The global fluorescence imaging market is experiencing strong momentum, driven by rising demand for advanced diagnostic techniques and increased R&D investments in life sciences. According to a 2023 report by Mordor Intelligence, the market was valued at USD 2.3 billion and is projected to grow at a CAGR of 9.8% through 2028. Expansion in applications across biomedical research, drug discovery, and clinical diagnostics—particularly in oncology and neurology—is fueling demand for high-performance fluoresc materials and technologies. As innovation accelerates and the need for brighter, more stable fluorophores intensifies, a select group of manufacturers are leading the charge in product development, reliability, and global reach. Based on market presence, product portfolio breadth, and technological advancement, here are the top 9 fluorescence manufacturers shaping the future of imaging and analysis.

Top 9 Fluoresc Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Light Sources

Domain Est. 1997

Website: light-sources.com

Key Highlights: We develop and manufacture high-quality germicidal lamps found in a multitude of water, air and surface disinfection applications worldwide….

#2 Aron Universal Ltd

Domain Est. 1999

Website: aronuniversal.com

Key Highlights: Fluorescent Pigments and Fluorescent Color Manufacturers. Aron Universal Ltd is a renowned manufacturer of high-quality pigments and aerosol spray paints ……

#3 We Serve Several Industries With Fluorescent

Domain Est. 1999

Website: angtech.com

Key Highlights: Angstrom Technologies, Inc. produces fluorescent dyes and pigments that are used by US government agencies and other countries to help prevent counterfeit ……

#4 Ikonisys is global leader in FISH

Domain Est. 2000

Website: ikonisys.com

Key Highlights: Discover Ikonisys, global leader in FISH (Fluorescence in Situ Hybridization) technology, that offers advanced solutions for genetic analysis….

#5 Uv fluorescent pigment Manufacturers , Suppliers

Domain Est. 2021

Website: topwelldyes.com

Key Highlights: UV Fluorescent pigment UV Green Y3C delivers an intense, pure green fluorescence under standard 365nm UV light. Engineered for unmatched brilliance….

#6 DayGlo Color Corp

Domain Est. 1996

Website: dayglo.com

Key Highlights: Discover our innovative fluorescent and phosphorescent pigments, engineered to infuse your products with vivid color and give your brand a true competitive edge ……

#7 Biotium

Domain Est. 1998

Website: biotium.com

Key Highlights: Explore Biotium’s cutting-edge fluorescent dyes, antibodies, and kits designed to advance molecular and cellular biology research. Find out more!…

#8 to Lumiprobe

Domain Est. 2008 | Founded: 2006

Website: lumiprobe.com

Key Highlights: Welcome to Lumiprobe. Since 2006, we manufacture and sell advanced chemicals for life science research and diagnostics. Our catalog includes fluorescent dyes, ……

#9 BMG LABTECH

Domain Est. 1996

Website: bmglabtech.com

Key Highlights: BMG LABTECH is a leading global manufacturer of innovative, high-quality, and reliable microplate reader instrumentation….

Expert Sourcing Insights for Fluoresc

H2: Fluorescent Market Trends in 2026

As of 2026, the global fluorescent materials and lighting market is undergoing significant transformation, shaped by evolving regulatory standards, technological advancements, and shifting consumer preferences. While traditional fluorescent lighting continues to decline due to the rise of energy-efficient alternatives, specialty fluorescent applications are experiencing growth in niche sectors. Below are the key market trends for fluorescent technologies in 2026:

-

Decline in General Lighting Applications

By 2026, fluorescent lamps—particularly linear fluorescent tubes (LFLs) and compact fluorescent lamps (CFLs)—have seen a continued decline in the general lighting sector. This trend is driven by the widespread adoption of LED lighting, which offers superior energy efficiency, longer lifespan, and lower maintenance costs. Many countries have enforced bans or phase-outs of fluorescent lighting under energy efficiency regulations (e.g., EU Ecodesign Directive, U.S. DOE rules), accelerating this transition. -

