The global force torsion component market is experiencing steady growth, driven by rising demand across automotive, industrial machinery, and aerospace sectors. According to Grand View Research, the global torsion spring market was valued at USD 1.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This expansion is fueled by increasing vehicle production and the need for precision mechanical systems in automation. As industries prioritize durability and performance, leading manufacturers are enhancing material science and production technologies to meet rigorous application standards. In this evolving landscape, nine key players have emerged at the forefront, combining innovation, scalability, and global reach to dominate the force torsion manufacturing space.

Top 9 Force Torsion Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Spring Manufacturers

Domain Est. 2003

Website: springmanufacturer.com

Key Highlights: Connect with top spring manufacturers and industrial suppliers who offer ISO certified industrial springs at competitive prices and with fast shipping….

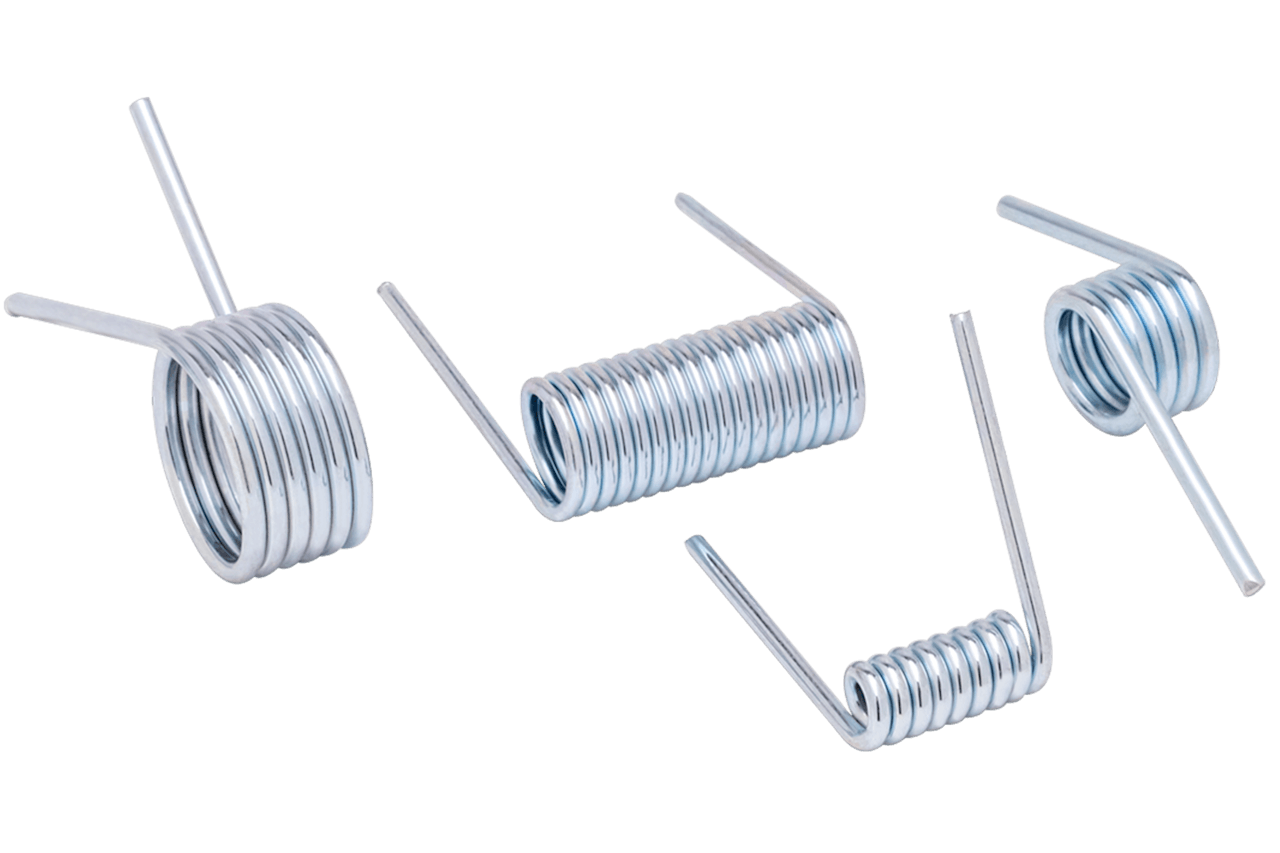

#2 Century Spring

Domain Est. 1996

Website: centuryspring.com

Key Highlights: Looking to buy custom quick-delivery springs for sale? Century Spring is your go-to spring manufacturer for extension, torsion, compression springs, and……

