The global flame tank market is experiencing steady growth, driven by increasing demand across oil & gas, petrochemical, and industrial processing sectors. According to Grand View Research, the global industrial burner market—closely tied to flame tank applications—was valued at USD 25.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by rising energy consumption, stricter combustion efficiency regulations, and the need for reliable thermal solutions in large-scale operations. As industries prioritize safety, efficiency, and emissions control, the role of high-performance flame tanks has become increasingly critical. With this demand, several manufacturers have emerged as leaders in innovation, durability, and compliance. Below are the top 10 flame tank manufacturers shaping the industry through cutting-edge engineering and global reach.

Top 10 Flame Tank Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

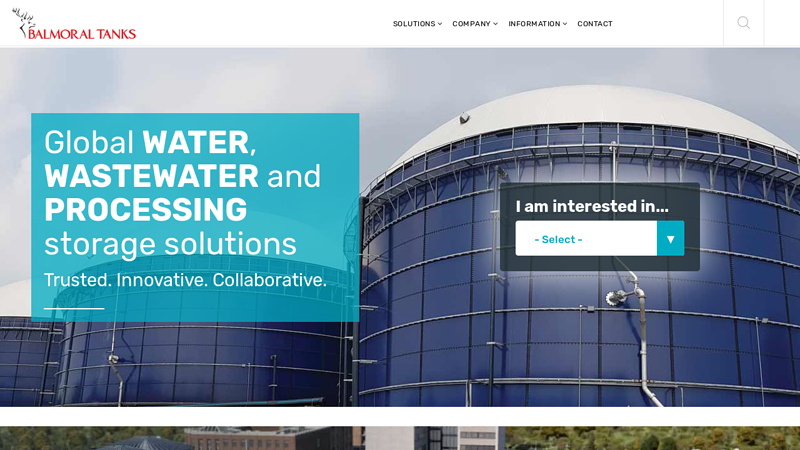

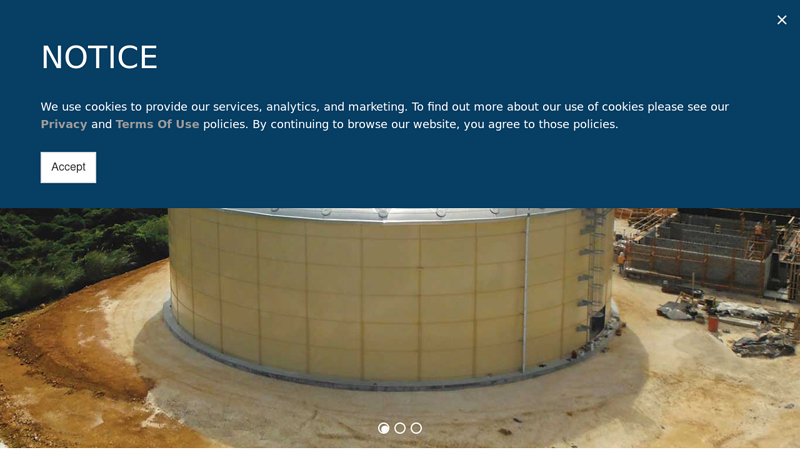

#1 Balmoral Tanks

Domain Est. 2000

Website: balmoraltanks.com

Key Highlights: World renowned manufacturer of water storage tanks, fire water tanks, AD tanks and wastewater processing. GRP, steel, epoxy and glass fused to steel tanks….

