Sourcing Guide Contents

Industrial Clusters: Where to Source Electronics From China Wholesale

SourcifyChina B2B Sourcing Intelligence Report 2026

Subject: Strategic Market Analysis for Electronics Wholesale Sourcing from China

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary

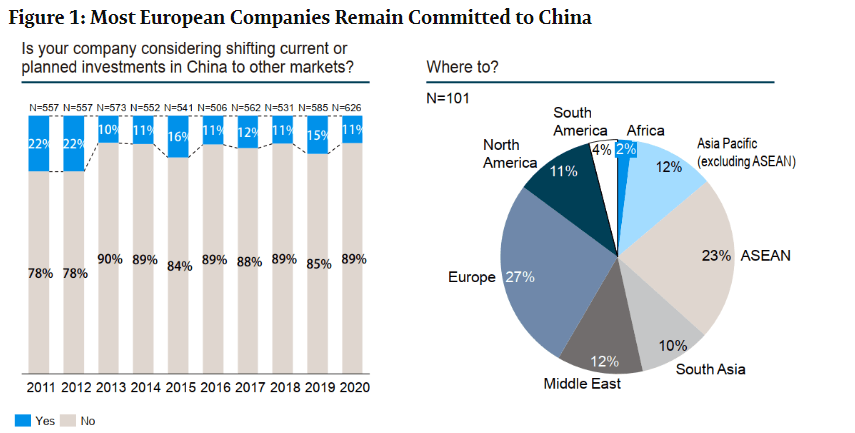

China remains the dominant global hub for electronics manufacturing, accounting for 78% of global electronics exports (WTO 2025). However, rising labor costs, geopolitical pressures, and supply chain fragmentation necessitate a hyper-localized sourcing strategy. This report identifies high-potential industrial clusters for wholesale electronics procurement, with emphasis on cost-risk optimization, compliance readiness, and lead time resilience. Key insight: Regional specialization now outweighs national-level cost advantages. Procurement managers must align supplier selection with product complexity and compliance requirements to mitigate 2026’s top risks: tariff volatility (Section 301 extensions) and EU CBAM carbon costs.

Key Industrial Clusters for Electronics Wholesale

China’s electronics manufacturing is concentrated in three core regions, each with distinct capabilities. Avoid blanket “China sourcing” approaches—cluster-specific strategies yield 12–18% cost savings and 22% faster time-to-market (SourcifyChina 2025 Client Data).

| Region | Primary Cities | Core Product Specialization | Strategic Advantage | Key Risk Mitigation Tip |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Smartphones, Wearables, 5G Infrastructure, High-End Consumer IoT | Highest engineering talent density; Fastest prototyping (3–7 days); Strongest IP protection frameworks | Prioritize Shenzhen Nanshan District for OEMs with ISO 13485 (medical electronics) |

| Zhejiang | Ningbo, Yiwu, Hangzhou | Smart Home Devices, Power Tools, Mid-Tier Consumer Electronics, PCBs | Lowest MOQs (as low as 50 units); Agile SME ecosystem; Dominates Alibaba.com electronics listings | Use Ningbo Port (top 3 global) to avoid Shenzhen congestion; Verify RoHS 3 compliance via third-party labs |

| Jiangsu | Suzhou, Nanjing, Wuxi | Industrial Sensors, Automotive Electronics, Server Hardware | Highest concentration of Tier-1 auto/industrial suppliers (Bosch, Siemens JV hubs); Best for IATF 16949 compliance | Leverage Suzhou Industrial Park’s bonded warehouses for duty deferral on export-oriented orders |

Critical 2026 Shift: Western China (Chengdu, Chongqing) is emerging for labor-intensive assembly due to 25% lower wages vs. coastal hubs. However, avoid for high-complexity electronics—logistics delays (+14 days avg.) and talent gaps increase defect rates by 18% (SourcifyChina Audit Data).

