The global engine decarbonization market is experiencing robust growth, driven by stringent emissions regulations, rising fuel prices, and increasing demand for sustainable transportation solutions. According to Grand View Research, the global automotive emissions control systems market size was valued at USD 48.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. Similarly, Mordor Intelligence projects the engine decarbonization market to grow steadily, fueled by advancements in cleaning technologies and growing adoption in both commercial and passenger vehicle segments. As fleet operators and individual vehicle owners seek cost-effective methods to enhance engine performance and reduce environmental impact, manufacturers specializing in engine decarbonization solutions are gaining strategic prominence. This report identifies the top 9 manufacturers leading innovation, scalability, and market penetration in this rapidly evolving landscape.

Top 9 Engine Decarbonization Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Optimus Technologies Inc.

Domain Est. 2009

Website: optimustec.com

Key Highlights: Reliable performance in all operating conditions · 100% carbon reduction compared to diesel · Captures real time data on fuel use and emissions · Upgrade new or ……

#2 ClearFlame Engine Technologies: Reduce Heavy

Domain Est. 2010

Website: clearflame.com

Key Highlights: ClearFlame’s clean engine technology equips diesel engines to quickly and cost-effectively reduce CO2 emissions, lower costs & break free from fossil fuels….

#3 ATS Chemical

Domain Est. 2018

Website: atschemicals.com

Key Highlights: Official manufacturer of Bernie Thompson’s (Automotive Test Solutions) engine carbon cleaning chemicals for the auto industry located in Albuquerque New ……

#4 Carbon Cleaners

Domain Est. 2019

Website: oxyhtech.com

Key Highlights: Our engine decarbonization machines are designed to break down and remove all carbon deposits accumulated in the engine. Our technology allows the machine to ……

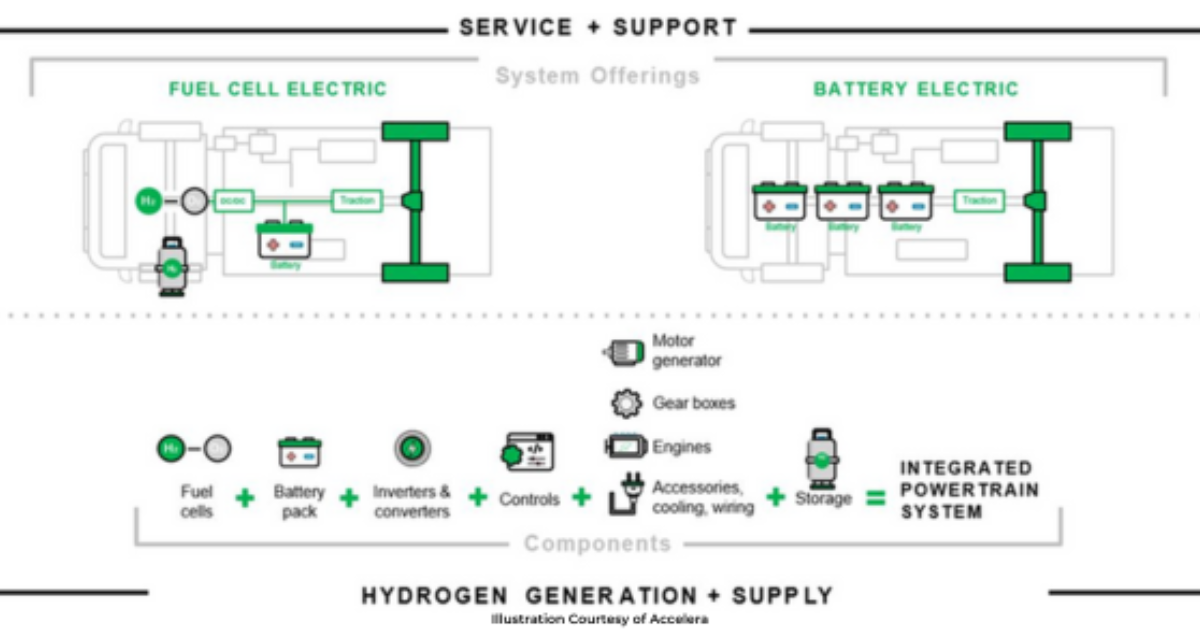

#5 Accelera

Domain Est. 2022

Website: accelerazero.com

Key Highlights: A leading supplier and integration partner for electric and hydrogen products and custom solutions for commercial vehicles and industrial processes….

