The global epicyclic gearbox market is experiencing robust growth, driven by rising demand in automotive, industrial machinery, and renewable energy sectors. According to Grand View Research, the global planetary gearbox market—central to epicyclic configurations—was valued at USD 15.4 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, fueled by increasing adoption in wind turbines and electric vehicles. Similarly, Mordor Intelligence forecasts a CAGR of approximately 6.2% over the next five years, highlighting the critical role of compact, high-torque transmission systems in automation and heavy-duty applications. As demand surges, innovation and production capacity among leading manufacturers are becoming key differentiators. In this landscape, nine companies have emerged as dominant players, combining engineering excellence, global reach, and scalable manufacturing to shape the future of power transmission.

Top 9 Epicyclic Gearbox Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ZF Product Range Industrial Gearboxes

Domain Est. 1996

Website: zf.com

Key Highlights: ZF offers a complete range of planetary transmissions for a wide scope of applications and always perfectly matched to the intended purpose….

#2 Neugart

Domain Est. 1997

Website: neugart.com

Key Highlights: Discover the high-quality planetary and custom gearboxes from Neugart GmbH. As one of the leading gearbox manufacturers, we offer innovative drive solutions ……

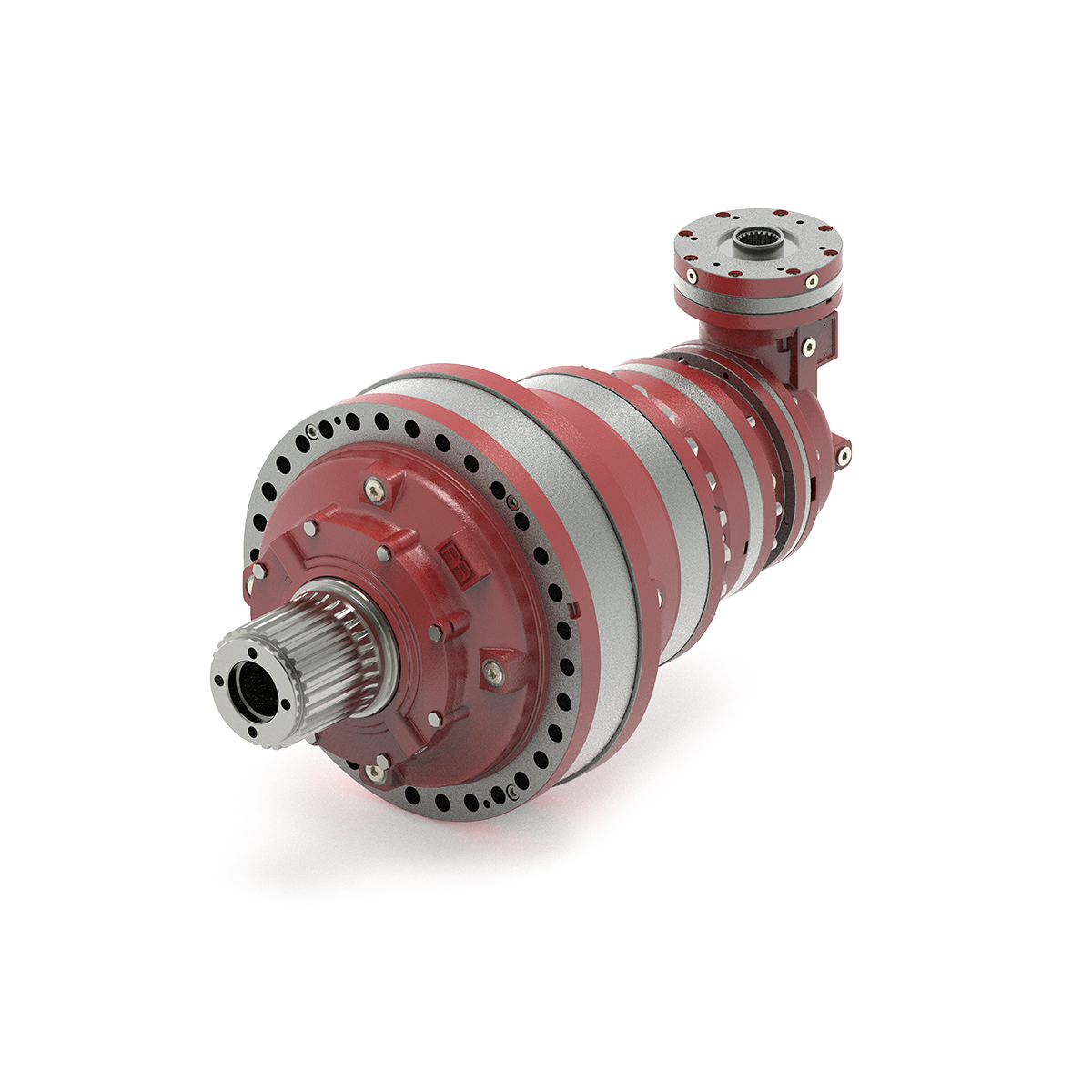

#3 Reggiana Riduttori

Domain Est. 2000

Website: reggianariduttori.com

