The global EMT (Electrical Metallic Tubing) pipe connectors market is experiencing steady growth, driven by increasing demand in construction, industrial, and commercial electrical installations. According to Grand View Research, the global electrical conduit market—of which EMT connectors are a critical component—was valued at USD 16.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by rising infrastructure development, stricter electrical safety regulations, and the proliferation of smart building technologies. As demand for reliable, corrosion-resistant, and easy-to-install connectors intensifies, manufacturers are innovating to meet evolving industry standards. In this competitive landscape, nine key players have emerged as leaders in producing high-performance EMT pipe connectors, combining quality, compliance with NEC standards, and scalable manufacturing capabilities to serve a global customer base.

Top 9 Emt Pipe Connectors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 EMT Fittings

Domain Est. 1994

Website: southwire.com

Key Highlights: Get reliable and durable EMT connectors for your electrical projects from Southwire’s range of commercial, industrial, and residential fittings….

#2 Wheatland Tube

Domain Est. 1995

Website: wheatland.com

Key Highlights: American-made steel pipe and tube for electrical, process, fire suppression, fence framework, mechanical and energy systems….

#3 Connectors and Couplings

Domain Est. 1996

Website: eaton.com

Key Highlights: Crouse-Hinds series EMT connectors and couplings are used to join EMT conduit to a box or enclosure, or to couple two ends of EMT conduit….

#4 EMT Fittings

Domain Est. 1998

Website: aifittings.com

Key Highlights: Wide variety of set-screw and compression connectors. Plus, EMT straps, bushings, caps, and couplings. Rain-tight models available….

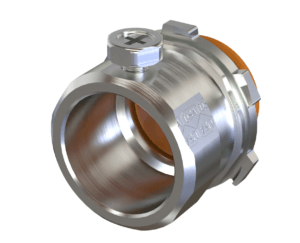

#5 Bridgeport

Domain Est. 2004

Website: nsiindustries.com

Key Highlights: Bridgeport can simplify every installation with our superior cable and conduit fittings, cord grips, wire mesh, molded cord and cordsets. We keep your business ……

#6 Allied Tube & Conduit

Domain Est. 2010

Website: atkore.com

Key Highlights: Atkore’s Allied Tube & Conduit® was first to develop inline galvanizing, which provides superior products for EMT, IMC, and Rigid conduits….

#7 American Fittings Corporation

Domain Est. 2012

Website: amftgs.com

Key Highlights: Manufacturing USA specification grade Steel Rigid Conduit Fittings | Cord Connectors | Liquid Tight | Steel EMT Fittings | MC Connectors ……

#8 Structural Connectors

Domain Est. 2012

Website: makerpipe.com

Key Highlights: Free delivery over $120 30-day returnsOur structural pipe connectors will play an integral part in your pipe project builds. Versatile & durable, find out what makes our connectors…

#9 A Complete Guide to Flexpipe’s Connectors and Fittings Compatibility

Domain Est. 2011

Website: flexpipeinc.com

Key Highlights: This adapter is designed to fit snugly onto standard ¾ EMT conduits, ensuring a stable and secure connection when used with Flexpipe connectors….

Expert Sourcing Insights for Emt Pipe Connectors

H2: 2026 Market Trends for EMT Pipe Connectors

The global market for Electrical Metallic Tubing (EMT) pipe connectors is poised for steady growth through 2026, driven by rising construction activity, increased demand for electrical safety, and advancements in building codes and green infrastructure. This analysis outlines key market trends shaping the EMT pipe connector industry in 2026.

1. Growth in Construction and Infrastructure Development

Urbanization and government-led infrastructure projects—especially in North America, Asia-Pacific, and parts of the Middle East—are major catalysts for the EMT connector market. With increased investments in commercial buildings, data centers, and smart city initiatives, demand for reliable electrical conduit systems is on the rise. EMT connectors, known for their durability and ease of installation, are preferred in non-corrosive indoor environments, making them ideal for modern construction.

2. Emphasis on Electrical Safety and Code Compliance

Stricter electrical safety standards, including updates to the National Electrical Code (NEC) in the U.S. and similar regulations globally, are pushing contractors and electricians to adopt certified EMT connectors. These regulations mandate proper grounding and bonding, which EMT systems facilitate efficiently. As compliance becomes non-negotiable, demand for UL-listed and code-compliant connectors is expected to grow.

3. Rise of Green and Energy-Efficient Buildings

The global shift toward sustainable construction is influencing electrical component selection. EMT systems, often made from recyclable steel, align with green building certifications like LEED. Their lightweight nature also reduces transportation emissions. In 2026, EMT connectors will benefit from integration into energy-efficient buildings where reliable, low-maintenance electrical pathways are essential.

