The global demand for precision baking molds, including financier molds, has seen steady growth, driven by the expanding specialty bakery sector and rising consumer preference for artisanal pastries. According to Grand View Research, the global bakeware market size was valued at USD 2.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This upward trajectory is fueled by increased home baking trends, the proliferation of boutique patisseries, and commercial food service operators demanding durable, high-performance tools. As financier cakes gain popularity in both European and emerging markets, the need for reliable, high-quality financier molds has intensified. This has propelled several manufacturers into prominence through innovation in materials, non-stick coatings, and ergonomic design. Based on market presence, product quality, and industry reviews, the following six manufacturers have emerged as leaders in producing premium financier molds.

Top 6 Financier Molds Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

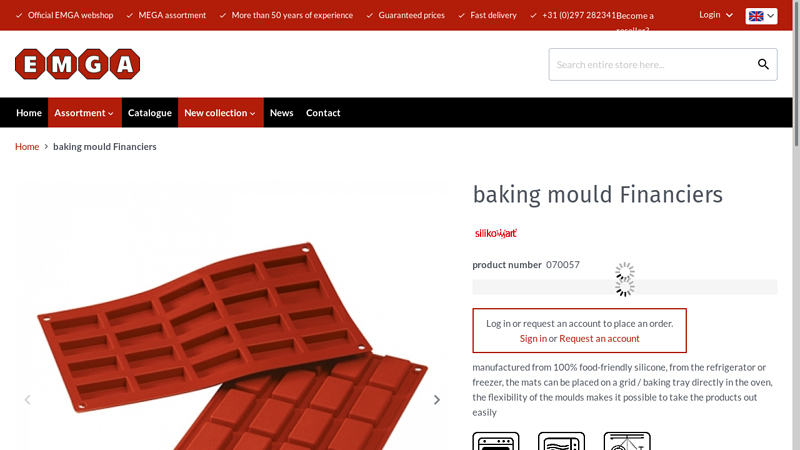

#1 baking mould Financiers

Domain Est. 1997

Website: emga.com

Key Highlights: Official EMGA webshop; MEGA assortment; More than 50 years of experience; Guaranteed prices; Fast delivery; +31 (0)297 282341. Become a reseller?…

#2 Silicone Financier – 36 Forms

Domain Est. 1997

#3 SILICONE MOLD

Domain Est. 1997

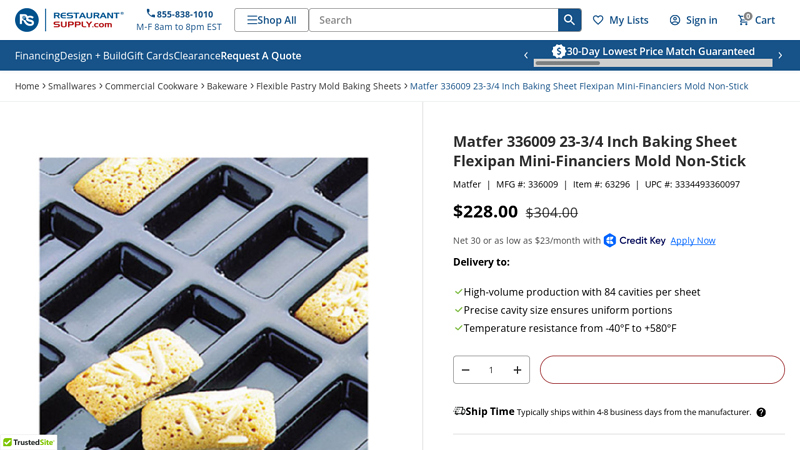

#4 Matfer 336009

Domain Est. 1998

Website: restaurantsupply.com

Key Highlights: In stock Free delivery over $2,500The Matfer 336009 Flexipan® Mini-Financiers Mold is a commercial-grade silicone baking mold designed for high-volume pastry and cake production….

#5 Gobel Financier Baking Sheet 120710

Domain Est. 2012

Website: louistellier.com

Key Highlights: In stock Free delivery over $1,000Tinplate Financiers baking sheet · Thickness: 0.2″ Tinplate. Heavy duty. Grease well before use. · Maximum cooking temperature: 250°C / 486°F….

