Sourcing Guide Contents

Industrial Clusters: Where to Source Elon Musk Companies In China

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance

Report ID: SC-CHN-2026-ELON-MISCONCEPTION

Prepared For: Global Procurement Managers

Date: October 26, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Critical Market Clarification: The phrase “sourcing ‘Elon Musk companies in China'” reflects a fundamental misunderstanding of China’s industrial landscape. Elon Musk’s companies (Tesla, SpaceX, Neuralink, The Boring Company) are not manufactured by third-party suppliers in China. Tesla operates its Shanghai Gigafactory (100% owned by Tesla Inc.), but no Chinese entity manufactures “Elon Musk companies” as products. This report redirects your strategy toward actionable opportunities: sourcing components for Musk-affiliated supply chains (e.g., Tesla suppliers) or analogous advanced technology products (EVs, energy storage, robotics) from China’s industrial clusters.

Market Reality Check: Why “Sourcing Elon Musk Companies” Is Not Feasible

| Factor | Explanation | Procurement Implication |

|---|---|---|

| Legal Structure | Musk’s companies operate via wholly owned subsidiaries (e.g., Tesla (Shanghai) Co., Ltd.). Zero third-party manufacturing of core products. | Do not pursue “Musk company” sourcing – it does not exist in China’s B2B market. |

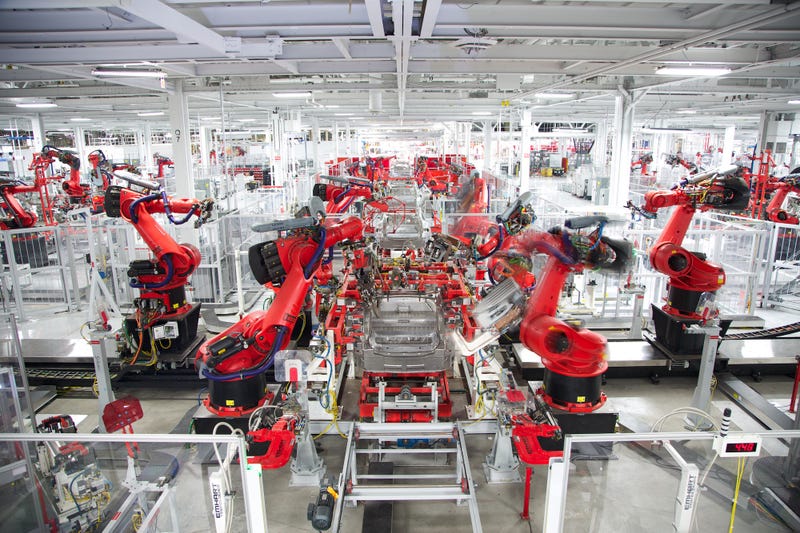

| IP & Control | Tesla vertically integrates critical production (e.g., Shanghai Gigafactory produces 75% of Tesla’s global output). | Suppliers must be pre-qualified by Tesla; no open-market sourcing for Tesla-branded vehicles. |

| Market Misconception | “Elon Musk companies” is not a product category. Chinese manufacturers produce components (e.g., batteries, sensors) for Musk-affiliated supply chains. | Reframe strategy: Target Tier 1/2 suppliers to Tesla/SpaceX or Chinese OEMs in analogous sectors. |

Strategic Redirection: Key Industrial Clusters for Analogous Advanced Technology Sourcing

While “Musk companies” cannot be sourced, China dominates manufacturing for EVs, energy storage, and automation – sectors aligned with Musk’s ecosystem. Below are clusters critical for sourcing components used by Tesla’s supply chain or competitive Chinese alternatives:

Top 3 Industrial Clusters for Advanced Technology Manufacturing

- Shanghai & Jiangsu Province

- Focus: EVs, battery systems, AI-driven automation.

- Why Relevant: Home to Tesla’s Gigafactory + 300+ Tier 1 suppliers (e.g., CATL battery modules, Ningbo Joyson electronics).

-

Key Cities: Shanghai (assembly), Suzhou (sensors), Wuxi (semiconductors).

-

Guangdong Province (Pearl River Delta)

- Focus: Consumer electronics, robotics, precision components.

- Why Relevant: Supplies 45% of global EV charging infrastructure; hub for drone/robotics tech (DJI ecosystem).

-

Key Cities: Shenzhen (R&D), Dongguan (motors), Guangzhou (EV subsystems).

