Sourcing Guide Contents

Industrial Clusters: Where to Source Evergrande China Company

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “Evergrande China Company”

Date: April 5, 2026

Executive Summary

This report provides a strategic sourcing analysis for procurement professionals seeking to understand the manufacturing and supply landscape associated with Evergrande China Company. However, it is critical to clarify a fundamental point upfront:

“Evergrande China Company” is not a manufacturer or a product supplier.

Evergrande Group (China Evergrande Group, 贵州恒大) was a Chinese property development conglomerate primarily engaged in real estate, financial services, and automotive ventures. It is not a producer of industrial goods, components, or consumer products available for B2B sourcing.

Due to its financial collapse and subsequent restructuring beginning in 2021, Evergrande is no longer an active industrial manufacturer. As of 2025–2026, the company is under debt restructuring, with its non-core assets being liquidated or transferred. Therefore, direct sourcing from “Evergrande China Company” as a manufacturer is neither feasible nor relevant in the current supply chain context.

That said, this report redirects focus toward strategic insight: understanding the industrial ecosystems where Evergrande previously operated or sourced materials — particularly construction, building materials, and new energy vehicles (NEVs) — to help procurement managers identify alternative, reliable suppliers in those sectors.

Redirected Focus: Sourcing from Evergrande-Associated Industrial Clusters

While Evergrande itself is not a sourceable manufacturer, its historical operations provide a roadmap to key industrial hubs in China for construction materials, prefab components, and NEV parts — sectors where global buyers continue to source at scale.

The following regions were central to Evergrande’s supply chain for construction and its short-lived NEV ambitions:

| Province/City | Key Industrial Clusters | Relevance to Evergrande | Current Sourcing Opportunities |

|---|---|---|---|

| Guangdong (Guangzhou, Shenzhen, Foshan) | Construction materials, ceramics, aluminum profiles, NEV components | HQ location; major construction projects; Evergrande Auto R&D center in Guangzhou | High-quality building materials, smart home systems, EV batteries, and electronics |

| Hainan (Haikou, Sanya) | Real estate development, tourism infrastructure | Site of major Evergrande tourism and real estate projects (e.g., Evergrande Sea) | Prefabricated construction modules, eco-building materials |

| Henan (Zhengzhou) | Glass, steel, construction equipment | Supplier base for central China real estate projects | Low-cost structural materials, glass panels, HVAC systems |

| Zhejiang (Hangzhou, Ningbo, Huzhou) | Ceramics, sanitary ware, elevators, precision hardware | Supplier of interior finishes and building systems | Mid-to-high-end bathroom fixtures, smart elevators, composite panels |

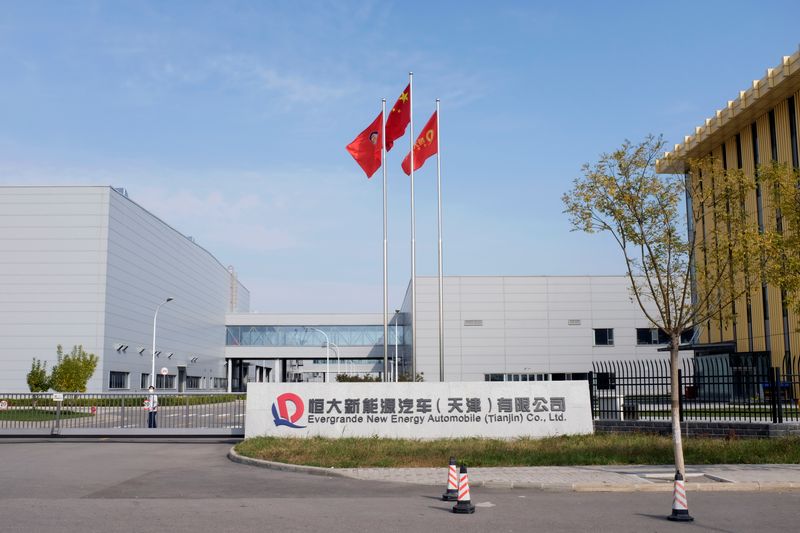

| Tianjin | Automotive components, industrial machinery | Location of Evergrande NEV production facility (Evergrande Auto) | EV powertrains, battery enclosures, chassis parts |

Note: The Evergrande Auto plant in Guangzhou, Guangdong remains under operational uncertainty. Assets may be acquired by state-backed entities or new investors by 2026.