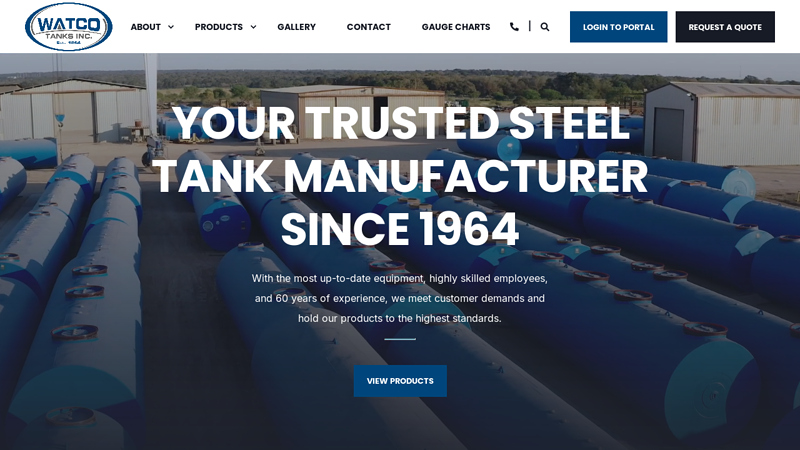

#2 Watco Tanks, Inc.

Domain Est. 2013 | Founded: 1964

Website: watcotank.com

Key Highlights: Watco Tanks, Inc., is a reliable steel tank manufacturer crafting American-made tanks with precision and serving customers like family since 1964….

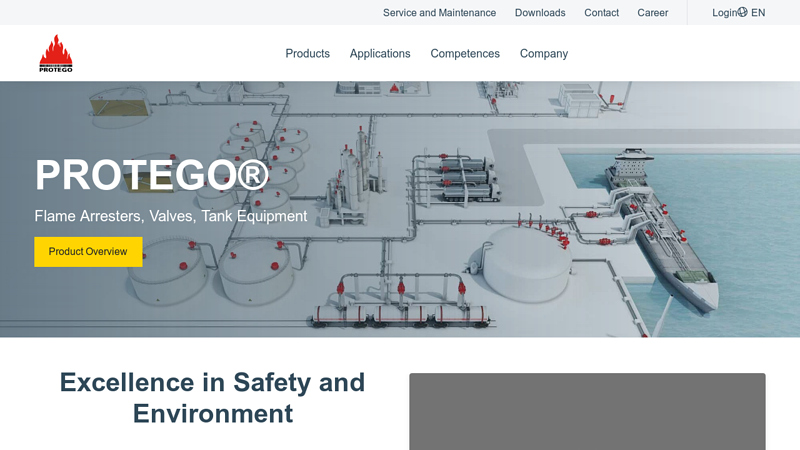

#3 PROTEGO®

Domain Est. 1997 | Founded: 1954

Website: protego.com

Key Highlights: Since 1954, PROTEGO® has built and provided flame arresters, valves and tank equipment, now with the help of more than 750 employees worldwide….

#4 Flameshield® Aboveground Storage Tanks

Domain Est. 1997

Website: lannontank.com

Key Highlights: Flameshield aboveground storage tanks are manufactured with a tight-wrap double-wall design. Standard features include 2-hour fire-tested performance….

#5 R.W. Beckett Corporation

Domain Est. 1997

Website: beckettcorp.com

Key Highlights: Located in North Ridgeville, Ohio, RW Beckett is the global market leader in the development and manufacturing of combustion products used in heating, cleaning ……

#6 Flameshield® Tanks

Domain Est. 1999

Website: stanwade.com

Key Highlights: Flameshield® storage tanks are manufactured with a tight wrap double wall design. They are engineered with built-in secondary containment and leak ……

#7 Flameshield

Domain Est. 1999

Website: modweldco.com

Key Highlights: Flameshield tanks are double wall steel aboveground storage tanks with interstitial monitoring capabilities. Flameshield tanks have been subjected to a 2 hour ……

#8 Tank Connection: Bolted Storage Tanks

Domain Est. 2003

Website: tankconnection.com

Key Highlights: Tank Connection designs, manufactures and installs all four major steel storage tank types including bolted tanks, field welded tanks, shop welded tanks and ……

#9 FLAMESHIELD TANK

Domain Est. 2005

Website: eatonsalesservice.com

Key Highlights: The FLAMESHIELD tank is designed to meet the UL 142 standard, which covers aboveground steel tanks for flammable and combustible liquids….