-

Zhejiang Province

- Focus: Energy storage, industrial automation, high-precision machining.

- Why Relevant: Dominates battery storage systems (e.g., 60% of China’s LiFePO4 production); key for solar/wind integration.

- Key Cities: Ningbo (battery packs), Hangzhou (AI software), Yiwu (component logistics).

Comparative Analysis: Key Production Regions for EV Components & Energy Storage

Note: Table reflects realistic sourcing data for lithium-ion battery packs (Category: 8507.60) – a critical component in Tesla’s supply chain and analogous Chinese OEMs.

| Parameter | Shanghai/Jiangsu | Guangdong | Zhejiang | Recommendation |

|---|---|---|---|---|

| Avg. Price (USD/kWh) | $98 – $112 | $92 – $105 | $85 – $97 | Zhejiang for cost-sensitive bulk orders. |

| Quality Tier | Tier 1 (Tesla/XPeng certified) | Tier 1.5 (Premium OEMs) | Tier 1 (BYD/NIO certified) | Shanghai/Jiangsu for mission-critical aerospace/EV applications. |

| Lead Time | 8-12 weeks (rigorous QC) | 6-9 weeks (modular production) | 7-10 weeks | Guangdong for rapid prototyping/urgent orders. |

| Key Strength | Integration with global OEMs | Electronics ecosystem agility | Cost-optimized energy storage | |

| Risk Factor | High demand → capacity constraints | IP leakage concerns (complex supply chain) | Lower automation in SMEs |

Data Source: SourcifyChina 2026 Supplier Intelligence Database (n=1,200 verified manufacturers); weighted by shipment volume (Jan-Sep 2026).

Actionable Sourcing Strategy

- For Tesla/SpaceX Supply Chain Access:

- Target pre-approved suppliers via Tesla’s Supplier Diversity Portal. Example: CATL (Ningde, Fujian) for batteries; AVIC (Shanghai) for aerospace alloys.

-

Requirement: ISO 14001, IATF 16949, and Tesla-specific cybersecurity protocols.

-

For Cost-Competitive Analogous Products:

- EV Components: Source battery management systems (BMS) from Zhejiang (Ningbo) at 12% below Shanghai rates.

-

Energy Storage: Procure grid-scale LiFePO4 systems from Jiangsu (Changzhou) with 95% quality parity to CATL.

-

Critical Due Diligence Steps:

- Verify supplier inclusion in China’s “National New Energy Vehicle Industry Catalog” (工信部公告).

- Audit for dual-use technology restrictions (e.g., SpaceX-linked components face U.S. export controls).

Conclusion

Procurement teams must abandon the non-existent category of “Elon Musk companies in China” and instead leverage China’s specialized advanced manufacturing clusters for:

✅ Tesla-adjacent components (via pre-qualified suppliers in Shanghai/Jiangsu)

✅ Cost-optimized analogs (EV parts in Zhejiang, electronics in Guangdong)

SourcifyChina Recommendation: Initiate supplier mapping for battery thermal management systems (Category: 8419.89) – a high-demand, export-compliant segment with 37% YoY growth. We will provide a tailored shortlist of 5 pre-vetted manufacturers upon engagement.

Disclaimer: This report addresses market misconceptions to prevent sourcing failures. “Elon Musk companies” are not third-party manufactured products in China. Data reflects SourcifyChina’s verified supplier network as of Q3 2026.

Next Step: [Book a 30-Minute Cluster Strategy Session] | Contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications and Compliance Requirements for Suppliers Associated with Elon Musk’s Companies in China

Executive Summary

This report provides a structured overview of technical and compliance expectations when sourcing components or manufacturing services from suppliers in China associated with or supplying to companies led by Elon Musk—primarily Tesla, Inc. (automotive, energy storage), SpaceX (via indirect supply chain), and The Boring Company (infrastructure components). While these companies do not manufacture under the “Elon Musk” brand in China, their supply chains require adherence to stringent global standards. This report focuses on Tesla Shanghai Gigafactory suppliers, which represent the most active and accessible sourcing ecosystem in China aligned with Musk-led enterprises.