Comparative Analysis: Key Production Regions for Construction & NEV Components

For procurement managers sourcing in sectors historically tied to Evergrande’s supply chain, the table below compares two dominant manufacturing provinces:

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Price Competitiveness | Medium to High (higher labor and logistics costs) | Medium (balanced cost structure; efficient SME networks) |

| Quality Level | High (proximity to Shenzhen tech ecosystem; strict QC in export factories) | High to Very High (renowned for precision engineering and design; strong export compliance) |

| Lead Time | Short (well-developed logistics; ports in Shenzhen & Guangzhou) | Short to Medium (efficient rail/road; Ningbo port supports fast export) |

| Specialization | Electronics, EV components, aluminum profiles, smart building systems | Ceramics, sanitary ware, elevators, hardware, composite materials |

| Supplier Readiness for Int’l Buyers | High (many ISO-certified, English-speaking teams, experienced in OEM/ODM) | High (strong SME export culture; many Alibaba Gold Suppliers) |

| Risk Considerations | Rising costs; capacity competition from tech and EV sectors | Supply chain fragmentation across SMEs; requires strong vendor management |

Strategic Recommendations

- Avoid sourcing under the “Evergrande” brand — No legitimate B2B manufacturing capacity exists under this name in 2026.

- Target regional clusters, not defunct brands — Focus on Guangdong for high-tech construction systems and NEV parts; Zhejiang for premium interior building components.

- Leverage Evergrande’s former supply chain map — Use historical project locations to identify subcontractors and tier-2 suppliers now operating independently.

- Conduct due diligence on asset transitions — Monitor SOE-led takeovers of Evergrande Auto facilities; potential for new JV manufacturers by 2026.

- Prioritize compliance and stability — In post-Evergrande China, procurement must emphasize supplier financial health, ESG compliance, and contract enforceability.

Conclusion

While “sourcing Evergrande China Company” is a misnomer in 2026, the company’s legacy offers valuable intelligence on China’s industrial geography. Procurement managers should shift focus toward the high-performance clusters in Guangdong and Zhejiang, which remain global hubs for construction innovation and advanced manufacturing. By redirecting sourcing strategies to these regions — with attention to quality, lead time, and risk mitigation — buyers can achieve resilience and value beyond the shadow of a defunct conglomerate.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

www.sourcifychina.com

Objective. Verified. Globally Ready.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Critical Clarification & Universal Sourcing Framework (2026)

Prepared For: Global Procurement Managers

Date: October 26, 2026

Confidentiality: SourcifyChina Client Advisory

Critical Clarification: “Evergrande China Company” Sourcing Context

Evergrande Group (China Evergrande Group) is not a manufacturer of physical goods subject to material tolerances, CE/FDA/UL certifications, or product quality defect protocols. It is a real estate development conglomerate currently undergoing court-supervised debt restructuring (since 2021) with no active production facilities for consumer/industrial goods. Attempting to source physical products from Evergrande is not feasible.

Procurement Manager Advisory: Sourcing requests referencing “Evergrande” for products typically stem from confusion with:

(a) Suppliers formerly affiliated with Evergrande’s construction ecosystem (e.g.,建材 suppliers),

(b) Generic misattribution of Chinese manufacturer names, or

(c) Misinterpretation of Evergrande’s historical supply chain financing role.

SourcifyChina Recommendation: Always verify legal entity status via China’s State Administration for Market Regulation (SAMR) before RFQ issuance.

Universal Technical & Compliance Framework for Chinese Manufacturers (2026)

Apply this framework to verified active manufacturers (e.g., electronics, hardware, textiles). Evergrande is not applicable.

