The global glass processing equipment market, driven by rising demand in construction, automotive, and decorative industries, is projected to grow at a CAGR of 6.8% from 2023 to 2030, according to Grand View Research. A key segment within this market is etching glass machinery, which enables precision surface modification for both functional and aesthetic applications. With increasing adoption of customized glass solutions in architectural design and interior décor, the demand for advanced, automated etching systems has surged. Mordor Intelligence reports that the Asia Pacific region alone accounts for over 40% of global glass manufacturing activity, further amplifying the need for high-efficiency etching equipment. As industries prioritize accuracy, repeatability, and integration with digital workflows, selecting the right manufacturer becomes critical. Based on market presence, technological innovation, and customer-reported performance, the following eight companies represent the leading etching glass machine manufacturers shaping the future of glass fabrication.

Top 8 Etching Glass Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Laser Marking Machines for Glass

Domain Est. 1996

Website: telesis.com

Key Highlights: You can produce the best glass marking results with a laser marking machine from Telesis Technologies, Inc. Get a quote on a glass laser marker today!…

#2 FlexMax Laser & CNC Machines for Cutting Engraving Welding and …

Domain Est. 1998

Website: flexmax.com

Key Highlights: Free delivery 30-day returnsFlexMax manufactures and sells industrial-grade laser and CNC machines for cutting, engraving, and welding. Our systems deliver precision, consistency, …

#3 Fiber Laser Engraving Machine

Domain Est. 2024

Website: haotianlasers.com

Key Highlights: As a leading manufacturer, not a reseller, we specialize in crafting high-quality CO2 laser engraving machines, UV laser marking machines, and fiber laser ……

#4 Laser Engraving & Etching Glass with an Epilog Laser Machine

Domain Est. 1997

Website: epiloglaser.com

Key Highlights: Glass engraving and etching with a CO2 laser produces a beautiful frosted effect, allowing you to etch custom logos and designs on nearly any glass product….

#5 Trotec Laser

Domain Est. 2002

Website: troteclaser.com

Key Highlights: High-end laser machines for precise engraving, marking and cutting. Trotec lasers for printers, manufacturing industry, engravers and schools. Based on over 25 ……

#6 Crystal & Glass Engraving

Domain Est. 2007

Website: gravotech.us

Key Highlights: Engrave and customize glass and crystal pieces and offer your customers unforgettable memories with our glass engraving machines….

#7 Laser Cutting, Engraving & Marking Machines

Domain Est. 2010

Website: thunderlaser.com

Key Highlights: Thunder Laser offers high-quality, reliable laser machines to meet the needs of a variety of industries. ThunderLaser has become a well-recognized icon in ……

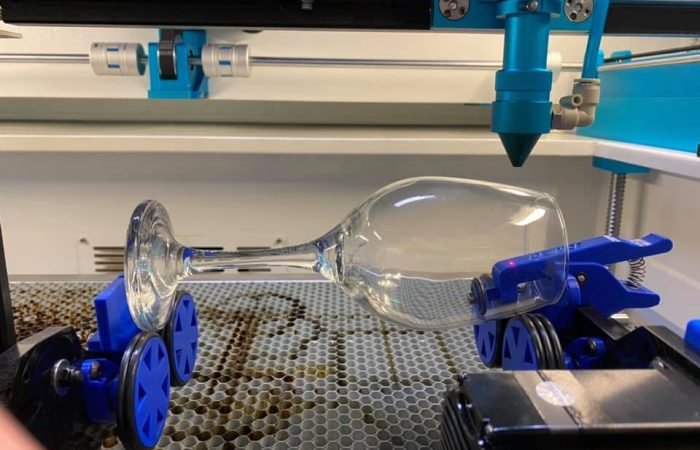

#8 BRM Lasers

Domain Est. 2011

Website: brmlasers.com

Key Highlights: BRM lasers ✓ High quality & affordable laser machines ✓ More than 10 years of experience ✓ Used in many industries ✓ Request a free quote….

Expert Sourcing Insights for Etching Glass Machine

H2: 2026 Market Trends for Etching Glass Machines

The global etching glass machine market is poised for notable transformation by 2026, driven by advancements in technology, evolving consumer preferences, and expanding applications across industries. This analysis explores key trends expected to shape the market landscape in the coming years.

-

Increased Demand from Architectural and Interior Design Sectors

A major driver for etching glass machines in 2026 is the rising demand for decorative glass in modern architecture and interior design. With a growing preference for aesthetically pleasing, privacy-enhancing, and energy-efficient building materials, architects and designers are increasingly incorporating etched glass in facades, partitions, doors, and windows. The trend toward minimalist and luxury design in both commercial and residential spaces is fueling the adoption of precision etching machines capable of intricate patterns and textures. -

Adoption of CNC and Laser Etching Technologies

By 2026, computer numerical control (CNC) and laser-based etching machines are expected to dominate the market due to their precision, speed, and ability to produce complex designs with minimal human intervention. Laser etching, in particular, offers high repeatability and is ideal for custom, small-batch production—catering to the growing demand for personalized glass products. Automation and integration with CAD/CAM software are enhancing productivity and reducing waste, making these systems more attractive to manufacturers. -

