The global LED lighting market is experiencing robust growth, driven by increasing demand for energy-efficient lighting solutions, advancements in solid-state lighting technologies, and supportive government regulations promoting sustainable energy use. According to Mordor Intelligence, the global LED market was valued at USD 70.3 billion in 2023 and is projected to grow at a CAGR of over 10.4% from 2024 to 2029. This expansion is further supported by rising adoption in automotive, consumer electronics, and smart lighting applications where flashing LED circuits play a critical role in signaling, aesthetics, and functionality.

With the proliferation of IoT-enabled devices and automation, the demand for reliable and innovative flashing LED light circuit manufacturers has surged. These circuits are essential in applications ranging from indicator panels and emergency lighting to decorative and safety systems. As the market becomes more competitive, identifying manufacturers with strong R&D capabilities, scalable production, and compliance with international standards becomes crucial. Based on technological innovation, market presence, and product reliability, the following nine companies have emerged as leading manufacturers of flashing LED light circuits, contributing significantly to the advancement of lighting solutions across industries.

Top 9 Flashing Led Light Circuit Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 LEDs and Displays

Domain Est. 1994

Website: broadcom.com

Key Highlights: We offer a broad range of LED light components including high brightness and high power LEDs, PLCC surface-mount LEDs, and display backlighting modules….

#2 Lumileds LED Lighting

Domain Est. 1998

Website: lumileds.com

Key Highlights: Lumileds is a global leader in led lighting and OEM lighting solutions employing more than 7000 team members operating in over 30 countries….

#3 onsemi

Domain Est. 1999

Website: onsemi.com

Key Highlights: The leader in intelligent power and image sensing technologies that build a better future for the automotive, industrial, cloud, medical, and IoT markets….

#4

Domain Est. 2016

Website: cree-led.com

Key Highlights: Cree LED delivers best-in-class technology and one of the industry’s broadest portfolios of application-optimized LED chips and components….

#5 Samsung LED

Domain Est. 1994

Website: led.samsung.com

Key Highlights: Compact light source for design flexibility and higher PPI. Learn More PixCell LED PixCell LED Ultimate precision for intelligent headlamps….

#6 Automated Lighting

Domain Est. 1995

Website: etcconnect.com

Key Highlights: A family of framing fixtures designed for the exacting demands of lighting production. Offering reduced cost, reduced weight, and increased output….

#7 Lighting and Indicators

Domain Est. 1998

Website: bannerengineering.com

Key Highlights: Banner’s expanding selection of LED light fixtures, tower lights, indicators, and actuators shine brilliant and bright to provide superior-quality illumination….

#8 BlinkStick

Domain Est. 2013

Website: blinkstick.com

Key Highlights: BlinkStick is a smart USB based color LED controller compatible with Windows, Linux, OS X and Raspberry Pi….

#9 Boca Lighting and Controls

Website: boca.lighting

Key Highlights: Boca Lighting and Controls is an industry leader in providing LED lighting solutions with over 27 years of expertise….

Expert Sourcing Insights for Flashing Led Light Circuit

2026 Market Trends for Flashing LED Light Circuits

The market for flashing LED light circuits is poised for dynamic evolution by 2026, driven by advancements in technology, shifting consumer preferences, and expanding applications. Here are the key trends expected to shape the industry:

Rising Demand in Automotive and Smart Mobility

The automotive sector will remain a major growth driver, with flashing LED circuits increasingly integrated into advanced lighting systems. By 2026, vehicle safety regulations and consumer demand for aesthetic customization will boost adoption in dynamic turn signals, adaptive brake lights, and ambient interior lighting. The rise of electric vehicles (EVs) and autonomous driving systems will further accelerate demand for energy-efficient, durable, and programmable LED flashing solutions.

Expansion in Consumer Electronics and Wearables

Flashing LED circuits will see increased use in consumer devices such as smartwatches, fitness trackers, and AR/VR headsets, where visual notifications and user feedback are essential. Miniaturization trends and the demand for low-power, high-brightness indicators will favor integrated LED driver ICs, enhancing efficiency and design flexibility. Smart home devices, including security systems and IoT appliances, will also rely on flashing LEDs for status indication and alerts.

Emphasis on Energy Efficiency and Sustainability

With global focus on energy conservation and carbon reduction, flashing LED circuits will benefit from their inherently low power consumption. By 2026, stricter energy standards and eco-labeling requirements will favor LED-based solutions over traditional incandescent or neon indicators. Manufacturers will prioritize components with higher lumens-per-watt ratios and longer lifespans, reducing environmental impact and maintenance costs.

Integration with Smart Controls and IoT

The convergence of flashing LED circuits with IoT platforms will enable intelligent lighting applications. In industrial, commercial, and residential sectors, networked LED systems will support remote monitoring, scheduling, and adaptive flashing patterns based on sensor inputs. Protocols like Zigbee, Bluetooth Low Energy (BLE), and Wi-Fi will facilitate seamless integration, making smart signaling more responsive and context-aware.

