The global flexible cord market is experiencing robust growth, driven by rising demand across industrial, construction, and consumer electronics sectors. According to Grand View Research, the global cords and cables market size was valued at USD 181.3 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030—fueled by increasing electrification, infrastructure development, and the proliferation of portable electronic devices. Similarly, Mordor Intelligence forecasts sustained momentum, citing advancements in flexible cable materials and growing adoption in automation and robotics as key contributors to market expansion. As reliability, durability, and adaptability become critical in dynamic applications, manufacturers are innovating to meet stringent performance standards. In this evolving landscape, the following ten companies have emerged as leading flexible cord manufacturers, distinguished by their technological expertise, global reach, and consistent product innovation.

Top 10 Flexible Cord Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Molex

Domain Est. 1994

Website: molex.com

Key Highlights: Molex is enabling next-generation technology for data centers, vehicles, industrial environments, medical technology, consumer devices and more….

#2 Wire and Cable Manufacturers

Domain Est. 1996

Website: encorewire.com

Key Highlights: Encore Wire is the leading manufacturer of copper and aluminum for residential, commercial and industrial wire needs. We’re unlike any other wire company….

#3 AFC Cable Systems

Domain Est. 2010

Website: atkore.com

Key Highlights: AFC Cable Systems, Inc., a part of Atkore International, is a leading designer, manufacturer and supplier of electrical distribution products….

#4 Amphenol

Domain Est. 1996

Website: amphenol.com

Key Highlights: Amphenol is one of the world’s largest designers, manufacturers and marketers of connectors and interconnect systems, antennas solutions, sensors and high-speed ……

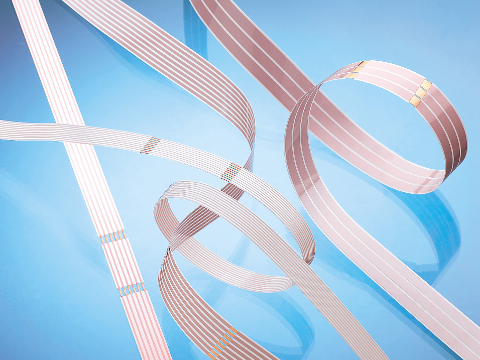

#5 Bulk flexible flat cables

Domain Est. 1996

Website: axon-cable.com

Key Highlights: Bulk flat flexible cables made by Axon’ are designed for any application where space reduction and flexibility are the most important criteria.Missing: cord manufacturer…

#6 Bus Bar

Domain Est. 1998

Website: watteredge.com

Key Highlights: ISO 9001:2008 Leading Global Supplier-Custom Fabricated Bus Bar, Copper Connector & High Current Flexible Power Cable Manufacturer….

#7 MAEDEN

Domain Est. 1999

Website: maeden.com

Key Highlights: Flexible Wire Manufacturer for Dynamic Applications … MAEDEN engineers exceptional wires that drive the future. From the delicate intricacies of in-ear monitors ……

#8 Southwire

Domain Est. 1994

Website: southwire.com

Key Highlights: Choose Southwire for your wire and cable needs – we offer high-performance products that are built to last….

