The global fragrance market is undergoing rapid expansion, driven by rising consumer demand for premium and niche perfumes across regions. According to Mordor Intelligence, the market was valued at USD 53.91 billion in 2023 and is projected to reach USD 74.24 billion by 2029, growing at a CAGR of 5.47% during the forecast period. This sustained growth directly fuels the need for high-quality packaging solutions, particularly empty perfume bottles, which serve as critical components in brand differentiation and product presentation.

As sustainability and customization take center stage in consumer preferences, manufacturers are investing in innovative designs, eco-friendly materials, and scalable production capacities. Grand View Research highlights that the global cosmetic packaging market—of which perfume bottles are a significant segment—is expected to grow at a CAGR of 5.3% from 2023 to 2030, underpinned by advancements in glass, aluminum, and recyclable plastic packaging.

In this evolving landscape, identifying reliable and versatile empty perfume bottle manufacturers has become essential for brands aiming to balance aesthetics, functionality, and cost-efficiency. The following list highlights the top 10 manufacturers shaping the industry through innovation, global reach, and data-backed performance metrics.

Top 10 Empty Perfume Bottle Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Perfume Glass Bottle Manufacturer Factory, Supplier, Wholesale

Domain Est. 2022

Website: feemio.com

Key Highlights: We Offer a Variety of Styles and Colors of Perfume Bottles for Worldwide Customers with the Most Competitive Price, 20% Lower Than Average Wholesale Prices. ……

#2 Perfume Glass Bottle Manufacturer » Explore

Domain Est. 1997

Website: stoelzle.com

Key Highlights: As high-end perfume glass bottle manufacturer Stoelzle stocks luxurious perfume flacons ✓ with tailored design ✓ Find our full product ……

#3 Glass Bottles and containers for Perfumes Wholesale, Perfume …

Domain Est. 2000

Website: bestbottles.com

Key Highlights: BestBottles is a distributor, wholesale supplier and manufacturer of perfume bottles, glass bottles, perfume atomizers, fine mist sprayers, lotion bottles, ……

#4 Private label perfume manufacturer

Domain Est. 2019

Website: privelabel.com

Key Highlights: Complete turnkey solution to start your own perfume line. USA based, we create natural fine fragrances with niche quality packaging and bottles….

#5 Buy Wholesale Perfume Bottles Online

Domain Est. 1996

#6 Glass Perfume Bottles & Vials

Domain Est. 2013

Website: stocksmetic.com

Key Highlights: $21.20 deliveryGlass perfume bottles and vials: elegant and durable. Available in multiple sizes, ideal for professional fragrance lines….

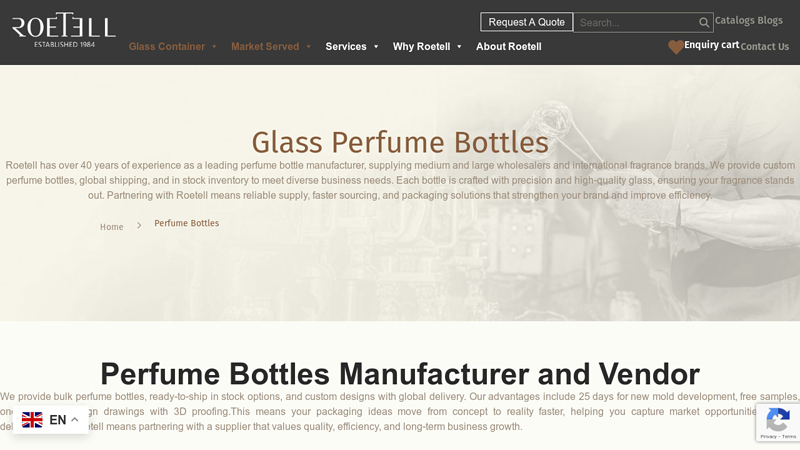

#7 Perfume Bottles

Domain Est. 2019

Website: roetell.com

Key Highlights: Roetell offers perfume bottles wholesale, featuring a wide selection of empty perfume bottles and perfume containers in various designs, from heel perfume ……

#8 Empty Perfume Bottles

Domain Est. 2019

Website: emptyperfumebottles.co.uk

Key Highlights: We have a selection of empty bottles available in various sizes. Single bottles or wholesale. Bulk Purchase Buy Direct. Bulk prices listed under each product….

