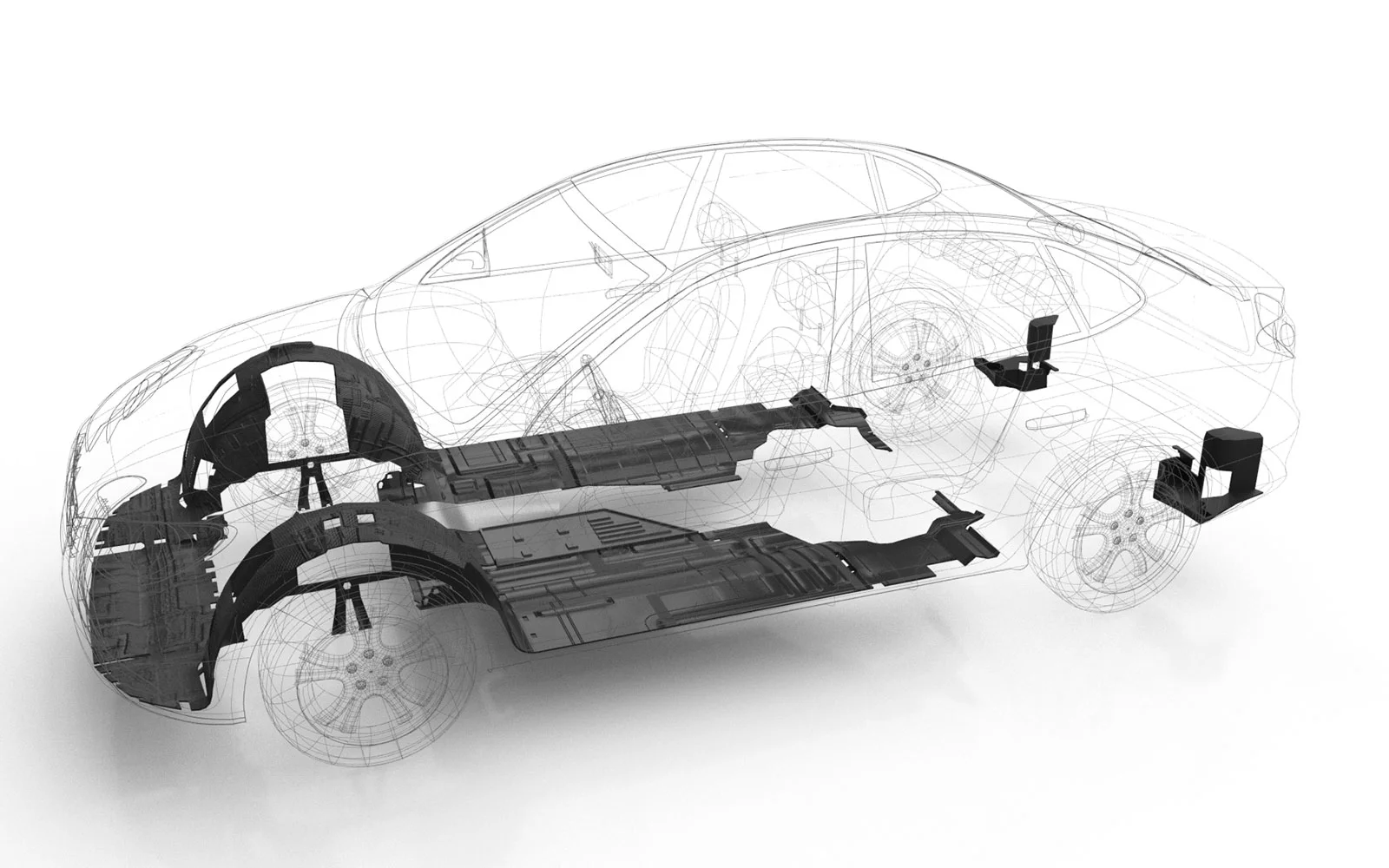

The global automotive underbody protection market, which includes engine splash guards, is experiencing steady growth driven by increasing demand for vehicle durability and reduced maintenance costs. According to Mordor Intelligence, the automotive underbody protection market was valued at USD 4.8 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This expansion is fueled by rising vehicle production, stricter emission regulations, and the growing adoption of lightweight materials in automotive manufacturing—factors that underscore the importance of protective components like engine splash guards. As OEMs and aftermarket suppliers prioritize performance and longevity, manufacturers specializing in splash guards are innovating with advanced polymers and design efficiency. In this competitive landscape, the following ten companies have emerged as leaders, combining scale, technological expertise, and global reach to meet evolving industry demands.

