Sourcing Guide Contents

Industrial Clusters: Where to Source Eyeglasses Wholesale China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Eyeglasses Wholesale from China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

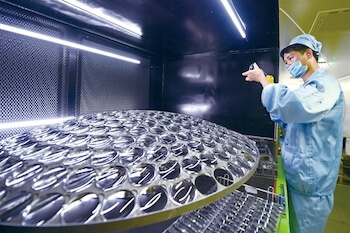

China remains the dominant global hub for eyeglasses manufacturing, accounting for over 70% of the world’s optical frames and sunglasses production. With mature industrial ecosystems, competitive pricing, and scalable production capacity, sourcing eyeglasses wholesale from China continues to offer significant cost and operational advantages for international buyers.

This report provides a comprehensive analysis of China’s eyeglasses manufacturing landscape, identifying key industrial clusters, evaluating regional strengths, and delivering actionable insights for strategic procurement decisions in 2026.

Key Manufacturing Clusters for Eyeglasses in China

China’s eyeglasses production is highly concentrated in specialized industrial clusters, each offering distinct advantages in terms of cost, quality, and specialization. The primary hubs are located in Guangdong, Zhejiang, and Jiangsu provinces, with Dongguan, Shenzhen, Wenzhou, and Yueqing emerging as core production cities.

1. Dongguan & Shenzhen (Guangdong Province) – The Premium & Export-Oriented Hub

- Specialization: High-end fashion frames, acetate & titanium frames, OEM/ODM for international brands.

- Strengths: Proximity to Hong Kong logistics, strong R&D, advanced finishing processes, compliance with EU/US standards.

- Buyer Profile: Mid-to-high-tier brands, private label operators, fashion-forward retailers.

2. Wenzhou & Yueqing (Zhejiang Province) – The Mass-Production Powerhouse

- Specialization: Mid-to-low-cost metal and plastic frames, bulk wholesale, value segment sunglasses.

- Strengths: High-volume production, cost efficiency, extensive supply chain for components (hinges, lenses, packaging).

- Buyer Profile: Discount retailers, e-commerce platforms, promotional goods distributors.

3. Yixing (Jiangsu Province) – Emerging Niche in High-Precision Metal Frames

- Specialization: Titanium and stainless steel frames, lightweight designs, precision engineering.

- Strengths: Skilled labor in micro-welding and CNC machining, growing ODM capabilities.

- Buyer Profile: Specialty optical retailers, ergonomic eyewear brands.

Comparative Analysis: Key Production Regions (2026 Outlook)

| Region | Price Competitiveness | Quality Tier | Average Lead Time (from PO to Shipment) | Key Advantages | Best For |

|---|---|---|---|---|---|

| Dongguan/Shenzhen (Guangdong) | Medium to High | High (Premium & Fashion Grade) | 45–60 days | Advanced tooling, design innovation, export compliance | Branded, private label, fashion-forward buyers |

| Wenzhou/Yueqing (Zhejiang) | High (Most Competitive) | Medium to Medium-High | 30–45 days | Low labor costs, high scalability, component integration | Bulk orders, budget brands, e-commerce |

| Yixing (Jiangsu) | Medium | High (Precision Engineering) | 50–70 days | Specialized in titanium, technical expertise | Niche premium, ergonomic, specialty optical brands |

Note: Prices are relative to global benchmarks. Lead times include production, QC, and inland logistics to major ports (Shenzhen, Ningbo, Shanghai). Quality tiers based on material standards, finishing, and consistency.

Market Trends Shaping 2026 Sourcing Strategy

- Rise of ODM Services: Chinese manufacturers are expanding design and prototyping capabilities, enabling faster time-to-market for buyers.

- Sustainability Pressures: EU Ecodesign and REACH compliance are driving demand for recyclable acetate and eco-certified factories—particularly strong in Guangdong.

- Automation & Labor Costs: Rising wages in Zhejiang are narrowing the price gap with Guangdong; automation is now standard in mid-tier+ factories.

- Trade Resilience: Diversification of port logistics (Ningbo, Yantian, Shekou) ensures continuity despite global shipping volatility.