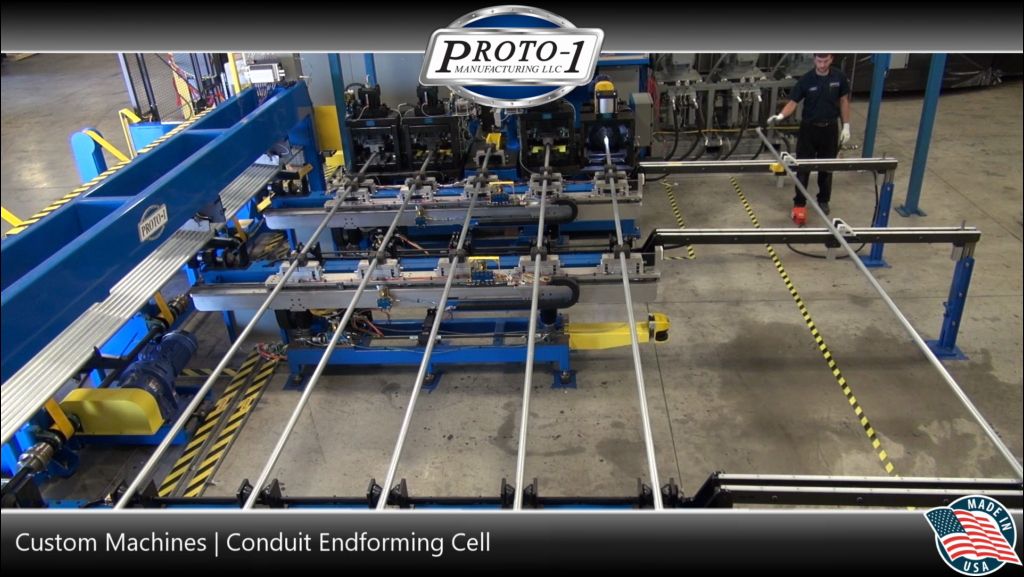

4. Technological Advancements and Product Innovation

Manufacturers are introducing innovations such as pre-galvanized connectors, snap-lock designs, and connectors with integrated grounding features. These improve installation speed and reliability, reducing labor costs. Additionally, smart connectors with monitoring capabilities—though still emerging—are beginning to appear in high-tech installations, signaling a future convergence with IoT-enabled building systems.

5. Supply Chain Resilience and Regional Manufacturing Shifts

Post-pandemic supply chain disruptions have pushed companies to localize production. In 2026, we see a trend toward regional manufacturing hubs for EMT connectors, particularly in India, Mexico, and Eastern Europe, to reduce dependency on single sources and mitigate logistics risks. This shift supports faster delivery and cost stability.

6. Competitive Landscape and Market Consolidation

The EMT connector market remains fragmented but is experiencing consolidation as larger players acquire regional brands to expand distribution networks. Companies like Thomas & Betts (ABB), Ideal Industries, and Hubbell are investing in R&D and sustainability initiatives to strengthen market position. Private-label and value-brand connectors are also gaining traction in cost-sensitive markets.

7. Regional Market Dynamics

– North America: Remains the largest market due to robust construction and strict NEC standards. Retrofitting older buildings also fuels demand.

– Asia-Pacific: Fastest-growing region, led by China, India, and Southeast Asia, driven by urbanization and industrial expansion.

– Europe: Steady growth supported by renovation projects and renewable energy integration (e.g., solar farms requiring secure conduit systems).

Conclusion

By 2026, the EMT pipe connector market will be shaped by regulatory compliance, sustainability demands, and innovation in product design. As construction and electrification trends continue globally, EMT connectors will remain a critical component in safe and efficient electrical installations. Stakeholders who adapt to these evolving trends—through innovation, localization, and adherence to standards—will be best positioned for long-term success.

Common Pitfalls Sourcing EMT Pipe Connectors (Quality, IP)

Sourcing Electrical Metallic Tubing (EMT) pipe connectors may seem straightforward, but overlooking key quality and intellectual property (IP) considerations can lead to safety hazards, compliance failures, and legal risks. Below are common pitfalls to avoid:

Poor Material Quality and Construction

Low-cost EMT connectors often use substandard steel or zinc plating, leading to premature corrosion, reduced mechanical strength, and compromised grounding. Thin metal walls or inconsistent threading increase the risk of breakage during installation or over time, potentially exposing electrical systems to damage or fire hazards.

Inadequate IP (Ingress Protection) Rating Compliance

Many suppliers misrepresent or omit the IP rating of connectors, especially for outdoor or damp environments. Sourcing connectors without verified IP66 or IP68 ratings—where required—can result in moisture ingress, short circuits, or equipment failure. Always verify test certifications rather than relying on marketing claims.

Lack of Recognized Safety Certifications

Using connectors without proper certification from recognized bodies (e.g., UL, CSA, or ETL) violates electrical codes and voids insurance in many jurisdictions. Non-certified products may not meet required electrical bonding or pull-out strength standards, posing serious safety risks.

