The global ferrules market is experiencing steady growth, driven by rising demand across industries such as telecommunications, automotive, aerospace, and industrial machinery. According to a report by Mordor Intelligence, the global fiber optic connectors market—of which ferrules are a critical component—is projected to grow at a CAGR of over 7.5% from 2023 to 2028. This expansion is fueled by the increasing deployment of fiber-to-the-home (FTTH) networks, 5G infrastructure development, and the growing need for high-speed data transmission. Additionally, Grand View Research estimates that the global fiber optic connector market size was valued at USD 1.8 billion in 2022 and is expected to expand at a CAGR of 7.8% through 2030. As precision components essential for signal integrity and mechanical alignment, ferrules play a pivotal role in this growth trajectory. With innovation in materials like zirconia and stainless steel, and rising investments in optical networking, leading manufacturers are scaling production and R&D to meet evolving industry standards. In this competitive landscape, the top 10 ferrules manufacturers stand out for their technological expertise, quality compliance, and global supply chain reach.

Top 10 Ferrules Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Brass Ferrules

Domain Est. 1997

Website: truexinc.com

Key Highlights: If you are looking for a brass ferrule, aluminium ferrules, or custom ferrules, TrueX Inc. has what you need. Check out our online catalog….

#2 Wire-end ferrules

Domain Est. 1997

Website: engeser.com

Key Highlights: ENGESER provides ferrules directly from the factory and warehouse at Waldmössingen. Our portfolio features ferrules in 300 standard sizes, shapes and colours….

#3 Ferrules Capabilities & Applications

Domain Est. 2005

Website: knightmfgco.com

Key Highlights: Ferrules can be made in different sizes and shapes. Ferrules are custom designed for the products they are meant to connect and are crimped to fit those pieces….

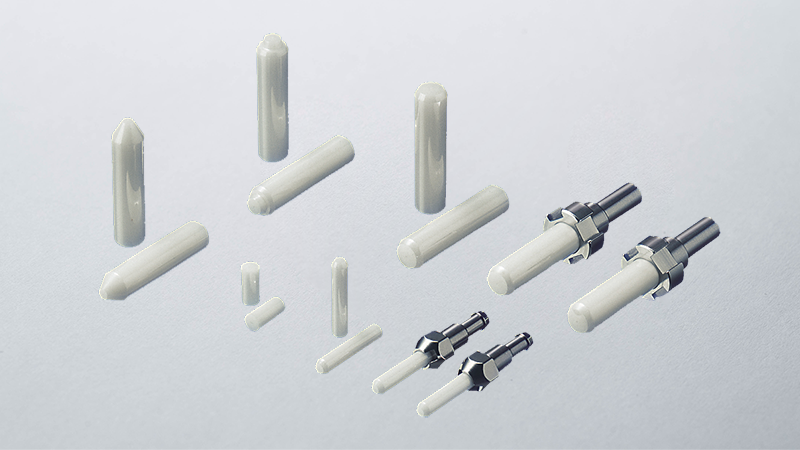

#4 Ceramic Ferrules / Sleeves

Domain Est. 1993

Website: global.kyocera.com

Key Highlights: Ceramic ferrules and sleeves are often used in optical connectors, attenuators, fiber stubs, and other optoelectronics requiring low signal loss….

#5 Wire

Domain Est. 1996

Website: weidmuller.com

Key Highlights: Crimp defects must be avoided in order to achieve high-quality crimp connections. This requires manual skills as well as matching tools and wire-end ferrules….