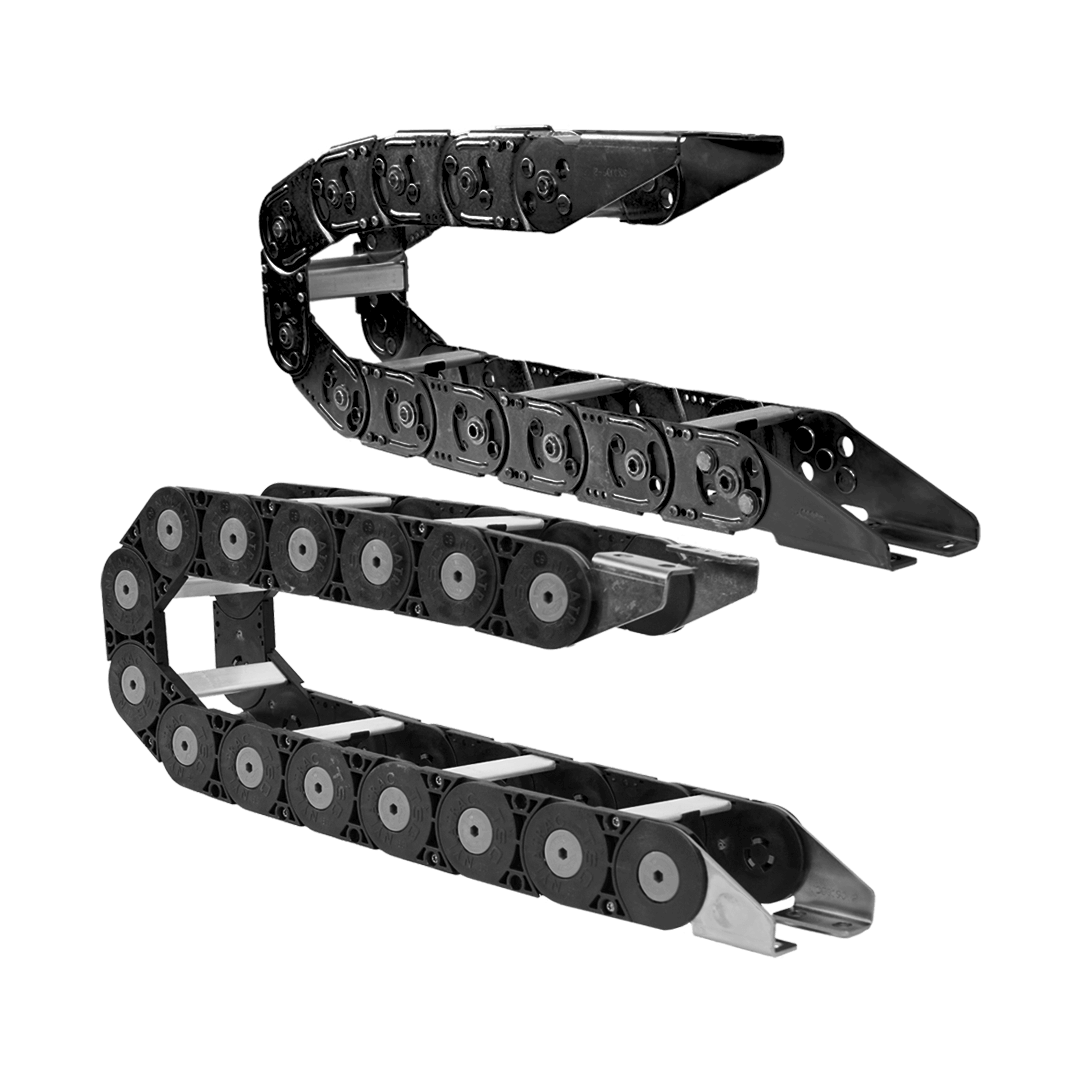

#9 Cable carriers, polymer bearings, flexible cable, & linear slides

Domain Est. 1995

Website: igus.com

Key Highlights: Choose from a variety of plastic components, such as plain & linear bearings, cable carriers, continuous-flex cables, and automation products….

#10 Heyco

Domain Est. 1996

Website: heyco.com

Key Highlights: Discover how our top-quality wire management and production solutions can elevate your HVAC/R systems. … Liquid Tight Flexible Conduit, Tubing & Fittings ……

Expert Sourcing Insights for Flexible Cord

H2: Market Trends Shaping the Flexible Cord Industry in 2026

By 2026, the global flexible cord market is projected for sustained growth, driven by technological advancements, evolving regulatory landscapes, and shifting end-user demands. Key trends shaping the sector include:

1. Accelerated Demand for High-Performance & Specialty Cords:

The proliferation of high-power devices, robotics, automation, and electric vehicles (EVs) is driving demand for flexible cords with superior attributes. Expect increased adoption of cords featuring enhanced thermal resistance (e.g., 105°C+), oil and chemical resistance, abrasion resistance, and extended flex life (millions of cycles). Silicone, TPE, and PUR jacketing materials will gain significant market share over traditional PVC, especially in industrial automation, medical equipment, and EV charging applications.

2. Sustainability and Regulatory Compliance as Core Drivers:

Environmental regulations (REACH, RoHS, SCIP, EU Green Deal) will intensify, pushing manufacturers towards halogen-free, low-smoke zero-halogen (LSZH), and recyclable materials. Demand for cords with reduced material usage (thinner, lighter gauges without sacrificing performance) and extended lifespans to minimize waste will rise. Supply chain transparency and verifiable sustainability claims will become critical differentiators.

3. Smart Cords and Integration with IoT:

The integration of sensing capabilities and connectivity into flexible cords will move beyond niche applications. By 2026, “smart cords” with embedded sensors for monitoring temperature, current load, mechanical stress, or wear will gain traction in industrial settings, data centers, and premium consumer electronics. This enables predictive maintenance, enhances safety, and provides operational data, aligning with Industry 4.0 trends.