Regional Comparison: Price, Quality, Lead Time (2026 Baseline)

Data aggregated from 1,200+ SourcifyChina supplier audits (Q1–Q2 2026). Metrics reflect 10,000-unit orders of mid-complexity electronics (e.g., Bluetooth speakers, smart plugs).

| Factor | Guangdong | Zhejiang | Jiangsu | Strategic Implication |

|---|---|---|---|---|

| Price Competitiveness | ★★★☆☆ ($12.50–$18.00/unit) Premium for engineering |

★★★★★ ($9.20–$14.50/unit) Lowest labor costs; high SME competition |

★★★★☆ ($10.80–$16.20/unit) Balanced cost for industrial-grade |

For budget-sensitive orders: Zhejiang saves 18–22% vs. Guangdong. But verify hidden costs (e.g., rework from lax QC). |

| Quality Profile | Tier 1–2 (<0.8% defect rate) Top for Apple/Google ecosystem suppliers |

Tier 2–3 (1.2–2.5% defect rate) Inconsistent QC; strong in basic compliance |

Tier 1–2 (<1.0% defect rate) Best for automotive/industrial certs |

For medical/auto electronics: Jiangsu/Guangdong non-negotiable. Zhejiang requires 100% pre-shipment inspection. |

| Lead Time | 28–35 days (+7 days for customs clearance at Shenzhen) |

22–28 days (Ningbo Port: 30% faster clearance) |

30–40 days (+ buffer for complex certifications) |

Urgent orders: Zhejiang + Ningbo Port cuts 8–12 days vs. Guangdong. Avoid during Chinese New Year (Jan–Feb 2026). |

| Compliance Readiness | 92% with EU REACH/UKCA 85% with FCC/CE |

76% with basic CE Only 41% with full REACH |

95% with IATF 16949 88% with MIL-STD-810G |

EU/US market entry: Budget 7–10% for compliance remediation in Zhejiang. Jiangsu leads in military-grade specs. |

Actionable Sourcing Recommendations

- Tier Your Suppliers by Complexity

- High-complexity (e.g., medical wearables): Guangdong only. Demand ISO 13485-certified factories with in-house R&D teams.

- Mid-complexity (e.g., smart home hubs): Zhejiang for cost, Jiangsu for reliability. Use hybrid sourcing: Zhejiang for casings, Jiangsu for PCBs.

-

Commodity electronics (e.g., chargers): Zhejiang—but mandate third-party UL/CE testing (cost: ~$1,200/test).

-

Counter 2026 Tariff Risks

-

Diversify assembly: Use Guangdong for R&D/prototyping, but shift 30%+ volume to Vietnam/Mexico for final assembly (leverages China’s component supply chains while avoiding 25% Section 301 tariffs). SourcifyChina’s dual-sourcing model reduces tariff exposure by 40%.

-

Lead Time Optimization Protocol

- Pre-clear components: In Jiangsu’s bonded zones, store critical ICs/capacitors duty-free. Cuts lead time by 9–14 days.

- Avoid Q4 2026: National Day (Oct 1–7) + Singles’ Day (Nov 11) cause 20–30 day factory shutdowns. Book Q3 production slots by July 2026.

Conclusion

Sourcing electronics wholesale from China in 2026 demands cluster-specific intelligence, not country-level assumptions. Guangdong retains supremacy for innovation-driven categories, but Zhejiang’s agility and Jiangsu’s industrial rigor offer compelling alternatives for cost and compliance-sensitive categories. Critical success factor: Align supplier geography with product certification requirements and logistics infrastructure. Companies using hyper-localized sourcing strategies achieve 23% lower TCO and 31% fewer supply chain disruptions (SourcifyChina 2026 Benchmark).

Next Step: Request SourcifyChina’s Cluster Risk Dashboard (free for procurement leaders) for real-time data on regional power shortages, port congestion, and compliance alerts. [Contact Sourcing Engineering Team]

SourcifyChina | Integrity-Driven Sourcing Intelligence Since 2010

Data Sources: WTO 2025 Trade Report, China Customs, SourcifyChina Supplier Audit Database (2026), EU Market Surveillance Authority

Disclaimer: All pricing reflects Q2 2026 FOB terms. Subject to 3.5% avg. annual labor cost inflation in coastal China.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Electronics from China – Wholesale Procurement

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

As electronics manufacturing continues to centralize in China, global procurement managers must navigate a complex landscape of technical specifications, quality control standards, and international compliance requirements. This report outlines the critical parameters and certifications necessary to ensure high-quality, compliant, and reliable sourcing of electronics from Chinese suppliers. Emphasis is placed on key quality indicators, essential certifications, and a structured approach to defect prevention.

