The global EMI filter market is witnessing steady expansion, driven by increasing electromagnetic interference concerns across industries such as automotive, industrial automation, telecommunications, and consumer electronics. According to a report by Mordor Intelligence, the EMI filter market was valued at USD 2.85 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 6.5% from 2024 to 2029. Similarly, Grand View Research estimates that the demand for EMI filters will continue to rise, fueled by stricter electromagnetic compatibility (EMC) regulations and the proliferation of high-frequency electronic devices. As power density increases and miniaturization accelerates in electronic systems, the role of reliable EMI suppression solutions becomes critical—elevating the importance of leading manufacturers that offer high-performance, compliant filtering technologies. In this evolving landscape, the following nine companies have emerged as key players, combining innovation, global reach, and robust product portfolios to meet growing market demands.

Top 9 Emi Filter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Astrodyne TDI

Domain Est. 2015

Website: astrodynetdi.com

Key Highlights: Astrodyne TDI is a leading EMI/RFI/EMC and power supplies manufacturer with over 60 years of experience. Request a quote to find a custom solution today….

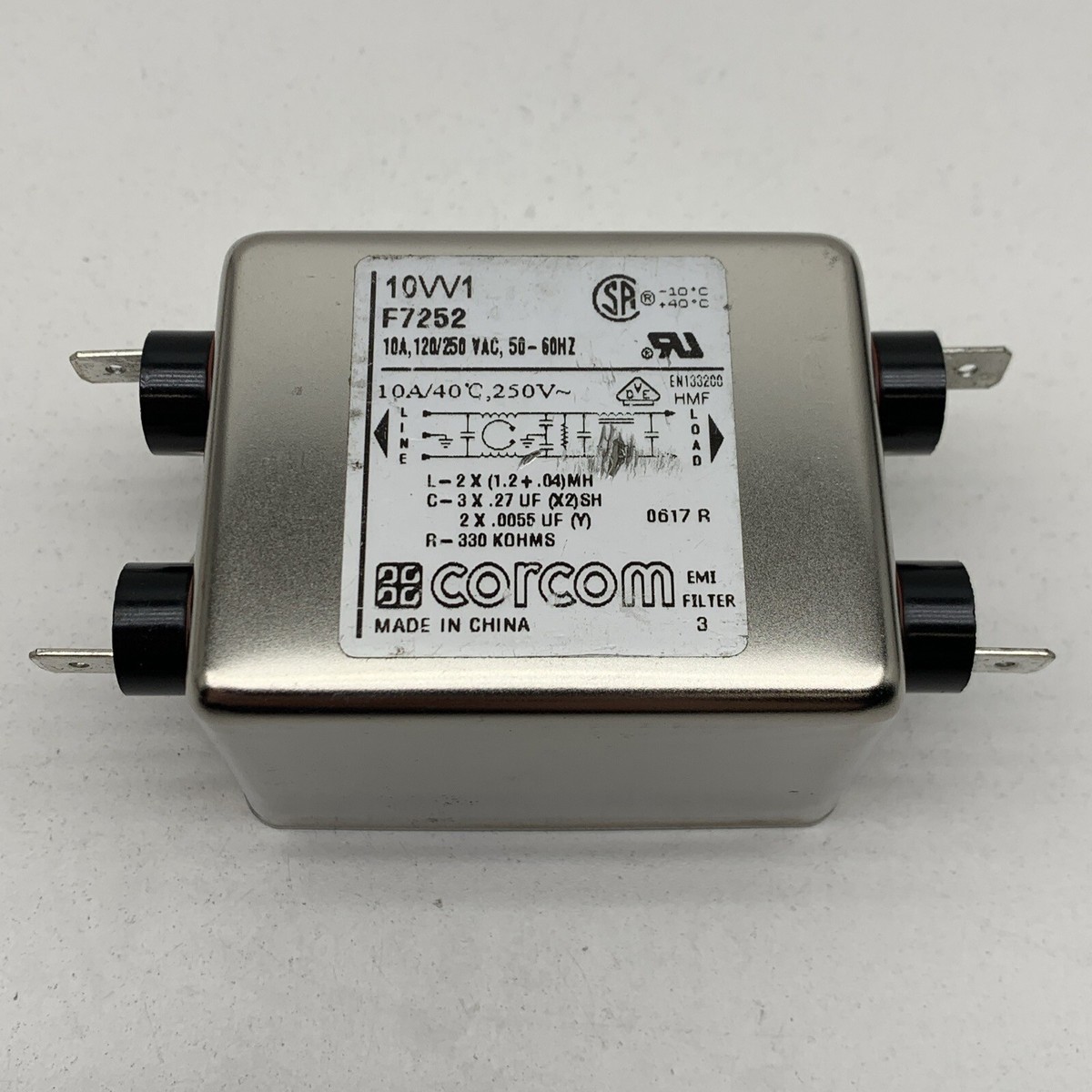

#2 Corcom EMI & RFI Filters

Domain Est. 1992

Website: te.com

Key Highlights: TE offers a catalog of over 70 Corcom filter series that provide solutions to your EMI or RFI signal issues….

#3 EMC & EMI Filters

Domain Est. 1993

Website: ctscorp.com

Key Highlights: CTS is the leader in EMI/RFI filters and offers a diverse product line of standard as well as custom filters to suppress electromagnetic interference (EMI)…

#4 Outline of EMI Suppression Filters (EMC and Noise Suppression)

Domain Est. 1994

Website: murata.com

Key Highlights: We provide you product information on EMI suppression filters, including ferrite beads, filters with integrated capacitors (EMIFIL), common mode choke coils, ……

#5 Custom EMI Filters & EMC Solutions

Domain Est. 1998

Website: captorcorp.com