Key Highlights: Reggiana Riduttori is a leading designer and manufacturer of gearboxes for the sugar production industry. Discover more · Mobile. Reggiana Riduttori, with half ……

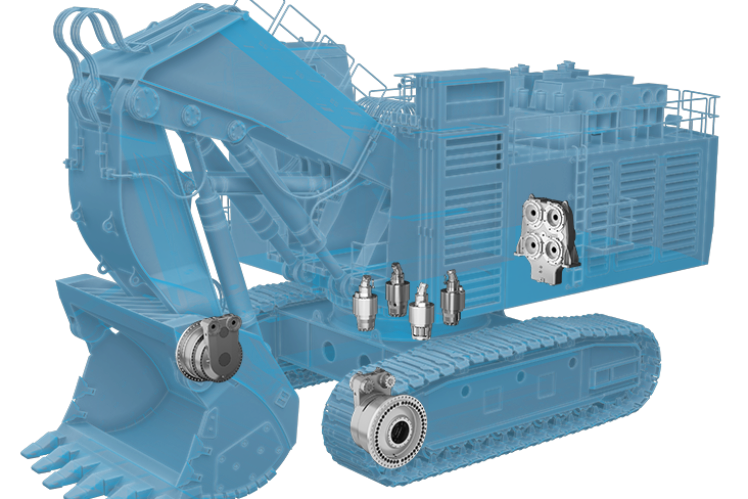

#4 Matex Planetary Gear Module

Domain Est. 2001

Website: matex-japan.com

Key Highlights: Matex Planetary Gear Module has a history of over 50 years. Our products are used for decades by many customers in both domestic and overseas….

#5 Planetary Gearbox Manufacturer

Domain Est. 2003

Website: apexdynamicsusa.com

Key Highlights: Apex Dynamics is a worldwide name in planetary gearbox manufacturing with over 20 years of accumulated experience producing high-quality components….

#6 Sesame Motor Corp.

Domain Est. 2007

Website: sesamemotor.com

Key Highlights: A top brand of superior technology and reputation. Combined 35 years of professional motors and gearboxes manufacturing and sales experience….

#7 Epicyclic Modules

Domain Est. 1996

Website: reliance.co.uk

Key Highlights: Reliance Epicyclic Modules are available in ratios of 3:1, 4:1 and 5:1. Their unique design allows the units to be stacked together providing higher ratios….

#8 Gearboxes Brevini Motion Systems

Domain Est. 2005

Website: brevinipowertransmission.com

Key Highlights: Brevini Power Transmission products consist of a mechanical transmission range combined with hydraulic – electronic products providing innovative solutions….

#9 TGSK Epicyclic Gears

Website: tgs-k.de

Key Highlights: Our epicyclic gears provide high power density and compact design – perfect for applications requiring high torque in limited space….