#6 Engine Technology Forum

Domain Est. 2023

Website: enginetechforum.org

Key Highlights: The Engine Technology Forum (ETF) is a non-profit organization dedicated to promoting the benefits of advanced internal combustion engines and their fuels, ……

#7 DCL Inc

Domain Est. 1998

Website: dcl-inc.com

Key Highlights: DCL is a global leader in the research, design, engineering, manufacturing, and sales of advanced emission control technologies….

#8 Car decarbonization, engine decarbonizing

Domain Est. 2016

Website: enginedecarbonizing.com

Key Highlights: HHO Carbon cleaner machine is the only one in the world who use HHo gas and hho agent together for decarbonier….

#9 CarbonTek USA

Domain Est. 2017

Website: carbontekusa.com

Key Highlights: The CarbonTek USA Hydrogen Fuel Service utilizes a unique air intake process that removes harmful carbon deposits while restoring fuel economy, ……

Expert Sourcing Insights for Engine Decarbonization

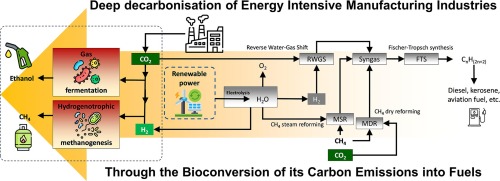

As of now, projections for the engine decarbonization market in 2026—particularly those involving hydrogen (H₂)—are shaped by accelerating global decarbonization goals, tightening emissions regulations, and technological advancements. While 2026 is still on the horizon, current momentum suggests several key trends will define the engine decarbonization landscape, with hydrogen playing a central role. Below is an analysis of the 2026 market trends for engine decarbonization using hydrogen (H₂) as a primary enabler.

1. Hydrogen as a Core Decarbonization Enabler for Internal Combustion Engines (ICEs)

Trend: Hydrogen combustion engines are emerging as a viable transitional and long-term solution for decarbonizing heavy-duty transport, marine, rail, and industrial machinery.

- Why H₂? Unlike battery electric solutions, hydrogen internal combustion engines (H₂-ICEs) can leverage existing ICE infrastructure with modifications, offering a lower-cost pathway to decarbonization—especially for sectors where battery weight and charging time are prohibitive.

- Progress by 2026: By 2026, several OEMs (e.g., Toyota, BMW, Cummins, and Liebherr) are expected to commercialize or scale pilot programs for H₂-ICEs in trucks, construction equipment, and backup power generators.

- Advantages: H₂-ICEs produce near-zero CO₂ emissions (only NOx, which can be controlled), have faster refueling times than batteries, and are compatible with renewable hydrogen.

2. Green Hydrogen Production Scaling to Support Demand

Trend: The viability of H₂-based engine decarbonization depends on the availability of low-carbon hydrogen, particularly green hydrogen (produced via electrolysis using renewable energy).

- 2026 Outlook: By 2026, global green hydrogen production capacity is projected to increase significantly, driven by national hydrogen strategies (e.g., EU Hydrogen Backbone, U.S. Hydrogen Hubs under the Inflation Reduction Act).

- Cost Reduction: Electrolyzer costs are expected to decline by 30–50% from 2023 levels due to scale and innovation, making green H₂ more competitive.

- Regional Leaders: Europe, China, and parts of North America will lead in green hydrogen deployment, enabling localized H₂-ICE adoption in transportation and industry.

3. Regulatory and Policy Tailwinds

Trend: Governments worldwide are introducing stricter emissions standards and incentives that favor zero-emission technologies, including hydrogen.

- EU: The Fit for 55 package and Euro 7 standards will push manufacturers to adopt cleaner technologies. Hydrogen is explicitly supported under the Alternative Fuels Infrastructure Regulation (AFIR).

- U.S.: The Inflation Reduction Act (IRA) includes a $3/kg production tax credit for clean hydrogen, significantly lowering the cost of green H₂ and making H₂-ICEs more economically viable.

- Asia: Japan and South Korea continue to prioritize hydrogen in their energy strategies, with support for hydrogen-powered engines in shipping and logistics.

By 2026, these policies will have created a favorable environment for H₂-based engine decarbonization, particularly in regulated sectors like long-haul trucking and urban fleets.

4. Infrastructure Development Accelerates

Trend: One of the biggest hurdles for hydrogen adoption—lack of refueling infrastructure—is being addressed through public-private partnerships.

