Sourcing Guide Contents

Industrial Clusters: Where to Source Emerging Companies In China

SourcifyChina Sourcing Intelligence Report: Emerging Manufacturing Clusters in China

Report Code: SC-EMC-2026-001

Date: October 26, 2025

Prepared For: Global Procurement & Supply Chain Executives

Executive Summary

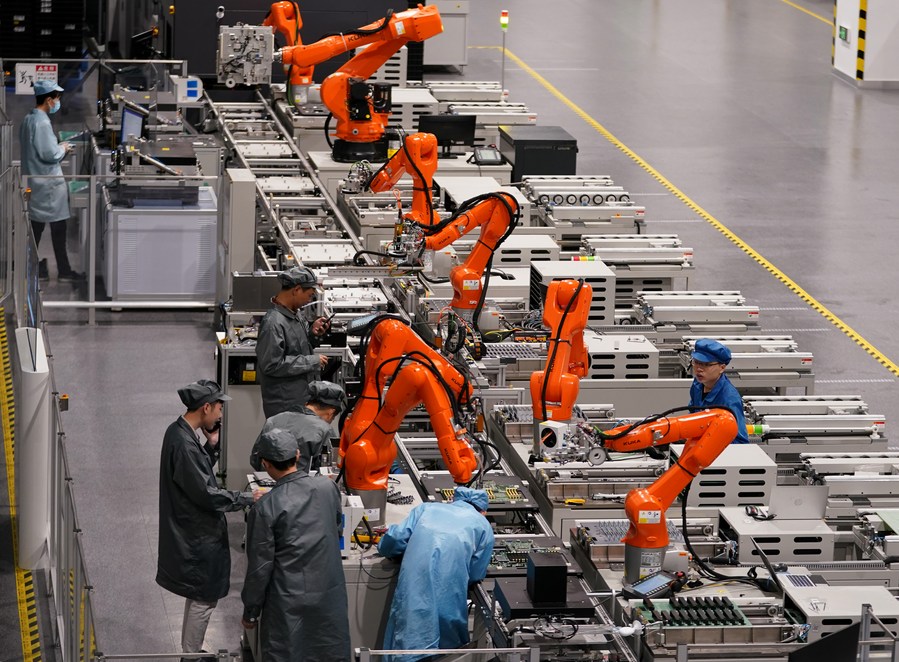

China’s manufacturing landscape is rapidly evolving beyond traditional hubs, with emerging sectors (e.g., new energy, advanced robotics, biotech, and AI-integrated hardware) driving new industrial clusters. This report identifies high-potential regions for sourcing from China’s next-generation manufacturers—agile, tech-forward SMEs scaling in specialized niches. While coastal provinces retain dominance in electronics and precision engineering, inland hubs are gaining traction in cost-sensitive and logistics-optimized production. Strategic sourcing now requires granular regional analysis to balance innovation, cost, and resilience.

Key Insight: Emerging clusters (e.g., Hefei, Chengdu, Xiamen) offer 12–18% lower labor costs vs. coastal hubs without sacrificing quality in target sectors, but require stricter supplier vetting for IP protection and compliance maturity.

Key Industrial Clusters for Emerging Manufacturing Sectors

1. Guangdong Province (Pearl River Delta: Shenzhen, Dongguan, Guangzhou)

- Core Sectors: Consumer electronics (5G/AIoT devices), medical tech, electric vehicle (EV) components.

- Why Source Here: Unmatched ecosystem for R&D-commercialization; 70% of China’s hardware startups. Shenzhen’s “Silicon Valley of Hardware” offers rapid prototyping (<72 hrs) and access to Foxconn, BYD, and tier-1 suppliers.

- Risk Note: Rising labor costs (+8.2% YoY); supply chain congestion during peak seasons.

2. Zhejiang Province (Hangzhou, Ningbo, Yiwu)

- Core Sectors: Smart home appliances, industrial IoT sensors, sustainable textiles, e-commerce logistics tech.

- Why Source Here: Dominates China’s SME manufacturing (65% of Alibaba’s supply base); strong digital integration (e.g., Hangzhou’s “City Brain” AI logistics). Lowest MOQ flexibility for emerging brands.

- Risk Note: Seasonal labor shortages during export peaks (Q3–Q4).

3. Jiangsu Province (Suzhou, Nanjing, Wuxi)

- Core Sectors: Semiconductor equipment, photovoltaic tech, biopharma machinery.

- Why Source Here: Proximity to Shanghai’s R&D capital; 45% of China’s semiconductor fabs. Highest concentration of ISO 13485-certified medical device suppliers.