Growth in Smart and Digital Glass Applications

The rise of smart buildings and IoT-integrated environments is creating new opportunities for etched glass in touch-sensitive panels, display units, and interactive architectural elements. Etching machines capable of producing micro-patterns on glass surfaces used in capacitive touchscreens or embedded sensors will see increased demand. This convergence of functionality and design is expected to open new revenue streams for etching machine manufacturers. -

Expansion in the Automotive and Transportation Industry

The automotive sector is emerging as a significant end-user of etched glass, particularly for interior design elements, backlighting, and branding on windows or panels. As automakers focus on premiumization and customization, especially in electric vehicles (EVs), demand for high-precision etching machines is projected to grow. Additionally, rail and aviation industries are adopting decorative and functional etched glass for cabin interiors. -

Sustainability and Eco-Friendly Manufacturing Practices

Environmental regulations and consumer awareness are pushing manufacturers to adopt dry etching (laser) methods over traditional chemical (wet) etching, which involves hazardous acids and generates toxic waste. By 2026, eco-conscious production processes will be a key differentiator. Laser etching machines, being chemical-free and energy-efficient, are expected to gain market share, especially in regions with strict environmental standards like the EU and North America. -

Regional Market Growth and Industrialization

Asia-Pacific, particularly China, India, and Southeast Asia, will remain a high-growth region due to rapid urbanization, infrastructure development, and a booming construction industry. Government initiatives promoting smart cities and green buildings are expected to boost demand for decorative and functional etched glass. Meanwhile, North America and Europe will see steady growth driven by renovation projects and high-end design applications. -

Integration of AI and Industry 4.0 Technologies

In 2026, leading etching machine manufacturers are anticipated to incorporate artificial intelligence (AI) and machine learning to optimize cutting paths, predict maintenance needs, and reduce downtime. Connectivity with cloud-based platforms will enable remote monitoring and real-time performance analytics, aligning with Industry 4.0 trends and improving operational efficiency. -

Customization and On-Demand Production

The shift toward mass customization in consumer markets is pushing manufacturers to invest in flexible, scalable etching systems. Small and medium enterprises (SMEs) are increasingly adopting desktop and modular etching machines to offer bespoke glass solutions for niche markets such as art, signage, and premium packaging.

Conclusion

By 2026, the etching glass machine market will be characterized by technological innovation, sustainability, and diversification of applications. Companies that invest in advanced laser systems, embrace digital integration, and align with green manufacturing norms will be best positioned to capitalize on emerging opportunities across construction, automotive, and smart technology sectors.

Common Pitfalls When Sourcing an Etching Glass Machine (Quality and Intellectual Property)

Sourcing an etching glass machine, especially from international suppliers, involves navigating several critical risks related to machine quality and intellectual property (IP) protection. Overlooking these pitfalls can lead to production delays, subpar output, legal complications, and financial loss.

Quality-Related Pitfalls

Inadequate Machine Specifications and Performance Validation

Many suppliers provide overly optimistic specifications or fail to disclose operational limitations. Buyers may receive machines that cannot achieve the desired etching depth, precision, or throughput. Always request third-party performance reports, conduct on-site testing, or perform factory acceptance tests (FAT) before shipment to verify real-world capabilities.

Use of Substandard Components and Materials

Lower-cost machines often incorporate inferior motors, pumps, seals, or control systems, leading to frequent breakdowns and higher maintenance costs. Ensure the supplier discloses component brands and warranties. Insist on using industrial-grade parts suitable for continuous operation.

Poor Build Quality and Lack of Safety Features

Some machines exhibit poor welding, misaligned parts, or inadequate electrical enclosures, posing safety risks and reducing lifespan. Verify compliance with safety standards (e.g., CE, ISO) and inspect build quality through video calls or independent quality audits.

Insufficient After-Sales Support and Technical Documentation

Suppliers may lack responsive technical support or fail to provide comprehensive manuals, schematics, or software updates. Confirm service availability, spare parts lead times, and language support before purchase to avoid prolonged downtime.

Intellectual Property (IP) Risks

Unauthorized Use of Proprietary Technology or Software

Some manufacturers replicate patented designs, control systems, or software algorithms without licensing. Purchasing such machines may expose buyers to IP infringement claims, especially when importing into regions with strong IP enforcement (e.g., EU, USA).

Lack of IP Ownership Clarity in Customization

If you request custom features or software modifications, ensure contractual agreements clearly define who owns the resulting IP. Suppliers may claim ownership over enhancements, limiting your ability to replicate or service the machine elsewhere.

Use of Unlicensed Software or Firmware

Etching machines often rely on specialized software for design and operation. Machines using pirated or reverse-engineered software can malfunction, lack updates, or trigger legal action. Require proof of software licensing and avoid suppliers who cannot provide it.

