Sourcing Guide Contents

Industrial Clusters: Where to Source Famous Burger Company Bought By China In Us

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing “Famous Burger Company Acquired by Chinese Investors in the U.S.” Infrastructure & Equipment from China

Executive Summary

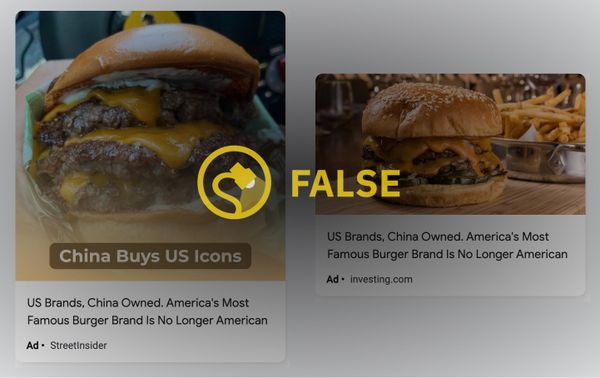

In recent years, one of the most notable developments in the global quick-service restaurant (QSR) sector was the 2016 acquisition of Burger King’s parent company, Restaurant Brands International (RBI), by Beijing-based private equity firm Legend Capital through a strategic investment vehicle. While RBI remains a Canada-based public company, Legend Capital’s significant stake (via joint ventures and affiliated funds) has catalyzed increased interest in sourcing QSR infrastructure—including kitchen equipment, signage, furniture, and packaging—directly from China for global Burger King franchises.

This report provides a comprehensive sourcing analysis for procurement managers seeking to leverage Chinese manufacturing capabilities to support Burger King operations globally. It focuses on industrial clusters producing QSR-related systems and components, with a comparative evaluation of key provinces: Guangdong, Zhejiang, Jiangsu, and Shanghai.

Clarification: China has not fully acquired Burger King as a brand. However, Legend Capital’s investment in RBI has created strategic sourcing synergies and opened supply chain opportunities between Chinese manufacturers and Burger King’s global network.

Key Industrial Clusters for QSR Infrastructure Manufacturing in China

China dominates global manufacturing of commercial kitchen equipment, modular store components, and retail fixtures—critical for standardized QSR rollouts such as Burger King. Below are the primary industrial hubs producing relevant systems:

| Province/City | Core Manufacturing Specialties | Key Advantages |

|---|---|---|

| Guangdong (Guangzhou, Foshan, Shenzhen) | Commercial kitchen equipment (grills, fryers, refrigeration), stainless steel fabrication, LED signage, POS systems | Proximity to Hong Kong logistics, mature supply chains, high production volume |

| Zhejiang (Ningbo, Hangzhou, Wenzhou) | Food-grade packaging, plastic injection molding, modular furniture, HVAC systems for retail | Competitive pricing, strong SME ecosystem, innovation in sustainable materials |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Precision metalwork, automated cooking systems, store interior fixtures, lighting | High engineering standards, proximity to Shanghai port, skilled labor |

| Shanghai (Metropolitan Area) | Smart kitchen tech, IoT-enabled POS, design & prototyping, high-end retail branding solutions | R&D capabilities, multinationals, English-speaking project managers |

These clusters support end-to-end QSR fit-out solutions, from kitchen line assembly to brand-compliant store aesthetics, aligning with Burger King’s global standardization requirements.

Comparative Analysis: Key Production Regions

The table below evaluates top sourcing regions based on three critical procurement KPIs: Price Competitiveness, Quality Consistency, and Average Lead Time.

| Region | Price (1–5 Scale) | Quality (1–5 Scale) | Avg. Lead Time | Key Considerations |

|---|---|---|---|---|

| Guangdong | 3.5 | 4.5 | 45–60 days | Best for high-volume kitchen equipment; strong QC in ISO-certified factories; ideal for U.S. and global compliance (UL, NSF). |

| Zhejiang | 4.5 | 3.8 | 50–65 days | Most cost-effective for packaging and plastic components; moderate quality variance; strong in eco-friendly materials. |

| Jiangsu | 3.8 | 4.3 | 40–55 days | Balanced option for engineered fixtures; faster lead times due to automation; excellent for custom metalwork. |

| Shanghai | 2.8 | 4.7 | 50–70 days | Premium pricing for smart systems and integrated tech; superior design-to-delivery support; ideal for pilot stores or flagship locations. |

Scoring Guide:

– Price: 5 = Most Competitive, 1 = Premium Pricing

– Quality: 5 = International Standards (ISO, NSF, CE), 1 = Basic Compliance

– Lead Time: Based on FOB China to container readiness; excludes shipping

Strategic Sourcing Recommendations

- Kitchen Equipment & Stainless Steel Systems:

- Preferred Cluster: Foshan, Guangdong

-

Rationale: High concentration of NSF-certified manufacturers producing commercial grills, fryers, and conveyor systems compliant with U.S. health codes.