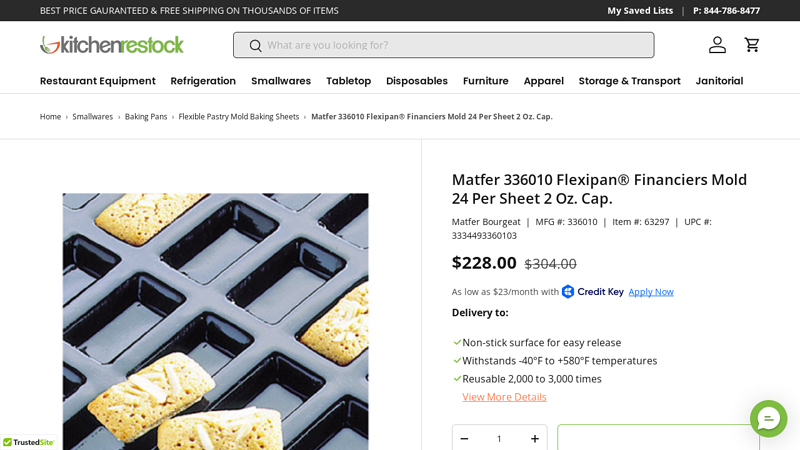

#6 Flexipan® Financiers Mold 24 Cup 2 Oz. by Matfer

Domain Est. 2014

Website: kitchenrestock.com

Key Highlights: In stock $16.79 deliveryInvest in quality French bakeware with the Matfer 336010 Flexipan® Financiers Mold. Non-stick and reusable up to 2000 to 3000 times….

Expert Sourcing Insights for Financier Molds

H2 2026 Market Trends for Financier Molds

The market for financier molds in H2 2026 is expected to reflect broader shifts in the global bakery, gourmet food, and specialty kitchenware sectors. Driven by evolving consumer preferences, technological advancements, and sustainability demands, financier molds—once niche tools for professional patisseries—are gaining traction among home bakers and artisanal producers. Below is an analysis of key trends shaping this market during the second half of 2026.

1. Rise of Home Artisan Baking and Premiumization

- Amateur Pastry Enthusiasm: The post-pandemic surge in home baking has matured into a sustained interest in artisanal techniques. Consumers are increasingly experimenting with French pastries like financiers, driving demand for specialized tools.

- Premiumization of Kitchenware: Home bakers are investing in high-quality, durable molds made from materials like non-stick carbon steel, silicone, and anodized aluminum. Brands emphasizing craftsmanship, ergonomic design, and aesthetic appeal are gaining market share.

- Influence of Social Media: Platforms like Instagram and TikTok continue to fuel interest in visually appealing baked goods. Financiers, with their elegant shape and golden crust, are popular content subjects, further boosting mold sales.

2. Sustainability and Eco-Conscious Materials

- Demand for Recyclable and Non-Toxic Materials: Consumers are prioritizing molds free from PFOA, PTFE, and other harmful coatings. Brands offering eco-certified non-stick surfaces or silicone molds derived from food-grade, BPA-free materials are seeing stronger sales.

- Longevity Over Disposability: There is a growing preference for durable, reusable molds over disposable paper or aluminum inserts. This aligns with broader environmental concerns and zero-waste kitchen movements.

- Packaging Innovation: Sustainable packaging—minimalist, recyclable, or compostable—is becoming a differentiator for retailers and direct-to-consumer brands.

3. Expansion Beyond Traditional Markets

- Asia-Pacific Growth: Markets such as South Korea, Japan, and China are showing rising interest in Western-style pastries. Urban middle-class consumers and specialty cafés are adopting financier molds as part of diversified dessert menus.

- Latin American and Middle Eastern Appetite: Boutique bakeries in countries like Mexico, Brazil, and the UAE are incorporating financiers into premium offerings, driven by tourism and cosmopolitan tastes.

- E-commerce Penetration: Global online marketplaces (e.g., Amazon, Alibaba, Etsy) are making financier molds accessible in regions where they were previously unavailable, accelerating international adoption.

4. Innovation in Design and Functionality

- Multi-Cavity and Space-Efficient Molds: Compact, high-capacity molds (e.g., 24-cavity) cater to both home users and small-batch producers seeking efficiency.

- Hybrid Silicone-Metal Composites: Emerging molds combine the durability of metal with the flexibility of silicone for easier demolding and cleaning.

- Customization and Branding: B2B suppliers are offering customizable molds (logos, unique shapes) for bakeries and hotels, creating new revenue streams.

5. Professional vs. Home Use Market Segmentation

- Commercial Segment Stability: High-volume patisseries and hotels continue to invest in heavy-duty, industrial-grade financier molds, often sourced through specialized culinary suppliers.

- Home Segment Growth: The fastest-growing segment is home users, particularly through D2C (direct-to-consumer) brands and influencer partnerships. Subscription boxes and baking kits often include financier molds as value-add components.