Top 10 Engine Splash Guard Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Genuine OEM Toyota Splash Shields

Domain Est. 1998

Website: parts.olathetoyota.com

Key Highlights: 4–7 day deliveryOEM Toyota splash shields come with a manufacturer’s warranty. When it comes to buying a real splash shield, you can count on Olathe Toyota Parts Center….

#2 OEM Nissan Splash Guards & Mud Flaps

Domain Est. 2001

Website: parts.nissanusa.com

Key Highlights: 30-day returnsOrder OEM Splash Guards & Mud Flaps For All Nissan Models At Affordable Prices From The Official Nissan Parts Store!…

#3 OEM Infiniti Splash Guards & Mud Flaps

Domain Est. 2002

Website: parts.infinitiusa.com

Key Highlights: 4.4 104 Description: • Reduces dirt spray on lower body panels while helping to prevent nicks and scratches caused by road debris • Contoured to match wheel….

#4 Shop OEM Honda® Splash Guards

Domain Est. 2017

#5 Ford® Splash Guards

Domain Est. 1988

Website: ford.com

Key Highlights: Shop Splash Guards from the official Ford® Accessories store. View your favorite products. Filter by category, brand, price & color….

#6 Splash Guards

Domain Est. 1994

Website: gates.com

Key Highlights: We manufacture with reinforced ridges to resist tearing and cracking, constructed with tough rubber and fabric-filling for maximum service life….

#7 Undercar Splash Shield

Domain Est. 2001

Website: dormanproducts.com

Key Highlights: This undercar shield is designed to match the fit, appearance and function of the original shield on specified vehicles, and is engineered for durability ……

#8 Lower Splash Shields

Domain Est. 2011

#9 Rad Rubber Design

Domain Est. 2016

Website: radrubberdesign.com

Key Highlights: As the official home of FJ Fender Flaps, FJ HD Engine Splash Guards, 4Runner, Tacoma, Tundra, 80 Series Landcruiser and Lexus GX/Prado HD Engine Splash Guards ……

