The global engine block resurfacing tools market is experiencing steady growth, driven by rising demand for precision engine maintenance in automotive repair and remanufacturing. According to Grand View Research, the global automotive aftermarket tools market was valued at USD 43.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030, bolstered by increasing vehicle ownership and the growing complexity of engine systems requiring specialized servicing. As critical components in engine rebuilding, resurfacing tools ensure optimal flatness and seal integrity of cylinder heads and engine blocks, making them indispensable in both professional and high-performance repair environments. Fueled by technological advancements and the proliferation of CNC-based resurfacing machines, the sector is seeing intensified competition among manufacturers to deliver high-accuracy, durable, and efficient solutions. This growing landscape has elevated the importance of identifying leading suppliers who combine innovation, reliability, and performance—qualities essential for modern engine restoration and performance tuning. In this context, the following seven manufacturers have emerged as top players in the engine block resurfacing tool space, setting industry benchmarks through engineering excellence and market reach.

Top 7 Engine Block Resurfacing Tool Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Haas Automation Inc.

Domain Est. 1996

Website: haascnc.com

Key Highlights: Haas Automation is the largest machine tool builder in the western world, manufacturing a complete line of CNC vertical machining centers, ……

#2 Prime Machine, Inc.

Domain Est. 1997

Website: primemachine.com

Key Highlights: Prime Machine Inc. as a world class performer has the ability to take an obsolete part and manufacture a new part rapidly….

#3 Automotive Rebuilding Products

Domain Est. 1997

Website: dcm-tech.com

Key Highlights: HB 3810 Head & Block Resurfacing Machine · 4455 Theurer Blvd, Winona, MN 55987 · (800) 533-5339 · (507) 452-4043 · [email protected]….

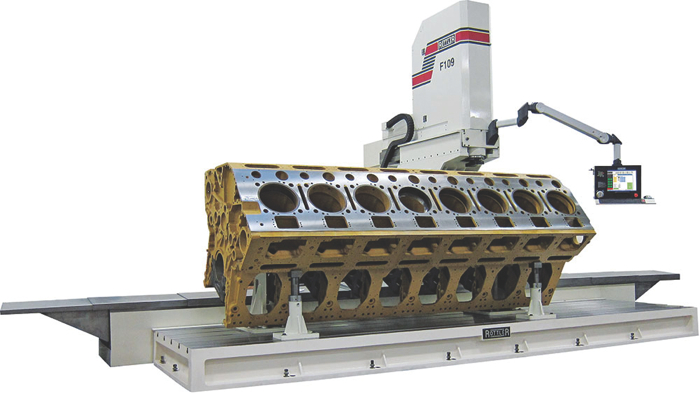

#4 Cylinder Head Resurfacing Machinery

Domain Est. 1998

Website: rottlermfg.com

Key Highlights: Cylinder head resurfacing is a key function of Rottler equipment. We offer dedicated automatic, manual and CNC surfacers, as well as multi-purpose machining ……

#5 Ever

Domain Est. 1998

Website: quinncompany.com

Key Highlights: Need engine block repair? Quinn Company offers reliable machining services to restore your engine’s performance. Trust us for quality and efficiency!…

#6 Head and Block Surfacing

Domain Est. 2008 | Founded: 1992

Website: carmec.si

Key Highlights: CARMEC doo has been in business since 1992 distributing, selling and manufacturing professional equipment for automotive workshops and industry….

#7 Engine Block Repair Machines ≡ Engine Block Resurfacing Tools

Domain Est. 2022

Website: machtrade.us

Key Highlights: MachTrade empowers you to do both, It is both a leading supplier of world-class engine block machining equipment, and a trusted and reliable full-service ……

Expert Sourcing Insights for Engine Block Resurfacing Tool

H2: 2026 Market Trends for Engine Block Resurfacing Tools

The global market for engine block resurfacing tools is anticipated to undergo notable transformations by 2026, driven by evolving automotive technologies, increased demand for engine remanufacturing, and advancements in precision machining. Key trends shaping the industry include:

-

Growing Demand for Remanufactured Engines

With rising awareness of sustainability and cost-efficiency, remanufactured engines are gaining popularity, particularly in commercial vehicle and heavy-duty equipment sectors. Engine block resurfacing tools are essential in restoring cylinder blocks to OEM specifications, fueling demand across automotive repair shops and remanufacturing facilities. -