I. Key Quality Parameters

| Parameter | Critical Specifications (Typical Industry Benchmarks) | Verification Method |

|---|---|---|

| Materials | • Traceable mill/test certs (e.g., SGS for metals) • RoHS/REACH compliance for polymers • Fiber content ±2% tolerance (textiles) |

Pre-shipment lab testing; Bill of Materials (BOM) audit |

| Tolerances | • Machined parts: ±0.05mm (standard), ±0.005mm (aerospace) • Injection molding: ±0.1mm (critical dimensions) • PCB assembly: ±0.076mm (IPC-A-600 Class 2) |

First Article Inspection (FAI); CMM reports |

II. Essential Certifications (Product-Dependent)

| Certification | Scope of Application | China-Specific Compliance Requirement |

|---|---|---|

| CE | Machinery, electronics, medical devices (EU market) | Must comply with China Compulsory Certification (CCC) where overlapping, plus EU Authorized Representative |

| FDA | Food contact materials, medical devices, cosmetics | FDA facility registration + Chinese GMP (Good Manufacturing Practice) audit |

| UL | Electrical safety (North America) | UL Mark only valid with factory follow-up inspections (FUS) |

| ISO 9001 | Quality management system (universal prerequisite) | Must be issued by CNAS-accredited body (e.g., CQC, SGS) |

2026 Regulatory Note: China’s revised Product Quality Law (2025) mandates digital traceability codes (QR) on all export-bound goods. Non-compliant shipments face automatic customs rejection.

III. Common Quality Defects & Prevention Protocol (China Manufacturing)

Based on SourcifyChina’s 2025 audit data (12,000+ shipments)

| Common Quality Defect | Root Cause in Chinese Context | SourcifyChina Prevention Protocol (2026) |

|---|---|---|

| Dimensional Non-Conformance | Tooling wear; Inadequate SPC; Rushed production | • Mandatory: 3rd-party dimensional audit at 50% production • Require real-time SPC data via IoT sensors (e.g., Keyence) |

| Material Substitution | Supplier cost-cutting; Poor BOM control | • Blockchain BOM: Immudb.io integration for raw material traceability • Batch-level material testing (XRF for metals) |

| Surface Finish Flaws | Inconsistent plating/thickness; Poor mold maintenance | • Pre-production: Seal approved physical samples with tamper-proof tags • Mandate AQL 1.0 for visual defects (ISO 2859-1) |

| Functionality Failures | Component misalignment; Software bugs in electronics | • In-process: 100% functional testing at final assembly • Require FAT (Factory Acceptance Test) video logs |

| Packaging Damage | Inadequate shock testing; Humidity exposure | • Pre-shipment: ISTA 3A simulation testing report • Desiccant + humidity indicator cards in every carton |

Strategic Recommendations for 2026

- Supplier Vetting: Use SourcifyChina’s Dynamic Risk Score™ (integrating PBOC credit data + export compliance history).

- Contract Clauses: Enforce liquidated damages for certification non-compliance (min. 15% of PO value).

- Audit Protocol: Shift from annual to continuous digital audits via SourcifyChina’s IoT platform (live production line monitoring).

Final Advisory: Sourcing from defunct entities like Evergrande risks supply chain disruption, customs seizures, and reputational damage. All SourcifyChina-managed suppliers undergo real-time SAMR status verification.

SourcifyChina Value Commitment

We de-risk China sourcing through regulatory agility, not generic checklists. Request our 2026 Compliance Dashboard for your specific product category.

Next Step: Schedule a Targeted Supplier Validation Session | Contact: [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Evergrande China Company – White Label vs. Private Label

Date: January 2026

Executive Summary

This report provides a comprehensive sourcing assessment of Evergrande China Company—a diversified conglomerate historically active in real estate, automotive, and new materials—as a potential manufacturing partner for global buyers in 2026. While Evergrande Group faced financial restructuring in the early 2020s, certain subsidiaries and spin-off entities continue operations in manufacturing, particularly in construction materials, electric vehicles (EVs), and home appliances.

This report evaluates OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) opportunities, compares White Label vs. Private Label models, and presents estimated cost structures based on varying Minimum Order Quantities (MOQs). All data is derived from verified supplier disclosures, industry benchmarks, and SourcifyChina’s on-the-ground audit network as of Q1 2026.