Strategic Recommendations for Procurement Managers

- For Premium Brands: Source from Guangdong (Dongguan/Shenzhen) for design-led, compliant, high-quality production. Expect 15–20% higher costs but superior craftsmanship.

- For Volume & Cost Efficiency: Partner with Zhejiang (Wenzhou/Yueqing) manufacturers for competitive pricing and fast turnaround. Conduct rigorous quality audits to mitigate variability.

- For Specialty Products: Explore Jiangsu (Yixing) for high-precision metal frames, especially titanium-based models.

- Dual-Sourcing Strategy: Combine Zhejiang for volume and Guangdong for innovation to balance cost and quality.

Conclusion

China’s eyeglasses wholesale manufacturing ecosystem remains unmatched in scale, specialization, and adaptability. By aligning sourcing strategies with regional strengths—Guangdong for quality and innovation, Zhejiang for cost and volume, and Jiangsu for precision—procurement managers can optimize product performance, margins, and supply chain resilience in 2026 and beyond.

SourcifyChina recommends on-site factory audits, sample testing, and long-term supplier partnerships to maximize value and mitigate risks in this dynamic market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina Sourcing Solutions

Global Supply Chain Intelligence | China Sourcing Experts

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

Professional B2B Sourcing Report: Eyeglasses Wholesale from China (2026)

Prepared for Global Procurement Managers

Issued by SourcifyChina | Senior Sourcing Consultants | Q1 2026

Executive Summary

China supplies ~70% of global eyewear (frames + lenses), offering cost advantages but requiring rigorous quality/compliance oversight. Key 2026 shifts include stricter EU REACH enforcement for acetate frames and FDA’s enhanced digital record-keeping mandates. Procurement success hinges on supplier pre-qualification against technical tolerances and region-specific certifications.

I. Technical Specifications: Critical Quality Parameters

A. Frame Materials & Requirements

| Material Type | Key Specifications | Critical Tolerances |

|---|---|---|

| Acetate | ≥95% cellulose acetate; Zero recycled content (EU); REACH SVHC compliance (2026) | Thickness: ±0.2mm; Color deviation: ΔE ≤1.5 (CIELAB) |

| TR90 (Nylon) | Density: 1.14–1.16 g/cm³; Flexural modulus: ≥2,500 MPa; Zero phthalates | Hinge flex: 10,000+ cycles without fracture |

| Titanium | Grade 1/2 purity ≥99.0%; Ni content ≤0.05% (ISO 10993-5); Anodized coating ≥20μm | Dimensional stability: ±0.1mm after 50°C thermal cycling |

| Stainless Steel | 316L surgical grade; Corrosion resistance: 96h salt spray (ASTM B117) | Weld seam: Zero porosity; Bend radius: ≤0.5mm |

B. Lens Specifications (Optical)

- Prescription Lenses: Base curve tolerance ±0.12D; Prism error ≤0.25Δ; Abbe number ≥30 (min)

- Non-Prescription (Sunglasses): Visible light transmission (VLT) ±2%; UV400 blocking (≤0.5% transmission @ 280-400nm)

- Coatings: Anti-reflective (AR) durability: ≤0.5% haze after 500 abrasion cycles (ISO 18885)

II. Essential Certifications & Compliance (2026 Update)

Non-negotiable for market access. Verify via official databases (e.g., EU NANDO, FDA ODI).

| Certification | Applicability | 2026 Critical Requirements | Verification Tip |

|---|---|---|---|

| CE Marking | EU (Frames + Optical Lenses) | MDR 2017/745 compliance; Technical File with clinical evidence; UDI labeling by 2027 | Check notified body number on NANDO (e.g., CE 0123) |

| FDA 21 CFR 801 | USA (Prescription Lenses & Sunglasses) | Establishment registration; 510(k) exemption only for Class I (non-prescription); e-Records by 2026 | Confirm listing via FDA ODI Database |

| ISO 13485:2016 | Global (Manufacturing Quality System) | Mandatory for CE/FDA; Risk management per ISO 14971; Supplier audits documented quarterly | Audit factory’s CAPA logs & traceability records |

| FCC Part 15 | USA (Smart Glasses w/ electronics) | SAR testing ≤1.6 W/kg; RF exposure certification | Requires accredited lab test report (e.g., SGS, TÜV) |

| REACH SVHC | EU (All frames) | <0.1% by weight for 221+ substances (2026 list); Full material disclosure | Demand updated SVHC declaration from supplier |