Regulatory Pressure and Mercury Concerns

Environmental regulations targeting mercury content remain a major constraint on fluorescent technologies. The Minamata Convention on Mercury has prompted stricter controls on the production and disposal of mercury-containing fluorescent lamps. In 2026, compliance costs and end-of-life recycling obligations are discouraging new installations in commercial and industrial settings. -

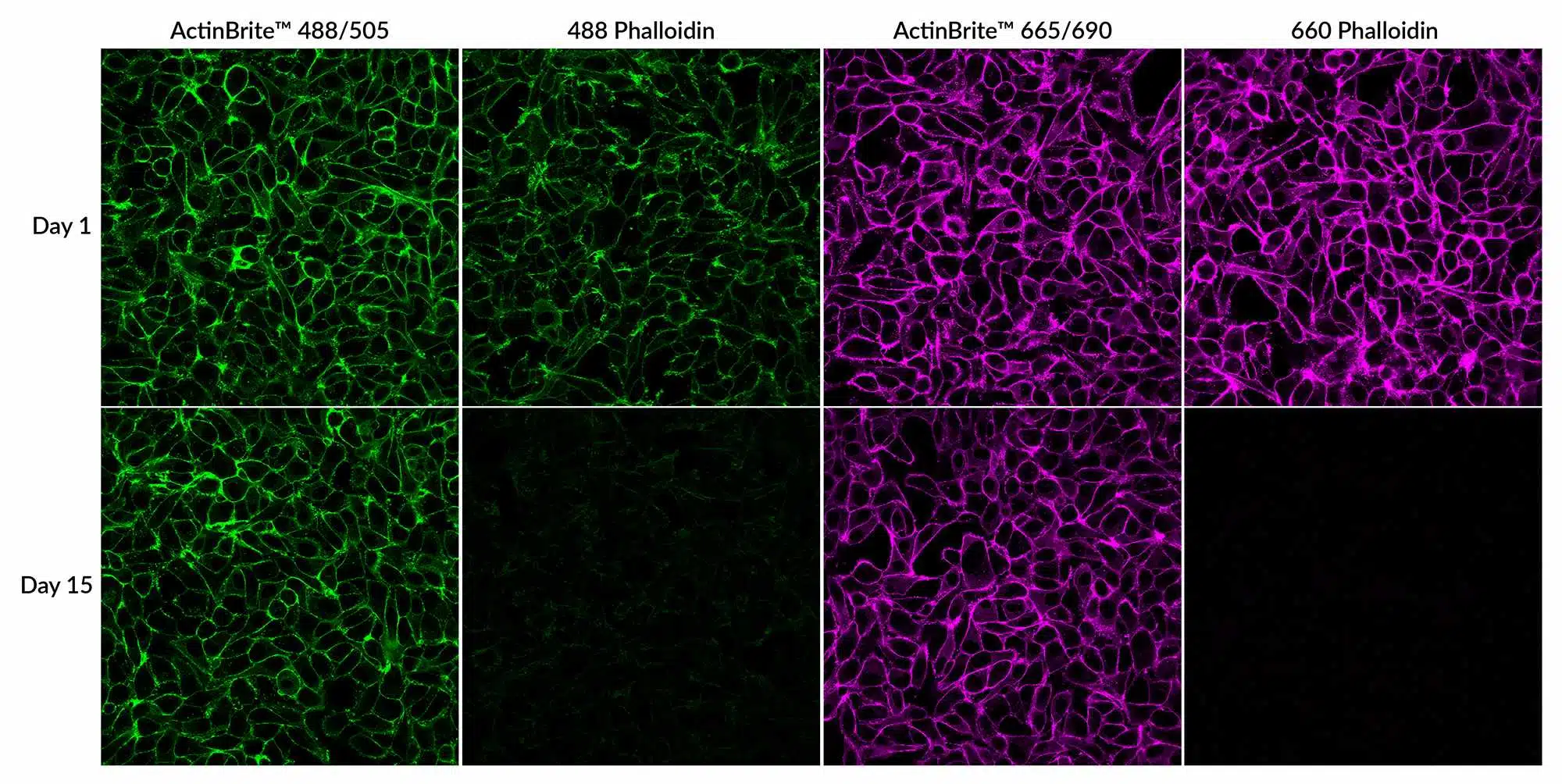

Growth in Specialty Fluorescent Applications

Despite the downturn in lighting, fluorescent materials are gaining traction in high-tech and scientific applications: - Biomedical Imaging & Diagnostics: Fluorescent dyes and probes are increasingly used in microscopy, flow cytometry, and in vivo imaging. Advances in quantum dot and organic fluorescent markers are enhancing sensitivity and multiplexing capabilities.