#6 Ferrules

Domain Est. 1996

Website: phoenixcontact.com

Key Highlights: Ferrules are used in process-reliable conductor processing and wiring. They protect the conductors against splicing and make it easier to insert them in the ……

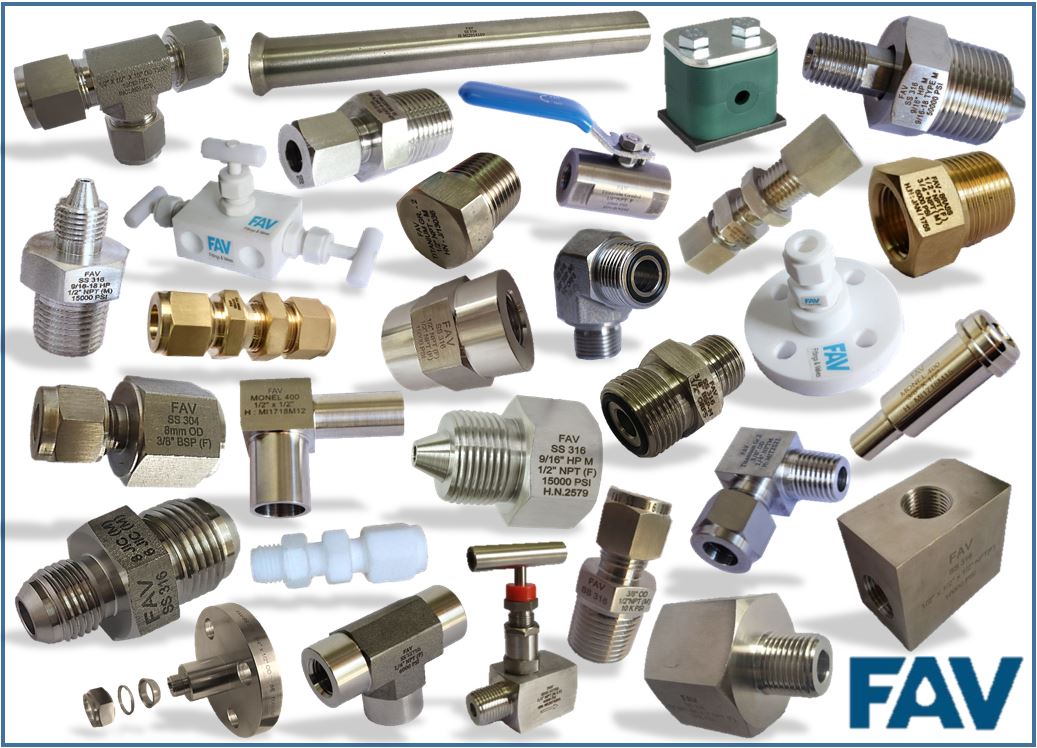

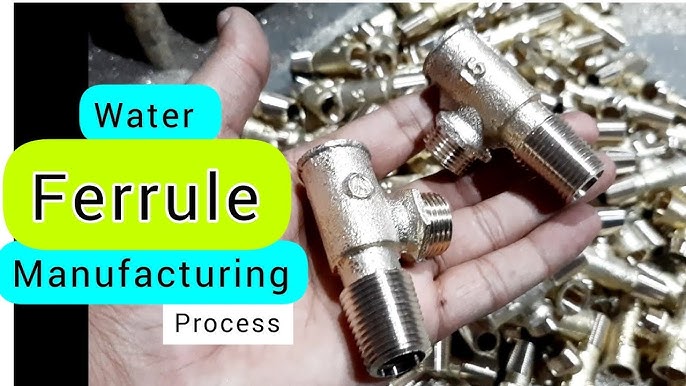

#7 Tube Fittings, Valves & Ferrules

Domain Est. 1997

Website: tylok.com

Key Highlights: Tylok Fittings and Valves offers instrumentation fittings, valves, tube fittings, compression fittings, and ferrules — all Made in the USA for quality and ……

#8

Domain Est. 1997

Website: dmctools.com

Key Highlights: For 75 years, DMC® has manufactured tooling for mission-critical electrical systems in aerospace and defense, rail, marine, and several other industries….

#9 Ferrule Suppliers

Domain Est. 2001

Website: metalstamper.net

Key Highlights: Ferrule companies on this site quickly respond to RFQ’s, and can help you design & prototype high quality ferrule products for your application needs….