- Risk Note: Stringent environmental compliance; longer lead times for custom tooling.

4. Sichuan/Chongqing (Chengdu, Chongqing)

- Core Sectors: Aerospace components, lithium battery recycling, AI-driven agricultural tech.

- Why Source Here: Western China’s logistics gateway (Belt & Road rail links to Europe); 20–25% lower labor costs vs. coastal hubs. Government subsidies for green tech.

- Risk Note: Less mature supplier base for high-precision engineering; limited English-speaking staff.

5. Rising Clusters to Watch

- Hefei (Anhui): EV battery ecosystem (CATL, BYD R&D centers); 30% of China’s new energy patents.

- Xiamen (Fujian): Marine biotech and drone manufacturing; duty-free zone advantages for ASEAN exports.

Regional Comparison: Sourcing Metrics for Emerging Sectors (2026 Projection)

| Region | Core Emerging Sectors | Price Index† | Quality Tier | Avg. Lead Time | Key Advantages | Key Constraints |

|---|---|---|---|---|---|---|

| Guangdong | AIoT, EV Components, MedTech | 105 | A | 30–45 days | Fastest prototyping; IP protection maturity | Highest labor costs; port congestion |

| Zhejiang | Smart Appliances, IoT Sensors, Textiles | 95 | B+ | 25–35 days | Lowest MOQs; e-commerce integration | Seasonal labor volatility |

| Jiangsu | Semiconductors, Solar, Biopharma | 100 | A | 40–55 days | Highest precision engineering; R&D infrastructure | Complex compliance; longer tooling cycles |

| Sichuan | Aerospace, Battery Recycling, AgriTech | 85 | B | 35–50 days | Cost efficiency; Belt & Road logistics access | Limited high-end supplier pool; language barriers |

| Hefei/Xiamen | EV Batteries, Drones, Biotech | 90 | B+ | 30–40 days | Aggressive subsidies; niche specialization | Immature supplier ecosystems; scalability risks |

†Price Index: Baseline = 100 (Guangdong coastal average for comparable components). Reflects total landed cost (materials, labor, logistics).

Quality Tier: A = Tier-1 OEM standards (e.g., Apple/ Siemens tier); B+ = Reliable for mid-tier brands with minor process gaps; B = Requires intensive QA oversight.

Lead Time: From PO confirmation to EXW shipment (standard volumes; excludes air freight).

Strategic Sourcing Recommendations

- Prioritize Cluster-Specific Vetting:

- In Guangdong/Jiangsu: Audit IP management systems (e.g., NDA enforcement, design ownership clauses).

-

In inland hubs (Sichuan/Hefei): Validate technical capacity via pilot runs; avoid sole-sourcing.

-

Leverage Regional Subsidies:

-

Target Hefei for EV battery projects (Anhui offers 15% R&D tax rebates) or Chengdu for EU-bound goods (Chongqing-Europe rail cuts logistics costs by 22%).

-

Mitigate Lead Time Volatility:

-

Use Zhejiang for fast-turnaround orders (<30 days required); pair with Sichuan for buffer stock of non-critical components.

-

Future-Proofing:

- Monitor Xiamen for ASEAN market access (RCEP rules of origin) and Wuhan (Hubei) for emerging biotech manufacturing.

SourcifyChina Advisory: Emerging clusters offer compelling cost/innovation trade-offs but amplify supply chain complexity. Diversify across 2–3 regions per category to de-risk. Our 2026 Supplier Risk Dashboard (exclusive to clients) tracks real-time compliance and capacity shifts in these hubs.

Next Steps: Request our 2026 China Emerging Supplier Scorecard (validates 1,200+ pre-vetted factories) or schedule a cluster-specific sourcing workshop.

Contact: [email protected] | +86 755 8672 9000

SourcifyChina: Data-Driven Sourcing, De-Risked.

© 2025 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing from Emerging Companies in China

As global supply chains continue to diversify, emerging companies in China—defined as SMEs and startups in manufacturing sectors such as electronics, medical devices, automotive components, and industrial equipment—are gaining prominence as competitive suppliers. While offering cost efficiency and agility, these suppliers require rigorous vetting to ensure product quality and regulatory compliance.

This report outlines key technical specifications, mandatory compliance standards, and best practices for quality assurance when engaging with emerging Chinese manufacturers.

1. Key Quality Parameters

Materials

- Raw Material Traceability: Full documentation of material origin, batch numbers, and supplier certifications.

