The global electrostatic precipitator (ESP) market is experiencing steady growth, driven by increasing air pollution concerns, stringent environmental regulations, and rising demand for emission control solutions across power generation, cement, and metal industries. According to Grand View Research, the global electrostatic precipitator market size was valued at USD 14.4 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030. This growth trajectory is further reinforced by the push for cleaner industrial operations and the modernization of aging energy infrastructure, particularly in emerging economies. As industries seek to comply with emissions standards such as the U.S. Clean Air Act and EU Industrial Emissions Directive, electrostatic precipitation remains a leading technology for particulate matter removal. In this evolving landscape, several manufacturers stand out for their technological innovation, global reach, and comprehensive service offerings. The following analysis identifies the top nine ESP manufacturers shaping the industry’s future.

Top 9 Electrostatic Precipitation Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Leading Electrostatic Precipitator (ESP) Supplier

Domain Est. 1995

Website: babcock.com

Key Highlights: OEM electrostatic precipitators (ESP), along with engineered rebuilds and upgrades, provide effective particulate control in a wide range of utility and ……

#2 Electrostatic Precipitators Manufacturer

Domain Est. 2003

Website: himenviro.com

Key Highlights: HIMENVIRO has installed numerous electrostatic precipitators in various fields of application. We have built more than 200 precipitators within last 5 years….

#3 Electrostatic Precipitation (ESP) Overview

Domain Est. 2008

Website: ppcair.com

Key Highlights: An Industrial Electrostatic Precipitator, often called an ESP, utilizes an electrode to produce a corona that ionizes and charges particles (dust, oil, fume, ……

#4 Electrostatic precipitator / dry and wet gas cleaning

Domain Est. 1995

Website: gea.com

Key Highlights: GEA’s Electrostatic Precipitator (ESP) uses electrostatic force to remove particulates from a flue gas stream. The physical principle applied in ESP sets no ……

#5 Electrostatic Precipitator

Domain Est. 1998

Website: power.mhi.com

Key Highlights: Electrostatic Precipitators (EPs) contribute to the preservation of the air environment in a wide range of fields, including thermal power plants….

#6 Electrostatic Precipitators (ESP)

Domain Est. 2000

Website: ftek.com

Key Highlights: Electrostatic Precipitators (ESP). Expertise from Experience in ESP Retrofits and Upgrades. Enhance ESP Performance and Efficiency….

#7 Beltran Technologies Wet Electrostatic Precipitator Air Pollution …

Domain Est. 2007

Website: beltrantechnologies.com

Key Highlights: Beltran systems include: Advanced wet and dry electrostatic precipitators, scrubbers, fume coalescers, biomass gasification with syngas cleaning….

#8 Electrostatic precipitators (Omnivise electrical solutions)

Domain Est. 2007

Website: siemens-energy.com

Key Highlights: Electrostatic precipitators (ESP) collect dust in the flue gas produced by the boiler and other components. They support air pollution control at thermal power ……

#9 Electrostatic Precipitators

Website: shi.co.jp

Key Highlights: The SHI Group has made numerous deliveries of electrostatic precipitators, exceeding 500 units in wide range of fields that include electric power, steel ……

Expert Sourcing Insights for Electrostatic Precipitation

H2: Key Market Trends Shaping Electrostatic Precipitation in 2026

The electrostatic precipitation (ESP) market in 2026 is being driven by a confluence of stringent environmental regulations, industrial modernization, and technological advancements. Key trends shaping this landscape include:

-

Stringent Emission Regulations as Primary Driver: Global and regional regulations, particularly targeting particulate matter (PM), sulfur oxides (SOx), and mercury emissions, are the dominant force. Policies like the EU Industrial Emissions Directive (IED), China’s “Ultra-Low Emission” standards, and evolving US EPA regulations (e.g., Mercury and Air Toxics Standards – MACT) are pushing power plants, steel mills, cement kilns, and waste incinerators to retrofit existing ESPs or install new, high-efficiency systems, often hybrid configurations. Compliance is non-negotiable, ensuring sustained demand.

