The expanded foam (exp foam) manufacturing industry has experienced robust growth over the past decade, driven by rising demand across construction, automotive, packaging, and consumer goods sectors. According to Grand View Research, the global flexible polyurethane foam market—of which expanded foam is a significant subset—was valued at USD 35.6 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by increasing demand for lightweight, thermally insulating, and shock-absorbent materials, particularly in automotive interiors and building insulation. Mordor Intelligence further highlights that innovations in sustainable foam production and the expansion of e-commerce packaging are accelerating market development, with Asia-Pacific emerging as the fastest-growing region due to rapid industrialization and urbanization. As competition intensifies and demand evolves, identifying leading manufacturers capable of delivering high-performance, cost-effective, and environmentally responsible foams has become crucial. Here, we present the top 10 expanded foam manufacturers shaping the global supply landscape through technological innovation, geographic reach, and strong customer partnerships.

Top 10 Exp Foam Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Benchmark Foam

Domain Est. 1998

Website: benchmarkfoam.com

Key Highlights: Located at 401 Pheasant Ridge Drive, Watertown, South Dakota, Benchmark Foam, Inc. is a premier manufacturer of Expanded Polystyrene (EPS) foam and specialty ……

#2 Foam Factory, Inc.

Domain Est. 2000

Website: foambymail.com

Key Highlights: We proudly offer traditional foam products like cushions, insulation, and packaging materials, as well as memory foam and latex mattresses, toppers, and even ……

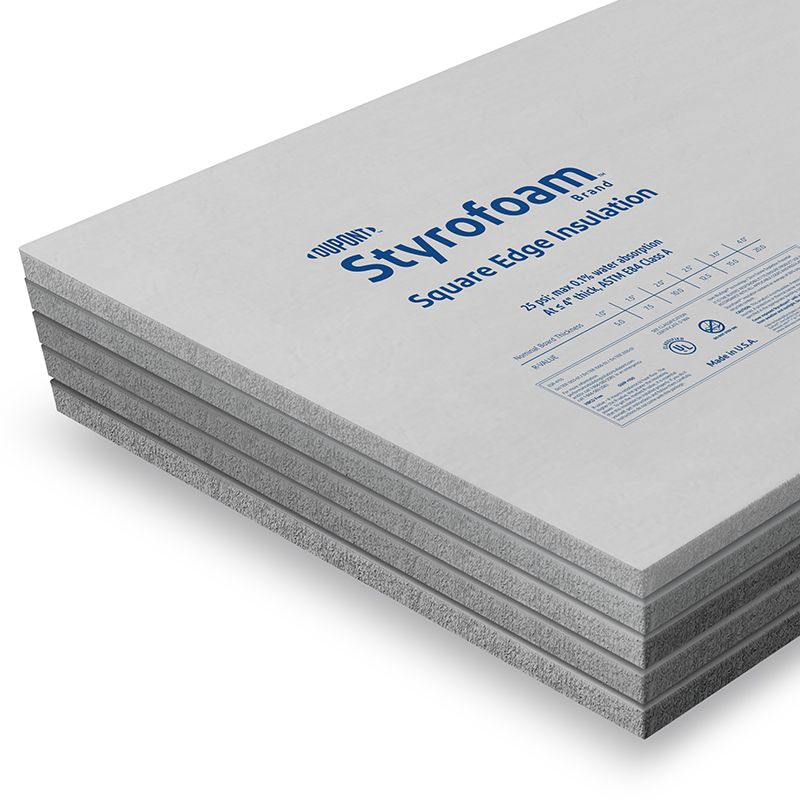

#3 DuPont™ Styrofoam™ Brand XPS Insulation

Domain Est. 1987

Website: dupont.com

Key Highlights: Its unique closed-cell structure and rigid foam board technology enables XPS to meet core thermal, moisture, air and vapor performance requirements….

#4 Extruded XPS Foam

Domain Est. 1997

Website: fpcfoam.com

Key Highlights: Rely on Foam Products Corporation for expert Extruded XPS Foam products. We supply commercial foam products & industrial foam products….