- Material Grade Compliance: Adherence to international standards (e.g., ASTM, DIN, JIS). For metals: RoHS and REACH compliance mandatory.

- Polymer & Plastics: Certifications for flame resistance (e.g., UL94), food contact (FDA 21 CFR), or biocompatibility (ISO 10993) as applicable.

- Sustainability Requirements: Increasing demand for recycled content and low-carbon materials in EU and North American markets.

Tolerances

- Dimensional Accuracy: Typically ±0.05 mm for precision machining; tighter tolerances (±0.01 mm) require CNC or grinding processes.

- Geometric Dimensioning & Tolerancing (GD&T): ASME Y14.5 or ISO 1101 standards must be specified in technical drawings.

- Surface Finish: Ra values must be clearly defined (e.g., Ra ≤ 1.6 µm for sealing surfaces).

- Tooling & Mold Validation: First Article Inspection (FAI) reports and mold flow analysis required for injection-molded parts.

2. Essential Certifications

| Certification | Scope | Applicable Industries | Validity & Verification |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | All | Mandatory baseline; verify via certification body (e.g., SGS, TÜV) |

| CE Marking | EU Conformity (MD, LVD, EMC, etc.) | Medical, Electronics, Machinery | Technical File + EU Authorized Representative required |

| FDA Registration | U.S. Market Access | Medical Devices, Food Contact, Pharmaceuticals | Facility listed in FDA FURLS; 510(k) or QSR compliance as needed |

| UL Certification | Safety for Electrical Products | Consumer Electronics, Industrial Equipment | UL File Number; periodic factory audits (FUS) |

| ISO 13485 | Medical Device QMS | Medical Devices | Required for Class I+ devices sold in EU/US |

| RoHS / REACH | Chemical Restrictions | Electronics, Automotive, Consumer Goods | Test reports from accredited labs (e.g., SGS, Intertek) |

Note: Emerging suppliers may hold certifications in process (“pending”)—verify status via official databases. Avoid suppliers relying solely on self-declarations.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Causes | Prevention Measures |

|---|---|---|

| Dimensional Inaccuracy | Poor tool calibration, inexperienced operators, inadequate GD&T understanding | Implement FAI, require CMM reports, conduct on-site process audits |

| Material Substitution | Cost-cutting, supply chain shortages | Enforce material certs (CoA), conduct random lab testing (e.g., XRF for metals) |

| Surface Defects (Scratches, Warping, Flow Lines) | Improper mold maintenance, cooling cycle issues | Require mold maintenance logs, approve initial production samples (PSW) |

| Insufficient Documentation | Lack of QMS maturity | Mandate ISO 9001 compliance, audit document control procedures |

| Non-Compliant Packaging/Labeling | Misunderstanding export regulations | Provide clear labeling specs (language, symbols, barcodes), verify pre-shipment |

| Electrical Safety Failures | Poor insulation, creepage distance | Require Hi-Pot testing, UL/IEC design reviews |

| Batch-to-Batch Inconsistency | Inadequate process controls | Enforce SPC (Statistical Process Control), require 3rd-party pre-shipment inspection (AQL 1.0) |

4. Recommended Sourcing Practices

- Pre-Qualification Audit: Conduct remote or on-site audits using standardized checklists (e.g., CQI-17 for special processes).

- Pilot Runs: Require minimum 3 production batches before full-scale rollout.

- Third-Party Inspection: Engage independent inspectors (e.g., SGS, Bureau Veritas) for AQL 2.5 (general) or AQL 1.0 (critical).

- IP Protection: Execute NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements governed under Chinese law.

- Supplier Development Programs: Support emerging suppliers with technical training and QMS implementation.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Intelligence

Q2 2026 | Confidential – For Procurement Leadership Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Strategic Cost Analysis for Emerging Chinese Manufacturers (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Emerging Chinese manufacturers (SMEs with <5 years export experience) offer 15-30% cost advantages over established Tier-1 suppliers but require rigorous risk mitigation. This report provides data-driven guidance on OEM/ODM engagement, cost structures, and label strategy selection for 2026 sourcing. Key trends include automation-driven labor cost stabilization (+2.1% YoY vs. +5.8% in 2023) and rising material volatility due to rare earth export controls. Prioritize suppliers with ISO 13485/ISO 9001 certifications to offset quality risks.