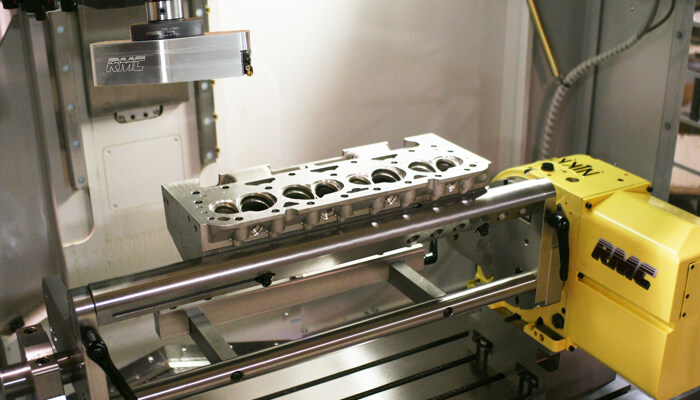

Integration of CNC and Automation Technologies

By 2026, Computer Numerical Control (CNC)-based resurfacing machines are expected to dominate the market. These tools offer higher precision, consistency, and reduced labor costs. The integration of automation and IoT-enabled diagnostics in resurfacing equipment allows for real-time performance monitoring and predictive maintenance, improving operational efficiency. -

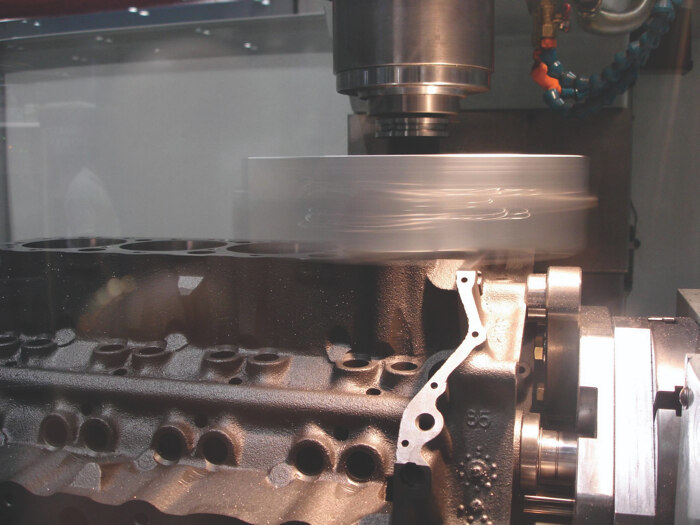

Shift Toward Lightweight and High-Performance Materials

As automakers adopt aluminum and composite materials to reduce vehicle weight and improve fuel efficiency, resurfacing tools must adapt to handle these softer, more sensitive materials without warping or damage. This trend is spurring innovation in cutting tools, clamping systems, and coolant delivery mechanisms tailored for non-ferrous engine blocks. -

Expansion in Emerging Markets

Regions such as Asia-Pacific, Latin America, and Africa are witnessing growth in automotive aftermarket services due to increasing vehicle ownership and aging fleets. This expansion is creating new opportunities for resurfacing tool manufacturers, especially in countries with developing industrial infrastructure and cost-sensitive repair environments. -

Focus on Portable and Compact Tools

There is a rising demand for portable engine block milling machines that offer precision in field or small-shop settings. These tools enable on-site repairs, reducing downtime and transportation costs. By 2026, manufacturers are expected to enhance the portability, ease of use, and accuracy of these compact systems to cater to independent mechanics and mobile repair services. -

Stringent Emission Standards and Engine Longevity

Governments worldwide are enforcing stricter emission regulations, prompting vehicle owners to maintain and upgrade existing engines rather than replace them. Resurfacing tools play a critical role in engine rebuilding to meet performance and emissions standards, supporting market growth through extended engine life cycles. -

Consolidation and Strategic Partnerships

The competitive landscape is likely to see increased mergers, acquisitions, and partnerships among tool manufacturers and automotive service networks. Companies are expected to bundle resurfacing tools with training, software, and technical support to provide integrated solutions and strengthen customer loyalty.

In conclusion, the 2026 market for engine block resurfacing tools will be shaped by technological innovation, environmental considerations, and changing automotive service models. Manufacturers that invest in precision, adaptability, and user-centric design will be best positioned to capture growth in both developed and emerging markets.