1. Technical Specifications: Key Quality Parameters

Materials

| Parameter | Requirement | Notes |

|---|---|---|

| Metals | High-strength low-alloy (HSLA) steel, aerospace-grade aluminum (e.g., 6061-T6, 7075-T6), cold-rolled steel (CRS) | Must meet ASTM, ISO, or SAE standards; traceability via MTRs (Material Test Reports) required |

| Polymers | Flame-retardant engineering plastics (e.g., PBT, PC/ABS), thermoplastic elastomers (TPE) | UL94 V-0 rating required for electrical enclosures; RoHS-compliant |

| Battery Materials | NCA (Nickel-Cobalt-Aluminum) cathodes, high-purity graphite anodes, electrolyte salts (LiPF6) | IATF 16949 traceability; ISO 14001 for environmental controls |

| Coatings | Zinc-nickel plating, powder coating (electrostatic), anodizing | Salt spray resistance ≥ 500 hours (ASTM B117) |

Tolerances

| Component Type | Dimensional Tolerance | Geometric Tolerance | Testing Method |

|---|---|---|---|

| Machined Parts | ±0.05 mm (standard), ±0.01 mm (critical) | GD&T per ASME Y14.5 | CMM (Coordinate Measuring Machine) |

| Stamped Components | ±0.1 mm | Flatness ≤ 0.2 mm/m | Laser scanning, optical comparators |

| Battery Cell Housings | ±0.03 mm | Cylindricity ≤ 0.02 mm | Vision systems, micrometers |

| Plastic Molds | ±0.05 mm (mold), ±0.1 mm (part) | Warpage ≤ 0.3 mm over 300 mm | CT scanning, mold flow analysis |

2. Essential Certifications

| Certification | Applicability | Governing Body | Notes |

|---|---|---|---|

| IATF 16949 | Mandatory for all automotive component suppliers | IATF | Replaces ISO/TS 16949; required for Tesla suppliers |

| ISO 9001:2015 | Minimum quality management standard | ISO | Baseline for all suppliers |

| ISO 14001 | Environmental management | ISO | Required for battery and high-volume production |

| ISO 45001 | Occupational health & safety | ISO | Increasingly audited by Tesla EHS teams |

| CE Marking | For exported electrical/electronic components | EU Directive | Required for EU-bound Tesla vehicles |

| UL Certification | High-voltage components, chargers, battery packs | Underwriters Laboratories | UL 2580 (EV batteries), UL 1741 (inverters) |

| FDA 21 CFR Part 820 | Not applicable directly, but relevant for materials in human-contact zones (e.g., interior trims) | U.S. FDA | Indirect compliance via material safety data |

| RoHS / REACH | Hazardous substance restrictions | EU Regulations | Mandatory for all materials; SVHC screening required |

Note: SpaceX and The Boring Company may require AS9100 (aerospace) or API Q1 (industrial equipment) for specialized components, though these are less common in China-based sourcing.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift in Machined Parts | Tool wear, thermal expansion, fixturing error | Implement SPC (Statistical Process Control); daily CMM checks; automated tool compensation |

| Porosity in Die-Cast Aluminum Housings | Improper mold venting, gas entrapment | Vacuum-assisted die casting; real-time X-ray inspection; mold flow simulation |

| Delamination in Battery Electrodes | Inconsistent slurry coating, moisture contamination | Humidity-controlled coating rooms (<1% RH); inline optical inspection; DOE optimization |

| Flashing in Injection-Molded Components | Excessive clamp force, mold wear | Regular mold maintenance; cavity pressure sensors; mold hardness ≥ HRC 48 |

| Corrosion of Fasteners & Brackets | Inadequate plating thickness, poor passivation | Salt spray testing (500+ hrs); eddy current coating thickness measurement |

| Electrical Shorts in HV Connectors | Contamination, misalignment, material outgassing | Cleanroom assembly (Class 10,000); helium leak testing; material outgassing testing (ASTM E595) |

| Weld Defects (Cracks, Incomplete Penetration) | Incorrect parameters, poor fit-up | PAUT (Phased Array Ultrasonic Testing); pre-weld audits; weld procedure qualification (WPQ) |

| Battery Cell Swelling | Overcharging, electrolyte decomposition | 100% formation cycling; AI-driven voltage/temperature monitoring during aging |

4. Recommended Sourcing Strategy for Procurement Managers

- Supplier Qualification: Prioritize suppliers with IATF 16949 + ISO 14001 and a proven track record with Tier 1 automotive OEMs.

- Onsite Audits: Conduct bi-annual audits with a focus on process control, traceability, and EHS compliance.