-

Rise of Hybrid and Advanced ESP Technologies: Pure conventional ESPs are increasingly being supplemented or replaced by advanced designs to meet tighter limits and handle challenging flue gas conditions:

- Flue Gas Conditioning (FGC): Wider adoption of chemical conditioning (SO3, ammonia) to improve particle resistivity and collection efficiency, especially in coal-fired plants burning low-sulfur coals.

- Hybrid Systems (ESP + Fabric Filters/Baghouses): Significant growth in hybrid configurations (e.g., ESP as a first stage, baghouse as final polishing) is occurring. This leverages the ESP’s strength in bulk dust removal with lower pressure drop and the baghouse’s superior efficiency on fine/PM2.5 particles, offering optimal cost-performance for ultra-low emission targets.

- Pulse Energization & Advanced Controls: Wider deployment of sophisticated power supplies (e.g., intermittent energization, pulse energization) and AI/ML-driven control systems to optimize voltage/current based on real-time flue gas conditions (dust load, resistivity, moisture), maximizing efficiency while minimizing energy consumption.

-

Focus on Energy Efficiency and Operational Cost Reduction: As energy costs rise and sustainability becomes paramount, operators are prioritizing ESP efficiency. Trends include:

- Retrofitting with High-Frequency Power Supplies: Replacing old transformer-rectifier (TR) sets with modern high-frequency switching power supplies significantly reduces energy consumption (often by 30-50%) while improving collection performance.

- Optimized Rapping Systems: Advanced rapping controls to minimize re-entrainment of collected dust, improving net efficiency and reducing the load on downstream equipment.

- Predictive Maintenance: Increased use of sensors (vibration, temperature, opacity) and data analytics for predictive maintenance, reducing unplanned downtime and maintenance costs.

-

Expansion Beyond Power Generation: While coal-fired power remains a major segment, growth is increasingly driven by other industries:

- Cement and Lime Production: Facing intense pressure to reduce PM and kiln dust emissions, driving ESP upgrades and new installations, often hybrid systems.

- Metals & Mining (Steel, Non-Ferrous): Sinter plants, blast furnaces, and smelters require effective ESPs for fume and dust control, with a focus on handling high-temperature and sticky dusts.

- Waste-to-Energy (WtE): Stringent regulations on dioxins, furans, and heavy metals (including mercury) necessitate high-efficiency ESPs, often combined with other technologies (scrubbers, fabric filters).

- Pulp & Paper: Recovery boilers and lime kilns rely on ESPs for chemical recovery and emission control.

-

Growth in Retrofit and Modernization Projects: A significant portion of the market involves upgrading older ESPs rather than new builds, particularly in mature markets (North America, Europe, parts of Asia). Retrofits focus on adding conditioning systems, upgrading power supplies, improving rapper systems, enhancing insulation, and installing advanced monitoring/control systems to extend asset life and meet new regulations cost-effectively.

-

Geographic Shifts and Regional Dynamics:

- Asia-Pacific Dominance: China, India, and Southeast Asian nations remain the largest markets due to rapid industrialization, significant coal-based power capacity (especially in India), and tightening environmental enforcement. China’s focus on ultra-low emissions continues to drive innovation and volume.

- Mature Markets Focus on Compliance & Efficiency: North America and Europe focus on maintaining compliance with existing regulations, optimizing performance of aging fleets, and retrofitting for efficiency, driven by carbon pricing and sustainability goals.

- Emerging Markets: Increasing industrialization in regions like the Middle East, Africa, and Latin America is creating new demand, though pace depends on local regulatory frameworks and investment.

-

Integration with Multi-Pollutant Control Strategies: ESPs are increasingly viewed as one component within integrated air pollution control systems (APCS). Their design and operation are optimized in conjunction with flue gas desulfurization (FGD) scrubbers, selective catalytic reduction (SCR) systems for NOx, and mercury control technologies (e.g., activated carbon injection), requiring holistic engineering approaches.

In conclusion, the 2026 ESP market is characterized by regulatory pressure driving demand, a strong shift towards advanced and hybrid technologies for efficiency and performance, a significant focus on retrofitting existing infrastructure, and geographical growth centered on industrializing regions. Success will depend on technological innovation, cost-effectiveness, and seamless integration into broader emission control strategies.

