The flexible packaging market is undergoing rapid expansion, driven by increasing demand for sustainable, lightweight, and cost-effective packaging solutions across food & beverage, pharmaceuticals, and e-commerce sectors. According to Grand View Research, the global flexible packaging market was valued at USD 235.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030. This growth is further fueled by innovations in recyclable materials, digital printing technologies, and a shift toward on-the-go consumer products. Within this evolving landscape, Flexsol packaging—known for its durability, sustainability, and high-performance barrier properties—has emerged as a key solution for forward-thinking brands. As demand rises, a select group of manufacturers are leading the charge in innovation, scalability, and environmental responsibility. Below, we spotlight the top six Flexsol packaging manufacturers shaping the future of flexible packaging through data-backed performance, strategic R&D investments, and strong market presence.

Top 6 Flexsol Packaging Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

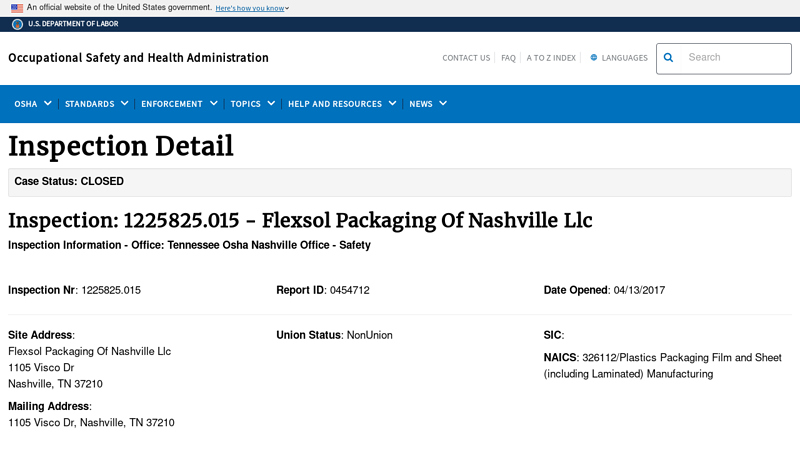

#1 Inspection: 1225825.015

Domain Est. 1997

Website: osha.gov

Key Highlights: At 6:30 p.m. on April 12, 2017, an employee was making a bale of scrap plastic in Baler Number 3. The employee ‘s head was between the baler and the baler ……

#2 Flexsol Packaging Corp of NC Archives

Domain Est. 2008

Website: sigmaplasticsgroup.com

Key Highlights: Flexsol Packaging Corporation of Statesville, NC is hiring a Warehouse Clerk. Apply today! Duties and Responsibilities: Pull, stage, re-label and load ……

#3 Flexsol Packaging Corp

Domain Est. 2012

Website: app.makersrow.com

Key Highlights: Flexsol Packaging Corp. Flexible packaging and value-added plastic films. Menu; Home · Projects · Factories · How It Works · Videos · View Plans · Log In….

#4 ISOFlex Packaging

Domain Est. 2015

Website: isoflexpackaging.com

Key Highlights: ISOFlex Packaging manufactures specialty plastic films and bags for shrink, barrier, laminating, coating, converting and can liners….

#5 Flexsol Packaging Corporation

Website: flexsol-packaging-corporation.pages.dev

Key Highlights: Unwavering Commitment to Quality: FlexSol utilizes premium materials and cutting-edge manufacturing processes. This isn’t merely a marketing ……

#6 Flexsol

Domain Est. 1996

Website: plasticsnews.com

Key Highlights: A recent visit to Flexsol’s Nashville plant – a specialty film operation where the company develops and produces many of its newer coextruded products – belied ……

Expert Sourcing Insights for Flexsol Packaging

H2: 2026 Market Trends Impacting Flexsol Packaging

As Flexsol Packaging looks toward 2026, the flexible packaging industry is poised for significant transformation driven by sustainability mandates, technological advancements, and shifting consumer behaviors. Understanding these key trends is critical for strategic positioning and sustained growth.