#9 Hua Glass

Domain Est. 2021 | Founded: 1993

Website: hua-glass.com

Key Highlights: Founded in 1993, Hua Glass specializes in perfume bottle, reed diffuser bottle, cosmetic glass bottle, candle jar porducts….

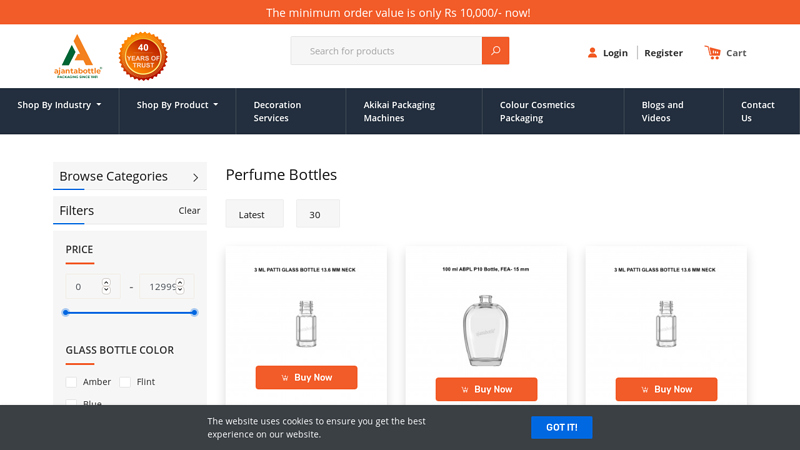

#10 Perfume Glass Bottles

Domain Est. 2006

Website: ajantabottle.com

Key Highlights: 7-day returnsBuy Online Perfume Glass Bottle from Ajanta Bottle. offers premium quality glass bottles for cosmetics, these bottles are 100% lead free ……

Expert Sourcing Insights for Empty Perfume Bottle

H2: 2026 Market Trends for Empty Perfume Bottles

The global market for empty perfume bottles is poised for significant transformation by 2026, driven by evolving consumer preferences, sustainability imperatives, and technological advancements in packaging. As the fragrance industry continues to grow—projected to exceed $150 billion by 2026—demand for high-quality, customizable, and eco-friendly empty perfume bottles is expected to rise in parallel.

One of the most prominent trends shaping the market is the increasing focus on sustainability. Consumers and brands alike are prioritizing environmentally responsible packaging solutions. By 2026, recyclable, refillable, and biodegradable materials such as recycled glass, aluminum, and bio-based plastics are expected to dominate the empty perfume bottle landscape. Luxury brands are investing in refillable bottle designs to reduce waste and enhance customer loyalty, aligning with circular economy principles.

Customization and personalization are also gaining traction. Advances in digital printing and mold technology allow for highly detailed, bespoke bottle designs. Niche and indie fragrance brands are leveraging unique bottle aesthetics to differentiate themselves, fueling demand for small-batch, customizable empty bottles. This trend is supported by the growing direct-to-consumer (DTC) model, which enables brands to offer limited editions and personalized packaging at scale.

Furthermore, regulatory pressures and corporate ESG (Environmental, Social, and Governance) commitments are pushing manufacturers to adopt greener production methods. By 2026, compliance with stricter packaging regulations in regions like the EU and North America will be a key driver of innovation in lightweighting, material sourcing, and end-of-life recyclability.

Geographically, Asia-Pacific is expected to emerge as a high-growth region due to rising disposable incomes, expanding middle-class populations, and growing interest in luxury and designer fragrances. China and India, in particular, will see increased local production of empty perfume bottles to meet domestic demand and reduce import reliance.

