The global refrigeration market is experiencing steady expansion, driven by rising demand for energy-efficient cooling solutions across residential, commercial, and industrial sectors. According to Grand View Research, the global refrigerator market size was valued at USD 108.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. A key component enabling the efficient operation of these refrigeration systems is the capillary tube—a critical element in refrigerant flow control within vapor-compression cycles. As manufacturers prioritize reliability, precision, and sustainability, the demand for high-quality capillary tubes has surged alongside this market growth. With production concentrated in technologically advanced manufacturing hubs across Asia, Europe, and North America, a select group of suppliers has emerged as leaders in innovation, scale, and global reach. The following list highlights the top six capillary tube manufacturers shaping the future of refrigeration systems worldwide.

Top 6 Fridge Capillary Tube Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

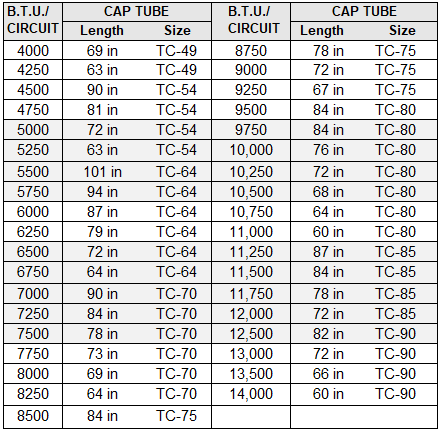

#1 Categories

Domain Est. 1998

Website: rsd.net

Key Highlights: 093 OD Capillary Tubing 12 FT Roll. JB TC-49-11 Image · JB TC-49-11 .049 ID … Manufacturers · Vendors · Careers · Cooling Towers · Total Control · RSD Notes ( ……

#2 Manufacturers

Domain Est. 2001

#3 Capillary & Restrictor Tube

Domain Est. 1996

Website: precisiontube.com

Key Highlights: Precision copper capillary tubing is available in all common sizes used in temperature controls, process equipment, refrigeration, and air conditioning systems….

#4 Capillary Tube Products

Domain Est. 2004

Website: bundyrefrigeration.com

Key Highlights: Discover Bundy’s premium refrigeration capillary tubes, tailored for optimal performance. Check our size guide and explore our product range….

#5 Capillary Tubing

Domain Est. 2007

#6 Capillary tube

Domain Est. 2011

Website: sogetub.fr

Key Highlights: Copper capillary tube in 30/60 kg coils or in bars. Ideal for the manufacture of rivets, fittings for refrigeration compressors and for special refrigeration ……

Expert Sourcing Insights for Fridge Capillary Tube

H2: Projected 2026 Market Trends for Refrigerator Capillary Tubes

The global market for refrigerator capillary tubes is expected to experience steady growth and notable transformation by 2026, driven by technological advancements, regulatory shifts, and evolving consumer demands. As a critical component in vapor-compression refrigeration systems, the capillary tube functions as a metering device that regulates refrigerant flow between the condenser and evaporator. Several macro- and micro-economic trends are shaping the trajectory of this niche yet essential market.

-

Increased Demand from Emerging Markets

By 2026, rising urbanization and improving living standards in Asia-Pacific, Latin America, and Africa are expected to fuel demand for household refrigeration. Countries like India, Indonesia, and Nigeria are witnessing a surge in appliance ownership, directly increasing the need for capillary tubes. Local manufacturing expansions by major refrigerator OEMs will further boost regional capillary tube production. -

Energy Efficiency and Regulatory Compliance

Global energy efficiency standards—such as the U.S. DOE regulations, EU Ecodesign Directive, and India’s BEE Star Label—are pushing manufacturers to optimize refrigeration systems. Although capillary tubes are simple and cost-effective, their fixed geometry limits adaptability. However, innovations in tube material and internal diameter precision are enhancing performance within energy-efficient models. By 2026, capillary tubes designed for use with low-GWP (Global Warming Potential) refrigerants like R600a and R290 will dominate production. -

Competition from Electronic Expansion Valves (EEVs)

While capillary tubes remain dominant in domestic refrigerators due to their low cost and reliability, EEVs are gaining traction in premium and smart refrigeration units. EEVs offer dynamic flow control, improving efficiency under variable loads. However, given the price sensitivity in mass-market refrigerators, capillary tubes are expected to maintain over 70% market share in volume terms by 2026, particularly in entry- and mid-tier models. -