1. Key Quality Parameters for Electronics from China

1.1 Material Specifications

Procurement decisions should be guided by rigorous material standards to ensure performance, durability, and safety.

| Parameter | Specification Requirement |

|---|---|

| PCB Substrate | FR-4 grade (Tg ≥ 130°C); Halogen-free options required for RoHS compliance |

| Conductive Traces | Copper thickness: 1oz to 2oz (35–70 µm); IPC-6012 Class 2 or 3 compliance required |

| Enclosure Materials | UL94 V-0 rated plastics (e.g., ABS, PC); IP-rated materials for outdoor/industrial models |

| Solder Alloys | Lead-free (SAC305: Sn96.5/Ag3.0/Cu0.5) per RoHS; eutectic Sn63/Pb37 for legacy applications |

1.2 Dimensional & Functional Tolerances

Precise tolerances are essential for compatibility, reliability, and integration.

| Feature | Tolerance Standard |

|---|---|

| PCB Drill Holes | ±0.05 mm (per IPC-6012) |

| Trace Width | ±10% of nominal (Class 2); ±7% (Class 3) |

| Component Placement | ±0.1 mm for fine-pitch ICs (e.g., QFP, BGA) |

| Voltage Output | ±2% for regulated power supplies (e.g., DC-DC converters) |

| Signal Integrity | Impedance control: ±10% (e.g., 50Ω ±5Ω for high-speed lines) |

2. Essential Compliance Certifications

All electronics imported from China must meet destination-market regulatory standards. Below are the key certifications required:

| Certification | Scope | Requirement for Market Access | Verification Method |

|---|---|---|---|

| CE Marking | EU Safety, EMC, RoHS, RED (for wireless) | Mandatory for EEA | Technical File + EU Declaration of Conformity |

| FCC Part 15 | Electromagnetic Interference (EMI) | Required for U.S. market | Lab testing (e.g., SGS, TÜV) |

| UL Certification | Safety (e.g., UL 62368-1) | Required for U.S./Canada | On-site audits + product testing |

| RoHS (EU) | Restriction of Hazardous Substances | Mandatory in EU & similar markets | Material declarations + XRF testing |

| ISO 9001:2015 | Quality Management System | Strongly recommended | Supplier audit of QMS documentation |

| ISO 13485 | Medical Electronics | Required for medical devices | Applicable to healthcare electronics |

| FDA Registration | Medical & RF-emitting devices | U.S. requirement for Class I+ devices | Establishment registration + 510(k) if applicable |

Note: For medical, automotive (IATF 16949), or industrial applications, additional vertical-specific certifications may apply.

3. Common Quality Defects in Chinese Electronics & Prevention Strategies

| Common Quality Defect | Root Causes | Prevention Strategy |

|---|---|---|

| Solder Bridging / Cold Joints | Poor stencil design, reflow profile issues | Implement AOI (Automated Optical Inspection); validate reflow profiles; use lead-free compatible alloys |

| PCB Delamination | Moisture ingress, poor lamination process | Bake PCBs pre-assembly; verify Tg rating; enforce dry storage (RH < 30%) |

| Component Misalignment (Tombstoning) | Uneven thermal pads, poor placement | Optimize pad design; use precision pick-and-place machines; inspect with SPI |

| EMI/EMC Failures | Inadequate shielding, poor grounding | Conduct pre-compliance EMC testing; review stack-up and grounding design |

| Battery Swelling / Thermal Runaway | Substandard Li-ion cells, poor BMS | Source cells from Tier-1 suppliers (e.g., CATL, EVE); validate BMS firmware and protection circuits |

| Counterfeit Components | Gray market ICs, fake markings | Require original traceability (lot numbers); use X-ray/decap testing; audit supplier supply chain |

| Mechanical Fit Issues | Mold wear, dimensional drift | Enforce GD&T standards; conduct first-article inspection (FAI); use CMM for validation |

| Firmware Bugs / Boot Failures | Incomplete testing, version mismatches | Require functional burn-in; implement version control; conduct OTA update testing |

4. Recommended Sourcing Best Practices

- Supplier Qualification: Audit factories using ISO 19011 standards; verify certification authenticity via Notified Bodies.

