The global refrigerator fan motor market is experiencing steady growth, driven by rising demand for energy-efficient appliances and advancements in cooling technology. According to Mordor Intelligence, the global refrigerator market—which directly influences component demand such as fan motors—is projected to grow at a CAGR of over 5.5% from 2024 to 2029. As OEMs and appliance brands prioritize reliability, noise reduction, and power efficiency, the role of high-performance fan motors has become increasingly critical. With the Asia-Pacific region accounting for a dominant share due to increasing household electrification and urbanization, manufacturers are investing heavily in precision engineering and brushless DC (BLDC) motor technologies. Against this backdrop, the following eight companies have emerged as leading fridge fan motor manufacturers, combining innovation, scale, and global supply chain reach to meet evolving industry demands.

Top 8 Fridge Fan Motor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ebm

Domain Est. 1998

Website: ebmpapst.com

Key Highlights: ebm‑papst Inc. is the world’s leading manufacturer of fans. As a technology company, we have continually set global industry standards since we were founded ……

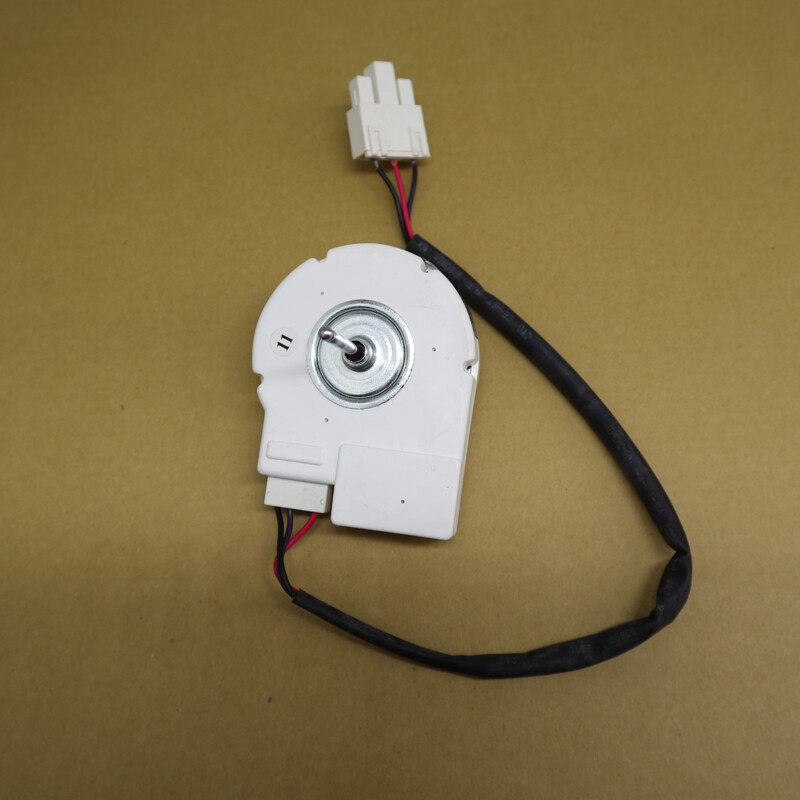

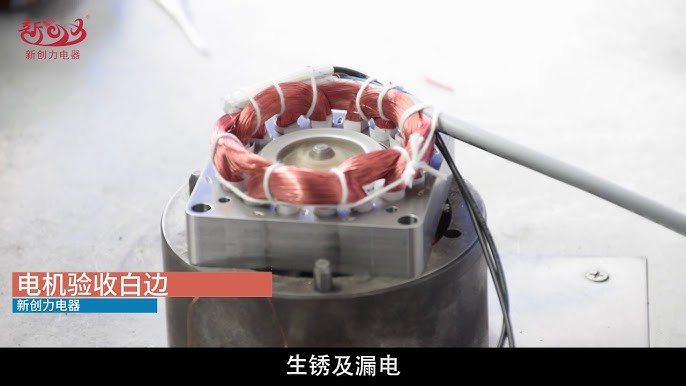

#2 Refrigerator Fan Motor Manufacturer and Supplier In China

Domain Est. 2020

Website: miracleref.com

Key Highlights: Miracle’s refrigerator fan motor uses patented technology developed by itself, which is more competitive. The Miracle team has strong R&D capabilities….

#3 Official Crosley Refrigerator Motors

Domain Est. 1995

Website: fix.com

Key Highlights: FIX3501052. Manufacturer Part Number: 242018301. This condenser fan motor circulates air over the coils to cool refrigerant and maintain fridge temperature….