Common Pitfalls When Sourcing Engine Block Resurfacing Tools (Quality and Intellectual Property)

Sourcing engine block resurfacing tools—whether milling machines, deck plates, or specialty cutters—requires careful consideration to avoid costly mistakes. Overlooking quality and intellectual property (IP) issues can lead to subpar performance, legal risks, and damage to your reputation. Below are key pitfalls to watch for in both areas.

Poor Quality Construction and Materials

Low-cost resurfacing tools may use inferior materials such as substandard steel alloys or poorly heat-treated components. This leads to premature wear, inaccurate cuts, and inconsistent surface finishes. Tools lacking precision engineering often result in warped or uneven engine decks, which compromise head gasket sealing and engine performance.

Lack of Calibration and Precision Tolerances

Many budget tools come uncalibrated or with loose manufacturing tolerances. Resurfacing requires micron-level accuracy. Tools that fail to maintain flatness or parallelism during operation produce engine blocks that are out of specification, potentially leading to engine failure. Always verify that tools meet OEM or industry-standard tolerances (e.g., within 0.001″ flatness).

Inadequate After-Sales Support and Spare Parts

Cheaper tools often come from suppliers with limited technical support, training, or availability of replacement parts. When a spindle fails or a calibration issue arises, downtime can be costly. Reputable manufacturers provide service networks, maintenance guides, and readily available components—critical for long-term reliability.

Counterfeit or Unbranded Tools with Misleading Claims

Some suppliers offer tools labeled as “compatible with OEM” or mimicking well-known brands without authorization. These may look similar but lack the performance, durability, or safety certifications of genuine tools. Always verify authenticity through official distributors and check for model-specific documentation.

Intellectual Property Infringement Risks

Using or sourcing tools that replicate patented designs—such as proprietary cutter geometries, alignment systems, or motor configurations—can expose your business to legal liability. Infringing on IP not only risks lawsuits but also undermines innovation and can lead to import seizures or product recalls, especially in regulated markets.

Failure to Verify Licensing and Compliance

Reputable resurfacing tool manufacturers often hold patents or licensed technology. When sourcing, confirm that the tool is legally produced and distributed. Tools from unauthorized OEM clones may lack necessary certifications (e.g., CE, ISO) and could violate trade agreements or import regulations.

Overlooking Software and Firmware IP

Modern resurfacing machines often include proprietary control software or firmware. Unauthorized copies may include pirated software, which violates copyright law and can lead to system instability, lack of updates, and security vulnerabilities. Ensure firmware is legally licensed and supported.

Choosing Price Over Long-Term Value

While upfront cost is a factor, the cheapest tool often costs more over time due to downtime, rework, part replacement, or legal exposure. Investing in high-quality, IP-compliant tools from trusted suppliers ensures reliability, accuracy, and protection against intellectual property disputes.

By focusing on verified quality standards and respecting intellectual property rights, businesses can avoid these common pitfalls and ensure durable, compliant, and high-performance engine block resurfacing operations.

Logistics & Compliance Guide for Engine Block Resurfacing Tool

Overview

This guide outlines the essential logistics and compliance considerations for the safe, efficient, and legal handling, transportation, and use of an Engine Block Resurfacing Tool. Adhering to these guidelines ensures operational safety, regulatory compliance, and equipment longevity.

Regulatory Compliance

Safety Standards

The Engine Block Resurfacing Tool must comply with relevant occupational health and safety regulations, including but not limited to OSHA (Occupational Safety and Health Administration) standards in the United States or equivalent bodies such as the HSE in the UK or EU directives (e.g., Machinery Directive 2006/42/EC). Key requirements include proper guarding, emergency stop functions, and noise level compliance.

Electrical Compliance

Ensure the tool meets electrical safety standards (e.g., UL, CE, or CSA certification). Voltage, grounding, and circuit protection must align with local electrical codes. Portable units should include ground-fault circuit interrupters (GFCIs) where applicable.

Environmental Regulations

Machining operations generate metal shavings and coolant mist. Proper containment and disposal of metal swarf and used coolant are required under environmental protection laws (e.g., EPA regulations in the U.S.). Recycling or hazardous waste disposal procedures must be followed as applicable.