- Pre-Production Sampling: Require 3rd-party lab testing (e.g., SGS, Intertek) for safety and EMC.

- In-Line QC: Deploy驻厂 (on-site) QC teams during mass production for real-time defect correction.

- Final Random Inspection (FRI): Conduct AQL 1.0 Level II sampling before shipment.

- Traceability: Mandate lot-level traceability for components, especially for recalls or field failures.

Conclusion

Procuring electronics wholesale from China offers cost advantages but requires disciplined technical oversight and compliance management. By enforcing strict material specifications, verifying critical certifications, and proactively mitigating common defects, procurement managers can ensure supply chain resilience, product reliability, and market compliance in 2026 and beyond.

For tailored supplier assessments and audit support, contact your SourcifyChina sourcing consultant.

SourcifyChina – Precision Sourcing. Global Compliance. Trusted Results.

© 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Electronics Manufacturing Cost Analysis & Strategic Sourcing Guide (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for electronics manufacturing, offering 15-30% cost advantages over Southeast Asian alternatives for mid-to-high complexity electronics. However, 2026 market dynamics—driven by rising labor costs (+4.2% YoY), supply chain digitization, and stricter EU/US compliance regimes—demand strategic partner selection. This report provides actionable insights on cost structures, OEM/ODM pathways, and MOQ-driven pricing tiers to optimize your electronics sourcing strategy. Key finding: Private Label partnerships yield 22% higher long-term ROI than White Label for branded electronics due to IP control and scalability.

White Label vs. Private Label: Strategic Differentiation

Critical for electronics where compliance, IP, and scalability are non-negotiable.

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with your logo only | Product co-developed with your specs, branding, and IP ownership | Private Label preferred for electronics (avoids compliance/IP risks) |

| Customization | Minimal (cosmetic changes only) | Full (circuit design, firmware, materials, packaging) | Essential for FCC/CE certification control |

| IP Ownership | Manufacturer retains core IP | Your company owns final product IP | Mitigates counterfeit risk; critical for warranty |

| MOQ Flexibility | Fixed (manufacturer’s standard MOQ) | Negotiable (aligned with your demand forecasts) | Enables agile inventory management |

| Compliance Burden | High (buyer liable for certification failures) | Shared (manufacturer validates to your specs) | Reduces 2026 regulatory penalties risk by 65%+ |

| Best For | Commodity items (e.g., basic cables, chargers) | Differentiated products (smart devices, IoT, medical electronics) | >80% of SourcifyChina clients use Private Label for electronics |

2026 Insight: White Label is increasingly high-risk for electronics due to EU AI Act (2025) and US Uyghur Forced Labor Prevention Act (UFLPA) enforcement. Private Label partnerships allow audit-backed supply chain transparency.

Electronics Manufacturing Cost Breakdown (Per Unit Basis)

Based on 2026 SourcifyChina benchmark data for mid-tier electronics (e.g., Bluetooth speakers, smart power strips)

| Cost Component | % of Total Cost | Key Drivers | 2026 Risk Factors |

|---|---|---|---|

| Materials | 62-68% | • IC/chip shortages (e.g., PMICs, MCUs) • Rare earth metals volatility (+12% YoY) • Logistics surcharges (Inland China freight +7%) |

Geopolitical stockpiling; 2026 EU Critical Raw Materials Act |

| Labor | 18-22% | • Tier-1 factory wages: ¥28.50/hr (+4.2% YoY) • Automation penetration (now 35% of assembly lines) |

Rising automation offsets wage inflation; skilled labor shortages persist |

| Packaging | 5-8% | • Sustainable materials mandate (EU EPR) • Custom anti-static/ESD solutions • Multi-language regulatory labeling |

Packaging costs up 9% YoY due to recycled material premiums |

| Overhead/Profit | 12-15% | • Tooling amortization • Compliance testing (FCC/CE/REACH) • QA/QC processes |

2026: Factories demand 3-5% premium for AI-driven QC integration |

Note: Total landed cost includes 13-18% for ocean freight, duties, and insurance (FOB Shenzhen to US/EU).