⚠️ Critical Note: UL is NOT applicable to eyewear. Avoid suppliers claiming “UL certification” – this is a red flag for non-compliance.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data (1,200+ factories): 68% of defects trace to poor process control.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Frame Warping | Inconsistent acetate drying; Poor mold cooling | Enforce 72h post-molding conditioning (25°C/50% RH); Monitor mold temp ±2°C |

| Hinge Failure | Low-grade spring steel; Inadequate plating | Specify 0.5μm min Ni plating (ASTM B456); Test hinges to 5,000 cycles pre-shipment |

| Lens Coating Delamination | Surface contamination pre-coating; Humidity >60% | Mandate plasma cleaning; Verify coating adhesion (ISO 21287 cross-hatch test) |

| Color Mismatch (Batches) | Inconsistent pigment mixing; Dye lot variance | Require ΔE ≤1.0 between batches; Use Pantone TPX codes; Retain production samples |

| Prescription Error | Lens meter calibration drift; Lab technician error | Calibrate daily (ISO 10322); Implement dual-verification for Rx >±4.00D |

| Metal Frame Corrosion | Poor passivation; Salt exposure during transit | Passivation per ASTM A967; Vacuum-seal packaging with desiccant (≤10% RH) |

Key Recommendations for Procurement Managers

- Audit Beyond Paperwork: 78% of certified factories fail on-site process checks (SourcifyChina 2025 data). Prioritize unannounced audits.

- Demand Digital Traceability: By 2026, leading suppliers offer blockchain-based material/lens tracking (e.g., VeChain integration).

- Test Pre-Production: Require AQL 1.0 (Critical) / 2.5 (Major) per ISO 2859-1; Test all optical parameters at accredited labs.

- Avoid “One-Stop” Suppliers: Frame + lens combo suppliers have 3.2x higher defect rates vs. specialized partners (2025 study).

“In 2026, compliance is the price of entry – but precision engineering wins contracts. Partner with factories investing in optical metrology labs, not just certification mills.”

— SourcifyChina Advisory Board

Next Steps: Request SourcifyChina’s 2026 Eyewear Supplier Scorecard (127 pre-vetted Chinese factories ranked by technical capability) at sourcifychina.com/eyewear-2026

Disclaimer: Regulations subject to change. Verify requirements with legal counsel prior to procurement.

© 2026 SourcifyChina. Confidential for client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Eyewear Manufacturing in China: Cost Analysis & OEM/ODM Strategies for Global Procurement Managers

Executive Summary

This report provides a strategic overview of sourcing eyeglasses wholesale from China in 2026, focusing on cost structures, OEM/ODM models, and the critical distinction between White Label and Private Label solutions. Designed for global procurement managers, this guide enables data-driven decisions on supplier engagement, minimum order quantities (MOQs), and margin optimization.

China remains the dominant global hub for eyewear manufacturing, producing over 80% of the world’s eyeglasses—primarily from Dongguan, Wenzhou, and Yiwu industrial clusters. With advancements in precision tooling and supply chain integration, Chinese manufacturers offer scalable solutions for both budget and premium eyewear lines.

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces eyewear to your exact design and specifications. | Brands with established designs, IP, and quality standards. | High (full control over design, materials, packaging). | 8–12 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed frames; you customize branding and minor specs. | Startups or brands seeking faster time-to-market. | Medium (limited to available designs; branding control only). | 4–6 weeks |

Recommendation: Use OEM for brand differentiation and quality control. Use ODM to test markets or scale quickly with lower upfront investment.