Key Highlights: Standard and custom-built capacitor winding equipment gives the engineers at Captor Corporation the advantage of almost limitless design capabilities….

#6 EMI Filter Company

Domain Est. 1999

Website: emifiltercompany.com

Key Highlights: Welcome to EMI Filter Company, a division of Nordquist Dielectrics. We manufacture bulkhead mounted low pass filters in threaded, solder-in, and press-in styles ……

#7 Genisco Filter

Domain Est. 1999

Website: genisco.com

Key Highlights: Genisco Filter offers a wide variety of EMI/RFI filters, designed to keep conducted high frequency noise from entering or exiting the shielded room….

#8 Products

Domain Est. 2001

Website: deltaww.com

Key Highlights: Diagnosis and Improvement on the EMI Effect of Stray Magnetic Field in a Telecom Power Supply. SupportCard-Image. Contact Us. Have a question?…

#9 Eliminate High Frequency EMI Noise and Transients

Domain Est. 2002

Website: 4emi.com

Key Highlights: EMI Solutions manufactures American made EMI filters, connectors and modules which eliminate high frequency noise and transients….

Expert Sourcing Insights for Emi Filter

2026 Market Trends for EMI Filters: Strategic Outlook for H2

As we approach the second half of 2026, the Electromagnetic Interference (EMI) filter market is poised at a critical juncture, shaped by accelerating technological adoption, stringent regulatory demands, and evolving supply chain dynamics. Here is a detailed analysis of key trends expected to define H2 2026 for EMI filter manufacturers and stakeholders.

1. Heightened Demand from EV and Advanced Automotive Systems

The automotive sector remains the dominant driver of EMI filter growth. By H2 2026:

– EV Powertrain Complexity will continue to escalate, with 800V architectures and silicon carbide (SiC) inverters becoming mainstream. These high-power systems generate intense EMI, demanding robust, high-frequency, and thermally efficient EMI filters.

– ADAS Proliferation (Level 2+/Level 3 autonomy) will increase the number of sensors, radars, and communication modules per vehicle, raising EMI noise sensitivity and necessitating miniaturized, multi-stage filtering solutions.

