The global fasteners market is experiencing robust expansion, driven by rising demand across automotive, aerospace, construction, and industrial manufacturing sectors. According to a report by Mordor Intelligence, the fasteners market was valued at USD 104.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5.8% from 2024 to 2029. Similarly, Grand View Research estimates that the market size reached USD 108.7 billion in 2022 and anticipates a CAGR of 6.3% from 2023 to 2030, fueled by increasing infrastructure development and advanced manufacturing technologies. With Asia-Pacific dominating production and consumption—particularly in China and India—the competitive landscape has intensified, giving rise to key players who combine innovation, scale, and quality assurance. As industries prioritize lightweight materials, corrosion resistance, and precision engineering, the world’s leading fasteners manufacturers are poised to shape the future of secure and reliable assembly solutions. Here’s a look at the top 10 fasteners manufacturers leading this evolution.

Top 10 Faseners Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Fasteners Institute

Domain Est. 2001

Website: indfast.org

Key Highlights: The Industrial Fasteners Institute, known as the IFI, is a trade association representing manufacturers of mechanical fasteners and formed parts produced in ……

#2 Fastener Supplier for OEM, Distributors, and Industrial Applications

Domain Est. 2021

Website: gobigbolt.com

Key Highlights: We are a specialty fastener supply company equipped to handle rush manufacturing to meet your schedule. We can work 24/7 to ensure your deadlines are met….

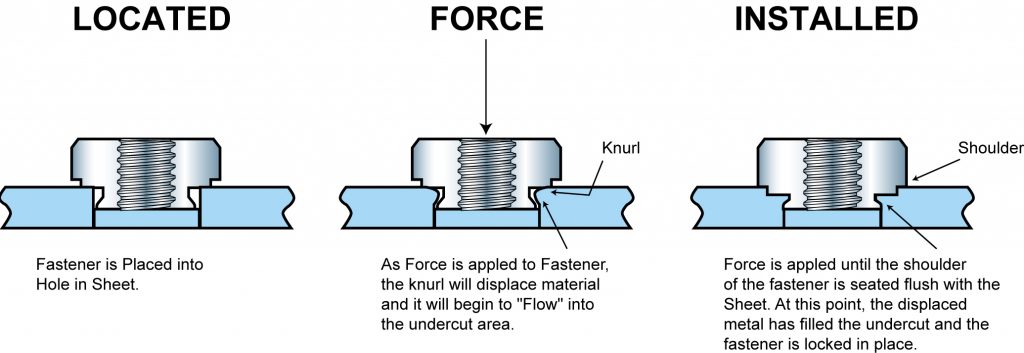

#3 Self-Clinching Fasteners

Domain Est. 1996

Website: captive-fastener.com

Key Highlights: Find the high-quality self-clinching fasteners you need. We manufacture a wide range of SC fasteners, for all your fastener needs. Find out more today….

#4 Custom Fasteners Manufacturer

Domain Est. 1999

Website: nationalbolt.com

Key Highlights: National Bolt and Nut Corporation is a ISO Certified Nationwide custom fasteners manufacturer of nuts, washers, bolts and fasteners. Contact us today!…

#5 Midwest Fastener

Domain Est. 2000

Website: fastenerconnection.com

Key Highlights: Midwest Fastener is a fastener supplier and fastener manufacturer offering construction fasteners, drywall screws, and much, much more….

#6 Fastener Manufacturers

Domain Est. 2015

Website: fastenermanufacturers.org

Key Highlights: Quickly find fastener manufacturers on this site. They make their high quality fasteners right here in the USA, and offer affordably priced parts, ……

#7 PEM – PennEngineering

Domain Est. 1996

Website: pemnet.com

Key Highlights: PEM offers innovative fastening solutions for a variety of applications across industries like Automotive Electronics, Consumer Electronics, Datacom and more….

