Thinking about expanding your business to new horizons? Exporting to Brazil could open doors to one of the world’s largest and most dynamic markets. But navigating Brazil’s trade landscape can seem daunting, especially with its unique regulations and cultural nuances.

Understanding how to export successfully is crucial to tap into Brazil’s vast opportunities. In this article, we’ll break down the key steps, essential tips, and insider insights to help you launch and grow your exports to Brazil with confidence.

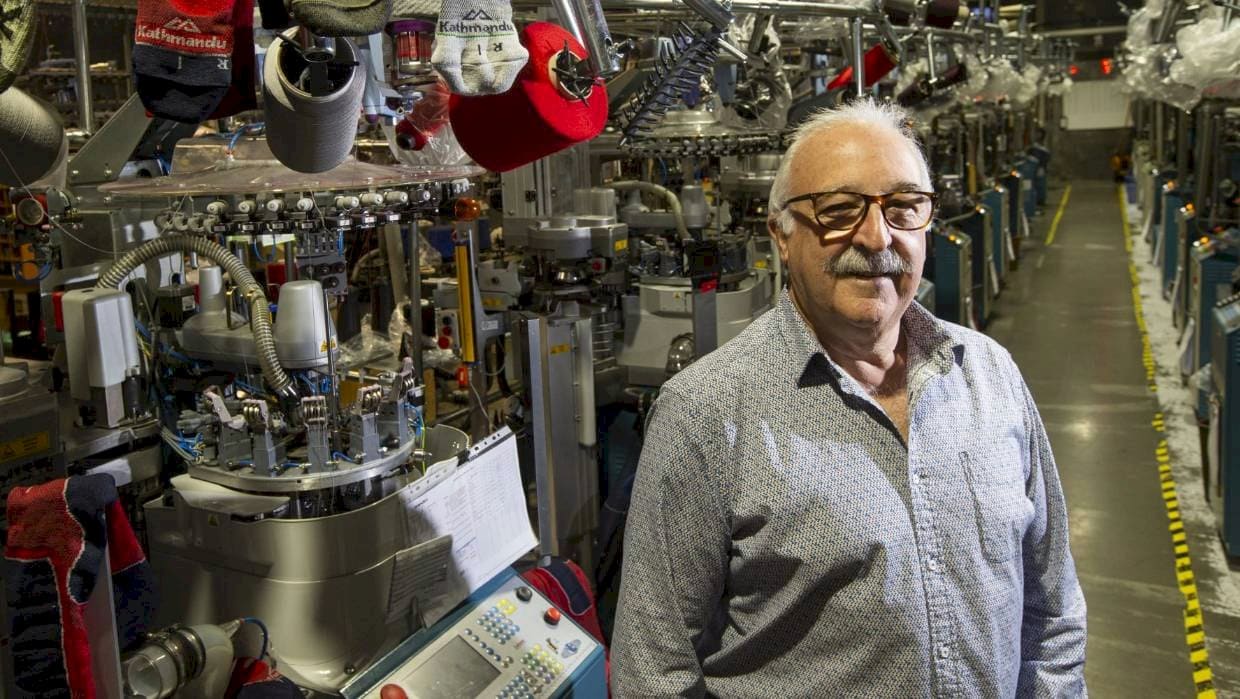

Related Video

How to Export to Brazil: A Comprehensive Guide

Exploring international trade can feel overwhelming, especially when breaking into a vibrant yet complex market like Brazil. If you’re considering exporting to Brazil, you’re opening doors to the largest economy in Latin America, rich in opportunity but also marked by a unique set of rules and requirements. Whether you’re a seasoned exporter or just starting your first shipment, understanding how to navigate Brazil’s regulations, logistics, and business culture is crucial for success.

In this article, you’ll discover the essential steps, practical tips, key challenges, and cost considerations involved in exporting to Brazil. By walking you through each area, you’ll be equipped to confidently tap into this dynamic marketplace.

Understanding the Brazilian Export Landscape

Exporting to Brazil involves much more than shipping goods across borders. The country has:

- A large consumer base, with over 200 million people.

- Complex import regulations and documentation.

- Stringent customs procedures and varying tariffs.

- Regional trade agreements and import controls.

Successfully exporting to Brazil requires a strategic approach—balancing compliance, relationship building, and operational efficiency.

Step-by-Step Guide to Exporting to Brazil

Let’s break down the process into manageable steps so you can get started without missing any critical details.

1. Research the Market

Before diving in, assess if there’s demand for your product and understand market trends.

- Study consumer preferences and local competitors.

- Identify your ideal target audience within Brazil.

- Analyze relevant industry sectors (like agriculture, tech, or consumer goods).

2. Understand Brazilian Import Regulations

Brazil’s import system is among the most regulated in the world. You’ll need to:

- Review import tariffs and taxes (often substantial in Brazil).

- Check if your product is subject to import quotas, bans, or licenses.

- Determine applicable technical or quality standards.

3. Register with Relevant Authorities

- Secure an exporter registration in your home country.

- Work with a Brazilian importer that holds a RADAR license (tax ID for import/export operations).

4. Prepare Export Documentation

Proper paperwork is non-negotiable. Typical documents include:

- Commercial Invoice

- Packing List

- Bill of Lading or Air Waybill

- Certificate of Origin

- Import License (when necessary)

- Insurance Documents

5. Choose the Right Shipping Solution

You have several transport options based on cost, time, and product type:

- Sea Freight: Ideal for large, bulky shipments or non-perishable goods.