Growth in Safety, Signage, and Emergency Applications

Public safety and infrastructure development will fuel demand for flashing LEDs in traffic signals, construction zone warnings, emergency vehicle lighting, and evacuation signage. Regulatory mandates for visibility and reliability in critical environments will drive innovation in circuit robustness, thermal management, and fail-safe designs. The use of high-intensity, weather-resistant LED modules will be standard in outdoor and industrial settings.

Technological Innovation in Circuit Design

Advancements in semiconductor technology will lead to more compact, efficient, and programmable flashing LED drivers. By 2026, integrated circuits with built-in timing, pulse-width modulation (PWM), and fault detection will dominate the market. Flexible PCBs and surface-mount technology (SMT) will enable new form factors, supporting curved and wearable applications. AI-assisted design tools may also streamline development and customization for OEMs.

Regional Market Developments

Asia-Pacific will remain the largest manufacturing and consumption hub due to strong electronics production in China, India, and Southeast Asia. North America and Europe will lead in high-value applications such as automotive and smart infrastructure, supported by government incentives for energy-efficient technologies. Emerging markets will see rising adoption in low-cost signaling and consumer goods.

In conclusion, the 2026 market for flashing LED light circuits will be characterized by intelligent integration, sustainability, and diversification across industries. Companies that innovate in miniaturization, energy efficiency, and smart connectivity will be best positioned to capture growth in this evolving landscape.

Common Pitfalls When Sourcing Flashing LED Light Circuits (Quality and IP Considerations)

Sourcing flashing LED light circuits involves more than just selecting the right brightness or color. Quality and intellectual property (IP) concerns are critical factors that, if overlooked, can lead to product failures, legal issues, and reputational damage. Below are common pitfalls to avoid.

Poor Component Quality and Reliability

One of the most frequent issues is sourcing low-quality components. Inexpensive flashing LED circuits may use substandard LEDs, resistors, or integrated circuits (ICs) that degrade quickly or fail prematurely. These components often lack proper certifications (e.g., RoHS, CE) and may not meet temperature, voltage, or longevity specifications.

Inadequate IP Due Diligence

Many generic flashing LED circuits are reverse-engineered or copied from patented designs. Sourcing from suppliers without proper IP clearance can expose your company to legal risks, including cease-and-desist orders, product recalls, or litigation. Always verify that the circuit design does not infringe on existing patents—particularly oscillator designs, blink patterns, or proprietary driver ICs.

Misleading IP (Ingress Protection) Ratings

Suppliers may claim high IP ratings (e.g., IP65, IP67) without proper testing or certification. Flashing LED circuits used in outdoor or industrial environments must be truly sealed against dust and moisture. Fake or unverified IP ratings can result in field failures, especially in harsh conditions.

Lack of Traceability and Documentation

Reputable suppliers provide detailed datasheets, test reports, and component traceability. Many low-cost suppliers fail to offer these, making it difficult to assess quality or troubleshoot issues. Without documentation, verifying compliance with safety or environmental standards becomes nearly impossible.

Inconsistent Manufacturing Processes

Even if a sample circuit meets expectations, inconsistent production batches can result in variable flash rates, brightness, or lifespan. Poor quality control during manufacturing leads to unreliable performance and higher return rates.

Hidden Costs from Rework and Warranty Claims

Initially low prices can be misleading. Poor-quality circuits often lead to increased costs from rework, field replacements, and warranty claims. Investing in higher-quality, IP-compliant circuits from vetted suppliers typically offers better long-term value.

Conclusion

To avoid these pitfalls, conduct thorough supplier audits, demand full technical documentation, verify IP ratings through third-party testing, and perform due diligence on IP rights. Prioritizing quality and legal compliance from the outset protects your product, brand, and bottom line.

Logistics & Compliance Guide for Flashing LED Light Circuit

This guide outlines the essential logistics considerations and regulatory compliance requirements for the manufacturing, distribution, and sale of flashing LED light circuits. Adherence to these guidelines ensures smooth operations, legal conformity, and market access.

Product Classification & Harmonized System (HS) Code

Identify the correct HS code for customs clearance and international trade. Flashing LED light circuits typically fall under:

- HS Code 8541.40: Light-emitting diodes (LEDs), other than those of heading 8541.40, but may also belong to broader categories depending on form and function.

- HS Code 8531.20: Electric sound or visual signaling apparatus (e.g., flashing lights for indicators or alarms).

- Final classification depends on the circuit’s end use (e.g., automotive, decorative, industrial). Consult local customs authorities or a trade compliance expert to confirm the appropriate HS code per destination country.