#4 True Fan Motor Kits

Domain Est. 1997

Website: store.truemfg.com

Key Highlights: Free deliveryGenuine True OEM fan motor kits that ensure a proper air-tight seal to consistently maintain temperatures and promote longer-lasting refrigeration equipment….

#5 Fan Motor

Domain Est. 1998

Website: turboairinc.com

Key Highlights: This is the Turbo Air Refrigerator Manufacturer site….

#6 Refrigerator Motors

Domain Est. 1999

Website: partselect.com

Key Highlights: This condenser fan motor is a genuine replacement part designed for select refrigerator models. It drives the fan blade to circulate air across the condenser ……

#7 Refrigerator

Domain Est. 1997

Website: nidec.com

Key Highlights: Here is how motors are used in refrigerators. Click on the labels for more details about the respective products….

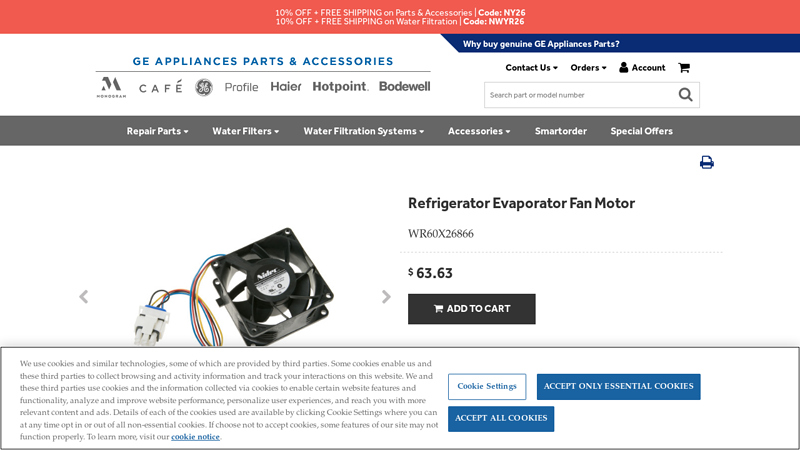

#8 Refrigerator Evaporator Fan Motor

Domain Est. 1999

Website: geapplianceparts.com

Key Highlights: In stock Rating 1.2 (45) Features. The Refrigerator Evaporator Fan Motor circulates air over the refrigerator coils and helps maintain the temperature inside the fridge and freez…

Expert Sourcing Insights for Fridge Fan Motor

H2: 2026 Market Trends for Fridge Fan Motors

The global market for refrigerator fan motors is poised for significant transformation by 2026, driven by technological advancements, regulatory shifts, and evolving consumer preferences. As a critical component in refrigeration systems—responsible for circulating cold air efficiently—fan motors are undergoing innovation to meet rising demands for energy efficiency, reliability, and smart integration. Below is an analysis of key trends expected to shape the fridge fan motor market in 2026.

1. Surge in Energy-Efficient Motor Technologies

With global energy regulations becoming stricter, particularly under standards like the EU Ecodesign Directive and U.S. DOE efficiency requirements, manufacturers are shifting toward high-efficiency fan motors. Brushless DC (BLDC) motors are expected to dominate the market by 2026 due to their superior energy efficiency, longer lifespan, and quieter operation compared to traditional AC motors. This transition is supported by incentives for energy-saving appliances and consumer demand for lower electricity bills.

2. Integration with Smart Refrigeration Systems

The proliferation of smart home ecosystems is driving demand for intelligent fridge fan motors capable of variable speed control and real-time performance adjustments. In 2026, fan motors will increasingly be integrated with IoT-enabled sensors and microcontrollers, allowing adaptive cooling based on usage patterns, door openings, and ambient temperature. This not only improves energy efficiency but also enhances food preservation.

3. Growth in Emerging Markets and Appliance Demand

Expanding middle-class populations in Asia-Pacific, Latin America, and Africa are fueling demand for household refrigeration. As refrigerator penetration increases, so does the need for reliable and cost-effective fan motors. Localized manufacturing and the adoption of modular motor designs will be key strategies for suppliers aiming to capture market share in these regions.

4. Focus on Noise Reduction and Compact Design

Consumer expectations for quieter appliances are pushing OEMs to adopt fan motors with advanced noise-dampening features and compact footprints. By 2026, motor designs will prioritize acoustic optimization, using improved blade aerodynamics and vibration-reducing materials—especially in premium and built-in refrigerator models.

