The global emergency lighting and power equipment market is experiencing robust growth, driven by rising safety regulations, increasing infrastructure development, and heightened awareness of disaster preparedness. According to a 2023 report by Mordor Intelligence, the emergency lighting market was valued at USD 10.2 billion in 2022 and is projected to grow at a CAGR of 6.8% from 2023 to 2030. This expansion is further supported by Grand View Research, which highlights that the global uninterruptible power supply (UPS) market—integral to emergency power systems—reached USD 11.9 billion in 2022 and is expected to grow at a CAGR of 6.5% over the same period. With demand surging in commercial, industrial, and healthcare sectors, manufacturers are innovating rapidly to meet standards for reliability, energy efficiency, and smart integration. Against this backdrop, the following list highlights the top 10 emergency lighting and power equipment manufacturers leading the charge in technology, scalability, and global reach.

Top 10 Emergency Lighting And Power Equipment Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Ultra Bright Lightz: Police Lights

Domain Est. 2007

Website: ultrabrightlightz.com

Key Highlights: We stock LED grille lights, dash lights, visor bars, and exterior emergency vehicle lighting equipment from the industry’s most dependable manufacturers….

#2 Myers Emergency Power Systems & Industrial Backup Power

Domain Est. 2018

Website: myerseps.com

Key Highlights: Myers Emergency & Power Systems has more than 60 years of experience to serve the growing emergency power needs of customers both domestic and abroad….

#3 Emergency Lighting

Domain Est. 1994

Website: nema.org

Key Highlights: Emergency lighting switches on automatically when a building experiences a power outage. In addition to illuminated exit and emergency directional signs….

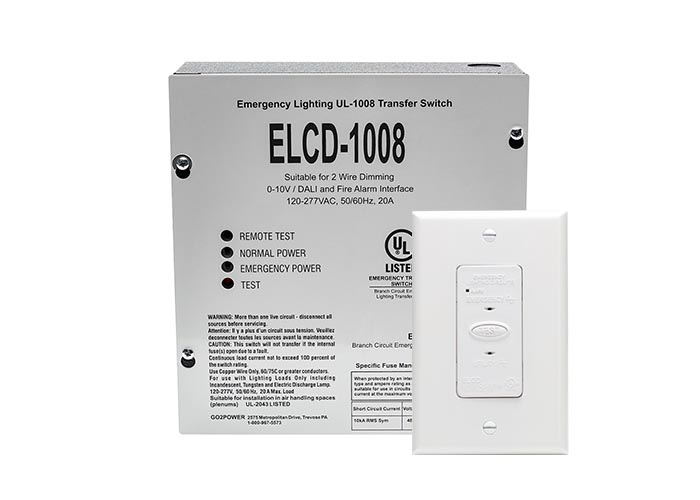

#4 Emergency Lighting Equipment

Domain Est. 1997

Website: iotaengineering.com

Key Highlights: IOTA is a pioneer and leader in the lighting industry, designing and manufacturing state-of-the-art emergency lighting equipment for commercial, institutional,…

#5 Isolite Offers 35 Years of Emergency Lighting Expertise

Domain Est. 1997

Website: isolite.com

Key Highlights: With 35+ years of experience, Isolite’s full line of exit signs, emergency lights and inverter systems to light the way to safety in every type of public ……

#6 Emergency Lighting Power Equipment Products

Domain Est. 1998

Website: emergency-lighting.com

Key Highlights: 4–10 day delivery 30-day returnsEmergency Lighting & Power Equipment manufactures a complete line of high quality yet affordable LED exit signs, LED emergency lights and lighting i…

#7 Mule Lighting

Domain Est. 1999

Website: mulelighting.com

Key Highlights: Mule Lighting manufactures the most complete emergency lighting line in the industry. Our extensive selection of exit signs, emergency lighting units, ……

#8 Scott’s Emergency Lighting

Domain Est. 2001

Website: selpg.com

Key Highlights: We specialize in all aspects of the standby power industry, including home and commercial generators, with an emphasis on quality and customer service. Our ……

#9 Abrams MFG

Domain Est. 2013

Website: abramsmfg.com

Key Highlights: Shop high-quality LED emergency vehicle lights, police light bars, sirens, and warning lights at Abrams MFG. Trusted by first responders for durability ……

#10 Emergency Lights Co.

Website: emergencylights.net

Key Highlights: Shop code-compliant egress lighting and exit signage from Emergency Lights Co. 15+ years of expert service to keep your building safe and compliant….