#5 XPSA

Domain Est. 2002

Website: xpsa.com

Key Highlights: The Extruded Polystyrene Foam Association (XPSA) is a trade association representing manufacturers of Extruded Polystyrene Foam (XPS) insulation products and ……

#6 Harbor Foam

Domain Est. 2007

Website: harborfoam.com

Key Highlights: ?Harbor Foam is a distinguished manufacturer specializing in the production of expanded polystyrene (EPS) products. Renowned for its innovative solutions and ……

#7

Domain Est. 1997

Website: plastifab.com

Key Highlights: Our EPS products are GREENGUARD certified, have superior material properties that boost energy efficiency, and have a lifetime Global Warming Potential that is 34 ……

#8 Hibco Foam Plastics

Domain Est. 1998 | Founded: 1959

Website: hibco.com

Key Highlights: Since 1959, Hibco Foam Plastics has built a reputation on creativity, innovation, precision, and responsiveness in the national foam plastics industry….

#9 Flexible Foams

Domain Est. 1999

Website: americanexcelsior.com

Key Highlights: Flexible foam can provide protection in packaging, comfort in furniture and support in medical and athletic applications….

#10

Domain Est. 2019

Website: builtwithfoam.com

Key Highlights: 3-day deliveryBuilt With Foam is your one-stop shop to bring any construction or remodeling vision to life through the power of Expanded Polystyrene (EPS), a rigid, high- ……

Expert Sourcing Insights for Exp Foam

H2: Analysis of 2026 Market Trends for Expanded Foam (Exp Foam)

The global expanded foam (Exp Foam) market is poised for significant transformation by 2026, driven by evolving consumer demands, technological advancements, and increasing regulatory pressures. This analysis examines key market trends expected to shape the Exp Foam industry through the mid-decade horizon.

1. Sustainable and Bio-Based Materials Gain Momentum

Environmental concerns are reshaping material preferences across industries. By 2026, demand for bio-based and recyclable expanded foams—such as bio-polyethylene (bio-PE), polylactic acid (PLA) foams, and natural rubber foams—is expected to grow at a CAGR exceeding 7%. Regulatory initiatives like the EU Green Deal and extended producer responsibility (EPR) schemes are compelling manufacturers to reduce carbon footprints. Companies investing in compostable or chemically recyclable foam solutions are likely to gain competitive advantage.

2. Lightweighting in Automotive and Transportation

The automotive sector remains a major consumer of Exp Foam, particularly for insulation, seating, and noise damping. With automakers accelerating electrification, lightweight materials are critical to improving battery efficiency and range. Polypropylene (EPP) and polyethylene (EPE) foams are gaining preference over traditional EPS due to better energy absorption and recyclability. By 2026, EPP foam usage in EV battery protection systems is projected to increase by over 15% annually.