Expert Sourcing Insights for Epicyclic Gearbox

2026 Market Trends for Epicyclic Gearbox

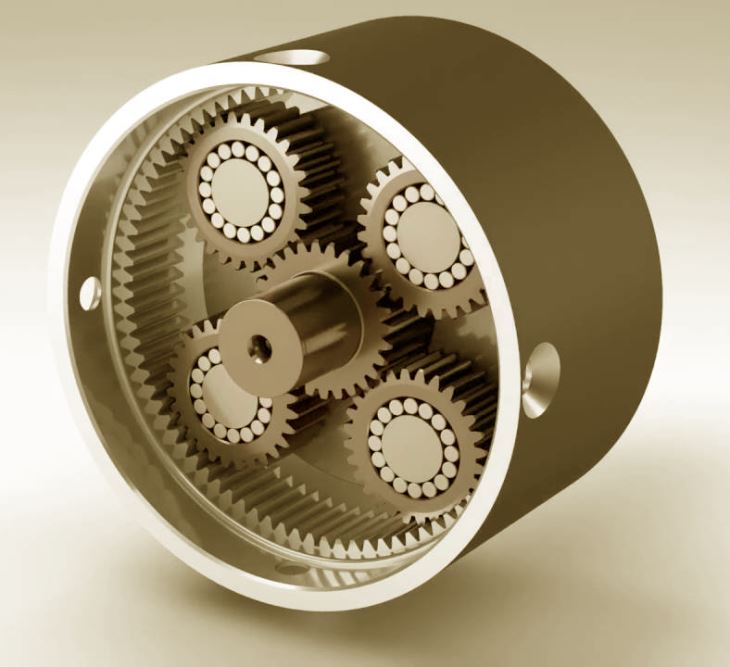

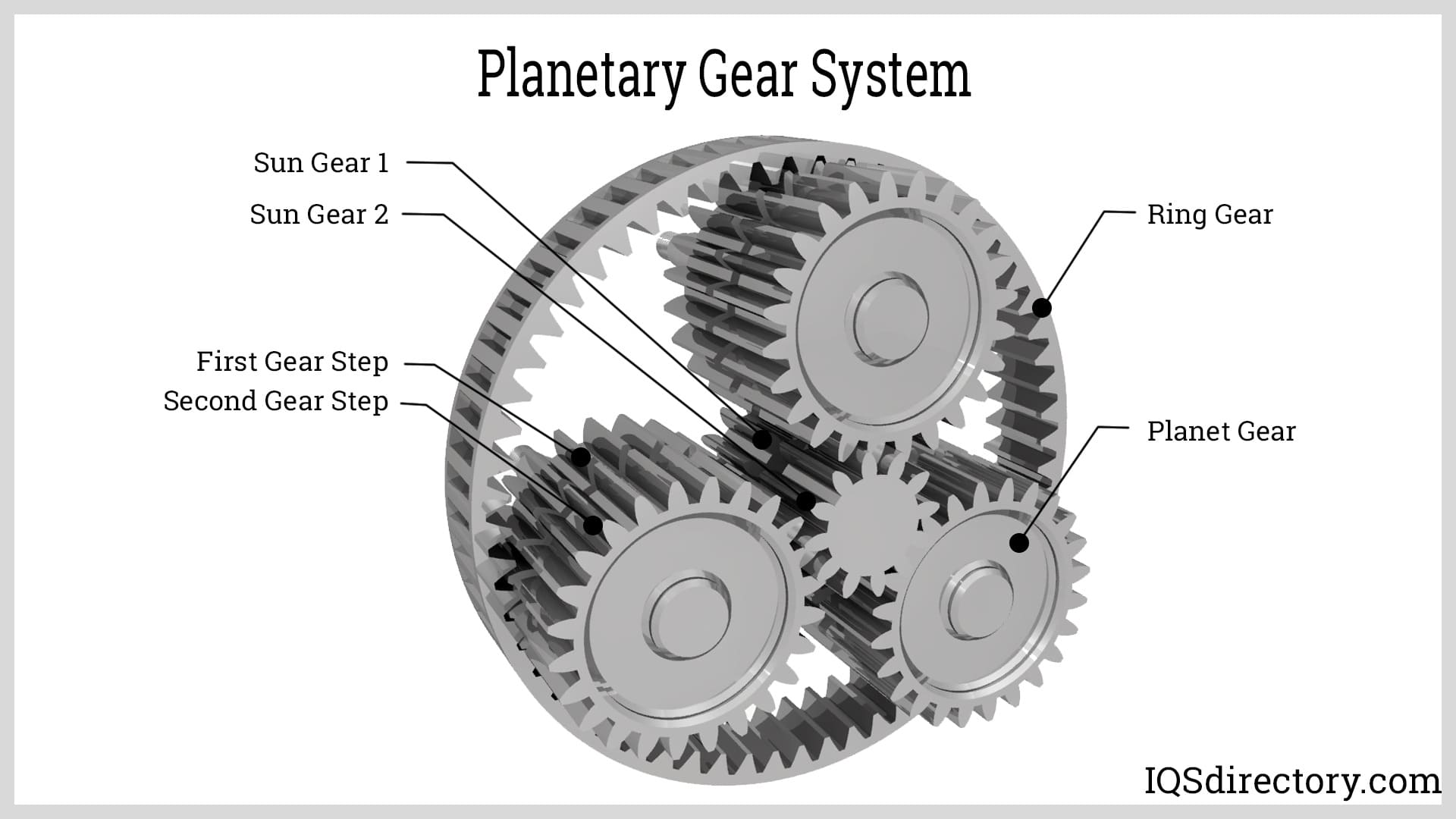

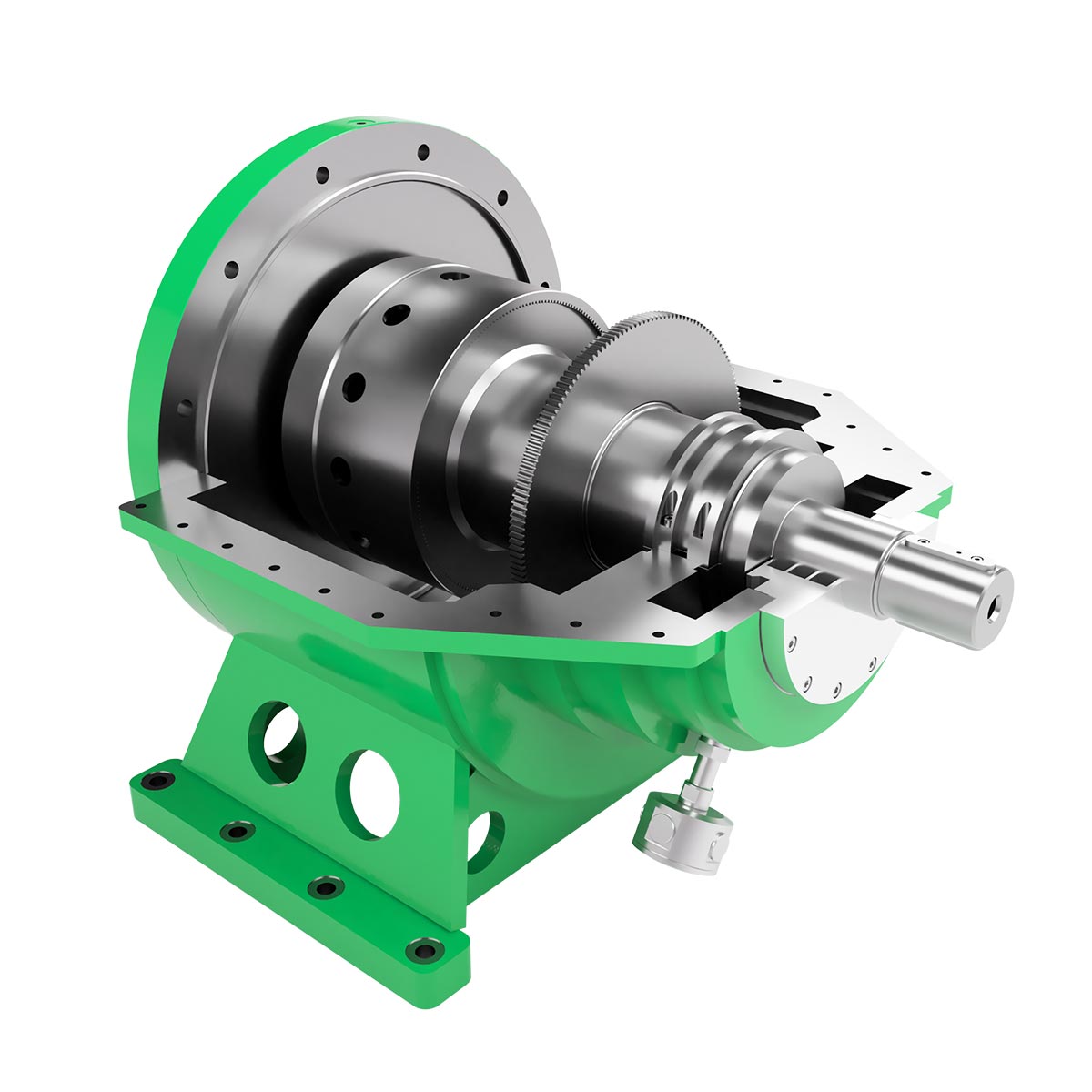

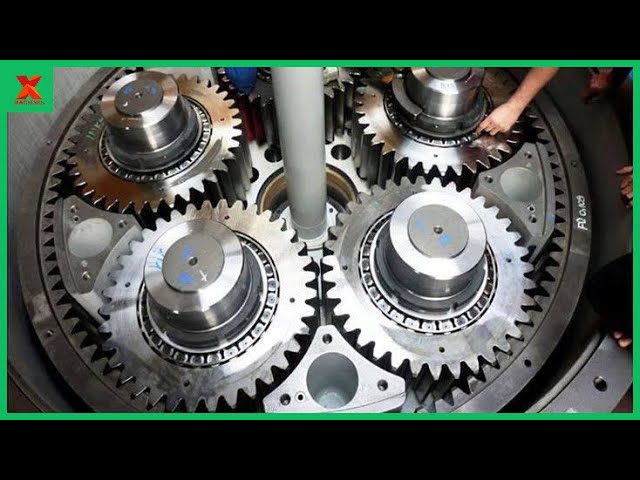

The global epicyclic gearbox market is poised for significant evolution by 2026, driven by technological advancements, increasing demand across key industries, and the ongoing shift toward energy efficiency and automation. Epicyclic gearboxes—also known as planetary gearboxes—are renowned for their compact design, high torque density, and superior efficiency, making them ideal for a wide range of applications from automotive and aerospace to renewable energy and industrial automation.

Rising Demand in Electric and Hybrid Vehicles

One of the most influential trends shaping the epicyclic gearbox market in 2026 is the rapid expansion of the electric and hybrid vehicle (EV/HEV) sector. As automakers worldwide accelerate their transition to electrification in response to stringent emissions regulations and consumer demand for sustainable transportation, epicyclic gear systems are becoming increasingly integral to EV drivetrains. Their ability to provide high torque multiplication within a compact footprint makes them ideal for electric motors, which typically operate at high speeds but require controlled torque output. By 2026, epicyclic gearboxes are expected to dominate the transmission systems in many next-generation EVs, especially in multi-speed electric drivetrains designed to optimize performance and energy efficiency.

Growth in Renewable Energy Applications

The renewable energy sector, particularly wind power, continues to be a major growth driver for epicyclic gearboxes. Wind turbines rely heavily on planetary gear systems to step up the low rotational speed of turbine blades to the higher speeds required by generators. With global investments in wind energy expanding—especially in offshore wind farms—the demand for high-reliability, high-efficiency epicyclic gearboxes is projected to rise significantly by 2026. Manufacturers are focusing on improving gearbox durability, reducing maintenance requirements, and incorporating smart monitoring systems to predict failures and extend service life, aligning with the industry’s push for lower levelized cost of energy (LCOE).

