The global ethane gas market is experiencing steady growth, driven by rising demand from the petrochemical industry, particularly for ethylene production used in plastics, packaging, and synthetic materials. According to a 2023 report by Mordor Intelligence, the ethane market was valued at approximately USD 52.6 billion and is projected to grow at a CAGR of over 4.3% from 2023 to 2028. This expansion is fueled by increased shale gas extraction in North America, ongoing investments in steam cracker facilities, and growing downstream applications in emerging economies. As global energy and chemical sectors evolve, ethane supply chain reliability and production efficiency have become critical. In this competitive landscape, a select group of manufacturers dominate output, technological innovation, and global distribution. Below is a data-informed overview of the top nine ethane gas manufacturers shaping the industry’s future.

Top 9 Ethane Gas Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Air Products:

Domain Est. 1995

Website: airproducts.com

Key Highlights: Air Products provide essential industrial gases, related equipment and applications expertise to customers in dozens of industries. Find out more….

#2 LyondellBasell (LYB)

Domain Est. 2007

Website: lyondellbasell.com

Key Highlights: LyondellBasell creates solutions for everyday sustainable living as the global chemical industry leader & leading polymer producer….

#3 Amid Hopes and Fears, a Plastics Boom in Appalachia Is On Hold

Domain Est. 1987

Website: e360.yale.edu

Key Highlights: With plans for a $10 billion ethane cracker plant, a local official says, “we saw the potential and what it meant for the township.” He added ……

#4 Energy Transfer

Domain Est. 1997

Website: energytransfer.com

Key Highlights: Energy Transfer is one of North America’s largest and most diversified midstream energy companies. See how we’re working to safely transport the oil and gas ……

#5 Why shale gas from the US still works with $30 oil

Domain Est. 1998

Website: ineos.com

Key Highlights: The availability of low-cost ethane, a natural gas derived from shale gas, has revitalised America’s chemical industry and given it an advantage over many ……

#6

Domain Est. 2000

Website: altagas.ca

Key Highlights: From Canada for the world. As early exporters of Canadian liquid petroleum gas (LPG) to overseas markets, we know what it takes to invest, build and grow ……

#7 ADNOC

Website: adnoc.ae

Key Highlights: We are a world-class gas processing and marketing company, publicly listed on ADX in March 2023. As a leading global player, we serve a wide array of domestic ……

#8 Liquified Gas Carrier Business

Website: mol.co.jp

Key Highlights: MOL manages its LNG carriers through six companies around the globe, in Tokyo, London, Singapore, Jakarta, Muscat (Oman), and Arzew (Algeria)….

#9 Top 10 Flammable Gases

Domain Est. 2016

Website: armadex.com

Key Highlights: In this article, we discuss the characteristics of the following flammable gases: Ammonia, Acetylene, Butane, Carbon Monoxide, Hydrogen, Methane, Propane, ……

Expert Sourcing Insights for Ethane Gas

As of now, there is no widely recognized analytical framework or methodology known as “H2” that is standardly applied to market trend analysis—particularly for commodities like ethane gas. It’s possible there may be a misunderstanding or typo in your request. However, I will interpret your query in two plausible ways and provide a comprehensive analysis accordingly:

-

If “H2” refers to Hydrogen (H₂): We will analyze how the development of the hydrogen economy (especially hydrogen production using ethane) might influence ethane gas market trends in 2026.

-

If “H2” refers to the second half of the year (e.g., H2 2026): We will analyze projected ethane market trends for the second half of 2026.

Given the context of “Ethane Gas,” the first interpretation—Hydrogen (H₂)—is more plausible. Below is a forward-looking analysis of 2026 ethane market trends under the influence of hydrogen (H₂) development.

