The global fiber laser cutting machine market is experiencing robust growth, driven by increasing demand for high-precision, energy-efficient cutting solutions across industries such as automotive, aerospace, and heavy manufacturing. According to a 2023 report by Grand View Research, the market was valued at USD 4.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by the superior performance of fiber lasers—offering higher beam quality, lower maintenance, and greater electrical efficiency compared to CO2 lasers—making them the preferred choice in modern metal fabrication. Additionally, advancements in automation and the rising adoption of Industry 4.0 technologies are accelerating integration of fiber laser systems into smart manufacturing environments. As global industrial output expands and precision fabrication becomes more critical, leading manufacturers are investing heavily in next-generation fiber laser technology. In this competitive landscape, a select group of companies have emerged as market leaders, combining innovation, reliability, and global reach to capture significant market share. Below, we spotlight the top 10 fiber laser cutting machine manufacturers shaping the future of industrial cutting.

Top 10 Fiber Laser Cutting Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mazak Leading Laser Machine Manufacturer

Domain Est. 1998

Website: mazak.com

Key Highlights: Mazak provides products and solutions that can support a wide range of parts machining processes, such as high-speed and high-accuracy machines….

#2 Bodor

Domain Est. 2003

Website: bodor.com

Key Highlights: Bodor laser is a fiber laser cutting machine manufacturer specialized in cnc fiber laser cutting machine equipment with integrating development, production, ……

#3 Wuhan Raycus Fiber Laser Technologies Co., Ltd.

Domain Est. 2008

Website: en.raycuslaser.com

Key Highlights: High efficiency of electro-optic conversion · Resistance to high resistance · Efficient sheet cutting · Output fiber length can be customized · Maintenance free ……

#4 Fiber Laser Cutting Machine and CO2 Laser Cutter Manufacturer …

Domain Est. 2016

Website: gwklaser.com

Key Highlights: Leading manufacturer of laser cutting machine, CO2 laser cutter, laser welding machine, laser bending machine and laser cleaning machine, etc….

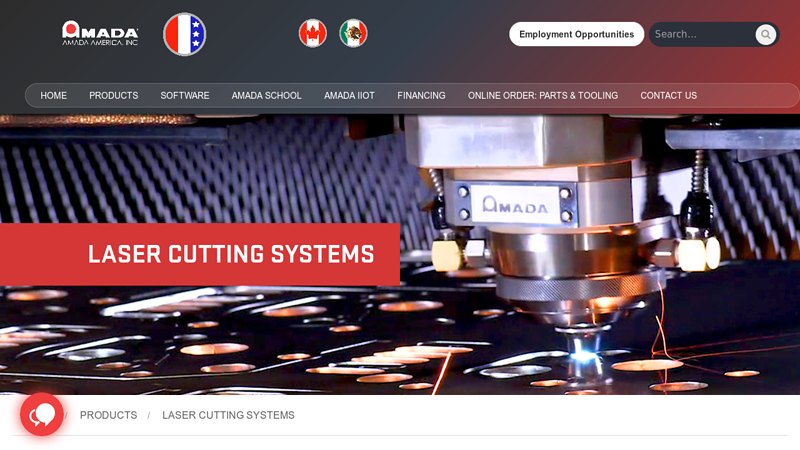

#5 Fiber Laser Cutting Machines

Domain Est. 1997

Website: amada.com

Key Highlights: AMADA’s Fiber Laser Cutting Systems range from 3kW to 12kW. Their advanced motion and innovative beam delivery systems are engineered to raise productivity….

#6 IPG Photonics

Domain Est. 1999

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

#7 CNC Fiber LASER Metal Cutting Machines

Domain Est. 1999

Website: piranhafab.com

Key Highlights: CNC Fiber LASER Metal Cutting Machines. starting at $132,900. Piranha Whitney CNC Fiber Lasers deliver unmatched cut quality and reliability — backed by U.S. ……

#8 Fiber Laser Cutting Systems

Domain Est. 1999

Website: e-ci.com

Key Highlights: Looking to boost your shop’s efficiency and cut quality? Look no further than Cincinnati Incorporated’s advanced fiber laser cutting machines….