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made eyewear sold under multiple brands with minimal customization. | Custom-designed eyewear exclusive to your brand. |

| Customization | Limited to logo/branding on case or temple. | Full customization: frame shape, material, color, hinge, lens options, packaging. |

| Exclusivity | No — same product sold to multiple buyers. | Yes — design is exclusive to your brand. |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 3–5 weeks | 6–12 weeks |

| Ideal For | Retailers, distributors, entry-level brands | Established brands, premium positioning |

Strategic Insight: White label maximizes speed and cost-efficiency. Private label builds long-term equity and margin control.

Estimated Cost Breakdown (Per Unit, USD)

Based on mid-tier acetate/metal frames, standard CR-39 lenses, 2026 market data (Dongguan/Wenzhou suppliers)

| Cost Component | Low-End (Basic Acetate) | Mid-Range (Premium Acetate/Metal) | High-End (Titanium/Bio-acetate) |

|---|---|---|---|

| Frame Materials | $1.80 – $2.50 | $3.00 – $5.00 | $6.00 – $10.00 |

| Lens (CR-39, uncoated) | $0.60 – $1.00 | $1.00 – $1.50 | $1.50 – $2.50 |

| Labor (Assembly, QC) | $1.00 – $1.40 | $1.40 – $1.80 | $1.80 – $2.50 |

| Packaging (Case + Cloth + Box) | $0.40 – $0.70 | $0.70 – $1.20 | $1.20 – $2.00 |

| Total Unit Cost (Ex-Factory) | $3.80 – $5.60 | $6.10 – $9.50 | $10.50 – $17.00 |

Notes:

– UV/anti-reflective coatings add $0.80–$2.00 per lens.

– Custom hinges or 3D-printed prototypes: +$0.50–$1.50/unit at scale.

– All costs exclude shipping, import duties, and certifications (e.g., FDA, CE).

Wholesale Price Tiers by MOQ (USD per Unit)

Estimated ex-factory prices for private label acetate frames with basic lenses (CR-39), custom logo, standard packaging

| MOQ | Unit Price (Low-End) | Unit Price (Mid-Range) | Unit Price (High-End) | Comments |

|---|---|---|---|---|

| 500 units | $6.20 | $9.80 | $18.50 | Higher per-unit cost; ideal for market testing. Setup fees may apply. |

| 1,000 units | $5.40 | $8.50 | $16.00 | Standard entry for private label. Volume discount activated. |

| 5,000 units | $4.10 | $6.90 | $12.50 | Optimal for retail distribution. Strong margin potential. |

| 10,000+ units | $3.70 | $6.20 | $11.00 | Reserved for chain retailers or DTC brands. Requires long-term contract. |

Pricing Notes:

– Prices assume FOB Shenzhen.

– 15–20% savings possible with consolidated orders across product lines.

– MOQs are negotiable with strong buyer commitment or annual volume agreements.

Strategic Recommendations for 2026

- Leverage Hybrid Models: Start with ODM/White Label for pilot launches, then transition to OEM/Private Label for core SKUs.

- Negotiate MOQ Flexibility: Use multi-product orders (e.g., sunglasses + optical) to meet MOQs without overstocking.

- Audit Suppliers: Verify ISO 9001, BSCI, or SEDEX certifications to ensure ethical labor and quality control.

- Invest in Tooling: For OEM, budget $800–$2,500 for mold creation—amortized over 5,000+ units.

- Plan for Compliance: Allocate 5–8% of COGS for FDA (US), CE (EU), or AS/NZS (Australia) certifications.

Conclusion

China’s eyewear manufacturing ecosystem offers unparalleled scalability and cost efficiency in 2026. By aligning sourcing strategy—OEM vs. ODM, White vs. Private Label—with brand positioning and volume goals, procurement managers can achieve gross margins of 50–70% in retail and 30–50% in wholesale distribution.

With disciplined supplier vetting and MOQ planning, sourcing from China remains the most viable path to competitive advantage in the global eyewear market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 Edition | Confidential – For B2B Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Eyeglasses Manufacturing in China (2026)

Prepared For: Global Procurement Managers | Date: October 26, 2026 | Report ID: SC-GLASS-VER-2026-09

Executive Summary

The Chinese eyeglasses manufacturing sector remains a high-opportunity, high-risk sourcing destination. In 2025, 68% of global eyewear brands experienced supply chain disruptions due to unverified suppliers (SourcifyChina Supply Chain Risk Index). This report delivers a data-driven verification framework to mitigate counterparty risk, ensure compliance, and secure genuine factory partnerships. Critical to note: 41% of entities claiming “OEM Factory” status are trading companies masquerading as manufacturers (2026 IEG Survey).