#10 Steel & Fiberglass Tanks and Vessels

Domain Est. 2010

Website: wwtank.com

Key Highlights: In additional to manufacturing fiberglass and steel tanks and vessels, WW also specializes in tank delivery and battery setup including full catwalk production ……

Expert Sourcing Insights for Flame Tank

H2: 2026 Market Trends for Flame Tank

As of 2026, the market for flame tanks—historically associated with military armored vehicles equipped with flame-throwing capabilities—remains highly specialized and constrained due to geopolitical, ethical, and technological factors. However, several emerging trends are shaping the perception, demand, and potential modern applications of flame-based military systems, including flame tanks.

1. Limited Military Deployment and Geopolitical Restrictions

Flame tanks have largely been phased out of active military service since the late 20th century, primarily due to their controversial nature and the 1980 Convention on Certain Conventional Weapons (CCW), which restricts the use of incendiary weapons against civilians or in densely populated areas. In 2026, no major military power fields traditional flame tanks. However, niche applications in urban warfare or bunker-clearing operations have prompted research into modernized, precision-based incendiary systems that may resemble flame tank capabilities in function, if not form.

2. Technological Evolution: From Flame Tanks to Directed-Energy and Thermobaric Systems

The traditional flame tank concept is being replaced by advanced thermobaric weapons, drone-mounted flamethrowers, and directed-energy systems. These modern alternatives offer greater range, precision, and reduced collateral damage. For instance, Russian and Chinese militaries have demonstrated thermobaric rocket launchers and drone-based incendiary devices that fulfill similar tactical roles—clearing fortifications or dense vegetation—without the logistical and ethical burdens of historic flame tanks.

3. Commercial and Civilian Use: Industrial Flame Systems

While military flame tanks are obsolete, the underlying technology sees renewed interest in industrial sectors. In 2026, “flame tank” concepts are being adapted for:

– Land management: Controlled burning in agriculture and wildfire prevention, using vehicle-mounted flame systems.

– Demining and explosive ordnance disposal (EOD): Flame-based systems for safely detonating unexploded munitions.

– Oil and gas industry: Flame trenching and wellhead ignition systems.

These applications leverage the controlled projection of fire but are distinct from combat flame tanks.

4. Entertainment and Simulation Markets

The “flame tank” remains a popular icon in video games, films, and simulation environments. In 2026, augmented reality (AR) and virtual reality (VR) military training platforms incorporate flame tank scenarios for historical or tactical education. Additionally, entertainment venues and live shows use custom-built flame-effect vehicles (non-combat) that simulate the visual and auditory impact of flame tanks, driving a small but growing niche market in experiential technology.

5. Ethical and Regulatory Pressures

Public and international scrutiny of incendiary weapons continues to grow. In 2026, NGOs and arms control organizations are advocating for stricter enforcement of the CCW, particularly as autonomous systems and drones make it easier to deploy flame-like weapons remotely. This regulatory environment discourages investment in offensive flame tank development but encourages research into non-lethal or humanitarian adaptations.

Conclusion:

In 2026, the flame tank as a traditional armored combat vehicle is effectively obsolete in modern militaries. However, its legacy lives on through advanced incendiary technologies, industrial applications, and cultural symbolism. Market trends reflect a shift away from direct military deployment toward precision incendiary tools, civilian applications, and digital representations. Any future “flame tank” development is more likely to emerge as a modular, drone-integrated system than as a standalone armored vehicle.

Common Pitfalls in Sourcing Flame Tanks: Quality and Intellectual Property (IP) Risks

Sourcing flame tanks—specialized equipment designed to withstand high temperatures and combustion environments—poses unique challenges. Buyers must carefully evaluate both product quality and intellectual property (IP) concerns to avoid operational failures, legal disputes, and reputational damage. Below are key pitfalls to watch for in both areas.

Quality-Related Pitfalls

1. Inadequate Material Specifications

A common issue is sourcing flame tanks made from substandard materials that cannot endure prolonged exposure to high heat or corrosive byproducts. Suppliers may use cheaper alloys or thin-walled construction to cut costs, leading to premature failure, safety hazards, or non-compliance with industry standards (e.g., ASME, API).

2. Lack of Third-Party Certification

Many suppliers, especially in low-cost manufacturing regions, provide flame tanks without proper certification or with falsified documentation. Relying solely on supplier claims without independent verification from accredited bodies (e.g., TÜV, Lloyd’s Register) increases the risk of receiving non-compliant or unsafe equipment.

