The global flatbed trailer market, including fifth wheel variants, is experiencing steady growth driven by rising demand for efficient freight transportation across key industries such as construction, steel, and energy. According to a 2023 report by Mordor Intelligence, the global flatbed trailer market size was valued at USD 9.47 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2028. This expansion is fueled by increasing infrastructure development, stricter safety regulations promoting advanced trailer designs, and the growing preference for modular and lightweight haulers that enhance fuel efficiency and payload capacity. As demand for durable, high-performance fifth wheel flatbed trailers rises—particularly in North America and Asia-Pacific—manufacturers are differentiating themselves through innovation in materials, customization, and smart trailer technology. In this competitive landscape, these top 10 fifth wheel flatbed trailer manufacturers have emerged as industry leaders, combining engineering excellence with scalable production to meet evolving logistics needs.

Top 10 Fifth Wheel Flatbed Trailer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Towmaster

Domain Est. 1997

Website: towmaster.com

Key Highlights: Towmaster is an industry-leading truck and trailer equipment manufacturer, upfitter, and distributor. Find a dealer near you to invest in a Towmaster ……

#2 KZ RV

Domain Est. 1999

Website: kz-rv.com

Key Highlights: KZ RV is an outstanding manufacturer of travel trailers, fifth wheels and toy haulers. KZ builds recreational vehicles that fit a variety of lifestyles….

#3 Gooseneck Trailers for Sale

Domain Est. 1999

Website: kaufmantrailers.com

Key Highlights: Kaufman gooseneck trailers include flatbed, equipment, car hauler, and lowboy designs. Built tough with factory-direct pricing to maximize your value….

#4 Roll-Off Trailers for Sale – Built Strong

Domain Est. 2006

Website: texaspridetrailers.com

Key Highlights: Free deliveryBuilt-to-order roll-off trailers with heavy-duty dumpsters, smart lifts, and fast delivery—factory-direct from Texas Pride. Customize yours today….

#5 Big Tex Trailers

Domain Est. 1997

Website: bigtextrailers.com

Key Highlights: Explore the Big Tex trailer lineup built for relentless professionals. Find a quality trailer for reliability, strength, and performance. Shop now!…

#6 PJ Trailers

Domain Est. 1999

Website: pjtrailers.com

Key Highlights: The #1 professional grade trailer company in the USA. Durable dump, gooseneck, tilt, equipment, and utility trailers. View our selection!…

#7 Diamond C Trailers

Domain Est. 2000

Website: diamondc.com

Key Highlights: We offer a robust lineup of premium grade trailers for sale: dump, gooseneck, equipment, tilt, step deck, and car hauler trailers….

#8 Fifth Wheel Company

Domain Est. 2001

Website: fifthwheelco.com

Key Highlights: Fifth Wheel Co. is the pinnacle of British luxury fifth wheel and caravan manufacturing, designed and built in the heart of North Wales….

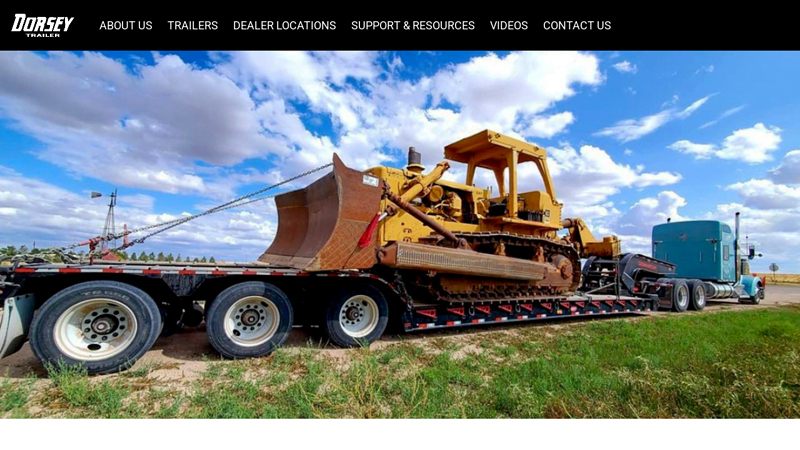

#9 Dorsey Trailer

Domain Est. 2007

Website: dorseytrailer.net

Key Highlights: For over 100 years, Dorsey has been committed to building the most durable trailers on the road. That commitment combined with a dedicated dealer network….