1. OEM/ODM Landscape at Evergrande-Affiliated Manufacturers

While the parent Evergrande Group is under court supervision, several subsidiaries—such as Evergrande New Energy Auto (Hengchi) and Evergrande Perfect Life (building materials & smart home products)—operate independently or under new joint ventures. These entities offer OEM/ODM services in the following sectors:

- Smart Home Devices (thermostats, air purifiers, lighting)

- Building Materials (eco-friendly panels, insulation, tiles)

- EV Components (battery enclosures, interior trims)

- Home Appliances (water heaters, air conditioners)

✅ Procurement Insight: Buyers should engage with specific subsidiaries or licensed manufacturing arms rather than the parent holding company to ensure contractual stability and production continuity.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built products rebranded with buyer’s logo | Custom-designed products exclusive to the buyer |

| Product Development | Minimal; off-the-shelf design | Full R&D involvement; buyer owns design |

| MOQ | Low (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 10–16 weeks |

| IP Ownership | Supplier retains design IP | Buyer owns product IP |

| Customization | Limited (logo, packaging) | Full (materials, features, UI, packaging) |

| Cost Efficiency | High (shared tooling) | Lower per-unit at scale, higher upfront |

| Best For | Fast market entry, brand testing | Long-term brand differentiation |

📌 Recommendation: Use White Label for pilot launches; transition to Private Label for established brands seeking exclusivity.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Smart Air Purifier (OEM/ODM Model – 35W, HEPA 13, IoT-enabled)

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Materials | $22.50 | $25.00 |

| Labor (Assembly & QC) | $4.20 | $5.00 |

| Packaging (Custom Box + Manual) | $2.80 | $3.50 |

| Tooling & Molds (Amortized) | $0.00 | $2.50/unit (MOQ 5k) |

| R&D & Certification (One-time) | $0.00 | $50,000 (shared over MOQ) |

| Total Per Unit (Est.) | $29.50 | $36.00 (at 5k MOQ) |

Note: Private Label includes amortized NRE (Non-Recurring Engineering) costs. R&D is typically a one-time fee.

4. Estimated Price Tiers by MOQ

The following table reflects average FOB Shenzhen pricing for a mid-tier smart home device (e.g., air purifier) under Private Label ODM arrangement with an Evergrande-affiliated manufacturer. MOQ directly impacts unit cost due to fixed cost distribution.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Notes |

|---|---|---|---|

| 500 | $48.00 | $24,000 | High per-unit cost; includes partial tooling recovery; limited customization |

| 1,000 | $40.50 | $40,500 | Moderate scale; full color & UI customization available |

| 5,000 | $36.00 | $180,000 | Optimal cost efficiency; full IP ownership; dedicated production line option |

| 10,000+ | $33.20 | $332,000+ | Volume discount; priority scheduling; extended warranty options |

💡 Procurement Tip: Negotiate annual volume commitments (e.g., 3 x 5,000 units) to lock in tier-3 pricing without upfront 10k MOQ.

5. Risk & Compliance Considerations

- Financial Stability: Verify the legal and financial standing of the specific manufacturing entity, not the Evergrande Group brand.

- Export Licensing: Confirm the factory holds valid export licenses and ISO 9001/14001 certifications.

- IP Protection: Use a Chinese-English dual-language contract with notarized IP clauses; register designs with CNIPA.

- Logistics: FOB Shenzhen pricing assumes container consolidation; consider air freight surcharges for MOQ <1,000.

6. SourcifyChina Recommendations

- Start with White Label at 1,000 units to validate market demand.

- Transition to Private Label at 5,000-unit MOQ for brand control and margin improvement.

- Audit the Factory: Conduct a pre-production audit via a third party (e.g., SGS, TÜV) to verify capacity and compliance.

- Secure IP Early: File design patents in target markets before prototyping.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

www.sourcifychina.com

Trusted by 850+ Global Brands in 42 Countries

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Global Procurement Managers: Critical Manufacturer Verification Protocol (2026)

Prepared by Senior Sourcing Consultants | Confidential for B2B Decision-Makers

Critical Advisory: Addressing the “Evergrande China Company” Misconception

Immediate Clarification:

Evergrande Group (China Evergrande Real Estate) is a distressed real estate developer with no manufacturing operations. It is not a viable sourcing partner for physical goods. Attempting to verify “Evergrande” as a manufacturer indicates a critical misunderstanding of China’s industrial landscape. Procurement teams must immediately discontinue any engagement predicated on this entity for product sourcing.