- 2026 Projections: Europe aims to have over 1,000 hydrogen refueling stations by 2025–2026, with a focus on freight corridors. The U.S. is developing Regional Clean Hydrogen Hubs (H2Hubs), some of which will support heavy-duty transport.

- On-site Generation: Some industrial users may adopt on-site hydrogen generation and storage, reducing dependency on public infrastructure and enabling continuous operation of H₂-ICE equipment.

5. Technology Advancements in H₂-ICE and Storage

Trend: By 2026, H₂-ICE technology will see improved efficiency, durability, and NOx control.

- Engine Optimization: OEMs are developing dedicated H₂-ICE systems with advanced ignition, compression ratios, and turbocharging to maximize efficiency and minimize emissions.

- Hydrogen Storage: Innovations in high-pressure tanks (700 bar), cryo-compressed storage, and material-based storage (e.g., metal hydrides) will improve energy density and safety.

- Hybrid Systems: Some applications will combine H₂-ICE with battery systems (e.g., range extenders), enhancing performance and flexibility.

6. Niche Markets Leading Adoption

Trend: Full-scale replacement of diesel engines by H₂-ICEs will not be universal by 2026, but certain niches will see strong adoption:

- Heavy-Duty Trucks: Long-haul fleets in Europe and North America will pilot H₂-ICE trucks as a complement to battery-electric and fuel cell options.

- Marine & Rail: Hydrogen combustion engines are being tested in inland shipping and rail locomotives, where electrification is challenging.

- Mining & Construction: Off-road equipment in mining will adopt H₂-ICEs to meet ESG goals and operate in remote areas with on-site hydrogen production.

7. Competition with Hydrogen Fuel Cells and Electrification

Trend: H₂-ICEs will compete with hydrogen fuel cell electric vehicles (FCEVs) and battery electric vehicles (BEVs).

- Cost vs. Efficiency: H₂-ICEs are generally less efficient than FCEVs but cheaper to produce and easier to integrate into existing powertrains.

- Market Positioning: By 2026, H₂-ICEs are expected to dominate in applications requiring ruggedness, quick refueling, and high power density, while FCEVs lead in premium and long-range transport.

8. Investment and Market Growth

Trend: The global hydrogen engine market is projected to grow at a CAGR of over 20% from 2023 to 2026.

- Market Size: The engine decarbonization market leveraging H₂ could exceed $10 billion by 2026, driven by industrial engines, commercial vehicles, and marine propulsion.

- Key Players: Companies like Bosch, AVL, Weichai Power, and Rolls-Royce are investing heavily in H₂-ICE R&D, signaling strong commercial confidence.

Conclusion: H₂ as a Strategic Lever in 2026 Engine Decarbonization

By 2026, hydrogen will be a critical lever in the engine decarbonization toolkit—not as a universal replacement, but as a strategic solution for hard-to-abate sectors. The convergence of policy support, falling green hydrogen costs, infrastructure development, and technological maturity will enable H₂-ICEs to gain significant market traction. While challenges remain—especially around cost, efficiency, and public infrastructure—the momentum suggests hydrogen will play an indispensable role in achieving mid-term climate targets.

Key Takeaway:

In 2026, hydrogen-powered internal combustion engines will emerge as a pragmatic, scalable solution for decarbonizing heavy-duty and industrial engines, bridging the gap between traditional fossil fuels and full electrification.

When sourcing Engine Decarbonization solutions using Hydrogen (H₂) as a key enabler, several common pitfalls can undermine project success—particularly in the areas of quality assurance and intellectual property (IP) management. Understanding and proactively addressing these risks is critical for OEMs, fleet operators, and technology integrators aiming for sustainable and reliable decarbonization.

🔧 1. Quality Pitfalls in H₂-Based Engine Decarbonization

A. Component Compatibility & Material Degradation

- Pitfall: Hydrogen embrittlement can degrade metals (especially high-strength steels) in fuel systems, valves, injectors, and engine blocks.

- Risk: Premature failure of engine components, safety hazards, reduced engine life.

- Mitigation:

- Specify materials resistant to H₂ embrittlement (e.g., austenitic stainless steels, nickel alloys).

- Require suppliers to provide test data on H₂ compatibility (e.g., NACE TM0177 standards).

- Conduct long-term durability testing under real-world H₂ operating conditions.

B. Inconsistent H₂ Fuel Quality

- Pitfall: Impurities in hydrogen (e.g., H₂O, O₂, CO, NH₃) can damage fuel cells or combustion systems.