#8 Reliable Wholesale Fastener Distributors

Domain Est. 1997

Website: intercorpusa.com

Key Highlights: For over 37 years, Intercorp has been a trusted wholesale fastener distributor, serving a diverse network of distributors from our 9 locations across the U.S. ……

#9 Global Fastener Platform

Domain Est. 2010

Website: globalfastener.com

Key Highlights: MS Precision: Experts in High-Precision Component Manufacturing. MS Precision Pte Ltd, a Singapore-based supplier of hardware fasteners, specializes in high- ……

#10 ITW fasteners

Domain Est. 2014

Website: itw-fasteners.com

Key Highlights: ITW Global Fasteners hold cars together. We develop, produce and market intelligent and innovative fastening solutions for the automotive industry….

Expert Sourcing Insights for Faseners

H2: Market Trends for Fasteners in 2026

As the global industrial landscape evolves, the fastener market is poised for significant transformation through 2026. Driven by advancements in manufacturing, shifts in supply chain dynamics, and increasing demand from high-growth sectors, the fastener industry is adapting to meet emerging challenges and opportunities. Below is an analysis of key market trends expected to shape the fastener industry in 2026.

1. Rising Demand from Electric Vehicles (EVs) and Automotive Lightweighting

The automotive sector remains a major consumer of fasteners, but the shift toward electric vehicles is reshaping demand. By 2026, EV production is expected to account for over 30% of global vehicle output, driving the need for specialized fasteners that are lighter, corrosion-resistant, and capable of withstanding unique thermal and electrical conditions. Aluminum and high-strength steel fasteners, along with non-metallic composite fasteners, are gaining traction to support vehicle lightweighting and improved energy efficiency.

2. Growth in Renewable Energy Infrastructure

The expansion of wind, solar, and energy storage projects is fueling fastener demand in construction and heavy equipment. Offshore wind farms, in particular, require high-performance, corrosion-resistant fasteners made from stainless steel or duplex alloys. With governments accelerating renewable energy targets, the construction and energy sectors will represent a key growth vector for industrial fasteners through 2026.

3. Automation and Smart Manufacturing Integration

Industry 4.0 technologies are transforming fastener production and application. By 2026, smart factories will increasingly use automated assembly lines equipped with precision robotic systems that rely on standardized, high-tolerance fasteners. Additionally, the integration of digital twins and predictive maintenance is driving demand for smart fasteners embedded with sensors to monitor stress, torque, and structural integrity in real time—especially in aerospace and defense applications.

4. Supply Chain Resilience and Regionalization

Ongoing geopolitical tensions and lessons from recent global disruptions have led manufacturers to prioritize supply chain localization. By 2026, nearshoring and regional production hubs—particularly in North America, Southeast Asia, and Eastern Europe—are expected to reduce dependency on single-source suppliers. This shift supports the growth of regional fastener producers and encourages investment in localized R&D and manufacturing capabilities.

5. Sustainability and Circular Economy Pressures

Environmental regulations and corporate ESG (Environmental, Social, and Governance) goals are pushing the fastener industry toward sustainable practices. By 2026, manufacturers are expected to increase the use of recycled materials, adopt low-carbon production methods, and design for disassembly and reusability. Water-based coatings and non-toxic surface treatments will become standard to meet tightening environmental standards, especially in the EU and North America.

6. Advanced Materials and Coatings Innovation

Material science advancements are enabling the development of next-generation fasteners with improved strength-to-weight ratios, heat resistance, and durability. Titanium, magnesium alloys, and engineered polymers are gaining ground in aerospace and high-performance applications. Additionally, innovations in anti-corrosion coatings—such as nano-ceramic and graphene-enhanced finishes—are extending product lifecycles and reducing maintenance costs.

7. Digitalization of Distribution and E-Commerce Expansion

B2B e-commerce platforms are transforming how fasteners are sourced. By 2026, digital marketplaces and integrated inventory management systems will dominate procurement, especially for MRO (Maintenance, Repair, and Operations) sectors. AI-driven demand forecasting and just-in-time delivery models will enhance efficiency, reduce inventory costs, and improve customer responsiveness.

Conclusion

By 2026, the global fastener market will be defined by innovation, sustainability, and digital transformation. Growth will be concentrated in high-tech industries such as EVs, renewable energy, and aerospace, while traditional sectors continue to modernize. Companies that invest in advanced materials, automation, and resilient supply chains will be best positioned to capitalize on these evolving trends.