5. Sustainability and Circular Economy Considerations

Environmental regulations and corporate sustainability goals are influencing motor material choices and end-of-life recyclability. By 2026, manufacturers are expected to increase the use of recyclable materials and design motors for easier disassembly. Additionally, the reduction of hazardous substances, such as certain lubricants and plastics, will align with global RoHS and REACH compliance standards.

6. Supply Chain Resilience and Regionalization

Post-pandemic disruptions and geopolitical factors have led to a reevaluation of supply chains. The fridge fan motor industry is expected to see increased regional production hubs by 2026, particularly in Southeast Asia and Eastern Europe, to reduce dependency on single-source suppliers and mitigate logistics risks.

7. Competitive Landscape and Innovation

Key players such as Nidec, Johnson Electric, Mitsubishi Electric, and AMETEK are investing heavily in R&D to differentiate their offerings. In 2026, differentiation will hinge on motor intelligence, energy performance, and compatibility with next-generation refrigerants (e.g., low-GWP alternatives), which influence thermal management needs.

In conclusion, the fridge fan motor market in 2026 will be characterized by a strong shift toward intelligent, efficient, and sustainable solutions. Companies that align with regulatory standards, embrace digital integration, and cater to regional market dynamics will be best positioned for growth in this evolving landscape.

Common Pitfalls When Sourcing Fridge Fan Motors (Quality and IP)

Sourcing refrigerator fan motors involves navigating several critical challenges related to quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to product failures, compliance issues, legal disputes, and reputational damage. Here are the most common pitfalls:

Poor Quality Control and Inconsistent Performance

Many suppliers, especially low-cost manufacturers, lack rigorous quality control systems. This can result in inconsistent motor performance, shorter lifespans, excessive noise, or premature failure. Buyers may receive batches with varying torque, speed, or power consumption, leading to inefficiencies and increased warranty claims.

Misrepresentation of IP Compliance and Authenticity

A significant risk is sourcing motors that infringe on existing patents or trademarks. Some suppliers falsely claim their products are IP-compliant or offer “compatible” versions that actually copy patented designs. This exposes buyers to legal liability, import bans, and costly litigation, particularly in regulated markets like the EU or North America.

Inadequate IP Due Diligence

Buyers often fail to conduct thorough IP checks before finalizing suppliers. Without verifying patent ownership, licensing agreements, or design rights, companies may unknowingly integrate infringing components into their appliances, jeopardizing entire product lines.

Substandard Materials and Construction

To cut costs, some manufacturers use inferior bearings, subpar copper windings, or low-grade plastics. These compromises reduce reliability, increase energy consumption, and can lead to overheating or mechanical failure — especially in the demanding thermal cycles of refrigeration systems.

Lack of Certifications and Regulatory Compliance

Reputable fridge fan motors must meet safety and efficiency standards such as UL, CE, RoHS, or IP ratings (e.g., for moisture resistance). Sourcing from suppliers without proper certifications risks non-compliance, product recalls, and failure to meet regional market requirements.

Hidden Tooling and Design Ownership Issues

Suppliers may claim they own the motor design but actually use tooling or engineering based on stolen or copied originals. If the original IP holder asserts rights, production can be halted, and buyers may be forced to redesign or re-source urgently and at high cost.

Insufficient Testing and Validation Data

Reliable suppliers provide performance test reports, life cycle data, and environmental testing results. Many low-tier vendors either lack this data or provide falsified documentation, making it difficult to assess real-world reliability and durability.

Overreliance on Price Over Partnership

Focusing solely on the lowest price often leads to compromised quality and IP risks. Establishing long-term partnerships with vetted suppliers who invest in R&D, quality systems, and IP integrity is essential for sustainable, trouble-free sourcing.

Logistics & Compliance Guide for Fridge Fan Motor

This guide outlines the essential logistics considerations and compliance requirements for the safe and legal transportation, handling, and sale of refrigerator fan motors.

Product Classification & Identification

Refrigerator fan motors are typically classified as electrical components or spare parts for household appliances. Accurate product identification is critical for logistics and regulatory compliance.

- HS Code (Harmonized System Code): Commonly falls under 8501.31 (Electric motors of an output not exceeding 37.5 W) or 8501.32 (Electric motors of an output exceeding 37.5 W but not exceeding 1.5 kW), depending on motor power. Confirm classification based on technical specifications.

- UN Number: Not typically applicable unless the motor contains restricted materials (e.g., certain oils or batteries).

- Product Labeling: Each unit must include manufacturer name, model number, voltage, power rating, CE/UKCA mark (if applicable), and production date/batch code.

Packaging & Handling Requirements

Proper packaging ensures product integrity during transit and storage.