H2: Common Pitfalls in Sourcing Electrostatic Precipitation Systems – Quality and Intellectual Property (IP) Concerns

Sourcing Electrostatic Precipitation (ESP) systems, particularly for industrial air pollution control, involves significant technical and legal considerations. Two critical areas where organizations often encounter challenges are product quality and intellectual property (IP) protection. Failing to address these aspects properly can lead to system inefficiencies, regulatory non-compliance, legal disputes, and financial losses.

H2: Quality-Related Pitfalls

-

Inadequate Performance Specifications

A frequent issue is procuring ESPs based on cost rather than performance criteria. Suppliers may offer lower-priced systems that do not meet required emission standards or operational efficiency benchmarks. Without clearly defined performance guarantees (e.g., particulate removal efficiency ≥ 99.5%), buyers risk installing underperforming equipment. -

Use of Substandard Materials and Components

Some suppliers cut costs by using inferior materials (e.g., thin-gauge steel, low-grade insulators, or non-corrosion-resistant coatings), which can lead to premature failure, especially in high-temperature or corrosive environments. This compromises long-term reliability and increases maintenance costs. -

Lack of Custom Engineering

ESPs must be tailored to specific flue gas conditions (flow rate, temperature, dust resistivity, particle size). Off-the-shelf or generic designs may not account for these variables, resulting in poor collection efficiency and operational instability. -

Insufficient Factory Acceptance Testing (FAT)

Skipping or minimizing FAT procedures allows defective or improperly assembled units to be shipped. Without rigorous pre-delivery inspection and testing, issues may only emerge during commissioning, leading to costly delays and retrofits. -

Poor After-Sales Support and Documentation

Inadequate technical documentation, training, and maintenance support can hinder effective operation. Buyers may find themselves unable to troubleshoot or optimize the system without ongoing vendor assistance.

H2: Intellectual Property (IP) Risks

-

Procurement of Reverse-Engineered or Infringing Designs

Some suppliers, particularly in regions with weak IP enforcement, may offer ESPs that mimic patented technologies without proper licensing. Purchasing such systems can expose the buyer to indirect liability, especially if the equipment is used in jurisdictions with strong IP laws. -

Unclear IP Ownership in Custom Solutions

When commissioning a custom ESP design, the contract may fail to specify who owns the resulting IP. This can lead to disputes if the buyer wishes to replicate, modify, or license the design later, or if the supplier reuses the design for competitors. -

Lack of Licensing for Proprietary Technologies

Advanced ESP features—such as pulse energization, smart rapping controls, or hybrid designs—may be protected by patents. Sourcing systems that incorporate these without proper licensing agreements can result in legal action from original technology developers. -

Exposure to Trade Secret Risks

During the design and integration process, buyers may need to disclose sensitive operational data (e.g., gas composition, process flow details). Without robust non-disclosure agreements (NDAs) and data protection clauses, this information could be misused or leaked. -

Dependency on Proprietary Spare Parts and Software

Some suppliers lock buyers into long-term dependencies by using proprietary components or control systems. This not only increases lifecycle costs but may also raise concerns about IP control and system interoperability.

Recommendations to Mitigate Risks

- Conduct thorough due diligence on suppliers, including site visits, reference checks, and third-party technical audits.

- Define clear performance and quality standards in procurement contracts, backed by penalties for non-compliance.

- Require full disclosure of technology sources and validate patent clearance for critical components.

- Establish IP ownership and usage rights explicitly in contracts for custom-engineered systems.

- Implement strong contractual safeguards, including NDAs, warranties, and licensing terms.

By proactively addressing quality and IP concerns, organizations can ensure reliable, compliant, and legally secure deployment of Electrostatic Precipitation systems.

