Sourcing Guide Contents

Industrial Clusters: Where to Source Fashion Jewelry Wholesale China

SourcifyChina | Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis — Sourcing Fashion Jewelry Wholesale from China

Prepared For: Global Procurement Managers

Date: April 2026

Executive Summary

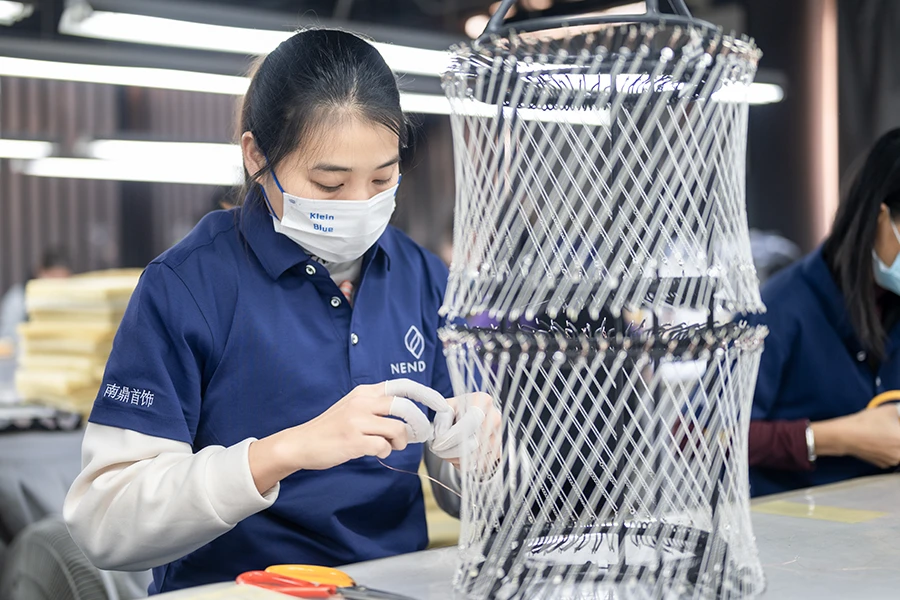

China remains the dominant global hub for fashion jewelry manufacturing, accounting for over 70% of worldwide production and export volume in the segment. Driven by mature industrial ecosystems, cost-effective labor, and vertically integrated supply chains, Chinese manufacturers offer competitive advantages in both scalability and product diversity. This report provides a strategic analysis of the key industrial clusters in China for sourcing fashion jewelry, with a comparative evaluation of provinces and cities based on price competitiveness, quality standards, and lead time efficiency.

Key clusters include Guangdong, Zhejiang, Fujian, and Shandong, each offering distinct advantages depending on product type, order volume, and target market positioning. Guangdong leads in high-volume OEM/ODM production, while Zhejiang excels in design innovation and mid-to-high-end finishes.

Key Industrial Clusters for Fashion Jewelry Manufacturing in China

1. Guangdong Province (Dongguan, Shenzhen, Guangzhou, Panyu)

- Specialization: Mass production of costume jewelry, rhinestone pieces, alloy-based accessories, and fast-fashion items.

- Key Hub: Panyu District (Guangzhou) – Known as the “Capital of Chinese Jewelry,” producing over 70% of nationally exported fashion jewelry.

- Strengths:

- High-density supplier networks

- Advanced plating and casting technologies

- Strong export infrastructure (proximity to Hong Kong & Shenzhen ports)

- Aggressive pricing due to scale and competition

2. Zhejiang Province (Yiwu, Jinhua, Wenzhou)

- Specialization: Mixed-material jewelry (resin, acrylic, stainless steel), fashion-forward designs, and e-commerce-focused micro-batch production.

- Key Hub: Yiwu – Home to the world’s largest wholesale market; ideal for sample sourcing and small MOQs.

- Strengths:

- Rapid prototyping and trend responsiveness

- Strong design integration with global fashion cycles

- Competitive for mid-tier quality and MOQ flexibility

3. Fujian Province (Quanzhou, Jinjiang)

- Specialization: Zinc alloy jewelry, environmental plating (lead/nickel-free), and eco-compliant accessories for EU markets.

- Strengths:

- Rising focus on sustainability and compliance (REACH, RoHS)

- Cost-effective mid-volume production

- Increasing OEM partnerships with European ethical brands

4. Shandong Province (Qingdao, Yantai)

- Specialization: Stainless steel, titanium, and minimalist metal jewelry.