Counterfeit or IP-Infringing Products

Some suppliers offer connectors that mimic patented designs from reputable manufacturers without licensing. These counterfeit products often fail to meet performance standards and expose buyers to intellectual property litigation, especially in regulated markets or large infrastructure projects.

Inconsistent Thread Quality and Fit

Poorly machined threads lead to improper tightening, creating loose connections that compromise grounding continuity and mechanical stability. This can violate NEC (National Electrical Code) requirements for secure, low-impedance bonding.

Inadequate Corrosion Resistance for Environment

Choosing standard galvanized connectors for corrosive environments (e.g., coastal areas, chemical plants) without specifying stainless steel or enhanced coatings results in rapid degradation. Always match connector material to the installation environment.

Omission of Traceability and Documentation

Reputable suppliers provide mill test reports, certification documents, and lot traceability. Sourcing without these increases risk during audits or failure investigations, especially in commercial or industrial projects requiring full compliance documentation.

Avoiding these pitfalls requires due diligence: vet suppliers thoroughly, request product certifications, conduct spot inspections, and prioritize long-term safety and compliance over upfront cost savings.

Logistics & Compliance Guide for EMT Pipe Connectors

EMT (Electrical Metallic Tubing) pipe connectors are essential components in electrical installations, providing secure and code-compliant connections between EMT conduit and electrical boxes, panels, or other conduit sections. Proper logistics and adherence to compliance standards are critical to ensure safety, performance, and legal conformity. This guide outlines key considerations for handling, shipping, storing, and ensuring regulatory compliance of EMT pipe connectors.

Regulatory Compliance Requirements

EMT pipe connectors must meet various national and international electrical and safety standards. Key compliance standards include:

- NEC (National Electrical Code) – NFPA 70: Mandates proper grounding, bonding, and mechanical protection for electrical systems. EMT connectors must ensure a continuous grounding path unless otherwise specified.

- UL (Underwriters Laboratories): Look for UL 486C or UL 486E certification, which covers wire connectors and outlet boxes, including conduit connectors.

- CSA (Canadian Standards Association): Required for sale in Canada; CSA C22.2 No. 65 ensures connectors meet Canadian electrical code requirements.

- RoHS and REACH Compliance: For international shipments, especially into the EU, verify that connectors are free of restricted hazardous substances.

- IP (Ingress Protection) Ratings: If used in damp or outdoor environments, connectors should meet appropriate IP ratings (e.g., IP66) to resist dust and water.

Ensure all product documentation includes certification marks and compliance statements. Distributors and contractors should verify compliance before installation.

Packaging and Transportation

Proper packaging and transportation practices are essential to prevent damage and maintain product integrity:

- Bulk vs. Retail Packaging: EMT connectors are typically shipped in bulk (bags, boxes, or reels) for contractor use or in retail packaging for end consumers. Ensure packaging is durable and moisture-resistant.

- Labeling: Include product specifications, UL/CSA listings, part numbers, and handling instructions. Barcodes and QR codes can aid inventory tracking.

- Stackability and Palletization: Use standardized pallets (e.g., 48” x 40”) and secure stacking with stretch wrap or strapping to prevent shifting during transit.

- Hazardous Materials: EMT connectors are generally non-hazardous, but confirm with SDS (Safety Data Sheet) if plating or coatings are used (e.g., zinc or nickel plating).

- Carrier Requirements: Choose carriers experienced in transporting construction materials. Ensure shipments are insured and tracked.

Storage and Inventory Management

Optimal storage conditions help maintain connector quality and prevent corrosion or mechanical damage:

- Environment: Store in a dry, climate-controlled warehouse to prevent rust, especially for galvanized or steel connectors.