Logistics & Compliance Guide for Electrostatic Precipitation

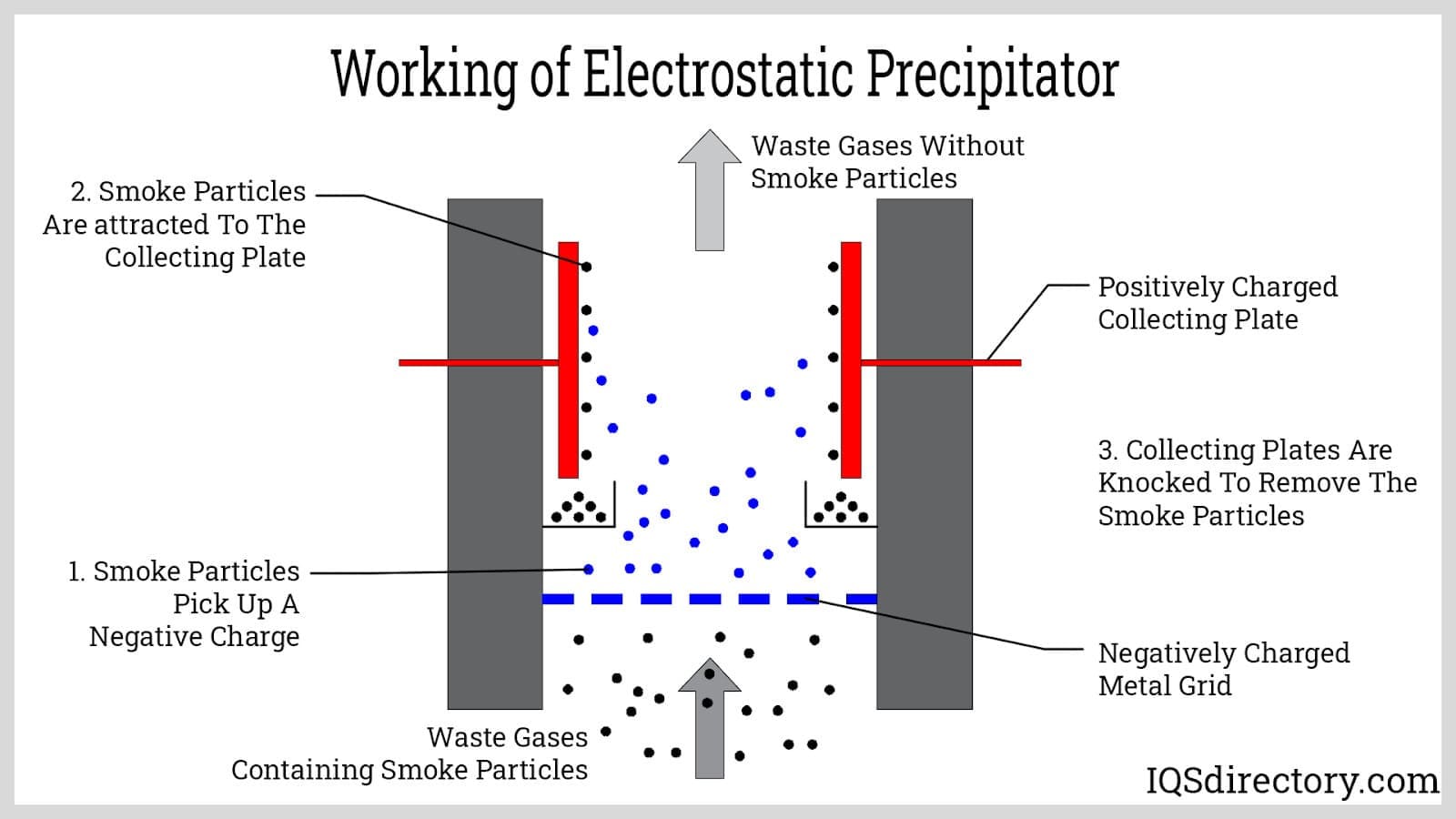

Overview of Electrostatic Precipitation

Electrostatic Precipitation (ESP) is a widely used air pollution control technology that removes fine particulate matter, such as dust and smoke, from industrial exhaust gas streams using electrostatic forces. ESPs are commonly used in power plants, cement kilns, steel mills, and other heavy industries to meet environmental emission standards. Proper logistics planning and regulatory compliance are essential for the successful installation, operation, and maintenance of ESP systems.

This guide outlines key logistical considerations and compliance requirements related to the deployment and use of electrostatic precipitation systems.