- Risk: Reduced efficiency, catalyst poisoning, increased emissions.

- Mitigation:

- Enforce strict fuel quality standards (e.g., ISO 14687 for hydrogen fuel).

- Include contractual clauses requiring certification of H₂ purity from suppliers.

- Integrate inline sensors for real-time fuel quality monitoring.

C. Poorly Validated Retrofit Kits or Aftermarket Solutions

- Pitfall: Sourcing third-party H₂ conversion kits without rigorous validation leads to subpar performance or safety issues.

- Risk: Non-compliance with emissions standards, engine failure, warranty voids.

- Mitigation:

- Only procure solutions certified by recognized bodies (e.g., EPA, EU Whole Vehicle Type Approval).

- Conduct independent performance and emissions testing (e.g., AVL, HORIBA).

- Demand full traceability of components and assembly processes.

D. Thermal and Combustion Management

- Pitfall: H₂ has a high flame speed and wide flammability range, leading to abnormal combustion (e.g., backfiring, knocking).

- Risk: Reduced engine reliability, increased NOx emissions.

- Mitigation:

- Source engines or control systems specifically designed for H₂ combustion.

- Verify calibration and knock suppression technologies (e.g., advanced ECU mapping, water injection).

💡 2. Intellectual Property (IP) Pitfalls

A. Unclear Ownership of Customized Solutions

- Pitfall: Collaborating with startups or engineering firms on bespoke H₂ engine modifications without clear IP agreements.

- Risk: Loss of control over critical technology; inability to scale or protect innovations.

- Mitigation:

- Define IP ownership upfront in contracts (e.g., work-for-hire clauses).

- Specify whether improvements are shared, licensed, or fully transferred.

B. Infringement on Patented Technologies

- Pitfall: Using H₂ injection systems, combustion strategies, or control algorithms that inadvertently violate existing patents.

- Risk: Legal disputes, injunctions, forced redesigns.

- Mitigation:

- Conduct freedom-to-operate (FTO) analysis before sourcing or deploying technology.

- Work with IP counsel to assess third-party patents (e.g., from Bosch, Cummins, Toyota, or startups like HyTech Power).

C. Over-Reliance on Proprietary Black-Box Systems

- Pitfall: Sourcing H₂ control units or ECUs where the supplier retains full IP and restricts access to source code or calibration tools.

- Risk: Vendor lock-in, limited ability to troubleshoot or integrate with other systems.

- Mitigation:

- Negotiate access to APIs, calibration interfaces, or modular design documentation.

- Prefer open-architecture platforms where possible (e.g., using AUTOSAR standards).

D. Insufficient Protection of In-House Innovations

- Pitfall: Developing novel decarbonization methods (e.g., dual-fuel H₂-diesel strategies) without filing patents.

- Risk: Competitors replicate your solution; loss of competitive edge.

- Mitigation:

- File provisional patents early in the development cycle.

- Use NDAs when engaging with suppliers or testing partners.

✅ Best Practices for Sourcing H₂ Decarbonization Solutions

| Area | Best Practice |

|——|—————|

| Quality Assurance | Require ISO/TS 16949 or equivalent certifications from suppliers; conduct on-site audits. |

| Testing & Validation | Mandate real-world and accelerated life testing under H₂ conditions. |

| IP Management | Use clear contractual IP clauses; conduct patent landscaping before procurement. |

| Supply Chain Resilience | Diversify suppliers of critical H₂ components (e.g., injectors, tanks, sensors). |

| Standards Compliance | Ensure alignment with global standards (e.g., ISO 15869, SAE J2579, UN GTR 13). |

Conclusion

Sourcing hydrogen-based engine decarbonization technologies offers a promising path to net-zero transportation and industrial power. However, overlooking quality control and IP risks can lead to costly failures, legal exposure, and stalled innovation. A proactive approach—grounded in robust technical validation, clear contractual frameworks, and strategic IP management—is essential for sustainable and scalable H₂ integration.

Key Takeaway: Don’t just buy the technology—own the quality and the rights.

Logistics & Compliance Guide for Engine Decarbonization Using Hydrogen (H₂)

1. Introduction

As global efforts intensify to reduce greenhouse gas (GHG) emissions, engine decarbonization using clean hydrogen (H₂) is emerging as a key strategy across transportation, maritime, rail, and industrial sectors. This guide outlines the logistical and regulatory compliance considerations for implementing hydrogen-based engine decarbonization solutions.