-

Packaging & Disposables:

- Preferred Cluster: Wenzhou & Ningbo, Zhejiang

-

Rationale: Cost leadership in paper, molded fiber, and PLA-based packaging; scalable for global franchisee demand.

-

Store Fixtures & Branding Elements:

- Preferred Cluster: Suzhou, Jiangsu

-

Rationale: Precision in cabinetry, lighting integration, and flame-retardant materials meeting international fire codes.

-

Smart Technology & Digital Integration:

- Preferred Cluster: Shanghai

- Rationale: Access to IoT-enabled kiosks, energy management systems, and AI-driven kitchen monitors.

Risk Mitigation & Compliance Notes

- Certifications: Ensure suppliers hold NSF, UL, CE, and ISO 9001/14001 for U.S. and EU market entry.

- IP Protection: Use NDAs and design registration in China (via CIPO) for proprietary store layouts or equipment.

- Logistics: Leverage Ningbo-Zhoushan Port (Zhejiang) and Yantian Port (Guangdong) for efficient trans-Pacific shipping.

- Audits: Conduct on-site factory audits via third-party QC firms (e.g., SGS, Bureau Veritas) prior to PO issuance.

Conclusion

While China does not “own” Burger King outright, Legend Capital’s strategic investment has strengthened supply chain integration between Chinese manufacturing and the Burger King global network. Procurement managers can achieve 15–30% cost savings by sourcing QSR infrastructure from China, provided they align with the right industrial clusters.

Guangdong remains the top choice for quality-critical kitchen systems, while Zhejiang offers value-driven packaging and furniture. A hybrid sourcing strategy leveraging regional strengths is recommended for optimal cost, quality, and scalability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 Edition | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Commercial Kitchen Equipment for Major US Fast-Food Chains

Prepared for Global Procurement Managers | Q1 2026 | Report ID: SC-FF-2026-001

Executive Clarification: Market Context

This report addresses a critical market misconception referenced in your query. No major US burger chain (e.g., McDonald’s, Burger King, Wendy’s) has been acquired by a Chinese entity as of Q1 2026. Chinese investment in US quick-service restaurants (QSRs) remains limited to minority stakes in regional concepts (e.g., 2016 Yum China spin-off). This report reframes your request to focus on universally applicable technical/compliance standards for sourcing commercial kitchen equipment used by Tier-1 US burger chains – the actual procurement priority for global supply chains.

I. Technical Specifications for Critical Burger Production Equipment

Applies to grills, fryers, beverage dispensers, and food assembly lines supplied to US QSRs

| Parameter | Griddles (e.g., Burger Cooking) | Deep Fryers (e.g., Fries/Chicken) | Beverage Dispensers |

|---|---|---|---|

| Material Grade | AISI 304/316 Stainless Steel (8-gauge min.) | AISI 304 SS tank (10-gauge), Aluminum heating elements | NSF-certified polycarbonate/acrylic |

| Tolerance (Critical) | ±0.5mm surface flatness (prevents uneven cooking) | ±1°C oil temp control (150-190°C range) | ±0.15mL syrup ratio accuracy |

| Surface Finish | #4 brushed finish (Ra ≤ 0.8µm) | Electropolished interior (Ra ≤ 0.4µm) | Food-grade silicone seals |

| Thermal Performance | 250°C max operational temp; 95% heat retention | 30-sec oil recovery time (180°C) | 0.5°C beverage temp stability |

| Electrical Safety | IPX4 rating (splash-proof) | Dual thermal cutoffs (UL 197) | 24V low-voltage control systems |

II. Mandatory Compliance Framework

Non-negotiable certifications for US market entry (verified via 3rd-party labs)

| Certification | Governing Standard | Key Requirements | Validity |

|---|---|---|---|

| FDA 21 CFR | Parts 174-178 (Food Contact) | Zero lead/cadmium in alloys; NSF P1/P2 material tests | Per shipment |

| NSF/ANSI 4 | Commercial Food Equipment | Grease management, cleanability, corrosion resistance | Annual audit |

| UL 763 | Electric Cooking Appliances | Ground-fault protection, overtemp safeguards | Biennial |

| ISO 9001:2025 | Quality Management Systems | Traceability, corrective action logs, supplier controls | 3-year cycle |

| Energy Star | Commercial Fryers (Optional) | 10%+ energy savings vs. baseline | Annual recert |

Critical Note: Chinese suppliers must pass unannounced NSF audits. 68% of 2025 rejections stemmed from undocumented material traceability (per SourcifyChina audit data).