Advancements in Industrial Automation and Robotics

In the industrial sector, the proliferation of automation and robotics is fueling demand for precision motion control components, including epicyclic gearboxes. By 2026, these gear systems are expected to see increased adoption in collaborative robots (cobots), CNC machines, and automated guided vehicles (AGVs), where space constraints and high torque transmission are critical. Innovations such as integrated sensors, backlash reduction technologies, and lightweight composite materials are enhancing performance and enabling new applications in smart factories and Industry 4.0 environments.

Regional Market Dynamics

Regionally, Asia-Pacific is anticipated to lead the epicyclic gearbox market in 2026, driven by robust industrial growth, government support for renewable energy, and the booming electric vehicle market in countries like China and India. Europe will remain a key market due to its strong automotive sector and aggressive climate targets, while North America will see steady growth fueled by investments in automation and clean energy infrastructure.

Competitive Landscape and Innovation

The competitive landscape is becoming increasingly dynamic, with established players and emerging manufacturers investing in R&D to develop more efficient, quieter, and longer-lasting epicyclic gearboxes. Key trends include the integration of digital twins for predictive maintenance, additive manufacturing for complex gearbox components, and the use of advanced lubricants and coatings to reduce wear and improve thermal performance.

In conclusion, the 2026 epicyclic gearbox market will be shaped by cross-sector demand, technological innovation, and sustainability imperatives. As industries continue to prioritize compactness, efficiency, and reliability, epicyclic gearboxes are set to play a pivotal role in the future of motion control and power transmission.

Common Pitfalls Sourcing Epicyclic Gearboxes

Quality-Related Pitfalls

Inadequate Material and Heat Treatment Specifications

Sourcing gearboxes without clearly defined material grades and heat treatment processes (e.g., case hardening, carburizing) can lead to premature wear, tooth pitting, or fatigue failure. Low-cost suppliers may use substandard alloys or skip critical heat treatment steps to cut costs, compromising durability under high-load conditions.

Poor Gear Tooth Profile and Surface Finish

Inaccurate gear tooth geometry or rough surface finishes increase noise, vibration, and power losses. Suppliers may lack precision grinding capabilities or quality control, resulting in misaligned or poorly meshing gears that reduce efficiency and service life.

Inconsistent Manufacturing Tolerances

Tight tolerances are essential for proper load sharing among planet gears. Variability in bore concentricity, planet carrier runout, or gear backlash due to poor machining control leads to uneven loading, accelerated wear, and potential gearbox failure.

Insufficient Testing and Quality Assurance

Some suppliers do not perform full-load testing, noise analysis, or dimensional inspections. Relying solely on visual checks or basic functional tests increases the risk of undetected defects, such as micro-cracks or assembly errors, that manifest in the field.

Intellectual Property (IP) and Legal Pitfalls

Unlicensed or Counterfeit Designs

Sourcing from manufacturers producing gearboxes that replicate patented designs (e.g., unique carrier layouts or load-distribution mechanisms) exposes buyers to IP infringement risks. These knockoffs may appear functionally similar but lack design validation and legal clearance.

Lack of Documentation and Traceability

Reputable suppliers provide full technical documentation, material certifications, and design validation reports. Absence of such documentation makes it difficult to verify compliance with industry standards (e.g., AGMA, ISO) and complicates liability assignment in case of failure.

Unclear Ownership of Custom Designs

When collaborating on custom epicyclic gearbox designs, unclear contractual terms may result in disputes over design ownership, reuse rights, or modification permissions. Without formal agreements, suppliers could reuse proprietary configurations for competing customers.

Weak Supply Chain Transparency

OEMs may unknowingly source gearboxes from subcontractors with questionable IP practices. Lack of supply chain visibility increases exposure to counterfeit components or designs derived from stolen or reverse-engineered technology.

Mitigating these pitfalls requires thorough supplier vetting, clear technical specifications, legal due diligence, and contractual safeguards to ensure both quality and IP compliance.

Logistics & Compliance Guide for Epicyclic Gearbox

Overview

This guide outlines the essential logistics and compliance requirements for the safe, efficient, and legal handling, transportation, import/export, and use of epicyclic gearboxes. Compliance with international, national, and industry-specific regulations ensures operational reliability and regulatory adherence.