Reverse Engineering and Design Theft Risk

When sharing proprietary etching patterns or specifications with suppliers for machine calibration, there’s a risk they may reuse or resell your designs. Use non-disclosure agreements (NDAs) and limit the disclosure of sensitive information to only what is necessary.

By proactively addressing these quality and IP pitfalls—through due diligence, contractual safeguards, and independent verification—buyers can secure a reliable, compliant etching glass machine that supports long-term operational success.

Logistics & Compliance Guide for Etching Glass Machine

Overview

This guide outlines the essential logistics and compliance considerations for the international shipment and regulatory adherence of Etching Glass Machines. Proper planning ensures timely delivery, avoids customs delays, and maintains compliance with safety and environmental standards.

Classification & Documentation

Harmonized System (HS) Code

The recommended HS Code for Etching Glass Machines is 8464.90 – “Machines for working stone, ceramics, concrete, asbestos-cement or like minerals, or for cold working glass; parts and accessories thereof.” Final classification may vary by country; verify with local customs authorities.

Required Documentation

Ensure the following documents accompany each shipment:

– Commercial Invoice (with detailed description, value, and HS code)

– Packing List (itemizing contents, dimensions, weight)

– Bill of Lading (for sea freight) or Air Waybill (for air freight)

– Certificate of Origin (preferably on a chamber of commerce form if required)

– Technical Specifications and User Manual (in the destination country’s official language)

– CE or other applicable conformity certificates (see Compliance section)

Packaging & Handling

Packaging Standards

– Use sturdy, wooden export crates with internal foam or custom-cut inserts to protect the machine.

– Seal all electrical components in moisture-resistant plastic.

– Clearly label packages with:

– “Fragile” and “This Side Up” indicators

– Proper shipping name and UN number (if applicable)

– Weight, dimensions, and handling instructions

Handling Instructions

– Lift only from designated points; use forklifts or cranes as per manual.

– Avoid tilting beyond manufacturer-specified angles.

– Protect from moisture, dust, and extreme temperatures during storage and transit.

Transportation & Shipping

Preferred Modes

– Air Freight: Recommended for small or urgent shipments. Ensure compliance with IATA regulations.

– Sea Freight (FCL/LCL): Cost-effective for large or heavy machines. Use moisture-absorbing desiccants in containers.

Incoterms

Use appropriate Incoterms (e.g., FOB, CIF, DDP) to define responsibilities. For clarity and control, EXW (Ex Works) or FCA (Free Carrier) are often recommended.

Regulatory Compliance

CE Marking (Europe)

Machines exported to the EU must comply with:

– Machinery Directive (2006/42/EC)

– Low Voltage Directive (2014/35/EU)

– Electromagnetic Compatibility (EMC) Directive (2014/30/EU)

Provide a Declaration of Conformity and affix the CE mark visibly on the machine.

Other Regional Requirements

– USA: Comply with OSHA and NFPA standards; FCC certification may be required for electronic components.

– Canada: CSA certification may be needed; ensure bilingual labeling (English/French).

– Australia/NZ: Comply with AS/NZS standards; obtain RCM mark.

– China: CCC certification may apply depending on voltage and components.

Environmental & Safety Regulations

– Ensure no restricted substances (e.g., lead, cadmium) exceed RoHS limits.

– Machines using abrasive blasting or chemical etching must disclose hazardous materials and include proper safety data sheets (SDS).

– Comply with REACH (EU) and TSCA (USA) chemical regulations if applicable.

Import Duties & Taxes

- Research destination country’s import tariffs based on HS Code 8464.90.

- Some countries offer reduced rates under trade agreements (e.g., USMCA, RCEP).

- Account for VAT, GST, or other local taxes during cost calculation.

After-Sales & Warranty Compliance

- Provide multilingual service manuals and contact information for technical support.

- Comply with local warranty and product liability laws (e.g., EU Product Liability Directive).

- Consider local service partnerships for maintenance and repair.

Summary

Successful logistics and compliance for Etching Glass Machines require accurate classification, robust packaging, complete documentation, and adherence to regional safety and environmental standards. Proactive planning reduces delays, ensures regulatory acceptance, and supports customer satisfaction. Always consult with freight forwarders and local regulatory experts before shipping.

Conclusion for Sourcing an Etching Glass Machine

After a thorough evaluation of available options, technical specifications, supplier reputation, and cost considerations, sourcing an etching glass machine is a strategic investment that can significantly enhance production capabilities and product diversification. Whether for industrial manufacturing, artistic design, or customized glassware production, selecting the right machine—be it sandblasting, laser, or CNC-based—depends on specific operational needs such as precision, volume, material thickness, and budget.

Key factors such as machine durability, ease of operation, maintenance requirements, and after-sales support must be prioritized to ensure long-term efficiency and return on investment. Additionally, choosing a reputable supplier with proven experience and technical expertise minimizes risks and ensures timely installation and training.

In conclusion, by carefully aligning the machine specifications with business objectives and production demands, sourcing the appropriate etching glass machine will enable consistent quality output, improved productivity, and a competitive edge in the growing glass decoration market.