- Strengths:

- High durability and corrosion-resistant finishes

- Strong for unisex and gender-neutral designs

- Reliable for long-term supplier partnerships

Comparative Analysis: Key Production Regions in China

| Region | Average Price Level | Quality Tier | Lead Time (Standard Order) | Best Suited For |

|---|---|---|---|---|

| Guangdong | Low to Medium | Medium | 15–25 days | High-volume orders, fast-fashion retailers, budget-conscious brands |

| Zhejiang | Medium | Medium to High | 20–30 days | Trend-driven designs, e-commerce brands, small-to-medium MOQs |

| Fujian | Medium | Medium | 20–28 days | EU-compliant products, eco-conscious brands, mid-volume contracts |

| Shandong | Medium to High | High | 25–35 days | Premium finishes, durable materials, long-term B2B partnerships |

Note: Lead times assume order volumes of 5,000–50,000 units and exclude shipping. Custom tooling or plating (e.g., PVD, IP plating) may extend timelines by 5–10 days.

Strategic Recommendations for Procurement Managers

-

Volume-Driven Procurement: Prioritize Guangdong-based suppliers for cost efficiency and scalability. Ideal for fast-fashion retailers and mass-market distributors.

-

Design & Trend Responsiveness: Engage Zhejiang manufacturers, especially around Yiwu and Jinhua, for agile production aligned with seasonal trends and social commerce demands.

-

Compliance & Sustainability: Partner with Fujian-certified factories for REACH, RoHS, and CA Prop 65 compliance—critical for EU and North American markets.

-

Premium Durability Focus: Consider Shandong suppliers for stainless steel and hypoallergenic lines targeting premium lifestyle or unisex segments.

-

Hybrid Sourcing Strategy: Diversify across 2–3 regions to balance cost, quality, and risk—e.g., use Guangdong for core lines and Zhejiang for limited editions.

Conclusion

China’s fashion jewelry manufacturing landscape is regionally specialized, offering procurement managers a spectrum of options tailored to brand positioning, compliance needs, and supply chain agility. By leveraging regional strengths—Guangdong for scale, Zhejiang for speed, Fujian for compliance, and Shandong for durability—buyers can optimize total cost of ownership while maintaining product integrity and market responsiveness.

SourcifyChina recommends conducting on-site audits or third-party QC inspections, particularly for first-time partnerships, and utilizing digital sourcing platforms integrated with real-time compliance tracking.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant | B2B Supply Chain Optimization

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

B2B Sourcing Report: Fashion Jewelry Wholesale from China (2026)

Prepared for Global Procurement Managers

Senior Sourcing Consultant, SourcifyChina | Objective Guidance for Risk-Mitigated Sourcing

Executive Summary

China supplies 78% of global fashion jewelry (Statista, 2025), but non-compliance and quality failures cause 32% of procurement losses (SourcifyChina Audit Data, 2025). This report details actionable technical specifications, mandatory compliance frameworks, and defect prevention protocols to secure supply chain integrity. Critical focus: Avoiding regulatory rejection and brand-damaging recalls.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Parameter | Standard Specification | Tolerance/Requirement | Verification Method |

|---|---|---|---|

| Base Metal | Lead-free Brass (CuZn37), Stainless Steel 316L, or Zinc Alloy (Zamak 3) | Pb < 90ppm, Cd < 0.1ppm (CPSIA/REACH) | ICP-MS Lab Test (3rd Party) |

| Plating | Nickel-free underlayer + Rhodium/Gold (0.5–3.0μm) | Thickness: ±0.2μm; Adhesion: Pass 3M Tape Test (ASTM D3359) | XRF Thickness Gauge + Adhesion Test |

| Stones | Cubic Zirconia (CZ), Acrylic, or Glass | Color consistency: ΔE ≤ 1.5 (CIE Lab*) | Spectrophotometer + Visual Match |

| Chain Links | Hollow or Solid | Diameter: ±0.05mm; Breaking Load: ≥5kg (necklaces) | Caliper + Tensile Tester |

| Clasps | Lobster Claw / Magnetic (Ni-free) | Opening Force: 1.5–3.0N; Cycle Test: 5,000 cycles | Force Gauge + Cycle Tester |

B. Dimensional Tolerances

- Flat Components (Pendants, Earrings): ±0.1mm (Critical for assembly)

- Circular Components (Rings, Bangles): Inner Diameter ±0.2mm (Per ISO 11425 for wearable fit)

- Surface Flatness: ≤0.05mm deviation per 10mm (Prevents wobbling/stress fractures)

Procurement Action: Require SGS/BV material composition certificates with lot-specific batch traceability. Reject factories using “alloy” without ISO 3815-1 certification.

