The global fiberglass and aluminum screen market has experienced steady growth, driven by rising demand in residential, commercial, and industrial construction sectors. According to Grand View Research, the global architectural mesh market—encompassing aluminum and fiberglass screening solutions—was valued at USD 4.8 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030. Similarly, Mordor Intelligence projects robust growth in the building screening materials segment, attributing the expansion to increased urbanization, energy efficiency regulations, and the growing preference for sustainable, durable building materials. As demand for insect, solar, and security screening rises, manufacturers specializing in fiberglass and aluminum screens are scaling innovation in material strength, UV resistance, and airflow efficiency. In this evolving landscape, nine key players have emerged as leaders through technological advancement, global distribution networks, and product diversification—setting the standard for quality and performance.

Top 9 Fiberglass Or Aluminum Screen Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Americas Choice

Domain Est. 2012

Website: windowscreensnow.com

Key Highlights: 2–10 day deliveryFactory Direct manufacturer of custom window screens, soffit vents, sliding screen doors, and components custom made or do it yourself Kits at wholesale ……

#2 Insect Screening, Sun Shading, Outdoor Fabrics & More

Domain Est. 1996 | Founded: 1952

Website: phifer.com

Key Highlights: Phifer Incorporated logo: Leading manufacturer of aluminum and fiberglass insect screening products since 1952. Insect Screening, Sun Shading Fabrics ……

#3 Super Screen®

Domain Est. 2003

Website: super-screen.com

Key Highlights: Super Screen® uses a revolutionary extrusion process that creates a tear-resistant screen tough enough to withstand dogs and cats as well as other pests pushing ……

#4 RiteScreen

Domain Est. 1998

Website: ritescreen.com

Key Highlights: Shop custom window screens, patio door screens, and screen parts from RiteScreen. Measure, choose size and mesh, and order online with fast shipping….

#5 About FlexScreen (good to know about our screens)

Domain Est. 1999

Website: flexscreen.com

Key Highlights: Significantly stronger than traditional fiberglass screen material. Heavy-duty polyester construction provides the ultimate in durability and longevity ……

#6 AMERICAN SCREEN CORPORATION

Domain Est. 2000

Website: screentechusa.com

Key Highlights: Our products range from screen cloth thresholds, screen frame components, to aluminum building products, hardware, patio extrusions, patio door accessories and ……

#7 Screens

Domain Est. 2003

Website: mdbuildingproducts.com

Key Highlights: Regular price From $19.32. 5/16 in. x 7 ft. Aluminum Screen Frame PC. Color – White. Color. White. Bronze. Mill. Matte Black….

#8 Insect Screen

Domain Est. 2012

Website: adfors.com

Key Highlights: ADFORS offers a wide range of fiberglass, polyester, and aluminum screen in multiple widths and lengths. Our easy to install window and door screens serve a ……

#9 Durable Fiberglass Screens for Windows & Doors

Domain Est. 2018

Website: breezescreens.com

Key Highlights: Explore Breeze Screens’ premium fiberglass screen doors and windows. Durable, stylish, and perfect for any home. Made in America, ensuring top quality….

Expert Sourcing Insights for Fiberglass Or Aluminum Screen

H2: 2026 Market Trends for Fiberglass vs. Aluminum Screen

The global market for window screening materials, particularly fiberglass and aluminum screens, is poised for notable shifts by 2026, driven by evolving consumer preferences, technological advancements, and sustainability demands. Here’s an in-depth analysis of the key trends shaping the competition between fiberglass and aluminum screens in the coming years:

-

Growing Preference for Fiberglass Screens in Residential Applications

Fiberglass screens are expected to maintain dominance in the residential sector due to their superior optical clarity, UV resistance, and reduced glare. As homeowners prioritize aesthetics and unobstructed views, fiberglass’ ability to offer a nearly invisible appearance makes it the preferred choice. Additionally, fiberglass does not corrode and is less prone to warping, making it ideal for humid or coastal climates—key factors fueling its adoption in regions like Southeast Asia, the U.S. Gulf Coast, and the Mediterranean. -