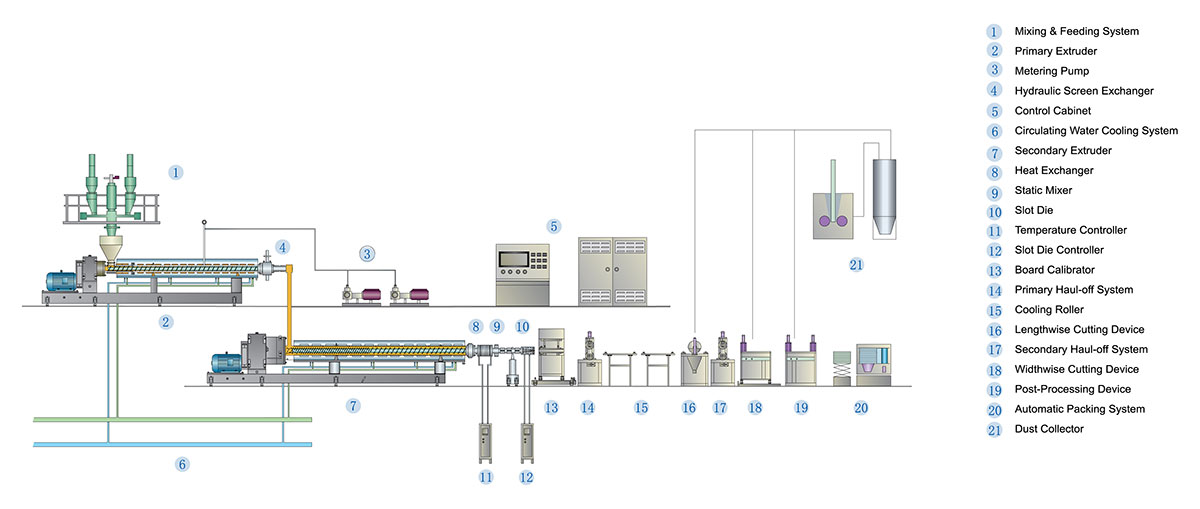

3. Advancements in Foam Manufacturing Technologies

Innovations in foam extrusion and molding—such as supercritical CO₂ foaming and reactive extrusion—are enhancing product performance while reducing VOC emissions. These technologies support the production of finer cell structures, improved thermal insulation, and reduced material density. Manufacturers adopting these processes are expected to lead in high-performance applications within construction and consumer electronics.

4. Growth in Packaging and E-Commerce Demand

The surge in e-commerce continues to drive demand for protective Exp Foam packaging, especially custom-molded foams for electronics, furniture, and medical devices. By 2026, the protective packaging segment is forecasted to account for nearly 40% of total Exp Foam consumption. However, this growth is tempered by sustainability pressures, pushing adoption of recyclable foam alternatives and foam-in-place packaging systems that use less material.

5. Regional Market Shifts

Asia-Pacific will remain the largest and fastest-growing market for Exp Foam, led by China, India, and Southeast Asia, due to robust industrialization and urbanization. North America and Europe are focusing on innovation and circular economy models, with stricter regulations on single-use foams. Latin America and the Middle East show moderate growth, driven by construction and infrastructure development.

6. Price Volatility and Supply Chain Resilience

Fluctuations in feedstock prices—particularly for propylene and styrene—will remain a challenge. Geopolitical instability and supply chain disruptions may persist, prompting companies to diversify sourcing and invest in regional production hubs. Vertical integration and long-term supplier partnerships are expected to become strategic priorities.

Conclusion

By 2026, the Exp Foam market will be defined by sustainability, performance innovation, and regional diversification. Companies that prioritize eco-friendly materials, adopt advanced manufacturing techniques, and align with regulatory trends will be best positioned to capitalize on emerging opportunities. The transition toward a circular foam economy will accelerate, making recyclability and lifecycle assessment key differentiators in the competitive landscape.

Common Pitfalls Sourcing Exp Foam (Quality, IP)

Sourcing expanded foam (Exp Foam) materials—such as expanded polyethylene (EPE), expanded polypropylene (EPP), or expanded polystyrene (EPS)—can present significant challenges, particularly concerning quality consistency and intellectual property (IP) risks. Being aware of these pitfalls is crucial for ensuring reliable supply, product performance, and legal compliance.

Quality Inconsistencies

One of the most frequent issues when sourcing Exp Foam is variability in material quality. Foam properties such as density, cell structure, compressive strength, and thermal insulation can differ significantly between batches or suppliers. Poor quality control from manufacturers—especially in low-cost regions—can result in foams that do not meet technical specifications, leading to product failures, increased scrap rates, or customer complaints. Inconsistent expansion ratios or additive formulations (e.g., flame retardants or UV stabilizers) may also affect performance in end-use applications like packaging, automotive components, or insulation.

Lack of Material Certification and Traceability

Many suppliers, particularly non-reputable ones, fail to provide adequate material data sheets (MDS), certificates of conformance (CoC), or test reports. Without proper documentation, it becomes difficult to verify compliance with industry standards (e.g., UL, ASTM, ISO) or regulatory requirements (e.g., REACH, RoHS). This lack of traceability also complicates root cause analysis in case of quality issues and can expose the buyer to compliance risks.