– Integration Pressure will grow, pushing demand for modular EMI filter solutions co-designed with power electronics, especially in motor drives and onboard chargers (OBCs).

2. Rise of High-Frequency and Wide-Bandgap Semiconductors

With GaN and SiC devices enabling faster switching speeds:

– EMI Noise Shifts to Higher Frequencies (extending into MHz-GHz range), challenging traditional filter designs based on ferrite cores and standard capacitors.

– Filter Material Innovation will be critical—expect broader adoption of nanocrystalline cores, advanced dielectric materials, and optimized layout techniques to suppress common-mode and differential-mode noise effectively.

– Customized Solutions will gain traction, as off-the-shelf filters struggle to meet performance targets in compact, high-efficiency power systems across industrial and consumer markets.

3. Regulatory Tightening and Global Standards Harmonization

By H2 2026, regulatory bodies will enforce stricter EMC compliance:

– CISPR 25 (Automotive) and CISPR 32 (IT/AV Equipment) updates will tighten limits, especially in the 150 kHz–1 GHz range.

– Regional Divergence (e.g., EU’s CE marking vs. China’s CCC) will persist, but efforts toward international harmonization (e.g., via IEC standards) may reduce compliance complexity for global OEMs.

– Pre-Compliance Testing will become standard practice, increasing demand for EMI filters with proven, certified performance data.

4. Supply Chain Resilience and Localization

Geopolitical tensions and past disruptions have prompted strategic shifts:

– Regional Sourcing will accelerate, with North American and European manufacturers investing in local production to reduce dependency on Asia.

– Vertical Integration will be pursued by leading players to secure access to critical materials (e.g., ferrite, rare-earth elements) and ensure quality control.

– Inventory Buffering will remain a priority, especially for high-reliability sectors like aerospace and medical.

5. Growth in Renewable Energy and Energy Storage

The global push toward decarbonization fuels demand:

– Solar Inverters and Battery Energy Storage Systems (BESS) will require EMI filters rated for high DC voltages and variable operating conditions.

– Grid-Interactive Systems must comply with IEEE 1547 and IEC 62109 standards, driving demand for filters with high surge immunity and long operational lifespans.

– Microgrid Deployments in remote and industrial settings will create niche opportunities for ruggedized, compact EMI solutions.

6. Miniaturization and Integration in Consumer and IoT Devices

As smart devices become smaller and more connected:

– Space-Constrained Designs (e.g., wearables, AR/VR headsets) will favor embedded or chip-scale EMI filters.

– 5G and Wi-Fi 6E/7 Integration will complicate EMI management due to high-frequency RF interference, increasing reliance on advanced filtering at PCB and module levels.

– EMI Shielding + Filtering Combos will gain popularity in compact form factors.

7. Sustainability and Lifecycle Considerations

Environmental regulations will impact materials and design:

– RoHS and REACH Compliance will extend to new substances, pushing innovation in lead-free, halogen-free filter components.

– Recyclability and Repairability will become design criteria, especially in EU markets under the Ecodesign Directive.

– Long-Term Reliability will be emphasized to reduce e-waste, favoring filters with extended MTBF (Mean Time Between Failures).

Strategic Implications for EMI Filter Manufacturers (H2 2026):

– Invest in R&D for high-frequency, high-temperature, and compact filter technologies.

– Expand Application-Specific Offerings, especially for EVs, renewables, and industrial automation.

– Strengthen Supply Chains through dual-sourcing and regional manufacturing.

– Leverage Digital Tools for simulation-driven design and faster time-to-market.

– Engage Early with OEMs to co-develop integrated EMI solutions.

In conclusion, H2 2026 will be a period of transformation and opportunity for the EMI filter market. Success will hinge on agility, innovation, and a deep understanding of end-market dynamics across rapidly evolving high-tech sectors.