Aluminum Screens Gaining Ground in Commercial and High-Durability Applications

While fiberglass leads in aesthetics, aluminum screens are projected to see increased demand in commercial buildings, industrial facilities, and high-traffic areas due to their superior strength and tear resistance. Their structural rigidity makes them suitable for security screens, pet-resistant applications, and hurricane-prone zones where impact resistance is crucial. Innovations such as powder-coated and corrosion-resistant aluminum alloys are helping mitigate traditional drawbacks like oxidation, boosting aluminum’s market relevance. -

Sustainability and Recyclability Influencing Material Choice

Environmental considerations will play a pivotal role in 2026. Aluminum, being 100% recyclable and energy-efficient in recycling processes, is gaining favor among eco-conscious builders and developers. However, fiberglass, though less recyclable, is being improved through bio-based resins and closed-loop manufacturing. Regulatory pressures in Europe and North America promoting circular economy principles may tilt procurement decisions toward aluminum in institutional and large-scale construction projects. -

Innovation in Hybrid and Smart Screening Technologies

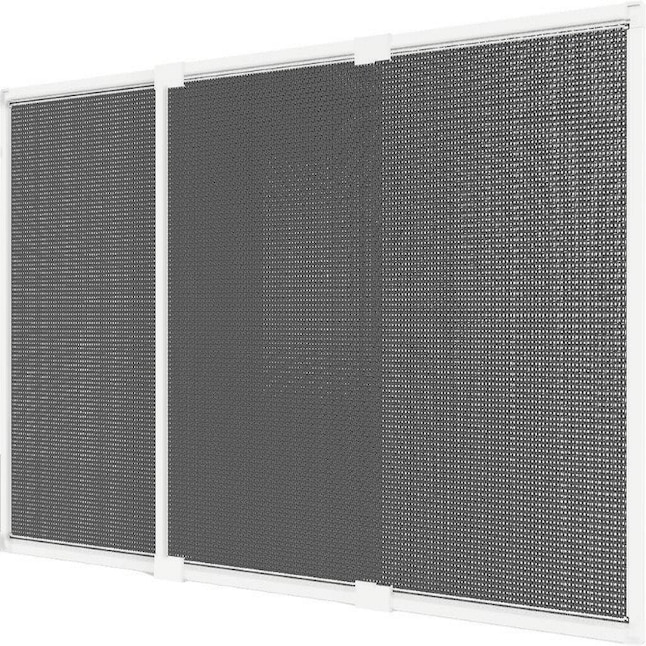

Emerging smart home integration is catalyzing development in both materials. Fiberglass is being embedded with solar-reflective and insect-repellent coatings, while aluminum is being integrated with sensors and automated retractable systems. Hybrid screens combining the flexibility of fiberglass with the strength of aluminum mesh are also entering the market, potentially blurring the lines between the two materials and creating new niche segments. -

Regional Market Dynamics and Supply Chain Shifts

Asia-Pacific is anticipated to be the fastest-growing market, driven by urbanization and rising construction activity in India and Southeast Asia. Here, cost sensitivity may favor aluminum due to lower production costs. In contrast, North America and Western Europe will lean toward fiberglass for premium residential builds. Supply chain resilience post-pandemic is also prompting localized production, with manufacturers investing in regional facilities to reduce dependency on imports and respond quickly to demand fluctuations. -

Price Volatility and Raw Material Costs

Fluctuations in aluminum prices—tied to global energy costs and bauxite supply—could impact affordability. Fiberglass, reliant on glass and polymer resins, may face cost pressures from oil prices. However, economies of scale and production efficiencies are expected to stabilize prices by 2026, with fiberglass maintaining a slight cost advantage in standard residential grades.

Conclusion

By 2026, the fiberglass vs. aluminum screen market will reflect a segmented landscape: fiberglass will lead in aesthetic and residential applications, while aluminum will strengthen its foothold in commercial, industrial, and high-performance niches. Sustainability, innovation, and regional demand will be the primary drivers, with hybrid solutions potentially redefining the competitive dynamic. Manufacturers investing in material science, eco-design, and smart integration will be best positioned to capture market share in this evolving sector.