- Security and Anti-Counterfeiting: Fluorescent inks and tags are being adopted in currency, pharmaceuticals, and luxury goods for authentication.

-

Agricultural and Environmental Monitoring: Fluorescent sensors are deployed to detect pollutants, monitor soil health, and assess plant stress through chlorophyll fluorescence.

-

Innovation in Fluorescent Materials

Research and development in organic and inorganic fluorescent compounds have led to more stable, efficient, and eco-friendly alternatives. In 2026, there is growing interest in metal-free organic fluorophores and upconversion nanoparticles (UCNPs), which reduce toxicity and enable new applications in bioimaging and optoelectronics. -

Niche Industrial and UV Applications

Fluorescent ultraviolet (UV) systems remain relevant in water purification, sterilization, and non-destructive testing. Fluorescent penetrant inspection (FPI) continues to be used in aerospace and automotive industries for detecting surface-breaking flaws. -

Market Consolidation and Shift in Manufacturing

The fluorescent lighting industry has seen consolidation, with major players either exiting the market or pivoting to LED and smart lighting solutions. Production has shifted toward regions with lower regulatory scrutiny, although global volume continues to decline.

Conclusion

In 2026, the fluorescent market is characterized by a sharp dichotomy: rapid obsolescence in mainstream lighting and robust innovation in specialized scientific and industrial domains. While the legacy fluorescent lighting sector continues to shrink, the broader field of fluorescent materials is adapting through technological reinvention, ensuring ongoing relevance in advanced applications. Companies that pivot toward high-value, low-volume fluorescent technologies are best positioned to thrive in this evolving landscape.

Common Pitfalls in Sourcing Fluorescein: Quality and Intellectual Property Concerns

When sourcing fluorescein—a widely used fluorescent dye in biomedical research, diagnostics, and industrial applications—procurement teams and researchers often encounter critical challenges related to quality consistency and intellectual property (IP) risks. Overlooking these pitfalls can lead to compromised experimental results, regulatory non-compliance, or legal disputes. Below are key areas of concern:

Inconsistent or Substandard Product Quality

One of the most prevalent issues in sourcing fluorescein is variability in chemical purity, isomeric composition (e.g., fluorescein vs. its isomers like resorcinol-based impurities), and batch-to-batch reproducibility. Lower-cost suppliers, especially from regions with less stringent quality controls, may provide material containing significant impurities that affect fluorescence intensity, photostability, and solubility. This can lead to unreliable assay performance or failed experiments, particularly in sensitive applications like flow cytometry or in vivo imaging.

Additionally, fluorescein is prone to degradation when exposed to light, moisture, or improper storage conditions. Suppliers may not adhere to strict handling and packaging standards, resulting in partially degraded product upon arrival. Certificates of Analysis (CoA) may be missing, falsified, or based on inadequate testing protocols, making it difficult to verify quality claims.

Intellectual Property and Regulatory Compliance Risks

Fluorescein and its derivatives (e.g., FITC, carboxyfluorescein) are often protected by patents, particularly in specialized formulations or novel conjugation chemistries. Sourcing from unauthorized or non-licensed manufacturers can expose end users to IP infringement liabilities, especially in commercial applications such as IVD kits or pharmaceutical development. Some suppliers may offer “generic” versions of proprietary fluorescein-based compounds without proper licensing, leading to potential legal action from patent holders.

Furthermore, regulatory requirements vary by region (e.g., REACH in the EU, TSCA in the US). Sourcing fluorescein from suppliers who do not comply with these regulations—or who cannot provide proper documentation—can result in shipment delays, customs rejection, or non-compliance in regulated environments.