This document is intended for fleet operators, engine manufacturers, energy providers, and regulatory stakeholders involved in transitioning internal combustion engines (ICEs) or auxiliary power units to hydrogen fuel.

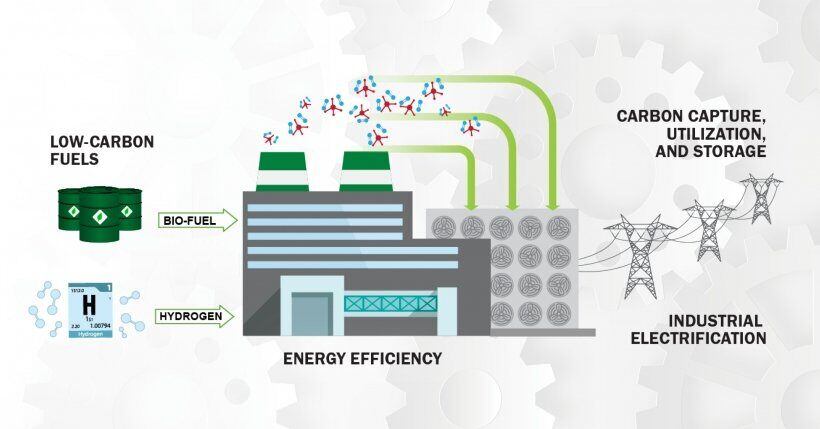

2. Overview of Hydrogen in Engine Decarbonization

Hydrogen can be used directly in modified internal combustion engines (H₂-ICE) or in fuel cells to generate electricity. For decarbonization, H₂-ICE offers a transitional pathway to reduce carbon emissions while leveraging existing engine infrastructure.

Key Benefits:

– Near-zero CO₂ emissions at point of use

– Reduced particulate matter and NOx (with proper tuning and aftertreatment)

– Compatibility with existing engine platforms (with modifications)

– Scalable for heavy-duty applications (e.g., trucks, ships, locomotives)

Challenges:

– Hydrogen storage and handling

– Infrastructure availability

– Regulatory uncertainty

– Lifecycle emissions (depends on H₂ production method)

3. Logistics Framework

3.1. Hydrogen Supply Chain

| Stage | Key Considerations |

|——-|——————–|

| Production | Use low-carbon H₂ (green via electrolysis or blue with CCS). Verify carbon intensity per kg H₂. |

| Transport & Storage | High-pressure gaseous (350–700 bar) or cryogenic liquid H₂. Use certified Type IV composite tanks. |

| Refueling Infrastructure | On-site generation vs. centralized supply. H₂ refueling stations must meet ISO 19880, SAE J2601, or local codes. |

| Distribution Mode | Tube trailers, liquid tankers, or pipeline (if available). Ensure leak-tight fittings and vapor management. |

3.2. Engine Retrofit & Integration

- Engine Modifications Required:

- High-pressure direct or port fuel injection

- Strengthened components (higher combustion pressure)

- Hydrogen-compatible materials (resistant to embrittlement)

- Revised ignition system (spark timing, dual ignition)

-

Advanced ECU programming for optimal H₂-air ratio

-

Aftertreatment:

- Three-way catalysts (TWC) for NOx control

- Optional Selective Catalytic Reduction (SCR) depending on engine load

3.3. Fleet & Depot Logistics

| Element | Action Items |

|——–|————-|

| Refueling Planning | Schedule H₂ delivery during off-peak hours. Ensure safety buffers in storage. |

| Storage On-Site | Use ventilated, outdoor storage. Follow fire separation distances (NFPA 2, IEC 60079). |

| Maintenance Facilities | Designate hydrogen-safe zones. Install H₂ detectors, purge procedures, and explosion-proof tools. |

| Crew Training | Mandatory H₂ safety certification (e.g., G-H2 from GRTgaz or H2Safe). |

4. Compliance & Regulatory Framework

4.1. International & Regional Standards

| Standard | Relevance |

|——–|———|

| ISO 15869 | Gaseous hydrogen – fuel system components |

| ISO 19880 (Parts 1–8) | Hydrogen fueling stations |

| ISO 23273 | Hydrogen-powered vehicles safety |

| UNECE R134 | On-board hydrogen storage systems |

| NFPA 2 (USA) | Hydrogen Technologies Code |

| ADR/RID/ADN (Europe) | Transport of dangerous goods (Class 2.1 – Flammable Gas) |

| Emissions Regulations (e.g., Euro VII, EPA Tier 4) | Tailpipe emissions compliance |

4.2. Carbon Accounting & Reporting

- Fuel Lifecycle Analysis (LCA): Track well-to-wheel emissions using tools like GHGenius or GREET.