Logistics Considerations

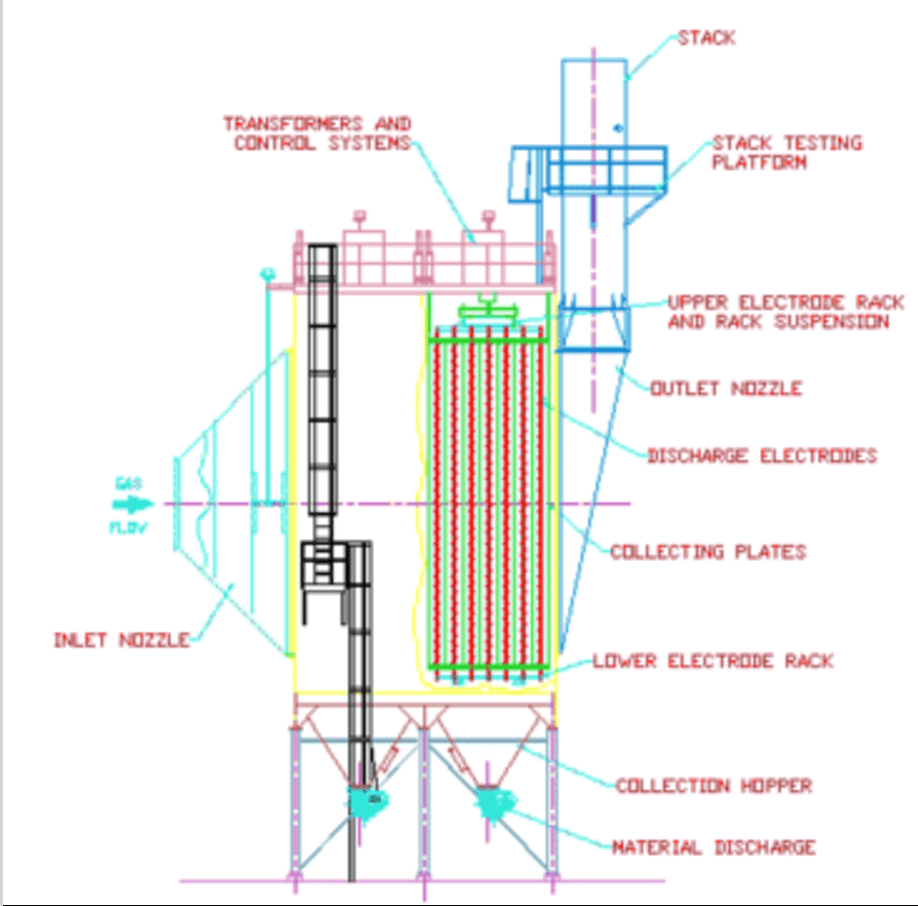

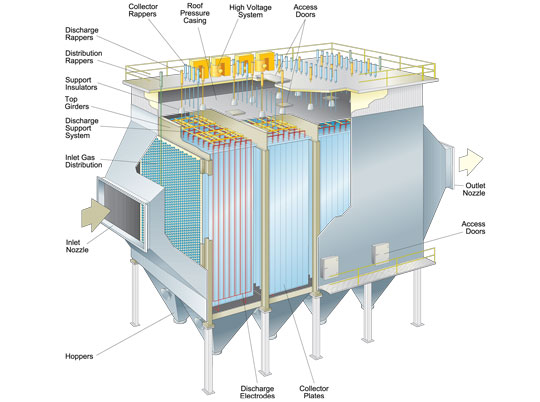

Equipment Transportation and Handling

Transporting ESP components—such as collection plates, discharge electrodes, high-voltage transformers, and support structures—requires careful planning due to their size, weight, and fragility. Oversized loads may require special permits and route planning. Use of cranes, rigging, and flatbed trailers must be coordinated in advance. Electrodes and insulators are sensitive to mechanical stress and moisture; protective packaging and climate-controlled transport are recommended.

Site Preparation and Installation

Site preparation must account for the ESP’s footprint, weight distribution, and integration with existing ductwork and exhaust systems. Foundations must support the structural load and accommodate thermal expansion. Access for construction equipment, worker safety zones, and temporary storage of components should be planned. Alignment of casing sections and precise electrode spacing are critical to performance and require skilled labor and quality control during installation.