Common Pitfalls Sourcing Fasteners (Quality, IP)

Sourcing fasteners—especially from low-cost manufacturing regions—can present significant risks if not managed carefully. Two of the most critical areas where companies encounter problems are quality inconsistencies and intellectual property (IP) infringement. Being aware of these pitfalls is essential to maintaining product integrity, safety, and legal compliance.

Quality Inconsistencies

One of the most frequent challenges in fastener sourcing is ensuring consistent quality across production batches. Poor quality can lead to product failures, safety hazards, and costly recalls.

- Non-Compliance with Standards: Many suppliers claim adherence to international standards (e.g., ISO, ASTM, DIN), but actual products may fall short. Variations in material composition, tensile strength, or thread accuracy are common.

- Inadequate Testing and Certification: Some suppliers provide falsified or incomplete test reports. Without third-party verification, it’s difficult to confirm mechanical properties or corrosion resistance.

- Material Substitution: To reduce costs, suppliers may use inferior-grade materials (e.g., substituting stainless steel 304 with 201) without disclosure, affecting durability and performance.

- Poor Process Control: Lack of robust quality management systems (e.g., ISO 9001) can result in inconsistent heat treatment, surface finishing, or dimensional tolerances.

Mitigation strategies include conducting on-site audits, requiring material certifications, performing independent lab testing, and establishing clear quality control protocols in supply contracts.

Intellectual Property (IP) Infringement

Fasteners may seem like commodity items, but many are protected by patents, trademarks, or technical specifications. Sourcing from unreliable suppliers increases the risk of IP violations.

- Counterfeit or Copycat Products: Some manufacturers produce fasteners that mimic patented designs (e.g., specialized locking mechanisms, thread profiles) without authorization, exposing buyers to legal liability.

- Unauthorized Use of Brand Names: Suppliers may falsely label fasteners with well-known brand marks (e.g., Huck, Nord-Lock), leading to trademark infringement claims.

- Reverse Engineering Without Licensing: Even if a fastener appears generic, replicating a patented design—even through reverse engineering—can constitute IP theft if done without permission.

- Lack of IP Clauses in Contracts: Absence of clear IP ownership and liability terms in procurement agreements can leave buyers vulnerable in case of disputes.

To reduce IP risks, conduct IP due diligence, work only with reputable suppliers, include IP warranties in contracts, and consult legal experts when sourcing technically specialized or proprietary fasteners.

By proactively addressing quality and IP concerns, businesses can avoid costly disruptions and protect their reputation and legal standing in global markets.

Logistics & Compliance Guide for Fasteners

Navigating the logistics and compliance requirements for fasteners is essential to ensure smooth international trade, avoid delays, and maintain regulatory adherence. This guide outlines key considerations for manufacturers, distributors, and importers/exporters of fasteners.

Classification & Harmonized System (HS) Codes

Accurate product classification under the Harmonized System (HS) is fundamental for customs clearance and determining applicable duties and taxes. Fasteners are typically classified under:

- 7318: Steel screws, bolts, nuts, washers, and similar threaded fasteners.

- 7318.15: Wood screws.

- 7318.16: Self-tapping screws.

- 7318.19: Other screws and bolts, whether or not with nuts or washers.

- 7318.21: Nuts.

- 7318.22: Washers and similar articles.

Ensure precise classification by considering material composition, dimensions, threading type, and intended use. Misclassification can lead to customs penalties and shipment delays.

Export Controls & Restrictions

Certain fasteners may be subject to export control regulations, especially if they are used in defense, aerospace, or high-tech applications.

- EAR (Export Administration Regulations): Administered by the U.S. Department of Commerce, check if fasteners fall under the Commerce Control List (CCL). Items with military or dual-use applications may require export licenses.

- ITAR (International Traffic in Arms Regulations): Fasteners used in defense articles may require registration and licensing under the U.S. State Department.

- Sanctions & Embargoes: Verify that destination countries are not subject to trade sanctions (e.g., via OFAC lists).

Always conduct a classification review and consult with legal or compliance experts when exporting to sensitive regions.

Packaging & Labeling Requirements

Proper packaging and labeling are critical for protecting fasteners and ensuring regulatory compliance.

