, companies can ensure legal compliance, protect worker safety, minimize environmental impact, and maintain supply chain efficiency.

In conclusion, sourcing the appropriate fuel filter is a critical step in ensuring the optimal performance, efficiency, and longevity of any engine system. A well-chosen fuel filter effectively removes contaminants and impurities from the fuel, protecting sensitive engine components such as fuel injectors and pumps. When sourcing a fuel filter, factors such as compatibility with the engine type, fuel quality, operating environment, and manufacturer specifications must be carefully evaluated. Additionally, considering supplier reliability, certification standards, cost-effectiveness, and availability of replacement parts contributes to a sustainable and efficient maintenance strategy. By selecting a high-quality fuel filter from a reputable source, organizations can reduce downtime, minimize maintenance costs, and enhance overall operational reliability.