Supply Chain Management

Reliable sourcing of replacement parts—especially emitter wires, rapping systems, and insulators—is vital for long-term operation. Lead times for custom or imported components can exceed several months. Maintaining an inventory of critical spare parts and establishing relationships with certified suppliers help minimize unplanned downtime. Tracking component lifecycle data supports predictive maintenance and timely procurement.

Commissioning and Performance Testing

After installation, ESPs must undergo commissioning, including electrical safety checks, insulation resistance tests, and no-load voltage rise tests. Performance verification includes stack testing to measure particulate removal efficiency under various operating conditions. Data from these tests are used to fine-tune rapping frequency, voltage settings, and gas flow distribution.

Regulatory Compliance

Emission Standards and Environmental Regulations

ESPs must comply with national and regional air quality regulations, such as the U.S. Environmental Protection Agency’s (EPA) National Emission Standards for Hazardous Air Pollutants (NESHAP) and New Source Performance Standards (NSPS), or the EU Industrial Emissions Directive (IED). Compliance typically requires continuous emission monitoring systems (CEMS) for particulate matter and periodic stack testing. Facilities must maintain records and submit reports to regulatory agencies.

Permitting Requirements

Installation or modification of an ESP often triggers the need for an air quality permit. This includes Prevention of Significant Deterioration (PSD) or Title V operating permits in the U.S. Permit applications must include engineering plans, predictive emission modeling, and a description of control efficiency. Local environmental agencies may also impose additional requirements based on ambient air quality.

Worker Safety and OSHA Compliance

High-voltage components in ESPs pose electrical hazards. Compliance with OSHA regulations (e.g., 29 CFR 1910.269 for electric power generation) is mandatory. Safety protocols include lockout/tagout (LOTO), grounding procedures, confined space entry permits, and personal protective equipment (PPE). Training programs for ESP operators and maintenance personnel must cover electrical safety, fall protection, and emergency response.

Waste Management and Byproduct Handling

Collected particulate matter (fly ash or process dust) must be handled as hazardous or non-hazardous waste, depending on its composition. Regulatory frameworks such as RCRA in the U.S. govern storage, transportation, and disposal. Dust collected from certain industrial processes may contain heavy metals or toxic compounds, requiring special handling and manifesting. Reuse options (e.g., ash in construction materials) should be evaluated for regulatory and economic feasibility.

Maintenance and Monitoring

Routine Inspection and Maintenance

Regular maintenance ensures sustained ESP efficiency. Key tasks include inspecting electrode alignment, cleaning collection plates, checking rapping systems, and monitoring transformer-rectifier (T-R) set performance. Scheduled shutdowns should be planned to minimize operational impact. Use of condition monitoring tools (e.g., voltage-current trending, opacity meters) helps identify performance degradation early.

Data Logging and Reporting

Modern ESPs are equipped with distributed control systems (DCS) that log operational data such as secondary voltage/current, gas temperature, and pressure drop. This data must be retained for compliance audits and can be used to demonstrate continuous compliance with emission limits. Automated reporting systems can streamline submission to environmental regulators.

Conclusion

Successful deployment of electrostatic precipitation systems depends on meticulous logistics planning and strict adherence to environmental and safety regulations. From transportation and installation to ongoing compliance and maintenance, each phase requires coordination across engineering, operations, and regulatory teams. Proactive management of these elements ensures optimal performance, regulatory compliance, and long-term operational sustainability.

In conclusion, sourcing electrostatic precipitation (ESP) technology presents a highly effective and reliable solution for controlling particulate emissions in various industrial applications. Its proven efficiency in removing fine particles, including dust, smoke, and aerosols, from exhaust gases makes it an essential component in meeting environmental regulations and improving air quality. When sourcing ESP systems, key considerations such as flue gas composition, particle characteristics, space constraints, energy consumption, and lifecycle costs should be carefully evaluated to ensure optimal performance and long-term sustainability. Partnering with experienced suppliers and integrating advanced features like pulse energizing or智能控制系统 (smart control systems) can further enhance efficiency and operational reliability. Overall, investing in the right electrostatic precipitation solution not only supports environmental compliance but also contributes to cleaner production processes and corporate social responsibility goals.