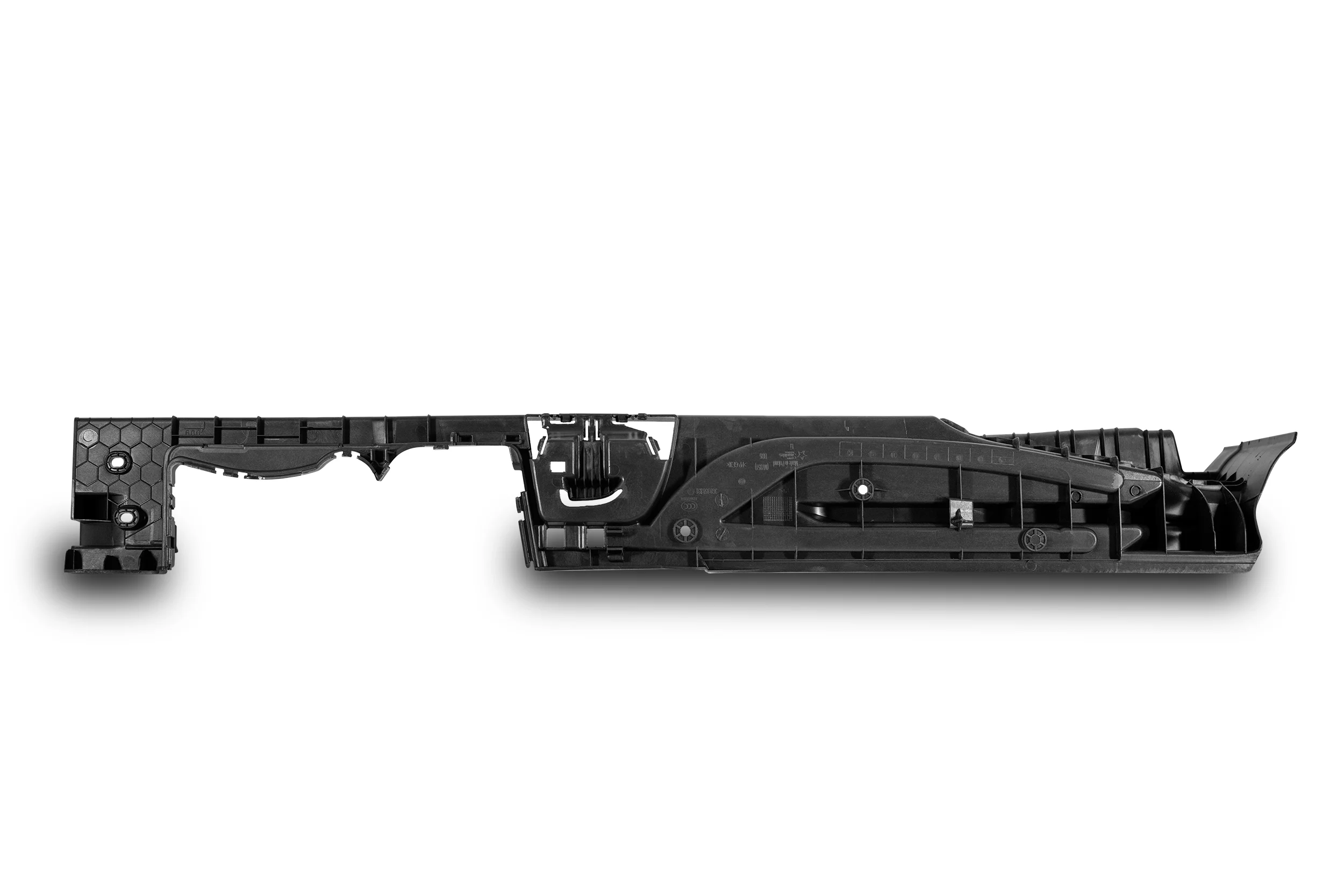

#10 Engine splash shields – aerodynamics and protection

Domain Est. 2017

Website: knaufautomotive.com

Key Highlights: We manufacture engine splash shields, as well as developing and producing a variety of products to support insulation, reduce vehicle weight ……

Expert Sourcing Insights for Engine Splash Guard

H2: 2026 Market Trends for Engine Splash Guard

The global engine splash guard market is poised for steady growth and transformation by 2026, driven by evolving automotive technologies, increasing vehicle production, and heightened consumer focus on vehicle protection and longevity. Below are the key trends shaping the engine splash guard market in 2026:

1. Rising Demand from the Automotive Aftermarket

The aftermarket segment is expected to dominate the engine splash guard market in 2026. As vehicle ownership increases globally—especially in emerging economies—consumers are becoming more proactive about vehicle maintenance. Engine splash guards are increasingly viewed as essential protective components, particularly for vehicles used in harsh terrains or adverse weather conditions. This shift is fueling demand for replacement and upgraded splash guards through independent retailers and online platforms.

2. Growth in Electric Vehicle (EV) Adoption

With automakers accelerating their transition to electric vehicles, the design and material requirements for engine splash guards are evolving. While EVs don’t have traditional internal combustion engines, they still require underbody protection for battery packs, electric motors, and sensitive electronics. By 2026, splash guards in EVs are expected to be more integrated, lightweight, and designed for aerodynamic efficiency and thermal management, opening a new niche in the market.

3. Material Innovation and Lightweighting

The trend toward lightweight vehicles to improve fuel efficiency and reduce emissions is driving innovation in splash guard materials. Traditional steel and heavy plastics are being replaced by advanced thermoplastics, composites, and recyclable polymers. These materials offer better resistance to impact, corrosion, and temperature extremes while reducing overall vehicle weight. In 2026, manufacturers investing in sustainable and high-performance materials are expected to gain a competitive edge.