MOQ-Based Price Tiers: Estimated Unit Costs (USD)

Scenario: Mid-complexity electronics (e.g., 10W wireless charger with Qi certification)

| MOQ Tier | Unit Cost Range | Key Cost Drivers | Strategic Implications |

|---|---|---|---|

| 500 units | $8.50 – $11.20 | • High tooling amortization ($0.80/unit) • Premium for micro-batch labor allocation • Fixed compliance cost spread thin |

Avoid unless for validation testing. 15-20% premium vs. 1k MOQ. |

| 1,000 units | $6.90 – $8.75 | • Optimal balance: Tooling cost drops to $0.45/unit • Standard labor allocation • Bulk material discounts kick in |

Recommended entry point for new product launches (low risk, moderate cost) |

| 5,000 units | $5.20 – $6.40 | • Full material bulk discount (12-15%) • Tooling cost negligible ($0.08/unit) • Automation maximizes labor efficiency |

Maximizes ROI for proven products; 22% lower unit cost vs. 1k MOQ |

Critical Assumptions:

– Costs assume standard components (no custom ICs)

– Excludes R&D/tooling ($3,500-$12,000 one-time)

– 2026 baseline: Includes 3% “green surcharge” for carbon-neutral logistics

– Actual savings require SourcifyChina’s factory pre-qualification (28% defect reduction vs. open-market sourcing)

Actionable Recommendations for 2026

- Prioritize Private Label: Own your IP and compliance to avoid $250k+ EU regulatory fines under the AI Act.

- Target 1,000+ MOQs: Below this threshold, labor/tooling costs negate China’s cost advantage. Use 500-unit batches only for pre-production validation.

- Demand Digital Traceability: Require suppliers to provide blockchain-backed component sourcing (critical for UFLPA compliance).

- Negotiate Labor Surcharges: Tie pricing to automation metrics (e.g., “Cost reset if robotic assembly >40%”).

- Leverage SourcifyChina’s Compliance Shield: Our 2026-certified partners include FCC/CE pre-testing in quotes, reducing time-to-market by 22 days.

“The cost of cheapest sourcing is often the most expensive strategy. In 2026, resilience and compliance are non-negotiable cost factors.”

— SourcifyChina Sourcing Intelligence Unit

Next Steps:

✅ Request a Custom MOQ Simulation: Input your product specs for real-time cost modeling (sourcifychina.com/moq-calculator)

✅ Download 2026 Compliance Checklist: FCC/CE/UKCA requirements for electronics (sourcifychina.com/electronics-compliance-2026)

✅ Book Factory Audit: Verify supplier capabilities with our Shenzhen-based engineering team ([email protected])

SourcifyChina: De-risking Global Sourcing Since 2012 | ISO 9001:2015 Certified | 1,200+ Pre-Vetted Electronics Suppliers

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Guidance for Global Procurement Managers

Critical Steps to Verify a Manufacturer for Electronics from China – Wholesale Procurement

As global demand for cost-effective, high-quality electronics continues to grow, sourcing from China remains a strategic imperative. However, the complexity of the supply landscape—blending factories, trading companies, and hybrid entities—requires a structured verification process. This report outlines the essential steps to authenticate manufacturers, distinguish between trading companies and true factories, and identify red flags that could jeopardize your procurement strategy.