Common Pitfalls When Sourcing EMI Filters (Quality, IP)

Sourcing EMI (Electromagnetic Interference) filters is critical for ensuring electromagnetic compatibility (EMC) in electronic systems. However, several pitfalls related to quality and intellectual property (IP) can lead to performance issues, compliance failures, or legal risks. Being aware of these challenges helps in selecting reliable suppliers and protecting your design integrity.

Poor Quality Control and Inconsistent Performance

One of the most common issues when sourcing EMI filters—especially from low-cost or unverified suppliers—is inconsistent quality. Filters may not meet specified attenuation levels, current ratings, or temperature tolerances due to substandard materials or manufacturing processes. Poor soldering, incorrect core materials, or non-compliant capacitors can lead to premature failure or insufficient noise suppression. Always verify certifications (e.g., UL, CSA, CE) and request test reports to confirm performance under real-world conditions.

Lack of Traceability and Component Authenticity

Counterfeit or recycled components are a growing concern, particularly in passive components used in EMI filters (e.g., X/Y capacitors, inductors). Sourcing from unauthorized distributors increases the risk of receiving non-genuine parts that fail under stress or do not comply with safety standards. Ensure suppliers provide full supply chain traceability and adhere to anti-counterfeit policies to protect product reliability and safety.

Inadequate IP Protection and Design Copying

When working with contract manufacturers or offshore suppliers, especially in regions with weaker IP enforcement, there is a risk that your filter design or specifications could be copied or sold to competitors. Custom EMI filter designs—particularly those optimized for specific noise profiles or form factors—are vulnerable to reverse engineering. Always use strong NDAs, limit access to sensitive design details, and consider patenting unique circuit topologies or mechanical configurations.

Misalignment with Regulatory Standards

EMI filters must comply with various international standards (e.g., CISPR, FCC, MIL-STD). A common pitfall is assuming that a filter rated for one standard will automatically meet another. Suppliers may misrepresent compliance, or filters may only be tested under ideal lab conditions that don’t reflect end-use environments. Verify that the filter is certified for your target market and application (industrial, medical, automotive, etc.).

Incomplete or Inaccurate Datasheets

Some suppliers provide incomplete or overly optimistic performance data, such as showing peak attenuation but omitting frequency response curves or derating information. This can lead to improper filter selection and EMC test failures. Always request full technical documentation, including insertion loss graphs, thermal derating curves, and mechanical drawings.

Overlooking Long-Term Supply and Obsolescence

EMI filters, particularly custom or obsolete parts, may be discontinued without notice. Relying on a single source without a lifecycle management plan can lead to production delays. Work with suppliers who offer long-term availability commitments and consider standard, widely available filter families when possible to reduce supply chain risks.

Avoiding these pitfalls requires due diligence in supplier qualification, rigorous technical validation, and proactive IP protection strategies. Choosing reputable suppliers with proven quality systems and transparent documentation is essential for reliable and compliant EMI filtering solutions.