1. Accelerated Shift Towards Sustainable & Circular Solutions (Dominant Trend)

* Regulatory Pressure Intensifies: Global regulations (EU Packaging & Packaging Waste Regulation – PPWR, US state-level laws, Extended Producer Responsibility – EPR schemes) will mandate higher recycled content, improved recyclability, and reduced plastic use. Flexsol must prioritize easily recyclable mono-materials (e.g., PE/PE laminates) and invest heavily in post-consumer recycled (PCR) content integration, especially food-grade PCR.

* Compostability & Reusables Gain Ground: Demand for certified compostable packaging (home/industrial) will rise, particularly for specific sectors like fresh produce or coffee pods. Reusable/refillable flexible packaging systems will move beyond pilot stages, requiring Flexsol to develop durable, returnable pouch solutions and partnerships with brands on logistics.

* Transparency & Traceability: Consumers and regulators demand proof of sustainability claims. Blockchain and digital product passports (DPPs) will become essential for tracking material origin, recycled content, and end-of-life pathways. Flexsol needs systems to provide verifiable data.

2. Advanced Materials & Functional Innovation

* High-Performance Recyclable Barriers: Breakthroughs in bio-based polymers (e.g., PHA, advanced PLA), recycled barrier coatings (SiOx, AlOx on rPET), and novel mono-material structures will enable high-barrier performance (moisture, oxygen, light) essential for food safety and shelf-life while maintaining recyclability. Flexsol R&D must focus on scaling these technologies.

* Active & Intelligent Packaging Integration: Incorporation of sensors (time-temperature, freshness indicators), QR codes linking to sustainability data, and antimicrobial properties will add value, reduce food waste, and enhance consumer engagement. Flexsol should develop partnerships with tech providers.

* Lightweighting & Material Efficiency: Continued focus on reducing material usage without compromising integrity remains crucial for cost and carbon footprint reduction.

3. Digitalization & Smart Manufacturing

* Industry 4.0 Adoption: AI-driven predictive maintenance, real-time process optimization, and digital twins will enhance production efficiency, reduce waste, ensure consistent quality, and enable faster changeovers for shorter runs. Flexsol’s manufacturing footprint needs significant digital investment.

* Demand for Agile Supply Chains: Increased demand for customization and shorter lead times requires flexible, responsive manufacturing. Digital platforms enabling direct customer collaboration on design and faster prototyping will be key.

* Data-Driven Decision Making: Leveraging production and market data for predictive analytics on demand, material sourcing, and sustainability impact will be essential.

4. Evolving Consumer & Brand Dynamics

* Premiumization & Functional Aesthetics: Consumers accept (and expect) premium pricing for sustainable, functional, and aesthetically pleasing packaging. Flexsol must offer high-end print quality (digital printing), innovative formats (stand-up pouches with easy-open/reseal), and designs that communicate sustainability effectively.

* Demand for Transparency: Beyond materials, consumers want to know the environmental impact (carbon footprint labeling) and ethical sourcing. Flexsol must build transparent supply chains and support brands with lifecycle assessment (LCA) data.

* E-commerce Growth: The surge in online grocery and direct-to-consumer (DTC) sales demands packaging that survives logistics, offers excellent shelf appeal, and includes features like easy opening. Durability and consumer experience are paramount.

* Regionalization vs. Globalization: Geopolitical factors and “nearshoring” trends may lead brands to prioritize regional suppliers. Flexsol must assess its geographic footprint and supply chain resilience.

5. Consolidation & Strategic Partnerships

* Industry Consolidation: The pressure to invest in sustainability R&D and advanced manufacturing may accelerate M&A activity. Flexsol needs to evaluate its competitive position and potential for strategic partnerships or alliances with material suppliers, recyclers, or technology firms.