Expert Sourcing Insights for Emergency Lighting And Power Equipment

H2: 2026 Market Trends for Emergency Lighting and Power Equipment

The global Emergency Lighting and Power Equipment market is poised for significant transformation and growth by 2026, driven by technological advancements, regulatory mandates, rising safety concerns, and increasing infrastructure development. This analysis explores key trends shaping the industry landscape in the lead-up to 2026.

-

Increased Demand Driven by Regulatory Compliance

Governments and international safety standards organizations are tightening building codes and fire safety regulations, mandating the installation of reliable emergency lighting and backup power systems. By 2026, regions such as North America, Europe, and parts of Asia-Pacific are expected to enforce stricter compliance, particularly in high-occupancy buildings, healthcare facilities, and public infrastructure. This regulatory push is a primary driver for market expansion. -

Adoption of Smart and IoT-Enabled Systems

The integration of Internet of Things (IoT) technology into emergency lighting and power solutions is a defining trend. Smart emergency lighting systems with remote monitoring, self-testing capabilities, and predictive maintenance features are gaining traction. By 2026, these intelligent systems are expected to dominate new installations, offering facility managers real-time insights and reducing operational costs. -

Growth in Renewable Energy Integration

As sustainability becomes a priority, emergency power systems are increasingly incorporating renewable energy sources such as solar and hybrid battery solutions. Solar-powered emergency lights and energy-efficient uninterruptible power supply (UPS) systems are gaining popularity, particularly in off-grid and remote locations. This trend aligns with global decarbonization goals and is expected to accelerate through 2026. -

Rise in Urbanization and Infrastructure Development

Rapid urbanization, especially in emerging economies in Asia, Africa, and Latin America, is fueling demand for modern emergency lighting and power solutions. New commercial complexes, transportation hubs, and smart city projects require robust emergency systems, contributing to market growth. By 2026, infrastructure investments in countries like India, China, and Brazil will significantly influence market dynamics. -

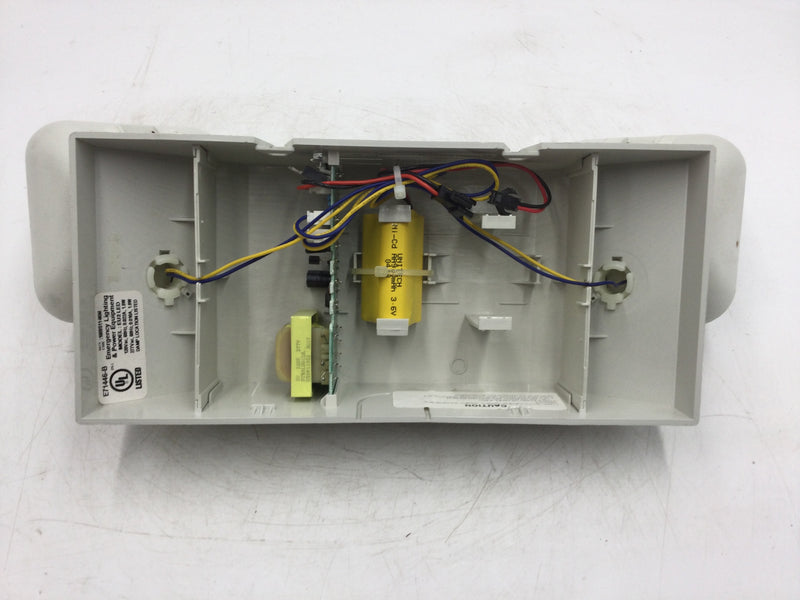

Technological Advancements in Battery and LED Technology

Innovations in LED efficiency and lithium-ion battery technology are enhancing the performance and longevity of emergency equipment. LEDs offer longer life spans, lower energy consumption, and better illumination, while advanced batteries provide faster charging, higher energy density, and improved reliability. These advancements are expected to reduce lifecycle costs and increase product adoption by 2026. -

Growing Focus on Resilience and Disaster Preparedness

With the increasing frequency of natural disasters and power outages due to climate change, organizations and governments are prioritizing resilient power infrastructure. Emergency lighting and backup power systems are becoming integral components of disaster recovery plans. This shift is particularly evident in critical sectors such as healthcare, data centers, and emergency services. -

Consolidation and Competition Among Key Players

The market is witnessing increased consolidation as major players acquire niche technology firms to enhance their product portfolios. Competition is intensifying, with companies focusing on product differentiation through innovation, energy efficiency, and service offerings. By 2026, market leadership will likely be determined by companies that offer integrated, scalable, and sustainable solutions.