Common Pitfalls Sourcing Fiberglass or Aluminum Screen (Quality, IP)

Sourcing fiberglass or aluminum screen mesh for construction, manufacturing, or replacement projects requires attention to detail to avoid quality and performance issues. Overlooking key factors can lead to premature failure, customer dissatisfaction, or non-compliance with project specifications. Below are common pitfalls related to quality and intellectual property (IP) concerns.

Substandard Material Quality

One of the most frequent issues is receiving screen material made from inferior-grade raw materials. Fiberglass screens may use low-tensile-strength glass fibers or inadequate PVC coating, leading to rapid degradation under UV exposure or physical stress. Aluminum screens might be manufactured from non-marine-grade alloys, making them prone to corrosion, especially in coastal or high-humidity environments. Buyers often assume standard specifications are met, but unverified suppliers may cut corners, compromising durability and lifespan.

Inconsistent Weave and Dimensional Accuracy

Poor manufacturing controls can result in inconsistent mesh weave, uneven openings, or variations in screen width and roll length. This inconsistency affects not only the aesthetic finish but also functional performance—such as airflow, visibility, and insect exclusion. Screens with irregular weaves may sag or tear easily during installation. Always verify that suppliers adhere to industry standards like ASTM E84 or ISO 9001 to ensure consistency.

Misrepresentation of Product Specifications

Some suppliers mislabel or exaggerate performance metrics such as shade factor, tensile strength, or UV resistance. For example, a fiberglass screen may be advertised as “heavy-duty” or “pet-resistant” without supporting test data. Without independent verification or third-party certifications, buyers risk purchasing products that fail under expected use conditions. Requesting material test reports (MTRs) and performance data sheets is essential.

Lack of Intellectual Property Verification

Certain high-performance screen products, such as solar/energy-saving screens or patented pet-resistant meshes, are protected by intellectual property rights. Sourcing generic versions that mimic branded products (e.g., Phantom® or E-Glass®) can lead to IP infringement, legal liability, and reputational damage. Always confirm whether the product is licensed or falls under legitimate generic alternatives. Engaging with unauthorized manufacturers or gray-market suppliers increases the risk of counterfeit goods.

Inadequate Packaging and Handling

Poor packaging can damage screen rolls during transit—leading to creasing, moisture exposure, or contamination. This is especially critical for fiberglass, which can degrade if exposed to humidity before installation. Aluminum screens may suffer surface scratches or oxidation if not properly sealed. Ensure suppliers use robust, climate-appropriate packaging and provide handling guidelines.

Absence of Compliance Documentation

For projects requiring building code compliance or green certifications (e.g., LEED), screens must meet specific fire, safety, and environmental standards. Some suppliers fail to provide necessary documentation like fire retardancy certificates (e.g., California Title 19) or environmental product declarations (EPDs). This omission can delay project approvals or result in rejected shipments.

Overlooking Supplier Reliability and Traceability

Choosing suppliers solely on price without vetting their production capabilities, quality control processes, or supply chain transparency increases the risk of receiving subpar or non-compliant products. Reliable suppliers should offer batch traceability, quality audits, and consistent communication. Failure to establish a trustworthy supply chain can lead to recurring quality issues and operational disruptions.

By addressing these pitfalls through due diligence, specification clarity, and supplier vetting, buyers can ensure they receive fiberglass or aluminum screen products that meet both quality expectations and legal requirements.

Logistics & Compliance Guide for Fiberglass or Aluminum Screen

Product Overview

Fiberglass and aluminum screens are widely used in residential, commercial, and industrial applications for window and door screening. These products are lightweight, durable, and designed to provide insect protection while allowing airflow and visibility. Understanding the logistics and compliance requirements ensures smooth international and domestic trade.

Packaging and Labeling

- Standard Packaging: Screens are typically rolled or folded and packed in protective plastic wrap or cardboard tubes. Bulk shipments may use shrink-wrapped pallets.

- Labeling Requirements:

- Include product specifications (mesh size, material type, roll dimensions, color).

- Add manufacturer name, country of origin, and batch/lot number.