Best Practices to Mitigate Risks

To avoid these pitfalls, organizations should:

– Source from reputable, audited suppliers with transparent quality control processes.

– Require detailed CoAs, including HPLC/GC data, spectral analysis, and water content.

– Verify IP status and licensing when using fluorescein in commercialized products.

– Ensure supplier compliance with relevant chemical regulations and shipping standards.

– Consider using certified reference materials for critical applications.

By proactively addressing quality and IP concerns, organizations can ensure the reliability, legality, and performance of fluorescein in their applications.

It seems you’re requesting a logistics and compliance guide for a substance referred to as “Fluoresc.” using hydrogen (H₂), possibly in a chemical or industrial context. However, “Fluoresc.” is ambiguous—it could refer to a fluorescent dye, pigment, compound (e.g., fluorescein), or even a placeholder. Additionally, the mention of “Use H₂” suggests hydrogen gas is involved in handling, synthesis, or storage.

Below is a generalized logistics and compliance guide for handling a fluorescent compound (assuming fluorescein as a representative example) in conjunction with hydrogen (H₂) use, with emphasis on safety, transport, and regulatory compliance. Always verify specifics based on the exact chemical and jurisdiction.

Logistics & Compliance Guide: Fluorescent Compound (e.g., Fluorescein) with Hydrogen (H₂) Use

1. Chemical Identification

- Substance: Fluorescein (example fluorescent compound)

- CAS No.: 2321-07-5

- Formula: C₂₀H₁₂O₅

- Appearance: Dark orange/red powder

- Uses: Tracer dye, biomedical imaging, leak detection

- Hydrogen (H₂)

- CAS No.: 133-74-0

- Gas, colorless, odorless, highly flammable

- Used in: Reduction reactions, carrier gas, fuel

Note: Confirm exact identity of “Fluoresc.”—may be sodium fluorescein, uranium fluorescent salts, or others with vastly different hazards.

2. Regulatory Frameworks

Ensure compliance with:

A. Globally Harmonized System (GHS)

- Fluorescein:

- GHS Classification: May be non-hazardous or cause eye/respiratory irritation (check SDS).

- Label: Irritant (if applicable), environmental hazard (to aquatic life).

- Hydrogen (H₂):

- GHS02 (Flame): Extremely flammable gas

- Label: “Extremely Flammable Gas,” “May form explosive mixtures with air”

B. Transport Regulations

- IMDG Code (Maritime): H₂ as UN1049, Class 2.1 (Flammable Gas)

- IATA DGR (Air): UN1049, PI 200, special provisions apply

- ADR/RID (Road/Rail in Europe): Class 2.1, tunnel code code C

- 49 CFR (USA): H₂ regulated by DOT as hazardous material (HM-218)

Fluorescein: Typically not regulated as hazardous for transport unless in solution with hazardous solvents.

C. Storage & Handling Regulations

- OSHA (USA): 29 CFR 1910 – Flammable gases, PPE, ventilation

- REACH/CLP (EU): Registration, labeling, safety data

- NFPA 55 & NFPA 2: For hydrogen storage and use

3. Logistics Considerations

A. Transportation

- Hydrogen:

- Must be transported in approved pressure cylinders or tube trailers.

- Secure from physical damage, heat, and ignition sources.

- Segregate from oxidizers.

- Use certified carriers with hazardous materials endorsements.

- Fluorescein:

- Solid form: Pack in sealed containers to prevent dust.

- Avoid moisture; store in cool, dry place.

- Not typically hazardous for transport unless classified.

B. Storage

- Hydrogen (H₂):

- Store outdoors or in well-ventilated, fire-rated gas cabinets.

- Minimum 20 ft from oxidizers and ignition sources.

- Use leak detection and automatic shutoff systems.

- Cylinders secured upright.

- Fluorescein:

- Store in original container, away from light (light-sensitive).

- Avoid contact with strong oxidizing agents.

4. Safety & Operational Controls

A. Hydrogen-Specific Hazards

- Flammability: Flammable range 4–75% in air; low ignition energy.

- Embrittlement: H₂ can degrade certain metals.