4. Stricter Environmental and Safety Regulations

Regulatory standards related to vehicle durability, emissions, and road safety are influencing splash guard design and adoption. Governments in North America, Europe, and parts of Asia are mandating underbody protection to minimize environmental debris damage and improve pedestrian safety. These regulations are pushing OEMs to include splash guards as standard components, even in entry-level models, thereby expanding market penetration.

5. Regional Market Expansion

Asia-Pacific is projected to be the fastest-growing region for engine splash guards in 2026, led by China, India, and Southeast Asian countries. Rapid urbanization, expanding road infrastructure, and rising middle-class vehicle ownership are key drivers. Meanwhile, North America and Europe will see steady growth, supported by high vehicle maintenance rates and the popularity of SUVs and off-road vehicles that require enhanced underbody protection.

6. Integration with Vehicle Aerodynamics

Automakers are increasingly designing splash guards to serve dual purposes—protection and aerodynamic optimization. By 2026, engine splash guards are expected to be more seamlessly integrated into vehicle underbody systems to reduce drag, improve fuel economy, and support active cooling systems. This integration is particularly evident in high-performance and premium vehicles.

7. Increased OEM Partnerships and Customization

Original Equipment Manufacturers (OEMs) are collaborating more closely with component suppliers to develop vehicle-specific splash guards. Custom-fit solutions that align with precise chassis configurations are becoming standard, reducing installation time and improving performance. The trend toward modular and easy-to-install designs is also gaining momentum, especially in the aftermarket.

Conclusion

By 2026, the engine splash guard market will be shaped by technological innovation, regulatory influences, and changing vehicle dynamics—especially the rise of EVs. Companies that focus on material science, sustainability, and integration with next-generation vehicle platforms will be best positioned to capitalize on these trends. As both OEM and aftermarket demand grows, the engine splash guard will evolve from a simple protective cover to a critical component in vehicle efficiency, safety, and longevity.

Common Pitfalls Sourcing Engine Splash Guard (Quality, IP)

When sourcing engine splash guards—also known as underbody shields or engine covers—organizations often encounter challenges related to quality consistency and intellectual property (IP) risks. Understanding these pitfalls is critical to ensuring reliable performance, compliance, and protection against legal and operational issues.

Quality-Related Pitfalls

Inconsistent Material Specifications

Suppliers may use substandard or non-compliant materials (e.g., incorrect grade of thermoplastic or inadequate UV resistance) to reduce costs. This can lead to premature cracking, warping, or failure under thermal and mechanical stress, compromising engine protection.

Poor Fit and Dimensional Accuracy

Even minor deviations in dimensions can result in improper installation, leaving gaps that expose sensitive components to road debris, water, and corrosion. Poor tooling or lack of OEM-level precision in manufacturing often causes fitment issues.

Inadequate Environmental and Durability Testing

Many sourced splash guards haven’t undergone rigorous testing for vibration resistance, chemical exposure, or extreme temperature cycles. This increases the risk of field failures, especially in harsh operating conditions.

Lack of Traceability and Certification

Suppliers may not provide material certifications (e.g., UL, ISO, or OEM-specific standards), making it difficult to verify compliance or troubleshoot quality issues in the supply chain.

Intellectual Property (IP) Risks

Design Infringement

Engine splash guards are often protected by design patents or technical IP. Sourcing generic or reverse-engineered versions without proper licensing can expose buyers to IP litigation, especially in regulated markets like North America or the EU.

Unauthorized Tooling and Replication

Some suppliers may use molds or tooling created from scanned OEM parts without authorization. This not only violates IP rights but may also result in inferior reproduction quality and legal liability for the buyer.

Inadequate Supplier Contracts

Failure to include IP indemnification clauses in sourcing agreements leaves the buyer vulnerable if third-party claims arise due to the use of infringing designs or manufacturing processes.

Grey Market and Counterfeit Components

Procuring splash guards through unauthorized distributors increases the risk of receiving counterfeit or non-genuine parts that mimic OEM designs, potentially leading to safety issues and brand reputation damage.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Require detailed material and test reports from suppliers.

– Perform fitment and durability validation before full-scale procurement.