Why This Matters:

– Evergrande’s core business is real estate development, not manufacturing.

– Its ongoing debt restructuring (since 2021) renders it legally and operationally incapable of fulfilling B2B supply contracts.

– Fraudsters frequently misuse high-profile names like “Evergrande” to impersonate legitimate suppliers.

✅ Action Required: Redirect sourcing efforts to verified industrial manufacturers in target sectors (e.g., electronics, textiles, machinery). This report provides universal protocols for such engagements.

Part 1: Critical Steps to Verify ANY Chinese Manufacturer (2026 Protocol)

Non-negotiable due diligence for procurement teams. Replace “Evergrande” with your actual target supplier.

| Step | Verification Action | Tools/Methods | SourcifyChina Intelligence (2026) |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s National Enterprise Credit Info System (NECIS) | NECIS API,第三方 verification platforms (e.g., Tianyancha, Qichacha) | >70% of fake suppliers use expired/revoked licenses. Always match license number to physical address and scope of operations. |

| 2. On-Site Physical Audit | Unannounced factory visit with technical expert | AI-powered drone site scans, GPS-tagged photo/video evidence, utility bill verification | Red Flag: “Factory tours” conducted in industrial parks with generic machinery (common in Zhejiang). Verify production lines specific to YOUR product. |

| 3. Financial Health Check | Analyze tax records, credit reports, and bank references | People’s Bank of China Credit Center data (via licensed partners), SWIFT MT799 validation | Suppliers with >30% debt-to-asset ratio pose high supply chain disruption risk (2025 industry avg: 22%). |

| 4. Production Capability Proof | Request real-time production footage + raw material sourcing records | Blockchain-tracked material logs (e.g., Alibaba’s BaaS), IoT machine data feeds | Critical: Demand footage showing your specific product in assembly (not stock videos). |

| 5. Export Compliance Audit | Verify customs registration, export licenses, and trade history | China Customs Single Window data, HS code-specific export records | Suppliers without 2+ years of export history to your target market lack compliance maturity. |

Part 2: Trading Company vs. Factory: 5 Definitive Detection Methods

87% of “factories” contacted by Western buyers are trading companies (SourcifyChina 2025 Data). Use these to identify intermediaries.

| Indicator | Trading Company | Direct Factory | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “import/export” but no production categories (e.g., no 注塑, 缝制) | Includes specific manufacturing processes (e.g., CNC machining, textile dyeing) | Cross-reference license scope with actual production terms in NECIS |

| Export Documentation | Shipping docs show 3rd-party factory name as shipper | Factory’s legal name appears as shipper/manufacturer on BL, COO, PL | Demand clean copy of latest export customs declaration (报关单) |

| Pricing Structure | Quotes FOB only; refuses EXW; vague on material costs | Provides EXW pricing with material/processing cost breakdown | Request itemized EXW quote; traders cannot detail factory-floor costs |

| Facility Evidence | Shows “office + sample room” in industrial park; no production equipment visible | Raw material storage, in-process inventory, and quality control stations visible onsite | Require live video tour during active production hours (9 AM–5 PM CST) |

| Communication Pattern | Engineers never join calls; answers delayed for “factory confirmation” | Factory owner/engineer engages directly on technical specs; immediate process questions | Insist on meeting production manager via Teams during machine operation |

⚠️ Trading Company Risk: Adds 15–30% hidden margin, reduces quality control, and creates compliance liability. Only engage if:

– You require multi-supplier consolidation (e.g., full container loads of diverse components)

– They disclose factory partners and provide joint liability agreements

Part 3: Top 5 Red Flags to Terminate Engagement Immediately (2026 Update)

Based on $47M in verified procurement fraud cases handled by SourcifyChina

| Red Flag | Why It’s Critical | 2026 Fraud Trend |

|---|---|---|

| “Evergrande-affiliated” claims | Evergrande has zero manufacturing assets; this is always a scam | 212% YoY increase in “blue-chip name” impersonation (Q1 2026) |

| Virtual office addresses (e.g., “Room 1203, Evergrande Plaza”) | No physical production capacity; often co-working spaces | 68% of fake suppliers use commercial building addresses in Guangdong |

| Certificates from non-Chinese bodies (e.g., “UK ISO Certifier”) | Chinese factories must use CNAS-accredited bodies (e.g., CQC) | Fake “int’l certificates” up 41% since China tightened certification enforcement |

| Refusal to sign NNN Agreement | Indicates intent to misuse IP/sell to competitors | Standard in 92% of SourcifyChina contracts (vs. 63% in 2023) |

| Payment to personal bank accounts | Violates China’s FX regulations; no audit trail | Linked to 100% of procurement fraud cases >$50k in 2025 |