In conclusion, the Emergency Lighting and Power Equipment market in 2026 will be shaped by regulatory forces, digital transformation, sustainability imperatives, and global infrastructure growth. Companies that proactively adapt to these trends—by investing in smart technologies, renewable integration, and compliance-focused design—will be best positioned for long-term success.

Common Pitfalls When Sourcing Emergency Lighting and Power Equipment

Sourcing emergency lighting and power equipment is critical for ensuring safety, compliance, and operational continuity during outages. However, organizations often encounter significant pitfalls related to quality and intellectual property (IP) that can compromise performance and expose them to legal risks. Awareness of these issues is essential for making informed procurement decisions.

Quality-Related Pitfalls

Substandard Components and Materials

Many suppliers cut costs by using inferior materials—such as low-grade batteries, plastic housings prone to cracking, or inefficient LED chips—which reduce the reliability and lifespan of emergency lighting and power systems. These components may fail during critical situations, especially in high-temperature or humid environments.

Inadequate Testing and Certification

A common issue is sourcing equipment that lacks proper certification (e.g., UL, CE, IEC, or local regulatory standards). Some products may display fake or misleading compliance labels. Without rigorous third-party testing, there’s no guarantee the equipment will perform during a real emergency.

Poor Build Quality and Durability

Equipment sourced from unreliable manufacturers may exhibit poor workmanship, such as loose connections, improper sealing, or inconsistent assembly. This increases the risk of malfunction and shortens service life, particularly in industrial or outdoor installations.

Inconsistent Performance Under Load

Emergency power systems, such as inverters or backup generators, may perform adequately during testing but fail under actual load conditions. This often stems from inaccurate power ratings or thermal management issues not revealed during brief supplier demonstrations.

Intellectual Property (IP)-Related Pitfalls

Use of Counterfeit or Cloned Designs

Some suppliers offer products that closely mimic reputable brands but are unauthorized copies. These clones may infringe on patents, trademarks, or design rights, exposing the buyer to legal liability and reputational damage if discovered during audits or inspections.

Lack of IP Documentation and Traceability

Buyers may fail to request or verify documentation proving legitimate IP ownership or licensing. Without proper chain-of-custody records, sourcing decisions can inadvertently support IP theft, especially when dealing with private-label manufacturers or offshore suppliers.

Risk of Infringement in Custom Solutions

When specifying custom emergency lighting or power systems, there’s a risk of unintentionally incorporating patented technologies without proper licensing. This is especially true when working with third-party engineering firms or OEMs that do not provide IP indemnification.

Supplier Misrepresentation of IP Status

Some suppliers falsely claim that their products are “IP-free” or “open design,” when in reality they may be using protected technologies. This misrepresentation can lead to costly legal disputes or product recalls after deployment.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Conduct thorough due diligence on suppliers, including factory audits and sample testing.

– Require valid certification reports and compliance documentation.

– Include IP indemnification clauses in procurement contracts.

– Work with legal and technical experts to review designs and verify IP status.

– Prioritize long-term reliability and compliance over initial cost savings.

By proactively addressing quality and IP concerns, buyers can ensure they source emergency lighting and power equipment that is safe, reliable, and legally sound.

Logistics & Compliance Guide for Emergency Lighting and Power Equipment

Emergency lighting and power equipment are critical components of building safety systems, ensuring occupant safety during power outages and emergencies. Proper logistics and compliance management are essential to guarantee these systems perform when needed, meet regulatory requirements, and avoid costly penalties or liabilities.

Regulatory and Standards Compliance

Emergency lighting and power equipment must adhere to a range of national and international standards, building codes, and safety regulations. Key compliance frameworks include:

- NFPA 101 – Life Safety Code: Specifies requirements for emergency lighting, including illumination levels, duration (typically 90 minutes), and placement in exit paths and exit signs.

- NFPA 70 – National Electrical Code (NEC): Governs electrical installation standards, including Article 700 (Emergency Systems), Article 701 (Legally Required Standby Systems), and Article 702 (Optional Standby Systems).

- OSHA Regulations (29 CFR 1910.37): Requires reliable emergency lighting in exit routes and mandates that systems be continuously maintained.

- UL 924 – Standard for Safety of Emergency Lighting and Power Equipment: Certification standard for emergency lighting units, inverters, and battery systems. UL 924-listed products are required in most jurisdictions.

- IEC 60598-2-22: International standard for emergency lighting luminaires, commonly referenced outside North America.