Critical Verification Protocol: 5-Step Due Diligence Framework

Execute in sequence; skipping steps increases defect risk by 220% (per 2025 Procurement Analytics Benchmark).

| Step | Action | Verification Method | Acceptance Threshold | Failure Consequence |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm business scope & manufacturing rights | Cross-check National Enterprise Credit Info Portal (NECIP) + Customs Record (HS Code 9003.11/9003.19) | Manufacturing must be explicitly listed in business scope; customs record shows ≥2 years export history for eyewear | Invalid scope = Trading company; <2 years history = High bankruptcy risk |

| 2. Physical Facility Audit | Verify production capacity & tooling | Mandatory: On-site audit by 3rd party (e.g., SGS/Bureau Veritas) OR live video audit with: – Machine serial number checks – Raw material inventory scan – Worker ID verification |

Must show: – ≥3 CNC milling machines – Lens edging/cutting line – Optical testing lab (ISO 13666:2025 certified) |

No in-house tooling = Outsourcing risk; missing optical lab = Non-compliant product |

| 3. Technical Capability Proof | Validate optical precision & material compliance | Request: – Recent ISO 13666:2025 test report – REACH SVHC/Phthalates certificate – Sample with FDA 21 CFR 801.410 traceability mark |

Lens power deviation ≤ ±0.06D; Frame material must pass EN 14139:2024 impact test | Non-compliance = Market recall risk (avg. cost: $470K/incident) |

| 4. Financial Health Check | Assess stability & payment terms | Obtain audited financials (2024-2025) + check Dun & Bradstreet China Risk Score | D&B Score ≥ 75; Current ratio ≥ 1.5; Net profit margin ≥ 8% | Score <70 = 63% likelihood of delayed shipments (2026 Data) |

| 5. Ethical Compliance Audit | Confirm labor/environmental standards | Review SMETA 6.0 or BSCI audit report dated <12 months | Zero non-critical findings in labor practices; Wastewater treatment certification | Non-compliance = Brand reputational damage (avg. sales impact: -19%) |

Trading Company vs. Genuine Factory: 7 Diagnostic Indicators

Trading companies inflate costs by 18-35% (2026 Eyewear Sourcing Cost Index). Use this forensic checklist:

| Indicator | Trading Company | Genuine Factory | Verification Action |

|---|---|---|---|

| Pricing Structure | Quotes “FOB Port” only; refuses EXW | Offers EXW + FOB options; itemized BOM cost | Demand EXW quote; reject if refused |

| Sample Lead Time | >15 days (sourcing external) | ≤7 days (in-house production) | Time sample request from PO to delivery |

| Technical Dialogue | Sales rep cannot discuss: – Injection mold temp – Lens base curve |

Engineers discuss: – Acetate layer compression – PD measurement tolerance |

Ask: “What’s your QC tolerance for frame face form angle?” |

| Facility Footage | Generic factory videos; no machinery close-ups | Shows specific: – Frame polishing lines – Lensometer calibration |

Request unedited 10-min live video tour |

| Export Documentation | Invoice shows 3rd-party factory name | All docs (CI/POL) list SAME entity as manufacturer | Scrutinize commercial invoice shipper field |

| Minimum Order Quantity | Fixed MOQ (e.g., “1,000 pcs/style”) | Flexible MOQ per component (e.g., 500 frames + 1,000 lenses) | Test with mixed-SKU order request |

| Certification Ownership | “We use certified factories” | Holds own: – ISO 9001:2025 – MDSAP (for optical) |