Intellectual Property Infringement Risks

Sourcing Exp Foam from unauthorized or unverified suppliers increases the risk of inadvertently using patented formulations, manufacturing processes, or branded materials. For example, certain high-performance foams (like Dow’s STYROFOAM™ or BASF’s Neopor®) are protected by patents and trademarks. Using generic equivalents that mimic these materials without proper licensing can lead to legal disputes, shipment seizures, or financial penalties. Additionally, reverse-engineered foams may infringe on process patents related to expansion, cross-linking, or additive integration.

Supply Chain Opacity and Counterfeit Materials

The global foam supply chain often involves multiple intermediaries, which can obscure the origin of materials. This opacity enables the circulation of counterfeit or substandard foams falsely labeled as compliant or high-grade. Some suppliers may blend recycled content without disclosure, affecting performance and recyclability claims. This not only undermines product integrity but can also damage brand reputation.

Inadequate Testing and Qualification

Buyers sometimes skip rigorous qualification processes for new foam suppliers, relying solely on samples or supplier claims. Without independent testing for mechanical properties, long-term aging, or environmental resistance, there’s a high risk of field failures. Accelerated aging tests, compression set analysis, and chemical compatibility checks are often overlooked but essential for critical applications.

Mitigation Strategies

To avoid these pitfalls:

– Conduct thorough supplier audits and request full material certifications.

– Require IP indemnification clauses in supply contracts.

– Perform batch testing and maintain a qualified supplier list.

– Work with suppliers who offer transparent chain-of-custody documentation.

– Consult legal experts to assess IP risks, especially when sourcing near-identical alternatives to branded foams.

By proactively addressing quality and IP concerns, companies can reduce risks and ensure the reliable performance of Exp Foam in their products.

Logistics & Compliance Guide for Expanded Foam (Exp Foam)

Overview of Expanded Foam Materials

Expanded foam, commonly referred to as Exp Foam, includes lightweight cellular materials such as expanded polystyrene (EPS), expanded polyethylene (EPE), expanded polypropylene (EPP), and other foamed plastics. These materials are widely used in packaging, insulation, automotive components, and protective cushioning due to their shock-absorbing properties and low density. Proper logistics and compliance protocols are essential to ensure safe handling, transportation, and regulatory adherence throughout the supply chain.

Regulatory Classifications and Compliance Requirements

Expanded foam products may be subject to various international, national, and industry-specific regulations depending on composition, application, and destination. Key compliance areas include:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals – applicable if foam contains regulated substances.

– RoHS (EU): Restriction of Hazardous Substances – relevant for electronic packaging applications.

– TSCA (USA): Toxic Substances Control Act – ensures chemical safety in imported or domestically produced foams.

– IMDG Code / IATA DGR: For international transport of foams classified as hazardous (e.g., when treated with flame retardants).

– EPA and State Regulations (USA): Includes volatile organic compound (VOC) emissions and waste management guidelines.

– Recycling & Extended Producer Responsibility (EPR): Jurisdictions may require reporting or fees for plastic packaging, including foam.

Ensure material safety data sheets (MSDS/SDS) are available and up to date for all foam types.

Packaging and Handling Guidelines

Proper packaging and handling prevent damage and maintain material integrity:

– Use clean, dry, and protected environments to store foam to avoid contamination or moisture absorption.

– Stack foam blocks or molded parts evenly to prevent deformation; use edge protectors if necessary.

– Avoid exposure to direct sunlight, extreme temperatures, and open flames to prevent degradation or fire risk.

– Use stretch wrap or banding for unitized loads; avoid over-compression during bundling.

– Label packages clearly with product type, batch number, handling instructions (e.g., “Fragile,” “Do Not Stack”), and any hazard warnings.

Transportation and Shipping Considerations

Transport logistics must address the low-density, bulky nature of expanded foam:

– Optimize load consolidation to maximize container or trailer space; consider nested designs or compacted forms if applicable.