Material and Manufacturing Innovations

Copper has traditionally been the material of choice for capillary tubes due to its thermal conductivity and formability. However, rising copper prices and sustainability concerns are prompting R&D into alternative materials and coating technologies. By 2026, expect increased adoption of copper alloys and surface-treated tubes that resist corrosion and improve longevity, especially in high-humidity environments. -

Supply Chain Localization and Resilience

Post-pandemic supply chain disruptions have led OEMs to diversify sourcing and localize component manufacturing. This trend benefits regional capillary tube producers in Southeast Asia and Eastern Europe. Integration with just-in-time (JIT) manufacturing models will enhance supply reliability and reduce lead times. -

Sustainability and Circular Economy Pressures

Environmental regulations targeting refrigerant leakage and end-of-life disposal are influencing component design. Capillary tubes that facilitate easier refrigerant recovery and are compatible with recyclable system architectures will be preferred. Manufacturers are also exploring recyclable packaging and reduced scrap rates in production.

In conclusion, while the refrigerator capillary tube market faces pressure from advanced alternatives and environmental regulations, its cost-effectiveness and simplicity ensure continued relevance. By 2026, the market will be characterized by incremental innovation, regional growth disparities, and stronger alignment with energy-efficient and sustainable refrigeration systems.

Common Pitfalls When Sourcing Fridge Capillary Tube (Quality, IP)

Sourcing capillary tubes for refrigerators involves several critical considerations, particularly concerning quality consistency and intellectual property (IP) risks. Overlooking these aspects can lead to product failures, safety issues, and legal complications.

Quality-Related Pitfalls

Inconsistent Material Composition and Purity

Using substandard copper or incorrect alloy compositions (e.g., non-oxygen-free copper) can compromise the tube’s corrosion resistance and thermal performance. Impurities may lead to internal blockages or reduced refrigerant flow efficiency, increasing the risk of system failure.

Dimensional Inaccuracy

Capillary tubes require precise inner diameter (ID), outer diameter (OD), and wall thickness. Variations—even within narrow tolerances—can disrupt refrigerant metering, affecting cooling performance and system reliability. Poorly controlled manufacturing processes often result in non-uniform lengths or diameters.

Poor Surface Finish and Internal Cleanliness

Residual oils, oxides, or particulate matter inside the tube can clog the narrow passage or contaminate the refrigeration system. Suppliers lacking proper cleaning and passivation processes may deliver tubes that cause compressor damage or reduced efficiency.

Inadequate Mechanical Strength and Bendability

Capillary tubes must withstand coiling, bending, and vibration during assembly and operation. Tubes that are too brittle or inconsistently annealed may crack during installation, leading to refrigerant leaks and field failures.

Lack of Certification and Traceability

Reputable suppliers should provide material test reports (MTRs), ISO certifications, and batch traceability. Sourcing from vendors without proper documentation increases the risk of receiving non-compliant or counterfeit materials.

Intellectual Property (IP)-Related Pitfalls

Infringement of Patented Designs or Processes

Some capillary tube configurations—especially those optimized for specific refrigerants or energy efficiency—may be protected by patents. Sourcing from suppliers who replicate proprietary designs without licensing exposes the buyer to legal liability and potential injunctions.

Reverse Engineering Without Clearance

Using capillary tubes reverse-engineered from competitor products can inadvertently violate IP rights, particularly if dimensional specs or manufacturing methods are protected. This is a common risk when sourcing generic alternatives.

Ambiguous Supplier IP Agreements

Contracts that fail to clearly define ownership of custom designs or co-developed specifications may result in disputes. Without formal IP assignment clauses, suppliers could claim rights to improvements or reuse designs for competing clients.

Unauthorized Use of Brand-Specific Specifications

Some OEMs develop proprietary capillary tube profiles (e.g., tapered, multi-port, or coiled designs) protected under trade secrets or technical copyrights. Sourcing equivalent parts without authorization—even if technically similar—can breach confidentiality agreements or licensing terms.

Mitigation Strategies

- Conduct thorough supplier audits, including factory visits and quality system reviews (e.g., ISO 9001).

- Require material certifications and perform incoming quality inspections (e.g., dimensional checks, burst pressure tests).

- Engage legal counsel to review supplier contracts for IP clauses and ensure freedom to operate.

- Work with suppliers who offer IP indemnification and can prove lawful design origins.

- Document all technical specifications and ensure alignment with regulatory standards (e.g., RoHS, REACH).

By proactively addressing these quality and IP pitfalls, companies can ensure reliable performance and avoid costly legal and operational disruptions in refrigerator manufacturing.