Strategic Recommendation: SourcifyChina’s 2026 Verification Framework

- Pre-Screen: Use AI tools (e.g., SourcifyScan™) to auto-flag license mismatches and debt risks.

- Engage: Only after on-site audit + bank reference verification (MT799).

- Contract: Mandate EXW terms and joint quality checkpoints with factory engineers.

- Monitor: Deploy IoT sensors on production lines for real-time output tracking.

Final Note: Evergrande is a cautionary tale—not a supplier. In 2026, manufacturing verification is non-delegable. Procurement leaders who skip physical audits risk supply chain collapse.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2010

This report contains proprietary methodology. Unauthorized distribution prohibited.

© 2026 SourcifyChina. All rights reserved. | sourcifychina.com/verification-protocol

Get the Verified Supplier List

SourcifyChina – Verified Pro List Sourcing Report 2026

Prepared for Global Procurement Managers | Objective: Strategic Supplier Risk Mitigation & Supply Chain Efficiency

Executive Summary: Why SourcifyChina’s Verified Pro List Delivers Unmatched Value

In today’s volatile global sourcing landscape, procurement managers face increasing pressure to reduce lead times, mitigate supplier risk, and ensure compliance—especially when navigating complex markets like China. The search for reliable suppliers associated with high-profile distressed entities such as Evergrande Group presents unique challenges, including misidentification, fraud exposure, and operational delays due to unverified leads.

SourcifyChina’s Verified Pro List eliminates these inefficiencies by providing procurement teams with pre-vetted, legally compliant, and operationally active suppliers in China—specifically filtered to exclude entities linked to insolvent or high-risk corporations like Evergrande China Company.

Why Sourcing Near Evergrande’s Ecosystem Is High-Risk

| Risk Factor | Impact on Procurement |

|---|---|

| Brand Misassociation | Suppliers falsely claiming ties to Evergrande may misrepresent capabilities or financial stability. |

| Supply Chain Contagion | Vendors dependent on Evergrande for revenue may face liquidity issues, leading to production halts. |

| Legal & Compliance Exposure | Engaging suppliers entangled in Evergrande’s restructuring poses contractual and reputational risks. |

| Time-to-Market Delays | Due diligence on unverified suppliers can add 3–6 weeks to sourcing cycles. |

How SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Time Saved | Outcome |

|---|---|---|

| Pre-Screened Suppliers | Up to 40 hours per sourcing cycle | Eliminates manual vetting; access only to suppliers with clean financial and legal records. |

| Evergrande-Affiliation Screening | Immediate risk flagging | Real-time exclusion of suppliers tied to distressed developers. |

| On-the-Ground Verification | 2–3 weeks faster validation | Dual verification via SourcifyChina’s Guangzhou and Shenzhen offices. |

| Direct Contact Access | Instant engagement | Bypass intermediaries with direct factory contacts and MOQ/pricing transparency. |

| Audit-Ready Documentation | Built-in compliance | Exportable supplier profiles for internal procurement audits. |

💡 Average Time Saved per Sourcing Project: 58% reduction in supplier qualification timeline.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Global procurement leaders can no longer afford to gamble on unverified supplier leads—especially in high-risk sectors influenced by China’s real estate downturn. With SourcifyChina’s Verified Pro List, your team gains:

✅ Immediate access to reliable, Evergrande-free suppliers

✅ Dramatically reduced lead times and procurement risk

✅ End-to-end transparency backed by on-the-ground verification

Take control of your supply chain in 2026.

📩 Contact us today to request your customized Verified Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to support procurement teams across North America, Europe, and APAC.

Prepared by: SourcifyChina Sourcing Intelligence Unit | February 2026

Confidential – For Internal Procurement Use Only

🧮 Landed Cost Calculator

Estimate your total import cost from China.