6. Supply Chain and Manufacturing Shifts

- Nearshoring and Regional Production: In response to geopolitical risks and shipping delays, some manufacturers are shifting production closer to key markets (e.g., EU-based companies sourcing from Eastern Europe or North Africa).

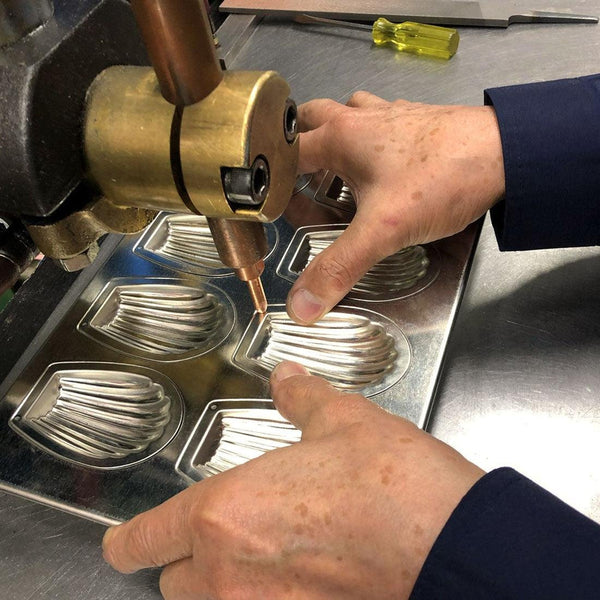

- Automation in Molding: Increased use of automated stamping and coating lines is improving consistency and reducing costs, especially for mass-market silicone and metal molds.

Conclusion

In H2 2026, the financier mold market is poised for steady growth, fueled by the convergence of culinary passion, sustainability, and global gastronomic trends. Success will depend on brands’ ability to innovate in materials and design, meet eco-standards, and effectively target both professional artisans and empowered home bakers through digital channels. As the line between professional and home kitchens continues to blur, financier molds are evolving from specialized tools into symbols of culinary craftsmanship and lifestyle aspiration.

Common Pitfalls When Sourcing Financier Molds: Quality and Intellectual Property Issues

Sourcing financier molds—especially for commercial or high-volume baking operations—requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these aspects can lead to production delays, product inconsistencies, legal risks, and reputational damage. Below are key pitfalls to avoid.

Quality-Related Pitfalls

Inconsistent Material Composition

One of the most common issues is receiving molds made from substandard or inconsistent materials. Financier molds require high-grade, food-safe aluminum or aluminized steel for optimal heat conductivity and durability. Sourcing from unreliable suppliers may result in molds made with impure alloys that warp, corrode, or degrade quickly under repeated baking cycles.

Poor Dimensional Accuracy

Precision in mold cavity dimensions is critical for producing uniformly shaped financiers. Molds that are not CNC-machined to tight tolerances can lead to uneven baking, inconsistent product sizing, and difficulty in automated filling systems. Suppliers in low-cost regions may lack the tooling precision needed for professional-grade results.

Inadequate Non-Stick Coating

Many financiers stick to the mold if the non-stick coating (e.g., PTFE or ceramic) is poorly applied or too thin. Low-quality coatings can flake off over time, contaminating food and failing health inspections. Ensure the coating is FDA-compliant and tested for repeated use at high temperatures.

Lack of Durability Testing

Some suppliers do not perform stress or longevity testing on their molds. Without proper validation, molds may fail prematurely under commercial kitchen conditions. Always request test reports or samples to verify performance under real-world use.

Intellectual Property (IP) Pitfalls

Unauthorized Replication of Branded Designs

Many premium bakeries use proprietary mold designs (e.g., unique cavity shapes, logos, or textures). Sourcing molds that copy these designs—especially from third-party manufacturers without licensing—can lead to IP infringement claims. This is especially risky when working with overseas suppliers who may reproduce protected designs without legal oversight.

Ambiguous Ownership of Custom Tooling

When commissioning custom molds, it’s essential to clarify IP ownership in the contract. Some manufacturers claim ownership of the tooling or design after production, limiting your ability to switch suppliers or reproduce the mold elsewhere. Always ensure contracts specify that design rights and tooling belong to your company.

Lack of Design Confidentiality

Sharing detailed design files with unvetted suppliers increases the risk of your proprietary mold designs being copied or sold to competitors. Use non-disclosure agreements (NDAs) and work only with trusted partners who have a track record of respecting IP.

Use of Open-Source or Public Domain Designs Without Verification

While some mold designs are marketed as “open-source” or generic, they may still be protected under design patents in certain jurisdictions. Failing to conduct due diligence can expose your business to legal action, even if the design appears widely available.