#3 FlexiForce expands torsion spring production in Hungary to meet …

Domain Est. 1997

Website: flexiforce.com

Key Highlights: At FlexiForce, we design and produce torsion springs and other high-quality door components that help manufacturers build reliable, ……

#4 Custom Constant Force Springs Manufacturer

Domain Est. 2019

Website: oscarprecision.com

Key Highlights: Oscar Precision is a leading Manufacturer of Constant Force Springs in Taiwan, providing various custom springs including extension springs, torsion springs ……

#5 spring and pressing solutions

Domain Est. 1998

Website: lesjoforsab.com

Key Highlights: Large diameter compression, torsion and tension springs, manufactured across hot and cold coiling CNC machine technologies for heavy-duty applications….

#6 Stock and Custom Torsion and Double

Domain Est. 1999

Website: zycon.com

Key Highlights: Torsion springs are mechanical devices that store energy and offer resistance when subjected to external forces, in this case, torque. Torsion springs exert ……

#7 N19 TORSION DRW

Domain Est. 2002

Website: americanforce.com

Key Highlights: Our wheels are made from aerospace-grade 6061-T6 forged aluminum and are machined at our York, South Carolina facility….

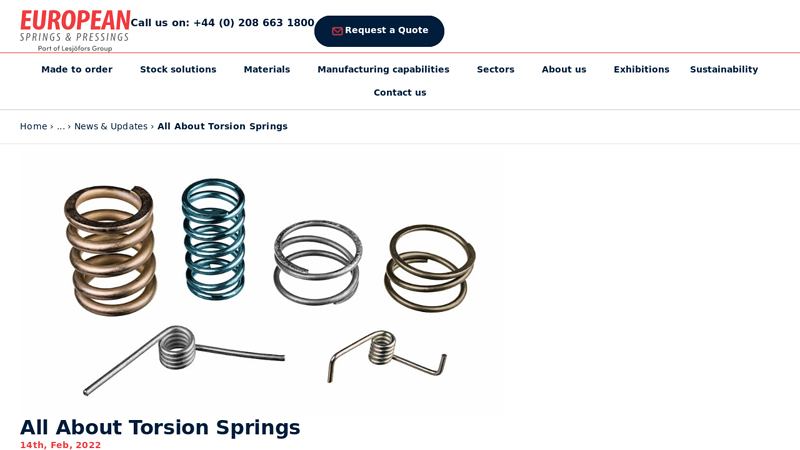

#8 All About Torsion Springs

Domain Est. 2002

Website: europeansprings.com

Key Highlights: Torsion springs are a different type of spring from your typical spring. These coiled springs work by a twisting motion; this rotational movement is known as ‘ ……

#9 TorsionX

Domain Est. 2013

Website: torsionx.com

Key Highlights: Powerful and reliable when your job demands it. TorsionX offers a full line of torque pumps and associated equipment available for purchase or rent….

Expert Sourcing Insights for Force Torsion

H2: Market Trends for Force Torsion in 2026

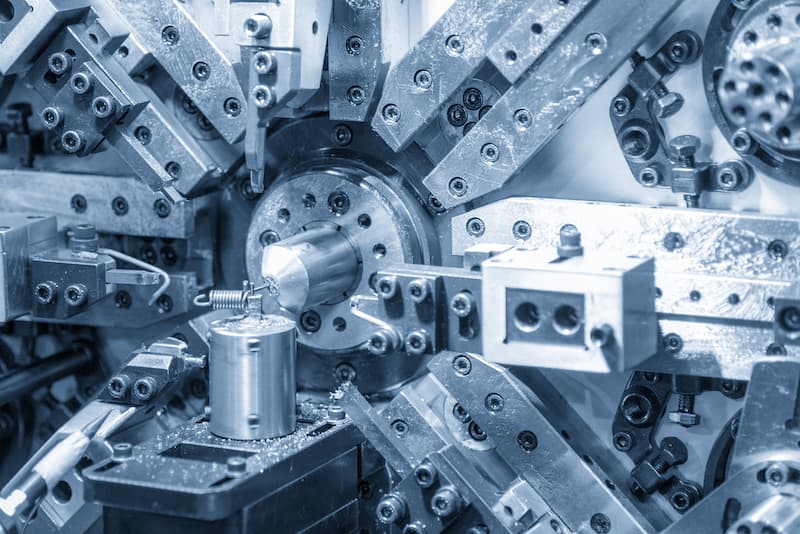

As we approach 2026, the market for force torsion—particularly in industries involving mechanical systems, automotive engineering, aerospace, and industrial automation—is undergoing significant transformation driven by technological innovation, sustainability demands, and evolving regulatory landscapes. Below is an analysis of key trends shaping the force torsion sector in 2026:

1. Increased Demand in Electric and Autonomous Vehicles

The rise of electric vehicles (EVs) and autonomous driving systems is intensifying the need for precision torsion components in drivetrains, steering mechanisms, and suspension systems. Force torsion sensors and torsion springs are critical in torque vectoring, stability control, and regenerative braking systems. With global EV adoption accelerating, manufacturers are investing in high-efficiency, lightweight torsion technologies, driving market growth.

2. Advancements in Smart Sensing and IoT Integration

By 2026, force torsion devices are increasingly embedded with smart sensors capable of real-time torque monitoring and predictive maintenance. Integration with Industrial Internet of Things (IIoT) platforms allows for data-driven performance optimization in manufacturing, robotics, and energy systems. This trend enhances system reliability and reduces downtime, particularly in high-stakes environments like aerospace and medical robotics.

3. Lightweight and High-Strength Materials

Material innovation is a defining trend. The use of advanced composites, high-strength alloys, and nano-engineered materials enables torsion components to deliver higher performance with reduced mass. This is especially critical in aerospace and automotive applications where fuel efficiency and emissions standards are tightening.

4. Focus on Sustainability and Circular Design

Environmental regulations and corporate sustainability goals are pushing manufacturers to adopt recyclable materials and energy-efficient production methods. In 2026, torsion product design emphasizes durability, repairability, and end-of-life recyclability, aligning with circular economy principles. This shift is supported by stricter emissions targets in regions like the EU and North America.

5. Growth in Renewable Energy Applications

Wind turbines and wave energy systems rely heavily on torsion control mechanisms for pitch and yaw systems. As global investment in renewable energy continues to expand, demand for robust, corrosion-resistant torsion components is rising, particularly in offshore installations requiring high reliability under extreme conditions.

6. Regional Market Shifts

Asia-Pacific, led by China, Japan, and South Korea, remains a dominant force in manufacturing and R&D for torsion technologies. However, North America and Europe are seeing resurgence due to reshoring initiatives and investments in advanced manufacturing (e.g., Industry 5.0). This geographic diversification is creating new supply chain dynamics and innovation hubs.

7. Regulatory and Safety Standards Evolution

By 2026, updated international standards for mechanical safety, especially in automotive and aviation sectors, are mandating higher precision and fail-safes in torsion systems. Compliance is driving innovation in fault-tolerant designs and redundancy mechanisms.

Conclusion

The force torsion market in 2026 is characterized by technological convergence, sustainability imperatives, and growing demand across high-growth industries. Companies that innovate in smart integration, materials science, and energy efficiency are best positioned to lead in this evolving landscape. Strategic investments in R&D and alignment with global decarbonization goals will be key differentiators.

Common Pitfalls in Sourcing Force Torsion Components (Quality and Intellectual Property)

Sourcing force torsion components—such as torsion springs, torsion bars, or torque sensors—requires careful attention to both quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to performance failures, legal disputes, or supply chain disruptions. Below are key pitfalls to avoid.

Inadequate Quality Control and Material Verification

One of the most frequent issues in sourcing force torsion parts is the lack of strict quality control. Suppliers, especially low-cost overseas manufacturers, may use substandard materials or inconsistent heat treatment processes, leading to premature fatigue, reduced torque capacity, or catastrophic failure under load. Without proper certification (e.g., ISO 9001), material test reports (MTRs), or third-party inspection protocols, buyers risk receiving components that do not meet mechanical specifications.

Insufficient Testing and Performance Validation

Many sourced torsion components are not subjected to rigorous performance testing, such as torque cycle testing, fatigue life analysis, or stress verification. Relying solely on supplier claims without independent validation increases the risk of field failures. Buyers should require documented test data and, when possible, conduct in-house or third-party validation to ensure compliance with design requirements.

Lack of Traceability and Documentation

Poor documentation—missing batch numbers, heat treatment records, or inspection reports—compromises traceability. In regulated industries (e.g., automotive, aerospace, medical devices), this can result in non-compliance with quality standards and hinder root cause analysis during failures. Ensure suppliers provide complete documentation packages for every production batch.