Packaging & Handling

Ensure epicyclic gearboxes are packed in robust, moisture-resistant containers with internal cushioning to prevent vibration and impact damage during transit. Use anti-corrosion coatings or VCI (Vapor Corrosion Inhibitor) wraps for long-term storage. Clearly label packages with “Fragile,” “This Side Up,” and handling instructions. Avoid direct lifting on shafts or flanges—use designated lifting points or cradles.

Transportation Requirements

Transport gearboxes via climate-controlled or covered vehicles to protect against moisture, dust, and extreme temperatures. Secure loads to prevent movement during transit. For international shipments, comply with IMDG (for sea), IATA (for air), or ADR (for road) regulations if lubricants or treated components are present. Provide shock and tilt indicators for high-value units.

Import/Export Compliance

Verify that epicyclic gearboxes meet export control classifications (e.g., ECCN under the EAR or USML under ITAR, if applicable). Most industrial gearboxes fall under EAR99, but confirm based on technical specifications. Complete accurate commercial invoices, packing lists, and certificates of origin. For shipments to sanctioned regions, conduct due diligence per OFAC, EU, or UN regulations.

Customs Documentation

Submit complete customs documentation including Harmonized System (HS) code—typically 8483.40 for gearboxes. Include product description, value, country of origin, and end-use declaration. Ensure markings on packaging and product reflect country of origin per local laws (e.g., “Made in Germany”).

Regulatory Standards & Certifications

Epicyclic gearboxes must comply with relevant mechanical and safety standards such as:

– ISO 1328 (Gear accuracy)

– ISO 6336 (Gear strength calculation)

– CE Marking (for EU—under Machinery Directive 2006/42/EC)

– UL or CSA (for North America, if integrated into machinery)

– ATEX/IECEx (if used in explosive environments)

Maintain technical files and Declaration of Conformity (DoC) for audits.

Environmental & Chemical Compliance

Ensure lubricants used in pre-filled gearboxes comply with REACH (EU), TSCA (USA), and other chemical regulations. Declare SVHCs (Substances of Very High Concern) if applicable. Provide Safety Data Sheets (SDS) for lubricants. Follow proper disposal protocols for packaging and used gear units per local waste regulations (e.g., WEEE for electronic components).

End-User Compliance & Traceability

Implement serial number tracking for full traceability. Provide installation, operation, and maintenance manuals in required languages. Train end-users on safe handling and regulatory maintenance obligations. Retain compliance records for a minimum of 10 years (as required by CE and other standards).

Audit & Documentation Retention

Conduct regular internal audits of logistics and compliance processes. Store all shipping records, certificates, customs filings, and conformity documents in a secure, accessible system. Prepare for potential customs inspections or regulatory audits with complete, up-to-date files.

Conclusion

Adhering to this logistics and compliance framework ensures that epicyclic gearboxes are delivered safely, legally, and in full conformity with global standards. Regular review of regulatory updates and supply chain practices is recommended to maintain continuous compliance.

Conclusion for Sourcing an Epicyclic Gearbox:

Sourcing an epicyclic (planetary) gearbox requires a careful evaluation of technical specifications, application requirements, supplier capabilities, and total cost of ownership. These gearboxes offer high torque density, compact design, and improved efficiency, making them ideal for applications in aerospace, automotive, industrial machinery, and renewable energy systems.

To ensure optimal performance and reliability, it is critical to partner with reputable manufacturers or suppliers who offer proven design expertise, quality certifications (such as ISO 9001), and rigorous testing standards. Customization options, availability of technical support, lead times, and after-sales service should also be factored into the sourcing decision.

Additionally, considerations such as load capacity, gear ratio, efficiency, noise levels, and compatibility with other system components must align with the intended application. Conducting thorough supplier assessments, requesting prototypes when necessary, and reviewing real-world performance data can mitigate risks and support long-term operational success.

In conclusion, a strategic and informed sourcing approach—balancing performance, reliability, cost, and support—ensures the selection of an epicyclic gearbox that meets current needs and supports future scalability and efficiency goals.