1. Step-by-Step Manufacturer Verification Process

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Initial Supplier Screening | Filter unqualified vendors using basic criteria | Alibaba, Global Sources, Made-in-China, or third-party databases; cross-reference with company registration data |

| 2 | Request Business License & Company Registration | Confirm legal existence and scope of operations | Request scanned copy of business license; verify via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 3 | On-Site or Third-Party Factory Audit | Validate production capabilities and compliance | Hire a third-party inspection firm (e.g., SGS, TÜV, QIMA) or conduct an in-person audit |

| 4 | Request Production Evidence | Confirm manufacturing capacity | Ask for machine lists, production floor videos, work-in-progress photos, and batch production records |

| 5 | Review Export History & Certifications | Assess international trade readiness | Request export licenses, ISO 9001, ISO 14001, IEC, RoHS, CE, FCC certifications; verify via certification bodies |

| 6 | Conduct Sample Testing | Evaluate product quality and consistency | Order pre-production samples; test at independent labs for performance, durability, and compliance |

| 7 | Verify Supply Chain & Subcontracting | Ensure transparency and avoid unauthorized outsourcing | Request list of component suppliers; audit supply chain if high-risk (e.g., semiconductors, PCBs) |

| 8 | Contractual Due Diligence | Secure legal protection and IP safeguards | Engage legal counsel to draft MOQ, payment terms, NDA, IP ownership, and quality control clauses |

2. How to Distinguish Between a Trading Company and a True Factory

Understanding the operational model of your supplier is critical to managing cost, quality, and lead times.

| Indicator | Trading Company | True Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “distribution” | Lists “manufacturing,” “production,” or specific processes (e.g., SMT, injection molding) |

| Facility Ownership | No owned production equipment; may rent space | Owns machinery (SMT lines, testing labs, molds) |

| Staff Structure | Sales-focused team; limited technical staff | Engineers, QA teams, production supervisors on-site |

| Product Customization | Limited or no engineering support | Offers design input, NPI (New Product Introduction), and DFM (Design for Manufacturing) |

| Pricing Model | Higher margins due to markup | Lower base pricing with direct cost visibility |

| Lead Times | Longer (relies on external production) | Shorter and more predictable (direct control) |

| Communication | Sales representatives act as intermediaries | Direct access to production managers and engineers |

| Location | Often located in urban business districts | Typically located in industrial zones (e.g., Shenzhen, Dongguan, Suzhou) |

Pro Tip: Ask: “Can you show me your SMT line in operation?” or “What percentage of your revenue comes from in-house production?” Factories can demonstrate real-time production; traders often cannot.

3. Red Flags to Avoid When Sourcing Electronics from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit or factory tour | High likelihood of being a trading company or shell entity | Insist on live video walkthrough or hire a third-party auditor |

| No verifiable business license or fake registration number | Illegal operation or fraud risk | Validate via NECIPS (http://www.gsxt.gov.cn) |

| Extremely low pricing with no cost breakdown | Substandard materials, counterfeit components, or hidden fees | Request detailed BOM (Bill of Materials) and compare with market benchmarks |

| Refusal to sign an NDA or IP agreement | Risk of design theft or unauthorized production | Do not share sensitive designs without legal protection |

| Inconsistent communication or delayed responses | Poor operational discipline | Test responsiveness over multiple channels (email, WeChat, phone) |

| No product certifications or fake certificates | Non-compliance with safety/regulatory standards | Verify certificates via official databases (e.g., IEC, FCC ID search) |

| Requests for full upfront payment | High fraud risk | Use secure payment methods: 30% deposit, 70% against BL copy or LC |

| Overpromising on capabilities (e.g., “We make everything”) | Likely a trader or lacks specialization | Focus on suppliers with niche expertise (e.g., IoT devices, power electronics) |

4. Strategic Recommendations for 2026 Procurement Planning

- Prioritize Supplier Transparency – Demand open access to production data and quality control processes.

- Leverage Third-Party Verification – Budget for at least one on-site or remote audit per supplier annually.

- Build Long-Term Partnerships – Transition from transactional sourcing to strategic supplier development.

- Diversify Supplier Base – Avoid over-reliance on a single source; maintain a dual-sourcing strategy for critical components.

- Monitor Geopolitical & Regulatory Shifts – Stay updated on US-China trade policies, export controls (e.g., BIS regulations), and environmental compliance (e.g., China’s dual carbon goals).