3. Poor Welding and Fabrication Practices

Flame tanks require precision welding and heat treatment to ensure structural integrity. Inconsistent weld quality, lack of post-weld heat treatment (PWHT), or insufficient non-destructive testing (NDT) can create weak points prone to cracking or leakage under thermal cycling.

4. Inconsistent Quality Control Processes

Suppliers with weak or inconsistent quality management systems (e.g., not ISO 9001 certified) may deliver variable product quality. This inconsistency can lead to mismatched components, dimensional inaccuracies, or deviations from design specifications.

5. Inadequate Testing and Validation

Some suppliers skip or perform insufficient performance testing—such as hydrostatic testing, thermal cycling, or burst testing—under real-world conditions. Without robust validation, the tank’s reliability in actual operating environments remains uncertain.

Intellectual Property (IP)-Related Pitfalls

1. Unauthorized Replication of Designs

A significant risk when sourcing from certain regions is the unauthorized copying of proprietary flame tank designs. Suppliers may reverse-engineer OEM equipment or use leaked blueprints, resulting in products that infringe on patents, trade secrets, or registered industrial designs.

2. Lack of IP Ownership Clarity in Contracts

Procurement agreements that fail to explicitly define IP ownership—especially for custom-designed tanks—can lead to disputes. Without clear clauses, suppliers may retain rights to design modifications or reuse your specifications for third-party clients.

3. Use of Counterfeit or Grey-Market Components

Suppliers might incorporate counterfeit valves, sensors, or control systems into flame tanks to reduce costs. These components not only compromise safety and performance but may also expose the buyer to liability for using unlicensed or pirated technology.

4. Weak IP Protection in Supplier Jurisdictions

In countries with lax IP enforcement, it can be difficult to pursue legal action against suppliers who misuse or disseminate your design data. Even with confidentiality agreements (NDAs), enforcement may be impractical or ineffective.

5. Insufficient Safeguards During Design Transfer

Sharing detailed engineering drawings or CAD models with suppliers without proper encryption, access controls, or audit trails increases the risk of IP leakage. Unsecured communication channels or inadequate IT security at the supplier end can lead to data breaches.

Mitigation Strategies

- Conduct thorough supplier audits, including on-site inspections of manufacturing and quality control processes.

- Require certified material test reports (MTRs), NDT records, and third-party inspection documentation.

- Include explicit IP clauses in contracts, specifying ownership, permitted use, and confidentiality obligations.

- Use secure data-sharing platforms and limit access to sensitive design information on a need-to-know basis.

- Work with legal counsel to assess IP risks in target sourcing regions and consider patent filings in key markets.

By proactively addressing these quality and IP pitfalls, organizations can ensure the safe, reliable, and legally compliant sourcing of flame tanks.

Logistics & Compliance Guide for Flame Tank

Overview

The transportation and handling of flame tanks—specialized equipment used in military, pyrotechnic, or industrial applications involving flammable substances—require strict adherence to safety, logistics, and regulatory compliance standards. This guide outlines key procedures and requirements to ensure the safe, legal, and efficient management of flame tanks during storage, transport, and deployment. All operations must comply with international, national, and local regulations, including those from the Department of Transportation (DOT), International Air Transport Association (IATA), International Maritime Organization (IMO), and relevant occupational safety authorities.

Regulatory Framework

Flame tanks are typically classified as hazardous materials due to their association with flammable liquids, gases, or pressurized systems. Key regulatory bodies include:

- DOT (U.S. Department of Transportation) – Governs domestic transport via road and rail under 49 CFR.

- IATA Dangerous Goods Regulations (DGR) – For air transport compliance.

- IMDG Code – International Maritime Dangerous Goods Code for sea shipments.

- OSHA (Occupational Safety and Health Administration) – Workplace safety standards.

- NFPA 30/58 – Standards for flammable and combustible liquids and LPG safety.

- ATEX/IECEx (for EU/International) – Applicable for use in explosive atmospheres.