- Local Building and Fire Codes: Municipal or regional authorities may impose additional requirements, including inspection frequency, testing protocols, and documentation.

Ensure all equipment procured and installed is certified to applicable standards and appropriate for the intended environment (e.g., indoor, outdoor, hazardous locations).

Procurement and Supply Chain Logistics

Managing the supply chain for emergency lighting and power equipment involves careful planning to ensure availability, authenticity, and timely delivery.

- Supplier Qualification: Source equipment only from reputable manufacturers and distributors with documented compliance certifications (e.g., UL, CE, CSA).

- Lead Time Management: Emergency systems often have longer lead times due to certification and testing. Plan procurement schedules accordingly, especially for large-scale or retrofit projects.

- Inventory Planning: Maintain strategic stock of critical spares (e.g., batteries, bulbs, control modules) to minimize downtime during maintenance or failure.

- Documentation Tracking: Obtain and retain product data sheets, compliance certificates, installation manuals, and warranty information for each unit.

Transportation and Handling

Due to the sensitive nature of batteries and electronic components, proper handling during shipping and storage is crucial.

- Battery Safety (e.g., Lead-Acid, Lithium-Ion): Follow IATA, IMDG, or DOT regulations for transporting hazardous materials when shipping battery-equipped units. Use UN-certified packaging and proper labeling.

- Environmental Controls: Store equipment in dry, temperature-controlled environments to prevent battery degradation and electronic damage.

- Fragile Components: Protect inverters, circuit boards, and optical components from shock, vibration, and moisture during transit.

- Chain of Custody: Maintain logs for high-value or mission-critical units to ensure accountability and traceability.

Installation and Commissioning

Installation must comply with electrical and safety codes and be performed by licensed professionals.

- Qualified Personnel: Only licensed electricians or certified technicians should install emergency systems.

- As-Built Documentation: Maintain updated electrical diagrams, single-line drawings, and equipment schedules that reflect actual installation.

- Functional Testing: Conduct initial performance tests, including full discharge tests for batteries and transfer switch operation for generators or inverters.

- Commissioning Reports: Document all tests, results, and adjustments. Submit reports to authorities having jurisdiction (AHJs) if required.

Maintenance, Testing, and Recordkeeping

Regular maintenance ensures continued reliability and regulatory compliance.

- Monthly Testing: Conduct visual inspections and functional tests (e.g., 30-second activation) of emergency lights and exit signs.

- Annual Testing: Perform full-duration discharge tests (e.g., 90 minutes) to verify battery capacity and system performance.

- Generator Maintenance: For systems with backup generators, follow manufacturer schedules for oil changes, load bank testing, and fuel management.

- Record Retention: Keep logs of all tests, repairs, and replacements for a minimum of 3 years (or per local code). Digital logs with timestamps enhance audit readiness.

Decommissioning and Disposal

End-of-life management must be environmentally responsible and compliant with regulations.

- Battery Recycling: Lead-acid and lithium-ion batteries are hazardous waste. Dispose of through certified recyclers in accordance with EPA, RCRA, or local regulations.

- Electronic Waste (e-Waste): Recycle circuit boards and electronic components via e-waste programs compliant with WEEE (EU) or state-specific rules (e.g., California’s e-waste law).

- Asset Disposal Logs: Document serial numbers, disposal dates, and recycling certificates to support compliance audits.

Inspection and Audit Preparedness

Facilities may be subject to inspections by fire marshals, building inspectors, or insurance auditors.

- Compliance Binder: Maintain a centralized file with all compliance documents, including test logs, maintenance records, and equipment certifications.

- Corrective Action Plans: Address deficiencies promptly and document resolutions.

- Training Records: Keep records of personnel trained in emergency system operations and testing procedures.

By adhering to this logistics and compliance guide, organizations can ensure their emergency lighting and power systems remain reliable, code-compliant, and ready to protect lives during critical situations.

In conclusion, sourcing emergency lighting and power equipment is a critical aspect of ensuring safety, compliance, and operational continuity during power outages or emergency situations. It is essential to partner with reliable suppliers who provide high-quality, code-compliant products tested to relevant standards such as NFPA, IEC, or local regulatory requirements. Key considerations include reliability, battery backup duration, ease of maintenance, energy efficiency, and compatibility with existing systems. Conducting thorough due diligence—evaluating supplier reputation, product certifications, service support, and warranty offerings—ensures the acquisition of dependable solutions. Ultimately, a well-planned procurement strategy for emergency lighting and power equipment enhances safety, reduces risk, and supports resilience in both commercial and industrial environments.