#9 Full Spectrum Laser

Domain Est. 2010

Website: fslaser.com

Key Highlights: 7–15 day delivery 30-day returnsFull Spectrum Laser is a US based company that designs, manufactures, and sells powerful and affordable laser cutting & laser engraving products….

#10 Fiber laser cutting machine

Domain Est. 2013

Website: hsglaser.com

Key Highlights: HSG LASER is an international company dedicated to R&D, production, sales of laser cutting, bending, welding machines, automatic loading & unloading and ……

Expert Sourcing Insights for Fiber Laser Cutting Machine

H2: 2026 Market Trends for Fiber Laser Cutting Machines

The global fiber laser cutting machine market is poised for significant transformation by 2026, driven by technological advancements, increasing industrial automation, and rising demand across key manufacturing sectors. Several critical trends are expected to shape the market landscape over the next few years:

-

Growing Adoption in Automotive and Aerospace Industries

The automotive and aerospace sectors are increasingly integrating fiber laser cutting machines for their precision, speed, and ability to cut complex geometries in high-strength materials like aluminum, titanium, and advanced composites. As electric vehicle (EV) production scales up globally, manufacturers are turning to fiber lasers for efficient battery enclosure fabrication and lightweight component manufacturing, fueling market growth. -

Rise of High-Power Fiber Lasers

A key technological trend is the shift toward high-power fiber lasers (6 kW and above). These systems enable faster cutting speeds and the ability to process thicker metals—up to 40 mm—making them ideal for heavy industrial applications in shipbuilding, construction, and energy infrastructure. By 2026, high-power systems are expected to dominate new installations, especially in emerging markets with expanding heavy manufacturing bases. -

Integration with Industry 4.0 and Smart Manufacturing

Fiber laser cutting machines are becoming increasingly connected through IoT-enabled controls, real-time monitoring, and AI-driven predictive maintenance. Integration with digital twin technology and cloud-based production management systems allows for optimized workflows, reduced downtime, and improved quality control—key demands of smart factories. OEMs are focusing on developing software ecosystems that enhance machine usability and data analytics. -

Expansion in Emerging Economies

Rapid industrialization in Asia-Pacific (particularly China, India, and Southeast Asia), along with growing investments in manufacturing in regions like Eastern Europe and Latin America, is driving demand for cost-effective and reliable fiber laser systems. Localized production and partnerships with regional distributors are expected to be strategic priorities for global manufacturers by 2026. -

Sustainability and Energy Efficiency

Fiber lasers are inherently more energy-efficient than CO₂ lasers, consuming up to 30–50% less power. As industries face increasing pressure to reduce carbon footprints, the environmental advantage of fiber lasers will become a key purchasing criterion. Additionally, advancements in beam delivery and cooling systems are further enhancing energy efficiency and reducing operational costs. -

Competitive Pricing and Market Consolidation

Intensifying competition, especially from Chinese manufacturers offering affordable yet high-performance machines, is driving down prices and increasing accessibility. This trend is prompting consolidation among mid-tier players and encouraging innovation to differentiate products through software, service support, and customization. -

Demand for Compact and Modular Systems

Small and medium-sized enterprises (SMEs) are seeking compact, modular fiber laser systems that require less floor space and can be easily integrated into existing production lines. By 2026, vendors are expected to expand their portfolios with entry-level and mid-range machines tailored to niche applications in electronics, medical devices, and custom fabrication.

In conclusion, the fiber laser cutting machine market in 2026 will be characterized by technological sophistication, deeper digital integration, and broader geographic reach. Companies that innovate in power efficiency, software intelligence, and application-specific solutions will be best positioned to capture market share in this dynamic and competitive landscape.