– Conduct IP due diligence and request proof of design rights or licensing.

– Use formal contracts with IP indemnification and audit rights.

– Source from authorized or certified manufacturers with OEM experience.

Proactively addressing quality and IP concerns ensures long-term reliability, regulatory compliance, and protection against legal exposure when sourcing engine splash guards.

Logistics & Compliance Guide for Engine Splash Guard

Product Classification and HS Code

The Engine Splash Guard is typically classified under harmonized system (HS) codes related to automotive body parts. A common classification is HS 8708.29.50 (Other body parts, panels, and structural components for motor vehicles). However, exact classification may vary by country and material composition (e.g., plastic vs. metal). It is essential to confirm the correct HS code with local customs authorities or a licensed customs broker to ensure accurate tariff application and avoid delays.

Packaging and Shipping Requirements

Engine Splash Guards must be packaged to prevent damage during transit. Recommended packaging includes:

– Corrugated cardboard boxes with internal dividers or foam inserts

– Plastic wrapping to protect against moisture and dust

– Palletization for bulk shipments, secured with stretch wrap or strapping

Standard shipping methods include full container load (FCL), less than container load (LCL), or air freight for urgent deliveries. Proper labeling with product description, part number, quantity, weight, and handling instructions (e.g., “Fragile,” “This Side Up”) is required.

Import/Export Documentation

Key documentation for international shipments includes:

– Commercial Invoice

– Packing List

– Bill of Lading (BOL) or Air Waybill (AWB)

– Certificate of Origin (may be required for preferential tariff treatment under trade agreements)

– Import/Export Declaration (as required by destination country)

Ensure all documents accurately reflect product details and comply with destination country regulations.

Regulatory Compliance

Engine Splash Guards must comply with relevant safety and environmental standards depending on the market:

– North America (USA/Canada): No specific federal safety certification is required, but products must meet general conformity to automotive standards (e.g., FMVSS for vehicle components when installed). Materials should comply with EPA and state-level environmental regulations (e.g., California Proposition 65).

– European Union: Must comply with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and may require conformity with ELV (End-of-Life Vehicles) Directive if installed in type-approved vehicles.

– Other Regions: Check local automotive and environmental regulations. Some countries may require homologation or testing for aftermarket parts.

Labeling and Marking

Products should be clearly labeled with:

– Manufacturer name and part number

– Material composition (e.g., “Made of Polypropylene”)

– Country of origin

– Compliance marks, if applicable (e.g., CE marking in Europe for applicable directives)

Labels must be durable and legible throughout the product lifecycle.

Customs Clearance and Duties

Customs clearance requires accurate declaration of value, origin, and classification. Duties and taxes vary by country and trade agreements. Consider using an approved customs broker to facilitate clearance and take advantage of duty exemptions or reduced rates (e.g., under USMCA or EU free trade agreements). Be prepared to provide technical specifications if requested by customs authorities.

Environmental and Disposal Considerations

Engine Splash Guards are generally recyclable based on material type. Provide disposal guidance to end users in line with local waste regulations. For exports to EU and other regulated markets, ensure compliance with WEEE or ELV directives if applicable.

Conclusion

To ensure smooth logistics and compliance for Engine Splash Guards, manufacturers and distributors should focus on accurate classification, proper packaging, complete documentation, and adherence to regional regulatory requirements. Proactive engagement with customs and regulatory experts is recommended to mitigate risks and ensure timely delivery.

Conclusion for Sourcing Engine Splash Guard:

After a comprehensive evaluation of suppliers, material quality, cost, lead times, and compliance with technical specifications, the optimal sourcing strategy for engine splash guards has been identified. The selected supplier offers a balance of durability, cost-efficiency, and reliability, ensuring that the splash guards meet required performance standards under various environmental conditions. Additionally, the chosen option supports just-in-time delivery, reducing inventory costs while maintaining supply chain resilience. Moving forward, establishing a long-term partnership with this supplier will enhance quality consistency, enable potential cost savings through volume agreements, and support ongoing vehicle performance and protection. Regular performance reviews and continuous improvement collaboration will be implemented to ensure long-term success in this component sourcing strategy.