#10 A True Four-Season Luxury Fifth Wheel

Domain Est. 2017

Website: luxefifthwheel.com

Key Highlights: Luxury fifth wheels by Luxe are designed for the Full-Time fifth wheel living experience. We build the best luxury fifth wheels & luxury toy haulers….

Expert Sourcing Insights for Fifth Wheel Flatbed Trailer

H2: 2026 Market Trends for Fifth Wheel Flatbed Trailers

The fifth wheel flatbed trailer market is poised for notable evolution by 2026, driven by shifts in freight logistics, regulatory developments, technological advancements, and broader economic conditions. This analysis outlines key trends expected to influence demand, production, and innovation in the sector.

-

Increased Demand from Infrastructure and Renewable Energy Projects

A major driver of growth in the fifth wheel flatbed trailer market by 2026 will be the surge in infrastructure development and renewable energy installations across North America. Government initiatives, such as the U.S. Infrastructure Investment and Jobs Act, are fueling construction activity requiring the transport of oversized and heavy loads—such as steel beams, utility poles, and wind turbine components. Fifth wheel flatbeds, known for their durability and versatility in hauling such cargo, are becoming essential assets for contractors and logistics firms. -

Adoption of Lightweight and High-Strength Materials

Manufacturers are increasingly integrating advanced materials such as high-strength steel and aluminum alloys into fifth wheel flatbed trailer designs. By 2026, the industry is expected to see wider adoption of these materials to reduce tare weight, increase payload capacity, and improve fuel efficiency. This trend aligns with carriers’ goals to maximize profitability and meet environmental regulations. -

Growth in Last-Mile and Regional Haul Applications

While traditionally used for long-haul freight, fifth wheel flatbed trailers are seeing increased use in regional and last-mile distribution networks. As supply chains become more decentralized, these trailers are being deployed for short-distance movement of construction materials, machinery, and industrial goods. Their adaptability to diverse cargo types makes them ideal for dynamic regional logistics operations. -

Technological Integration and Smart Trailer Features

By 2026, digitization is expected to play a larger role in fifth wheel flatbed trailer operations. Telematics systems, real-time load monitoring, GPS tracking, and predictive maintenance tools are being increasingly integrated into trailers. These technologies enhance operational efficiency, improve safety, and support fleet management—especially as transportation companies adopt data-driven logistics strategies. -

Regulatory Pressures and Emissions Standards

Environmental regulations, particularly those targeting greenhouse gas emissions from heavy-duty vehicles, will influence trailer design and usage. Though trailers themselves are not powered, they contribute to overall vehicle efficiency. As such, aerodynamic enhancements, low-rolling-resistance tires, and compatibility with electric or hybrid tractors are becoming design priorities. These changes support carriers’ compliance with EPA and NHTSA Phase 3 greenhouse gas standards anticipated to take fuller effect by 2026. -

Supply Chain Resilience and Domestic Manufacturing

Ongoing emphasis on supply chain resilience is encouraging nearshoring and reshoring of manufacturing in North America. This shift is expected to increase domestic freight movement, boosting demand for flatbed trailers capable of handling raw materials and fabricated goods. Fifth wheel configurations remain popular due to their ease of coupling and compatibility with a wide range of tractors. -

Used Trailer Market Dynamics

With new trailer prices rising due to material costs and added technology, the used fifth wheel flatbed market is expected to remain robust through 2026. Fleets seeking cost-effective solutions may turn to refurbished or lightly used units, particularly as reliability and durability of modern trailers extend their usable lifespans.