- Primary Packaging: Individual motors should be sealed in anti-static bags or protective wrap to prevent dust, moisture, and electrostatic damage.

- Secondary Packaging: Use sturdy corrugated cardboard boxes with internal dividers or foam inserts to prevent movement and mechanical shock.

- Palletization: Stack boxes on wooden or plastic pallets. Secure with stretch wrap or strapping. Max pallet height: 1.8 m (6 ft). Max gross weight: 1,000 kg (2,200 lbs), depending on carrier.

- Handling Instructions: Mark packaging with “Fragile,” “This Side Up,” and “Protect from Moisture” labels. Avoid direct stacking of pallets without reinforcement.

Transportation & Shipping

Ensure safe and compliant movement across supply chains.

- Mode of Transport: Suitable for road, air, and sea freight. For air freight, verify compliance with IATA regulations (no hazardous materials).

- Temperature & Humidity Control: Store and transport in dry, temperature-controlled environments (5°C to 35°C / 41°F to 95°F recommended).

- Documentation: Include commercial invoice, packing list, bill of lading/air waybill, and certificate of origin. Retain product specifications and test reports.

- Insurance: Obtain cargo insurance covering damage, loss, and delay.

Regulatory Compliance

Adhere to international and regional standards to access target markets.

- CE Marking (EU): Required for sale in the European Union. Compliance with:

- Low Voltage Directive (2014/35/EU): Electrical safety.

- EMC Directive (2014/30/EU): Electromagnetic compatibility.

- RoHS Directive (2011/65/EU): Restriction of hazardous substances (Pb, Cd, Hg, etc.).

- REACH (EC 1907/2006): Registration, Evaluation, Authorization of Chemicals.

- UKCA Marking (UK): Required for Great Britain (England, Scotland, Wales). Similar requirements to CE.

- Energy Efficiency: Comply with EU Ecodesign (Regulation 2019/2021) for electric motors, if applicable.

- North America (USA/Canada): May require UL or CSA certification for safety. Check local regulations for electrical components.

- Other Markets: Verify country-specific requirements (e.g., CCC in China, PSE in Japan, KC in South Korea).

Environmental & Disposal Compliance

Ensure responsible end-of-life management.

- WEEE Directive (EU): Refrigerator fan motors are considered electrical waste. Producers must register and support recycling programs.

- Battery/Chemical Content: Confirm motors do not contain restricted batteries or oils. If present, additional disposal and labeling rules apply.

- Packaging Waste: Comply with local packaging waste directives (e.g., EU Packaging Waste Directive 94/62/EC). Use recyclable materials where possible.

Quality Assurance & Traceability

Maintain product reliability and support recalls if needed.

- Quality Standards: Follow ISO 9001 for quality management systems.

- Testing: Conduct routine electrical safety, performance, and durability tests. Retain test reports for at least 10 years.

- Batch Traceability: Use serial or batch numbers to track production, distribution, and customer deliveries.

Import/Export Controls

Monitor trade regulations and restrictions.

- Export Licenses: Generally not required unless shipping to sanctioned countries or involving dual-use technologies.

- Customs Clearance: Provide accurate documentation. Cooperate with inspections if required.

- Duty & Tax Calculation: Apply correct HS code to determine import duties and VAT/GST.

Summary

Compliance and efficient logistics are essential for refrigerator fan motors. Key actions include accurate classification, robust packaging, adherence to electrical and environmental regulations (especially CE, RoHS, REACH, WEEE), and maintaining traceability. Regularly review regulatory changes in target markets to ensure continued compliance.

Conclusion for Sourcing Fridge Fan Motor:

After a thorough evaluation of suppliers, technical specifications, cost considerations, and reliability factors, the sourcing strategy for fridge fan motors should focus on a balanced approach that ensures quality, efficiency, and long-term supply chain resilience. Selecting suppliers with proven expertise in manufacturing compliant and energy-efficient motors—preferably those certified to international standards (such as ISO, CE, or RoHS)—is critical for maintaining product performance and safety.

Cost-effectiveness should not compromise durability or noise levels, as these directly impact end-user satisfaction in refrigeration appliances. Establishing partnerships with suppliers offering scalable production, technical support, and consistent quality control will help mitigate risks such as delivery delays and component failures.

In conclusion, the optimal sourcing decision involves choosing a reliable supplier that offers a competitive total cost of ownership, adheres to technical requirements, and supports sustainable and flexible manufacturing needs. Continuous performance monitoring and periodic supplier reviews will further ensure ongoing alignment with quality and business objectives.