– Secure loads with straps, dunnage, or bracing to prevent shifting during transit.

– Use covered vehicles or containers to protect foam from rain, wind, and debris.

– For air freight, comply with IATA regulations—especially if foam is classified as flammable or treated with chemicals.

– Declare accurate weight and volume; lightweight but voluminous loads may be subject to dimensional weight pricing.

Environmental and Sustainability Compliance

Expanded foams, particularly EPS and EPE, face increasing scrutiny due to environmental concerns:

– Adhere to local and international plastic waste regulations, including bans on single-use EPS in some regions (e.g., EU, certain U.S. cities).

– Implement or support foam recycling programs; EPS is recyclable via densification.

– Provide documentation for recyclability claims (e.g., “100% Recyclable” only if verified).

– Explore bio-based or recyclable alternative foams to meet sustainability goals.

– Comply with carbon reporting standards if required (e.g., GHG Protocol, Scope 3 emissions tracking).

Import/Export Documentation and Restrictions

Cross-border shipments require careful documentation:

– Provide accurate HS codes (e.g., 3921.11 for EPS plates/sheets).

– Include commercial invoices, packing lists, and bills of lading.

– Certify compliance with destination country standards (e.g., FDA for food-contact foams, CE marking in Europe).

– Check for import bans or restrictions on specific foam types (e.g., non-recyclable EPS in food service).

– Declare any flame retardants or chemical treatments used in production.

Fire Safety and Hazard Management

Foam materials can pose fire risks:

– Store away from ignition sources; maintain minimum distances from heaters or electrical equipment.

– Use fire-retardant (FR) treated foams where required by building or safety codes.

– Comply with flammability standards such as ASTM E84 (surface burning characteristics) or FMVSS 302 (automotive).

– Train personnel on fire response procedures; ensure fire suppression systems are in place in storage areas.

Storage Best Practices

Optimize warehouse operations with the following measures:

– Store on pallets off the floor to prevent moisture absorption and pest infestation.

– Limit stack height to prevent collapse or compression damage.

– Rotate stock using FIFO (First In, First Out) to avoid aging or brittleness.

– Keep storage areas clean and free of combustible waste.

End-of-Life and Disposal Compliance

Manage post-consumer and post-industrial foam responsibly:

– Follow local waste disposal regulations; do not landfill recyclable foam where recycling is mandated.

– Partner with certified recyclers for foam densification and reprocessing.

– Document waste tracking and disposal for audit and EPR compliance.

– Avoid littering or illegal dumping; expanded foam is often cited in plastic pollution concerns.

Audit and Continuous Improvement

Establish internal and supplier audits to ensure ongoing compliance:

– Conduct regular reviews of logistics practices, safety data, and regulatory updates.

– Train staff annually on handling, safety, and environmental protocols.

– Engage third-party verifiers for sustainability claims or certifications (e.g., ISO 14001, EPDs).

– Monitor regulatory trends (e.g., plastic taxes, microplastic restrictions) to proactively adapt operations.

By adhering to this guide, organizations can safely and compliantly manage the logistics of expanded foam materials while minimizing environmental impact and maintaining supply chain efficiency.

Conclusion for Sourcing Expanded Polystyrene (EPS) Foam:

Sourcing expanded polystyrene (EPS) foam requires a strategic approach that balances cost, quality, sustainability, and supply chain reliability. After evaluating various suppliers, production methods, and regional availability, it is evident that selecting the right source involves considering factors such as material specifications, environmental impact, certifications, and logistical efficiency. While EPS foam remains a cost-effective and lightweight solution for packaging, insulation, and construction applications, increasing regulatory and consumer pressure toward sustainability calls for responsible sourcing—prioritizing recyclable content, local suppliers to reduce carbon footprint, and partnerships with vendors committed to eco-friendly practices. Ultimately, a well-structured sourcing strategy for EPS foam should align with both operational needs and long-term environmental goals, ensuring resilience, compliance, and value across the supply chain.