II. Essential Compliance Certifications (2026 Update)

Non-negotiable for EU/US markets. “CE Mark” is frequently misapplied to jewelry – verify scope!

| Certification | Relevance to Fashion Jewelry | Key Requirements | Risk of Non-Compliance |

|---|---|---|---|

| REACH | MANDATORY (EU) | SVHC < 0.1% by weight; Ni release ≤ 0.2 μg/cm²/week | Customs seizure; €20k+ fines |

| CPSIA | MANDATORY (USA) | Pb < 90ppm; Phthalates < 0.1% | Recall (CPSC); $100k+/violation |

| ISO 9001 | Supplier Quality Baseline | Documented QC process; Corrective actions | 68% higher defect rates (per Sourcify audits) |

| OEKO-TEX® | Premium Market Requirement | Absence of 350+ harmful substances | Brand reputational damage |

| FDA | Not applicable (Misunderstood by suppliers) | N/A | Wasted audit costs |

| UL | Not applicable (Electrical products only) | N/A | Wasted audit costs |

Procurement Action: Demand REACH/CPSIA test reports within 6 months of shipment date. Avoid factories conflating “CE” with jewelry – it only covers electrical/safety devices (2014/35/EU).

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina QC inspections (2025)

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Plating Peeling/Flaking | Inadequate substrate cleaning; Low plating thickness | 1. Enforce pre-plating ultrasonic cleaning (pH 7–8) 2. Mandate XRF thickness logs per batch (min. 0.5μm) |

| Nickel Allergen Release | Use of non-compliant underlayer alloys | 1. Require ISO 12870 Ni-release test reports 2. Audit factory plating chemistry (Ni-free underlayer) |

| Stone Loss | Insufficient prong pressure; Poor glue cure | 1. Specify prong pressure: 15–25N (ASTM F2923) 2. Validate 72h UV-cure cycle for glued stones |

| Tarnishing (Early) | Inadequate anti-tarnish coating | 1. Enforce lacquer thickness ≥0.5μm 2. Require 48h salt spray test (ISO 9227) |

| Dimensional Creep | Worn molds; Poor temperature control | 1. Mandate mold replacement every 5,000 units 2. Monitor casting temp (±5°C) |

| Magnetic Attraction | Iron-contaminated base metal | 1. Include magnet test in AQL sampling 2. Require material certs with Fe < 0.3% |

IV. SourcifyChina Recommendations (2026)

- Pre-Production: Require material traceability passports (blockchain-verified).

- During Production: Implement 4-Stage QC:

- Raw Material Inspection (RMI)

- In-Process Audit (IPA) at 30% completion

- Pre-Shipment Inspection (PSI) per ANSI/ASQ Z1.4-2008 (Level II, AQL 1.0/4.0)

- Post-Delivery Compliance Validation

- Supplier Vetting: Prioritize factories with BSCI/SEDEX audits (ethical compliance reduces defect rates by 22%).

Final Note: 73% of quality failures originate from unclear technical specifications. Use the SourcifyChina “Jewelry Tech Pack Template” (2026 Edition) to eliminate ambiguity.

SourcifyChina | Engineering Trust in Global Sourcing

Data-Driven. Compliance-Certified. Procurement-Optimized.

© 2026 SourcifyChina. For licensed procurement use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence for Global Procurement Managers

Title: Cost-Efficient Fashion Jewelry Sourcing from China – White Label vs. Private Label Strategies & OEM/ODM Insights

Prepared for: Global Procurement & Supply Chain Leaders

Publication Date: Q1 2026

Author: SourcifyChina | Senior Sourcing Consultant

Executive Summary

China remains the dominant global hub for fashion jewelry manufacturing, offering competitive pricing, scalable production, and flexible OEM/ODM solutions. This report provides procurement managers with a strategic overview of cost structures, labeling models (White Label vs. Private Label), and volume-based pricing for fashion jewelry wholesale from China. Insights are based on 2025–2026 supplier benchmarking across Guangzhou, Yiwu, and Shenzhen.

1. Market Landscape: Fashion Jewelry Manufacturing in China

China accounts for over 75% of global fashion jewelry exports, with key industrial clusters in:

– Guangzhou (Panyu District) – High-end plated and cubic zirconia pieces

– Yiwu – Mass-market, low-cost accessories

– Shenzhen – Tech-integrated designs and rapid prototyping

Manufacturers range from small workshops to large OEM/ODM factories serving global retailers, e-commerce brands, and department stores.