Logistics & Compliance Guide for EMI Filters

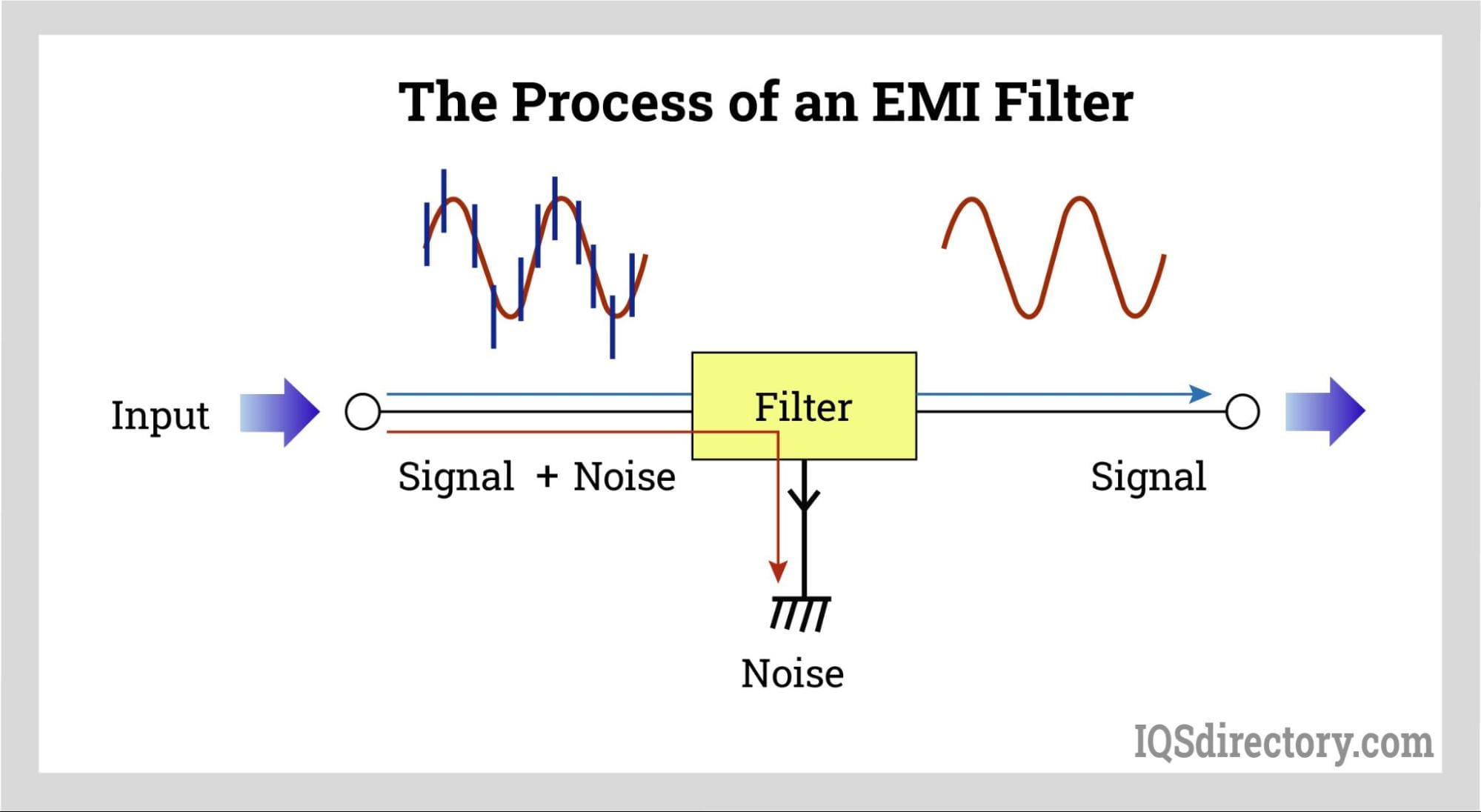

Product Overview

EMI (Electromagnetic Interference) filters are essential components used to suppress electromagnetic noise in electronic devices, ensuring compliance with electromagnetic compatibility (EMC) standards. Proper logistics handling and adherence to regulatory requirements are critical for the safe and legal distribution of these components.

Regulatory Compliance Requirements

EMI filters must meet international and regional regulatory standards to ensure electromagnetic compatibility and safety. Key compliance standards include:

– IEC/EN 60939: Standard for passive filter units for electromagnetic interference suppression.

– UL 1283: Standard for EMI filters in the United States.

– CISPR 22 / CISPR 32: Emission standards for IT and multimedia equipment.

– RoHS (EU Directive 2011/65/EU): Restriction of hazardous substances in electrical and electronic equipment.

– REACH (EC 1907/2006): Regulation on chemicals and their safe use.

– China RoHS: China’s regulation on pollution control for electronic products.