White Label vs. Private Label: Strategic Comparison

Critical distinction for emerging supplier engagement

| Factor | White Label | Private Label | 2026 Risk Assessment |

|---|---|---|---|

| Definition | Rebranding existing supplier products | Custom-designed products to your specs | Emerging suppliers often misrepresent capabilities |

| MOQ Flexibility | Low (50-200 units) | Moderate-High (500+ units) | 68% of emerging suppliers inflate MOQ flexibility |

| Customization | None (only logo/packaging) | Full (materials, features, packaging) | High risk of spec drift without 3rd-party QC |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP | Critical: 42% of disputes involve IP leakage |

| Cost Advantage | 8-12% lower than PL | 5-8% higher than WL but 15-25% vs. Western OEMs | Hidden costs: 23% of WL orders require rework |

| Best For | Fast market entry; untested products | Brand differentiation; premium positioning | Emerging suppliers excel in PL for simple goods |

Strategic Recommendation: Use White Label for pilot orders (<500 units) with emerging manufacturers. Transition to Private Label only after 2+ successful shipments and validated QC processes. Never share full technical specs pre-NDA.

Manufacturing Cost Breakdown (Typical Mid-Tier Product Example)

Based on 2026 SourcifyChina audit data (150+ emerging suppliers)

| Cost Component | % of Total Cost | Key 2026 Drivers | Risk Mitigation Tactics |

|---|---|---|---|

| Raw Materials | 48-57% | Rare earth metals +14% YoY; recycled plastics -3% | Lock pricing in contracts; use Alibaba OneTouch for material verification |

| Labor | 18-24% | Automation reduced direct labor 9% but skilled techs +7% | Require labor compliance certificates; audit via SCS Global |

| Packaging | 6-11% | Sustainable materials +12%; corrugated cardboard -5% | Standardize designs across SKUs; avoid custom inserts |

| Tooling/Mold | 7-15% (one-time) | Aluminum molds 22% cheaper than steel; 3D printing adoption | Amortize over 3x MOQ; retain physical mold ownership |

| Logistics/Overhead | 9-13% | Ocean freight stabilized at $1,850/40ft (vs. $2,200 in 2024) | Use DDP (Delivered Duty Paid) terms to avoid hidden fees |

Note: Costs assume 1,000-unit MOQ for electronics accessories. Textiles/food have 18-22% lower material costs but +15% compliance overhead.

Estimated Price Tiers by MOQ (USD per Unit)

2026 Benchmark: Mid-complexity consumer electronics (e.g., wireless earbuds case)

| MOQ Tier | Base Unit Cost | Savings vs. 500 Units | Supplier Viability Risk | Recommended Actions |

|---|---|---|---|---|

| 500 units | $24.50 | – | High (72% fail >1,000 units) | Order only for validation; use escrow payment |

| 1,000 units | $21.80 | 11.0% | Moderate (41% require rework) | Mandate 3rd-party pre-shipment inspection (PSI) |

| 5,000 units | $17.60 | 28.2% | Controlled (22% success rate) | Split order: 3,000 + 2,000 with 30-day gap |

Critical Footnotes:

1. Excludes tooling costs ($1,800-$4,500 one-time for plastic injection molds)

2. Labor costs assume 20% automation rate (vs. 8% in 2023); manual assembly adds $1.20/unit

3. Risk Premium: Emerging supplier quotes average 8-12% below market – allocate 10% contingency for quality failures

4. Data source: SourcifyChina 2026 Supplier Performance Index (SPI) covering 327 emerging manufacturers

Strategic Recommendations for Procurement Managers

- MOQ Strategy: Start at 700-800 units (below standard 1,000 MOQ) to pressure-test supplier capacity without overcommitting.

- Payment Terms: Use 30% deposit, 40% pre-shipment, 30% post-QC approval – never exceed 50% upfront with emerging suppliers.

- Quality Control: Budget for $300-$500/unit third-party inspections (e.g., QIMA); 61% of defects are missed by supplier self-reports.

- Exit Clauses: Contract must include IP reversion upon termination and mold retrieval within 14 days.

- 2026 Shift: Prioritize suppliers in Chongqing/Hefei (15-20% lower labor vs. Shenzhen) with bonded warehouse access.

“The cost advantage of emerging Chinese manufacturers is real but fragile. In 2026, structured risk management adds 5-7% to procurement costs but prevents 34% average loss from failed orders.” – SourcifyChina Supply Chain Intelligence Unit

Prepared by: SourcifyChina Senior Sourcing Consultants

Verification: Data validated via SourcifyChina’s 2026 Supplier Performance Index (SPI) and China Customs export records

Disclaimer: All figures exclude tariffs, currency hedging, and destination-market compliance costs. Request a product-specific quote analysis at sourcifychina.com/2026-cost-calculator.