Market Trends for Ethane Gas in 2026: Influence of Hydrogen (H₂) Development

1. Overview of Ethane in 2026

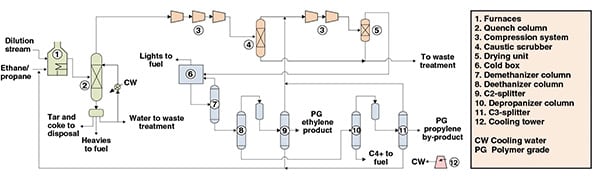

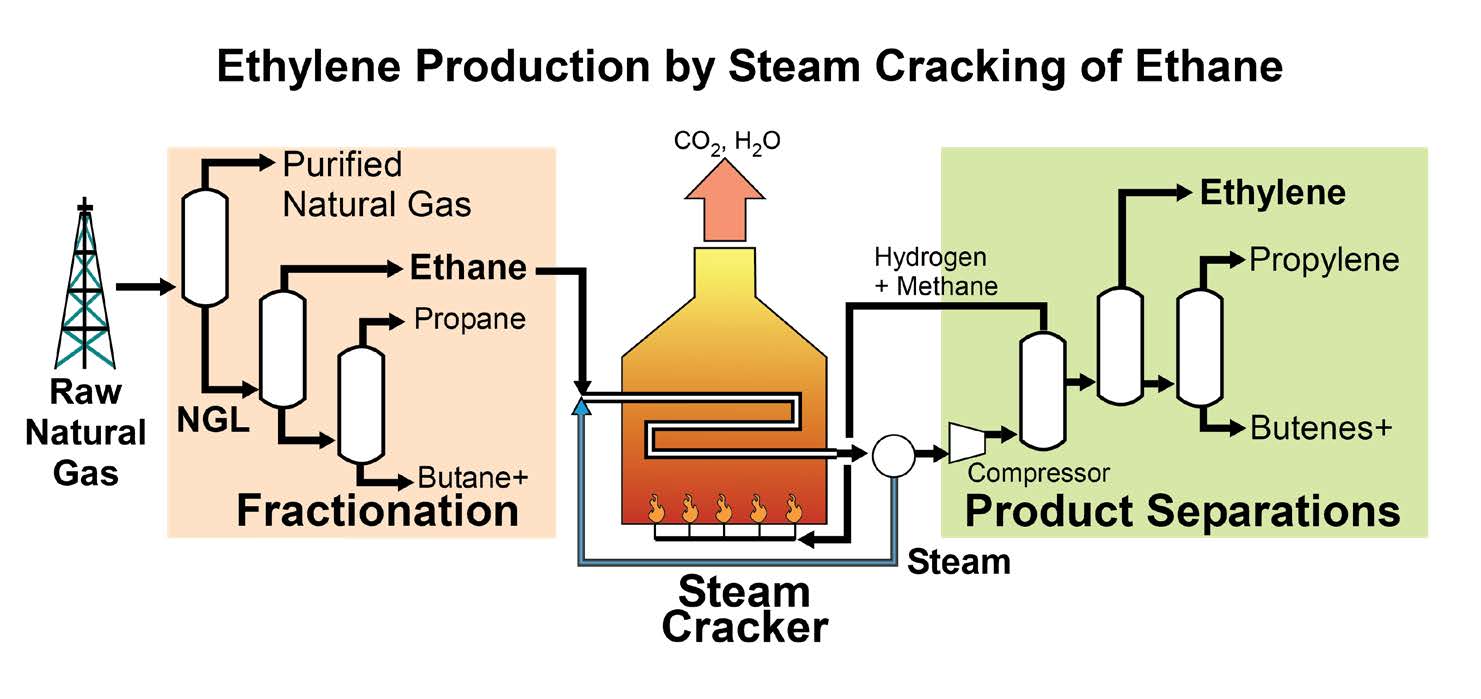

Ethane (C₂H₆) is a key component of natural gas liquids (NGLs) and serves primarily as a feedstock for ethylene production in steam crackers—essential for plastics manufacturing. In recent years, ethane has also gained interest as a potential feedstock for blue hydrogen production via steam methane reforming (SMR) or oxidative coupling.