#10 Ferrules Direct

Domain Est. 2002

Website: ferrulesdirect.com

Key Highlights: Explore our top-quality crimping tools for efficient and reliable wire terminations, enhancing your work with precision and durability….

Expert Sourcing Insights for Ferrules

H2: 2026 Market Trends for Ferrules

The global ferrules market is poised for steady growth and transformation by 2026, driven by advancements in material science, rising demand across key industries, and evolving manufacturing practices. Ferrules—small, cylindrical components used to secure and protect fibers, wires, or tubes—are critical in sectors such as telecommunications, automotive, industrial machinery, medical devices, and energy. Below are the key market trends expected to shape the ferrules landscape in 2026:

1. Expansion in Fiber Optic Communication

The ongoing global rollout of 5G networks and the increasing adoption of fiber-to-the-home (FTTH) infrastructure are significantly boosting demand for high-precision optical fiber ferrules. By 2026, the telecommunications sector will remain the largest end-user, with zirconia and ceramic ferrules dominating due to their thermal stability and low signal loss. Innovations in multi-fiber push-on (MPO) and expanded beam ferrule designs will support higher data transmission rates and network reliability.

2. Growth in Electric Vehicles (EVs) and Automotive Electrification

The automotive industry’s shift toward electric mobility is increasing demand for ferrules in high-voltage cable assemblies and battery interconnects. Metal and composite ferrules that offer superior electrical insulation, mechanical strength, and resistance to vibration and temperature fluctuations are gaining traction. By 2026, manufacturers are expected to focus on lightweight, corrosion-resistant ferrules tailored for EV power systems.

3. Adoption of Advanced Materials

Material innovation is a key driver in the ferrules market. While stainless steel and brass remain prevalent in industrial applications, emerging materials such as thermoplastics, PEEK (polyether ether ketone), and composite ceramics are gaining ground. These materials offer improved performance in harsh environments and support miniaturization—especially critical in medical and aerospace applications.

4. Miniaturization and Precision Engineering

As electronic devices become smaller and more complex, demand for micro-ferrules with tight tolerances is rising. The medical device and consumer electronics industries are pushing for ultra-compact ferrules used in endoscopes, sensors, and wearable tech. In 2026, precision machining and automated manufacturing will be essential for meeting these specifications at scale.

5. Regional Market Shifts

Asia-Pacific will continue to lead ferrule production and consumption by 2026, fueled by strong industrial growth in China, India, and Southeast Asia. Meanwhile, North America and Europe are expected to see growth driven by investments in smart infrastructure, renewable energy, and next-generation telecom networks. Localization of supply chains and nearshoring trends may also reshape manufacturing footprints.

6. Sustainability and Regulatory Compliance

Environmental regulations are prompting manufacturers to adopt eco-friendly materials and production processes. Ferrule producers are increasingly focused on recyclable materials, reduced waste, and compliance with RoHS and REACH standards. This trend is especially prominent in Europe and North America.

7. Integration of Smart Manufacturing

Industry 4.0 technologies—including IoT-enabled monitoring, AI-driven quality control, and digital twins—are being integrated into ferrule production. By 2026, smart factories will enhance efficiency, reduce defects, and enable rapid customization for niche applications.

Conclusion

By 2026, the ferrules market will be characterized by technological innovation, material diversification, and strong demand from high-growth industries. Companies that invest in R&D, sustainability, and agile manufacturing will be best positioned to capitalize on emerging opportunities across global markets.

Common Pitfalls When Sourcing Ferrules: Quality and Intellectual Property (IP) Concerns

Sourcing ferrules—particularly those used in fiber optic, fluid handling, or mechanical systems—can involve significant risks if not managed carefully. Two of the most critical areas prone to pitfalls are product quality and intellectual property (IP) issues. Overlooking these aspects can lead to system failures, legal disputes, and reputational damage.