4. Reshoring and Supply Chain Resilience:

Geopolitical tensions and recent supply chain disruptions have prompted manufacturers to diversify sourcing and bring production closer to end markets (nearshoring/reshoring). This trend will continue, increasing regional manufacturing capacity, particularly in North America and Europe, to reduce lead times, mitigate risks, and meet local content requirements, albeit potentially at higher costs.

5. Growth in Key End-Use Sectors:

Renewable Energy & EVs: Surge in demand for specialized cords in solar installations (PV wire), wind turbines, and especially EV charging (Type 2/CCS, CHAdeMO, NACS), requiring high durability, weather resistance, and safety certifications.

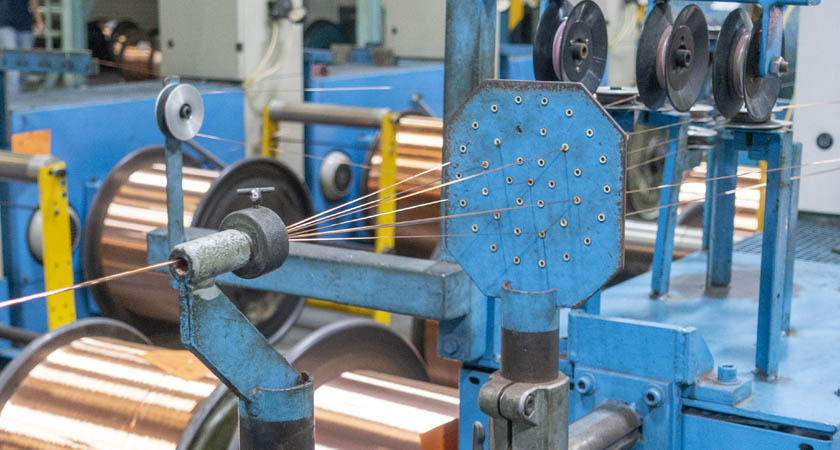

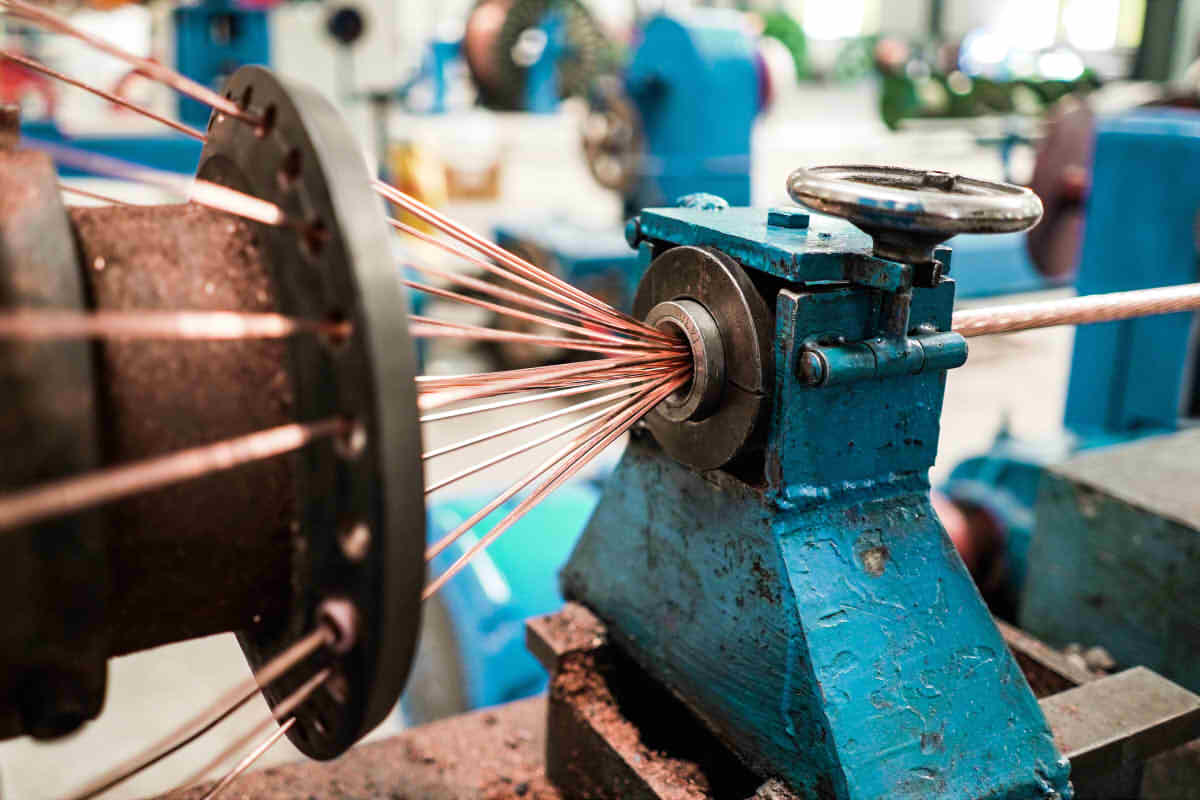

* Industrial Automation & Robotics: Exponential growth will fuel demand for highly flexible, oil-resistant, and torsion-resistant cables (e.g., continuous flex, chain-suitable) for robotic arms, AGVs, and automated production lines.

* Consumer Electronics & Home Appliances: Focus on compact, lightweight, tangle-free cords with improved aesthetics and durability for premium devices, smart home appliances, and portable power tools.

* Data Centers:* Need for high-flexibility power cords in densely packed server racks and for mobile equipment, often requiring higher temperature ratings and fire safety compliance.

6. Consolidation and Innovation in Manufacturing:

The market will likely see further consolidation among suppliers, with larger players acquiring niche technology providers (e.g., in smart cables or ultra-flexible materials). Simultaneously, continuous innovation in conductor stranding (finer strands, improved lay lengths), jacketing compounds, and manufacturing processes (e.g., improved extrusion) will enhance performance and cost-effectiveness.

Conclusion:

The 2026 flexible cord market will be characterized by a shift from commodity products towards value-added, specialized solutions. Success will hinge on a manufacturer’s ability to innovate with advanced materials, embrace sustainability, integrate digital technologies, ensure supply chain robustness, and effectively serve high-growth sectors like automation, renewables, and EVs. Companies failing to adapt to these H2 trends risk commoditization and margin erosion.

Common Pitfalls When Sourcing Flexible Cord: Quality and IP Issues

Poor Quality Materials and Construction

One of the most frequent issues when sourcing flexible cords is receiving products made from substandard materials. Low-cost suppliers may use inferior-grade copper (such as copper-clad aluminum instead of pure copper), leading to reduced conductivity, overheating, and potential fire hazards. Additionally, inadequate insulation or jacketing materials can result in reduced flexibility, poor resistance to abrasion, UV exposure, or chemicals—compromising safety and durability in real-world applications.