Common Pitfalls When Sourcing Fiber Laser Cutting Machines (Quality & Intellectual Property)

Sourcing a fiber laser cutting machine is a significant investment, and overlooking key factors related to quality and intellectual property (IP) can lead to costly mistakes, operational inefficiencies, and legal risks. Being aware of these common pitfalls is crucial for making a sound procurement decision.

Poor Build Quality and Component Sourcing

One of the most frequent issues is encountering machines constructed with substandard materials and low-grade components. Some suppliers, especially lesser-known or budget-focused manufacturers, may use inferior linear guides, drive motors, or structural frames to cut costs. This leads to reduced cutting precision, faster wear and tear, increased downtime, and higher maintenance expenses over time. Always verify the brand and specifications of critical components like the motion system, laser source, and chiller.

Misrepresentation of Laser Source Specifications

Many suppliers exaggerate or obscure the true performance of the laser source—the heart of the machine. Pitfalls include advertising peak power instead of sustained power, failing to specify the actual brand (e.g., claiming IPG when using a cheaper alternative), or using reconditioned or cloned laser modules. Always demand verifiable documentation, such as laser source serial numbers and manufacturer warranties, and consider third-party verification if possible.

Intellectual Property Infringement Risks

Sourcing from regions with lax IP enforcement increases the risk of purchasing machines that incorporate pirated or reverse-engineered technology. This includes cloned control software, copied mechanical designs, or unauthorized use of proprietary algorithms. Using such equipment may expose your business to legal liability, especially in markets with strong IP protections. Ensure your supplier can legally prove ownership or licensing of all software and critical design elements.

Lack of Transparency in Software and Controls

Hidden software limitations are a common issue. Some machines run on modified or unlicensed CNC control systems (e.g., unauthorized versions of CypCut, LaserCut, or proprietary software). This can result in limited functionality, no future updates, poor technical support, and potential malware or security vulnerabilities. Always confirm the authenticity of the control software and whether it is legally licensed.

Inadequate After-Sales Support and Spare Parts Availability

Even high-quality machines require maintenance and support. A major pitfall is partnering with suppliers who lack a reliable service network or stock critical spare parts. Delays in repairs due to unavailable components—especially proprietary or IP-protected parts—can halt production. Evaluate the supplier’s global support infrastructure, warranty terms, and responsiveness before committing.

Counterfeit or Recertified Components

Some suppliers pass off used, refurbished, or counterfeit parts as new. This is particularly common with high-cost items like laser cutting heads, capacitive sensors, and fiber delivery cables. Insist on factory-sealed packaging, original equipment manufacturer (OEM) documentation, and performance testing before final acceptance.

Failure to Verify Compliance and Certifications

Non-compliant machines may lack essential safety certifications (e.g., CE, FDA, ISO) or electromagnetic compatibility (EMC) standards. This poses safety risks and can prevent installation or operation in regulated environments. Always request and verify relevant compliance documentation tied to the specific machine model being purchased.

By carefully evaluating these quality and IP-related pitfalls, buyers can mitigate risks and select a fiber laser cutting machine that delivers reliable performance, legal safety, and long-term value.

Logistics & Compliance Guide for Fiber Laser Cutting Machine

Overview

Transporting and deploying a fiber laser cutting machine involves complex logistics and strict regulatory compliance due to the equipment’s size, weight, electrical systems, and laser safety requirements. This guide outlines key considerations for safe, efficient, and compliant handling from origin to installation.

Packaging and Crating

Ensure the fiber laser cutting machine is securely packaged in a custom-engineered wooden crate that meets international shipping standards (e.g., ISPM 15 for wood packaging). Use anti-vibration mounts, foam insulation, and moisture barriers to protect sensitive components such as the laser source, control systems, and linear guides. Clearly label the crate with handling instructions (e.g., “Fragile,” “This Side Up,” “Do Not Stack”).

Transportation Mode and Handling

Choose the appropriate transportation method—road, sea, or air—based on machine dimensions, weight, and delivery timeline. For oversized or heavy machines, coordinate with freight forwarders experienced in industrial equipment. Use forklifts or cranes with proper lifting points; never lift by control panels or moving parts. Confirm site accessibility (door width, floor load capacity, ceiling height) before delivery.