- Comply with destination country labeling laws (e.g., bilingual labels for Canada).

- Include handling symbols (e.g., “Fragile,” “This Side Up”) for transport safety.

Transportation and Handling

- Mode of Transport: Suitable for road, rail, air, and sea freight. Rolls should be stored horizontally to prevent deformation.

- Storage Conditions: Store in dry, temperature-controlled environments to avoid moisture damage (especially for aluminum, which may corrode).

- Palletization: Secure rolls on standard pallets (48” x 40”) with edge protectors. Max stack height: 5–6 pallets to avoid bottom deformation.

- Hazardous Materials: Fiberglass and aluminum screens are non-hazardous; no special handling under IMDG, IATA, or DOT regulations.

Import/Export Regulations

- Harmonized System (HS) Codes:

- Fiberglass Screen: Typically 7019.90 (Other glass fiber products).

- Aluminum Screen: Usually 7616.99 (Other articles of aluminum).

- Verify with local customs authority for accuracy.

- Country-Specific Requirements:

- USA: No import license required; subject to CBP inspection. Duties vary based on origin (check USITC dataweb).

- EU: CE marking not required for basic screening; REACH and RoHS compliance may apply if coated or treated.

- Canada: Must meet Customs Tariff classifications; bilingual labeling required under the Consumer Packaging and Labelling Act.

- Australia: Complies with ABF import regulations; no quarantine concerns.

Material Compliance and Standards

- Fiberglass Screen:

- Should meet ASTM E84 for surface burning characteristics (flame spread, smoke development).

- Free from restricted substances under REACH (SVHC) and RoHS (if applicable).

- Aluminum Screen:

- Comply with ASTM B209 for aluminum and aluminum alloy sheet and plate.

- Recyclability and material origin should be documented (especially for green building certifications).

- Environmental Regulations:

- Ensure no use of PBT/vPvB substances.

- Recyclable packaging encouraged under EU Packaging Waste Directive.

Quality Control and Documentation

- Pre-Shipment Inspection: Verify roll integrity, mesh count, and coating uniformity.

- Required Documents:

- Commercial Invoice

- Packing List

- Bill of Lading / Air Waybill

- Certificate of Origin (for preferential tariffs under USMCA, etc.)

- Material Safety Data Sheet (MSDS) – optional but recommended.

Special Considerations

- Sustainability and EPR: In regions with Extended Producer Responsibility (e.g., EU), ensure recyclability claims are substantiated.

- Customs Delays: Avoid by ensuring accurate HS coding, complete documentation, and compliance with trade agreements.

- Returns and Reverse Logistics: Plan for damaged goods; use returnable pallets where feasible.

Conclusion

Proper logistics and compliance practices ensure timely delivery and regulatory adherence for fiberglass and aluminum screen products. Partnering with experienced freight forwarders and staying updated on international trade regulations will minimize risks and support market access.

Conclusion: Sourcing Fiberglass vs. Aluminum Screen

When deciding between sourcing fiberglass or aluminum screen mesh for your application, the choice ultimately depends on the specific requirements of the project, environmental conditions, and long-term performance expectations.

Fiberglass screens are ideal for standard insect protection in residential and light commercial settings. They offer excellent visibility, reduce glare, and are resistant to UV degradation and corrosion. Additionally, fiberglass is more affordable and easier to handle during installation. However, it is less durable under physical stress and may sag or tear over time, especially in high-traffic or high-wind areas.

Aluminum screens, on the other hand, provide superior strength, durability, and resistance to tearing, making them better suited for high-traffic areas, pet-friendly environments, or regions with harsh weather conditions. Aluminum is also more resistant to heat and fire, and maintains its shape over time. While slightly more expensive and prone to corrosion in salty or humid coastal areas (unless coated), aluminum offers a longer lifespan and minimal maintenance in many applications.

Final Recommendation:

For general residential use where cost and visibility are priorities, fiberglass is the preferred choice. For commercial buildings, high-traffic areas, or locations requiring enhanced durability, aluminum is the more sustainable and reliable option. Evaluate factors such as climate, intended use, budget, and aesthetic preferences when sourcing the appropriate screen material.