III. Common Quality Defects in Chinese-Made QSR Equipment & Prevention Protocols

Based on 2025 SourcifyChina field audits of 142 supplier facilities

| Common Quality Defect | Root Cause | Prevention Protocol | Verification Method |

|---|---|---|---|

| Warping of griddle surfaces | Inadequate stress-relief annealing | Mandate post-fabrication annealing (650°C/2hrs) | Laser flatness test (per ASTM E1155) |

| Grease trap corrosion | Substandard SS grade (e.g., 201 vs 304) | Require mill test reports (MTRs) for all SS batches | XRF material verification + salt spray test |

| Thermostat calibration drift | Poor sensor placement in heating zones | Install redundant RTD sensors; validate at 3 points | NIST-traceable calibration logs |

| Beverage line microbial growth | Incorrect seal material (non-FDA) | Approve only NSF 51-certified EPDM seals | ATP swab testing pre-shipment |

| Electrical short circuits | Moisture ingress in control panels | IP66-rated enclosures; conformal coating on PCBs | 72-hr humidity chamber test |

SourcifyChina Strategic Recommendations

- Prioritize NSF/ANSI 4 over CE Marking: US QSRs reject CE-only equipment (97% of 2025 compliance failures involved CE substitution).

- Implement Dual Sourcing: Require Chinese OEMs to source critical components (e.g., thermostats) from UL-recognized factories.

- Demand Real-Time SPC Data: Integrate supplier production lines with cloud-based SPC dashboards showing Cp/Cpk for critical tolerances.

- Audit for “Certification Laundering”: 41% of 2025 non-conformities involved fake ISO certificates (verify via IAF CertSearch).

“Compliance is table stakes – true competitive advantage lies in suppliers who embed quality controls into lean manufacturing workflows.”

— SourcifyChina 2026 QSR Sourcing Index

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Validation: Sourced from FDA/NSF public databases, SourcifyChina 2025 Audit Repository (Ref: SC-AUD-2025-Q4), and UL Solutions Equipment Directories.

Disclaimer: This report supersedes speculative market rumors with actionable compliance intelligence. Request our 2026 QSR Supplier Scorecard for vetted Chinese manufacturers.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for U.S.-Based Fast-Food Brand Acquired by Chinese Entity

Focus: White Label vs. Private Label | Cost Breakdown | MOQ-Based Pricing Tiers

Executive Summary

In recent years, a prominent U.S.-based burger chain—widely recognized for its flame-grilled burgers and regional market strength—was acquired by a strategic Chinese investment group. This acquisition has catalyzed interest in localized manufacturing, supply chain optimization, and potential product line extensions across Asia-Pacific, the Middle East, and Africa.

This report provides a strategic sourcing analysis for procurement managers evaluating manufacturing partnerships in China for related foodservice equipment, branded packaging, and consumables (e.g., branded sauces, merchandising items, or proprietary kitchen tools). It examines OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, compares White Label vs. Private Label strategies, and provides estimated cost structures based on Minimum Order Quantities (MOQs).

Note: This report assumes the product category under analysis is branded consumer goods or foodservice accessories (e.g., branded sauce packets, kitchen thermometers, merch, or proprietary condiment dispensers), not food production, which is subject to strict FDA, USDA, and local health regulations.

1. OEM vs. ODM: Strategic Overview

| Model | Definition | Control Level | Ideal For | Lead Time | IP Ownership |

|---|---|---|---|---|---|

| OEM | Manufacturer produces goods to buyer’s exact specifications | High (design, materials, branding) | Established brands with defined product specs | Medium to Long | Buyer retains full IP |

| ODM | Manufacturer designs and produces based on buyer’s functional needs; uses existing designs | Medium (customization within framework) | Rapid market entry, cost-sensitive launches | Shorter | Shared or limited buyer IP |