Import/Export Compliance

Verify export control regulations (e.g., U.S. EAR or EU Dual-Use Regulations) as high-power lasers may be subject to restrictions. Obtain necessary export licenses if required. For import, provide accurate Harmonized System (HS) codes—typically 8456.20 for laser cutting machines—and ensure compliance with local customs procedures, duties, and import permits.

Electrical and Safety Standards

Ensure the machine meets regional electrical standards (e.g., CE in Europe, UL/cUL in North America, CCC in China). Voltage, frequency, and plug types must match the destination’s power supply. Include documentation such as Declaration of Conformity (DoC), electrical schematics, and safety certifications. Confirm laser safety compliance with IEC 60825-1 (laser classification) and local occupational safety regulations.

Laser Safety and Regulatory Documentation

The fiber laser cutting machine must be classified (typically Class 1 or Class 4 depending on enclosure) and labeled accordingly. Provide a Laser Safety Manual, Risk Assessment, and compliance with OSHA (U.S.), PUWER (UK), or equivalent local workplace safety laws. Include protective measures such as interlocks, emergency stops, and fume extraction systems.

Site Preparation and Installation

Prepare the installation site with a level, vibration-free concrete floor capable of supporting the machine’s weight (typically 2,000–10,000 kg). Ensure adequate power supply (3-phase, stable voltage), compressed air, cooling systems, and exhaust ventilation. Allow clearance for maintenance and material handling. Schedule technician-led installation and calibration to ensure optimal performance and warranty validity.

Training and Operational Compliance

Provide on-site operator and maintenance training covering safe operation, emergency procedures, and compliance with laser safety protocols. Ensure end-users have documented safety procedures, personal protective equipment (PPE), and a designated Laser Safety Officer (LSO) if required by local regulations.

Environmental and Waste Compliance

Implement proper disposal procedures for consumables (e.g., nozzles, lenses) and manage metal fumes through certified filtration systems. Comply with local environmental regulations regarding emissions, noise levels, and waste recycling. Maintain records of maintenance and filter replacements.

Documentation and Recordkeeping

Keep a complete compliance file including:

– Bill of Lading, Packing List, Commercial Invoice

– Certificates of Origin and Conformity

– Technical Manuals and Safety Documentation

– Installation and Training Records

– Maintenance Logs and Regulatory Permits

Retain these records for audit and warranty purposes.

Conclusion

Successful logistics and compliance for a fiber laser cutting machine require proactive planning, adherence to international and local regulations, and coordination among manufacturers, shippers, and end-users. Prioritizing safety, documentation, and technical compatibility ensures smooth deployment and long-term operational compliance.

Conclusion for Sourcing a Fiber Laser Cutting Machine

Sourcing a fiber laser cutting machine is a strategic investment that can significantly enhance manufacturing efficiency, precision, and productivity. After evaluating various factors such as machine specifications, power requirements, brand reputation, service and support, and total cost of ownership, it is clear that selecting the right fiber laser cutter requires a balanced approach tailored to specific production needs.

Fiber laser technology offers distinct advantages over traditional cutting methods, including faster processing speeds, lower maintenance, higher energy efficiency, and superior cut quality—especially for thin to medium-thickness metals. When sourcing, it is crucial to partner with reputable suppliers who provide reliable technical support, comprehensive training, and readily available spare parts.

Additionally, considering future scalability, automation compatibility, and software integration ensures long-term adaptability in a competitive manufacturing environment. While initial costs may be significant, the return on investment through improved throughput and reduced operating costs makes fiber laser cutting a worthwhile advancement.

In conclusion, a well-researched sourcing decision—aligned with operational requirements, quality standards, and budgetary constraints—will ensure the successful integration of a fiber laser cutting machine, driving innovation, competitiveness, and growth in your manufacturing capabilities.