Lack of Compliance with International Standards

Many flexible cords fail to meet essential safety and performance standards such as UL, CSA, VDE, or IEC certifications. Sourcing non-compliant cords can lead to product recalls, legal liabilities, and safety risks. Always verify that cords are certified for their intended region and application, especially regarding temperature ratings, voltage capacity, and environmental suitability.

Inconsistent Manufacturing Tolerances

Flexible cords sourced from unreliable suppliers often exhibit inconsistencies in wire gauge, insulation thickness, and overall dimensions. These variances can affect performance and compatibility with connectors or devices, leading to unreliable connections, increased resistance, and premature failure.

Counterfeit or Misrepresented Products

Some suppliers may pass off lower-grade or imitation cables as high-quality originals. This includes falsifying markings, certifications, or labeling (e.g., fake UL stamps). Conducting supplier audits and third-party testing can help mitigate the risk of receiving counterfeit goods.

Intellectual Property (IP) Infringement Risks

Sourcing flexible cords—especially custom or branded versions—can inadvertently involve IP violations. Using patented designs, trademarks, or proprietary connector configurations without authorization may expose your business to legal action. Always ensure that designs and branding used in sourced cords do not infringe on existing patents or registered trademarks.

Inadequate Documentation and Traceability

Missing or falsified documentation (e.g., RoHS, REACH, or conflict minerals compliance) is a common issue. Without proper traceability and material disclosures, companies risk non-compliance with environmental regulations and may struggle during audits or product certifications.

Overlooking Supply Chain Transparency

Many flexible cords originate from complex, multi-tier supply chains where oversight is minimal. Without visibility into sub-suppliers and manufacturing processes, companies risk exposure to unethical labor practices, inconsistent quality control, and supply disruptions.

Failure to Conduct On-Site Audits or Pre-Shipment Inspections

Relying solely on supplier-provided samples or certifications without independent verification can be risky. Pre-production audits and third-party inspections help confirm that mass-produced batches match approved samples in both quality and specifications.