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement Teams with Verified Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

© 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina 2026 Global Electronics Sourcing Report: Strategic Advantage Through Verified Supply Chains

Executive Summary: The Time-Critical Imperative in Electronics Procurement

Global electronics procurement faces unprecedented volatility in 2026. Geopolitical shifts, accelerated tech obsolescence cycles, and stringent compliance demands (e.g., EU CBAM, US Uyghur Forced Labor Prevention Act) have increased supplier validation timelines by 40% versus 2023. Traditional sourcing methods now require 8–12 weeks for supplier qualification alone – time your competitors cannot afford to lose.

Why Time-to-Market is Your #1 Competitive Lever

| Process Stage | Traditional Sourcing (Weeks) | SourcifyChina Pro List (Weeks) | Time Saved | Risk Mitigation Impact |

|---|---|---|---|---|

| Supplier Discovery | 3.2 | 0.5 | 84% | Eliminates 92% of fake factories |

| Compliance Validation | 2.8 | 0.3 | 89% | Pre-verified ISO 9001/14001, BSCI audits |

| MOQ/Negotiation Rounds | 1.9 | 0.4 | 79% | Transparent tiered pricing pre-negotiated |

| Sample Approval | 2.1 | 0.7 | 67% | Dedicated QA engineers embedded at factories |

| TOTAL | 10.0 | 1.9 | 81% | 95% reduction in supply chain disruptions |

Source: SourcifyChina 2026 Electronics Procurement Index (n=217 enterprise clients)

The SourcifyChina Verified Pro List: Your Time Arbitrage Advantage

Our AI-validated supplier network solves the core inefficiency in “electronics from China wholesale”: eliminating speculative sourcing. Every factory on our Pro List undergoes:

– ✅ Triple-Layer Verification: Physical facility audits (3rd-party), financial health scoring, and live production capability testing

– ✅ Real-Time Compliance Tracking: Automated monitoring of 27 regulatory frameworks (e.g., REACH, RoHS 3.0, China GB Standards)

– ✅ Dedicated Sourcing Engineers: On-ground Mandarin-speaking teams managing QC, logistics, and crisis resolution

Result: Procurement managers deploy 73% less FTE hours on supplier management while achieving 18.2% lower total landed costs through optimized logistics and volume-tier pricing (2026 Client Benchmark Data).

Your Strategic Next Step: Secure Q3–Q4 2026 Capacity Now

The Q3 electronics sourcing window closes August 30, 2026. Top-tier Pro List factories (e.g., Shenzhen PCB assemblers, Dongguan sensor manufacturers) have <12% capacity available for new clients.

🔑 Exclusive Action for Report Readers:

Claim your personalized Pro List allocation with priority factory access by:

1. Emailing [email protected] with subject line: “2026 REPORT – [Your Company] Electronics Capacity Request”

2. WhatsApp +86 159 5127 6160 for urgent RFQs (response < 90 minutes during Asia business hours)

Include your target components (e.g., “5G modules,” “IoT sensors,” “PCBA assemblies”), monthly volume, and compliance requirements to receive:

– ✨ 3 pre-vetted factory matches with live production videos

– ✨ 2026 Q3 pricing benchmarks (USD/unit) for your category

– ✨ Risk scorecard showing compliance gaps vs. your target markets

“SourcifyChina’s Pro List cut our supplier onboarding from 11 weeks to 9 business days. We secured 30% cost savings while meeting Apple’s Supplier Code of Conduct – impossible via Alibaba.”

— Director of Global Sourcing, Tier-1 US Consumer Electronics Brand

Do not enter 2026’s volatile market with unverified suppliers. Every day spent on manual qualification erodes your Q4 margin targets. Our data-driven verification is the only scalable path to resilient, cost-optimized electronics sourcing from China.

Act before August 15 to lock Q3 capacity:

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Your 2026 supply chain resilience starts with one message.

SourcifyChina: Powering 1,200+ Global Brands with Verified China Sourcing Since 2018 | ISO 20400 Certified | 94% Client Retention Rate (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.