In summary, the 2026 market for fifth wheel flatbed trailers will be shaped by infrastructure demand, material innovation, digital integration, and regulatory evolution. Stakeholders across manufacturing, logistics, and transportation should anticipate increased specialization, efficiency demands, and opportunities in both new and secondary markets.

Common Pitfalls Sourcing Fifth Wheel Flatbed Trailers (Quality & Intellectual Property)

Sourcing fifth wheel flatbed trailers, particularly from overseas or less-regulated markets, presents significant risks related to both product quality and intellectual property (IP) infringement. Failing to address these pitfalls can lead to safety hazards, financial losses, legal liabilities, and reputational damage.

Poor Manufacturing Quality and Safety Risks

One of the most critical pitfalls is receiving trailers that fail to meet structural, safety, and durability standards. Poor quality often stems from cost-cutting measures, such as using substandard steel, inadequate welding practices, or improper component selection. These deficiencies can result in premature fatigue, frame cracking, axle failure, or brake system malfunctions—posing serious safety risks during transportation. Additionally, trailers may not comply with regional regulations (e.g., FMVSS in the U.S. or ADR in Australia), leading to failed inspections, fines, or operational downtime.

Non-Compliance with Certification and Regulatory Standards

Many sourced trailers lack proper certification (such as DOT, CVSA, or ISO standards) or bear counterfeit compliance labels. Buyers may assume the product meets required safety and emissions regulations, only to discover upon import or use that the trailer does not conform. This can result in costly recalls, import denials, or legal penalties. It is essential to verify certification documentation and conduct independent third-party inspections before shipment.

Intellectual Property Infringement and Brand Counterfeiting

Sourcing from manufacturers that replicate branded designs—such as mimicking identifiable features of established trailer brands like Manac, Great Dane, or Wabash—exposes buyers to IP violations. These knock-offs may copy patented frame designs, coupling mechanisms, or proprietary technology without authorization. Purchasing or distributing such trailers can lead to cease-and-desist orders, lawsuits, seizure of goods by customs, and damage to the buyer’s reputation. Even if unintentional, IP infringement liabilities typically fall on the importer or distributor.

Lack of Traceability and After-Sales Support

Low-cost suppliers may not provide traceable manufacturing records, weld certifications, or material test reports. This lack of documentation complicates warranty claims and makes it difficult to address defects or failures. Additionally, poor after-sales support—such as limited spare parts availability or unresponsive service—can lead to extended downtimes and increased total cost of ownership.

Inadequate Due Diligence on Suppliers

Many buyers fall into the trap of selecting suppliers based solely on price or attractive marketing materials without conducting proper vetting. This includes skipping site audits, failing to review past customer references, or neglecting to engage third-party inspection services. Without due diligence, businesses risk partnering with manufacturers lacking the capability, integrity, or consistency to deliver quality trailers.

To mitigate these risks, buyers should prioritize supplier verification, demand full compliance documentation, conduct pre-shipment inspections, and consult legal experts regarding IP and import regulations.

Logistics & Compliance Guide for Fifth Wheel Flatbed Trailer

Operating a fifth wheel flatbed trailer requires strict adherence to safety, regulatory, and logistical standards. This guide outlines key considerations for safe and compliant transportation operations.

Vehicle Configuration and Inspection

Ensure the tractor-trailer combination is correctly configured. The fifth wheel coupling on the tractor must securely engage the kingpin on the flatbed trailer. Conduct pre-trip, en route, and post-trip inspections per DOT regulations (49 CFR Part 396), focusing on:

- Fifth wheel condition (locking jaws, pivot pins, grease levels)

- Kingpin integrity (no cracks or excessive wear)

- Trailer landing gear (fully retracted and secured)

- Lights, reflectors, and electrical connections

- Tires and wheel assemblies (proper inflation, tread depth, no damage)

Weight Distribution and Legal Limits

Proper weight distribution is critical for control and compliance. Adhere to federal and state weight restrictions:

- Gross Vehicle Weight Rating (GVWR) must not be exceeded

- Axle group weights must comply with federal bridge formula (23 U.S.C. 127)

- Standard federal limits: 20,000 lbs on a single axle, 34,000 lbs on a tandem axle group

- Gross combination weight limit: 80,000 lbs on interstate highways

- Use certified scales to verify weights; adjust cargo placement as needed

Cargo Securement Requirements

Flatbed loads are exposed and require robust securement per FMCSA regulations (49 CFR Part 393, Subpart I):

- Use tiedowns (straps, chains, binders) appropriate for cargo weight and type

- Minimum working load limit (WLL) must equal at least 50% of cargo weight

- Number of tiedowns based on cargo length and characteristics (e.g., one tiedown per 10 feet of cargo)

- Use edge protectors to prevent tiedown damage

- Chock wheels or use blocking and bracing for rollable items

- Re-inspect tiedowns every 50 miles and after breaks

Permits and Oversize/Overweight Considerations

If cargo exceeds standard dimensions or weights, obtain necessary permits:

- State-specific oversize/overweight permits required for length, width, height, or weight violations

- Typical limits: 8.5 feet wide, 13.5 feet high, 53 feet long (varies by state)

- Escort vehicles may be required for extreme loads

- Plan routes carefully to avoid low bridges, narrow roads, and restricted zones

Driver Qualifications and Documentation

Only qualified drivers may operate commercial flatbed combinations:

- Valid Commercial Driver’s License (CDL) with appropriate endorsements (Class A, possibly tanker or hazardous materials)

- Medical examiner’s certificate (MEC) on file and current

- Driver must carry:

- Valid CDL and MEC

- Vehicle registration

- Proof of insurance

- Bill of lading or freight documentation

- Oversize/overweight permits (if applicable)

Hours of Service (HOS)

Comply with FMCSA Hours of Service rules to prevent driver fatigue:

- 11-hour driving limit after 10 consecutive hours off duty

- 14-hour on-duty window

- 60/70-hour limit over 7/8 consecutive days

- 30-minute break after 8 hours of driving

- Use Electronic Logging Device (ELD) to record duty status accurately

Safety and Operational Best Practices

- Conduct regular maintenance on fifth wheel, trailer suspension, brakes, and lights

- Secure all loose equipment (tarps, tiedowns, chocks) when not in use

- Use high-visibility vests and proper signage during loading/unloading

- Train drivers on flatbed-specific procedures, including tarping and cargo inspection

- Monitor weather and road conditions; avoid high winds when carrying tall or unbalanced loads

Compliance and Enforcement

Failure to comply with regulations may result in:

- DOT roadside inspection violations (out-of-service orders)

- Fines and penalties

- CSA (Compliance, Safety, Accountability) score impacts

- Increased insurance premiums

- Suspension of operating authority

Maintain thorough records of inspections, maintenance, driver logs, and permits for at least one year.

By following this guide, carriers and drivers can ensure safe, legal, and efficient operation of fifth wheel flatbed trailers across the transportation network.

Conclusion for Sourcing a Fifth Wheel Flatbed Trailer

After conducting a thorough evaluation of market options, supplier capabilities, cost considerations, and operational requirements, sourcing a fifth wheel flatbed trailer is a strategic decision that supports efficient and reliable heavy-duty transportation. The selected trailer meets key criteria including load capacity, durability, compliance with safety standards, and compatibility with existing towing vehicles.

Sourcing from reputable manufacturers or suppliers ensures quality construction, warranty support, and access to after-sales service—critical factors for minimizing downtime and maintaining operational continuity. Additionally, considering total cost of ownership, including maintenance, fuel efficiency, and lifespan, helps maximize long-term value.

In conclusion, proceeding with the acquisition of a fifth wheel flatbed trailer from a vetted supplier will enhance hauling capabilities, improve logistical efficiency, and contribute to overall operational success. It is recommended to finalize supplier selection, confirm delivery timelines, and implement a maintenance plan to ensure optimal performance and return on investment.