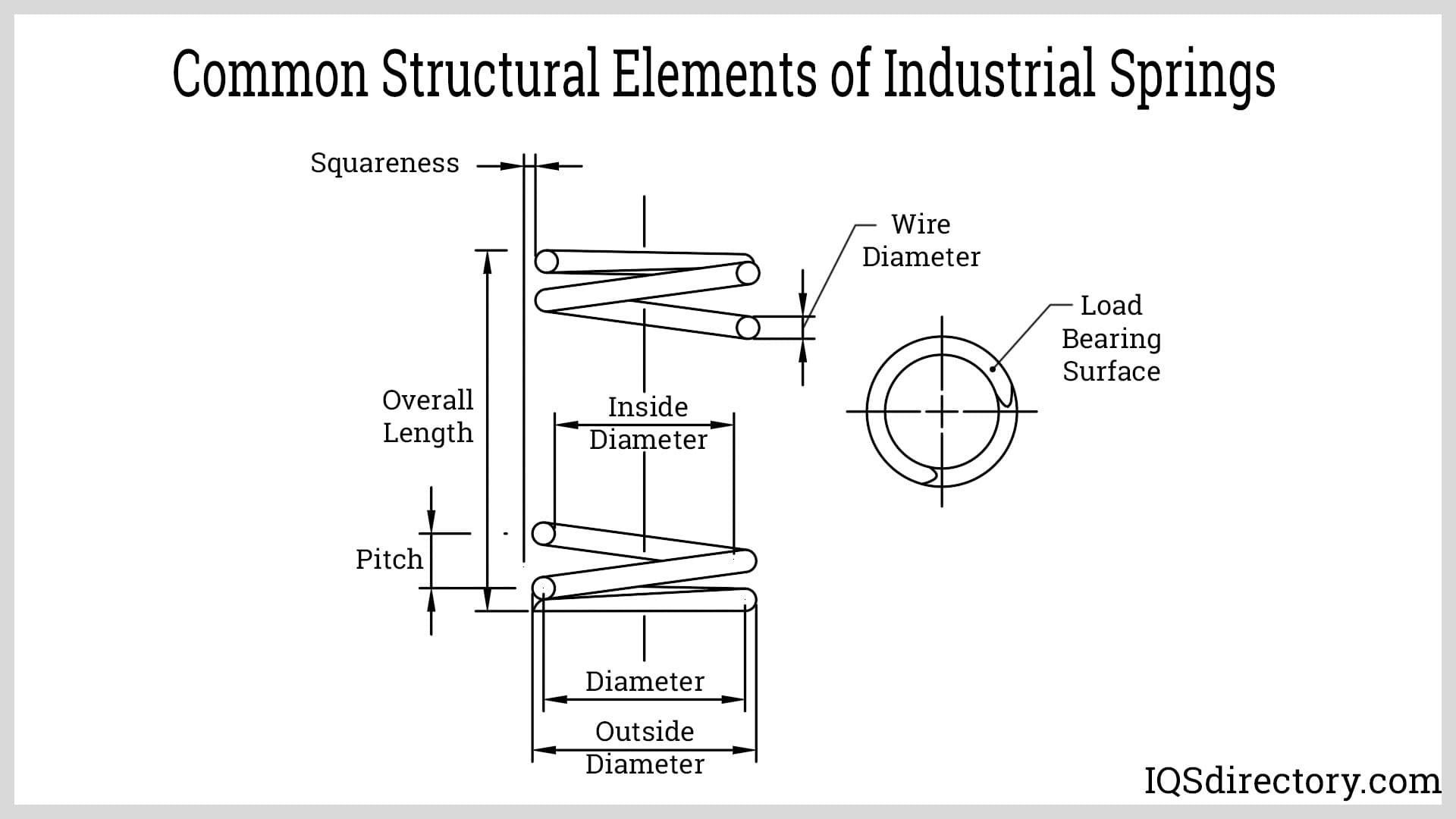

Ignoring Geometric and Dimensional Tolerances

Torsion components are highly sensitive to dimensional accuracy. Small deviations in diameter, length, or angular deflection can significantly alter performance. Sourcing without clearly defined and enforced tolerances (e.g., via detailed engineering drawings with GD&T) often results in non-interchangeable or underperforming parts.