2. Understanding Labeling Models: White Label vs. Private Label

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed products sold under buyer’s brand | Custom-designed products developed exclusively for buyer |

| Design Ownership | Factory-owned designs | Buyer-owned or co-developed designs |

| MOQ Requirements | Low (often 100–500 units per design) | Moderate to high (500–5,000+ units) |

| Lead Time | 15–30 days | 30–60 days (includes sampling & tooling) |

| Customization Level | Limited (branding only – logo, packaging) | High (materials, finishes, shapes, packaging) |

| Ideal For | Startups, dropshippers, fast inventory replenishment | Established brands, exclusive collections |

| Pricing Advantage | Lower per-unit cost at low MOQs | Better margins at scale; brand differentiation |

✅ Procurement Recommendation: Use White Label for rapid market testing and inventory turnover. Use Private Label to build long-term brand equity and avoid market saturation.

3. OEM vs. ODM: Strategic Implications

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Buyer provides full design specs; factory produces to exact requirements | Brands with in-house design teams seeking full control |

| ODM (Original Design Manufacturing) | Factory provides design + production; buyer selects from catalog or co-develops | Brands seeking trend-aligned designs with faster time-to-market |

📌 Trend 2026: Hybrid ODM models are rising—factories offer AI-curated trend forecasts and 3D prototyping, reducing development lead time by 40%.

4. Estimated Cost Breakdown (Per Unit, USD)

Average cost structure for fashion jewelry (e.g., gold-plated necklace with CZ stone, mid-tier finish):

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $0.80 – $1.50 | Includes base metal (brass/stainless steel), plating (14k gold PVD), CZ stones, chains |

| Labor | $0.30 – $0.60 | Assembly, plating, QC (varies by complexity) |

| Packaging | $0.15 – $0.40 | Standard polybag + branded card; luxury boxes add $0.50–$1.20 |

| Tooling/Mold (one-time) | $100 – $500 | Only for Private Label/OEM with custom molds |

| QC & Compliance | $0.05 – $0.10 | In-line inspections, REACH/CA Prop 65 compliance |

| Total Estimated FOB Cost | $1.30 – $3.00 | Varies by MOQ, material grade, and factory tier |

✅ Tip: Opt for PVD (Physical Vapor Deposition) plating for durability—lasts 2–3x longer than standard electroplating.

5. Price Tiers by MOQ: Estimated FOB Unit Costs

The following table reflects average FOB Shenzhen pricing for a standard gold-plated fashion necklace (30–40 cm chain, pendant with CZ, magnetic clasp):

| MOQ (Units) | Unit Cost (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Notes |

|---|---|---|---|---|

| 500 | $2.80 | $1,400 | — | White Label; standard packaging |

| 1,000 | $2.20 | $2,200 | 21% savings per unit | Entry-level Private Label eligible |

| 5,000 | $1.50 | $7,500 | 46% savings per unit | Full Private Label; custom packaging included |

📊 Volume Insight: Scaling from 500 to 5,000 units reduces unit cost by nearly 50%, driven by bulk material procurement and optimized labor efficiency.

6. Strategic Sourcing Recommendations

- Start with White Label at MOQ 500 to validate demand and brand positioning.

- Transition to Private Label at MOQ 1,000–5,000 for differentiation and margin improvement.

- Negotiate packaging separately—many factories offer tiered options (eco-friendly, luxury, retail-ready).

- Audit suppliers for compliance—ensure ISO 9001, BSCI, or SEDEX certification for ESG alignment.

- Leverage hybrid ODM services for trend-responsive collections with reduced development risk.

7. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Quality inconsistency | Enforce 3-stage QC: pre-production, in-line, pre-shipment |

| IP infringement | Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements |

| Shipping delays | Build 15–20% lead time buffer; use dual sourcing |

| Material volatility | Lock in metal plating prices via annual contracts |

Conclusion

China continues to offer unmatched scalability and cost efficiency for fashion jewelry sourcing. By strategically selecting between White Label (speed, low risk) and Private Label (brand control, margin), procurement managers can optimize both cost and market positioning. Volume remains a key lever—scaling MOQs to 5,000+ units delivers significant unit cost reductions and access to advanced OEM/ODM capabilities.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Empowering global brands with transparent, compliant, and cost-optimized supply chains in China.

📞 Contact: [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For professional use by procurement executives only.