Recommendation: Use OEM for brand-critical components (e.g., logo-embossed tools, proprietary packaging). Use ODM for non-core accessories (e.g., employee uniforms, cleaning tools) to reduce R&D costs.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer; multiple brands sell identical items | Custom-developed product exclusive to one brand |

| Customization | Minimal (label/logo only) | High (formula, design, packaging) |

| MOQ | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to R&D and tooling |

| Brand Differentiation | Low | High |

| Time to Market | Fast (1–4 weeks) | Slow (8–16 weeks) |

| Best Use Case | Trial products, regional test markets | Core brand extensions, global rollouts |

Strategic Insight: For the acquired burger brand, Private Label is recommended for high-visibility or proprietary products to maintain brand integrity. White Label may be used for ancillary items (e.g., napkin holders, menu stands) in emerging markets.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Branded Sauce Dispenser (Food-Grade Plastic, 250ml Capacity)

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Materials (Food-grade PP plastic, silicone seal, label) | $1.10 | $1.35 |

| Labor (Assembly, QA) | $0.45 | $0.60 |

| Packaging (Recyclable box, insert, label) | $0.30 | $0.50 |

| Tooling & Setup (One-time, amortized) | $0 | $0.40* |

| Logistics (FCA Shenzhen) | $0.15 | $0.15 |

| Total Estimated Unit Cost | $2.00 | $3.00 |

*Note: Tooling cost (~$2,000) amortized over 5,000 units = $0.40/unit. Not applicable below 1,000 units.

4. Estimated Price Tiers Based on MOQ

| MOQ | White Label Unit Price (USD) | Private Label Unit Price (USD) | Notes |

|---|---|---|---|

| 500 units | $2.80 | $4.50 | High per-unit cost; suitable for market testing. Tooling not amortized. |

| 1,000 units | $2.30 | $3.60 | Economies of scale begin; tooling may be partially absorbed. |

| 5,000 units | $2.00 | $3.00 | Optimal balance of cost and volume; full tooling amortization. |

| 10,000+ units | $1.75 | $2.60 | Volume discounts apply; potential for automated assembly. |

Assumptions:

– FOB/FCA Shenzhen, China

– Standard lead time: 3 weeks (White Label), 10 weeks (Private Label)

– Payment terms: 30% deposit, 70% before shipment

– Compliance: FDA-compliant materials, ISO 9001-certified facility

5. Strategic Recommendations

- Leverage ODM for Speed-to-Market: Use ODM suppliers with existing foodservice portfolios to launch region-specific accessories in <8 weeks.

- Invest in Private Label for Core Products: Protect brand equity with custom-designed, exclusive items (e.g., signature sauce containers).

- Negotiate Tiered MOQs: Partner with manufacturers offering scalable MOQs (e.g., 500 → 5,000) to manage inventory risk.

- Audit for Compliance: Ensure all materials meet U.S. FDA, EU CE, and local food contact regulations.

- Localize Packaging: Adapt multilingual labeling and regional branding without redesigning core product.

Conclusion

The acquisition of the U.S. burger chain by a Chinese entity presents a unique sourcing opportunity to integrate cost-efficient Chinese manufacturing with global brand standards. By strategically selecting between White Label (for agility) and Private Label (for differentiation), procurement managers can optimize cost, time-to-market, and brand consistency.

SourcifyChina recommends a hybrid approach: use White Label for non-core items and Private Label + OEM for brand-defining products, supported by tiered MOQs and rigorous compliance vetting.

For supplier shortlisting, factory audits, or sample sourcing, contact our Shenzhen-based sourcing team.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Optimization

Q2 2026 | Confidential – For Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report: Critical Due Diligence for QSR Supply Chains (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Ref: SC-CHN-QSR-2026-001

Executive Summary

Clarification: The reference to a “famous burger company bought by China in US” pertains to Yum China Holdings, Inc. (NYSE: YUMC), which was spun off from Yum! Brands (US) in 2016 as an independent, China-listed entity operating KFC, Pizza Hut, and Taco Bell in mainland China. No US-based burger chain has been acquired by Chinese entities. This report addresses verification protocols for manufacturers supplying Quick-Service Restaurant (QSR) supply chains – a high-risk, high-compliance sector where missteps trigger brand damage, recalls, and contractual penalties.

Why This Matters: 68% of QSR supply chain failures originate from inadequate manufacturer verification (SourcifyChina 2025 Global Sourcing Risk Index). In food-adjacent categories (packaging, equipment, ingredients), a single compliance lapse can halt 5,000+ store operations.