However, ethane is not a primary source for hydrogen today, but indirect linkages are emerging through:

- Ethane cracking for hydrogen co-production

- Blue hydrogen initiatives using hydrocarbon feedstocks

- Carbon capture integration in ethylene plants

2. Key 2026 Market Drivers Influenced by H₂ (Hydrogen)

a) Blue Hydrogen Projects Using Ethane Feedstock

- By 2026, several blue hydrogen projects are expected to come online, particularly in the U.S. Gulf Coast, Middle East, and Canada, where ethane is abundant.

- Ethane can be reformed to produce hydrogen and CO₂. When paired with carbon capture, utilization, and storage (CCUS), this pathway becomes a lower-carbon hydrogen source.

- Example: Gulf Coast projects may use ethane from shale gas (e.g., Permian and Marcellus basins) to produce hydrogen for industrial use or ammonia export.

👉 Market Impact: Increased demand for ethane as a hydrogen feedstock could tighten ethane supply and support higher prices, especially in regions with hydrogen hubs.

b) Co-Production of Hydrogen in Ethane Cracking

- Steam cracking of ethane to produce ethylene also generates hydrogen-rich off-gases.

- By 2026, more ethylene plants are expected to capture and purify this hydrogen for use in refineries, chemical processes, or fuel cells.

- Technological advances in hydrogen separation and compression make this economically viable.

👉 Market Impact: This increases the value proposition of ethane cracking, potentially leading to expanded ethylene capacity and sustained ethane demand.

c) Policy and Incentives (Inflation Reduction Act, EU Green Deal)

- The U.S. Inflation Reduction Act (IRA) offers $3/kg subsidy for clean hydrogen, including blue hydrogen with high carbon capture rates.

- Projects using ethane with ≥90% CO₂ capture may qualify.

- Similar incentives in Canada and the EU could stimulate ethane-based hydrogen initiatives.

👉 Market Impact: Subsidies may redirect ethane toward hydrogen projects, competing with petrochemical demand.

d) Regional Shifts

- U.S.: Expected to remain the largest ethane producer, with growing export capacity. Ethane-to-hydrogen projects may emerge near export terminals.

- Middle East: Countries like Saudi Arabia and Qatar are investing in blue and turquoise hydrogen. Ethane, often separated from associated gas, could serve dual roles in petrochemicals and hydrogen.

- Asia: China and India may increase ethane imports for plastics, but hydrogen strategies remain coal-dominated. Limited direct ethane-to-H₂ impact.

3. Supply and Demand Outlook for Ethane (2026)

| Factor | 2026 Projection |

|——-|—————–|

| Global Ethane Production | ~220 million tons (up from ~200 Mt in 2023) |

| Ethane Consumption in Steam Crackers | ~180 million tons (majority) |

| Ethane Use in Hydrogen/CCUS Projects | ~5–10 million tons (emerging segment) |

| Ethane Exports (Liquefied) | ~30 million tons (U.S. dominant) |

| Price Trend (U.S. Gulf Coast) | $0.25–$0.35/gallon (moderate increase due to H₂ demand) |

4. Challenges and Risks

- Carbon Capture Costs: High CAPEX for CCUS may limit ethane-based blue hydrogen scalability.

- Methane vs. Ethane Reforming: Methane (CH₄) remains the preferred feedstock for hydrogen due to infrastructure and reaction efficiency.

- Regulatory Uncertainty: Clean hydrogen definitions and certification vary by region, affecting project viability.

- Ethane Oversupply Risk: If shale gas production slows, ethane availability could constrain both chemical and hydrogen sectors.

5. Conclusion: Ethane and H₂ Synergy in 2026

By 2026, hydrogen (H₂) development will not dominate ethane demand, but it will create a niche but growing market for ethane as a feedstock in low-carbon hydrogen production. The integration of CCUS with ethane-based hydrogen or ethylene plants will enhance the economic and environmental value of ethane.

Key Trends:

– Ethane demand supported by both plastics and clean hydrogen.

– Regional hubs (U.S., Middle East) lead in ethane-to-H₂ integration.

– Ethane pricing may firm due to competition from hydrogen projects.