Ensure all EMI filters are certified with applicable marks (e.g., CE, UKCA, UL, CCC) based on the target market.

Packaging & Labeling Guidelines

Proper packaging and labeling are essential to maintain product integrity and meet regulatory demands.

– Use anti-static and ESD-safe packaging to protect sensitive components.

– Clearly label packaging with:

– Product name and part number

– Manufacturer information

– Compliance markings (e.g., CE, RoHS)

– Handling symbols (e.g., “Fragile,” “Do Not Stack”)

– Country of origin

– Include datasheets and compliance documentation (DoC – Declaration of Conformity) with shipments when required.

Storage Conditions

Store EMI filters in a controlled environment to prevent degradation:

– Temperature: 5°C to 35°C (41°F to 95°F)

– Humidity: 30% to 60% RH (non-condensing)

– Avoid exposure to dust, corrosive gases, and direct sunlight.

– Use original packaging until ready for use to prevent contamination.

Transportation & Shipping

Follow these best practices during transit:

– Use secure, shock-absorbent packaging to prevent physical damage.

– Clearly mark packages as “Electronics – Handle with Care.”

– Comply with IATA/IMDG regulations if shipping by air or sea (though EMI filters are typically non-hazardous).

– Maintain traceability through barcode/QR code systems for inventory and recall management.

Import/Export Documentation

Ensure all necessary documentation accompanies international shipments:

– Commercial Invoice

– Packing List

– Bill of Lading / Air Waybill

– Certificate of Origin

– Declaration of Conformity (DoC)

– RoHS/REACH Compliance Statements

– Import licenses (if required by destination country)

Verify customs tariff classifications (HS Code: typically 8504.40 or 8536.90 for EMI filters) for accurate duty assessment.

Customs Clearance & Duties

- Confirm that the destination country accepts the certifications provided (e.g., CE, CCC).

- Be aware of preferential trade agreements (e.g., USMCA, EU-South Korea FTA) that may reduce or eliminate duties.

- Account for potential import VAT, customs duties, and compliance verification delays at borders.

End-of-Life & Environmental Compliance

- Ensure end-of-life handling follows WEEE (Waste Electrical and Electronic Equipment) Directive requirements in applicable regions.

- Provide recycling guidance to customers where required.

- Maintain records of substance declarations for 10+ years as per RoHS and REACH.

Audit & Traceability

- Maintain a robust quality management system (e.g., ISO 9001, IATF 16949 for automotive).

- Keep records of batch numbers, test reports, and compliance certifications for full traceability.

- Conduct regular audits of suppliers and logistics partners to ensure ongoing compliance.

Contact & Support

For compliance inquiries, documentation requests, or logistics assistance, contact:

Compliance Team

Email: [email protected]

Phone: +1 (800) 555-EMI1

Website: www.emifilter.com/compliance

Ensure all stakeholders (distributors, freight forwarders, end customers) are informed of compliance and handling requirements to maintain product integrity and regulatory adherence.

Conclusion for Sourcing EMI Filters:

Sourcing EMI (Electromagnetic Interference) filters is a critical step in ensuring the electromagnetic compatibility (EMC) and reliable operation of electronic systems. After evaluating technical specifications, performance requirements, cost, supplier reliability, and compliance with international standards (such as IEC, UL, and CISPR), it is evident that selecting the right EMI filter involves a balance between quality, performance, and cost-effectiveness.

Key considerations include the operating voltage and current, insertion loss characteristics, leakage current limits, environmental conditions, and mechanical footprint. Additionally, partnering with reputable suppliers offering certified products, technical support, and consistent supply chain performance enhances long-term reliability and reduces design rework or compliance risks.

In conclusion, a well-sourced EMI filter not only meets regulatory requirements and prevents interference-related failures but also contributes to the overall durability and efficiency of the end product. A strategic sourcing approach—combining technical evaluation with supplier assessment—ensures optimal performance, regulatory compliance, and cost efficiency in both development and production phases.