- Packaging: Use durable, moisture-resistant materials to prevent corrosion. Bulk packaging should prevent shifting during transport; retail packaging must meet safety standards.

- Labeling: Include:

- Product description and specifications (e.g., size, grade, material)

- HS code

- Country of origin

- Manufacturer/importer details

- Compliance marks (e.g., CE, RoHS, REACH where applicable)

- Barcodes and batch/lot numbers for traceability

Ensure labels are legible, multilingual (if required), and affixed securely.

Import Regulations & Duties

Importers must comply with destination country regulations.

- Customs Documentation: Prepare commercial invoices, packing lists, bills of lading/air waybills, and certificates of origin.

- Duty Rates: Vary by country and HS code. Leverage free trade agreements (e.g., USMCA, EU agreements) where applicable to reduce tariffs.

- Origin Rules: Fasteners must meet regional value content or tariff shift rules to qualify for preferential treatment.

Verify local requirements with customs brokers or trade authorities in the importing country.

Product Compliance & Standards

Fasteners must meet technical and safety standards in target markets.

- ISO Standards: ISO 898 (mechanical properties), ISO 3269 (acceptance inspection), ISO 4042 (hexagon products) are widely recognized.

- ASTM/SAE: Common in North America (e.g., ASTM A307, SAE J429).

- CE Marking (EU): Required for fasteners sold in the European Economic Area. Indicates conformity with health, safety, and environmental protection standards.

- RoHS & REACH (EU): Restrict hazardous substances and require chemical registration. Ensure fasteners are free of restricted substances like lead, cadmium, and certain phthalates.

- UKCA Marking: Required for the UK market post-Brexit.

Maintain test reports, declarations of conformity, and technical documentation.

Transportation & Logistics Best Practices

Efficient logistics reduce costs and delivery times.

- Mode of Transport: Choose between air (fast, expensive), ocean (cost-effective, slower), or land (regional).

- Incoterms: Clearly define responsibilities using standard trade terms (e.g., FOB, CIF, DDP).

- Inventory Management: Use lot tracking and FIFO (first in, first out) to manage shelf life and recalls.

- Cold Chain (if applicable): For coated or specialty fasteners sensitive to temperature.

Partner with experienced freight forwarders familiar with hardware shipments.

Environmental & Sustainability Compliance

Increasing focus on sustainability impacts fastener logistics.

- WEEE & Battery Directives: May apply if fasteners are part of electronic assemblies.

- Carbon Footprint Reporting: Some customers or regions require emissions data for transportation and manufacturing.

- Recyclability: Promote use of recyclable materials and packaging.

Adopt eco-friendly practices to meet corporate and regulatory expectations.

Recordkeeping & Audits

Maintain comprehensive records for at least 5–7 years, including:

- Export/import documentation

- Certificates of compliance

- Test reports

- License applications

- Audit trails

Regular internal audits help identify and correct compliance gaps proactively.

Conclusion

Compliance in fastener logistics involves meticulous attention to classification, regulations, standards, and documentation. By implementing robust procedures and staying informed on global trade developments, businesses can ensure reliable supply chains and avoid costly disruptions.

Conclusion on Sourcing Fasteners:

Sourcing fasteners effectively requires a strategic approach that balances cost, quality, lead time, and supplier reliability. Given the critical role fasteners play in manufacturing, construction, and engineering applications, selecting the right fastener type—whether bolts, nuts, screws, or specialized components—must align with technical specifications, industry standards (such as ISO, ASTM, or DIN), and environmental requirements.

Key takeaways include the importance of partnering with reputable suppliers who offer consistent quality, material traceability, and compliance with regulatory standards. Evaluating total cost of ownership—beyond unit price—to include logistics, inventory management, and potential failure risks is crucial. Additionally, global sourcing can offer cost advantages but may introduce supply chain vulnerabilities; thus, diversifying suppliers and maintaining strong supplier relationships enhance resilience.

In conclusion, a well-structured fastener sourcing strategy supports operational efficiency, product integrity, and long-term cost savings. Continuous supplier evaluation, investment in supply chain visibility, and staying updated on material and manufacturing innovations will ensure a robust and reliable fastening solution for any industry.