– Technological advances in hydrogen recovery from cracking will improve margins.

Strategic Implications:

– Producers should assess dual-use potential of ethane (ethylene vs. hydrogen).

– Investors should monitor policy incentives tied to clean hydrogen.

– Exporters may see new opportunities in hydrogen-ready ethane supply chains.

Final Note: If “H2” was intended to mean “second half of 2026,” the above trends are still applicable, with H2 2026 likely seeing the acceleration of announced hydrogen projects, seasonal ethane demand peaks (due to petrochemical run rates), and potential price volatility tied to export dynamics and policy developments.

Let me know if you meant a different “H2” framework (e.g., a proprietary analytical model), and I can adapt the analysis accordingly.

When sourcing ethane gas, especially with considerations around quality and intellectual property (IP), several common pitfalls can arise. Using hydrogen (H₂) as a reference or contrast can help clarify these issues by highlighting differences in handling, purity requirements, and IP sensitivity. Below is a breakdown of common pitfalls in sourcing ethane gas, analyzed through the lens of hydrogen as a comparative benchmark.

1. Purity and Quality Variability

Pitfall: Ethane is often co-produced with other hydrocarbons (e.g., methane, propane) in natural gas streams. The purity of ethane can vary significantly depending on the source (e.g., shale gas, associated gas), leading to contamination risks (e.g., sulfur compounds, moisture, heavier hydrocarbons).

Contrast with H₂:

Hydrogen is highly sensitive to impurities (e.g., CO, CO₂, H₂O, H₂S), especially in fuel cell applications. However, hydrogen is often purified via standardized processes (e.g., PSA, membrane separation). In contrast, ethane purity standards are less universally enforced, and off-spec ethane can damage downstream processes (e.g., ethylene crackers).

Mitigation:

– Specify strict ethane purity (e.g., >95% C₂H₆) and limits on contaminants (e.g., H₂S < 4 ppm, H₂O < 1 ppm).

– Use gas chromatography for verification—similar to protocols used for H₂ quality assurance.

2. Lack of Standardized Specifications

Pitfall: Unlike hydrogen, which has emerging global standards (e.g., ISO 14687 for fuel cell H₂), ethane lacks universally adopted quality specs. This leads to inconsistent supply and potential disputes.

Contrast with H₂:

Hydrogen markets are developing robust quality frameworks due to safety and performance needs. Ethane, while mature in petrochemicals, often relies on bilateral agreements, increasing IP and contractual risk.

Mitigation:

– Adopt or reference standards such as GPA 2145 (for ethane in NGL streams).

– Include detailed quality clauses in supply agreements to avoid ambiguity.

3. Intellectual Property (IP) Risks in Processing and Use

Pitfall: Ethane is primarily used in steam cracking to produce ethylene—a process involving proprietary catalysts, furnace designs, and operating conditions. Suppliers or partners may require access to your process details, risking IP exposure.

Contrast with H₂:

Hydrogen production (e.g., via electrolysis or SMR) also involves IP (e.g., catalyst formulations, cell designs), but modular systems often allow for technology separation. In ethane cracking, integration between feedstock quality and furnace performance is tighter, increasing interdependence and IP exposure.

Mitigation:

– Use tolling agreements where the processor handles cracking without accessing your full process data.

– Limit data sharing to essential parameters (e.g., heating value, contaminant levels), similar to how H₂ suppliers provide purity without exposing electrolyzer IP.

4. Logistical and Storage Challenges

Pitfall: Ethane requires cryogenic storage (-89°C) or high-pressure transport, unlike methane. Infrastructure is limited compared to H₂ in some regions (e.g., hydrogen pipelines in the EU, ethane pipelines in the US Marcellus region).

Contrast with H₂:

H₂ poses different logistical challenges: low density, embrittlement, leakage. Ethane is easier to liquefy than H₂ but still demands specialized infrastructure.

Pitfall: Relying on unproven or shared infrastructure can expose supply chains to disruptions and quality degradation (e.g., cross-contamination).