Overlooking Intellectual Property Risks

Sourcing torsion components with patented designs—such as proprietary spring geometries, mounting configurations, or torque calibration methods—can expose companies to IP infringement claims. Failing to conduct due diligence on supplier designs or assuming “off-the-shelf” parts are free to use can lead to costly litigation or product recalls.

Using Suppliers with Questionable IP Practices

Some suppliers may reverse-engineer or replicate patented torsion components without proper licensing. Sourcing from such vendors, even unknowingly, makes the buyer complicit in IP violations. It is essential to vet suppliers for IP compliance and obtain written assurances that components do not infringe on third-party patents.

Inadequate Contractual Protections

Purchase agreements that lack clear IP indemnification clauses, confidentiality terms, or quality warranties leave buyers vulnerable. Without contractual safeguards, recourse in the event of IP disputes or quality failures is limited. Always include specific terms protecting your company’s interests in sourcing contracts.

Failure to Secure Custom Design Rights

When working with suppliers to develop custom torsion components, companies often assume they own the resulting design. However, unless explicitly stated in a written agreement, IP rights may remain with the supplier. This can prevent future sourcing flexibility or lead to royalty demands. Always clarify IP ownership in development partnerships.

By proactively addressing these pitfalls—through stringent supplier vetting, comprehensive specifications, testing protocols, and robust legal agreements—companies can ensure reliable performance and legal compliance in their force torsion component sourcing.

Logistics & Compliance Guide for Force Torsion

This guide outlines the essential logistics and compliance procedures for Force Torsion operations. Adherence to these standards ensures efficient delivery, regulatory compliance, and customer satisfaction.

Shipping and Distribution

Force Torsion utilizes a network of certified carriers to ensure timely and secure delivery of products. All shipments must be properly packaged to prevent damage during transit, using materials that meet ISTA performance standards. Shipping documentation, including packing lists, commercial invoices, and bills of lading, must be accurate and completed in accordance with destination country requirements.

Import/Export Compliance

All international shipments must comply with applicable export control regulations, including those set forth by the U.S. Department of Commerce (EAR) and the International Traffic in Arms Regulations (ITAR), where relevant. Force Torsion classifies products under the appropriate Harmonized System (HS) codes and obtains required export licenses prior to shipment. Personnel involved in export activities must complete biennial export compliance training.

Customs Clearance

To facilitate smooth customs clearance, all documentation must include correct product descriptions, values, country of origin, and end-use statements. Force Torsion partners with licensed customs brokers in key markets to ensure compliance with local import regulations. Any changes in product composition or manufacturing location must be reported immediately to the compliance team for reassessment.

Regulatory Standards and Certifications

Force Torsion products are designed and manufactured in compliance with ISO 9001:2015 quality management standards. Where applicable, products meet regional requirements such as CE marking (EU), UKCA (UK), and compliance with ANSI/ASME standards. Certificates of Conformity (CoC) and Declarations of Performance (DoP) are available upon request for regulated markets.

Hazardous Materials Handling

Force Torsion does not manufacture or ship hazardous materials under normal operations. Should any component or byproduct be classified as hazardous under DOT, IATA, or ADR regulations, proper labeling, packaging, and documentation will be implemented. Employees handling such materials must be trained in accordance with OSHA’s Hazard Communication Standard (HCS).

Record Retention and Audit Preparedness

All logistics and compliance records—including shipping logs, export licenses, certificates, and training records—must be retained for a minimum of five years. Digital records are stored in secure, access-controlled systems. Internal audits will be conducted annually to verify compliance with this guide and relevant regulations.

Corrective and Preventive Actions (CAPA)

Non-conformances related to logistics or compliance must be reported immediately through the company’s incident reporting system. The compliance team will initiate a root cause analysis and implement corrective actions to prevent recurrence. CAPA reports are reviewed quarterly by senior management.

Conclusion for Sourcing Force Torsion:

In conclusion, accurately determining and sourcing the torsional force in mechanical systems is critical for ensuring structural integrity, performance, and safety. Proper assessment involves understanding the applied torque, material properties, component geometry, and operational conditions. Effective sourcing of torsion data relies on a combination of theoretical calculations, simulation tools (such as FEA), and real-world testing to validate design assumptions. Additionally, selecting appropriate materials and components with sufficient torsional strength helps prevent failure due to shear stress, fatigue, or deformation. By integrating engineering principles with precise measurement and reliable component sourcing, designers and engineers can optimize system efficiency and durability in applications ranging from automotive drivetrains to industrial machinery and aerospace systems.