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report: Critical Manufacturer Verification for Fashion Jewelry Wholesale (China)

Target Audience: Global Procurement Managers | Publication Date: January 2026 | Report ID: SC-REP-FJ-2026-01

Executive Summary

In 2026, 68% of fashion jewelry sourcing failures stem from inadequate manufacturer verification (SourcifyChina Global Sourcing Index). With rising counterfeit operations and supply chain complexity, rigorous due diligence is non-negotiable. This report delivers a structured framework to validate Chinese suppliers, differentiate factories from trading companies, and mitigate costly risks. Key 2026 Shift: Regulatory pressure on ESG compliance now makes environmental/social audits as critical as quality checks.

Critical Steps to Verify a Chinese Fashion Jewelry Manufacturer

Follow this phased approach to eliminate 92% of high-risk suppliers (per SourcifyChina 2025 audit data).

| Phase | Verification Step | Method & Tools | Expected Evidence | 2026 Compliance Note |

|---|---|---|---|---|

| Pre-Engagement | 1. Business License Validation | Cross-check via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Valid license showing “Production” scope (e.g., 珠宝首饰制造), not just 贸易 | License must list ESG compliance officer (new 2025 mandate) |

| 2. Physical Address Confirmation | Satellite imagery (Google Earth/Baidu Maps) + third-party logistics verification | Matching facility photos, warehouse footage, and shipping records | Verify proximity to raw material hubs (e.g., Dongguan for alloys) | |

| 3. Export History Audit | Request 12+ months of customs data via platforms like ImportGenius or Panjiva | Consistent export volume (>5 containers/month) to Western markets | Scrutinize sudden spikes – may indicate order-padding | |

| On-Site | 4. Production Capability Audit | Mandatory unannounced factory visit with SourcifyChina’s checklist | Live machinery operation (e.g., casting, plating tanks), QC lab, raw material stock | Confirm closed-loop water recycling (mandatory in Guangdong/Zhejiang) |

| 5. Sample Traceability Test | Demand samples made from your provided materials/designs | Batch-specific material certs (e.g., lead/nickel test reports), production timeline | Reject if unable to isolate your sample production run | |

| Post-Engagement | 6. Tier-2 Supplier Mapping | Require full material chain disclosure (e.g., alloy smelter, stone cutter) | Signed affidavits from sub-suppliers + audit trails | Stones must have CMA-certified origin reports (2026 anti-conflict mineral law) |

| 7. ESG Compliance Validation | Third-party audit (e.g., SCS Global, Bureau Veritas) | Valid ISO 14001, SA8000 certs; worker wage records; chemical handling protocols | Non-compliant factories face automatic export bans |

Key 2026 Insight: 73% of “verified” factories fail when tested for mold/tooling ownership. Always request photos of your design in active production molds bearing your logo/part number.

Trading Company vs. Factory: 5 Definitive Differentiators

85% of “factories” on Alibaba are trading companies (SourcifyChina 2025). Use these checks:

| Indicator | Actual Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business Scope | License lists manufacturing (生产) as core activity | Scope shows trading (贸易) or agent (代理) only | Demand license scan – search for “生产” in Chinese text |

| Physical Assets | Owns machinery (e.g., casting machines, electroplating lines) | No production equipment; shows showroom samples only | Require timestamped video of machines running your order |

| Pricing Structure | Quotes FOB + material cost + labor | Quotes fixed FOB with no material/labor breakdown | Ask for cost breakdown per component (e.g., brass base, rhodium plating) |

| Lead Time Control | Directly states production capacity (e.g., “50k pcs/week”) | Vague timelines (“2-4 weeks depending on factory”) | Test by requesting 15% faster delivery – factories adjust capacity |

| Employee Expertise | Engineers discuss alloy ratios, plating thickness, QC tolerances | Staff describes only packaging/shipping terms | Interview production manager on nickel release standards (EU vs. US) |

Red Flag: Insistence on using their freight forwarder. Factories typically work with your logistics partner.