Ignoring Environmental and Operational Requirements

Flexible cords are often used in demanding environments (e.g., industrial, outdoor, or medical settings). Sourcing generic cords without considering specific requirements—such as oil resistance, low smoke zero halogen (LSZH) properties, or medical-grade safety—can lead to early failure or regulatory non-compliance.

Conclusion

To avoid these pitfalls, businesses should prioritize supplier due diligence, demand full compliance documentation, conduct regular quality testing, and ensure all designs and branding respect existing IP rights. Establishing strong quality agreements and maintaining transparent communication with suppliers are critical to sourcing reliable, compliant, and legally sound flexible cords.

Logistics & Compliance Guide for Flexible Cord

This guide outlines key logistics considerations and compliance requirements for the handling, transportation, and sale of flexible cords. Adherence to these standards ensures safety, regulatory compliance, and operational efficiency throughout the supply chain.

Regulatory Standards and Certifications

Flexible cords must comply with regional and international safety standards. Key certifications include:

– UL 62 (USA): Standard for Flexible Cords and Cables by Underwriters Laboratories.

– CSA C22.2 No. 49 (Canada): Covers flexible cords for use in accordance with the Canadian Electrical Code.

– IEC 60227 / IEC 60245 (International): International standards for PVC- and rubber-insulated cables, respectively.

– CE Marking (Europe): Indicates conformity with health, safety, and environmental protection standards under EU directives (e.g., Low Voltage Directive, RoHS).

– REACH & RoHS Compliance: Restriction of hazardous substances in electrical components; ensure cord materials are free from restricted chemicals (e.g., lead, phthalates).

Manufacturers and importers must maintain certification documentation and ensure product labeling includes required marks.

Product Classification and Harmonized System (HS) Codes

Accurate classification is essential for customs clearance and duty assessment. Common HS codes for flexible cords include:

– 8544.42 – Insulated electric conductors, fitted with connectors, for a voltage ≤ 1,000 V.

– 8544.49 – Other insulated electric conductors, fitted with connectors.

Region-specific variations may apply; verify with local customs authorities.

Packaging and Labeling Requirements

Proper packaging ensures product integrity and compliance:

– Protective Packaging: Use moisture-resistant, crush-proof materials to prevent damage during transit.

– Labeling: Include:

– Manufacturer or brand name

– Model and part number

– Voltage and current ratings

– Wire gauge (e.g., 16 AWG)

– Length

– Compliance marks (UL, CSA, CE, etc.)

– Date of manufacture (recommended)

– Country of origin

Labels must be legible, durable, and permanently affixed.

Import/Export Documentation

Ensure all shipments include:

– Commercial invoice

– Packing list

– Certificate of Conformity (CoC)

– Test reports (e.g., UL certification)

– Bill of lading or air waybill

– Import licenses (if required by destination country)

Verify destination-specific import regulations, especially for electrical goods.

Transportation and Handling

- Storage: Store in dry, temperature-controlled environments away from direct sunlight and chemicals.

- Handling: Avoid sharp bending, kinking, or crushing. Use appropriate pallets and avoid overstacking.

- Transport Mode: Flexible cords can be shipped via air, ocean, or ground. Use climate-controlled containers when necessary to prevent insulation degradation.

- Hazardous Materials: Flexible cords are generally non-hazardous but must be declared as electrical components.

Environmental and Disposal Compliance

- Comply with WEEE (Waste Electrical and Electronic Equipment) regulations in the EU and similar e-waste laws elsewhere.

- Provide end-of-life disposal guidance to customers.

- Partner with certified e-waste recyclers for returned or defective products.

Quality Assurance and Traceability

- Implement batch/lot tracking for traceability.

- Conduct regular audits of manufacturing and supply chain partners.

- Retain compliance documentation for a minimum of 5–10 years, depending on jurisdiction.

Summary

Compliance and efficient logistics for flexible cords require attention to safety standards, accurate documentation, proper labeling, and careful handling. Staying current with regulatory changes in target markets ensures uninterrupted distribution and minimizes risk of non-compliance penalties.

Conclusion for Sourcing Flexible Cord:

Sourcing the right flexible cord is a critical step in ensuring the safety, performance, and longevity of electrical equipment and systems. It requires careful consideration of factors such as cord type, insulation material, flexibility, temperature and environmental resistance, regulatory compliance (e.g., UL, CSA, CE), and application-specific requirements. By partnering with reputable suppliers, conducting thorough quality assessments, and staying aligned with industry standards, organizations can secure flexible cords that meet both operational demands and safety standards. Ultimately, a well-informed sourcing strategy not only reduces downtime and maintenance costs but also enhances overall product reliability and user safety.