Quality-Related Pitfalls

-

Inconsistent Material Specifications

Ferrules made from substandard materials (e.g., impure zirconia in ceramic ferrules) can result in poor thermal stability, low durability, and signal loss in optical applications. Buyers may unknowingly receive materials that do not meet industry standards like IEC or Telcordia GR-326. -

Tolerance and Dimensional Inaccuracy

Precision is critical—especially in fiber optic ferrules where micron-level deviations can cause high insertion loss or poor mating performance. Suppliers from less-regulated regions may lack advanced metrology tools, leading to batch inconsistencies. -

Poor Surface Finish and Polish Quality

A flawed polish (e.g., scratches, pits, or incorrect curvature) directly impacts optical performance. Some suppliers cut corners in polishing processes to reduce costs, compromising return loss and signal integrity. -

Lack of Traceability and Certification

Reputable ferrule suppliers provide material certifications, test reports, and lot traceability. Sourcing from vendors without documented quality control increases the risk of receiving non-compliant or counterfeit parts. -

Inadequate Testing and Validation

Some suppliers skip rigorous environmental or lifecycle testing (e.g., temperature cycling, durability under repeated mating). This increases field failure risks, especially in harsh operating conditions.

Intellectual Property (IP) Pitfalls

-

Unauthorized Production of Patented Designs

Many high-performance ferrule designs (e.g., physical contact (PC), UPC, APC angles) are protected by patents. Sourcing from manufacturers who reverse-engineer and replicate proprietary designs without licenses exposes buyers to legal liability through induced infringement. -

Use of Counterfeit or Clone Components

Especially prevalent in online marketplaces, counterfeit ferrules may mimic the appearance of well-known brands but lack performance and reliability. These clones often infringe on trademarks and design patents, and their use can void warranties on end products. -

Unclear IP Ownership in Custom Designs

When working with contract manufacturers on custom ferrules, failure to define IP ownership in contracts can lead to disputes. Suppliers may claim rights to tooling or design modifications, limiting your freedom to switch vendors or scale production. -

Geopolitical IP Enforcement Risks

Sourcing from regions with weak IP enforcement increases the likelihood of encountering infringing products. Even if unintentional, importing such components can trigger customs seizures, legal action, or exclusion orders in markets like the U.S. or EU. -

Lack of Due Diligence on Supplier IP Compliance

Many buyers fail to audit suppliers for IP compliance. Without reviewing supplier certifications, design licenses, or patent disclaimers, companies risk being complicit in IP violations embedded in the supply chain.

Mitigation Strategies

- Qualify Suppliers Rigorously: Require ISO certifications, on-site audits, and sample testing against industry standards.

- Demand Full Documentation: Insist on material certifications, test reports, and traceability data.

- Conduct IP Audits: Verify that suppliers have rights to manufacture the ferrules they offer, especially for proprietary designs.

- Use Legally Binding Contracts: Clearly define IP ownership, warranty terms, and liability in sourcing agreements.

- Source from Reputable Channels: Avoid gray-market suppliers; prefer authorized distributors or OEMs with established IP practices.

By proactively addressing quality and IP concerns, companies can ensure reliable performance, avoid legal exposure, and maintain the integrity of their end products.

Logistics & Compliance Guide for Ferrules

Overview of Ferrules in Supply Chains

Ferrules—small metal or plastic components used to reinforce or secure connections in cables, hoses, and tubing—are commonly shipped globally across industries such as automotive, aerospace, construction, and telecommunications. Despite their size, proper logistics and compliance management are essential to ensure timely delivery, product integrity, and adherence to international regulations.

Material Classification and HS Code

Identifying the correct Harmonized System (HS) code is crucial for customs clearance. Ferrules are typically classified under:

– HS 7318.19: Other screws, bolts, nuts, washers, and similar articles, of iron or steel — may apply to metal ferrules.

– HS 8544.49: Insulated fittings (e.g., for electrical use) including ferrules — applicable to electrical crimp ferrules.

– HS 3926.30: Other articles of plastics — for plastic ferrules.