Packaging and Handling

Packaging Requirements

Ship the resurfacing tool in robust, shock-resistant packaging with internal supports to prevent movement. Include moisture barriers if shipping in humid environments. Clearly label packages with “Fragile,” “This Side Up,” and “Do Not Stack.”

Handling Instructions

Use mechanical lifting equipment (e.g., forklifts, pallet jacks) for moving the tool. Avoid dragging or dropping. Use lifting points if provided. Personnel should wear appropriate PPE (gloves, safety shoes) during handling.

Transportation

Domestic Transport

For road transport, secure the tool on a pallet using straps or shrink wrap. Ensure the load is balanced and within vehicle weight limits. Include shipping documentation with contents, weight, dimensions, and any hazardous components (e.g., coolant residue).

International Shipping

Comply with International Maritime Dangerous Goods (IMDG) Code or IATA regulations if applicable. Declare the tool accurately under the correct HS code (e.g., 8466.30 for parts of machine tools). Include export documentation such as commercial invoice, packing list, and certificate of origin.

Temperature and Environment

Avoid exposure to extreme temperatures or high humidity during transit. Store and transport in dry, temperature-controlled environments when possible to prevent condensation or corrosion.

Import/Export Documentation

Required Documents

Prepare the following for cross-border shipments:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Conformity (if required)

– Export Declaration (as per local customs)

– Import License (if applicable in destination country)

Customs Classification

Classify the tool correctly using the Harmonized System (HS) code. For engine block resurfacing tools, typical classifications fall under 8464 (machining tools) or 8466 (parts and accessories). Consult a customs broker for accuracy.

Installation and Operational Compliance

Site Requirements

Ensure the installation site has adequate floor space, ventilation, power supply, and anchoring options. The surface must be level and vibration-resistant. Provide local exhaust ventilation if coolant mist or metal dust is generated.

Operator Training

Only trained and authorized personnel should operate the tool. Training must cover startup/shutdown procedures, emergency stops, tool calibration, and maintenance routines. Maintain training records.

Maintenance and Calibration

Follow the manufacturer’s maintenance schedule. Keep logs of inspections, part replacements, and calibration checks. Calibrate measuring systems (e.g., depth gauges) regularly to ensure machining accuracy.

Waste and Disposal Compliance

Coolant Management

Used coolant must be treated or disposed of in compliance with local environmental regulations. Implement a coolant filtration/reclamation system where possible to reduce waste.

Metal Swarf Disposal

Collect metal chips and shavings in designated, labeled containers. Recycle ferrous and non-ferrous metals through certified recyclers. Maintain records of disposal or recycling.

Recordkeeping and Audits

Documentation Retention

Keep records of compliance certifications, maintenance logs, training records, and waste disposal manifests for a minimum of five years or as required by local regulations.

Internal Audits

Conduct regular audits to verify compliance with safety, environmental, and operational procedures. Address non-conformances promptly and update procedures as needed.

Emergency Procedures

Spill Response

In the event of coolant or oil spill, follow spill response protocols. Use absorbent materials and dispose of contaminated waste properly. Report significant spills to environmental authorities if required.

Equipment Malfunction

In case of tool malfunction, shut down immediately using the emergency stop. Tag and isolate the equipment until inspected and repaired by qualified personnel.

Conclusion

Proper logistics and compliance management for an Engine Block Resurfacing Tool minimizes risks, ensures legal adherence, and supports efficient operations. Always consult local regulations and the manufacturer’s guidelines to maintain full compliance.

In conclusion, sourcing a reliable and high-precision engine block resurfacing tool is crucial for ensuring optimal engine performance, longevity, and sealing integrity. After evaluating various suppliers, equipment types (such as milling machines, belt grinders, and on-site resurfacers), and key factors like accuracy, durability, cost, and after-sales support, it is evident that investing in a quality resurfacing solution yields significant long-term benefits. Whether opting for in-house equipment or outsourcing to certified service providers, the decision should align with operational demands, volume requirements, and quality standards. By prioritizing precision, compatibility with different engine materials, and adherence to OEM specifications, automotive workshops and manufacturing facilities can maintain consistency, reduce downtime, and deliver superior results. Ultimately, a well-sourced engine block resurfacing tool enhances productivity and supports the overall reliability of engine rebuilding and remanufacturing processes.