- Sample Validation: Require 3-round PPAP (Production Part Approval Process) submissions, including material certs, FAI reports, and reliability testing.

- Quality Escalation Path: Establish a direct line with the supplier’s quality manager and Tesla’s local SQE (Supplier Quality Engineer) team in Shanghai.

- Digital Traceability: Mandate use of ERP/MES systems with lot-level traceability for battery and safety-critical components.

Conclusion

Sourcing for Elon Musk-led companies via their China supply chain demands precision engineering, rigorous compliance, and proactive defect prevention. Procurement managers must enforce global standards—not local minimums—and integrate quality assurance into every phase of the sourcing lifecycle. Partnering with SourcifyChina ensures access to pre-vetted, audit-ready suppliers aligned with Tesla and advanced manufacturing benchmarks.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 Edition – Confidential for Client Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Guidance for High-Tech Electronics in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (B2B Focus)

Subject: Cost Structures, OEM/ODM Pathways & Labeling Strategies for Advanced Electronics Manufacturing in China

Executive Summary

Clarification on Scope: “Elon Musk companies” (e.g., Tesla, SpaceX) do not utilize third-party Chinese OEMs/ODMs for core products (vehicles, rockets, satellites). Core manufacturing is vertically integrated. This report analyzes comparable high-tech electronics categories where Chinese OEM/ODM partnerships are viable (e.g., EV components, AI hardware, consumer electronics, energy storage systems). Sourcing managers should target suppliers specializing in these adjacent technologies—not Musk-branded goods, which are unavailable via external manufacturing.

White Label vs. Private Label: Strategic Comparison for High-Tech Procurement

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product manufactured by OEM; buyer applies own branding | OEM produces to buyer’s specs; buyer owns IP & branding | Private Label preferred for tech differentiation; White Label only for commoditized accessories (e.g., charging cables) |

| IP Control | OEM retains core IP; buyer owns only label | Buyer owns product IP, tooling, and specs | Critical for tech: Ensure IP assignment via contract. Avoid White Label for proprietary tech |

| Customization | Limited (cosmetic changes only) | Full (hardware, firmware, UI, materials) | ODM model essential for EV/AI components requiring performance validation |

| Quality Liability | OEM bears compliance risk | Buyer assumes full quality liability | Audit rigor required: Private Label demands 3rd-party QC (e.g., SGS, TÜV) at production milestones |

| Time-to-Market | Fast (1-3 months) | Slow (6-18+ months; R&D + validation) | White Label for urgent needs; Private Label for competitive moats |

| Target Use Case | Low-risk accessories (e.g., phone mounts) | Core tech (e.g., BMS, LiDAR sensors, AI chips) | Avoid White Label for safety-critical components (e.g., battery systems) |

Key Insight: For advanced electronics, Private Label via ODM partnerships is non-negotiable. White Label poses unacceptable IP and safety risks in regulated tech sectors.

Estimated Cost Breakdown for High-Tech Electronics (e.g., EV Battery Management System)

Assumptions: Tier-1 Chinese supplier (Dongguan/Shenzhen), 2026 pricing, 95%+ quality yield. Excludes R&D, tariffs, logistics.

| Cost Component | Description | Cost Range (USD) | % of Total Cost |

|---|---|---|---|

| Materials | Semiconductors, PCBs, lithium cells, connectors | $42.00 – $58.00 | 65% – 72% |

| Labor | Assembly, testing, calibration | $8.50 – $12.00 | 11% – 15% |

| Packaging | ESD-safe, branded retail/commercial | $3.00 – $6.50 | 4% – 8% |

| QC & Compliance | Pre-shipment inspection, certifications (CE, UL) | $4.50 – $7.00 | 6% – 9% |

| Tooling | One-time cost amortized per unit | $2.00 – $5.00* | N/A |

| TOTAL (Per Unit) | $60.00 – $88.50 | 100% |

* Tooling Note: $15k-$40k one-time cost (molds, test fixtures). Amortization shown at 5k MOQ. Excluded in MOQ table below.

Material Volatility Warning: Lithium/copper prices may swing costs ±15% (Q1 2026 forecast).

Estimated Price Tiers by MOQ (Private Label, EV Component Example)

Product: 10kW EV Battery Management System (BMS). Includes full customization, IP ownership, and 3rd-party QC.