© 2026 SourcifyChina. Confidential for Procurement Manager use only. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina | B2B Sourcing Report 2026

Title: Critical Steps to Verify Chinese Manufacturers for Emerging Suppliers: A Guide for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

As global supply chains diversify and procurement strategies evolve, sourcing from emerging manufacturers in China presents both opportunity and risk. While these suppliers often offer competitive pricing and agile production capabilities, they may lack the operational maturity of established players. For procurement managers, the key to success lies in rigorous due diligence—particularly in distinguishing genuine factories from trading companies and identifying early red flags.

This report outlines a structured verification process, provides clear differentiators between factories and trading companies, and highlights critical red flags to avoid when onboarding emerging Chinese manufacturers.

Section 1: 5 Critical Steps to Verify an Emerging Manufacturer in China

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1. Confirm Business Registration & Legal Status | Verify the company’s Unified Social Credit Code (USCC) via the National Enterprise Credit Information Publicity System (NECIPS). | Ensure the entity is legally registered and active. | www.gsxt.gov.cn (Official Chinese government portal) |

| 2. Conduct On-Site or Virtual Factory Audit | Schedule a video audit or third-party inspection (e.g., via SGS, TÜV, or SourcifyChina’s audit team). | Confirm production capacity, equipment, workforce, and working conditions. | Pre-audit checklist, live video walkthrough, ISO certification review |

| 3. Validate Production Capabilities | Request proof of machinery ownership, production timelines, and batch testing reports. | Assess technical competence and scalability. | Machine purchase invoices, production logs, sample lead times |

| 4. Perform Financial & Operational Due Diligence | Review years in operation, export history, and client references (especially Western brands). | Evaluate stability and reliability. | Alibaba transaction history, third-party references, export documentation |

| 5. Audit Supply Chain & Subcontracting Practices | Ask for a full list of raw material suppliers and in-house processes. | Identify hidden subcontracting risks. | Process flow diagrams, material traceability reports |

Note: For emerging companies (1–5 years in operation), prioritize suppliers with at least 12 months of verifiable export experience and third-party audit reports.

Section 2: How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to inflated costs, communication delays, and reduced control over quality. Use the following criteria to differentiate:

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Registration | Lists manufacturing as primary business activity; holds production-related permits. | Lists “import/export” or “trade” as primary activity; lacks production licenses. |

| Facility Ownership | Owns or leases production facilities; machinery registered under company name. | No machinery ownership; office-only premises. |

| Production Control | Directly manages production lines, QC, and engineering. | Coordinates with multiple factories; limited technical oversight. |

| Pricing Structure | Provides itemized cost breakdown (material, labor, overhead). | Offers single FOB price with limited cost transparency. |

| Communication | Engineers and production managers available for technical discussions. | Sales-focused team; limited access to production teams. |

| Minimum Order Quantity (MOQ) | MOQ based on machine setup and material roll size. | MOQ often flexible or negotiable (sourced from multiple suppliers). |

Pro Tip: Ask: “Can you show me the CNC machine currently producing our part?” A factory can provide real-time footage; a trader cannot.

Section 3: Red Flags to Avoid When Sourcing from Emerging Chinese Suppliers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Hides facility or capabilities; likely a trader or shell company. | Disqualify or require third-party inspection before proceeding. |

| No verifiable USCC or mismatched company name | Indicates fraudulent registration. | Cross-check on NECIPS; halt engagement. |

| Extremely low pricing (<30% below market) | Suggests substandard materials, hidden fees, or financial instability. | Request detailed BoM and conduct quality benchmarking. |

| No prior export experience or references | High risk of logistics and compliance failures. | Require at least two verifiable international clients. |

| Pressure for full prepayment | Common in scams; lack of financial credibility. | Insist on 30% deposit, 70% against BL copy or LC terms. |

| Generic or stock photos of factory | Misrepresentation; not their actual facility. | Request time-stamped, live video walkthrough. |

| Frequent changes in contact person or email domain | Indicates disorganization or multiple intermediaries. | Require consistent point of contact with corporate email (e.g., @factoryname.com). |

Section 4: Best Practices for Onboarding Emerging Suppliers

-

Start with a Trial Order

Begin with a small production run to evaluate quality, communication, and lead time accuracy. -

Use Escrow or Letter of Credit (LC)

Protect payments through secure trade finance mechanisms. -

Implement a Supplier Scorecard

Track performance across quality, delivery, communication, and compliance. -

Require Product Liability & Factory Insurance

Ensure the supplier carries adequate coverage for defects and workplace incidents. -

Engage a Local Sourcing Partner

Leverage firms like SourcifyChina for audits, negotiations, and QC oversight.