Note: Final classification depends on composition, function, and country-specific interpretations. Always verify with local customs authorities.

Packaging and Handling Requirements

To prevent damage during transit:

– Use anti-static packaging for electrically conductive ferrules.

– Employ moisture-resistant materials for metal ferrules to avoid corrosion.

– Secure small parts in sealed bags or trays within sturdy outer cartons.

– Label packages with part numbers, quantities, and handling symbols (e.g., “Fragile,” “Do Not Stack”).

Transportation and Storage

- Mode of Transport: Ferrules are typically shipped via air, sea, or ground freight based on volume and urgency. Small-volume shipments often use express couriers.

- Storage Conditions: Store in dry, temperature-controlled environments. Avoid exposure to extreme heat, humidity, or corrosive agents.

- Stacking Limits: Respect weight limits on packaging to avoid crushing lower layers.

Regulatory Compliance

International Standards

- RoHS (EU): Restricts hazardous substances in electrical and electronic components. Applies to conductive ferrules used in electronics.

- REACH (EU): Requires declaration of Substances of Very High Concern (SVHCs) in metal or plastic components.

- Conflict Minerals (U.S. Dodd-Frank Act): If ferrules contain tin, tantalum, tungsten, or gold, suppliers may need to disclose sourcing.

- UKCA/CE Marking: Required for certain end-use applications in construction or electrical systems.

Country-Specific Requirements

- USA: Comply with EPA and OSHA standards if ferrules involve hazardous coatings or materials.

- China: May require CCC certification if integrated into regulated electrical devices.

- Canada: Adhere to Health Canada and CBSA import regulations; use proper B3 documentation.

Documentation for International Shipments

Ensure the following documents accompany shipments:

– Commercial Invoice (with accurate valuation and HS codes)

– Packing List (detailing quantities, weights, and dimensions)

– Certificate of Origin (for preferential tariff treatment under trade agreements)

– Material Safety Data Sheet (MSDS), if applicable

– RoHS/REACH Compliance Declarations (for electronic or industrial use)

Import Duties and Trade Agreements

Duty rates vary by country and material. For example:

– The U.S. may apply 2.5–5% duty on steel ferrules under HTSUS 7318.19.

– Use of trade agreements (e.g., USMCA, ASEAN, or EU Free Trade Agreements) may reduce or eliminate tariffs with a valid Certificate of Origin.

Reverse Logistics and Returns

Establish clear procedures for defective or excess inventory returns:

– Include Return Merchandise Authorization (RMA) numbers.

– Comply with destination country import rules for returned goods.

– Reuse packaging where possible to support sustainability goals.

Sustainability and Environmental Compliance

- Recycle packaging materials and encourage suppliers to do the same.

- Source ferrules from vendors with ISO 14001-certified environmental management systems.

- Assess carbon footprint across transportation modes and optimize routes.

Conclusion

Efficient logistics and strict compliance are vital for the global movement of ferrules. By classifying products correctly, using appropriate packaging, meeting regulatory standards, and maintaining accurate documentation, companies can minimize delays, reduce costs, and ensure supply chain reliability. Regular audits and supplier assessments further support continuous compliance and operational excellence.

Conclusion for Sourcing Ferrules:

Sourcing ferrules requires a strategic approach that balances quality, cost, supplier reliability, and material specifications. After evaluating various suppliers, conducting material assessments, and considering application requirements—such as durability, precision, and compatibility with mating components—it is clear that selecting the right ferrule supplier is critical to ensuring long-term performance and system integrity. Prioritizing suppliers with certifications, traceable materials, consistent manufacturing standards, and responsive technical support will mitigate risks related to failures or downtime. Ultimately, an optimized sourcing strategy for ferrules not only reduces total cost of ownership but also enhances the reliability and efficiency of fluid or mechanical systems in which they are used. Continuous supplier evaluation and market monitoring are recommended to maintain supply chain resilience and adapt to evolving industry demands.