Conclusion

To avoid these pitfalls, conduct thorough supplier vetting, request material certifications, insist on sample testing, and ensure all IP rights are clearly defined in writing. Investing time upfront in quality assurance and legal safeguards will protect both product integrity and your brand.

Logistics & Compliance Guide for Financier Molds

Overview

This guide outlines the essential logistics and compliance considerations for the manufacturing, distribution, and import/export of financier molds—specialized bakeware used in the production of small, dome-shaped cakes. Adhering to these guidelines ensures product safety, regulatory compliance, and efficient supply chain operations.

Material Sourcing & Supplier Compliance

Ensure all mold materials (typically food-grade aluminum, stainless steel, or silicone) comply with relevant food safety regulations such as FDA 21 CFR (U.S.) or EU Regulation (EC) No 1935/2004. Verify supplier certifications, including ISO 9001 and food contact material (FCM) compliance. Maintain documentation of material safety data sheets (MSDS) and supplier declarations of conformity.

Manufacturing & Quality Control

Implement standardized quality control procedures during production, including dimensional accuracy checks, surface finish inspection, and non-toxicity validation. Conduct routine audits to ensure adherence to Good Manufacturing Practices (GMP). All molds must be free from sharp edges, burrs, and contaminants. Retain production records for traceability.

Packaging & Labeling Requirements

Package molds in durable, protective materials to prevent damage during transit. Labeling must include:

– Product name and model number

– Manufacturer name and location

– Material composition (e.g., “Food-Grade Aluminum”)

– Care and usage instructions

– Compliance marks (e.g., FDA, CE, LFGB) where applicable

– Country of origin

Ensure multilingual labeling for export markets as required.

Domestic & International Shipping

Use reliable freight partners experienced in handling metal or silicone kitchenware. For international shipments:

– Classify molds under the appropriate HS Code (e.g., 7323.93 for stainless steel tableware)

– Prepare accurate commercial invoices, packing lists, and certificates of origin

– Comply with destination country import regulations, including customs duties and product standards

– Consider Incoterms (e.g., FOB, DDP) to clarify responsibilities

Import/Export Compliance

Verify compliance with import regulations in target markets. For example:

– U.S.: FDA registration and prior notice for food contact items

– EU: CE marking and compliance with REACH and RoHS directives

– Canada: Compliance with CFIA and Safe Food for Canadians Regulations (SFCR)

Engage customs brokers when necessary to facilitate clearance.

Product Safety & Regulatory Testing

Conduct third-party testing to validate compliance with food safety and material standards. Tests may include:

– Migration testing for metals and plastics

– Heavy metal content analysis (e.g., lead, cadmium)

– Dishwasher and heat resistance validation

Maintain test reports for audits and customer inquiries.

Sustainability & Environmental Compliance

Adopt eco-friendly practices in packaging (e.g., recyclable materials) and manufacturing (e.g., energy-efficient processes). Comply with local waste disposal and recycling regulations. Consider certifications such as Cradle to Cradle or Environmental Product Declarations (EPD) to enhance brand reputation.

Recordkeeping & Audits

Maintain comprehensive records for a minimum of five years, covering:

– Supplier agreements and material certifications

– Quality control logs and inspection reports

– Shipping and customs documentation

– Regulatory test results and compliance certificates

Schedule regular internal audits to ensure ongoing adherence to standards.

Conclusion

Effective logistics and compliance management are critical for the successful global distribution of financier molds. By following this guide, Financier Molds can ensure regulatory alignment, optimize supply chain performance, and maintain customer trust in product quality and safety.

Conclusion for Sourcing Financier Molds

In conclusion, sourcing the right financier molds is a crucial step in ensuring consistent quality, efficiency, and professionalism in producing financier cakes. After evaluating various materials—such as non-stick coated steel, silicone, and aluminum—alongside factors like durability, heat conductivity, ease of release, and cost, it becomes evident that investing in high-quality, well-designed molds significantly impacts the final product. Commercial-grade non-stick or anodized aluminum molds often emerge as the optimal choice for professional kitchens, offering excellent heat distribution and long-term reliability. For home bakers or smaller operations, flexible silicone molds may provide a cost-effective and convenient alternative.

Additionally, considering mold dimensions, compatibility with existing equipment, and supplier reputation ensures seamless integration into production workflows. Ultimately, careful selection based on specific operational needs, volume requirements, and budget constraints will enhance both product consistency and overall baking performance. By prioritizing quality in mold sourcing, bakeries and culinary enterprises can maintain high standards, improve efficiency, and deliver an exceptional financier experience to their customers.