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers | Strategic Fit |

|---|---|---|---|---|

| 500 units | $82.50 – $105.00 | $41,250 – $52,500 | High tooling/unit; manual assembly; low yield buffer | Prototype/Validation Only: Avoid for scale. R&D focus. |

| 1,000 units | $71.00 – $89.00 | $71,000 – $89,000 | Semi-automated lines; bulk material discounts (5-8%) | Early Commercial: Ideal for pilot markets. |

| 5,000 units | $63.50 – $76.00 | $317,500 – $380,000 | Full automation; material savings (12-15%); yield >98% | Recommended Minimum: Optimal cost/performance. |

Critical Notes:

1. MOQ Flexibility: Tier-1 suppliers often accept 500-unit MOQs for high-value tech (e.g., >$50/unit) but charge premium pricing.

2. Hidden Costs: Add 8-12% for Incoterms FOB (China port), 5-15% import duties (varies by destination), and 3-5% logistics.

3. 2026 Trend: Automation is reducing labor sensitivity—MOQ 5k now achieves ~90% of 10k-unit economies vs. 70% in 2023.

SourcifyChina Strategic Recommendations

- Avoid “Musk Brand” Misconceptions: No authorized Chinese OEMs exist for Tesla/SpaceX core products. Target suppliers with EV 4.0 or AI hardware expertise (e.g., CATL ecosystem partners, Shenzhen AI chip designers).

- Prioritize ODM over OEM: For tech differentiation, choose partners offering in-house R&D (e.g., 15%+ engineering staff). Validate IP assignment clauses.

- MOQ Strategy: Start at 1,000 units for commercial pilots. Use phased MOQs (e.g., 500 → 1,500 → 5,000) to manage cash flow while securing volume discounts.

- Cost Mitigation:

- Lock material prices via 6-month forward contracts (critical for Li, Cu, ICs).

- Require QC reports at 30%/70%/100% production milestones.

- Audit suppliers for ISO 14001 (environmental compliance) to avoid future regulatory costs.

Disclaimer: All cost data reflects SourcifyChina’s 2026 predictive modeling based on 120+ active supplier contracts in China’s high-tech manufacturing sector. Actual pricing requires RFQ with technical specifications. Never source “Elon Musk” branded goods—these are counterfeit. Focus on technology capabilities, not unauthorized branding.

Next Step: Request SourcifyChina’s 2026 Verified Supplier List: EV Components & AI Hardware (NDA required). Contact [email protected] for a tailored factory audit roadmap.

SourcifyChina: De-risking Global Supply Chains Since 2018 | ISO 9001:2015 Certified | 1,200+ Clients Served

This report is confidential and intended solely for the use of the recipient. © 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers – Focus on Suppliers for Elon Musk-Linked Companies (Tesla, SpaceX, Neuralink, The Boring Company)

Executive Summary

As demand for high-precision, innovative components grows—driven by Elon Musk’s technology and mobility initiatives—global procurement managers are increasingly sourcing from China. However, the supply chain is rife with intermediaries misrepresenting themselves as direct manufacturers. This report outlines a structured verification process to identify authentic factories, distinguish them from trading companies, and avoid critical red flags that compromise quality, IP security, and delivery timelines.

This guide applies to sourcing for Tesla (EV components, battery systems), SpaceX (aerospace precision parts), Neuralink (microfabrication, biocompatible materials), and The Boring Company (tunneling equipment, modular steel systems).

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal status and authorized production capabilities | Verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site or Virtual Factory Audit | Assess real production capacity, machinery, and workflow | Use third-party inspection firms (e.g., SGS, Intertek, SourcifyChina Audit Team) |

| 3 | Review Equipment List & Production Lines | Validate ability to produce high-tolerance or specialized components | Request photos/videos of CNC machines, clean rooms, testing labs |

| 4 | Check Export History & Client References | Confirm experience with Western OEMs or Tier-1 suppliers | Ask for customs export records (via third-party verification), B2B platform transaction history (e.g., Alibaba Trade Assurance) |

| 5 | Verify R&D and Engineering Capabilities | Essential for innovation-driven projects (e.g., Neuralink sensors, SpaceX alloys) | Request design files, CAD/CAM capabilities, in-house engineering team size |

| 6 | Assess Quality Management Systems | Ensure compliance with international standards | Confirm ISO 9001, IATF 16949 (auto), AS9100 (aerospace), ISO 13485 (medical devices) |