Mitigation:

– Audit logistics partners using H₂-like integrity protocols (e.g., material compatibility, leak detection).

– Specify custody transfer points with quality testing, akin to H₂ refueling station checks.

5. Feedstock-Process Matching (Hidden IP Link)

Pitfall: Ethane quality directly affects cracker performance (e.g., coking rate, yield). Off-spec ethane can invalidate process IP or reduce efficiency. Unlike H₂, which is often combusted or used catalytically with tolerance, ethane is chemically transformed—making feedstock quality integral to IP protection.

Example: A proprietary cracker may be optimized for ethane with <1% methane. Higher methane increases methane recycle load, reducing efficiency and potentially revealing operational setpoints.

Mitigation:

– Treat ethane quality as part of your process IP envelope.

– Require feedstock pre-approval and testing—like qualifying H₂ sources for fuel cell durability.

6. Market Transparency and Pricing Complexity

Pitfall: Ethane pricing is often opaque, linked to oil or ethylene prices, and regionally fragmented. This complicates long-term sourcing and budgeting—unlike emerging transparent H₂ markets (e.g., H₂ color pricing: grey, blue, green).

Contrast with H₂: Green H₂ pricing is becoming benchmarked (e.g., $/kg), aiding investment decisions. Ethane lacks such clarity, increasing financial and supply risk.

Mitigation:

– Use indexed pricing with clear quality adjustments (e.g., BTU correction), similar to H₂ energy content pricing.

– Secure term contracts with quality guarantees.

Summary Table: Ethane vs. H₂ Sourcing Risks

| Risk Area | Ethane Pitfall | H₂ Comparison | Mitigation Strategy |

|————————–|————————————————–|————————————————|——————————————————-|

| Purity | Variable C₂H₆, contaminants affect cracking | Strict specs (ISO 14687) | Enforce GPA 2145; use GC analysis |

| Standards | No global specs; bilateral agreements | ISO, SAE, national H₂ standards | Adopt GPA/ASTM; define in contracts |

| IP Exposure | Feedstock quality tied to cracker IP | Modular H₂ systems reduce exposure | Use tolling; limit data sharing |

| Logistics | Cryogenic transport; limited infrastructure | Compression/liquefaction; embrittlement | Audit carriers; specify handling protocols |

| Process Integration | Off-spec ethane degrades yield/IP performance | H₂ impurities affect catalysts/fuel cells | Pre-qualify feedstock; include in IP risk assessment |

| Pricing & Transparency | Opaque, oil-linked, regional | Emerging color-based pricing (e.g., green H₂) | Use indexed, quality-adjusted contracts |

Conclusion

Sourcing ethane gas involves significant quality and IP risks that are often underestimated due to its status as a commodity. By learning from the more rigorously managed hydrogen supply chain—especially in areas like standardization, purity control, and IP-safe contracting—companies can better mitigate risks. Treating ethane with the same diligence as H₂ in terms of quality assurance and contractual clarity is key to securing reliable, IP-protected operations.