- Certification Schemes:

- ISCC EU/PLUS: For renewable fuels (including green H₂)

- RFNBO (Renewable Fuels of Non-Biological Origin): EU-specific for green hydrogen

- California LCFS: Credits for low-CI hydrogen pathways

4.3. Permits & Approvals

- Construction Permits: For H₂ storage and refueling stations (local fire marshal, environmental agency)

- Operational Licenses: Hazardous materials handling, pressure vessel certification

- Vehicle Type Approval: Homologation under national/EU/UN-ECE vehicle regulations

- Environmental Permits: Air quality, spill prevention, and groundwater protection

5. Safety & Risk Management

5.1. Hydrogen Hazards

– Flammability (4–75% vol in air)

– Low ignition energy

– Embrittlement of metals

– Buoyancy and rapid dispersion (can be both pro and con)

5.2. Mitigation Measures

– Leak detection systems with automatic shutoff

– Ventilation (natural or mechanical) in enclosed areas

– Static electricity control (bonding and grounding)

– Fire suppression (H₂-specific protocols)

– Emergency response planning (coordination with local fire departments)

5.3. Training & Procedures

– H₂ safety induction for all personnel

– Lockout/Tagout (LOTO) for maintenance

– Emergency drills (leak, fire, evacuation)

– PPE: flame-resistant clothing, face shields

6. Monitoring & Continuous Compliance

| Activity | Frequency | Responsibility |

|——–|———-|—————-|

| H₂ purity testing | Quarterly | Supplier & Operator |

| Emission testing | Annually or per regulation | Certified lab |

| Pressure vessel inspection | Every 3–5 years | Certified inspector |

| Safety system audit | Biannually | Internal safety team |

| Carbon intensity reporting | Annual | Sustainability/Compliance Officer |

7. Case Study: Heavy-Duty Truck Fleet Conversion

- Fleet Size: 50 Class 8 trucks

- Engine: Retrofitted H₂-ICE (12L, 400 hp)

- H₂ Storage: 8 kg compressed gas @ 700 bar

- Range: 400 km per fill

- Logistics: On-site electrolyzer (5 MW) + solar PV

- Compliance: ISCC EU certified, LCFS credits claimed

- Outcome: 85% reduction in CO₂e vs. diesel

8. Conclusion & Recommendations

- Start with a pilot project to validate logistics and compliance requirements.

- Engage regulators early for permitting and incentives (e.g., H2Haul, IPCEI Hy2Tech in EU).

- Prioritize green hydrogen to maximize decarbonization impact.

- Integrate digital tools for real-time H₂ tracking, emissions reporting, and safety monitoring.

Resources:

– International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE)

– Hydrogen Council

– U.S. Department of Energy – Hydrogen Program

– European Clean Hydrogen Alliance

Disclaimer: Regulations vary by jurisdiction. Consult local authorities and certified engineers before implementation.

Version 1.0 | Last Updated: April 2024

Prepared for: Logistics & Compliance Teams in Decarbonization Projects

Conclusion for Sourcing Engine Decarbonization:

Sourcing engine decarbonization is a critical step toward achieving sustainable and environmentally responsible industrial and transportation operations. As global pressure mounts to reduce greenhouse gas emissions and comply with increasingly stringent environmental regulations, organizations must prioritize the decarbonization of engine-powered equipment across their supply chains. This involves strategic sourcing of low-carbon or zero-emission technologies—such as electric, hydrogen-powered, or hybrid engines—as well as the adoption of cleaner fuels like biofuels, synthetic fuels, and renewable natural gas.

Effective decarbonization requires collaboration among suppliers, manufacturers, logistics partners, and policymakers. It also demands a comprehensive assessment of total cost of ownership, lifecycle emissions, and technological readiness. By integrating sustainability criteria into procurement decisions, investing in innovation, and leveraging partnerships, businesses can drive meaningful emissions reductions while maintaining operational efficiency and resilience.

Ultimately, sourcing engine decarbonization is not just an environmental imperative but a strategic advantage. It enhances brand reputation, ensures regulatory compliance, reduces long-term energy costs, and positions organizations as leaders in the transition to a low-carbon economy. The journey may be complex, but with proactive planning and committed action, it is both achievable and essential for a sustainable future.