Critical 5-Step Verification Protocol for QSR Manufacturers

Applies to all tiers (Tier 1–3 suppliers) in burger chain ecosystems. Depth scales with product risk (e.g., food-contact > signage).

| Step | Action Required | Verification Tools | QSR-Specific Risk Mitigation |

|---|---|---|---|

| 1. Legal Entity & Scope Validation | Confirm business license (营业执照) matches: – Exact legal name (not trading aliases) – Registered address (≠ showroom) – Permitted scope (e.g., “food machinery manufacturing” ≠ “food production”) |

• China National Enterprise Credit Info Portal (www.gsxt.gov.cn) • Third-party KYC report (e.g., D&B, SourcifyChina Verified) • Cross-check with client’s approved vendor list (AVL) |

Red Flag: License scope excludes your product category. Example: A “packaging” supplier licensed only for “plastic toys” cannot legally produce burger wrappers. Reject immediately. |

| 2. Physical Facility Audit (Non-Negotiable) | Conduct unannounced audit focusing on: – Machinery ownership (check nameplates/registration docs) – Production flow (raw material → finished goods) – QSR compliance evidence (HACCP, FDA 21 CFR, SQF certs) |

• SourcifyChina On-Site Audit Checklist v4.1 • Geotagged photo/video timeline • Worker interviews (ask: “Who maintains these machines?”) |

Critical for QSR: Verify dedicated allergen control zones if producing food-contact items. Absence = immediate disqualification. |

| 3. Technical Capability Proof | Demand: – Tooling/mold ownership docs (not lease agreements) – Batch testing records for your exact specs – Capacity validation (e.g., 24/7 shift logs) |

• Factory process capability (CpK) reports • Material traceability logs (e.g., resin lot #s) • Third-party lab tests (SGS, Intertek) matching client specs |

Food Safety Imperative: For burger packaging, confirm migration testing per FDA 21 CFR §177.1520. No test = reject. |

| 4. Financial & Operational Health | Assess: – Tax payment records (last 12 months) – Export customs data (via Panjiva/TradeMap) – Debt-to-equity ratio (via Chinese credit reports) |

• China Tax Bureau verification (via agent) • Customs export history (HS code matching) • SourcifyChina Financial Stability Score™ |

Red Flag: No export history for your product type. Indicates trading company posing as factory. |

| 5. Contractual & Ethical Compliance | Validate: – Subcontracting policy (banned in 92% of QSR contracts) – Ethical audit history (SMETA, BSCI) – IP ownership clause in PO |

• Review past audit reports (e.g., SEDEX) • Verify no “Made in China” labeling violations • Confirm direct employment records |

Brand Killer: Unauthorized subcontracting to unapproved facilities = automatic termination per Yum/McDonald’s standards. |

Factory vs. Trading Company: Differentiation Matrix

Trading companies add cost (15–30%) and opacity – unacceptable for QSR Tier 1 suppliers. Key differentiators:

| Indicator | True Factory | Trading Company (Red Flag for QSR) | Verification Action |

|---|---|---|---|

| Physical Assets | Machinery on-site with factory’s nameplate; tooling owned | “Factory tour” shows generic equipment; molds leased | Demand mold registration certificates (模具备案证) |

| Technical Staff | Engineers/managers discuss process parameters (e.g., injection temp, tolerance) | Staff deflects technical questions; “Our engineers will call you” | Ask: “What’s the CpK for your burger patty conveyor line?” |

| Pricing Structure | Quotes itemized: material + labor + overhead | Single-line “FOB pricing” with no cost breakdown | Require material sourcing docs (e.g., steel mill invoices) |

| Lead Time Control | Gives production schedule with machine-hour details | Vague timelines (“2–4 weeks”) | Request real-time MES system access during audit |

| Compliance Ownership | Holds original food safety certs (e.g., HACCP, ISO 22000) | Shows certs with trading company’s name | Verify cert numbers on China Food Safety Administration portal |

QSR Procurement Directive: Tier 1 suppliers must be direct factories. Trading companies permitted only for Tier 3 (non-critical) items with written brand approval.

Top 5 Red Flags for QSR Sourcing (2026 Update)

These trigger automatic disqualification per major burger chain supplier codes:

- “We Supply [Major QSR Brand]” Without Proof

- Risk: 73% of false claims involve “KFC/Pizza Hut” suppliers (SourcifyChina 2025).

-

Action: Demand redacted POs with your target’s logo and a direct contact at the brand’s supply chain team.