Packaging & Labeling Requirements

Ensure packaging protects the product during transit and meets labeling standards.

- Use anti-static packaging for sensitive electronic components.

- Include clear labeling with:

- Product name and model number

- Manufacturer/importer contact information

- Voltage and current ratings (e.g., 3–12V DC)

- RoHS and CE markings (if applicable)

- Country of origin

- Electrostatic discharge (ESD) warning symbols if required

- Labels must be durable, legible, and in the official language(s) of the destination country.

Regulatory Compliance

Meet mandatory safety and environmental regulations in target markets.

CE Marking (European Union)

- Comply with:

- RoHS Directive (2011/65/EU): Restricts hazardous substances (e.g., lead, mercury, cadmium).

- REACH Regulation (EC 1907/2006): Addresses chemical substances.

- Low Voltage Directive (LVD 2014/35/EU): Applies to devices operating between 50–1000V AC or 75–1500V DC.

- EMC Directive (2014/30/EU): Ensures electromagnetic compatibility.

- Maintain a technical file and issue an EU Declaration of Conformity.

FCC Compliance (United States)

- If the circuit emits radio frequency energy, it must comply with FCC Part 15 regulations.

- Classify as either intentional or unintentional radiator.

- Testing may be required to ensure electromagnetic interference (EMI) is within limits.

- Label with FCC ID if certification is required.

Other Market-Specific Regulations

- UKCA Marking: Required for UK market (post-Brexit); similar to CE but with distinct rules.

- KC Mark (South Korea): Mandatory for electronic products.

- PSE Mark (Japan): Required for certain electrical products under DENAN law.

- RCM Mark (Australia/New Zealand): Indicates compliance with electromagnetic and safety standards.

Shipping & Transportation

Follow international shipping regulations for electronic goods.

- IATA/IMDG Compliance: If shipping by air or sea, ensure compliance with dangerous goods regulations. Most LED circuits are non-hazardous, but verify power sources (e.g., integrated batteries may require special handling).

- Battery Considerations: If the circuit includes lithium batteries, follow IATA Dangerous Goods Regulations (DGR) for packaging, labeling, and documentation.

- Use reliable carriers with experience in handling electronic components.

- Insure shipments against loss or damage.

Import Duties & Taxes

Understand financial obligations in destination countries.

- HS code determines applicable import tariffs.

- Some countries offer reduced or zero tariffs for electronic components under trade agreements.

- Account for Value Added Tax (VAT), Goods and Services Tax (GST), or other local taxes.

- Utilize a licensed customs broker to facilitate accurate duty assessment and clearance.

Documentation Requirements

Maintain accurate records for compliance and traceability.

- Commercial Invoice

- Packing List

- Bill of Lading or Air Waybill

- Certificate of Origin

- RoHS Compliance Certificate

- Test Reports (EMC, safety, etc.)

- Declaration of Conformity (CE, FCC, etc.)

- Risk assessments and technical documentation

End-of-Life & Environmental Responsibility

Comply with waste management regulations.

- Adhere to WEEE Directive (EU): Register as a producer and provide take-back options for electronic waste.

- Ensure proper disposal and recycling pathways.

- Design for disassembly and recyclability where possible.

Conclusion

Successfully managing the logistics and compliance of flashing LED light circuits requires attention to classification, regulatory standards, packaging, shipping, and documentation. Proactive compliance reduces delays, avoids penalties, and supports sustainable business practices in global markets. Engage with legal and logistics experts to ensure full adherence to all applicable regulations.

Conclusion for Sourcing a Flashing LED Light Circuit:

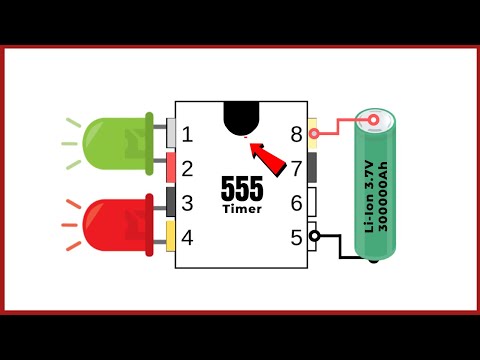

In conclusion, sourcing a flashing LED light circuit involves careful consideration of several key factors including cost, reliability, power efficiency, component availability, and intended application. Whether opting for a ready-made module or building a custom circuit using discrete components such as a 555 timer, transistors, or dedicated LED driver ICs, it is essential to balance performance with budget and ease of integration. Sourcing from reputable suppliers ensures consistent quality and compliance with safety and regulatory standards. Additionally, evaluating options from both local and global markets—such as online electronics distributors or manufacturing partners—can help achieve the best value and scalability. Ultimately, a well-sourced flashing LED circuit will offer dependable operation, longevity, and suitability for its specific use in applications ranging from indicator signals to decorative lighting and safety warnings.