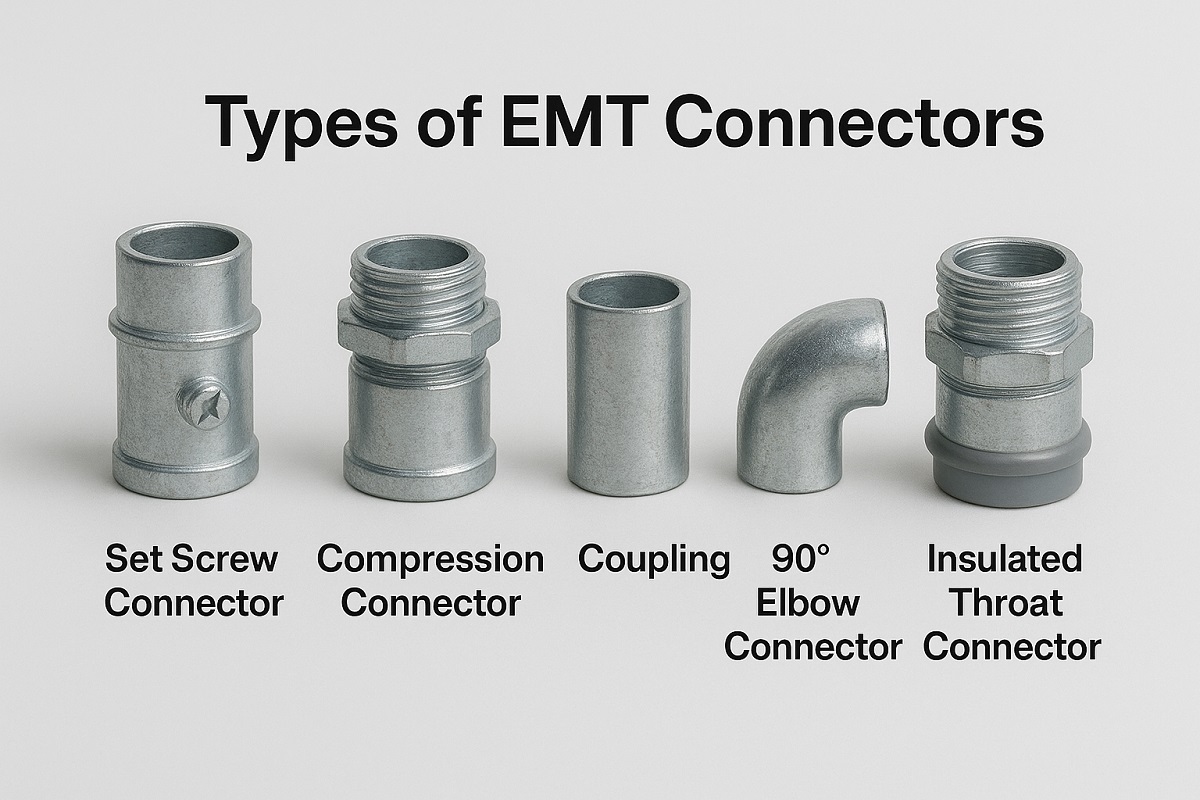

- Shelving: Use adjustable shelving to organize by size and type (e.g., set-screw, compression, or self-grounding connectors).

- First-In, First-Out (FIFO): Implement FIFO inventory rotation to minimize obsolescence and ensure older stock is used first.

- Inventory Tracking: Use inventory management software with barcode scanning to track stock levels, reorder points, and batch numbers for traceability.

Import and Export Considerations

For international logistics, additional compliance and documentation may be required:

- HTS Codes (Harmonized Tariff Schedule): Use correct classification codes (e.g., 7307.29.00 for steel pipe fittings) to determine import duties.

- Customs Documentation: Provide commercial invoices, packing lists, and certificates of origin. Include compliance certifications (UL, CSA, RoHS).

- Trade Agreements: Leverage agreements like USMCA (U.S.-Mexico-Canada Agreement) for reduced tariffs when applicable.

- Product Marking: Ensure connectors and packaging are labeled with country of origin and required regulatory marks.

Installation and Field Compliance

While not strictly logistics, proper installation impacts compliance and product performance:

- Grounding: Use self-grounding connectors where permitted, or install bonding jumpers as required by the NEC.

- Torque Specifications: Follow manufacturer guidelines for tightening set-screw or compression connectors to avoid damage or poor electrical contact.

- Environmental Suitability: Use weatherproof or corrosion-resistant connectors in damp, corrosive, or outdoor locations.

Sustainability and Disposal

- Recyclability: Steel and zinc-plated connectors are recyclable. Encourage return or recycling programs for scrap materials.

- Packaging Waste: Use recyclable or biodegradable packaging materials where possible to meet environmental goals.

By adhering to this logistics and compliance guide, distributors, contractors, and manufacturers can ensure EMT pipe connectors are safely transported, stored, and installed in full compliance with applicable regulations.

Conclusion for Sourcing EMT Pipe Connectors

Sourcing EMT (Electrical Metallic Tubing) pipe connectors requires a strategic approach that balances quality, cost, compliance, and supply chain reliability. After evaluating various suppliers, product specifications, and market options, it is clear that selecting the right connectors is critical to ensuring electrical safety, code compliance, and long-term performance in electrical installations.

Key factors in successful sourcing include adherence to standards such as UL, NEC, and NEMA, material quality (typically zinc-plated steel or stainless steel), and compatibility with regional electrical codes. Additionally, working with reputable suppliers—whether domestic or international—ensures consistent product availability, reduces risk of counterfeit or substandard components, and supports timely project execution.

Ultimately, a well-informed sourcing strategy that prioritizes quality assurance, strong supplier relationships, and cost-efficiency will result in reliable electrical installations and reduce the risk of rework or compliance issues. Regular evaluation of supplier performance and market trends will further support continuous improvement in procurement outcomes.