* Collaborative Ecosystems: Success will depend on close collaboration within the value chain – brand owners, material suppliers, converters like Flexsol, recyclers, and waste management – to close the loop effectively.

Implications for Flexsol Packaging:

- Core Strategic Focus: Sustainability is non-negotiable. R&D investment must prioritize recyclable, compostable, and high-PCR-content solutions.

- Technology Investment: Significant capital expenditure in digital manufacturing (Industry 4.0), advanced coating/extrusion lines for new materials, and digital printing capabilities is essential.

- Business Model Evolution: Move beyond being a supplier to becoming a sustainability partner, offering data, LCA support, and co-innovation with brands.

- Operational Resilience: Strengthen supply chains, diversify raw material sources (especially PCR), and ensure geographic agility.

- Talent Acquisition: Attract expertise in sustainable materials science, digital manufacturing, data analytics, and circular economy models.

Conclusion: The 2026 landscape for Flexsol Packaging is defined by the imperative of sustainability, enabled by technology, and driven by informed consumers and stringent regulations. Success hinges on proactive investment in next-generation materials and manufacturing, deep collaboration across the value chain, and a fundamental shift towards circularity. Flexsol must act decisively in the next 1-2 years to position itself as a leader in the future of responsible flexible packaging.

Common Pitfalls When Sourcing Flexsol Packaging (Quality, IP)

Sourcing Flexsol packaging—known for its flexible, often multi-layered materials used in pharmaceuticals, food, and consumer goods—can present unique challenges, especially concerning quality consistency and intellectual property (IP) protection. Failing to address these areas can lead to product recalls, legal disputes, and reputational damage. Below are key pitfalls to watch for:

Quality Inconsistencies and Non-Compliance

One of the most frequent issues when sourcing Flexsol packaging is variability in product quality. Suppliers may use substandard raw materials or inconsistent manufacturing processes, leading to defects such as delamination, poor sealing, or compromised barrier properties. Additionally, packaging that fails to meet regulatory standards (e.g., FDA, EU food contact, or pharmaceutical GMP requirements) can jeopardize the safety and efficacy of the final product.

Key Risks:

– Inadequate testing protocols (e.g., for oxygen/moisture barrier, burst strength)

– Lack of traceability in material sourcing

– Insufficient documentation for compliance audits

Mitigation Strategy: Conduct regular on-site audits, require full material disclosure, and implement third-party quality testing. Ensure suppliers are certified to relevant industry standards (e.g., ISO 13485 for medical packaging, or ISO 22000 for food safety).

Intellectual Property Infringement and Misappropriation

Flexsol packaging often incorporates proprietary designs, formulations, or printing techniques protected by patents, trademarks, or trade secrets. When sourcing from third-party manufacturers—especially in regions with weaker IP enforcement—there is a significant risk of unauthorized replication or leakage of sensitive information.

Key Risks:

– Suppliers reverse-engineering packaging designs for resale

– Unauthorized use of patented laminate structures or printing processes

– Weak contractual IP clauses that fail to assign ownership or restrict usage

Mitigation Strategy: Execute comprehensive IP agreements that clearly define ownership, usage rights, and confidentiality obligations. File patents and design registrations in target markets and consider watermarking or digital tracking in packaging to detect counterfeits. Limit access to technical specifications on a need-to-know basis.

Supply Chain Opacity and Subcontracting Without Approval

Some Flexsol suppliers outsource production to unvetted subcontractors to cut costs, leading to a lack of visibility and control over the manufacturing process. This can result in unapproved material substitutions, inconsistent quality, and increased IP exposure.

Mitigation Strategy: Define approved manufacturing locations in contracts and conduct unannounced audits. Require written consent before any subcontracting occurs.

Inadequate Change Control and Communication

Suppliers may alter materials or processes without notifying the buyer—such as switching adhesive types or film suppliers—which can affect performance and compliance. Poor communication exacerbates these issues, especially when urgent changes impact product integrity.