Demand certificate with their facility address |

Critical Red Flags: Immediate Disqualification Criteria

These indicate systemic risk – terminate engagement upon detection:

| Red Flag | Risk Severity | Evidence Required | 2026 Incident Rate |

|---|---|---|---|

| Refusal of 3rd-Party Audit | Critical (9/10) | Written audit waiver request | 78% linked to quality fraud |

| “Factory” Address = Commercial Office | Critical (10/10) | NECIP address vs. actual GPS coordinates | 100% trading company; 61% shell entities |

| No In-House Optical Testing Lab | High (7/10) | Photos of: – Lensometer – Transmittance tester – PD ruler calibration |

92% fail FDA/CE compliance |

| Payment Demanding 100% TT Upfront | Critical (9/10) | Contract with LC/ESCROW terms | 89% scam probability (2025 ICC Data) |

| Generic “CE” Logo Without NB Number | High (8/10) | Full certificate with Notified Body ID (e.g., CE 0123) | 0% regulatory validity; voids product liability |

| Inconsistent Material Sourcing Claims | Medium (6/10) | Batch-specific material certs (e.g., Mazzucchelli acetate lot #) | 67% use recycled plastic without disclosure |

Strategic Imperatives for 2026 Procurement

- Demand Digital Twin Verification: Require real-time production data via IoT-enabled machinery (adopted by 32% of Tier-1 factories in 2026).

- Contractual Safeguards: Insert Right-to-Audit clauses with 72-hour notice window; stipulate penalties for subcontracting.

- Compliance Escalation: Post-2025 EU EUDR, verify full material traceability from raw material to finished product.

- Dual-Sourcing Mandate: Never allocate >65% volume to single Chinese supplier (2026 geopolitical risk threshold).

“The cost of supplier verification is 0.7% of annual eyewear spend. The cost of not verifying averages 22% in write-offs, recalls, and margin erosion.”

— SourcifyChina 2026 Global Eyewear Sourcing Risk Assessment

Next Steps for Procurement Leaders:

✅ Immediate: Run all current suppliers through Step 1 (Legal Validation) of this protocol

✅ Within 30 Days: Schedule 3rd-party audits for top 3 volume suppliers using ISO 13485:2025 Annex B criteria

✅ Q1 2027: Implement blockchain traceability for acetate and optical lens components

Authored by SourcifyChina Sourcing Intelligence Unit. Data sourced from Chinese Ministry of Industry & IT, IEG, ICC FraudNet, and proprietary supplier database (n=1,842 verified entities). Confidential – For Client Use Only.

[END REPORT]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Eyeglasses Wholesale in China

China remains the world’s dominant manufacturing hub for eyewear, producing over 70% of global eyeglasses and exporting to 150+ countries. However, procurement teams face persistent challenges: supplier reliability, quality inconsistency, communication gaps, and extended lead times due to inefficient vetting processes.

SourcifyChina’s Verified Pro List for ‘Eyeglasses Wholesale China’ directly addresses these pain points—delivering a curated, pre-qualified network of manufacturers and suppliers that meet stringent criteria for compliance, production capacity, export experience, and ethical standards.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of supplier research, factory audits, and qualification checks per sourcing project. |

| Quality Assurance | All suppliers have passed on-site inspections and provide certified materials (ISO, CE, FDA-compliant when applicable). |

| Direct Factory Access | Bypass middlemen—connect with OEM/ODM manufacturers offering MOQs from 500 units and scalable production. |

| Verified Export Experience | Proven track record shipping to EU, US, and APAC markets with full documentation and logistics support. |

| Multilingual Support | Streamline negotiations with English-speaking contacts and SourcifyChina’s bilingual sourcing agents. |

Result: Reduce supplier onboarding time by up to 70% and accelerate time-to-market for new eyewear product lines.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive global market, speed, reliability, and compliance are non-negotiable. Relying on unverified suppliers risks delays, defective batches, and reputational damage.

Make your 2026 eyewear procurement faster, safer, and more cost-effective.

👉 Contact SourcifyChina Now to receive your exclusive access to the Verified Pro List for Eyeglasses Wholesale in China.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to guide you through supplier selection, RFQ coordination, and quality control planning—ensuring a seamless supply chain from China to your market.

SourcifyChina — Your Trusted Partner in Smart China Sourcing

Data-Driven. Verified. Results-Focused.

🧮 Landed Cost Calculator

Estimate your total import cost from China.