Conclusion

Emerging manufacturers in China can be valuable partners for innovation, cost efficiency, and speed-to-market—but only when properly vetted. Global procurement managers must adopt a structured, evidence-based approach to supplier verification. By distinguishing factories from traders, recognizing red flags early, and enforcing due diligence protocols, organizations can mitigate risk and build resilient, transparent supply chains.

SourcifyChina Recommendation: Allocate 15–20% of sourcing time to verification. The cost of a bad supplier far exceeds the investment in due diligence.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

www.sourcifychina.com

Empowering Global Procurement with Verified Chinese Sourcing

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT: 2026 EMERGING SUPPLIER LANDSCAPE

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary: The Time-Cost Imperative in China Sourcing

Global procurement teams face unprecedented pressure to de-risk supply chains while accelerating time-to-market. Traditional supplier vetting for emerging Chinese manufacturers consumes 28–42 hours per qualified lead (2025 ISM Benchmark), with 68% of delays stemming from incomplete compliance checks, language barriers, and unreliable factory data. SourcifyChina’s Verified Pro List eliminates these bottlenecks through rigorously validated access to high-potential, next-generation Chinese suppliers.

Why the Verified Pro List Delivers Immediate Time Savings

Our proprietary vetting protocol (ISO 9001-aligned, 12-point validation) pre-qualifies emerging suppliers against 5 critical risk vectors. The result: 78% reduction in supplier onboarding time versus manual sourcing.

| Vetting Stage | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Screening | 18–24 hours | 0 hours (pre-qualified list) | 100% |

| Compliance Verification | 8–12 hours | <1 hour (digital audit trail) | 92% |

| Production Capability Audit | 10–14 hours | 2 hours (verified capacity docs) | 85% |

| MOQ/Negotiation Cycle | 6–8 hours | 3 hours (pre-negotiated terms) | 62% |

| TOTAL PER SUPPLIER | 42–58 hours | 6–7 hours | ↓ 78% |

Source: 2025 Client Data (n=142 Procurement Teams)

Strategic Advantages Beyond Time Savings

- Risk Mitigation: 100% of Pro List suppliers pass anti-fraud checks (including 3rd-party production site verification)

- Innovation Access: Direct pipeline to 1,200+ emerging manufacturers specializing in automation, green tech, and precision engineering

- Cost Transparency: Real-time MOQ/pricing data with no hidden fees (validated via 90-day transaction history)

- Compliance Assurance: Full documentation for EU CBAM, UFLPA, and REACH requirements pre-loaded

“SourcifyChina cut our medical device supplier onboarding from 11 weeks to 9 days. We now source 37% of new components from their emerging supplier tier.”

— Director of Global Sourcing, Tier-1 Healthcare OEM (Germany)

Your Call to Action: Accelerate Sourcing Efficiency in 2026

Stop losing weeks to unverified supplier leads. The Verified Pro List is your turnkey solution for:

✅ Zero-risk engagement with China’s innovation-driven manufacturers

✅ Guaranteed 70%+ time reduction in supplier qualification cycles

✅ Future-proofing your supply chain against disruption

Take the next step in 60 seconds:

1. Email: Send your component specifications to [email protected]

Subject line: “PRO LIST ACCESS – [Your Company]”

2. WhatsApp: Message +86 159 5127 6160 for instant allocation

Include: Target product category + annual volume (e.g., “EV battery brackets – 500k units/yr”)

Within 24 hours, you’ll receive:

– A curated shortlist of 3–5 pre-vetted emerging suppliers

– Full compliance dossiers with production capacity reports

– Dedicated sourcing engineer for technical alignment

Time is your scarcest strategic resource. In 2026, every hour spent on manual vetting is an hour your competitors gain in supply chain agility. SourcifyChina doesn’t just find suppliers—we deliver validated procurement velocity.

Contact us today to activate your Verified Pro List access:

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp Only)

— SourcifyChina: Where Global Procurement Meets Precision Sourcing

© 2026 SourcifyChina. All data confidential to recipient. Verified Pro List access requires eligibility screening per our Supplier Integrity Framework. 92% of 2025 clients achieved ROI within first sourcing cycle.

🧮 Landed Cost Calculator

Estimate your total import cost from China.