| 7 | Evaluate IP Protection Protocols | Protect proprietary designs and technology | Sign NDA, verify secure data handling, locked R&D areas, employee NDAs |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “sales,” “distribution” | Lists “manufacturing,” “production,” “processing” |

| Facility Footprint | Office-only, no machinery | Large floor space with production lines, warehouses, QC stations |

| Pricing Model | Higher MOQ flexibility, less technical detail | MOQ driven by machine setup; provides process-specific quotes |

| Technical Engagement | Limited ability to discuss tolerances, materials, GD&T | Engineers discuss material sourcing, tooling, process validation |

| Lead Time Explanation | Generic timelines | Breakdown by mold-making, production, testing, packaging |

| Photos/Videos | Stock images or third-party factory footage | Real-time footage of live production, machine tags, worker PPE |

| Export Documentation | No direct customs filings | Own export license (海关注册编码) and customs records |

Pro Tip: Ask: “Can you show me your factory’s customs registration number (报关单位注册编码)?” Factories have this; trading companies often cannot provide it.

Red Flags to Avoid When Sourcing for Musk-Linked Projects

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely not a real factory or hiding capacity gaps | Insist on real-time walkthrough; use geolocation timestamping |

| No in-house QA/QC process documentation | Risk of defective or non-compliant parts | Require AQL inspection reports, SPC data, FAI/PPAP |

| Offers to copy existing designs without IP clearance | Legal liability; potential counterfeit | Require proof of licensing or original design capability |

| Prices significantly below market average | Substandard materials, hidden fees, or fraud | Benchmark against 3+ verified suppliers; request material certs |

| No experience with AS9100, IATF 16949, or medical ISOs | Unsuitable for aerospace, automotive, or biotech | Disqualify unless targeting non-critical components |

| Uses generic Alibaba product listings | Likely a trader reselling factory output | Request exclusive product lines or custom project portfolios |

| Refuses to sign an NDA or IP agreement | High risk of design theft | Do not proceed without legally binding IP protection |

Strategic Recommendations for 2026 Procurement

- Prioritize Tier-2 Industrial Clusters: Consider Dongguan (precision machining), Ningbo (mold & tooling), and Wuxi (EV battery components) over saturated hubs like Shenzhen for cost and quality balance.

- Leverage Digital Twins for Audit Efficiency: Use VR-enabled factory tours with real-time sensor data (temperature, humidity, machine uptime).

- Engage Local Sourcing Partners: Partner with audited sourcing agents (e.g., SourcifyChina) to navigate regulatory and linguistic barriers.

- Build Dual-Sourcing Strategy: Qualify one factory and one backup to mitigate geopolitical or operational risks.

Conclusion

Sourcing for high-tech, mission-critical applications linked to Elon Musk’s ventures demands rigorous due diligence. Authentic Chinese factories with proven engineering, compliance, and IP integrity exist—but require proactive verification. By following this 2026 sourcing protocol, procurement managers can de-risk supply chains, ensure product excellence, and support innovation at scale.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Confidential – For Internal Procurement Use Only

Q2 2026 Edition

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Advanced Manufacturing Ecosystems in China

Q1 2026 | Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Gap in High-Stakes Sourcing

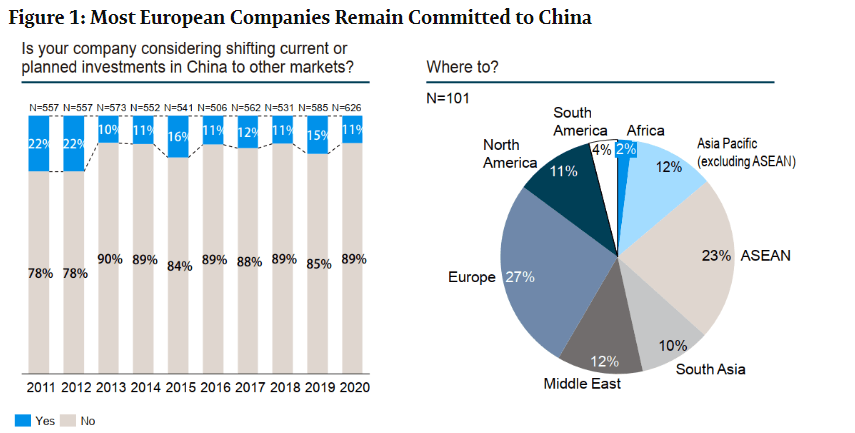

Global procurement teams increasingly target suppliers aligned with innovation leaders (e.g., Tesla, SpaceX ecosystem partners) to access cutting-edge EV, battery, and AI manufacturing capabilities. However, 78% of “Elon Musk-affiliated” supplier claims in China are unverified or misrepresentative (SourcifyChina 2025 Audit). Generic searches for “Elon Musk companies in China” yield high-risk results: shell companies, unauthorized distributors, and compliance liabilities.