- Air Freight: Best for smaller high-value, urgent, or perishable items.

- Courier/Parcel Services: Suitable for small packages or samples.

6. Partner with Local Experts

- Work with certified customs brokers or freight forwarders familiar with Brazilian regulations.

- Consider logistics partners with strong networks in Brazil to handle last-mile delivery.

7. Price Your Product Competitively

Factor in all cost elements:

- Import duties, taxes, and shipping fees.

- Local distributor or customs broker commissions.

- Currency exchange fluctuations.

8. Ensure Compliance with Product Standards

Brazil enforces strict rules for safety, labeling, and product certification.

- Consider product adaptation if required by Brazilian law.

- Obtain certification from local regulatory agencies when necessary.

9. Finalize Distribution and Delivery

- Decide on direct sales or appointing a local distributor.

- Monitor shipment tracking and address customs clearance proactively.

10. Provide After-Sales Support

Strong after-sales service builds trust and encourages repeat business.

- Make arrangements for warranty, repairs, or customer queries.

- Train local partners or representatives if needed.

Key Challenges when Exporting to Brazil

Every market has obstacles. Here’s what to be aware of in Brazil:

- Complex Bureaucracy: Documentation and customs procedures can be lengthy and complicated. Attention to detail is crucial.

- High Tariffs and Duties: Taxes on imports can be significant, impacting profit margins if not calculated upfront.

- Changing Regulations: Brazil updates its trade and technical standards regularly. Staying updated reduces risk.

- Language Barrier: Portuguese is Brazil’s official language. Clear communication is key during negotiations and documentation.

- Distribution Network: Geographic size and road infrastructure vary by state, so plan logistics accordingly.

Practical Tips for Successful Exports

Set yourself up for success with these proven strategies:

- Start Small: Pilot with a limited shipment to test procedures and build relationships.

- Use Incoterms Properly: Clarify delivery terms and responsibilities with your buyer.

- Leverage Local Contacts: Develop connections with local agents, distributors, or chambers of commerce.

- Stay Informed: Join export support programs or industry associations for up-to-date insights.

- Double-check Documentation: Even minor errors can mean costly delays at customs.

Shipping and Cost-Saving Tips

Brazil’s import taxes and fees can quickly add up. Here’s how to manage costs effectively:

- Consolidate Shipments: Bulk shipping can lower per-unit freight costs.

- Negotiate with Shipping Partners: Get quotes from multiple forwarders and compare.

- Understand Tax Structure: Calculate the cumulative effect of Import Duty, IPI (Tax on Industrialized Products), ICMS (State VAT), and PIS/COFINS (social contributions).

- Consider FTZ (Free Trade Zones): Where possible, route shipments through Brazil’s free trade zones for potential exemptions.

- Plan for Last-Mile Delivery: Urban congestion and rural distribution challenges can increase costs at the final stage. Partner with reliable local logistics firms.

Building Relationships within the Brazilian Market

Success in Brazil often hinges on strong business relationships. Brazilians value:

- In-person meetings and trust-building over time.

- Prompt and professional customer service.

- Commitment to local market needs and adaptation.

Be patient—developing a network and reputation does not happen overnight.

Common Export Sectors & Opportunities

Certain industries are particularly attractive for foreign exporters:

- Technology and Electronics: High demand, but requires compliance with local certification.

- Agricultural Equipment: Supports Brazil’s vast agribusiness sector.

- Fashion and Consumer Goods: Brazil’s emerging middle class is hungry for international brands.

- Automotive Parts: Ongoing modernization of the auto sector creates opportunities for quality imports.

Summary: Takeaways on Exporting to Brazil

While exporting to Brazil presents unique challenges, the rewards of entering such a dynamic market are significant. By understanding the regulatory environment, planning logistics thoroughly, adapting to local expectations, and partnering with experienced local professionals, you can minimize risks and maximize your chances for success.

Careful research, clear communication, and tailored market strategies will help you overcome barriers and capitalize on Brazil’s vast potential.

Frequently Asked Questions (FAQs)

What documents are needed to export to Brazil?

Typical documents include a commercial invoice, packing list, bill of lading/air waybill, certificate of origin, and in some cases, an import license. Ensure all paperwork matches Brazilian customs requirements to avoid delays.

How high are the import taxes and duties in Brazil?

Import taxes can be substantial and include import duty, IPI, ICMS, and PIS/COFINS. The exact amount depends on the product’s classification and the state of entry. Be sure to calculate all applicable taxes before setting your pricing.

Is Portuguese required for documentation and communication?

While some Brazilian businesspeople speak English, Portuguese is the official language. It’s best to have documents translated and, when possible, include a local partner or translator to avoid misunderstandings.

Do I need a local partner or distributor to export to Brazil?

While it’s possible to export directly, having a local partner can simplify navigation of customs, compliance, and distribution. Local representation is particularly helpful for market entry and customer support.

How long does customs clearance take in Brazil?

Customs clearance timelines can vary widely. With correctly-prepared documentation, it may take a few days. However, errors or missing paperwork can result in longer delays and added costs.

With the right preparation and support, entering the Brazilian market is a rewarding endeavor that can help your business grow and thrive in Latin America’s biggest economy.