Logistics & Compliance Guide for Fridge Capillary Tube

Overview

This guide outlines the logistics handling, transportation, storage, and regulatory compliance requirements for Fridge Capillary Tubes—thin copper or steel tubes used in refrigeration systems to regulate refrigerant flow. Proper management ensures product integrity, safety, and adherence to international and regional regulations.

Classification & Identification

- Product Type: Fridge Capillary Tube

- Material: Typically copper (Cu) or stainless steel

- HS Code (Example): 7411.21.00 (Copper tubing for refrigeration systems – varies by country)

- UN Number: Not typically classified as hazardous (unless contaminated)

- Commodity: Refrigeration components / HVAC spare parts

Packaging Requirements

- Primary Packaging: Coiled tubes protected with plastic end caps to prevent contamination and damage

- Secondary Packaging: Sealed polyethylene bags inside rigid cardboard boxes or wooden crates

- Palletization: Securely stacked on standard EUR/ISO pallets, stretch-wrapped, and labeled

- Marking: Include product name, batch/lot number, net weight, handling instructions (e.g., “Fragile,” “Keep Dry”)

Storage Conditions

- Temperature: 5°C to 35°C (41°F to 95°F)

- Humidity: Below 60% RH to prevent oxidation (especially for copper)

- Environment: Dry, well-ventilated, indoor area

- Shelf Life: Indefinite if stored properly; inspect for corrosion or deformation before use

- Stacking: Limit stack height to prevent crushing; max 5 layers per pallet

Transportation Guidelines

- Mode: Road, air, or sea freight (non-hazardous classification)

- Handling: Use forklifts or pallet jacks; avoid dropping or bending tubes

- Climate Control: Not required but avoid extreme temperatures or prolonged exposure to moisture

- Documentation: Commercial invoice, packing list, bill of lading/air waybill

- Insurance: Recommended for high-value shipments

Regulatory & Compliance Standards

- RoHS (EU): Compliant – ensure capillary tubes contain no restricted substances (e.g., Pb, Cd) above threshold

- REACH (EU): Confirm no SVHCs (Substances of Very High Concern) in materials

- EPA (USA): No direct regulation, but part of refrigeration systems subject to Section 608 of the Clean Air Act (handling of refrigerants)

- China RoHS: Labeling may be required if used in electronic equipment

- Customs Clearance: Accurate HS code declaration; potential import duties based on destination

Environmental & Safety Considerations

- Disposal: Recyclable as metal scrap (copper/steel); follow local e-waste or metal recycling guidelines

- Worker Safety: Minimal risk; gloves recommended during handling to prevent cuts from sharp edges

- Spill/Leak Response: Not applicable unless contaminated with refrigerant or oil (treat as hazardous waste if so)

Quality Assurance & Traceability

- Batch Tracking: Maintain records of material source, manufacturing date, and test results

- Certifications: ISO 9001 (quality management), ISO 14001 (environmental) if applicable

- Testing: Dimensional checks, burst pressure test, visual inspection for defects

Import/Export Documentation Checklist

- Commercial Invoice

- Packing List

- Certificate of Conformity (if required by destination)

- Bill of Lading or Air Waybill

- Export Declaration (as per country requirements)

- RoHS/REACH Compliance Statement

Special Considerations

- Country-Specific Rules: Verify import regulations in target markets (e.g., BIS in India, INMETRO in Brazil)

- Free Trade Agreements: Leverage agreements (e.g., USMCA, RCEP) for duty reduction if applicable

- Anti-Dumping Measures: Monitor for copper product tariffs in sensitive markets

Conclusion

Proper logistics and compliance management for Fridge Capillary Tubes ensures timely delivery, regulatory adherence, and product reliability. Always consult local regulations and partner with certified freight forwarders for international shipments.

Conclusion for Sourcing Fridge Capillary Tube:

Sourcing a capillary tube for refrigerators requires careful consideration of technical specifications, material quality, supplier reliability, and compliance with industry standards. The capillary tube plays a critical role in the refrigeration system by regulating refrigerant flow and maintaining proper pressure differential between the condenser and evaporator. Therefore, selecting the correct diameter, length, and material (typically copper) is essential for optimal system performance and energy efficiency.

After evaluating various suppliers, it is evident that partnering with certified manufacturers who adhere to international quality standards ensures durability and compatibility. Additionally, cost-effectiveness should not compromise quality, as substandard tubes can lead to system failure and increased maintenance costs. Establishing long-term relationships with reliable suppliers offering consistent product quality, timely delivery, and technical support is recommended.

In conclusion, a strategic sourcing approach that balances quality, cost, and supplier capability will ensure the efficient operation of refrigeration units and support long-term reliability in both manufacturing and service environments.