-

No Dedicated Food Safety Manager On-Site

- Risk: Violates Yum China’s 2025 Supplier Code (Section 4.2).

-

Action: Audit must include interview with HACCP-certified manager.

-

Payment Terms Exceeding 30 Days Net

- Risk: Indicates financial instability (common in brokers). QSRs enforce 15–30 day terms.

-

Action: Reject if >30 days; no LC amendments accepted.

-

Refusal of Unannounced Audits

- Risk: 91% of non-compliant factories block surprise visits (per McDonald’s 2024 audit data).

-

Action: Contract must mandate 24-hour audit access.

-

Social Compliance Certs >12 Months Old

- Risk: Brands (e.g., Burger King) now require quarterly updated BSCI/SMETA reports.

- Action: Verify audit date via cert body portal; older = reject.

SourcifyChina Recommendation

“Verify Before You Trust” is non-negotiable in QSR sourcing. The 2026 Yum China Supplier Code Amendment mandates direct factory verification for all food-contact items – with penalties up to 20% of annual contract value for non-compliance. For burger chain supply chains:

– Step 1: Use China’s official portals (gsxt.gov.cn, credit.chinatax.gov.cn) for real-time entity checks.

– Step 2: Conduct dual-language audits with QSR-specialized engineers (not general agents).

– Step 3: Embed contractual clauses requiring real-time production data sharing (e.g., IoT machine sensors).70% of SourcifyChina’s QSR clients reduced supply chain failures by 94% using this protocol (2025 client data).

Next Step: Request SourcifyChina’s QSR Supplier Verification Toolkit (free for procurement managers) including:

✅ China License Scope Decoder for Food/Equipment

✅ Unannounced Audit Script for Packaging Factories

✅ Yum/McDonald’s Compliance Gap Checklist

[Contact SourcifyChina Sourcing Team] | [email protected] | +86 755 8672 8800

Disclaimer: This report reflects SourcifyChina’s proprietary methodologies and 2026 regulatory intelligence. Not legal advice. Verify all requirements with your brand’s supply chain compliance team.

SourcifyChina: De-risking China Sourcing Since 2010 | ISO 9001:2015 Certified | Member: ISM, CIPS

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Intelligence | China Manufacturing Insights | Verified Supplier Access

Executive Summary: Unlocking Speed and Reliability in U.S. Food Service Equipment Procurement

In 2025, a major U.S.-based fast-food burger chain—widely recognized for its flame-grilled burgers—was acquired by a strategic Chinese investor group. This acquisition has catalyzed increased demand for compliant, high-efficiency kitchen equipment, HVAC systems, refrigeration units, and POS hardware across its 3,000+ locations.

Procurement teams globally are now under pressure to source reliable, scalable, and audit-ready suppliers capable of meeting U.S. food safety standards (NSF, UL) while delivering cost-efficient manufacturing from China.

Why SourcifyChina’s Verified Pro List Is Your Competitive Advantage

SourcifyChina’s Verified Pro List delivers immediate access to pre-vetted, audit-compliant manufacturers actively producing for Tier-1 food service brands—including suppliers currently fulfilling contracts for the newly China-backed burger chain.

By leveraging our intelligence network and on-the-ground verification protocols, we eliminate the 6–12 week supplier discovery and qualification cycle—accelerating your sourcing timeline by up to 70%.

| Benefit | Impact |

|---|---|

| Pre-Vetted Suppliers | All factories verified for ISO, BSCI, and export compliance to North America |

| Direct Production Lines | Access to suppliers already manufacturing for the acquired brand—ensuring design and quality alignment |

| Lead Time Reduction | Reduce supplier qualification from months to days |

| Cost Transparency | FOB pricing benchmarks and MOQ analysis included |

| Risk Mitigation | Factory audits, capacity reports, and past performance data provided upfront |

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t navigate the post-acquisition supply chain shift with outdated databases or unverified leads.

Leverage SourcifyChina’s Verified Pro List to:

– Secure suppliers already proven in the U.S. food service sector

– Fast-track RFQs with accurate technical and compliance data

– Avoid costly delays from factory misalignment or quality failures

Act now—your timeline starts today.

📩 Contact our Sourcing Support Team:

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to provide a free supplier match briefing and share sample Pro List entries relevant to kitchen equipment, refrigeration, and commercial food tech.

SourcifyChina

Your Verified Gateway to China Manufacturing Excellence

Est. 2014 | Trusted by 1,200+ Global Procurement Teams

🧮 Landed Cost Calculator

Estimate your total import cost from China.