H2: Logistics & Compliance Guide for Ethane Gas

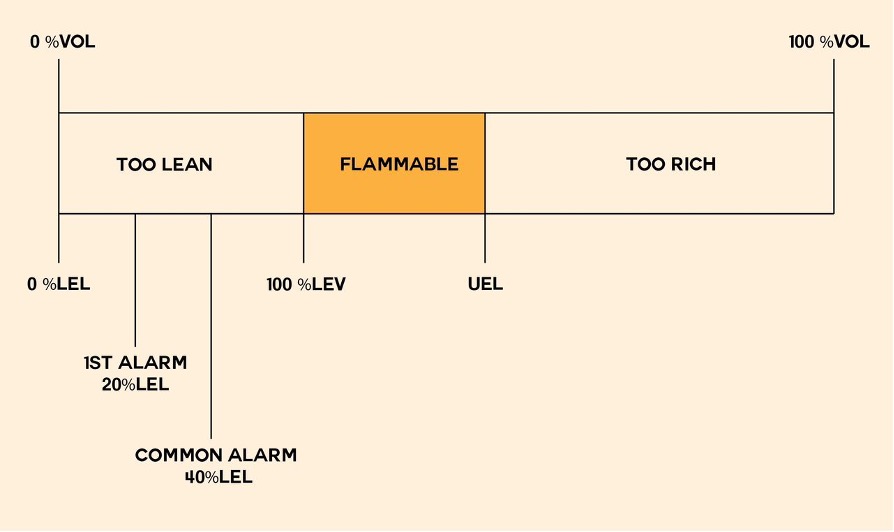

Ethane (C₂H₆) is a colorless, odorless, flammable hydrocarbon gas primarily used as a petrochemical feedstock for ethylene production. Due to its physical properties and potential hazards, ethane requires strict logistics and regulatory compliance throughout its supply chain. This guide outlines key considerations for the safe and compliant handling, transportation, storage, and regulatory adherence related to ethane gas.

1. Physical & Chemical Properties

- Chemical Formula: C₂H₆

- Boiling Point: -88.6°C (-127.5°F)

- Density: Lighter than air (vapor density ~0.97)

- Flammability: Flammable range in air: 3.0–12.4% by volume

- State: Typically transported as a liquefied gas under pressure or refrigeration

- Odor: Odorless; odorants may be added for leak detection in certain applications

2. Classification & Regulatory Framework

Ethane is regulated under multiple international and national frameworks:

GHS Classification (Globally Harmonized System)

- Flammable Gas, Category 1

- Hazard Statements:

- H220: Extremely flammable gas

- H280: Contains gas under pressure; may explode if heated

Transportation Regulations

- UN Number: UN 1035

- Proper Shipping Name: Ethane

- Hazard Class: 2.1 (Flammable Gas)

- Packing Group: Not applicable (gases are classified by hazard division only)

- Labels Required: Flammable Gas (Class 2.1), Gas Under Pressure

Regulatory Bodies

- USA:

- Department of Transportation (DOT) – 49 CFR

- Occupational Safety and Health Administration (OSHA) – 29 CFR 1910

- Environmental Protection Agency (EPA) – Clean Air Act, RMP, and EPCRA

- International:

- IMDG Code (Maritime)

- ADR (Road, Europe)

- IATA DGR (Air)

- ICAO TI (Air Transport)

- Europe:

- REACH, CLP Regulation (EC) No 1272/2008

- Seveso III Directive (for storage thresholds)

3. Storage Requirements

- Cylinders & Tanks:

- Must be designed and tested to meet pressure standards (e.g., DOT 3AA, TC, or ISO 9809).

- Stored upright, secured, and protected from physical damage.

- Temperature Control:

- Store in cool, well-ventilated areas away from heat sources and ignition.

- Avoid exposure to temperatures >50°C (122°F).

- Separation:

- Keep away from oxidizers, halogens, and strong acids.

- Minimum 6 m (20 ft) separation from oxygen or chlorine.

- Ventilation:

- Indoor storage requires continuous ventilation to prevent accumulation.

- Fire Protection:

- Fire-rated storage areas with automatic suppression systems (if applicable).

- Dike or bunding not typically required due to gas dispersion behavior.

4. Transportation Logistics

Modes of Transport

- Road (Trucks/Tankers):

- Use DOT/ADR-compliant cargo tanks.

- Vehicle must display Class 2.1 placards.

- Driver training in hazardous materials (HazMat) required.

- Rail:

- TC/DOT-spec tank cars (e.g., DOT-112J340W)

- Routing restrictions may apply near populated areas.

- Marine (IMDG):

- Transported in pressure vessels or as liquefied gas in refrigerated tanks (Type C independent tanks).

- Requires stowage away from heat and living quarters.

- Air (Limited):

- Generally prohibited for passenger aircraft; limited exceptions for small quantities (e.g., scientific use).

- Must comply with IATA DGR, Packing Instruction 200.