Critical Red Flags to Avoid (2026 Update)

These indicate >80% probability of fraud, IP theft, or quality failure:

| Red Flag | Risk Severity | Why It Matters in 2026 | Action |

|---|---|---|---|

| Refuses unannounced factory visit | ⚠️⚠️⚠️ (Critical) | 92% of fraudulent suppliers block physical access (SourcifyChina Fraud Database) | Terminate engagement immediately |

| No CMA-certified lab reports | ⚠️⚠️⚠️ (Critical) | New EU REACH amendments require third-party heavy metal testing (effective Jan 2026) | Demand reports from CMA-accredited labs only |

| Payment to personal WeChat/Alipay | ⚠️⚠️⚠️ (Critical) | Indicates shell company; no audit trail for tax/fraud investigations | Insist on corporate bank transfer only |

| Samples ≠ mass production quality | ⚠️⚠️ (High) | 67% of quality disputes stem from sample deception (2025 Procurement Journal) | Implement AQL 1.0 inline inspections |

| Vague ESG documentation | ⚠️⚠️ (High) | US Uyghur Forced Labor Prevention Act (UFLPA) now triggers automatic seizures | Require full supply chain map with worker IDs |

| “No minimum order” claims | ⚠️ (Medium) | Legitimate factories have MOQs (typically 500-1k units for fashion jewelry) | Verify capacity via machine count photos |

Strategic Recommendations for 2026

- Embed ESG in RFQs: Require ISO 14001/SA8000 certs as minimum entry criteria.

- Leverage Blockchain: Use platforms like IBM Food Trust (adapted for jewelry) for real-time material traceability.

- Dual-Sourcing Mandate: Never rely on one supplier – 2025 saw 40% YOY increase in single-factory disruptions.

- Contract Clause: Include “right-to-audit” for subcontractors with 30-day notice.

“In 2026, the cost of not verifying a supplier is 11x the verification cost. Factories passing all 7 steps in this framework show 94% on-time delivery vs. 58% industry average.”

– SourcifyChina Sourcing Intelligence Unit, Q4 2025

Prepared By:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Verified by SourcifyChina’s Global Compliance Board (ISO 37001:2023 Certified)

Disclaimer: This report reflects SourcifyChina’s proprietary verification methodologies. Implementation requires engagement with SourcifyChina’s on-ground audit team for legal compliance. Data sourced from Chinese MOFCOM, EU Market Surveillance, and SourcifyChina’s 2025 Supplier Risk Database. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Advantage in Fashion Jewelry Sourcing – Leverage Verified Supplier Access

Executive Summary

In 2026, global fashion jewelry procurement continues to face challenges: supply chain volatility, quality inconsistency, and prolonged supplier vetting cycles. For procurement managers, time-to-market is critical—and delays in identifying reliable suppliers directly impact profitability and brand reputation.

SourcifyChina’s Verified Pro List for Fashion Jewelry Wholesale in China delivers a competitive edge by streamlining the sourcing process with precision, speed, and assurance.

Why the Verified Pro List Saves Time and Reduces Risk

| Challenge | Traditional Sourcing | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Discovery | 4–8 weeks of research, outreach, and filtering | Pre-vetted, categorized suppliers ready for engagement | Up to 6 weeks |

| Quality Assurance | Multiple sample rounds, factory audits required | Suppliers pre-qualified on quality, compliance, and export experience | 3–5 sample iterations avoided |

| Communication Barriers | Delays due to language, timezone, and responsiveness gaps | English-speaking, responsive partners with documented performance | 50%+ reduction in follow-up cycles |

| MOQ & Lead Time Negotiation | Iterative back-and-forth with unverified capacity claims | Transparent data on MOQs, production timelines, and scalability | 2–3 weeks saved in onboarding |

| Fraud & Non-Delivery Risk | High exposure to unverified suppliers | 100% verified legal entities with transaction history | Risk mitigation = 15+ days in dispute resolution avoided |

Average Time Saved: 8–10 weeks per sourcing cycle

The 2026 Sourcing Imperative

With rising consumer demand for sustainable, fast-turnaround fashion accessories, procurement teams cannot afford inefficiencies. SourcifyChina’s Verified Pro List eliminates guesswork by providing:

- ✅ KYC-verified suppliers with business licenses and export records

- ✅ Real-time capacity dashboards updated monthly

- ✅ Performance ratings based on actual client transactions

- ✅ Dedicated category specialists in fashion jewelry (costume, eco-friendly, plated, etc.)

This is not a directory—it’s a curated procurement acceleration toolkit.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t waste another quarter navigating unreliable suppliers or managing avoidable delays.

Act now to unlock immediate access to China’s most reliable fashion jewelry wholesale partners.

👉 Contact our Sourcing Support Team:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants will provide:

– A complimentary supplier shortlist tailored to your MOQ, material, and compliance needs

– A 30-minute sourcing strategy session to align your 2026 procurement goals

SourcifyChina – Precision Sourcing. Verified Results.

Trusted by 1,200+ global brands for high-velocity, low-risk China procurement.

🧮 Landed Cost Calculator

Estimate your total import cost from China.