Classification of flame tanks depends on contents:

– Flammable liquids (UN 1202, 1203, etc.)

– Flammable gases (UN 1075, etc.)

– Pressure vessels (regulated under DOT/ISO standards)

Packaging & Labeling Requirements

- Flame tanks must be transported in approved, UN-certified packaging suitable for the hazard class.

- Tanks must be securely mounted within transport vehicles to prevent movement.

- All containers must bear appropriate hazard labels:

- Class 3 (Flammable Liquids)

- Class 2.1 (Flammable Gases)

- Class 5.1 (Oxidizers, if applicable)

- Include GHS-compliant labels with pictograms, signal words, and hazard statements.

- Shipping papers must contain:

- Proper shipping name

- UN number

- Hazard class

- Total quantity

- Emergency contact information

Transport & Handling Procedures

- Road Transport:

- Use DOT-compliant vehicles with fire extinguishers and spill kits.

- Load flame tanks in well-ventilated areas; secure with braces or straps.

- Prohibit smoking within 25 feet of the vehicle during loading/unloading.

-

Drivers must hold valid hazardous materials endorsement (HME) where required.

-

Air Transport:

- Flame tanks are generally prohibited as cargo or baggage under IATA DGR unless empty, cleaned, and purged.

-

Exceptions require special permits and must comply with State and Operator Variations.

-

Marine Transport:

- Follow IMDG Code stowage and segregation rules.

- Segregate from oxidizers, acids, and ignition sources.

-

Ensure proper ventilation in holds or containers.

-

Storage:

- Store in dedicated, fire-resistant hazardous materials storage areas.

- Maintain separation from incompatible materials.

- Use flame-proof electrical fixtures and grounding systems.

- Limit quantities per NFPA or local fire code.

Safety & Emergency Response

- Personnel must be trained in:

- Hazard communication (HazCom)

- Emergency response (spill, fire, exposure)

- Use of PPE (fire-resistant clothing, gloves, face shields)

- Emergency equipment must be on-site:

- Class B fire extinguishers

- Spill containment kits

- Eyewash stations and safety showers

- Maintain a Site-Specific Emergency Response Plan (ERP) including:

- Evacuation procedures

- Fire suppression protocols

- Notification of local emergency services

Documentation & Compliance

- Maintain records of:

- Safety Data Sheets (SDS) for all contents

- Training certifications

- Inspection and maintenance logs

- Shipping manifests and permits

- Conduct regular audits to ensure compliance with:

- DOT HM-181 and HM-126F

- OSHA 29 CFR 1910.106

- EPA regulations (e.g., SPCC if storing large volumes)

Disposal & Decommissioning

- Flame tanks must be properly decommissioned before disposal:

- Drain and purge all flammable contents

- Render inert with nitrogen or steam cleaning

- Cut or disable tanks to prevent reuse

- Disposal must follow RCRA regulations for hazardous waste if contaminated.

- Recycle metal components via certified recyclers.

Conclusion

Safe and compliant handling of flame tanks demands rigorous attention to regulatory requirements, proper training, and detailed planning. Adherence to this guide ensures the protection of personnel, the public, and the environment while maintaining operational integrity. Always consult local authorities and regulatory updates before initiating any transport or storage activity involving flame tanks.

Conclusion: Sourcing a Flame Tank

Sourcing a flame tank requires careful consideration of safety, regulatory compliance, technical specifications, and supplier reliability. It is essential to select a tank designed and certified for high-pressure flammable gas storage—typically constructed from materials like carbon steel or stainless steel with appropriate pressure relief systems. Compliance with standards such as ASME, DOT, or PED is critical to ensure operational safety and legal adherence.

Evaluating suppliers based on reputation, quality certifications, and after-sales support will help mitigate risks associated with performance and maintenance. Additionally, logistics, including safe transportation and proper handling procedures, must be planned in advance due to the hazardous nature of the contents.

Ultimately, a well-informed sourcing decision balances cost-efficiency with uncompromised safety and reliability, ensuring the flame tank meets operational demands while protecting personnel, assets, and the environment.