Mitigation Strategy: Implement a formal change control process requiring supplier notification and approval prior to any modifications. Maintain open lines of communication and designate technical liaisons.

By proactively addressing these pitfalls, companies can ensure reliable, compliant, and secure sourcing of Flexsol packaging while protecting both product quality and intellectual assets.

Logistics & Compliance Guide for Flexsol Packaging

This guide outlines the key logistics and compliance considerations to ensure efficient, safe, and legally compliant handling, transportation, and use of Flexsol Packaging products.

Supply Chain Coordination

Ensure seamless communication across all supply chain partners including suppliers, internal teams, distributors, and end customers. Utilize standardized documentation (purchase orders, delivery notes, packing lists) and maintain real-time inventory tracking to prevent delays and stockouts.

Transportation and Handling

All Flexsol packaging materials must be transported and handled in accordance with manufacturer specifications. Use appropriate protective measures during transit—including moisture barriers, palletization, and secure strapping—to prevent damage. Avoid exposure to extreme temperatures, direct sunlight, and physical impact.

Storage Conditions

Store packaging materials in a clean, dry, and temperature-controlled environment. Keep products off the floor on pallets or racks and protect from dust, moisture, and contaminants. Follow FIFO (First In, First Out) inventory practices to maintain product integrity and minimize waste.

Regulatory Compliance

Flexsol Packaging complies with all relevant international, national, and regional regulations, including but not limited to:

– REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals)

– RoHS (Restriction of Hazardous Substances)

– FDA 21 CFR (for food-contact materials, where applicable)

– EU Packaging and Packaging Waste Directive (94/62/EC)

– ISO standards (e.g., ISO 9001 for quality management)

Ensure all products are properly labeled with compliance markings, batch numbers, and safety data where required.

Product Safety & Documentation

Provide Safety Data Sheets (SDS) for applicable materials upon request. Ensure that all packaging components meet safety standards for their intended use, particularly in food, pharmaceutical, and medical applications. Conduct periodic audits to verify ongoing compliance.

Environmental Responsibility

Adhere to sustainable practices throughout the logistics cycle. Optimize packaging to reduce waste and material use. Support recyclability by providing clear disposal and recycling instructions. Comply with Extended Producer Responsibility (EPR) schemes where applicable.

Incident Reporting & Corrective Actions

Establish procedures for reporting and investigating logistics or compliance incidents (e.g., damaged goods, non-conforming materials, regulatory breaches). Implement corrective and preventive actions promptly to mitigate risks and improve processes.

Training & Awareness

Provide regular training to staff and partners on logistics best practices, handling procedures, and compliance requirements. Maintain training records to demonstrate due diligence and regulatory adherence.

Audits & Continuous Improvement

Conduct internal and third-party audits to verify compliance with this guide. Use audit findings, customer feedback, and performance metrics to drive continuous improvement in logistics efficiency and regulatory alignment.

Conclusion for Sourcing FlexSol Packaging

After a thorough evaluation of FlexSol as a packaging solution, it is evident that sourcing from this provider offers significant advantages in terms of sustainability, flexibility, and performance. FlexSol’s innovative approach to recyclable and lightweight flexible packaging aligns well with growing environmental regulations and consumer demand for eco-friendly options. The material’s durability, barrier properties, and print quality also ensure product protection and enhanced shelf appeal.

Furthermore, FlexSol’s scalable production capabilities and commitment to sustainable sourcing make it a reliable partner for brands aiming to reduce their carbon footprint while maintaining cost efficiency. Although initial costs may be slightly higher compared to conventional packaging, the long-term benefits—such as reduced material usage, lower transportation emissions, and improved brand image—justify the investment.

In conclusion, sourcing FlexSol packaging represents a strategic move toward sustainable innovation, operational efficiency, and brand differentiation in a competitive market. It is recommended for businesses seeking to future-proof their packaging solutions while meeting environmental and performance goals.