Documentation

- Shipper’s Declaration for Dangerous Goods

- Safety Data Sheet (SDS) – Section 14 (Transport Information)

- Emergency Response Information (e.g., ERG Guide 115)

- Carrier permits and route-specific approvals (e.g., tunnel codes for ADR)

5. Handling & Safety Procedures

- Personal Protective Equipment (PPE):

- Flame-resistant clothing, face shield, chemical-resistant gloves, safety goggles.

- Self-contained breathing apparatus (SCBA) for confined space or large leak response.

- Leak Detection:

- Use combustible gas detectors calibrated for ethane.

- Inert gas tracing (e.g., helium) for pinpointing leaks.

- Ventilation:

- Ensure adequate ventilation during transfer operations.

- Static Electricity Control:

- Bonding and grounding required during transfer to prevent ignition.

- No Smoking:

- Strict no-smoking policy within 15 meters (50 ft) of operations.

6. Emergency Response

- Fire:

- Use dry chemical, CO₂, or water spray to cool exposed containers.

- Let burning gas burn if safe to do so; do not extinguish unless leak can be stopped.

- Leak:

- Evacuate area, eliminate ignition sources, and ventilate.

- Stop flow if safe; do not touch damaged containers.

- First Aid:

- Inhalation: Move to fresh air, administer oxygen if needed.

- Frostbite (from liquid contact): Warm affected area gradually with lukewarm water (do not rub).

- Spill Response:

- Ethane dissipates quickly in air; focus on vapor dispersion and ignition control.

- Do not attempt to contain liquid ethane—evacuate and isolate area.

7. Compliance & Documentation

- Safety Data Sheet (SDS): Must be up to date and accessible (per OSHA HazCom, REACH, WHMIS).

- Training:

- HazMat employee training (DOT 49 CFR 172.704) every 3 years.

- Emergency response and site-specific procedures.

- Permits:

- Facility permits for bulk storage (e.g., EPA RMP if >10,000 lbs stored).

- Local fire code compliance (NFPA 55, NFPA 30B).

- Inspections & Maintenance:

- Regular inspection of storage vessels, valves, and pressure relief devices.

- Records of hydrostatic testing (typically every 5–10 years).

8. Environmental & Sustainability Considerations

- Ethane is a VOC (Volatile Organic Compound) and contributes to ground-level ozone formation.

- Fugitive emissions must be minimized under EPA regulations (e.g., LDAR programs).

- Flaring or venting may require permits under Clean Air Act.

- Leak detection and repair (LDAR) programs recommended for stationary sources.

9. Best Practices Summary

- Always verify regulatory requirements based on jurisdiction and volume.

- Use only certified containers and equipment.

- Implement robust training and emergency response plans.

- Maintain accurate records of shipments, inspections, and incidents.

- Coordinate with emergency services and provide site-specific response plans.

10. References

- 49 CFR (U.S. DOT)

- GHS Rev. 9 (UN)

- IATA Dangerous Goods Regulations (Current Edition)

- IMDG Code (Amendment 41-22)

- ADR 2023

- NFPA 55: Compressed and Liquefied Gases

- OSHA 29 CFR 1910.106, 1910.110

- EPA Risk Management Program (40 CFR Part 68)

Note: Always consult local authorities and updated regulatory texts before transporting or storing ethane. Regulations may vary by country, state, or municipality.

For detailed operational planning, engage a qualified hazardous materials safety professional or regulatory consultant.

In conclusion, sourcing ethane gas requires a strategic approach that balances availability, cost, reliability, and regulatory compliance. With its growing importance in petrochemical production—particularly for ethylene and polyethylene manufacturing—securing a stable ethane supply is critical for industrial operations. Key considerations include proximity to natural gas processing facilities or shale gas reserves, contractual agreements with suppliers, infrastructure for transportation and storage, and adherence to environmental and safety standards. Regions such as the United States, the Middle East, and emerging shale-rich areas offer significant sourcing potential due to abundant reserves and established production infrastructure. Ultimately, a diversified and long-term sourcing strategy, supported by market analysis and risk assessment, ensures supply security and supports sustainable growth in the petrochemical and energy sectors.