In summary, the 2026 market for empty perfume bottles will be defined by sustainability, design innovation, personalization, and regional manufacturing growth. Companies that invest in eco-conscious materials, agile production capabilities, and strategic branding partnerships will be best positioned to capture value in this evolving landscape.

Common Pitfalls When Sourcing Empty Perfume Bottles (Quality and Intellectual Property)

Sourcing empty perfume bottles can be a cost-effective way to package fragrances, but it comes with significant risks—especially regarding quality consistency and intellectual property (IP) violations. Avoiding these common pitfalls is crucial for brand integrity and legal compliance.

Quality Inconsistencies

One of the most frequent issues when sourcing empty perfume bottles, particularly from overseas suppliers, is inconsistent quality. Bottles may vary in glass thickness, weight, color, or finish from batch to batch. Defects such as micro-cracks, misaligned sprayers, or poorly fitting caps can compromise product integrity and customer experience. Always request pre-production samples and conduct third-party quality inspections before placing large orders.

Counterfeit or IP-Infringing Designs

Many suppliers offer bottles that mimic high-end designer fragrances (e.g., replicas of Chanel, Dior, or Tom Ford). While visually appealing, using such bottles constitutes trademark and design patent infringement. Even if the bottle is unbranded, its shape, logo engraving, or cap design may still be protected under intellectual property law. Sourcing these bottles exposes your brand to legal action, shipment seizures, and reputational damage.

Lack of Customization Control

Off-the-shelf bottles may not align with your brand’s aesthetic or functional needs. Limited options for customization—such as unique embossing, color tinting, or spray mechanism—can restrict branding potential. Suppliers may also lack the capability or willingness to modify molds, leading to compromises in design quality or scalability.

Poor Material and Component Standards

Low-cost bottles may use substandard glass or plastic that affects fragrance preservation. Inferior materials can interact with alcohol-based perfumes, causing cloudiness, leakage, or degradation over time. Additionally, low-quality spray pumps may malfunction, resulting in inconsistent spray patterns or product waste.

Unverified Supplier Credibility

Many online marketplaces and sourcing platforms feature suppliers with misleading claims about authenticity, production capacity, or compliance. Without proper due diligence—such as factory audits, MOQ verification, or business license checks—brands risk delays, fraud, or receiving non-compliant products.

No Legal Protection or Contracts

Informal agreements or lack of written contracts with suppliers can leave buyers vulnerable. Without clear terms on IP ownership, quality standards, or liability for infringement, resolving disputes becomes difficult. Always establish formal agreements that specify design rights, quality benchmarks, and compliance responsibilities.

Environmental and Regulatory Non-Compliance

Some sourced bottles may not meet regional environmental or safety regulations (e.g., REACH in Europe, FDA guidelines in the U.S.). Non-compliant materials or manufacturing processes can lead to import restrictions or consumer safety issues, especially if bottles contain harmful substances like lead or phthalates.

To mitigate these risks, work with reputable manufacturers, conduct thorough IP clearance checks, and invest in custom-designed bottles that reflect your brand while respecting intellectual property laws.

Logistics & Compliance Guide for Empty Perfume Bottles

Overview

Empty perfume bottles, while no longer containing hazardous liquid, may still be subject to specific logistics and regulatory considerations due to residual fragrance content, materials used in construction (e.g., glass, plastic, metal components), and previous classification as hazardous goods when full. This guide outlines the key logistics and compliance requirements for the safe and legal transport and handling of empty perfume bottles.

Classification and Regulatory Status

Empty perfume bottles are generally not classified as dangerous goods if they have been properly emptied and cleaned. However, if residues of flammable liquids remain (e.g., alcohol-based perfumes), they may still fall under hazard classes such as Class 3 Flammable Liquids (UN1266, Perfumery products, flammable) under the United Nations Recommendations on the Transport of Dangerous Goods (UN Model Regulations). Always verify the hazard status based on residual contents and local regulations.