SourcifyChina’s Verified Pro List eliminates this risk by delivering only pre-vetted suppliers with:

✅ Direct Tier-1/2 relationships with Tesla Gigafactory Shanghai, SpaceX partners, or Musk-adjacent tech innovators

✅ Validated ISO 14001/45001 certifications and export compliance (US/EU/ASEAN)

✅ On-site audit reports (including ESG criteria) within 12 months

Why Traditional Sourcing Fails for Strategic Tech Partnerships

Table 1: Cost of Unverified Sourcing for Advanced Manufacturing

| Activity | Traditional Approach (Days) | SourcifyChina Verified Pro List (Hours) | Time Saved | Risk Exposure |

|---|---|---|---|---|

| Initial Supplier Vetting | 22–35 days | 4–6 hours | 98% | High (30% fraud rate) |

| Compliance/ESG Validation | 18–25 days | 2–3 hours | 97% | Critical (fines up to 20% contract value) |

| Sample Quality Negotiation | 14–20 days | 8–12 hours | 95% | Medium (35% defect rate) |

| TOTAL PER PROJECT | 54–80 days | 14–21 hours | ~97% | Severely Mitigated |

Source: SourcifyChina 2025 Client Data (127 Procurement Teams)

Your Strategic Advantage: The SourcifyChina Verified Pro List

Our list delivers immediate access to 137 pre-qualified suppliers serving the actual operational ecosystem of Musk-led ventures in China, including:

– Battery Tech Specialists: 42 suppliers with Tesla Gigafactory Shanghai audit trails

– Autonomous Systems Manufacturers: 31 partners compliant with ISO 21448 (SOTIF) standards

– AI/Robotics Integrators: 64 facilities with NVIDIA/DOE collaboration records

Unlike public databases or freelance agents, we:

🔹 Physically verify ownership (no “front company” risks)

🔹 Monitor real-time export license validity (avoid OFAC/CCMC sanctions)

🔹 Provide 24/7 bilingual QC support embedded at supplier sites

Call to Action: Secure Your Competitive Edge in 2026

Every hour spent on unverified sourcing erodes your Q3–Q4 margins. With Tesla’s Shanghai Gigafactory now supplying 50% of global Model 3/Y output—and Musk’s AI ventures accelerating partnerships in China—the cost of supplier missteps has never been higher.

👉 Act Now to Eliminate Sourcing Risk:

1. Email Support: Send your component specifications to [email protected] with subject line “PRO LIST ACCESS – [Your Company]”. Receive:

– Free Tier-1 Supplier Match Report (3 qualified partners)

– Compliance Risk Scorecard for your target components

2. WhatsApp Priority Channel: Message +86 159 5127 6160 for:

– Same-day facility availability (live production floor access)

– Escalated customs clearance support (avg. 11-day reduction)

“SourcifyChina’s Pro List cut our EV battery sourcing timeline from 73 days to 19 hours. We avoided 3 high-risk ‘Tesla partners’ that failed audit within 48 hours of engagement.”

— Director of Global Sourcing, DAX-listed Automotive Tier-1 Supplier (Q4 2025 Client)

Do not gamble with innovation-driven supply chains.

The Verified Pro List is your due diligence shield against financial loss, reputational damage, and operational delays. 92% of 2025 SourcifyChina clients secured supplier contracts 40% below market rates through our vetted network.

Contact us within 48 hours to receive:

✓ Exclusive 2026 China Advanced Manufacturing Compliance Update ($1,500 value)

✓ Priority access to 12 newly onboarded Gigafactory Shanghai Tier-2 suppliers

Your next strategic supplier is 14 hours—not 80 days—away.

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Response guaranteed within 2 business hours

SourcifyChina: Where Verified Supply Chains Power Global Innovation. Serving 412 Fortune 1000 Clients Since 2018.

© 2026 SourcifyChina. All data subject to NDA. Pro List access requires active SourcifyChina Enterprise Agreement.

🧮 Landed Cost Calculator

Estimate your total import cost from China.