- Asphyxiation Risk: In confined spaces.

Controls:

– Ventilation: >1 ft/sec airflow or continuous monitoring.

– Gas detection: H₂ sensors with alarms.

– No ignition sources: Intrinsically safe equipment.

– Grounding and bonding during transfer.

B. Fluorescein Handling

- Dust control: Use local exhaust ventilation.

- PPE: Gloves (nitrile), safety goggles, lab coat.

- Avoid inhalation and skin contact.

C. Combined Use (e.g., Hydrogenation Reaction)

- If H₂ is used in synthesis (e.g., reducing a precursor to a fluorescent compound):

- Conduct in a fume hood or closed reactor with pressure relief.

- Use catalysts (e.g., Pd/C) with care—pyrophoric when dry.

- Follow strict SOPs for hydrogenation (NIOSH/OSHA guidelines).

5. Emergency Response

A. Hydrogen Leak or Fire

- Evacuate area.

- Shut off source if safe.

- Use water spray to cool containers; do NOT extinguish flame unless leak can be stopped (risk of explosion).

- Fire class: Class B (flammable gas); use dry chemical or CO₂.

B. Fluorescein Spill

- Sweep up carefully, avoid dust formation.

- Collect in sealed container for disposal.

- Decontaminate surface with water.

C. Exposure

- Inhalation: Move to fresh air.

- Skin Contact: Wash with soap and water.

- Eye Contact: Flush with water for 15 minutes; seek medical attention.

6. Waste Disposal & Environmental Compliance

- Fluorescein: May be hazardous if concentrated; check local rules. Often disposed as non-hazardous waste if below thresholds.

- Hydrogen: No residue, but residual gas in cylinders must be purged safely.

- Dispose of contaminated materials per RCRA (USA) or local hazardous waste regulations.

- Avoid release to sewers or waterways (fluorescein is highly visible and toxic to aquatic organisms).

7. Documentation & Training

- SDS: Maintain Safety Data Sheets for both fluorescein and hydrogen.

- Training: Employees must be trained in:

- HAZCOM (OSHA)

- Hydrogen safety (NFPA 2)

- Emergency response

- Permits: Required for H₂ storage > allowable quantities (varies by jurisdiction).

8. Compliance Checklist

| Item | Requirement |

|——|————-|

| SDS Available | ✅ |

| H₂ Storage Compliant with NFPA 2 | ✅ |

| Ventilation & Gas Detection | ✅ |

| Approved Transport for H₂ Cylinders | ✅ |

| Employee Training Completed | ✅ |

| Spill Kits & PPE Accessible | ✅ |

| Waste Disposal Program in Place | ✅ |

Disclaimer: This guide is a general reference. Always consult:

– The specific Safety Data Sheet (SDS) for your “Fluoresc.” compound.

– Local, state, and federal regulations (EPA, OSHA, DOT, etc.).

– A qualified chemical safety officer or industrial hygienist.

If you can clarify the exact compound (e.g., fluorescein, uranyl fluorescein, etc.) and the role of H₂ (carrier gas, reactant, purge gas), a more tailored guide can be provided.

It seems your query may be incomplete—perhaps you meant “sourcing fluorescent materials,” “fluorescent dyes,” “fluorescent proteins,” or something similar. However, I can provide a general conclusion for sourcing fluorescent substances, which can be adapted based on your specific context:

Conclusion:

Sourcing fluorescent materials—whether dyes, proteins, or nanoparticles—requires careful consideration of application requirements, including excitation/emission wavelengths, photostability, biocompatibility, and conjugation chemistry. Reliable suppliers, product purity, and batch-to-batch consistency are critical for reproducible results in research or industrial applications. Additionally, ethical and environmental considerations, especially with synthetic dyes or rare biological materials, should not be overlooked. By evaluating cost, availability, regulatory compliance, and technical support, organizations can establish a robust supply chain that supports high-quality, sustainable fluorescence-based technologies.

If you provide more details (e.g., fluorescent dyes for microscopy, GFP for molecular biology, or industrial phosphors), I can tailor the conclusion accordingly.