Packaging Requirements

Empty perfume bottles should be securely packaged to prevent breakage and contamination:

– Use rigid outer packaging (e.g., corrugated cardboard boxes) with adequate cushioning.

– Individually wrap fragile glass bottles to prevent movement and damage.

– Ensure closures are tightly secured to minimize leakage risks from residual liquid.

– Segregate bottles with any remaining liquid from fully empty units if necessary.

Labeling and Documentation

Proper labeling is essential for compliance:

– If bottles contain any residual flammable liquid, label as “Residue Last Contained – Flammable” and apply appropriate hazard labels (e.g., Class 3 Flammable Liquid).

– For non-hazardous shipments (fully empty and cleaned), no hazard labels are required.

– Include accurate shipping descriptions on transport documents (e.g., “Empty Perfume Bottles – Not Restricted” or “Residue of Flammable Liquid” as applicable).

– Maintain records of cleaning and decontamination procedures if required for customs or regulatory audits.

Transportation Modes

Air Transport (IATA DGR)

- Per IATA Dangerous Goods Regulations, empty packaging that previously contained Class 3 flammable liquids may be excepted from full dangerous goods requirements if cleaned and purged (Special Provision A193 or A1).

- Use “EMPTY, UNCLEANED” or “RESIDUE, LAST CONTAINED” labels with proper notification if applicable.

- Consult IATA DGR Section 3.4 and Packing Instructions 355 or 376 as relevant.

Road and Rail (ADR/RID)

- Under ADR (Europe), empty uncleaned containers may still require Class 3 labeling unless properly cleaned.

- If cleaned and non-hazardous, transport as general cargo without restrictions.

- Documentation must reflect the correct classification and packaging group.

Sea Freight (IMDG Code)

- Empty containers with flammable residue may be subject to IMDG Code regulations.

- Use Proper Shipping Name: “EMPTY, UNCLEANED, PREVIOUSLY CONTAINED CLASS 3” (UN3509) if applicable.

- Follow Packing Instruction P003 and ensure containers are secured against leakage.

Customs and Import/Export Compliance

- Declare goods accurately based on material composition (glass, plastic, metal) and prior contents.

- Provide Harmonized System (HS) codes—common codes include:

- 7010.90 (Glass containers for technical or industrial use)

- 3307.90 (Empty perfume bottles may fall under beauty accessory categories depending on country)

- Some countries may impose restrictions or duties on imported empty containers used for re-filling.

Environmental and Waste Regulations

- If bottles are being discarded or recycled, comply with local waste handling regulations (e.g., WEEE, REACH in EU).

- Residual liquids must be disposed of according to hazardous waste regulations where applicable.

- Reuse or refill operations may require compliance with product safety and labeling laws (e.g., EU Cosmetics Regulation 1223/2009).

Best Practices

- Conduct a risk assessment to determine hazard classification prior to shipment.

- Clean and purge bottles thoroughly when possible to avoid regulatory burden.

- Train staff on proper handling, classification, and documentation procedures.

- Partner with certified logistics providers experienced in handling residual goods.

Conclusion

Proper handling of empty perfume bottles requires careful evaluation of residual contents, packaging, and applicable transport regulations. By following this guide, businesses can ensure compliance across all logistics stages, minimize risks, and avoid delays or penalties during transport. Always consult the latest regulatory texts and seek expert advice when in doubt.

In conclusion, sourcing empty perfume bottles requires a strategic approach that balances quality, cost, sustainability, and compliance. Whether for refilling, resale, or creative reuse, selecting the right supplier—be it manufacturers, wholesalers, or eco-friendly vendors—plays a crucial role in ensuring product integrity and customer satisfaction. Factors such as material quality (glass vs. plastic), design customization, minimum order quantities, and packaging standards must all be carefully evaluated. Additionally, prioritizing sustainable and reusable options not only supports environmental responsibility but also aligns with growing consumer demand for eco-conscious products. By establishing reliable supply chains and maintaining rigorous quality control, businesses and individuals can effectively source empty perfume bottles that meet both operational needs and market expectations.